Types of financial behavior of the population in post-crisis conditions. Theoretical approaches to the financial behavior of the population Stereotypes of financial behavior and their consequences

during the period financial crisis

(SU-HSE, IPU RAS);

Identifying the groups of commercial banks that bring the greatest instability to the banking sector, as well as determining the factors that determine the stereotypes of their behavior, is always an urgent task, especially during the financial crisis.

The report analyzes the stereotypes of behavior of Russian commercial banks and identifies groups of potentially unstable banks. For this, the method of dynamic analysis of patterns is used from year to year, the sample is 366 Russian commercial banks. For the first time, this approach was used to identify the structural features of Turkey's development in 1988-1999. (Aleskerov et al., 1997; Aleskerov et al., 2001). The methodology allows one to compare the models of banks 'behavior in the pre-crisis period of time and the stereotypes of banks' behavior that they choose during the crisis. The paper provides a comprehensive analysis based on a system of indicators that takes into account the structure of banks' operations, the level of financial intermediation, capital and liquidity adequacy, as well as the quality of the loan portfolio.

The method described above has been repeatedly applied in practice to analyze Russian commercial banks. In particular, an analysis of the development banking system in 1999-2003 (Aleskerov, Solodkov and Chelnokova, 2006) and studies of the largest Russian banks in terms of balance sheet total for the period from 1999 to 2007 (Aleskerov et al., 2008).

It is shown that the majority of Russian commercial banks (about 54% of all considered banks) are focused on providing traditional ones. There are also banks (their share is 4-5%) that specialize exclusively in investment activities. In addition, some banks (about 34%) are reorienting to investment activity more risky. The most volatile behavior during the crisis is demonstrated by banks that are part of financial and industrial groups or are focused on serving strategic clients, and thus directly depend on their core business.

Moreover, it can be noted that the dominant patterns can be assessed as adequate to the long-term development of the banking sector: a high level of credit activity with good capital adequacy (on average, about 17-18%) in combination with a liquidity reserve (70% and more). About 20% of Russian banks either firmly adhere to, or in most periods choose such behavior models. But on the considered interval, the growth of patterns in time and a greater manifestation of abnormal for the traditional commercial bank patterns (too high profitability and excess liquidity), the share of which is about 7-8%, which can be regarded as a signal of increased riskiness of commercial banks' operations, and, consequently, their instability.

Under financial behavior understands the diverse external manifestations of activities for the use of money, focused on the achievement of various goals, in the context of formal and informal rules and social relations... Thus, the field of financial behavior, in contrast to sociological theories of money, involves the analysis of people's actions in specific sociocultural contexts, including their motivation and meanings due to belonging to groups, social roles, statuses, the nature of connections, the level of culture, etc.

Financial behavior is historically specific and fluid. It is associated with diverse attitudes towards money that have developed in various social contexts, generated by myths and prejudices, customs and habits of people. His motives do not always correspond to the criterion of rationality as a property of culture determined by money; on the contrary, the observed actions of people in relation to money are often irrational, affective in nature. Also, real financial behavior is not always characterized by methodicalness and accuracy, often takes the form of spontaneous, panic actions.

The most important aspect of the analysis of financial behavior is the identification of its types depending on the motivation and nature of the actions that form its basis. To analyze the motivational component of financial behavior, one can use the "ideal types" identified by M. Weber social action, with the help of which the meanings of money management in the daily life of people are revealed. It should be borne in mind that this classification represents only "ideal types" of financial behavior, which 1) do not occur in their pure form in real life; 2) are always in complex dynamics, mutually rearranging and flowing into one another. The dynamics of the types of financial behavior reflects the transformations of both the economic and sociocultural situation and individual life situations individuals and groups.

Rational the type of financial behavior presupposes in its essence a value-rational action and "is based on strict accounting for the balance of income and expenses, on the corresponding calculation of expenses and savings." Rational behavior is focused on the selection of the most effective means of achieving goals, involves minimizing risks while maximizing profits. The goals of rational financial behavior can be both the preservation and accumulation of resources, and their increase, investment, as well as spending. The basis of rational financial behavior is methodology, accuracy, calculation, focus on avoiding excess expenses over income and minimizing accidental losses. Rational financial behavior implies freedom to make independent decisions, as well as a sufficient level of awareness and qualifications of actors.

Value-oriented the type of financial behavior is based on value-rational actions aimed at the implementation of ethical, ideological, spiritual values. This behavior is characterized by altruism based on observance of moral standards, solidarity with the social environment, the use of money to maintain and strengthen group belonging and identity. Examples of value-oriented financial behavior are charitable donations, philanthropy, gratuitous support of relatives and close people, donating money for religious needs, etc. It is motivated not by utilitarian calculation, but by social norms and moral and spiritual values.

Rational and value-oriented behavior can be separated and analytically opposed through the use of models " economic man"and" sociological man ", however, as already noted, modern science uses not so much their rigid dichotomy as the analysis of transitional, intermediate forms that are in the continuum between two polar types.

Traditional action shapes and traditional financial behavior, involving the reproduction of stable stereotypes of dealing with money, learned in the process of socialization. It is based on everyday common sense, coupled with empirically grounded "practical" (in M. Weber's terminology) rationality as the ability to calculate the immediate consequences of one's actions, but does not go beyond the usual goals and means of achieving them. Traditional financial behavior is closely related to rational behavior, but it also presupposes the inclusion of altruistic actions, if such are included in stable rules, for example, giving gifts to loved ones, participating in joint spending for public needs, donating to the church, alms, etc.

Affective actions in relation to money determine affective financial behavior, which is based on thoughtless spending, subject to emotional impulses, or, on the contrary, refusal to spend. Its variety can be recognized as the actions of gamblers, focused on the maximum winnings without any insurance guarantees; intuitive, not fully calculated investment of money; panic actions performed under the influence of spontaneous mass moods, spread of rumors, etc. Affective financial behavior can be based on both emotional attitudes towards money itself - stinginess, passionate greed in acquiring them, and affects caused by other experiences, for example, fear of political instability.

Researchers also identify more rare models of financial behavior, for example, deliberately dysfunctional, based on absolutization or, on the contrary, on a conscious ignorance of the objective functions of money and the rules for dealing with them. Persistently incompetent models appear in the absence of skills in dealing with money and financial instruments, inherent in young people, old people, etc.

The general typology of financial behavior at the level of practical money management to achieve specific life goals is expressed in strategies several types, among which it is customary to distinguish;

- consumer strategy - spending on current needs, both of a daily nature (buying food, clothing, etc.), and spending associated with the purchase of durable goods; social spending (gifts, contributions, charity, etc.); expenses associated with the implementation of life strategies and plans (payment for education, self-development), with treatment and maintenance of health, with entertainment, etc. Consumption also includes the necessary payments of taxes, interest on loans, etc .;

- credit and loan strategy - loans (consumer and targeted, for example, for education) and non-institutional debts, interest-free or involving the payment of interest. Loans and debts are liabilities of household budgets;

- savings strategy - saving money for specific purposes, for example, for future consumption, implementation in the future large purchases, implementation of life plans (for the education of children), etc. In conditions of distrust of money, savings can be carried out in natural forms of treasures (jewelry), those items that are considered as "eternal values" - antiques, works of art, real estate, etc. Saving behavior can manifest itself in the form of purposeful saving of certain amounts or simply saving unused balances of income, be of a planned, regular or spontaneous nature. The amount of savings can vary significantly; large savings are considered to be those for which a household can survive for a year without changing the prevailing type of consumption and lifestyle;

- insurance strategy - a kind of savings, which involves saving money not for future consumption, but "for a rainy day", "just in case." This can also include the acquisition of various insurance policies, taking into account that in the absence of insured event payments of insurance premiums are non-reimbursable expenses;

- investment strategy, which involves the rational investment of funds in economic activities with the aim of subsequent profit.

