Evaluation of equipment for the purposes of pledge. Features of real estate assessment for bank lending purposes on bail brief description of the commercial real estate market segments

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Posted on http://www.allbest.ru/

- Introduction

- CHAPTER 1.

- 1.1 Real estate as an object of pledge

- 1.2

- Chapter 2. Evaluation of the market value of real estate for the purposes of collateral on the example of a warehouse building

- 2.1 Description of the object of assessment

- 2.2 Analysis of the assessment market

- 2.3 Defining the market value of the assessment object

- Chapter 3. Recommendations for improving activities Real estate assessment for collateral purposes

- Conclusion

- BIBLIOGRAPHY

- Applications

- Introduction

Assessment of real estate value is relevant now and will be relevant until the property is existed. In Russia, there is an active formation and development of the real estate market and an increasing number of citizens, enterprises and organizations participate in real estate operations.

To make many real estate operations and other estimates, the conclusion of the appraiser may not only be desirable, but also strictly mandatory. Evaluation as an object legal regulation Represents an appraiser for an independent expert to determine the market value, on the other hand, a legal factor establishes the value of the assessment object for the purposes defined in the assessment agreement.

Evaluation for the purposes of pledge - one of the most relevant aspects of the practical use of the theory of the assessment, because It is one of the most sought-after types of services in the assessment market.

When choosing assets for the purposes of collateral, real estate objects are most attractive. Such "attractiveness" is explained primarily by the reliability of the object of pledge as in the physical aspect - the impossibility of its movement and in the legal entity - the obligation of state registration (the presence, encumbrance of the deposit does not allow implementing the object without informing the pledgee).

Errors in the assessment of the pledge is quite expensive by the bank, and the negative consequences lead errors both in one and the other way. The revalued pledge is fraught with losses during default, underestimated - limit the volume of lending (in any case, in many banks) and accordingly leads to incomplete income. That is, the bank is most interested in the objective assessment of the value of the pledge, contrary to the common opinion that the Bank is beneficial to underestimate.

The above arguments led to the relevance of the chosen topic.

The subject of the graduation work was the assessment of the market value of real estate for the purposes of pledge.

The object of research in the graduation work was a warehouse building.

Date of determining the market value of the warehouse building: 01.07.2010

Date of preparation date: 09/12/2010

The purpose of this appearance was to analyze the theoretical foundations of real estate assessment and their practical implementation on the example of an assessment of the warehouse building, taking into account the specifics of the application of the assessment results - for pledge.

When solving the goal, the following tasks were solved:

Analyze theoretical basis real estate estimates for collateral purposes;

Illustrate the areas of application and restrictions on methods and approaches to the assessment of real estate for the purposes of the pledge.

Analyze source information, group the data obtained, make up short review real estate market at the evaluation date;

Substantiate and carry out the coordination of the results of the assessment of the market value of the warehouse building for the purposes of the pledge;

CHAPTER 1.Theoretical foundations of real estate assessment for deposit purposes

1.1 Real estate as an object of pledge

The concept of "real estate" includes a fairly wide range of objects. It includes: Real estate objects of office, commercial, warehousing: Objects used by the service sector (car dealerships and car services, car wash, hotels, etc.); Production facilities (workshops and plants housing, etc.). All of the above objects can be considered by owners as a collateral speaking in the form of a credit transaction.

It should be noted that in addition to estimated issues, the deposit is affecting the significant area of \u200b\u200bthe legal field. Therefore, before considering the range of issues lying in the plane of estimating the market value of real estate objects with the purpose of collateral, we define the boundaries of the legal field.

Legal field in the field of property collateral

The main regulatory documents regulating the pledge of real estate objects are:

Civil Code of the Russian Federation, part of the first;

Land Code of the Russian Federation;

Federal Law "On State Registration of Rights to Movable Property and Transactions with Him" \u200b\u200bNo. 122-ФЗ;

Federal Law of July 16, 1998 No. 102-FZ "On Mortgage (Property Pledge)".

In accordance with the current legislation norms (FZ "On Evaluation Activities in the Russian Federation", Article 8) in relation to crediting goals, the assessment of the assessment objects is mandatory in the following cases:

Involvement in the transaction of assessment objects belonging to a fully or partially Russian Federation, the subjects of the Russian Federation or municipalities, including in determining the value of the assessment objects owned by the Russian Federation, the subjects of the Russian Federation or municipalities, as the subject of the pledge;

Upon assignment of debt obligations related to the objects of the assessment belonging to the Russian Federation, the subjects of the Russian Federation or municipalities;

When the objects are transferred to the assessment belonging to the Russian Federation, the subjects of the Russian Federation or municipalities, as a contribution to the authorized capital, funds of legal entities, as well as in the event of a dispute about the value of the object of assessment, including with mortgage lending to individuals and legal entities in cases The emergence of disputes about the value of the value of the mortgage.

Definition of real estate object

The definition of real estate objects is given in the Civil Code of the Russian Federation under Art. 130 Civil Code of the Russian Federation "... to real estate (real estate, real estate) include land plots, plots of subsoil, and all that is firmly related to the Earth, that is, objects that are impossible to move without disproportionate damage, including forests, perennial plantings, Buildings »Constructions, objects of unfinished construction. Also are also subject to state registration of air and maritime courts, internal navigation vessels, space, objects.

In accordance with MSO "Real Estate includes land and all things that are natural frequent land plot - For example, trees and minerals, as well as all things that are attached by people, such as buildings and improving the territory. All long-term accession to buildings, such as water supply, heating and cooling systems, wiring, as well as embedded objects similar to lifters and elevators are also part of real estate. Real estate includes all connections - both underground and overhead. "

The objects of the pledge cannot be the following real estate objects:

1. Buildings of uncertain destination;

2. Buildings recognized in the prescribed manner unsuitable for use (emergency, located in the cultivated territories, in the zones of the CHP dump, in the Zonase of Karst, damaged due to natural disasters or fire);

3. Outstandingly erected and unfinder objects;

4. Structures that have not passed state registration in the prescribed manner.

It should be borne in mind that the agreement of the property of the object of real estate (mortgages) enters into force from the moment it is registered in the territorial division of the Federal Registration Chamber. The contract that has not passed state registration is invalid.

At the same time, the security of the property is scheduled for the security of the rights of use (property, including the equity, economic management or lease) by the land plot, which ensures the functioning of the building if these rights belong to the owner of the building.

