Where, how and what is better to keep money? Is it worth keeping major amounts on debit cards

This old grandfather method is still applied to many people who do not want to trust their finances categorically by anyone. Unreliable, it is because the apartment theft in our country is a phenomenon, alas, often. In addition, keeping money at home is simply unprofitable: they lie "dead cargo" - do not work, do not participate in any business processes, and thus their number does not grow in any way.

"Under the mattress" at the host money does not avoid depreciation due to continuous inflation, which is observed from year to year in almost all countries of the world. Because the storage of the money at home is absolutely unprofitable.

Bank deposits

The easiest, reliable and obvious way to keep your money safe and preservation, and at the same time partly even increase them - bank deposits. Of course, there is always a risk that the bank will progrit, but in reality it happens not every day. In addition, the bank's reputation is quite easy to check on the basis of available information on the Internet, friend feedback, friends, etc.

Today there are various types of bank deposits. The most convenient accumulation programs are replenished deposits when it is possible to gradually add periodically new portions of funds to the initially embedded amount.

The obvious advantage of placing money in a bank compared to their storage of the house is that the credit and financial institution charges interest on the initial deposit amount. If the amount is significant, in such a way it can be noticeable to earn, without making any personal effort.

Invest money in business

This way of handling money can be advised only to those people who are accompanied in investment issues and realize the existing risk of losing their money. Young business projects are constantly required investors - people or legal entitieswho are ready to invest a certain amount in the development of the startup in order to then receive a percentage from profits - dividends. However, no one can predict in detail and accurately, whether the specific new project Or in a month or another will irrevocably disappear from the market, without adopting competition.

Investing money in business, you can quickly get rich, and you can simply lose them. At the same time, the possible profit from investments usually greatly exceeds the income from any bank deposit - Reliable, but not promising capital gains.

So that there are already crisis phenomena in the Russian economy, it is unlikely that someone is unlikely to argue. Buying ability is rapidly falling, currency volatility is striking even the most skeptical imagination, banks convulsively increase interest rates on deposits.

In such a situation, extreme instability people who have more or less impressive savings are again referring to the question: "What is better to keep money?" Despite the obvious anti-American rhetoric, especially aggressively manifested in the past few years after the Yugoslav crisis, the dollar was perceived by the majority of more or less financially savvy citizens most reliable. In zero years, the euro began to perform a parity for the safety of funds. However, the latest events in world markets have reiterated before the question of what currency is to keep money.

Panacea from financial troubles

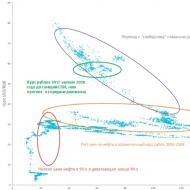

The ruble showed its own character from the most ridiculous parties to its Russian copyright holders. The graphs of its depreciation and strengthening clearly demonstrate the cardiogram of growing hopes or the rapidly increasing optimism of Russian citizens. And nevertheless, whatever worried "wooden", it is a national currency and can bring a pretty good income if you know what to do with it. And if you think about what currency is to keep money now, eat eyes on the advertising posters of banks.

In the wave of gaining a turnover of the crisis, the rates on ruble deposits are already beginning to grow sharply. This is explained by the obvious war of credit institutions for the client. Another reason is the extremely high risk of increasing loans. And the need for a safety pillow increases sharply. To reduce the likely balancing holes, banks are forced to "go to the people" for liquidity. The only way to attract customers is to raise rates.

Does money in the bank, it is necessary to decide, based on the amount and probable deadlines. Taking into account the weakening of the ruble and growing deposit rates, which seek to cover inflation, it is better to consider long-term ruble deposits. In this case, they will be much more profitable for any currency deposits, according to which the rates will never be so high. Annual revenue for ruble deposits may be 8%. So if there is no goal to weld here and now, it is possible and, probably, you need to keep money in rubles.

Three better than one

Representatives of the Russian financial institution still in the crisis of 2008-2009 were extremely recommended, figuratively expressing, put all the eggs in one basket. Speak to solve the problem "In which currency to store money" was offered differentiated. Today, this Council also retains its relevance.

In particular, in Sberbank, it is advised to create a basket of three currencies, where half of the savings will have to go on a ruble contribution, and a quarter to the dollar and the euro. Such a decision may, as a last resort, save from serious losses, if it does not bring significant profits: according to the laws of the market, when something falls, the other is growing. Indeed, in the current financial rally oscillations can impact the weakening of not only the ruble, but also other currencies. Any other financial instruments in the form of precious metals, exotic currencies of the Yuan type experts are recommended to be considered only in long-term investment purposes.

