Favorable investment methods. Investing for beginners - where to start, types of investments. Visit the free master class

- 7 specific examples - where to invest money so that they work, which we will look further

- Deposits or investment under the percentage

- Create your own reserve Fund Before you go to high-yield and risky investment

- 3 ways to invest money in currency and stock

- My experience is an investment in the FIF with a minus sign

- Investment in stock in stock market

- Exchange trading On Forex and hype with increasing currency rate

- Investing in Real Estate - New Buildings, Hotel Business, Profitable House

- The first object of real estate - a new building in the Moscow region in 4km from the Moscow Ring Road

- Second Real Estate Object - Profitable House in Moscow Region

I was looking for various options where to invest money. It was a funny and, undoubtedly, useful experience, with the exception of one problem - ignorance was very expensive and demanded money for each new attempt.

For reference - the price of ignorance in investment is too high:

One of the latter houses acquired by me with the purpose of investing money cost me additional expenses At 967,000 rubles, which could really save on the bargain, about buying a house, if I used one of the principles of real estate investment:

Everything that is stated by the seller of real estate and increases the value of the object, but not connected - must be checked and started before you hit the hands.

Warm floors, heating, gas, drinking water and its analysis, electricity and so on - in my case it happened so that an incredibly expensive heating system had to be disconnected, as it was dropped. Pumps and water purification change - it did not fit under local conditions and so on.

7 specific examples - where to invest money so that they work, which we will look further

3 ways of investment of money in the foreign exchange and stock markets:

- Investing in the shares of blue chips on the strategy "Four Dough"

- Attachment of money in PIF - mutual investment funds of shares

- Investment in currency on Forex

3 options to invest in the real estate market:

- Investing in new buildings

- Business on daily rent

- Investing in profits

- (+) 1 way of temporary storage of money and stub. Fund - bank deposit

Once you suddenly understand that your income is growing, and there is no bank account and savings - everything is earned, it is also quickly descended to maintain the growing standard of living and payments on loans. Each sooner or later wonders - where to invest money so that they work for you.

Save in bookmarks not to lose

Save to yourself for 2 clicks

In order not to tire you with a long theory, I will say that the deposits cannot be considered to be a tool for profitable money investment, at best this is a temporary place for your savings until you find a more profitable and profitable investment method.

Income from deposits at the inflation level (usually below), although it is still 2 times better than give money in pension FundBut it's still not enough to create capital due to a complex interest - when you receive dividends, they invest them again, and interest on them is also charged.

Create your reserve fund before you go to high-yielding and risky investments.

The stabilization fund should be stored on the deposit and is at least 3-4 monthly expenses of your family, and better than 6 monthly expenses.

In the event of any cash flow interruption, you will have enough time to fix it, while your standard of living will not suffer. With such a safety pillow, you have a lot more chance to succeed in highly profitable real estate investments and you do not have to urgently sell your assets for snapsals to pay on current accounts.

3 ways to invest money in currency and stock

There are players and speculators on the stock and foreign exchange market, which play at the difference in currency exchange rates, while it is already unlikely to call the investment, because you need to have quite large knowledge in this area and constantly monitor your open positions - Every business day.

From passive investments, you can consider the investment in the promotion of a long shoulder for example on the strategy of four fools, as well as PIF-s ( food investment funds) In which the manager performs the trading for you.

FIF is a mutual investment fund, when you buy a share (Pai), and managing companies Already acquires for money shareholders and other assets and takes off their modest small percentage.

If you decide to invest in this tool - consider the option of investing money in the index disease sharesas the most independent of the manager.

My experience is an investment in the FIF with a minus sign

When I first puzzled by the question of investing, I bought a mutual action, which it seemed to me, has a very good potential growth. As a result, on 5 years of investing in this PIS, its profitability was minus 4%.

I naturally used averaging method - when you put equal amounts monthly to smooth out the possible drops of the market and compensate for the bottom.

I believed that the FIF is at all passive view Investing and missed explicit moments when it was necessary to close the position and go out into the money, although there is another problem - to sell the PIF it was necessary to go to the bank branch and write an application for repayment, which completely deprived this tool of attractiveness.

Therefore, after 5 years, I repaid a PIF and received the final yield minus 4%. Although it is certainly in this market a lot of people who give out (or they say that they are issued) a greater profitability. In my surrounding there are no people who have made their condition on PIF-Ah, and you?