Sources of funds can serve as labor and business activities, payments and benefits (pensions, scholarships, alimony), interest on deposits and dividends, as well as income from the use of property, which itself is a natural saving, for example, renting an apartment, summer cottage, garage, etc. .d. Along with regular receipts, there may be occasional and temporary ones, for example, gifts and donations, inheritance, financial gaming behavior associated with the extraction of income from the stock market game, financial pyramids, lotteries, etc.

Thus, strategies of financial behavior, including the choice of sources of income, can have active and passive character. Active strategies include earning and entrepreneurship, credit and investment behavior, and passive ones - social and private payments, savings and insurance behavior.

Different strategies of financial behavior can be used in combinations of different levels of complexity, including both savings and insurance strategies, as well as investing and using loans.

The choice of a strategy by specific actors and social groups is one of the main areas of research in financial behavior today. So, one of the most modern active strategies is the use of loans. This strategy has become extremely widespread in economically developed societies that have reached the stage of mass consumption. Wealthy groups with a stable financial position and confident in the future, rationally planning their finances, are inclined towards it. According to sociologists, in modern Russia credit strategies are most common among the middle class. At the same time, credit is not an alternative to savings, but makes up for their insufficiency. An obstacle to expanding the use of credit strategy is, on the one hand, the low level of income of the majority, and on the other hand, the development of interpersonal relations and the preference for non-institutional private debts over bank loans, especially since it is not customary in Russia to lend money at interest (only 3% of creditors and 3.5% of borrowers report this practice). At the same time, groups are being formed, which are characterized by risky credit behavior focused on the development of the household through loans, mainly consumer loans. Savings for these groups, which are dominated by young people under 27 years of age, are insignificant and represent "insurance capital" that is lost over time, and debts increase, which makes them very vulnerable to external factors - changes in the economic situation, job loss, etc. ...

In the early 2000s. The researchers, while recognizing the generally passive and conservative financial behavior of Russians, noted the predominance of savings strategies over all others, with the exception of the consumer one. In 2013, a VTsIOM poll showed that 2/3 of Russians have no savings at all, since all income is spent to the end. The third of the respondents who said they have savings are dominated by passive insurance strategies ("for a rainy day"), rather than active investment ones.

This attitude towards savings can be explained, on the one hand, by distrust of existing financial institutions and the banking system, on the other hand, by poor awareness of possible tools and mechanisms for managing savings, conservatism and traditional financial behavior of the main population groups. A significant role in the reproduction of passive strategies is played by the negative experience of the 1990s, when, as a result of the spread of massive financial games and the lack of regulatory possible construction"financial pyramids", some have suffered large and irreparable losses. Mistrust in financial institutions is associated with distrust of the regulatory system as a whole, which makes the majority of even wealthy and competent people care about saving, rather than increasing them.

UDC 338.1

Publication date: 10/04/2016

International Journal of Professional Science №2-2016

Marketing Analysis of the Financial Behavior of Citizens of the Russian Federation in Crisis Economic Conditions

Marketing analysis of financial behavior of Russian citizens in crisis economic conditions

Tyotushkin Vladimir Alexandrovich

Candidate of Technical Sciences, Associate Professor, Department economic analysis and quality,

Tambov State Technical University

Email: [email protected]

Tetushkin Vladimir Aleksandrovich

candidate of technical sciences, associate professor, sub-department of economic analysis and quality,

Tambov State Technical University

Annotation: The relevance of the study is explained by the fact that today it is necessary to regularly monitor the mood and needs of citizens and track the dynamics of demand for certain financial products, identifying frequent mistakes or misunderstandings that Russians face when making financial decisions. The Russian consumer is unique, and the financial behavior of Russians has a pronounced national, cultural and geographic specificity. The financial culture, literacy, and experience of our population are just beginning to take shape as we grow. The purpose of this study is to combine scattered fragments with data from 2008 to 2015 contained in open sources of information to obtain a volume of information that makes it possible to better understand the interdependencies between financial market players and predict further development and possible consequences for business and the population in the financial sector under conditions crisis. Materials and methods. In this work, using a systematic approach and a comparison method, aspects of the influence economic crisis on the financial behavior of citizens of the Russian Federation. Results. The scope of the results covers scientific research for students and teachers, as well as recommendations for banking or other financial enterprises and organizations. Analytical data reflecting trends in the field of financial behavior of citizens are presented. A qualitative description of the financial behavior of citizens of the Russian Federation in crisis economic conditions is presented on the basis of available data.

expert agencies. Conclusions. Promotion issues financial literacy populations are increasingly on the agenda of governments different countries... Today, when Russia is more and more integrated into the world community and becomes a full-fledged player in the world market, the need to improve the financial literacy of the local population is growing.

Abstract: The relevance of the study due to the fact that today it is necessary to regularly monitor the attitudes and needs of citizens and to monitor the dynamics of the demand for certain financial products, identifying common mistakes or misunderstandings faced by the Russians when making financial decisions. Russian consumers are unique, and financial behavior of Russians has a distinct cultural and geographic specifics. The financial awareness, literacy and expertise of our people are just beginning to emerge as growth. The purpose of this study is to combine disparate pieces of data 2008 - 2015, contained in open sources of information to obtain amount of information allowing a better understanding of the interdependence between the players of the financial market and predict the further development and possible implications for businesses and people in the financial sector in a crisis. Materials and methods. In the present work using a systematic approach and comparison method analyzed aspects of the impact of the economic crisis on the financial behavior of Russian citizens. Results. The scope of the results covers research for students and teachers, as well as recommendations for banking or other financial enterprises and organizations. Presented analytical data to indicate trends in the financial behavior of citizens. Presents a qualitative description of the financial behavior of Russian citizens in crisis economic conditions based on available data expert agencies. Conclusions. The issues of improving financial literacy are increasingly on the agenda of governments of different countries. Today, when Russia is increasingly integrated into the world community and becomes a full player on the world market, the need to improve financial literacy of the local population increases

Keywords: marketing, finance, economics, behavior, analysis, crisis

Keywords: marketing, Finance, Economics, behavior analysis, crisis

Introduction

With the help of the theory of the cycle, we can say that all spheres of human life, as well as natural phenomena, develop cyclically. The same applies to the economic sphere. There is a theory of the business cycle that explains the nature of the development of the economy over time. Statistical data indicate that the change in indicators characterizing economic activity is not monotonous, but oscillatory (cyclical). The direction and degree of change of an indicator or a set of indicators characterizing development National economy are defined as economic environment... Therefore, the theory of economic cycles is also called the theory of conjuncture. The economic cycle means the period of economic development between two identical conditions of the conjuncture. One of these states in the theory of the cycle is a crisis.