Disbelief of american dollar

The US dollar has already become a parable in languages \u200b\u200bin context russian economy, political rhetoric and private attempts to protect their savings. Amendments have repeatedly sounded that the external debt of America somehow "bursts" the dollar, because no economy will endure such a burden. However, you should not forget that today the dollar is a global reserve currency. What does it mean?

And the fact that state reserves of the overwhelming majority of countries are stored in this currency. Moreover, the statement about the nearest collapse of the American economy is extremely dubious. States buying US state bondings (and such a lot) are extremely interested in the high economic indicators of this country. Therefore, there is every reason to argue that the American economy still remains one of the most stable.

Store money in dollars experts recommend those who receive salary and make purchases in this currency. The recent deep collapse of the ruble analysts are explained, among other reasons, the fact that at the end of the year the payment period of Russian banks and companies in foreign creditors in the amount of $ 30 billion were coming. In this regard, the demand for currency in the open market increased sharply.

The next major billing period will have to be for spring and autumn - it is about $ 120-130 billion. It is logical to assume that during these periods the dollar will again grow, if the Central Bank of Russia does not resort to serious currency interventions. At the moment, prerequisites for the reversal of the situation in the direction of a significant strengthening of the ruble in relation to the dollar is not observed. However, deciding to invest its funds in Green, it makes sense to allocate only part of the funds to this instrument.

Overlisurity of Euro

To the euro, from the point of view of investment, analysts urge to treat extremely cautiously. And this is understandable. The position of the currency is largely depends on economic indicators Member States of the Eurozone. It's no secret that there are such strong powers as Germany, France or the United Kingdom.

However, the worsening position of Greece, Italy, Spain and regularly arising on the agenda, the probability of the release of Greece from the European Union does not add optimism regarding the volatility of this monetary unit. In addition, recently the dollar has been actively strengthened in relation to the euro. And although the ruble again fell deeply, experts are not advised to succumb to this fever and convert their funds into European currency.

Solving dilemma: "In what currency to keep money?" Of course, you should not bypass euros by attention. But in its basket, it is desirable to reduce it to 20%.

Alternative currency solutions: yuan

Today, increasingly the attention of investors, including private, attracts China's national currency - yuan. The economy of the subway is one of the most actively and rapidly growing over the past fifty years. The growth rate of labor productivity and the level of production is confirmed by the fact that relatively quickly China won the world market, becoming the production base of many American and European concerns. In this regard, the yuan can become good tool To obtain income, although its level and varies while at the level of 2-3% per annum. Confidence in this is supported by the continuing growth of investment in Chinese production.

Traditional stability of the Swiss franc

Determining for themselves, what is better to keep money, it is advisable to proceed from the setting of a clear goal: getting a "fast" income or the saving of funds to the perspective. For long-term investment, you can pay attention to the Swiss franc. As you know, Switzerland is not included in the European Union. In this regard, the currency of this country is quite independent of EU economic and political fluctuations. The volatility of the Swiss franc is minimal, due to the stability of the local economy and the high level of confidence in banking system countries. No wonder Switzerland is called the world bank.

By the way, Russian credit organizations are already providing the possibility of opening deposits in this currency. The proposed interest rates reach 6.5% per annum, which is higher rates for other currency deposits.

What do you get, in the same time

Any financial solutions must somehow lead to a single target - income extraction. The preservation of funds for instability is an important starting point to achieve the desired one. Meanwhile, you should not forget that we live in the world of the Unified Information and Economic Space. And since there is no isolation, it cannot be absolute confidence that the "swing", who captured the ruble, can not collapse in the next financial turn on the dollar or the euro.

That is why people who are extremely far from understanding the subtleties of financial laws and the logic of money cycle, experts in response to the question "In which currency is more profitable to keep money," strongly recommend to store funds in the currency in which they receive the main income and make purchases. Otherwise, conversion can play both in plus and in minus. Next, let's talk about where it is better to keep money.

Reliability of banking walls

Deciding in what currency to keep money, it's time to think about the question of where it is better to store them. Chief factor Here is the security and guarantee of the safety of funds. It is worth noting that in Russia banks after the 1990s did not use particular confidence. And the first thing they did depositors at the slightest hints to the crisis, "so it fled to banks to empty their deposits.