Article 62. Federal Law "On mortgage (property pledge dated July 16. 1998 No. 102-FZ indicates land plots that may be subject to pledge (mortgages):

1. Under the mortgage agreement, land plots may be laid out, since the corresponding land on the basis of the federal law is not excluded from the turnover or not limited in the turnover.

1.1. If the land plot is transmitted under a lease agreement to a citizen or a legal entity, the tenant of the land plot has the right to give the rental rights of the land plot in a pledge within the term of the lease agreement of the land plot with the consent of the owner of the land plot;

2. With a common share or joint ownership On land specified in paragraph 1 this articleThe mortgage can be established only to a land plot owned by a citizen or legal entity allocated in nature from lands in the overall share of joint ownership.

Article 63 lists land plots that are not subject to mortgage:

· Mortgage land in state or municipal property in accordance with this Federal Law is not allowed;

· The mortgage of the land plot is not allowed, the area of \u200b\u200bwhich is less minimum sizeinstalled regulatory acts Subjects of the Russian Federation and regulatory acts of bodies local governments For lands different target and allowed use.

Acting arbitrage practice Indicates the possibility of a collateral of the property without the simultaneous pledge of the land plot "... when the pledger is not the owner or tenant of the land plot, it is entitled to lay only the building (construction). Such an agreement is not invalid. "

IN this case It is necessary to document the absence of such rights from the owner of the building. Such a confirmation may be an extract from the USRP or (in the absence of information of the USRP) a certificate from the land body. At the pledge of the premises, the deposit of land use rights is required if the premises holder decorated such rights (with selection in nature or without selection).

In tab. 1 are described possible options The presence of rights, ownership of the land plot, given the appropriate comments indicating the main points to which it is necessary to pay attention to the formation of the collateral mass and carrying out the cost of value estimation.

Table. 1

|

Possible options |

Comments |

||

|

Land relations are not decorated |

If ownership of the building and land use rights belong to different persons, it is not necessary to design the depreciation of land use rights, but it is necessary to document the absence of such rights to the owner of the building for such a confirmation. . At the pledge of the premises, the pledge of land use rights is required if the room holder has such rights (with separation in nature or separated) |

||

|

Land relations are decorated |

|||

|

Own |

The most preferred option for collateral. It is necessary to pay attention to target use object of the current and existence of encumbrances |

||

|

Permanent (indefinite) use |

The land plot belonging to the pledger on the ownership of (perpetual) use is not the subject of mortgage. * According to paragraph 2 of Article 3 of the Federal Law "On the introduction of the Land Code of the Russian Federation" No. 137-FZ of 25.10.2001, with the exception of those specified in paragraph 1 of Art. The 20 RF RF LEGAL ENGLISHs are obliged to re-provide the right of constant indefinite) use by land for leases until January 1, 2010 in accordance with the rules of Article 36 of the RF RF. At a pledge of such objects, it is necessary to provide that in case of renewal of land use rights, the owner or tenant of the land plot must conclude an additional agreement to the mortgage agreement, according to which the right to lease of the land, or the right of ownership, must conclude an additional agreement to the mortgage agreement. |

||

|

Rent (long-term or short-term) |

The timing of the lease agreement should be taken into account when conducting an assessment. |

||

|

Should be considered: |

If the land plot is more building stains. Need analysis for availability additional cost Land plot, if its area, more area necessary for the full functioning of the object. |

||

|

If only the decline is decorated, then in a similar situation, it is necessary to carefully and reasonably approach the issues of formation of the value of the object. The text provides an example of such a situation that occurs when evaluating the shopping center |

|||

|

* According to paragraph 1 of Art. 6 of the Federal Law "On Mortgage (Pledge of Real Estate)" of July 16, 1998, No. 102-FZ Morty may be established on property that belongs to the Laughty on the right of ownership or on the right economic management. The right of permanent (indefinite) use among the rights transmitted by the deposit is not named. At the same time, in accordance with paragraph 4 of Article.36 of the Land Code of the Russian Federation, citizens or legal entities with land plots on the right of permanent (perpetual) use are not entitled to dispose of these land plots, and the transfer of property to the deposit involves the disposal of such property. Land plots transferred to citizens and organizations in constant (indefinite) use are state or municipal property, and the mortgage of land plots in state or municipal property is not allowed (Article 63 of the Federal Law "On Mortgage (Property Pledge)"). |

1.2 Analysis of approaches to estimating the value of real estate for the purpose of pledge

Russian legislative practice is regulated by the use of comparative, cost and income approaches in real estate evaluation.

The choice of one or another approach depends on the nature of the estimated object, its market environment, the essence of typical motivations and actions of potential landlords and tenants, availability and quality of the necessary source information.

To form the market value of the real estate object, the following stages of work must be performed:

1. To analyze the market of commercial real estate objects;

2. To form an opinion on the advantages and disadvantages of the assessment object;

3. Analyze the best and most efficient use (as part of the assessment of real estate objects for the purposes of collateral, this analysis is used in certain situations, but in most cases it is not required, as it is assumed that the object will be transferred on the basis of its current use);

4. Select appreciation approaches;

5. Perform calculations within the selected approaches;

6. To form the final conclusion about the cost.

Let us dwell on the main points that need to be taken into account within each of the above-mentioned stages in the assessment of real estate objects in order to pledge.

Market analysis

The qualitative analysis of the market analysis largely determines the reliability of the final evaluation result.

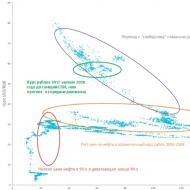

Market analysis is closely linked to liquidity analysis. For example, when evaluating a production facility, an analysis of the demand for production facilities (sought-after area, constructive design and condition) is needed, as well as an analysis of the supply of such objects.

It should be noted that when evaluating the collateral of the collateral, liquidity is an important characteristic of the collateral and in many cases it allows us to judge how quickly due to the implementation of the mortgagee rights on the subject of the collateral can pay off the debt on the loan. The correct formation of the output about the degree of liquidity of the real estate object allows to obtain a reasonable opinion on its value, make a decision on the value of the collateral discount.

Significant factors affecting the liquidity of real estate objects are: location, physical characteristics of the object (wear, condition of engineering communications), the size of the object, the state of the real estate market in the region and the village. It should be noted that compliance with the specified factors to a greater or lesser extent will determine the objective of the object to one or another class.

As indicators of liquidity, the average exposure time is used in a particular settlement for objects of the same market segment, which is considered and similar to the main characteristics.