The main thought of the day - invest money in those tools in which you understand

The principle of "input-forget-and-non-call" always leads to the fact that your money will be destroyed.

Therefore, before making your first investment, learn the mature, and more precisely the theory and practice of investing with sharpening on the tool that you have chosen.

Investment in stock in stock market

Another investment experience is investing money in shares of blue chips on strategy four fool. The full version of the strategy to write somehow later, the main point is that you choose the company from the list of blue chips, according to the principle of dividend profitability - the relationship of dividends paid to the profit gained.

The logic is simple - the smaller the money from the received profits has paid to shareholders, the more it invests in its development, and accordingly, the shares can grow in price.

From the list received, 4rd companies are selected in which money is investing.

This experience was pretty good, I earned buying and selling stocks, but it did not seem to invest, but it was just funny trading at the monitor, which you need to do constantly:

groundhog Day at the Trader Monitor

My conclusion about the investment of money in stock - stock market Not suitable for creating passive income and cash flow:

This method can be viewed as one of the investment options, but it is necessary to regularly monitor the market and in the event of a change in the course - to bring into money. My opinion is that this is a rather risky and non-predictable investment, if you do not regularly and do not track the daily dynamics. Therefore, either learn and go to the stock market as a job, or get ready to lose money.

Therefore, for me this option as a source of passive income is not suitable.

Exchange trade on Forex and hype with increasing currency rate

One of the advantages of my business is that income comes in different currenciesGradually, they accumulate on accounts and once I made a VIP card in one of our banks and received a personal manager as a gift. There is also an opportunity to trade on Forex through your broker without a retail spread (the difference between buying and selling currency).

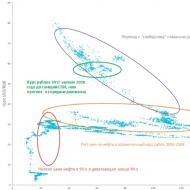

This gave me the opportunity simply by typing the phone number in a matter of minutes to deal with the sale of one currency and buying another. When the excitement began with the growth of the dollar, I did this, the course rose from 52 rubles to 69 rubles.

I was certainly glad, remembering the first principle of investment. Invest what you understand. I armed with courses and books on Forex trade and began to regularly view stock news about the cost of oil, a bunch of other information and activity of the Central Bank on the market.

When the dollar rose to 69 rubles, I also bought it and immediately he began to fall to 54-55 rubles values. As a result, from all my actions, I lost about 300,000 rubles, just that I did not want to fix losses and sell, hoping that the course would grow back.

When you read this advice in books worth 300 rubles, you think that I am not exactly from these naive guys, but only when you lose real serious money - it comes to the head and ....

Investing D EGEG. in Forex and PAMM accounts - This is a roulette and game

In this thread you need to constantly keep your hand on the pulse if you traded yourself. This can be done, but again the experience will be worth you a significant amount of money, plus this topic requires quite large, in my opinion the amount of time and attention.

If you select a PAMM account (when your account mirrors the transactions of top traders for modest deductions) in principle can be viewed as an investment option, but again you need to understand how justified the risk and what share of capital you are ready to take a chance, i would allocate about 20% of savings on this topic, and the rest has invested in real estate. About it further

Investing in Real Estate - New Buildings, Hotel Business, Profitable House

After various experiments, I came to the fact that the investment in real estate is most interesting in my case and that's why:

- Real estate, in contrast to stocks and currency, usually growing in price, but the growth of the value of the object is like a cherry on the cake, because Basic money gives cash flow from rental

- Regardless of the current value of real estate we pass the object and get passive income monthly

- Credit shoulder can repeatedly increase real estate investment

- Further, this income can also be taken into account in the bank, in order to use the leverage to purchase the following objects, which also bring revenue and so on to raise revenues with seven-world steps.

- It turned out that you can even invest with the minimum amounts of 200-300 thousand rubles + there are start options in general with minimal sums (profitable house, daily rent, co-investment, etc.)

The first object of real estate - a new building in the Moscow region in 4km from the Moscow Ring Road

Initially, an apartment was purchased, an area of \u200b\u200b100m2 in the house under construction in 4km from the Moscow Ring Road, its cost at the time of purchase was 7,500,000 rubles.

After 12 months, when the house was delivered and the keys were obtained, market value Real estate amounted to 9.5 million rubles, height + 2 million.

The first contribution amounted to 1 million rubles, the rest was issued in the mortgage - 75,000 rubles per month for 20 years.

At the time of delivery of the house personal capitalInvested in the new building amounted to 1,000,000 (the first installment + insurance) + 75 000 * 12 \u003d 1 900 000 rubles.