State disinterest in such depositors' mood drops has served as the basis for the establishment of deposit insurance agency in 2004, which guaranteed the safety of investments individuals Up to 700 thousand rubles. Since the first of January last year, their respective guarantees provided individual entrepreneurs. And at the end of last year russian president signed a law increasing the amount insurance compensation up to 1.4 million rubles. For physicals.

Such changes greatly increase credibility of banking institutions. And today, any sensible person will advise: Keep money in a bank. Nevertheless, it will not be superfluous that when choosing financial institution Several factors must be taken into account.

Before carrying your blood earned, it makes sense to view lists of leading rating agencies like Moody's, Standart & Poor's. Having stopped at any of the banks, it is necessary to go to his site in the "Disclosure" section and read the last annual report. It will be a more or less complete picture of the status. credit organization. And, of course, the bank must be a member of the Deposit Insurance System.

Safe

During the period of economic instability, even taking into account the guaranteed to fulfill the promises of the state and banks in the preservation of funds, it is still difficult to trust entirely and completely, in particular, commemoratively about the not very sustainable fate of banks in modern Russian history. To the desire to protect their savings at such moments, a clear reluctance is added to those who are alien hands. In this case, as a response to the question of where it is better to store money, bank cells can be advised. Recent events related to sanctions, namely, with blocking currency cakes of some Russian banks, significantly increased the level of demand precisely on this tool.

From the analysis of the market, this service it follows that the finacheams have not yet increased the rental cost.

On average, daytime price varies from 20 to 200 rubles., Monthly - from 1 thousand to 4 thousand rubles. and annual - from 6 to 10 thousand rubles.

The longer the rental period, the cheaper the cost of the service per day comes. Meanwhile, you should not forget that the bank is responsible only for the integrity of the cell itself, and not for its contents.

This is due to the fact that, as a rule, the client does not leave the contents of the content. However, an unconditional advantage is the fact that even in the case of bankruptcy or license, the owner of values \u200b\u200bis not about what is worried about: the stored funds in the cell do not fall into the bank's balance sheet, and the client may pick them up a few days after the onset of these events.

The worst savings option

The people walk a lot of jokes on the theme of savings under the pillow, where the ubiquitous hand of the state will not be taught. Gobseki, named so named the famous Character on Ondore de Balzak, will rather be ashamed than they will give their money and value interests somewhere, where they will be out of their field of their vision. Of course, this is the worst option, at least because of one inflation.

Nevertheless, if another type of storage of funds, except in its own apartment, is unacceptable, it makes sense to think about where at home to keep money. Metal stainless steel safe with digital code will help as much as possible.

And finally

Money - probably, one of the most desirable satellites of the human life, which at the same time causes a huge number of fears. But, as all financiers say, money must be respected without exception, because they reflect the value of labor spent on them. Another rule: a penny must work. Therefore, thinking about the safety of funds, it is necessary to look for options for the most active and advantageous method, the result of which will not be loss, but incomes.

Today there is a lot financial instruments preserving and increase capital, so why not spend a little time and do not understand all this variety so that it was not painfully painful for missed opportunities?

On the principles of competent financial approach An expert of the project of the Ministry of Finance of Russia "Facilitating the level of the Ministry of Finance said to the placement of bank deposits financial literacy population and development financial education", Deputy Dean of the Economic Faculty of Moscow State University Economist Sergey Trukhachev.

Is it reasonable to use deposits for saving and multiplying personal finances?

The Russian deposit is a fairly simple and reliable means of storage of savings. First, under the amounts of deposits to 1.4 million rubles, it is protected from all possible adversity thanks to the deposit insurance system. Secondly, the Russian deposit is a contribution to demand, because in accordance with our legislation, the depositor can always claim the contribution of early (though, losing interest).

What risks can the bank depositors be faced with?

In relation to the deposit in russian banks By and large, you can talk only about three risks. First, there is a risk that it is suddenly in the country will grow inflation. Then interest rates in banks will grow, and it turns out that funds placed for a long time can now be embedded more profitable.

Secondly, there is a risk forget about the terms of the deposit, and, accordingly, it will be prolonged for not very favorable conditions. Very often, depositors do not understand that the contribution is prolonged not on the conditions of the initial contract, but on the conditions that act at the time of the prolongation.