The following gradation of property liquidity is proposed, depending on the implementation time:

The main tasks in the framework of market analysis are:

· The formation of an objective opinion on which transactions are presented to a greater extent on objects similar to the estimated (rental transactions or sale transaction);

· Determination of analogs to calculate the rental rate (with a profitable approach) and for a comparative approach;

· Detection of the ratio ratio between rental rates of various types of objects (rental rate of commercial premises with respect to the rental rate for office space, etc.).

When forming a report on the assessment of the commercial real estate object, for collateral purposes, the text part of this section of the report should contain the following information:

1. A brief description of the segments of the commercial real estate market of the city;

2. Characteristics of the local market segment (average rental rates and selling prices 1 sq. M at the current date, the growth dynamics compared with last year, the average level of incompressibility, the average level of operating costs for such objects (in absolute or relative indicators);

3. Availability investment projects In the city associated with the construction or reconstruction of objects of this type (description, characteristics, developer, total investment costs, current state).

Description of the location i Assessment object

The location is one of the key parameters that determine the possible yield of the object. The incorrect definition of this parameter can lead to the formation of the inaccurate value of the estimated real estate object.

The main factors for which, you need to pay attention to when describing the location of the assessment object:

- for the office of office real estate - the location in the "business" area of \u200b\u200bthe city (more liquid object) or vice versa, the location in the depths of the industrial platform (possible difficulties with the implementation), the presence of convenient transport accessibility, etc.;

for the object of trading real estate - location in the trading corridor (or, on the contrary, in the depths of the "dead-end" street), the intensity of the movement, the popularity of the place, etc.;

for warehouse property - transport accessibility, the presence of infrastructure (railway branch, etc.), the presence of all necessary communications in sufficient volume (electricity, gas, water, etc.).

When describing the location of the assessment object, quite visual representation is the presentation of graphic information, on the basis of which you can understand where the assessment object is located,

The source of this information may be electronic and paper cards of the city. We give an example of a graphic image and a brief text description of the location of the assessment object.

The best and most effective use

Since evaluation assumes the definition of market value, the analysis of the most efficient use reveals the most profitable and competitive type of use of a specific property object.

Analysis of the most efficient use of the real estate object involves a detailed study of the market situation, the characteristics of the estimated object, identifying the in-demanding options that are compatible with the parameters of the estimated object, the calculation of the profitability of each option and estimate the value of real estate with each use option. Thus, the final conclusion about the most efficient use can be made only after calculating the cost.

The best and most efficient use of the real estate object represents the use of a free or built-up area of \u200b\u200bland, which is legally possible and is appropriately decorated, physically implement, is ensured by the appropriate financial resources And gives the maximum cost.

The optimal use of the land plot is determined by the competing factors of a particular market, which belongs to the estimated object of property, and is not the result of the subjective speculation of the owner, a developer or appraiser. Therefore, the analysis and choice of the most efficient use is, in fact, the economic study of market factors substantial for the estimated object.

In most cases, analyzing the best and most efficient use for assessment for the purpose of pledge is not required. When evaluating for the purposes of the deposit, this analysis is carried out only in the case of an obvious inconsistency of the object of assessment to its existing use. At the same time, the assessment, taking into account the change in the objective of the object, should be carried out if such an appointment is already defined and explicitly. (http://www.audit-it.ru/articles/appraisal/a109/188103.html).

In accordance with Federal Standard Estimates No. 1, approved by Vimpelz Ministry of Economic Development of Russia of July 20, 2007 No. 256, the market value estimation procedure is carried out using three approaches:

An income approach (capitalization approach or revenue discount to real estate assessment);

Cost approach;

Comparative approach ( market approach to real estate assessment).

Before making calculations of the value of an assessment facility for each approach, the applicability of approaches to the assessment is based.

The choice of one or another approach, as well as the method in each of the approaches, is carried out, based on the specifics of the estimated object, the characteristics of the particular market and the composition of the information contained in the information collected. Estimated approaches are usually interrelated and complementary.

Cost approach to the assessment of real estate for the purposes of pledge

The cost approach is a set of methods for estimating the value of an assessment object based on the determination of the costs needed to restore either, replacing the object of the assessment, taking into account its wear.

This approach in assessing for the purposes of the pledge is usually used quite rarely. However, in some cases, for example, in the absence of a fairly developed market and information about it, the cost approach may be the only one.

From the use of the cost approach, it is unambiguously refused to evaluate objects for which you can find a sufficiently large number of market information, as well as when evaluating enough "age" objects. Assessment with the use of a cost approach in this case does not form a fairly reliable opinion about the possible price for the implementation of such an object in the market.

When evaluating on new objects, as a fairly good landmark in the absence of proper volume of market information, the estimated calculation can be used, while it is necessary to carefully analyze the calculation provided by the owner (it can significantly differ from the average market).

The logic of performing work within the framework of the cost approach involves the following actions:

assessment of the replacement cost of the estimated building (or substitution cost);

evaluation of the value of entrepreneurial profit (Investor's profits);

calculation of identified types of wear;

assessment of the market value of the land plot;

calculation of the total value of the assessment object by adjusting the rehabilitation value to wear with the subsequent increase in the value obtained on the value of the land plot.

This logic can be described in the form of the following formula,

allowing to obtain a conclusion about the cost: the object of commercial real estate:

Object cost \u003d sun * (i - and) + juze, where

Sun - the replacement cost of the object of assessment (or the cost of substitution), taking into account the profit of the entrepreneur;

And - the value of the identified wear of the object;

Juze - The cost of property rights to the land plot.

Evaluation of replacement cost

The replacement cost (Sun) is the cost of construction of the estimated object of real estate as a new, excluding wear, and correlated. To. Evaluation date.

The replacement cost can be calculated on the basis of the cost of reproduction or the cost of substitution.

Under the cost of reproduction, the cost of construction at current prices to the actual date of the assessment of the exact copy of the estimated building, p. using the same building materials, standards and projects.

The cost of substitution is determined by the construction costs at current prices at the actual date of assessing the object of the same utility using modern, materials, standards, projects and architectural solutions.

As can be seen from the above definitions, the calculation of the replacement cost is more preferable, since in the second case the costs of building a building, differing from the characteristic estimated according to the characteristics, and the estimate of the difference in the usefulness of compared buildings is very subjective.

On the other hand, the choice of the calculation of the value of the substitution may also be justified if the building is estimated a number of features of the availability of functional wear, which cannot but reduce the commercial attractiveness for the potential buyer.

In general, the choice between the value of "reproduction" and the value of "substitution" depends on many factors: the objectives of the assessment, the number and quality of the information collected about the object of assessment, its physical characteristics, etc.