Crises, according to many scientists, can reflect not only the contradictions between functioning and development - they can also arise in the very processes of functioning. This is, for example, a contradiction between the level of technology and the qualifications of personnel, precise technologies and the conditions for its use (premises, climatic environment, technological culture, etc.). A crisis is an extreme aggravation of contradictions in the socio-economic system (organization), threatening its viability in environment... The reasons for the crisis can be objective, related to the cyclical needs of modernization and restructuring; subjective, reflecting errors; natural, etc. The causes of the crisis can be external and internal. If we understand the crisis in this way, then we can state that the danger of a crisis always exists, that it must be foreseen and predicted.

The savings behavior of the population has recently been studied quite closely. The attention to this issue is not accidental. Bank deposits are an important investment resource, and the financial literacy of the population is already seen as an essential factor in the development of the country as a whole. Let's analyze Russian and foreign sources on the topic under study.

In the work of Fatikhov A.I. describes the main problems of social management of financial behavior of the population. In the article by A.V. Yarashev. analyzes the features of the functioning of the Islamic economic model, in particular the banking system, active and passive operations in Islamic banks. The use of such financial instruments in Russia could be used as an effective anti-crisis measure. How is their financial behavior changing during the crisis? The author of the article, MS Shcherbal, tries to find an answer to this question by analyzing the data of all-Russian surveys on the financial behavior of households during the crisis of 2008–2009. Positive change in the financial behavior of the population is one of the main goals of the launch state program financial education population of Russia. This goal can be achieved by studying the factors and motives that influence the choice of a behavior model - savings, credit, investment or insurance. Galishnikova E.V. stresses the need to organize training for the population of our country on planning issues personal budget... Many investment implications are related to weak institutional support effective use personal savings of the population as an investment. Undoubtedly, personal savings are a reliable and significant source of the formation of credit resources and financial resources for the implementation of the investment process. However, this source is almost never used and largely due to the fact that the corresponding institutions have not been created. In this regard, among the specific areas of more active use of institutional and organizational forms of attracted personal savings of the population in investment purposes The article highlights such as the creation of a reliable system of state protection of bank deposits of individuals, the issuance of various financial instruments designed to serve the population, the regulation of the interest rate, the yield on deposits and securities, the streamlining of the legal framework and the development of incentives for financial institutions working with the population ... Voronov A.A. examines some of the features of the financial behavior of consumers banking services during the economic crisis of late 2008 - early 2009. Arkhipov A.A. considers a model of the economy with optimization of consumer utility, which reflects the impact of the degree of development of financial markets on consumer behavior.

Analyzing the results of all-Russian polls of such sociological services as NAFI, VTsIOM, FOM, September-November 2008, the author of the article examines how the financial crisis that began in September 2008 influenced the behavior of Russians. Special attention Kuzina O.E. identifies social groups, most affected by the crisis, fixing what exactly the impact of the crisis manifested itself in and what reaction it caused. The paper presents the main theoretical provisions of the financial behavior of the population, shows its main types and characteristics. The topical areas of research of the financial behavior of the population in Russia are highlighted. The article presents the main phenomena of behavioral economics and highlights on specific examples differences in understanding of consumer behavior between traditional and behavioral economics. Knyazev P.A. showed the differences in the strategies of economic behavior of Russian youth in comparison with the economic behavior of the population of mature age during the financial crisis. Alieva I.A. considers the factors and types of financial behavior of the population that determine the state and volume of domestic savings as sources of expansion of the reproduction process in the real sector.

In conditions of economic instability, savings behavior becomes key factor ensuring the financial security of a person, since financial well-being for many years can depend on a correctly chosen savings strategy, G.A. Abramyan believes. ... Highly skilled workers, workers of medium and low qualifications, as well as ordinary workers in trade and services are very close to each other in terms of their real financial behavior and attitudes that dominate in this area. At the same time, they noticeably differ from persons holding positions of the middle class, as well as from non-working Russians, believes A.V. Karavai. ...

The article examines the institutional subjects of the financial market as buyers of financial instruments and the risks associated with the process of consuming these instruments. Mordashkina Y. notes the role of large investors in terms of accumulation and capital management in terms of internal processes of consumer behavior. Brekhova Yu.V. and Almosov A.P. presented a model of the formation of a person's financial behavior with the identification of features associated with the stages life cycle... Based on the results of the analysis, the features of the stages of a person's life cycle, factors that determine his financial behavior were identified, and the infrastructure of financial relationships between individuals and the external environment was considered. D.V. Latyninproposes the author's classification of the types of financial behavior of credit institutions and gives recommendations on the advisability of using a specific type depending on the value of the aggregate index of the region's provision of banking services... Burdastova Yu.V. explores the evolution of views on the financial behavior of the population in economic science. The basic provisions of various economics schools on the motives of the financial behavior of citizens. The model of saving behavior of the population in the conditions of the financial crisis is presented in the work of A.R. Afanasyeva, A.A. Rabtsevich. ... Financial literacy of the population as an element of financial behavior is considered in the work of Rubtsov E.G. ... A number of foreign scientists were engaged in the analysis of trends in financial behavior during the crisis.

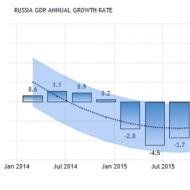

In this article, we will consider the generally recognized crisis periods in the Russian Federation in 2008-2009. and 2014-2015 Despite the improvement in the economic situation in Russia after 2009, the study of the peculiarities of the financial behavior of the population during the crisis has remained relevant. This is due to the fact that today not only Russia, but also most countries have entered a dangerous period of uncertainty. Back in early 2009, when the financial and economic crisis was just gaining momentum, experts predicted that the first wave could be followed by a second, more powerful one. Recently, the scale and depth of the crisis in a given country is increasingly determined not only by the peculiarities of the national model. market economy but also powerful factors of globalization.

The central element of any socio-economic strategy, which is the most important prerequisite for material well-being and social well-being, is its financial component associated with the problems of earning, accumulating, saving and spending money, including the issues of making decisions about spending and saving, accumulating funds for purchasing expensive goods. , getting an education, ensuring a prosperous old age. Economic instability and the lack of a clear vision of the future cause some of them to strive to reduce or limit spending, while others, on the contrary, strengthen their orientation towards current consumption. In crisis conditions, 36.3% of respondents are ready to spend money more intensively out of fear of losing their modest savings or for other reasons, while 32.6% of respondents disagree with this position. Among the latter there are many people who, trying to protect themselves from negative economic impact, try to keep their savings without resorting to unplanned purchases, believes P.M. Kozyreva. ...