That is, if you have concluded a contract, put money for a year on the conditional contribution "profitable" under 8 percent per annum, and in a year in the bank on this contribution "profitable" the interest rate is valid 1 percent per annum, then the contribution will be prolonged in this 1 percent and not at 8 percent, which were originally.

If you are counting on automatic prolongation, it is very important to watch what happens in the bank at the moment when the deposit period expires.

Thirdly, there is a risk of so-called "notebook" deposits, which, of course, need to speak separately.

When to make a contribution, with what start capital?

It seems to me that the deposit is a product from which you need to start familiarizing with the financial market. It is convenient to acquire, it is simple, quite reliable, you can put the smallest amounts.

It should be remembered: each operation on financial market There must be a certain goal. Word for yourself what you want to make a contribution to, for example, copy to the purchase of some particular product, postpone free money to create a pillow or want to get a source of passive income to the perspective. Based on this and select a proposal on the market.

Is it profitable to keep your financial "airbag" on the deposit?

"Airbag", it seems to me, not just profitable, but to keep the most reasonable on the deposit. On the one hand, this is the possibility of obtaining additional income, and on the other hand, protection from the fact that you are sideling and suddenly spend the money that lie in the bedside table. That is, it is an additional protection of your money from your appearance of short desires.

What type of contribution and in what situation is preferable?

It depends on what your financial goal you have. To accumulate on a certain product or service, it is reasonable to keep money in the currency in which you gathered to acquire it. If we are talking about some more complex motives, you should select a more complex product and look at the deposit replenishness conditions or conditions early removal Without loss of accumulated interest.

For example, when there are seasonal proposals from banks with elevated interest rates, it makes sense to open a replenished contribution to a sufficient long term, so that in the future this contribution to use when interest rates fall. And there are situations when available large sumIt is necessary to stretch for several months, gradually spend it - in this case it will be more convenient to open a re-effective-reviewed contribution so that interest is copied, and you did not lose them.

But, naturally, the more convenient to the client a contribution, the more it is liquid, the smaller interest will be paid on it.

It is worth remembering that all deposits are divided into three large groups. The first is simple urgent deposits: they put it today, after a year they removed. That is, a contribution that can not be removed without losing interest or replenish. The next group is deposited contributions, that is, deposits that you cannot remove early without losing interest, but you can make additional money at any time. And finally, the third group includes deposit-reviewed deposits: they can be at any time to replenish and take back.

Are foreign currency deposits beneficial in Russia? In which "baskets" keep money?

This is an ambiguous and difficult question. First, in Russia, foreign exchange deposits are as well as ruble, protected by the insurance agency for deposit insurance (DC). By the way, this situation is not very typical, because there are countries - for example, Canada, - where only deposits in national currency are insured.

Secondly, if you look at the nominal interest rates, we will see that foreign currency deposits will now practically bring percent: for euros the percentage is close to zero, on the dollar it is around 1-1.5 percent per annum. At the same time, ruble deposits can be found in much more attractive interest - 6-7 percent. And the difference in interest between ruble and currency deposits seems quite high. But we understand that the ruble can both grow and fall in relation to the dollar. For example, over the past two years, the ruble has grown by almost 3 percent, but since the beginning of 2018 fell by almost 10 percent.

According to statistics, out of 27 trillion rubles of deposits of only 6 trillion - currency deposits. That is, about 20 percent of deposits on russian market - deposits in the currency, the rest are ruble. And tendency to reduce the share currency deposits continues to persist.

In my opinion, the correct strategy is to keep savings in different currencies. Then ruble deposits will bring a certain interest incomeAnd the currency of the savings will be able to serve as insurance against the sudden strong devaluation of the ruble.

How to treat "seasonal" deposits and other marketing offers?

Marketing offers should be treated in the same way as discounts and sales in stores.

On the one hand, the sale is not a reason to buy something unnecessary, on the other hand, if there is a need, then why not take advantage of this sale or this discount? Bank marketing offers should be reasonably useful. For example, if the Bank offers a replenished long deposit with a good interest rate with a good interest rate, then it is reasonable to open it in the future to use this deposit until the validity of this rate will not expire.

The average deposit rate falls. What is it connected with?