Sources of information for calculating the cost of "reproduction" or the value of "substitution":

estimated calculations ( local estimates, object estimates, consolidated estimated calculation);

commands of the Federal Security Committee (collections of enlarged indicators of the replacement value of buildings and structures for the revaluation of fixed assets by industry) USS collections (the cost is given in prices in 1969):

collections manufactured by Ko-Invest (industrial, residential, public buildings, etc.) (cost in prices 2009,2010);

Construction value indices (Resolution Gosstroy, CO-Invest Collections), etc.

The estimated practice uses the following methods for determining the full replacement cost:

1) the method of comparative unit,

2) component breakdown method,

3) Method of quantitative examination.

The choice of the method is determined by the purpose of the assessment and the necessary accuracy of the calculation.

Comparative unit method It is based on the use of the value of the construction of a comparative unit (1kv.meter, 1kub.meter) of a similar building. The cost of a comparative unit of analogue requires adjustment to the identified differences between it and the estimated object (physical parameters, the presence of easily mounted equipment, financing conditions, etc.).

The total reducing cost of the estimated object is determined by multiplying the corrected value of the comparison unit on the number of comparison units (area, cubature). To determine the amount of costs, various reference and regulatory materials are usually applied, for example, "enlarged construction cost indicators", "enlarged indicators of the cost of reducing value."

For calculation, the following formula is used:

SN= SE.S.C. SO.C. TO1 C. TO2 C. TO3 C. TO4 ch TO5,

where: SN- the cost of the estimated object;

SE.S.- The cost of 1 square. or cubic meter of typical constructions on the base date;

SO- Number of comparison units (area or scope of the object)

TO1 is a coefficient that takes into account the identified differences between the estimated object and the selected typical construction in the area, the volume, other physical parameters;

TO2 - coefficient of adjustment to the location of the object;

TO3 - the coefficient of changes in the cost of construction and installation work in the period between the base date and date at the time of the assessment;

TO4 - coefficient, taking into account the profit of the developer;

TO5 is a coefficient taking into account VAT (%).

The basis of this method is the cost of a comparison unit of a typical object or analogue, when choosing which it is necessary to observe functional purpose, physical characteristics, class of constructive systems, dates of commissioning and other characteristics.

The comparative unit method estimates the cost of the object at the cost of substitution. This is due to the fact that the cost of the comparative unit used in the calculations is, as a rule, is not an identical object, but a close analog.

Component breakdown methodbased on using qualitatively other information. Separate building components of the building: foundation, walls, overlaps, etc. - are evaluated by cost indicators that include direct and indirect costs needed to build a single component volume unit. The cost of the entire building is calculated as the sum of the values \u200b\u200bof all components by the formula:

where FROMhR. - the cost of building a building as a whole;

VJ.- Volume j.- th component;

CJ.- the cost of a unit of volume;

N.- the number of highlighted components of the building;

CN is a coefficient that takes into account the differences between the estimated object and the selected typical structure (for an identical object Kn \u003d 1);

Ki - coefficient, taking into account the cumulative wear.

The partitioning method on components has several varieties:

Subcontract method;

Breakdown by profile of work;

Cost allocation.

Subcontracting methodit is based on the use of information on the cost of work performed under the subcontract agreements concluded by the General Contractor with specialized construction organizations - subcontractors. Complete replacement cost is calculated as the amount of costs for all subcontracting construction and installation work.

Profile breakdown methodensures an assessment of a complete reducing value as the amount of costs for hiring individual builders' specialists (Masonicians, plasterers, carpenters, etc.)

The method of highlighted costsit assumes the system use of comparison units to evaluate the various components of buildings, after which the results of private estimates are summed up.

Method of quantitative examinationit assumes the creation of a new estimate on an estimated object in prices for the evaluation date. For these purposes, a detailed quantitative and cost analysis is carried out, as well as the calculation of the costs of construction and mounting work Separate components and buildings as a whole. When calculating, direct costs, overhead costs and other costs representing a full estimate for the construction of an estimated object are taken into account.

The method of quantitative survey gives the most accurate result of a complete replacement value, but is the most time consuming and requiring practical knowledge in the area of \u200b\u200bdesign and estimate.

Estimates of the value of entrepreneurial profit (Investor profits)

Entrepreneur's profit (investor) is a remuneration that requires a typical investor (developer, developer) for the risk associated with the construction of a project similar in structure with an estimated object.

In fact, this value reflects the average profit profit of the investor, which the project implementation can bring, including the costs of managing and organizing construction, overall surveillance and related risk. As a rule, when forming this indicator does not pay attention to the stage life cyclewhere the segment of the commercial real estate market is located, which includes the estimated object, on the dependence of its magnitude from the volume and time of construction, from whether the functions of the investor (customer) and the builder (contractor) are divided from other factors. Accordingly, when considering the report, it is important to maximally note the range of the profit of the entrepreneur (investor) and set the range of the current average value.

It should be noted that the magnitude of the profit of the entrepreneur, depending on the degree of development of the real estate market and the life cycle, which contains this segment of the commercial real estate market, can vary in a significant range. For example., In the commercial real estate market in Moscow in 2005, but the opinion of the largest analytical agencies, the profit of the entrepreneur in the trade real estate segment varied in the range from 25 to 40%, in 2006 and 2007 there was a decrease and stabilization of this indicator . In practice, getting market data is difficult, as they are most often a commercial secret.

Calculation of identified types of wear

Wear is characterized by a decrease in the utility of the real estate object and its consumer attractiveness from the point of view of a potential investor.

As a rule, wear is expressed in reducing the value (impairment) of the object during a certain period due to the impact of various factors.

Depending on the reasons that cause impairment of the object of real estate, highlight the physical, functional and external types of wear.

Physical deterioration. Reflects changes in the physical properties of the real estate object with time (for example, defects of structural elements). Physical wear is two types: the first one occurs under the influence of operational factors, the second - under the influence of natural and natural factors.

There are four basic methods for calculating the physical wear of buildings: expert, value, regulatory (or accounting) and method for calculating the life of the building.

The percentage of physical wear of the object, assessed by the expert method, is determined on the basis of the rules for assessing the physical wear of residential buildings. The deadlines for the service of buildings as a whole depends on the durability of its components. The physical wear of the elements of the building is calculated as a product of the proportion of the structural element of the building and the percentage of wear of this element, divided by 100. The physical wear of the entire building is defined as a weighted average value for all elements of the building. The expert method for determining physical wear is usually used in the inventory of real estate.