The mortgage was paid a loan body of about 100,000 rubles (for the first year)

Total when selling apartments for 9.5 million rubles

- Repayment of mortgage debt - 7.5 million (initial cost) - 1 million (first installment) - 100,000 rubles (paid loan) \u003d 6,400,000 rubles

- It remains 3,100,000 rubles minus personal capital (1,900,000 rubles) \u003d 1,200,000 rubles (profit per year)

- The profitability of investments for the year (1.2 million / 1.9 million) \u003d 63% per annum

Errors made in the implementation of the strategy

27.03.2018 78098 0Hello! In this article we will tell you where to invest money.

Today you will learn:

- Basic principles of reasonable investment;

- What very main object investment;

- And where to invest any amount of money in 2018.

Principles of investment

The main principle on which the entire modern prosperous society is based - money should make money. And this does not mean that the main goal in life is an endless chase for money. If you translate this principle for a more affordable language, it will sound like this - free cash Always need to work and bring additional, passive income.

People who earn huge money with their help initial Capitalare called investors. The main thing is not to confuse investors with professional speculators - people who commit many short-term transactions in order to profit. The investor is counting on a long-term result - by investing his money, he expects to receive income at a distance of several months to decades.

Professional investors are a special category of people who make money due to successful projects of other businessmen. On the one hand, it is quite simple - put your free funds, do nothing and get a profit. But if you dug deep - that even at the stage of choosing an object for investment, significant difficulties arise. And after that, watching the project, it is necessary to ensure that it develops in the right direction, continued to function successfully and profit.

That is why if you want to successfully invest money, to make a profit in a timely manner and work competently with risks, your task is to comply with simple principles.

Principle 1. Risk diversification. This condition is in the first place, because it is basic. Without it, absolutely any investment will be unprofitable, regardless of the experience, intuition, finance and opportunities of the investor. Diversify assets - it means to share money between several objects.

Investments are inextricably linked with risk. From this follows one of the main principles - the higher the risks, the higher the yield. These two parameters are directly dependent. At the same time, a person must understand that its investment portfolio should always have low-risk assets that are guaranteed to bring small income, regardless of the financial situation in the market and risky assets that will bring very high income under favorable conditions.

Principle 2. Only free cash can invest. This principle is based on banal logic. You can not withdraw funds that require a person personally to investment needs. For example, it will be completely illogical to ignore the claims of creditors, and in the amount of debt to acquire a specific investment facility.

That is why, only those cash, the loss of which will not be quite noticeable, and which can then be earned within 1-3 months. Otherwise, it is better to refrain from investment activities until you fully resolve your financial situation.

Principle 3. Investments should always make a profit. The latter, but no less important principle. He, too, before simplicity, banal, but many forget about it. If attachments do not make a profit, then they are unprofitable, and therefore, very soon they will ruin you.

That is why, often the profit should go to first place and sometimes should noticeably close the risks, despite the fact that in most cases it will be more important than money, and not be able to get them.

These three simple principles are quite banal, but even some investors with experience are managed not to use them. With all its simplicity, the third one of them remains the most disturbed. Some professional investors spend their time, money and other resources for in advance unprofitable projects, speaking that they sooner or later begin to bring money. But the main principle of investment is that the project should bring money, regardless of what it is directed (with the exception of charity).

If you remember the three of these simple principles, the investment activity will be successful and will bring high and stable income.

Where to invest less than 10 thousand rubles

Private lending

Private lending is one of the alternatives to a bank loan. In the role of debtors, everyone can also act as physical and legal entities, only the usual people who have free finances are speaking. Private lending is good because interest on it is often varied depending on the risks and systems in which loans are carried out.

Most payment systems have their own sites on which users carry out short-term loans at elevated interest rates. Often they even exceed interest on loans in MFIs - from 10 to 100% of the day. At the same time, crediting through payment systems is quite strongly associated with the risks of non-return of funds: according to statistics, about 60% of loans on the Internet are not returned.

An alternative to payment systems with their increased risks and huge percentages are special sites for private loans. Their work is carried out as follows: the user contributes to the system, it itself automatically selects the trusty borrowers, selects the optimal interest rate and gives a loan.

After that, in the event of repayment, the system returns money + interest less than its own commission. Risks of no return here are also present, but already at least. Consequently, I. interest rates According to loans hesitate around 30 to 100% per annum.