The factors that hinder the processes of socio-economic adaptation in today's Russia include a huge deficit of literacy in the field of financial management and skills of active financial behavior, the ability to manage funds. This disadvantage is part of a more general and wider problem of the deficit in all social groups of modern economic culture, under which, according to R.V. Rybkina, we understand those traditions, habits and established norms of behavior that are implemented in the economic sphere and are associated with economic activity of people. Developing in the process of long-term economic development, based on economic experience, economic culture fixes the most stable beliefs and behavior patterns of the participants in this process. The presence of a highly developed economic culture is a prerequisite for the formation of a civilized market. The financial behavior of the population is broadly characterized as an activity to mobilize and use financial assets... So, A.I. Fatikhov interprets the financial behavior of the population as "the activity of individuals, social groups and communities to achieve general and personal goals aimed at satisfying their needs through the use of financial resources in the interaction between themselves and financial institutions." In the conditions of cyclical development of the economy, both the amount and the structure of savings change. According to Yu.A. Varlamova, at the stage of economic growth with a stable functioning of the banking system and stock market income growth is accompanied by an increase in household savings and the spread of an organized form of their storage (bank deposits, purchase of securities). On the stage economic downturn reduction cash income population forces households to reduce savings in order to maintain the level of consumption; while trusting financial market is lost, and households convert the accumulated organized savings into cash, acquiring foreign currency, or in kind (real estate purchase).

In my opinion, financial behavior is a combination of financial strategies implemented by the population to mobilize, redistribute and invest money, built to meet their needs. Financial behavior includes an individual's income generation strategy, consumer, savings and investment behavior.

Analysis of the dynamics of the demand for banking services

The number of users of banking services in 2014 stabilized. The most popular remain salary cards, recurring payments and consumer loans... Total share banking clients among the population over the past 7 years has grown steadily. If in 2008 only every second Russian citizen used the services of banks (52%), in 2011 there were 74% of them, and in 2012 - already 77%, in 2015 - 83%. However, during 2012, the growth rate did not increase, and the share of banks' clients stabilized at 77%.

The shares of users of most types of banking services in 2013 did not undergo significant changes. The exception was term deposits and money transfers - for these services there is a slight decrease in the share of users. In part bank deposits this is largely due to seasonality. As for money transfers, the outflow of clients from banks is explained by the active development of non-bank payment service providers in the market.

To solve the problem of universal coverage of the population with banking services, banks need to search for qualitatively new ways of providing services (for example, such as remote banking) that will serve the representatives of low-income market segments, as well as residents of remote and rural areas. According to CGAP research on the state of financial inclusion in Russia, these categories today remain the least covered by financial services. In addition, in some countries (for example, the United States) there are laws requiring banks to equally serve all market segments in their coverage area, experts say.

The reasons for the stabilization of the share of banking customers largely depend on the product and the market situation. For example, at the beginning of 2016, there is an increase in the propensity to save, which will inevitably lead to an increase in the share of bank depositors. If mortgages, taking into account the cost of housing, are still not available to a significant part of the population, then a low share of users bank cards and Internet banking is explained, first of all, by the insufficient level of financial literacy of the population, which does not fully realize the benefits of using them. The task of banks, together with the state, is to clarify this, as well as to expand the availability of banking services, for example, by using special programs, such as government-backed mortgages.

Every fifth Russian planned to start using a banking service in 2012 within the next 12 months. Among them are both future new clients and those who already have experience of interaction with banks and plan to expand the range of consumed banking services. Potential clients of banks in 2012 were determined to borrow more than save, in contrast to the indicators of early 2016. For example, 10% of Russians planned to use a bank loan, and only 4% planned to use a deposit. Among the credit products, consumer loans were most in demand - 60% of potential borrowers were going to arrange them in the coming year. In second place was a car loan, and in third place was a mortgage. Among deposits, time deposits (deposits for a certain period, at interest) have traditionally been in the lead.

With increasing age, there is a change in credit motives. If young people under 24 are more likely to use a consumer loan, and older Russians (25–34 years old) are more likely to use a car loan, then representatives of the middle age group (35–44 years old) are more interested in getting a mortgage.

Table 1.

Use of banking services by the population of the Russian Federation

Source: NAFI

The plastic card is the second most popular segment of the potentially demanded. So far, this is largely due to the growing popularity salary projects... And the fact of possessing such a salary plastic card remains an element of “forced” loyalty, since the decision to choose a bank is made exclusively by the employer. However, the Russians intend to quite actively draw up plastic cards and on their own initiative - both debit (27%) and credit (28%).

Table 2. Structure of potential demand for banking services,% of respondents

Source: NAFI

Financial, economic and political upheavals in Russia alternate with periods of more or less stable stability. That is why consumer behavior is based on the lack of planning habits, including financial issues. And decisions about whether to take a loan or open a deposit in a bank are made spontaneously, depending on the current circumstances. Therefore, at the beginning of 2016, almost 80% of Russians surveyed either find it difficult to answer, or say that they do not plan to start using new banking services in the next 12 months.

Russians are increasingly comparing the terms of financial services before purchasing them. The share of those who do this has increased over the past 5 years by more than one and a half times. A third of Russians always compare financial services before purchasing. This indicator has remained stable since 2009. People who have experience of interacting with the bank choose financial services more rationally. For example, among Moscow banking clients, two-thirds always compare the terms of service in various companies, while among Russians in general, only 29% adhere to this strategy.

The most attentive to the choice of financial services are representatives of the middle age groups. Comparisons of tariffs for financial services are carried out by 71% of respondents aged 25 to 34 years, 66% - from 35 to 44 years old, and 65% - from 45 to 60 years old. The only exceptions are the youngest (18-24 years old) and the oldest (over 60 years old) Muscovites. Rational behavior is less common in these populations. It is noteworthy that the number of consumers comparing conditions increases significantly with the growth of income levels. Those who make comparisons of conditions and tariffs of financial services irregularly are one and a half times less among the residents of the capital than among the population as a whole (29% versus 45%). But the number of those who never compare the terms of providing financial services has not changed since 2009. and remains at the level of 14-18%. These are more often representatives of the older generation, as well as residents of small towns.

The ability to compare financial products and services from different companies before purchasing them, according to scientists, characterizes the positive financial behavior of consumers. However, the almost two-fold decrease in 2011 compared to 2008 in the share of Russians who never compare financial services before buying them is not an unambiguously optimistic trend. Behavioral economics has shown that a person does not always follow logic when making a choice. An emotional reaction to appeals, words, images can influence the decision to purchase a financial product more than an accurate calculation. An excessive variety of choices can confuse the consumer, and even after comparing several products, he will choose the one that is most familiar and understandable to him. Market financial products and services are characterized by an asymmetry of information, which increases with the growth of their diversity, complexity and novelty. To make an informed decision that meets the needs and budget, the consumer must understand the key terminology used in the contract, have the patience and time to read it through, and be able to assess the risks. Comparing financial services requires more than improving consumer financial literacy. It is essential that financial institutions provide information on simple language in a standard and comparable form. The bank's experience, its scale and the professionalism of its employees are the three factors that have the greatest influence on the choice credit institution among internet users. Least of all, the Internet audience is guided by the presence of a bank branch near the house, office, the number of bank advertisements or its belonging to a foreign brand. The long term of the bank is mentioned by network users most often as a criterion for choosing a credit institution. And this fact is often paid attention to by consumers of the middle age category (from 25 to 44 years old). The second place was shared by two criteria - the size of the bank and the level of professionalism of its employees. It is noteworthy that the scale of the bank and the presence of a large branch network are more important for men - 48% of the stronger sex indicated this (versus 42% among women). The cost of services closes the four most important factors in choosing a bank. However, with the increase in the age of the Internet audience, this criterion becomes more and more important. The popularity of the bank, as well as its state ownership, are less important for network visitors than the cost of services. It is noteworthy that with an increase in the level of income of Internet users, the importance of whether a bank is state-owned or not significantly decreases.