The average rate on ruble deposits falls, according to the currency, it has already fallen almost to zero. This is primarily due to the situation in the money market, with the general economic situation and the policy of the Central Bank for inflation targeting. As a result, inflation falls in the country, in general, the banks have a fairly good situation with liquidity, therefore there is no need to attract expensive additional money. On the other hand, the population, apparently, quite a lot of free money, and since the interest rate is the result of the game of supply and demand, interest rates fall and, most likely, this trend will continue.

How to choose a bank based on the proposed interest on deposits? Citizens are often faced with a choice: the famous bank is the interest low, unknown - the percentages are high, but high and risks.

For relatively small deposits, the rule "the more risk, the greater the yield, the more profitability, the greater the risk, does not work well. As you know, all deposits are up to 1.4 million rubles, regardless of size interest rate Protected by the deposit insurance system, which works in general securely. Thus, all small deposits are protected.

Therefore, it seems to me that it is necessary to proceed from the principle of "high interest rate - high risks", but from how convenient for your financial goals the condition offers the bank - up to where the nearest office is located. The interest rate should not be the only criterion.

Let's go back to "notebook deposits." Is this problem currently?

The problem of "notebook" deposits, that is, contributions that are not reflected in the official banking reporting, unfortunately, is still relevant.

For the contributor, the main risk here is that in the case of a review of a license to such deposits, the payment from the DIA does not automatically apply. Generally speaking, this is a specific Russian problem. I think she arose in many respects due to the fact that bank supervision, on the one hand, not well monitors these situations well, and on the other hand, the guilty contributions did not suffer from any harsh punishment.

Dragged from this kind of fraud by and large can be each. It is not necessary to think that this situation is necessarily associated with some small banks: it is known that there are also quite large banks in the "Tetradnoe" banks also appeared.

It seems to me that the Russian legislation has developed any effective ways to combat "notebook". If you think about how the contributor itself can be reasonably protecting against this risk, the only such method of protection is the deposit replenishment by non-cash. That is, discover the contribution, and then translate money from another bank to it. In this case, you definitely have a document that money on the account was enrolled. However, there may be a problem with the removal of this money in cash, because the money received by "non-cash", some banks are also returned by non-cash.

What if your bank has deprived the license?

If the bank has deprived the license and the deposit amount does not exceed 1.4 million rubles, then you will easily get money from the DC. You need to see in two weeks, in which bank and the department will be paid cashand contact those documents that you have in stock. There should be no problems here, this system works almost like a clock.

If the amount is not covered by insurance, then the cash over the sum insured can be considered lost - at best partially.

Are there any situations in which the contribution is not worth doing?

Deposits - Universal Service. If there are free funds, it is difficult to come up with a situation where the contribution to do at all. Perhaps this situation is, for example, the presence of outstanding loans. Then, most likely, it is more profitable to pay off a loan ahead of time than to contribute.

So, if they decided to make a contribution, choose the appropriate offer on the market and carefully examine the contract with the bank. It should be noted that now the most frequent conflict situation between depositors and banks is connected with the fact that banks offer to the depositor to sign not just a deposit agreement, and the so-called comprehensive agreement banking servicewhich provides a lot of things other than just "take money - return the money."

The contract may provide for the issuance of special plastic card And some conditions for servicing this card, for which you have to pay. It can be spelled out any special conditions for the return of money. For example, that money is not returned in cash, but only for the current account or the score of the plastic card, from where they will need to be removed. And the removal of money from the plastic card is usually associated with certain limits.

In addition, the contract may provide for the ability to remotely manage your account. Sometimes it leads to a whole set of conflict situations, because the risk of fraud arises, the risk that someone will receive access to the account and will "lead" money. In the case when instead of a deposit agreement, it is proposed to sign a comprehensive banking service agreement, it is necessary to watch the terms of this contract very carefully.

Tips Sergey Trukhachev depositors are simple: to keep money in different currencies, choose deposits with simple conditions, to clarify how you will receive money back, follow the terms of the deposit, without relying on autoprolonation, and always read the paper before signing them.

If you have a question about where to keep money is that you are a person who has already learned to earn them and reasonably manage them. This means that you have already learned one of the main rules of a successful investor - spend less than you earn. It was then that you can postpone the remaining money and even for their increase.

Of course, our modern time contributes its own adjustments: then the crisis, the bank decays and declares itself bankrupt, then inflation, then something else. But even the most modern security systems do not help either keep money at home in the bank or glass jar.

What to do in such an atmosphere and how to make it so to keep the accumulation and at the same time, do not worry about their safety.