And the last option is credit cooperatives. In Russia, this type of lending is not developed sufficiently, but still takes place. It is not worth talking about him - it's just enough to know that this is a kind of investment type, when many people accumulate money to lend one borrower.

Forex

Forex would never have appeared on this list if it was impossible on it. But according to statistics, only 20% of traders earn, and the remaining 80 - only bring money to their broker.

In order to start playing for forex, it will take a lot of time to devote to the formation of the psychological qualities of this trader. Despite the fact that at first glance the graphics move chaotically, the ability to understand them arrives after 2-3 days of study technical analysis. And to form psychological stability, his own look at the market and the player of the game, goes on average 2-3 account trader.

Of course, more than 10 thousand rubles can be attached to Forex, but due to a huge number of risks, this is extremely recommended. Unlike exchange investments that are conjugate only with the financial risks of assets in which you invest in Forex, many incidents can still occur, up to the broker bankruptcy.

Small business for resale goods

Now it has become fashionable to create one-page, make advertising on them some product and sell it, winding up 200-300%. For this, you can thank the guys from the youth business who explain to everyone, why he should spend 200-300 thousand to learn how to trade in goods for 2-3 thousand rubles.

But despite the fact that many people hurried to this, as it seems a profitable business, Niche is really not yet occupied. There is no huge number of advertisers who know how to attract customers with minimal investments, there is no cauldron of businessmen who can make a competent sales funnel and hold a client on Landing so as not to leave him and a single chance of refusal.

That is why, if you have 5-10 thousand rubles, the desire to understand with sites and advertising, you can start a business on the resale of goods through one-page. If working with lending for you is too difficult, you can choose a simpler version of the sale of goods - groups on social networks and bulletin boards, like Avito.

Haip

Well, where without Haipov. A very controversial type of investment, which is nonetheless one of the main sources of income for a certain group of very risky "investors". The essence of Haipov is such - a small financial pyramid is created, which promises fabulous interest for your deposits. It can be argued by any way, up to the "purchase of shares, bonds" or something else.

Money for interest go from new revenues and is created by such a "vicious circle" from which only one output is a fictitious bankruptcy of High after a certain period of time. It would seem - the usual pyramid, on which it is unreal to earn. But it is not so. Haip diligently pays interest at first. Depending on the scale - from 1 month to 1 year. That is why some people recognize Highypes, invested in them, and after a short period of time, they take their means with interest. Approximately the scheme works - who managed, he earned who did not have time - lost money.

As you can see, everything except the third way is quite risky investments. But that is why they bring big revenues. If you have free funds - no more than 10 thousand rubles, the loss of which will not hit your pocket much, then these investments for you.

Where to invest a sum from 10 to 50 thousand rubles

Here we have collected 7 relevant ways for you, where you can earn, having from 10 to 50 thousand rubles. For each of them there will be any amount from this range. Methods are distinguished by the fact that they have an average yield and, in most cases, a short payback period.

Game on the stock exchange

In the first place, of course, there is a game on the stock exchange. Having small amount Money, from 300 to 1000 dollars, you can open an investment account with any broker and start comprehending the Aza Trade.

The feature of the game on the stock exchange is that the first time (from 2 months to 2 years) will be your task - exit to zero yield. That is, you will need to return all the perfect operations to interrupt the Commission of the Broker, Trade and Settlement System. Achieve this minimum strip is one of the main steps of any trader.

Then there must be the next step - the minimum yield. It is measured by the level of inflation, or the average levels of bank deposits (which in Russia is often much less than the real level of inflation). In general, to reach an acceptable level of income, the trader will leave 1 to 3 years. But after that you can actively trade on the stock exchange and, thanks to this, get a stable income.

Bank deposit

Simple and low-income. Investing money to the bank - a great way to cover inflation, or to go with it almost on equal. For nothing more bank deposits are adapted.

A small board for choosing a bank for the contribution: Do not look at the top players of the market, like Sberbank, VTB, Rosselkhozbank and others. They can dictate their conditions to customers, which is why interest on deposits is always lower than in other, middle banks, which for the sake of resource involvement should increase their rates.

The optimal term for which bank deposits are being made are: 1 - 2 years. It no longer makes sense, because no one knows what will happen in the country, which economic crisis will come this time this time, and a smaller term reduces the yield. The only thing to remember is if there is such an opportunity - do not remove the cash ahead of schedule. Then, in most cases, your accumulated interest will simply burn. If you urgently need money, it is better to take a loan, and imagine bank deposit.