There is an eliminable and non-resistant physical wear. Disposable physical wear It assumes that the cost of the maintenance is less than the value added by the cost of the object. Foreign physical wear It is considered when the costs of correction of a defect exceed the cost, which will be added to the object. All elements of the building are divided into two categories: long-term (foundations, walls, overlappings, etc.) and quickly inspection (roofing, decorative finish, coloring and other, i.e. those elements that can be repaired (restore) at the current repair) .

The value method provides for determining the cost of reproduction of the elements of the building. By inspection, the percentage of wear of each building element is determined, which is then translated into the value expression. A more accurate, corrected value calculation of physical wear is obtained when the percentage of wear is defined as a weighted average value.

Regulatory (or accounting) Method for determining the physical wear of buildings involves the use of uniform rules depreciation deductions On the full restoration of fixed assets.

When using the method of calculating the life of the building, a number of terms apply.

The term of economic life is the time during which the object can be used, removing profits. During this period, improvement contributes to the cost of the object; The term of the economic life of the object ends when the improvements made do not contribute to the value of the object due to its overall obsolescence.

The term of the physical life of the object is a period when the building exists and you can live in it or work. The term of physical life ends when the object is demolished.

Effective age is based on the evaluation of the appearance, technical condition, economic factorsaffecting the cost of the object.

The chronological age is the period that has passed since the input of the object to operation before the date of the assessment.

The period of the remaining economic life of the building is a period from the date of evaluation until the end of the economic life of the object. Repair and modernization of the facility increase the period of the remaining economic life.

The regulatory service life (or typical life of physical life) is a service life and structures defined by regulatory acts.

Functional wear of the object.Functional obsolescence is that the object does not comply with modern standards in terms of its functional utility. Functional obsolescence can manifest itself in the outdated architecture of the building, in the conveniences of its layout, volumes, engineering, etc. Functional obsolescence is due to the influence of scientific and technological progress in the field of architecture and construction. Functional wear in domestic practice is referred to as moral wear.

Functional wear, as well as physical wear, can be eliminable and unrelated. The disposable functional wear can be attributed to the restoration of built-in wardrobes, water and gas meters, plumbing equipment, floor coverings, etc. The criterion of whether the wear is elimible or not, is a comparison of the cost of repair costs with an additional value. If additionally the cost exceeds the cost of recovery, then the functional wear is eliminable. The magnitude of the disposable wear is defined as the difference between the potential cost of the building at the time of its assessment with the updated elements and its value at the date of the assessment without updated items.

There is a decrease in the cost of the building due to the factors associated with the quality characteristics of the building due to continuous functional wear. Moreover, it can be both an excess and lack of qualitative characteristics. For example, in the rental market in great demand two-room apartments Compared to one-room apartments. The value of this type of wear is calculated as the amount of losses from the rent when leaseing these apartments, multiplied by the gross-month-older multiplier, characteristic of this type of apartments. Thus, the magnitude of the fatal functional wear is determined by capitalizing the rental losses.

External (Economic) Wear- This is a decrease in the cost of the building due to a negative change in its external environment, due to either economic or political factors or other external factors. The causes of external wear can be, for example, the total decline in the area in which the object is located, the actions of the government or local administration in the field of taxation, insurance and other changes in the employment market, recreation, education, etc. Significant factors affecting the magnitude of the external wear are close proximity to "low-attractive" natural or artificial objects: marshes, sewage facilities, restaurants, dance sites, gas stations, railway stations, hospitals, schools, enterprises, etc. Wear external influence in most cases Failure.

Evaluation of the market value of the land

The assessment of the land plot is usually a rather complicated and time-consuming task.

Consider the highlights for which it is necessary to pay attention to the assessment of the market value of the built-up land plots as part in the composition of a single real estate object, which is most often found in the "mortgage" situations.

When analyzing the land lease agreement, you need to pay attention to:

· contract time;

· The presence of encumbrance and servitude, which must be further analyzed for accounting of encumbrances when calculating the market value of the object.

When analyzing the cadastral plan, you need to pay attention to:

Boundaries of the land plot;

Lack of direct restrictions on the possibility of additional buildings.

In the evaluation report, it is necessary to fix the category of land specified in the certificate of ownership or cadastral Plan The site attached to the lease agreement.

When determining the right to land on land, the following types of rights are possible:

ownership;

the right of perpetual use;

rental legal (long-term, short-term).

The choice of method and method of calculating the marketcost Land plot

The main methods for assessing land plots are given in "Methodological recommendations for determining the market value of land plots" approved by the order of the Ministry of Property of Russia dated March 06, 2002 No. 568-p.

It should be noted that before proceeding to calculations of the value of the land plot, it is necessary to formulate a conclusion about the "density coefficient" and the opinion on the "sufficiency" of the land plot for the full functioning of the object.

When forming an output, it is necessary to identify the ratio of the area of \u200b\u200bthe land plot and the construction area. The source of information on the area of \u200b\u200bdevelopment may be a certificate of the owner, or data of technical passports. BTI buildings located on this land plot.

In this situation. The question is, how to allocate the necessary adjacent territory. To form a reasonable opinion on "sufficiency" of the land plot, it is possible to "repel" from the existing SNIPs (if they remained relevant to modern objects) or on the requirements of professional developers, presenting investment projects related to commercial development.

Comparative approach to real estate assessment for deposit purposes

A comparative approach is one of the most frequently used approaches during the assessment of real estate objects for the purposes of pledge.

This assessment approach is based on the substitution principle. It is based on the assumption that the prudent buyer for the landing facility will not pay great amountThan that for which you can purchase a similar quality and fitness. A comparative approach is based on the dependence of the cost of the estimated object with the sale of similar objects. Each comparable sale is compared with the estimated objects. The price of comparable sales are amended, reflecting significant differences between them.

A comparative approach includes several stages.

1st stage.The state and trends of market development and especially the segment to which the estimated object belongs is studied. Objects are detected, most comparable to the estimated.

2nd stage. Collecting and checked information on facilities-analogues; The collected information is analyzed and each analog object is compared with the estimated object.

3rd stage. On the selected differences in the pricing characteristics of the compared objects, adjustments are made in prices of sales of comparable analogues.

4th stage. Contributed to the adjusted prices of facilities - analogues and displays the total value of the market value of the assessment object based on a comparative approach.

The main advantage of the comparative approach is that it is focused on the actually achieved purchase and sale prices of similar objects.

In general, the possibility of applying a comparative approach depends on the availability of an active market, since the approach involves the use of data on actually perfect transactions, as well as from the openness of the market and the availability of financial information.