The recommendations of friends and relatives are also indicated by the Internet audience as one of the criteria for choosing a bank. It is interesting that with the increase in the age of network visitors, as well as with the growth of their income level, the significance of this factor significantly decreases. In addition, men attach more importance to the level of fame, and women - to the availability of state support from the bank and the recommendations of loved ones. The absence of queues at the bank is more important for Internet users of the older age group (45 years and older), and convenient opening hours of branches are more important for the capital's network visitors.

Almost a third of Russians (29%) are ready to pay an increased commission for banking services under certain conditions. The majority (59%) under no circumstances will pay a higher commission than in other banks. The willingness to pay higher fees decreases with age. Thus, among Russians who are not ready to pay a higher commission, the share of older respondents (55 years and older) was 33%, while those aged 18 to 24 are only 13%. Reliability and popularity of the bank (40%), efficiency of service (34%), as well as proximity to home / office (32%) are the main conditions under which the population is ready to pay a higher commission than in other banks.

Table 3. Important characteristics of the bank for clients

Source: NAFI

It is noteworthy that the above three factors persist in relation to any banking products and services. There are also a number of additional conditions affecting the decision of consumers of certain banking services. For example, loan borrowers are loyal to higher commissions if they receive more profitable terms by service (% rate, required documents, terms of service provision, etc.). And when implementing money transfer and payments (housing and communal services, fines, etc.), a high commission can be compensated for by faster service and the absence of queues.

Most Russians bought New Year's gifts for own funds or accumulation. Those who spent borrowed money on gifts are few - no more than 5% of the population. Bank loans were in little demand among Russians as a way to pay for New Year's gifts. So, in particular, no more than 1% of the population planned to issue a loan for a product / service directly in the store, use borrowed funds with credit card- the same amount, and Russians did not plan to take bank loans in cash to buy gifts. Another 3% of the population was still going to borrow, but not from a bank, but from relatives or friends. And 15% of the respondents admitted that they refused any New Year's gifts and did not plan any purchases. It is important to note that both men and women, as well as Russians of almost all age groups, demonstrated rational and restrained behavior in matters of purchasing gifts.

Analysis of the problems of financial literacy of Russians

Russians' assessments of their own level of financial literacy continue to decline. The number of respondents who consider their knowledge of finance to be excellent or good is decreasing. The share of those who assess their knowledge as unsatisfactory or admit in their absence, on the contrary, is growing. A decrease in the proportion of those who rate their level of financial literacy at “5” (excellent knowledge) and “4” (good knowledge) has been observed over the last 5 years. For example, in 2010 there were 25% of them, in 2011 - 20%, and in 2013 - 13%. The number of respondents who consider their knowledge of finance to be satisfactory also decreased (37% in 2013 versus 44% in 2011). The share of those who rated their level of financial literacy as unsatisfactory increased by 11 points and in 2013 amounted to a third of the respondents (32%). The tendency has also persisted towards an increase in the number of Russians who admit that they lack knowledge and skills in the field of personal finance(7% in 2010, 15% in 2011, 18% in 2013). The respondents aged 24 to 35 give the highest assessment of their level of financial literacy. Among the representatives of this age group, 17% consider their knowledge and skills in the use of financial services to be good. Among the population as a whole, this figure is 11%. The level of income and the activity of using the Internet have a significant impact on the subjective self-assessment of the level of financial literacy. The percentage of Russians who consider themselves financially literate is higher among high-income groups of the population, as well as among active Internet users.

Table 4. Analysis of financial literacy of the population

Source: NAFI

Subjective financial literacy, or what Russians think they know, is just as important as objective financial literacy, or what Russians actually know. High self-esteem of financial literacy is influenced by confidence in knowledge of personal finance and in actions in the financial services market. Having an interest in financial issues, a positive outlook on life, personal experience, and a sense of personal control over the situation also increase self-esteem. Conversely, the emergence of a wide range of new complex financial products and services can increase people's uncertainty about the preparedness to use these products and cause a decrease in self-esteem. People can be confused about how much they really know. Inaccurate self-assessment of financial knowledge has negative consequences. Overconfidence in the securities market often turns into making unfounded investment decisions, experts say.

Less than a third of Russians manage the family budget. At the same time, the level of financial discipline of the population has remained practically unchanged since 2009 and remains low. The share of Russians keeping strict records of income and expenses is not growing too much (11% in 2009, 2010, 2011 and 12% in 2013, 13% in 2014-2015). At the same time, family finances are becoming more common, when not all income and expenses are recorded. The share of those who do not control family finances remains too high (68% in 2013). Most of them do not record income and expenses, but in general they are guided by how much money was received and spent. There were 53% of them in 2013 (against 45% in 2008). The share of Russians who do not keep records and do not know exactly the amount of financial receipts and expenses in the family for a month increased by 6 points compared to 2008 and amounted to 15% in 2013. Traditionally, the practice of keeping family income and expenses as clear and strict as possible is most common among high-income groups of the population. Lax family budgeting is more typical of the middle and so-called "pre-middle" class. And the lack of skills and practice of keeping records of family finances is more characteristic of representatives of low-income groups. Russians' assessments of their own level of financial literacy continue to decline. The number of people who consider their knowledge in the field of finance to be excellent or good is decreasing. The share of those who assess their knowledge as unsatisfactory or admit in their absence, on the contrary, is growing.

2012 went down in history as the year of aggressive growth in consumer lending in Russia. Much of this growth came from lending to precisely those segments of the population who responded that they had no control over family finances. It is difficult to be a responsible payer of your debts without basic financial discipline, but hardly credit institutions they will en masse demand that potential clients pass the financial literacy exam, without a positive assessment for which a loan will be denied. If there is no internal financial discipline, The best way to instill such a habit - to make banks interested in creating such a "habit" for their clients from the outside. By making fines proportionate to the amount of arrears, lawmakers will force banks to work not for fines and can thus push banks to proactively remind customers of the timing and amount of payments.

In the context of the crisis in 2016, the formation of savings and the optimization of daily expenses are the main incentives for managing the family budget. And the main reasons for abandoning this practice are the low level of financial literacy and low earnings. In 2013, less than a third of the population noted that they keep records of their income and expenses. And this figure has decreased significantly since 2008 (from 42% in 2008 to 31% in 2011). The majority of Russians do not adhere to the practice of accounting for the family budget. Among the motives for managing the family budget, inappropriate savings (just in case, for a "rainy" day) are in the lead. A similar motive is relevant for 28% of those surveyed who control family finances. The unwillingness to live in debt and the desire to have confidence in the future stimulate the keeping of records of family income and expenses for almost a fifth of the disciplined residents of Russia. And 10% of the respondents, who control the family budget, cultivate financial discipline in themselves. Every fourth among those who do not have the practice of managing a family budget does not see the point in such actions. The same number of Russians who do not keep records of income and expenses do not do it because of low earnings (“I earn little, so I have nothing to plan”). And 7% admitted that they do not know how to keep such records. And almost a third of Russians who do not adhere to the practice of accounting for the family budget could not explain the reasons.