Mutual investment fund

Pypnes in Russia, as in general, the culture of investment is very poorly developed. But despite this, several leading banks - Alfa-Bank, VTB, discovery and Tinkoff have several mutual investment funds that really deserve attention.

What imagine from themselves from themselves: these are peculiar trust management funds, only with another legal component of transactions. If in trust management funds you list the money manager, and it buys profitable on them financial assets, In the case of PIPs, everything is built as follows:

- you buy a share in the Foundation - Pai;

- the investment fund joins the money for Pay to its own funds;

- carries out securities transactions at the expense of all funds;

- distributes profits according to the pairs.

This scheme is most similar to - when revenues are distributed according to shares, but the means directly from the company are not transmitted - a kind of cash exchange and shares in the company occurs. Pynes are good in that they provide profitability higher than that of the bank deposit, but at the same time they have risks relative to the same.

Purchase site.

The most favorable way of investments from all presented in this list. Website - Playground for earnings, Capital for resale and the ability to promote our own goods and services.

You can make money on buying sites in two ways: sale of advertising and resale site. Each method is good in its own way. For 50 thousand rubles you can buy a website that brings to your owner from 5 to 15 thousand rubles per month, depending on how competently the owner appreciates him. And after time on self-sufficiency, you can get pure profits, almost without spending effort.

Resale sites is a more complex process that requires certain skills in the assessment and sale of Internet resources. In order to deal with the resale, it is recommended to create a website independently and only after all the way is passed, you can proceed to resale as a full-fledged business.

Precious metals

When we say "Investments in precious metals"Most often we mean investment in gold. This is one of the most popular metals in today's market, its price is steadily growing on a long distance, and during the periods of world crises just takes off to heaven.

A little about why this metal is so appreciated. Gold in the investment plan is very attractive because any state, regardless of which economic condition, is interested in attracting gold reserves. That is why when prices are beginning to fall around the world, only one thing remains to look for salvation in the "safe harbor" - investments in gold.

Invest in it is easy. It is enough to open an impersonal metallic account in any bank that provides these services, and you will already be on your hands. money amountequivalent to the volume of gold that you purchased. But you should not count on the fact that it will immediately go up, and money will go to you on the bank account. In order for gold to bring substantial income, it must pass for 5-10 years.

Cryptovaluta

Cryptovaya now is one of the subjects of a fierce dispute among investors and economic specialists from all over the world. Some say that it is not a currency, because It is not secured and will disappear over time (we would like to know what is provided, for example, the dollar), others, on the contrary, argue that thanks to demand for it and limited quantity, it will be more valuable, until it is replaced by new Types of money.

Cryptocurrency in its essence - computer code. It does not have a physical weight, ensure and clear, fixed courses. But it does not prevent her from enjoying mad popular with people who want to keep their payments anonymous.

The types are cryptocurrency, but the largest currency is Bitcoin. Now he costs about 1 thousand dollars, although some 5-6 years ago, a person bought pizza for 10,000 bitcoins.

It is possible to use cryptocurrency as an object of investments in two cases: when you intend to earn on speculation and, if you really believe in the perspective of cryptocurrency growth.

Where to invest an amount from 50 to 500 thousand rubles

Here we have prepared more large-scale investment methods for you, which require bulk capital size.

Investing in stocks and bonds

Investing in securities - a fundamental cash procedure in Europe and America, which replaces bank deposits almost completely. According to statistics, about 50% of American families hold their accumulation in valuable papersoh.

Investments are beneficial to trade in papers. If you have a sum of 100-200 thousand rubles, any broker will be able to not only provide access to the securities market, but also will help with the tips to invest.

There are two investment options: aggressive and passive. With an aggressive style, you will invest in the paper of promising companies, with the passive style, you will only need to pour money into the paper of famous companies, winning on the price difference and dividends.

If you need a way to invest in which you will need to minimizely participate in the process, periodically checking and insuring yourself from large losses, while having a yield of 2-2.5 times more bank deposits, then investments in securities are the best option.

Trust capital management

Trust capital management - relatively new servicewhich companies represent different calibers. Starting from banks and ending with special centers, companies provide services for the management of assets of individuals and legal entities.

Trust capital management is as follows: each company has the field of activity in which it has achieved success and can earn decent money. For the most part, this sphere is trade in the stock market. And in order to increase the volume of investments and reduce the risks, such companies attract additional capital, which invest in an income assets, taking march for their services.