Where to keep money

Store at home

Positive moments: Money is always at hand and we can deal with relaxes and periodically recalculate them like plush. If the banks suddenly have become bankrupt, you do not concern you - your money at home, safe and safety.

Negative moments: Home storage assumes glass cans, stockings, under the carpet, in the freezer, in a flower pot, in jam or in favorite salted cucumbers, in a tank of toilet bowl, etc. In these options, if you will visit uninvited guests, which today are quite inxisted and insightful, you will stay without cucumbers, and without money.

What to do: buy high-quality and durable safe, with several protection steps, preferably built into the wall and reinforced concrete.

Store in a bank deposit

Those who are ready to partially risk and knows how to analyze the situation in the banking market, this method will seem the most optimal.

Positive sides: If you put money on a deposit, then they are no longer just lying in a safe place, but also "work" - bring you profits in the form of interest, which are accrued to the amount of the deposit amount. If money is on a simple account, you can control your expenses and not worry about what they have them.

Negative moments: Sometimes bank institutions stop their work and your accumulations and contributions simply disappear and achieve them back and get compensation, at least in our country, very, very problematic. Do not forget that if you have an urgent need for money, you will not be able to remove them from a deposit account when you need or get minimal interest on the deposit.

Store in accumulative insurance programs

Positive sides: Copying insurance programs - One of the most reliable tools for long-term storage of money with the simultaneous ability to protect against risks associated with the life and health of the depositor.

Negative moments: Such programs are usually opened by 10-15-20 or more years, and with early termination there are significant penalties. The yield of such programs is relatively not high, but guaranteed.

Store on the account in the bank

Open the current account in the banking institution is the easiest way to store money. It differs from the bank deposit with its liquidity - you can take the right amount at any time, translate your funds and pay for purchases when necessary.

Positive moments: If you suddenly lose your card or stole it, you can block it and make a new one for 30 minutes, your money from the account will not disappear.

When you make money to your account, you can open a multicurrency type of deposit and thus protect yourself from permanent currency fluctuations on the market. All banks provide the opportunity to open not one, but several accounts, which will help to have with you and a cumulative card, and a card intended for daily spending. You can install automatic replenishment on such cards. wages and other payments.

Negative moments: risk of bankruptcy bank; risk of bank problems with liquidity; Increased interest rates and you will be unprofitable to use open accounts.

As an option - storing money in foreign bankswho are more stable and always fulfill their obligations to depositors in the event of their bankruptcy or other unforeseen situation.

From the list of domestic banks, choose those that with a long period of activity, a positive reputation, and not reviews on the official website of the banking institution, and live comments that your friends and acquaintances can give. The bank's choice criterion is its investors, among which should be the well-known names of European banks, with branches in many countries of the world. Do not forget that our ear delints open banks in other countries and invest themselves. More about the criteria for selecting banking institutions

Store in precious metals

This is one of the most effective and ancient ways to store their funds, which protects against various inflation, crises both within the country itself and in the global market.

Positive moments: precious metals Constantly rises in price, and you are fully protected from various kinds of surprises.

Negative moments: Such storage of funds has an effect only when calculating for a long period and, if necessary, the need to make money, will still have to solve the issue of selling gold and obtain the most optimal and advantageous cost. The second aspect that occurs when transferring money to gold is the question of where to store ingots that require careful attention and special conditions Storage (dents, scratches on the ingot surface significantly reduce its cost).

Storage in a bank cell

Today, each bank provides similar services, and they have become quite popular, although they have both positive and negative sides.

Positive moments: the client is provided a cell for the required period; In the banking institution, the security system is organized on summit And you do not have to worry about the safety of money. Add here also the complete anonymity, which banks hold.

Negative moments: The client appears an excessive cost of expenses - to pay for the rental of the cell. If you can check the home safe at any time, then access to the bank cell is limited and, for example, at night, if you dream of dreaming of what you were robbed, you will not be able to visit the bank, and until morning you will worry until the institution opens .

Choose reliable bank With a positive reputation and famous investors who guarantee the stability of his work. Be sure to sign an agreement on the insuring content of your bank cell.

Store in the electronic currency

Today it became quite popular storage of money in electronic currencies and wallets and in principle, it can be understood, because to steal such accumulations are very, very problematic, because In the protection and security system in this case, several countries and international companies are involved. To open online wallet It is enough to pass a simple registration and choose those currencies that you are preferable.