Russians have little idea what taxes they pay, whether they do it on time and what responsibility they bear. Muscovites understand these issues a little better. About a third of Russians and every fifth Muscovite do not know what taxes they pay (30% and 20%, respectively). Young people from 18 to 24 years old are the least informed - up to 41% of Russians of this age do not have this information. 43% of Russians are well aware of the responsibility in case of non-payment of taxes (among Moscow residents - 38%), while 44% of our fellow citizens (among Muscovites - half) are poorly informed about the consequences. More than half of Russians (54%) are not aware of the budget and for what the taxes they pay are allocated. Capital residents have such information more often (61% of respondents versus 36% in Russia). Every fifth respondent in Russia indicated that he knows entrepreneurs in his region who evade taxes. In Moscow, the share of such respondents is about 15%. Most often, the identity of defaulters is familiar to residents of large cities with a population of 500 to 950 thousand people (29%), as well as those surveyed in small towns (50-100 thousand people - 31%).

Half of Russians (51%) have no experience bank lending... Either low-income groups of the population for whom credit is not available, or respondents with a high level of earnings who do not need loans were not covered. Bank loans are more often inaccessible to residents of villages and small towns (with a population of less than 100 thousand people), as well as young people aged 18 to 24 years old and representatives of the older generation (from 60 years old).

Attractive conditions, experience of cooperation and state participation are the three most important criteria for choosing a creditor bank. Every second Russian with lending experience (56%) is primarily guided by the loan conditions offered by the bank - the interest rate, commissions and other parameters. In second place is the already existing experience of cooperation with a specific bank, which for a quarter of borrowers (23%) is one of the factors in applying for a loan there. The same number of respondents answered that it is important for them that the bank is state-owned (23%).

Picture 1. Analysis of the experience of citizens in the field of lending

An informal channel in the form of recommendations from acquaintances and friends also remains an important factor in the choice of most products and services by Russians. Almost every fifth borrower (19%) noted good reviews as a criterion determining the further choice of a bank. Convenient location of branches closes the five most important criteria for choosing a bank for lending (15%).

The number of Russians planning to improve their living conditions using mortgages and other credit products is growing. Almost a third of our compatriots plan to improve their living conditions in the next three years (30%). And traditionally this question is most acute among young respondents (from 18 to 34 years old). Major repairs or redevelopment are the most popular and affordable ways to improve living conditions for Russians. They were indicated by 38% of respondents who outlined improvements. Another 32% of those surveyed are going to radically change their living conditions - to buy, build or exchange housing through a purchase with an additional payment. 11% of respondents intend to exchange housing without additional payment. Other possible measures (getting free housing, due to demolition or rent) are unlikely.

Table 5 . Criteria for choosing a bank for a loan

Types of financial behavior of the population in post-crisis conditions

Types of People's Financial Behavior in Post-Crisis Conditions

Annotation. In order to determine new trends in the financial behavior of the population after the economic crisis, the author conducted a small sociological survey, in which representatives of different groups population. The poll showed a relatively high level of confidence in banks on the part of the population and an average propensity for credit. People in the post-crisis period are ready to help friends and relatives with money, for the most part they consider themselves generous, but are not ready to take risks.

Keywords: Duty. Saving. Financial literacy. Financial behavior. Income level. Consumers. Savings. Borrowers. Post-crisis period.

Keywords: Debt. Savings. Financial literacy. Financial behavior. Income level. Consumers. Savers. Post-crisis period.

Abstract. In order to identify emerging trends in the financial behavior of the population after the economic crisis, author had an opinion poll, which was attended by representatives of various groups. The survey showed a relatively high level of confidence in the banks of the population and the average propensity to credit. People in post-crisis period are ready to contribute money to friends and relatives, most of them consider themselves to be generous, but are not willing to take risks.

My work is devoted to a very urgent problem at the junction of two disciplines - psychology and economics, the study of population groups that are fundamentally different from each other in their attitude to credit, debt, savings. The purpose of my work is not just to clarify certain preferences of certain categories of the population, but also to identify new trends that have emerged at a time when our country has already got rid of the consequences of the recent financial and economic crisis. The problem that interested me cannot be attributed to the fully studied and analyzed, since at present there is a discussion about the allocation of certain groups of the population depending on their financial behavior. There are various classifications that make it possible to distinguish certain categories of the population, and yet the problem is still very fresh and requires additional research.

The main method that I used in the course of the research is empirical. It consisted of conducting an anonymous sociological poll, in which representatives of various strata of the population took part. Along with the empirical one, I also used the theoretical method - this is the study of articles of an economic and psychological nature in order to obtain the necessary information for further independent study.

As mentioned earlier, there are various classifications of the population by financial behavior, but, in my opinion, the most complete and striking is the classification that we will consider. It allows you to take into account a number of factors that affect the financial activity of the population.

In accordance with the considered classification, there are six so-called clusters: forced consumers, active savers, cautious savers, cautious borrowers, active borrowers and active consumers. Each cluster is characterized by its own characteristics, which, in my opinion, are interesting and require additional consideration.

Forced consumers- these are very poor and desperate people, they have no savings. They do not lend money to anyone and they themselves never borrow, do not take loans and under no circumstances are they ready to take risks. Almost all income goes to the purchase of food and basic necessities. They no longer need anything, they do not believe in anything and do not hope for anything. Life has made them angry and irritated. Wealthy people are treated extremely negatively. They don't understand at all financial matters.

Active savers are also characterized by a rather low level of financial situation, but if they have free cash, try to postpone them, make savings. Savings are viewed as important indicator stability, security. They practically never lend money, and they themselves try not to borrow, since there is nothing to give back. Separate the concepts of credit and debt. They treat credit positively, and debt negatively. They believe that you need to live within your means, economically, and only loafers and parasites get into debt.

Cautious savers on the contrary, they are willing to lend money to others, but they themselves are not inclined to borrow and take loans. Rather, they will work as long as necessary to accumulate the required amount. In financial matters, they exercise caution and prudence: they believe that "a bird in the hand is better than a pie in the sky." They are not ready to take risks, they treat money carefully and carefully. In their opinion, money is borrowed not by idlers and not prudent, self-confident citizens, but by unhappy people who are forced to do this by circumstances, therefore, they treat them with understanding and sympathy.

Cautious borrowers they almost never lend money to other people, but they themselves have a very positive attitude towards loans and credits. They make savings, but they believe that with their help it is impossible to solve the problems that they have. Be wary of large spending. These are people with moderate incomes - not rich, but not poor either. They strive to raise the level of their financial situation, which they are not satisfied with. They have a need for a loan and a desire to take it, but they are afraid that they will not be able to repay the loan on time. Risk appetite is medium.