Trust management is best "trusted" by the specialists of the banking or adjacent financial sector. Never pass your money into the hands of private entrepreneurs or traders. Most often, it is not enough professional participants stock market that can not earn money and try to get investor funds.

Own business

Here everything is simple and understandable, but at the same time difficult and confusing. Establish your own business is one of the best (if not the best) method of cash investment.

Open your business now - the task is not from the lungs. Need an original idea, capital, investors, and, preferably, also a team of like-minded people who will follow one idea.

It is important to know that statistics are not lying: only 20% of businessmen continue to work with their projects. But at the same time, it does not take into account many companies that were sold to major giants, like Google, Microsoft and Yandex for huge money. And therefore it is important to understand that those businessmen who were overboard are not victims of the system. They are victims of their own mistakes, laziness and insufficient hardworking.

Buying currency

We are talking about currency speculations yet since the time of the USSR. But then the currency was in short supply and therefore used quite in great demand. Now freedom of market relations, therefore, the currency is as much as it should. That is why investments in the currency are now a rather controversial way of investments.

Investments in currency make sense when the global crisis begins, or the inside of the crisis in one of the countries. Then the quotes of one of the currencies fall sharply (in most cases deservedly), but literally in a year - one and a half are restored to the usual volumes. Several bright recent examples: russian ruble, Euro and pound sterling - due to various macroeconomic events (sanctions, destination Trump and exit from the EU)

In which currencies can still be invested:

- the currencies of Arab countries provided by gold (they are resistant to inflation and therefore all world fluctuations will stably maintain their high course);

- currencies of developing countries of the 3rd world (they consistently increase their course, enjoy secondary demand and they can easily be exchanged for your country's currency at any time without loss);

- cryptocurrency (with all the last rumors cryptocurrencies and hundreds of rumors around it, it becomes an interesting object for investments and speculation. For the period, from the beginning of June 2017 and before its middle, Bitcoin pierced the price indicator of 3 thousand dollars several times, and so much It fell back to 2.5 thousand times. Nevertheless, all 2017, starting with the spring, passed under the flag of virtual currencies)

In general, investments in the currency are suitable for those who love active investment - follow their money, make important decisions more than once a few months, and every day. At the same time, competent investments in the currency can make you a millionaire per crisis.

Attachment to develop their own applications

Own applications are a startup, which is fond of up to 50% of all world entrepreneurs. Most of them create their own projects, being on the main job, but then the latter becomes uninteresting.

If you have money for the development and promotion of the application (costs will be about 20 to 80 in favor of advertising), you can safely occupy this niche, which only begins to gain momentum. Developing your application can go in two ways: manually or with hired freelancers. The first way takes a lot of time and effort not only to create an idea and bring to the desired result, but also to develop, while the second will require average financial costs.

Weighing simple mobile application Can do at $ 500-1000. A large online project will cost more. In general, the development and promotion of the application can do in 100-300 thousand rubles. Such investments pay off, depending on the project, for 3-6 months.

Where to invest more than 500 thousand rubles

Here we will talk about investments from 500 thousand and to several million. If you have money more than 3-4 million, then you need to know where they need to be investigated to make a profit.

Investing in real estate

For some reason, in our country, investments in real estate, despite its absolute non-infliction and illiquidity, still remain quite attractive. It is enough enough for two reasons: interest income from real estate exceeds the minimum (bank deposit) by 3-4% per annum; And the liquidity of investment objects is somewhere in the zero area. But despite this, most people who have money from 1 million rubles still continue to spend their money for real estate.

Real estate is good because it is stable. But it is stable in the worst sense of the word. Even gold grows more dynamic than real estate prices in Russia. For the most part, in some areas of apartments, houses, and so on, such property went into minus over the past 2-5 years.

Situation B. major cities A little better - there is a lot of real estate, while refusing to grow. The exception will be the constantly expanding Moscow region, but it is also difficult to guess which of the districts will be in the plus, and what - in the minus.

In general, investments in Russian real estate are suitable only for those who want a stable average income at large spending. Payback of such investments will be from 5 to 10 years. For those who really want to receive a stable-high income using real estate, it is recommended to look at home and apartments of Eastern and Western Europe. In them, real estate is becoming much faster than in our countries, in view of the constant flow of immigrants from other, less developed countries. Russia has other, more interesting and profitable alternatives.