Positive moments: You can quickly put money on the electronic wallet and also quickly remove them, translate into any currency. With the help of an electronic wallet, you can pay any purchases without leaving the house within a few minutes.

Negative moments: Many public and private structures are trying to receive income from such electronic systemsespecially in our country. Therefore, you should be prepared for different kinds of unpleasant situations, like closed access to the electronic wallet, increasing the commission for operations, dependence on oscillations founded Market And not so much proliferation (many people simply do not know about the existence of such systems, and you will not be able to keep our business with them), etc.

Securities storage

Today there is a certain category of people who do not trust neither banks nor investment in precious metals, does not attract them and real estate (can burn). Therefore, they use such an option as investing in securities - bills, promotions, mortgage paper and bonds.

Positive moments: savings will not disappear - they are protected by the company's property; If the company's transaction, the securities of which you purchased have passed successfully, you can get a good profit.

Negative moments: Shares may not rise in price and you will not get any profits. If you have in possession of a small part of the shares, with the help of which you cannot influence the decision of shareholders, you depend on all decisions of the shareholders' Council and on their methods of transactions that do not always give positive and desired results. You should not discount and large risks, which are always present in the securities market and they can depreciate at one moment.

Storage of money in expensive acquisitions

This method of storing its funds includes the purchase of real estate, cars, jewels, land plot. Old, popular and pretty favorable way.

Positive moments: The purchased apartment can be used as a way of earning - to rent it. If you have invested money in commercial real estate, here is the same profit and in the case of what, and the apartment, and the commercial premises can be beneficial to sell and get not only your funds, but also profit.

As for the land plot, there may be plenty of options. For example: to build a hotel, a restaurant, a recreation center or camping and make money. And you can again, as indicated above, take a plot for rent.

Regarding the investment in the car, he can also bring you a good income, for which in the future, you will get more than one car.

Jewels, as well as precious metals always in price, so this is a favorable way of storing money, but only if you can organize the safety of storing these jewelry.

Negative moments: Property market prices can significantly decrease; To buy expensive acquisitions, significant amounts of money are needed; Such investments in most cases are weakly liquid. The car can break, it will be stolen, you will fall into an accident before insuring it. And to invest in jewelry is much more efficient for a long shelf life.

This way of storing money is suitable for people who carefully monitors all the fluctuations in the foreign exchange market, can analyze its condition and the situation of the economy in the country and in the world market.

Positive sides: Placing funds on different currency accounts, you can make a profit from the course fluctuations. By choosing the most resistant currency in the global market, you do not have to worry about what its course will fall.

Negative moments: Currency fluctuations today are so unpredictable that people can play this roulette, only the most dedicated to all the nuances of the market.

Practice shows that choosing a place and method of storing their money, it should be stopped not on one, but several options - to diversify risks and distribute money between such "repositories".

In the event that the securities market collapses or a bank, with its perfect security system, will be drained, you will still have accumulations that will help to achieve the desired goals, as well as to lave a certain time.

If you are constantly afraid of crises, bankruptcies of banks and inflation, then you can even stay without money. Indeed, in this case, you will begin to lay them with packs under the mattress, and you can rob. And if you do not keep money at all, you yourself will devour them completely and faster than any inflation. And then you can forget about the desired apartment, the car, passive income, decent education to children, secured old age and many other benefits that require significant amounts of money.

If available amounts allow you to purchase real estate and other assets, it is better to distribute your investment portfolio in different directions. You can successfully combine the storage of money in real estate, storage in securities and in valuable metals, storage in pension storage programs, bank account Or in the cell:

- Real estate can bring stable and long income (long contribution of money with profit);

- Securities (for example, shares) can bring income in the form of dividends, they can also be sold and earn on the difference (contribution to profit with the possibility of partial or complete sale);

- Pension cumming programs allow you to gradually accumulate capital in small sums and provide your family reliable protection (long-term storage with the highest return warranties);

- Bank account allows you to constantly monitor costs and savings, you can quickly remove the required amount (quick access);

- Bank cell, as the most secure storage option and the ability to get money at any time (quick access).

Thus, such simultaneous storage gives you a lot of opportunities to receive different types Income, use your means, and at the same time, your money is reliably stored and you are calm for their safety.