The question of the correctness of using a comparative approach in the absence of market transactions is quite complicated. As a rule, this situation may be observed in small settlementsWhere the market is developed weakly and in the available information sources there are no information about the sale and sale of comparable objects.

In this case, as an acceptable solution, the following algorithm can be used:

the "similar" cities, located in the same area, region, etc. are defined. (the criteria of comparability may be - the number and level of income of the population, the availability of the developed housing market, the location in relation to the "key" transport highway, etc.);

the search for data on comparable transactions is carried out:

the calculation is calculated, if necessary, appropriate adjustments are made.

It is important to note that such an approach should be applied with sufficient accuracy. This method can be used as an auxiliary approach that allows you to understand whether the cost of an object obtained within the framework of other approaches (income and expense), in a comparable range or not.

When applying this approach, it is important to prevent an error in incorrect identification of the degree of liquidity of the assessment object and, as a result, the assessment of a completely illiquid object with the subsequent issuance of the "desirable" result for "valid".

The main stages of real estate assessment during comparative approach:

choosing analogues and collecting information on analogues;

choice of comparison unit;

amendments to the dedicated differences in the pricing characteristics of the compared objects;

formation of the total value of the cost.

Consider the highlights for which it is necessary to pay attention to each of the stages.

The choice of analogues and the collection of information on the analogs is the first and actual key stage as part of the use of a comparative approach.

The following basic comparison elements can be used to select analogs:

Functional purpose;

location;

Physical characteristics (size, state of object, etc.).

Functional purpose is one of the key comparison elements. A gross error may be a choice as analogs of objects of completely different functional purposes.

With great care, it is necessary to approach the choice of analogues if the object is potentially subject to demolition or reconstruction. When choosing analogs it is important to understand what is based on the buyer's motivation. As a rule, in a similar situation, the basis of motivation will first of all, the acquisition of the rights of a new facility can be laid. Accordingly, it is advisable to focus on objects to be demolished as analogs, with a comparable location and pay attention to the possible allowed use of rights to the land plot.

Sources of information, for the formation of a list, analogs and obtaining necessary for the evaluation of information are:

Preliminary data obtained as a result of search on the Internet;

Data provided by analytical agencies and real estate companies;

Own databases that are conducted by an estimated company.

A sufficiently typical is the situation when information does not contain all the necessary data that makes it possible to form the conclusion that the choice of analogs is carried out correctly.

In case of incomplete information about the values \u200b\u200bof the basic pricing factors of objects offered as analogue, an external inspection of these objects is required. Of course, the application of photos of the analogs and the application of objects analogs on the city map along with the object of the assessment will give even more complete visual, information.

After selecting analogs and information collection follows stage selection Unit of comparison.

As the most frequently used comparison units can be:

1 sq. M. total area;

1 sq.m. Useful or rental area.

It is necessary to note the importance of the correct choice of the comparison unit and determining the value characteristics of this parameter.

After selecting comparison units make amendments.

The theory of real estate assessment distinguishes the following types of amendments:

Percentage (for example, corrections for location, wear, sale time, etc.);

Costs (for example, amendments to high-quality characteristics, as well as amendments calculated by statistical methods). The monetary amendments contributing to the price of the analogue-analogue sold as a whole should be attributed to the presence or absence of additional improvements (warehouse attacks, parking lots of vehicles to Ave.);

Absolute

Relative.

Let's stop more basic moments, which must be taken into account when forming amendments.

Allocate ten basic, comparison elements (actually by adjustments), which must be taken into account in the sales comparison method:

1. Transferred rights transmitted;

2. Financing conditions (in Russian practice it is rare enough);

3. Terms of sale;

expenses committed immediately after purchase;

market conditions;

location;

physical characteristics (size, quality of building materials, building condition);

economic characteristics (operating costs, the terms of the lease agreement, administrative expenses, the composition of tenants, etc.);

type of use;

10. The components of the cost not included in the real estate.

In essence, the above-mentioned comparison elements are criteria when choosing analogs. Than. More precisely, the analogue corresponds to the specified characteristics object of the assessment, the less the amendments will be made and the more reliable result will be obtained.

Consider each of these items in more detail.

Transferred property rights. The price of the transaction depends on the transferred property rights. The situation is quite typical when there are existing lease agreements on the areas of the estimated object. In this case, when determining the value of the object, the amendment should reflect the differences between the revenue potential of the estimated object and analogue.

Financing conditions. The presence of a borrowed source of financing can also affect the cost of the object. To calculate the amendment, it is necessary to have full information about the financing scheme adopted in a particular case. Based on the conditions formed on russian marketThis adjustment is rare enough.

Similar documents

Concept, features housing mortgage And the need, the methodology for assessing real estate for mortgage lending purposes. Determination of the cost of the building with various approaches to real estate assessment and the use of a cost, comparative and profitable approach.

thesis, added 06/23/2011

Features of the assessment of the objects of the pledge. Analysis of the use of land. Determining the market value of the assessment object on the basis of cost, comparative and profitable approaches. Justification of liquidity coefficient and final value conclusion.

thesis, added 12/19/2011

Classification of real estate objects, general principles for their assessment. Analysis of the situation in the secondary market of commercial real estate in Novosibirsk. The use of expensive, income and comparative approaches to the assessment of the market value of the administrative building.

thesis, added 28.06.2012

Assessment of office real estate. The main characteristics of the application of three assessment approaches (comparative, income and cost). Determination of the market value of the land. Coordination of results and conclusion about market value.

thesis, added 04.08.2012

The concept, main stages and methods for assessing real estate. Calculation of the value of the property (four-room apartment) using comparative, profitable and costly approaches to the assessment. Capitalization of income, its relationship with the current value.

coursework, added 02/27/2014

Determination of the market value of the real estate object using cost and profitable approaches to real estate assessment and comparative analysis Sales. Assessment of the physical wear of individual structural elements and engineering systems of a residential building.

coursework, added 12.03.2013

Features of real estate as an assessment object. Cost types defined in real estate evaluation. Calculation of the value of the property complex "Complex of buildings" using methods within the framework of comparative, costly, income approaches. Ellwood technique.

course work, added 12/14/2010

Assessment of the cost of machinery, equipment and vehicles for deposit purposes. Types of value used in assessing in order to pledge. Comparative, costly and profitable approaches to the assessment. Calculation of the market and liquidation cost of the estimated car.

coursework, added 11/11/2014

Analysis of the real estate market of the Tula region. Determination of the market value of the property. The location environment of the assessment object, a description of its main parameters. Characteristics of approaches to real estate assessment. Calculation of liquidation cost.

coursework, added 03/14/2014

Determination of the estimated value of an unequipped non-residential premises for pledge. Analysis of the best and most efficient use of the real estate object. Determination of the value of non-residential premises by various approaches to real estate assessment.