Active borrowers They are calm about money: they can lend themselves to others, and if necessary, borrow or take out a loan, make savings, are able to take risks. Well informed on financial matters. The most promising group from the point of view of obtaining a loan - and although they are planning to take it.

Active consumers have a relatively high level of income and show an easy attitude towards life. They do not know what thrift is - they think that money should be spent, used, and not saved in any way, and accordingly they do not consider it necessary to make savings. They are skeptical about loans, do not seek to take them, since they themselves are able to provide themselves with a decent standard of living. They prefer not to contact banks and financial institutions; they solve their problems through relatives and friends. If necessary, they can easily borrow money, because they know that they can always pay off. In the same way, they themselves can provide financial assistance to their friends. Are willing to take risks - they demonstrate a very high risk appetite.

The most numerous cluster is the cluster of active savers, although from the point of view of financial institutions, the best option is to increase the cluster of “active borrowers”.

It should also be noted that such parameters as age, education, occupation, sphere of employment, and the level of family income have a significant impact on the attitude of citizens to borrowing money.

The greatest propensity to borrow is shown by citizens aged 31 to 44 years. Young people (18-30 years old) have a slightly weaker desire to live on debt. Perhaps this is due to the fact that their future does not yet seem certain to them: many of them do not have a stable job, there is no confidence in the future. Between the ages of 45 and 54, attitudes towards debt are rather neutral, and after 55 they are sharply negative. These circumstances are probably associated with the pronounced conservatism of the older generation, for which the concept of duty has a special symbolic meaning. Debt is a rather negative phenomenon that causes shame and is accompanied by a loss of self-esteem. It is not even a sign of poverty, but extreme poverty.

Citizens in higher, secondary and secondary specialized education are not characterized by any specific attitude to debt: among them there are approximately the same number of those who support borrowing and those who do not approve of them. But people with incomplete secondary and primary education are extremely negative about the possibility of borrowing money.

Temporarily unemployed and housewives are willing to borrow money, hired workers and students also have a positive attitude in general, pensioners and entrepreneurs have a negative attitude to borrowing. The opinion of pensioners is likely to be significantly influenced by their age and low income level, while entrepreneurs, whose income is relatively high, may simply not need additional borrowed funds.

Among working citizens, representatives of the intelligentsia and state employees, who are employed in the spheres of culture and art, education and health care, stand out for their positive attitude to borrowing; workers financial sector and police officers and police officers. The negative attitude is typical only for the workers of housing and communal services and the sphere of consumer services.

With the growth of the average monthly family income, the willingness of citizens to borrow money also increases. Wealthy people are much more willing to borrow money than those who live below the poverty line. Naturally, having a high level of income, psychologically it is much easier to take on debentures... These people, in comparison with the rest, have more confidence in themselves and in the future, they are not overloaded with stereotypes that you need to live “within your means”, they are used to striving for more. If for the poor debt means fear and poverty, then for many wealthy citizens living on credit seems to be becoming fashionable, prestigious, and even natural.

Parameters such as gender and position do not affect attitudes towards borrowing.

The data were collected and processed in the pre-crisis period and reflect the picture of that time. It is obvious that the lending activity of the population during the financial crisis and after it changed. In the post-crisis period, lending activity is still at the stage of freezing. In this regard, it is important for the banking sector to learn lessons from the global financial and banking crisis and use the most effective approaches in shaping lending activity.

In my opinion, it is advisable to first say a few words about the changes in the behavior of banks. The easy money policy helped banks avoid bankruptcy. But they are already giving up the credit risks they took before the crisis. One of the problems directly related to the financial crisis is that, in their lending practice, banks have switched from a model of “stable client relationships” and a thorough analysis of credit risk for each borrower to a model of “queuing up strangers” and acquiring credit risk based on someone else's opinion. ... The post-crisis period is generally characterized by an increase in lending risks. Unfortunately, the number of good borrowers has not increased. As for the bank loans themselves, the following facts take place: car loans and mortgage credit lending are not currently priority growth areas. Growth is demonstrated only by consumer loans, which are adequate due to the short maturity, which explains the continued demand for them. Banks are more aggressively reducing the volume of retail lending compared to corporate. This means that large Russian companies are more likely to rely on credit than medium-sized companies, which is explained by the banks' concern about the demand for their products and their burden with debt. The financial behavior of the population is also in question. It may be that in an environment of limited income growth, leverage increases are less attractive. The main factor here is the predictability and security of jobs and income in the future. It is most likely that a change in the population's attitude to savings will also be associated with the banks' policy. If banks try to keep interest rates at a sufficiently low level, this will mean a decrease in deposit rates and, as a consequence, a decrease in the savings rate of the population. Thus, access to financial resources the state, as it were, automatically means the impossibility of relying on the savings of the population and makes the banking sector more and more vulnerable to the policies of the financial authorities. This dependence is not conducive to a long-term recovery in lending activity. Household loans are growing slowly as consumer demand recovers.

The financial crisis is over, and it's high time to find out what new trends have manifested themselves in the financial behavior of the population of our country. To this end, I conducted a sociological survey, asking the respondents to answer the questions of the questionnaire entitled "Attitudes towards debt and credit." The survey involved university students in the city of Saratov, employees of financial and credit organizations, retirees and some other persons.

The results of the study showed that the majority of respondents (57%) almost never borrow money. The overwhelming majority of respondents, namely 72%, believe that borrowing is possible only in case of urgent need, and only 7% said that you need to rely only on yourself. Ready to provide financial assistance to friends 86%, to help everyone, not only friends - 4%. They are ready to lend to a well-known person, but at the same time 29% will feel anxiety, 64% will remain absolutely calm, and 7% will be very nervous, since they have been deceived more than once.

Only 7% of all respondents recognized themselves as greedy, 43% consider themselves greedy only in some situations, half of the respondents, in their own opinion, are rather generous, of which 14% hate greedy and envious people the most.

As for the lending activity of the population, the situation here is not so bad. They are ready to take out a loan to buy an expensive item, and most likely 43% of those surveyed will do it. large percentage of respondents (7%) said they would not take a loan, even if they really like the thing. Still, most people prefer to make do with their own resources and save a little every month.

An interesting fact, in my opinion, is the unanimous decision of all those I interviewed regarding the fact that money should work. A 100% “yes” means that in the post-crisis period people understand that money should not just lie, it should be invested. This suggests that the investment activity of citizens is on high level in the post-crisis time.

Now about savings: they are ready to deny themselves the essentials in order to save money for a rainy day 29%, the same number of people spend money as soon as they appear, and 36% said that this problem might worry them when they have for 40, until they save money for a rainy day.

Mercantile interests were manifested in 36% of the respondents, who believe that money is the main thing in life. And again, back to lending issues. It is noteworthy that 21% of respondents took a loan from a bank, moreover, these are mainly people with higher economic education, of which 33% rated their level of financial literacy as high. The survey showed that the financial crisis of 2008-2009. negatively affected the psychological mood of the population. 57% of those who participated in the survey are afraid that they will not be able to repay the loan on time. And nevertheless, the same %% of respondents can say with confidence that they trust the bank of which they are clients. Banks are mostly distrusted by students, possibly due to a low level of financial literacy and mainly with an average income level, which does not allow them to be full-fledged participants in financial and credit relations.