Buying a finished business

Buying a finished business is an excellent embedding of 1-3 million rubles. It became popular in Europe in the late 90s. Then entrepreneurs who urgently needed had big money on new project, Or just those who are tired of the business, sold it to other, more interested parties.

In order to understand whether the project really makes a profit, it is enough to stay in the team (or work, if it is a small business). Then you can see if there are customers, are there really business brings an informed income, a little plunge into the process and understand whether it is worth buying this business at all.

By buying a business, you will not need to think about how to run it, how to deal with competitors and customize production with minimal cost. For you, it will be done, will explain how everything works, and you will only remain controlling all business processes and make a profit. This option is more suitable for experienced entrepreneurs.

Business on franchise

In contrast to buying a finished business, you can choose a business for a franchise. Franchise - exclusive right to use trademark. In essence, this is a business management under a well-known brand.

Advantage of franchise:

- simplicity;

- convenience;

- stability;

- profit.

Working with world companies, you can use their successful experience in order to fully develop in the new direction. And you will also have a full-fledged development strategy, which takes into account absolutely everything, up to the specifics of the population in your city. True, it is waiting for you only if you choose the partner to open a business.

Most often, the franchise is provided by the company in the sphere of fast food and restaurant business. The brightest representative is McDonalds.

To open a franchise business, it will take from 300 thousand to several million rubles. In this amount there will be the cost of the franchise itself, the costs of opening a business, as well as monthly contributions from profits.

Investments in startups

Investments in startups are now one of the highest shipments of earnings in Europe and America. Since the culture of investments is developed, most of the novice entrepreneurs lay out their ideas for everyone and thus are looking for potential investors.

Investing in startups risky, but also extremely beneficial. Many young people hurry to realize their ideas and require large investments in their projects. But some of them do not have the basics of business, do not understand how to work correctly to get money. That is why investments in startups are associated with great risks.

Small council. In Russia, the culture of startups, as such, not yet. Therefore, if you decide to invest your money, it is worth choosing a good foreign project. Of course, you do not know many business features, and there are chances that the idea in which you invest money will procee, but nevertheless, it is much less risky than Russian startups.

But despite the fact that this way of earning is quite risky, professional investors earn huge amounts of money. The best business angels (those who invest in novice projects) earned millions of dollars, invested only a few tens of thousands.

Unique art objects

And finally, the most ambiguous, but definitely, an interesting way to invest cash - unique art objects.

About this method, it is impossible to say for a long time - it is quite simple. You can buy a picture of you, a statuette or any other work of the famous figure you can buy for decent money, and then resell several times more expensive to collectors.

Main investment object

Above we presented almost all working investment methods that can bring good profits. But the main object of investments should remain. Get a good education, the necessary knowledge, develop your talents and get so necessary skills - that's what is really important.

The first of your temporary and monetary investment should go to the formation of yourself. If you are interested in investment, as a way of earning, you need to pay a lot of time to get necessary knowledge, as well as skills that are so necessary to investors:

- stress tolerance;

- "Live" mind;

- patience.

Working in any area, you have to spend some of the forces to find out something new about it, regardless of how high you are.

That is why every time you think where to invest this or that amount of money, think if you can put them in yourself.

Now to more practical investment advice. They will help you to properly invest your funds, reduce the risks to a minimum and in time "fix" profits.

Tip 1. Share assets

The simplest rule that is often forgotten by many investors when they really fall into hand profitable proposition. Share your attachments into several fronts. So you are reduced by the risks of one-time loss of capital minimum.

Separate assets profitable because they begin to balance each other. Bright example - investment in securities. Most investors in investment portfolios, the ratio of risky securities with reliable - approximately 30/70. When risky go to "+", they bring a tangible profit, about 2 times more than reliable. But when risky falls in price, reliable compensate for their drawdown, withdrawing an investment portfolio in zero or a small minus. There must also be in other types of investments.

For example, buying already ready business, Leave some amount of money in a bank or invest it in profitable securities. Then you can at least partially compensate for the loss if the business begins to bring losses.

Tip 2. Correct the risks and profitability.

Risk analysis and profitability, as well as their comparison - the main task of the investor. The main rule of the financial market - risks and profitability are directly proportional to each other. This means that when one increases, it grows and the second.

But the market is not always "right." Sometimes he can overestimate something, on the wave of universal positive attitude to the idea, or vice versa, underestimate. Then there are situations when, at first glance, a reliable and low-income tool is actually very risky. A bright recent example is the situation with bank deposits and reviews of licenses of credit institutions.