The value assessment for the purposes of the pledge is a procedure that allows you to determine the current market value of the collateral real estate and understand the objective ratio of the amount of the collateral and the amount provided by the loan, arranging the borrower and the creditor. Moreover, this species Estimates can be carried out to resolve disputes between the parties to the credit transaction arising from the recovery of the laid real estate.

Real estate assessment process for pledge

Real estate assessment for the purposes of collateral has its own characteristics, are primarily due to the fact that three sides are involved in this process:

- banking institution - lender;

- borrower;

- independent appraiser expert.

At the same time, the bank bank is interested in identifying the real price of property provided as collateral and assess the risks associated with issuing credit funds. And in the interests of the borrower to get the maximum loan size under the asset. The feature of the assessment of the property with the purpose of pledge is that an independent expert in this situation protects the commercial interests of both parties and ensures the transparency of the credit transaction.

The assessment of property for the purposes of pledge is made in several stages:

- agreed technical task with a borrower and a representative of the banking organization;

- the assessment object is established and the specified value;

- current rights and encumbrances are determined;

- the approaches and methods that will be used to evaluate real estate is secured;

- assumptions and restrictive conditions are established;

- the required amount of information and the deadlines necessary for the evaluation procedures are determined.

- collecting and processing received information;

An appraiser expert or a group of appraisers holds necessary documents and analyze the data obtained. In the process of inspection of real estate, inconsistencies of the planning (or other properties of real estate) of information displayed in the right-point documents can be revealed. In such a situation, the need to make the need to make appropriate changes to the documentation to prepare an expert report and receive a loan.

- the building is made (build), apartments, private houses, premises, land;

The market, liquidation or other cost is determined using the techniques and approaches set at the first stage.

- the results obtained when using different methods are coordinated;

- a report on the assessment of real estate for the purposes of the pledge and is provided to the parties, in accordance with the Treaty.

Who can conduct an independent assessment?

Real estate assessment for the purposes of pledge has the right to evaluate firms and independent evaluator experts:

- having appropriate qualifications;

- being a valid member of one of self-regulatory organizations appraisers;

- insupporting their professional responsibility.

In addition to the above criteria, it is also important to also pay attention to the accreditation of the company or the appraiser in the bank, in which it is planned to receive a loan.

- objective assessment of the market value of real estate to obtain a loan in accordance with legislative requirements, international and banking standards;

- free provision of consultations;

- the ability to order the determination of the value of any assets for various purposes. Customers are available for assessment of shares, investment projects, business, property complexes, commercial and residential real estate, land plots, intangible and other assets;

- free preliminary request for the estimated value of any assets;

- analysis of liquidity and estimated exposure period;

- analysis of the real estate market to which the estimated object belongs.

Assessment of property for a pledge of a bank is a way to find out current price mortgage property, as well as calculate the optimal ratio of credit and collateral provided. Many borrowers are interested, is the assessment of the subject of pledge? Answering this question, it is worth noting that no bank institution will issue a loan without having information about the objective price of collateral real estate. Also estimate for the collateral is obligatory in the event of disputes between the participants of the credit transaction.

Features of property assessment of collateral

Assessment of pledges during lending has certain features that are determined by the fact that two parties are interested in estimation:

- borrower;

- bank creditor.

With this banking institution, it is necessary to obtain objective information on the value of assets that ensure the guarantees of repayment of the loan, as well as determine the level of possible risks. In the interests of the credit consumption - getting the maximum amount of credit funds to ensure your property.

At the same time, the assessment of property for the purposes of pledge is made by an independent expert in order to protect the property interests of both parties and ensure the transparency of the credit transaction.

Procedure evaluation

The value assessment for the purposes of pledge, as a rule, is carried out in accordance with the following algorithm:

- There is a coordination of the details of the contract with the borrower and the authorized representative of the Bank.

- The estimate object is determined.

- The presence of existing rights and encumbrances is established.

- Approaches and methods for assessing pledge are indicated.

- Indicates assumptions and restrictions.

- The duration of the evaluation procedure and the amount of information about the object you want to receive are set.

- Collection and analysis of the information received.

An independent graduate assessment specialist or an appraiser expert team carries out:- inspection of property;

- collecting the necessary documentation;

- analysis of the market situation;

- definition key factorsaffecting the value of the estimated object;

- processing received data.

- Assets are evaluated for the purposes of collateral, in the process of which the market, liquidation or other cost is established in accordance with the methodology specified in the first stage.

- Comparison of the results obtained using different techniques occurs.

- The expert opinion (report) is prepared, which displays the market value of the assessment of the pledge.

- The report is provided to the parties to the contract.

Methods Evaluation

The procedure for assessing the deposit may include the use of a variety of estimated techniques that are used in the framework of the three approaches:

- Cost. The calculation of the cost of the asset is made by analyzing the costs needed to create or restore the object characteristics and functionality.

At the same time, various methods can be applied to calculate the cost:- comparative unit;

- quantitative examination;

- breakdowns on the components;

- definition of estimated cost.

- Comparative. Assessment of the property of pledge (real estate) is made on the basis of information about market prices for identical or similar objects. At the same time, information about actual proposals On the market, as well as recently perfect transactions.

- Profitable. The cost is calculated on the basis of methods that predict the level of income from the ownership of the object in the future.

Using this method is advisable if the following conditions are followed:- the estimated object generates income;

- it is possible to ensure reliable forecasting of future profitability.

- exploitation;

- delivery in short or long-term lease;

- resale.

It is worth noting that the most appropriate methods are determined by the appraiser's expert based on the specifics of a particular situation. However, using the above approaches can be made

Assessment for the purpose of pledge

Assessment for the purpose of pledge - This is a procedure for determining the actual market value of the collateral property, which makes it possible to determine the fair and arrangement of both parties the ratio of the value of the pledge and value of the loan. It is also carried out in order to resolve disagreements between the parties to the transaction, which appear when making the recovery of the mortgaged property.

The company "Active Business Consultation" offers qualitatively evaluation for the purpose of pledge, in compliance with international and Russian standards, reporting standards and examination.

What do we mean by bail

Pledge is the most effective way to ensure the fulfillment of obligations, since if it is presented, the creditor no longer depends on the financial state of the debtor or the guarantor. This allows you to really improve your obligations to the lender due to property, which is the subject of pledge.