It is impossible not to pay attention to the issues aimed at finding out whether citizens are ready to take risks, having survived the financial and economic crisis. 21% of respondents are ready to take risks and invest most of their financial assets. Most of them are not inclined to take risks (50%). The crisis probably forced 57% of respondents to carefully calculate their budget and could not force 29% to do it, the rest, most likely, did it both before the crisis and after it.

Only 7% of respondents are ready to take out a loan, assuming that the interest rate will change, only if they really need money - 36% and 57% are not ready to do it.

When asked where would you spend 1 million €, 50% answered that they had invested them in real estate, 22% thought that the best option would be to open a bank account and live on interest. Options such as organizing a business, investing in securities- were less popular.

conclusions

Summing up my small research, it is necessary to note the following: despite the rather difficult economic situation and a state of certain tension, the level of public confidence in banks cannot be characterized as low. A relatively large percentage of the respondents expressed a positive attitude towards a loan and readiness to take it, if the need arises. Undoubtedly positive is the fact that in the post-crisis period money did not come to the fore in the minds of our citizens, many are ready to help their loved ones and relatives if they find themselves in a difficult financial situation.

The financial behavior of the population can be considered from the point of view of psychology. According to psychologists D. Kahneman and W. Smith, the economic behavior of the subject is in most cases controlled by intuitive "cognitions", and rational thinking is used only for correction. The dominance of intuition is explained by the fact that intuitive decisions are reactions to aspects of reality that are more accessible to perception. But distortions are inherent in such a "lightweight" perception, since the similarity of objects is easier to perceive than differences, changes of objects are easier than their absolute value. The above authors talk about the existence of two types of rationality - conscious and unconscious. However, most of the knowledge we use and the ability to make decisions are unconscious in nature. In addition, each person has rules of action, traditions and principles developed at the family and social levels, in accordance with which he builds his behavior, including economic.

It is considered proven that the economy is not an area where the subjects economic activity can make decisions based on rational thinking. The nature of the behavior of economic entities is determined by the genetic (innate) foundations of their psyche, habits (i.e. institutions). Their actions are determined not by the desire to maximize utility, as is believed in the neoclassical tradition, but by the desire, first of all, to preserve the status quo, to avoid risk and uncertainty. All this suggests that a person, on the basis of his own intuition, decides whether to take out a loan or whether it is better to engage in savings. The subjective factor, in my opinion, plays a significant role in determining the financial behavior of the population. If during the crisis period everyone feels a negative mood, then this is likely to be one of the reasons for the decline in confidence in banks and the fall in lending activity.

Our country has emerged from the financial crisis and has practically returned to its original positions, however, a sociological survey has shown some negative trends. This applies primarily to lending. Despite the fact that the majority still trust banks, a large percentage of the respondents are afraid that they will not be able to repay the loan on time, which may cause a decrease in the number of people willing to take out a loan from a bank. I think that in this matter the greatest effect can be achieved only by correct and carried out in the interests of working citizens. public policy... If it is able to provide the citizens of our country with confidence in the future, I think everything will be in perfect order with lending activity. It would be advisable for banks to concentrate their efforts on increasing the level of financial literacy of the population, since, as the survey shows, those who are better educated in financial matters take out loans more often - they work in financial institutions or at least has economic Education... In my opinion, even such measures on the part of banks as consultations of citizens on lending issues and a clear explanation of all the advantages and disadvantages will give a visible result.

Literature

1. Mekhryakov V.D. Lessons from the crisis and new approaches in the formation of credit activity // Banking. 2010. No. 5. p.46-48.

2. Olsevich Yu.Ya. On psychogenetic and psychosocial foundations of economic behavior // Bulletin of Moscow University. 2008. No. 1. p. 3-15.

3. Olsevich Yu.Ya. On psychogenetic and psychosocial foundations of economic behavior // Bulletin of Moscow University. 2008. No. 2. p.3-40.

4. Strebkov D. The main types and factors of credit behavior of the population in modern Russia // Problems of Economics. 2004. No. 2. p.109-128.

Don't lose it. Subscribe and receive a link to the article in your mail.

A social stereotype is a relatively stable and simplified image of a social object - a person, group, phenomenon or event. These are also general opinions about the distribution of certain traits in groups of people. For example: "Italians are emotional" or "Politicians are liars."

Why do stereotypes arise? There are probably two main reasons. First: mental laziness. A person does not want to make an intellectual effort in order to learn more about an event, a group of people or a person, therefore, he sincerely believes in what he knew about before. Second: lack of information or time. This happens a lot: you only have a few small facts on which to make a quick decision. Social stereotypes also arise under the influence of personal experience, beliefs and preferences. One has only to understand that all these three parameters are purely personal, that is, subjective.

Stereotypes can be:

- positive;

- negative;

- accurate;

- approximate;

- neutral;

- overly generalized;

- overly simplistic;

There is no need to engage in self-deception and think that you are definitely not subject to stereotypes. They live in us, affect our worldview, behavior and sometimes contribute to a misunderstanding of reality. The Internet, TV, communication, personal (and at the same time often spoiled by force) experience, wrong feelings and intuition - all this creates a huge number of stereotypes in our psyche.

At the same time, we must not forget that stereotypes can be related to the truth, albeit not always. For example, minibus drivers, lawyers, politicians, actors and many other professions are subject to professional deformation.

Professional deformation is a cognitive distortion, psychological disorientation of the personality, which is formed due to the constant pressure of external and internal factors of professional activity. That is, a randomly selected lawyer will be more like another randomly chosen lawyer than a minibus driver. The profession changes a person and this cannot be denied. Due to this, the approach to a representative of different professions may differ.

It is impossible to completely get rid of stereotypes, so you need to at least learn to live with them and notice, especially when making important decisions: with whom to do business, where to move, what job to get.

But first, let's discuss what functions the stereotyping process has.

Functions and role of stereotyping

Early research suggested that stereotypes were only used by tough and authoritarian people. Modern research argues that a complete understanding of stereotypes requires considering them from two additional perspectives: as divided within a certain culture / subculture and formed in the consciousness of an individual person.

The relationship between cognitive and social functions

Stereotyping can serve cognitive functions at the interpersonal level and social functions at the intergroup level.

Cognitive function

Stereotypes help us understand the world. They are a form of categorization that helps to simplify and organize information. In this way, information is easier to identify, recall, predict, or respond to.

Psychologist Gordon Allport suggested possible answers to the question of why people can more easily understand information by category.

- First, so they can check the category to determine the response pattern.

- Second, categorized information is more specific than uncategorized because categorization emphasizes properties that are shared by all members of the group.

- Third, people can easily describe an object in a category because objects in the same category have common characteristics.

- Finally, people can take for granted the characteristics of a particular category, because the category itself can be an arbitrary grouping.

Stereotypes function as temporary and save our time, allowing us to act more effectively.

Social functions: social classification

People present their collective self (their group membership) in a positive light in the following situations:

- When stereotypes are used to explain social events. Take this situation, for example. Scholar Henri Tajfel believes that the Protocol of the Elders of Zion allowed people to explain social events and only makes sense because Jews have certain characteristics.