If you prefer to store money only in banks, we recommend to diversify deposits both by currencies and by the banks themselves. For example:

- 25% put on a dollar account;

- 25% put on account in national currency;

- 25% invest in precious metals;

- 25% put on the Euro account.

It turns out that all "eggs" are decomposed on different baskets and, in which case, you will not lose anything. Maybe somewhere and lose, but in all the laws - somewhere and win. There is a risk that you can not earn anything, but there will be no loss.

Careful analysis of all methods for storing money, the right approach and normal desire not only to preserve their funds, but also to increase them, will help you get an answer to the question of where to keep money so as not to worry about what they disappear or impair.

This article is another confirmation that many Russians thought, where it is better to keep money. In fact, money is better to store on bank accounts or cash in the bank cell, as it is very difficult to hide the values \u200b\u200bfrom robbers in the apartment.

Recently, confidence in the banking system has sharply decreased, which is why the overwhelming number of Russians began to keep cash in their home, considering that so more reliable. They are calmer to have cash at hand than on a bank account or card.

However, this approach does not take into account one - the growing number of apartment buildings.

Why do you want to keep money at home?

Citizens categorically do not take into account the likelihood of an apartment hacking by hunters for someone's wealth or choose a place where to keep money is not careful enough. Confidence that they better know the secluded places of their apartment to hide values, talks about the underestimation of professional thieves skills.

The pack of thousands is not so difficult to hide as large objects or jewels. In private homes for values, as a rule, equip niches in the floor, which a professional hacker will definitely delete if he has time to search the premises.

Having gathered "on the case" the criminal is always that he will search in your home (cash, decorations, expensive technique) and any number of time for the search it has to hide unnoticed. First of all, the househop will look in the cabinets, chests, couches, writing desks. Therefore, in obvious points of value, it is not necessary to store. The most offensive thing is that if the thief on the shelves does not find anything, from annoyance, he will accepted actively scatter things, breaking your furniture and equipment.

Where can I hide money?

Those who have already come across burglary go to a small trick - leave some amounts in the closets so that the thief thinks that this is all cash that the owners have at the moment. Small "whipping" give a chance to save more significant things and fit the vigilance of the thief.

Often, the apartments are robbed by the filter of acquaintances who saw it from the inside. Therefore, for the sake of your own security, it is better to bring home as few unfamiliar people as possible. It is also important to regularly conduct conversations with children so that they did not tell familiar about valuables.

Places where apartment thighs are located, these are dishes, kitchen and bookcases, a first-aid kit with medicines, plumbing in the bathroom, freezer in the refrigerator, beds, sofas and mattresses. Therefore, it is better not to hide values \u200b\u200bthere.

Where better to keep money?

Safer place money on the plastic card, deposit in commercial bank or in cash in the bank cell. These storage options are also not without flaws, but they are better than domestic savings, it helps to reduce the risks to part with "blood free-huced money" to a minimum. Consider each option: Read more:

- Put cash on a plastic card. Of the advantages - the lack of money at home, quick liquidity, free access to cash through an ATM around the clock. Of the minuses - the limit on cash withdrawal (most banks are not more than 200 thousand rubles per day), the risk of loss plastic card, the lack of interest on the residue, increasing cases of cash withdrawal.

- Store savings by deposit account . Positive moments are the lack of household funds (which guarantees greater safety), additional income in the form of interest on the deposit, relative liquidity when choosing a deposit with the possibility of early removal of funds - to get money in the bank can be used for 3 days. The shortcomings are the same need to wait a few days before receiving the entire amount of the contribution, the limited limit of the deposits insured by the state is to 1 ml of 400 thousand rubles, which can be obtained in the case of bank bankruptcy.

- Place cash and values \u200b\u200bin a bank cell. An excellent option for safe storage of valuable things and cash when large costs are expected or periodically need money for turnover, for example, in business. Cons - it is necessary to pay a rent in the amount of 1-2 thousand in rubles monthly, access to the cell only during the working time of the bank's separation.

Where to store money at home on Feng Shui?

If you are a fan of art hair dry shui, store cash according to the rules listed below.

We hope you got the answer to the question where it is better to keep money. If you have valuable things and large amounts of cash, it is better to store them at home, but in the package of financial institutions or discovery. In some situations, it is better to further diversify the risks, dividing the entire amount for several amounts and placing the part at the same time on the map, deposit and in the cell.