The lender, according to a secured pledge obligation, in the event of a debtor of these obligations, has the right to satisfy its requirements from the value of the pledge of the pledge, mainly to other creditors of the pledger, with the exception of the seizures regulated by law. In order for the deposit to be a truly effective obligations to provide, it is necessary to take into account the following points:

The pledger must be the owner of the pilable subject, or have the right of economic management. Potential borrower Must provide its creditor documentary confirmation of the rights to the following property - to such documents include: a contract, on the basis of which the laid property was acquired, together with the proof of the transfer of property rights (invoice, act of acceptance), as well as registration certificate. In practice, a situation often arises quite often when the pledger has no agreement for the acquisition of property, due to the loss of years. In such cases, according to the current legislation of the Russian Federation, that citizen or legal entity who owns real estate for 15 years or other property for 5 years, but is not its owner, automatically acquires the right to this property.

The rental rights of the rental can also be the right to rent, or other rights to someone else's property - but in this case, the written consent of the owner or person who has such an ownership is necessary.

The subject of the pledge can be any property, including things and property rights, with the exception of the property that was withdrawn from turnover, as well as those requirements that are associated with the personality of the lender (alimony, harm to health, and other rights, which is prohibited law). There is also a list of types of property that cannot be recovered - and, as a result, they cannot be a pledge. A complete list of such property is given in Article 446 of the Civil Procedure Code of the Russian Federation.

The deposit begins to act when entering into force the contract, and on the basis of the circumstances listed in it, in accordance with the law, to provide obligations to the lender, the property is recognized as pledged. At the same time, the deposit can also be transmitted - this is allowed if it is not denied by a contract with the lender. Violation of this requirement entails recognition of the subsequent pledge invalid.

The conclusion of the pledge agreement should be carried out in writing, which is drawn up in the form of a single document, as well as in the case of exchange between persons pledges to occur with the help of a postal, telephone, electronic or other connection that allows you to establish that the document has been sent by one of the parties under the contract.

What real estate is subject to a pledge?

The bank presents fairly simple requirements for pledge: cost, liquidity. These indicators are closely interrelated - for example, market value often reduces liquidity, and the liquidation, on the contrary, increases. That is why the bank is primarily interested in the last type of value, since if the loan is not returned, the object of the pilable is alienated at a price of 10-30% lower than market value. For insurance against such risks, banks take the deposit, the market value of which is at least 30% higher than the amount of financing.

The loan secured is much easier if the rights are issued correctly and there are no court claims to the object of pledge. The liquidity of the property is also the liquidity of the property - more likelihood to get a positive decision if the object is profitable, and the size of this profits is estimated and documented in the independent examination report. But, it should be borne in mind that commercial real estate objects can be an object of deposit only if the company allocates them of all assets of the company into an independent object of the pledge agreement. The objects that are recognized as emergency and not passing state registration and inventory are not accepted as collateral.

Assessment for the purpose of pledge Commercial real estate in the company "Active Business Consultation" is primarily aimed at meeting the interests of the bank - and lenders are primarily interested in the availability of information about really concluded transactions. It is here that not only the magnitude of the transaction and the number of rented or purchased premises are indicated, but also other factors - the terms of the transaction, the level of profitability, technical characteristics. Banks need a clear substantiation of profitability regarding the estimated object - but if we are talking about just erected object, estimated estimates of building costs.

What we understand under an assessment for the purpose of pledge

Assessment for the purpose of pledge It happens with the participation of three sides: the bank, the borrower, and independent experts of the company "Active Business Consultation". The purpose of our specialists in the lending process is to protect the commercial interests of the participants, and the creation of more transparent conditions for the provision of lending services.

We offer services estimates for the purpose of pledge credit banks and borrowers (both legal and individuals), working both with the assets of the enterprise and in relation to the rights to intangible assets. It should be noted that the indication of the accurate value is a mandatory part of the granting of a loan on the security of property, this is provided for in the Civil Code of the Russian Federation, namely in Article 339.

Assessment for the purpose of pledge can be carried out by several approaches:

Comparative approach;

Profit approach;

Cost approach.

Active Business Consultation Company evaluation for the purposes of pledge Uses an integrated approach, assumed a comprehensive study of the object, its characteristics and cost.

When conducting estimates for the purpose of pledge A detailed analysis of the object is carried out, all possible ways of efficient operation of the subject of pledge are detected. A thorough study also is also subject to property that is transmitted secured by a non-single property complex, which is capable of making a profit - but only partially, but at the same time preserving independence. In the process estimates for the purpose of pledge The specialists of the company "Active Business Consultation" determine the possibility of the elemental realization of the collateral property, there are options for a gradual decline in the value of the pledge subject, which is only a link of a single production chain, in the event of a target rupture.

Basic criterion estimates for the purpose of pledge is the reliability of the pledger that implements the project. Moreover, the owner is desirable to show their "positive intentions" and confirm the movement of financial flows to the bank.

For banking institutions is a huge plus when the client provides them with the necessary understanding of the business, and due to which profit is extracted. After all, even despite the deposit, the lender will ask to submit financial documents, information on the number of clients and partner providers, to confirm the stability of financial flows. Our company "Active Business Consultation" will help in this borrower, which will develop a report in accordance with all the preferences and interests of the creditor bank - after all, if he sees that the client's business is stable, even during failures in activities and late for a small period of time Payments, the borrower necessarily calculates its loan obligations.

Also relevant assessment for the purpose of pledge And with mortgage lending. It is mandatory for the implementation of the procedure in order to resolve possible disputes, and is regulated in Article 8 of the Federal Law "On Appraisal Activities in the Russian Federation". Thus, on the usual study of modern legislative requirements, it can be concluded that independent assessment for the purpose of pledge It is durable and fair for both sides by the basis of further successful and favorable cooperation.

Results of the assessment for the purposes of pledge

As a result estimates for the purpose of pledge A report is drawn up in which the answers to the following questions will be indicated:

What is the real market value of the potential pledge?

What is the duration of the marketing period? And how much does this factor affect the cost of the pledget?

Is it possible to implement the collateral property elementary? And what is the degree of reducing the cost when the target links in the property complexes?

The report presented also contains full information About the subject of collateral - depending on whether it is a private property or a commercial asset, the main emphasis is carried out on:

The degree of liquidity of the subject of pledge and the possible deadlines for its implementation;

The value of the cash flow of the borrower, the stability of his business and the amount of income;

Development prospects.

The company "Active Business Consultation" is a professional assessment for the purpose of pledge Using all the features for the best permission of your problems.