That is why try to always analyze how risky is the idea or another, and how many profits it can bring. Always relate these two important indicators with each other, and when you see that the risks exceed the income, then boldly refuse further actions. But if the profit significantly exceeds the risks - it is worth thinking if everything is just really.

Tip 3. Try to get a maximum of information about your investment.

Of course, you should not know absolutely all about where they invest your money. But at least the superficial knowledge of the object of investment should be present. If you want to invest in gold, see why he is so valuable. Want to buy an apartment and hand over it - find out why the real estate market is considered reliable.

Council 4. Clean the game in time

One of the most valuable skills - be able to stop on time. It is necessary to be able to give up the unpromising ideas that losses are losses or completely outlined itself, and you feel that they do not deliver the initial inspiration.

Tip 5. Get profit.

And most importantly - money should make money. So you must make a profit from your financial investments. Not "promising ideas", not "100% payback" and not "everything will turn out" must be worried. The main thing is to look at what you should achieve profit or not. And whether it is satisfied with its size.

No matter how attractive was the idea, you should always think about money. This is an investment, not charity

The problem of preserving and multiplying own finances in the conditions of unstable russian economy It is very acute. Despite the presence in the market for many different options for investment of funds, choose optimal way quite difficult. However, there are several simple rules, following which will help competently investing a small amount of money or serious financial resources in 2018 safely and with maximum benefits.

Rules of investment

Before answering the question, which is most profitable and reliably invest free money today, it is necessary to list several recommendations of experienced investors. Their execution will allow to avoid unnecessary risks and ensure the safety of money. Most important advice Financial market professionals look like this:

- Do not invest late. Investing is almost always a long process. Therefore, you must first create a financial pillow capable of providing an investor and its family within a minimum, 5-6 months.

Council. A bank deposit can be a bank deposit as a financial pillow, since it is rather not an investment, but a savings tool.

- Do not fold eggs in one basket. The term is economic theory "Diversification" as it is impossible to suitable as one of the main principles of any investment.

- Carefully learn risks. An important investor rule is not to overestimate the profit value, especially declared, and always consider it in combination with reliability.

- Cooperate with other investors. Large attachments are able to bring more serious profits. Another important plus of similar associations is the division of responsibility, which reduces the risk of each individual participant.

- Strive for the creation of passive income. Optimal option - This is to ensure your own life exclusively at the expense of this source. financial resources.

- Invest in education. Often best investment It is not buying an apartment, a car or another product, but investigating and developing your own potential.

Definition. Under passive income is understood as the income of a person who does not depend on its daily activities. Typical examples are interest on deposits, dividends on shares or from their own business, copyright, in some cases rent.

Of course, competent investment is a complex and multifaceted process, which is difficult to implement, guided only by the 5th Councils described above from experts. However, their observance will allow us to correctly invest money in order to receive a stable monthly income, without risking at the same time to lose investments.

Bank deposits

The easiest and most common way to save money. Its main feature performs a combination of low yield and minimum risks. Now in Russia banks are ready to discover deposits on average under 5-8% per annum, which is difficult to call a serious earnings even in low inflation.

The main advantages of the decision to invest in interest in the bank are:

- Low risk. Although you should not forget the numerous cases of recalling licenses of banks that have occurred in 2016-2017;

- Liquidity. Money from the deposit can always be removed, even if you lose interest;

- A variety of deposits offered, both in profitability and time. Investor can invest money for a short time, for six months, year or several years;

- Minimum entry threshold. As a rule, the contribution can be opened, having only 1 thousand rubles on the hands;

- The possibility of opening a contribution to both rubles and in currency, for example, in dollars or euros;

- A simple and understandable investment mechanism.

Among the disadvantages of investment by opening a deposit account, low interest can be distinguished and their loss with premature deregulation. As a result, bank deposits can be considered effective tool Preserving funds, but it does not allow you to increase the amount of financial resources. The most attractive embodiments are large state banks, for example, Sberbank, Rosselkhozbank, VTB, or banks with foreign participation, in particular, Raiffeisenbank or Rosbank.

Attachments in Fiffius

Funny investment funds are a form of collective investment. The mechanism of work of the FIF is simple enough - it collects money from private investors and carries out investment in the stock market. The estimated effectiveness of investments is assessed by the specialists of the FIF. The main advantages of this type of investment are:

- Minimum entry threshold. Usually its value is 1 thousand rubles, as in the case of a bank deposit;

- Higher than in the bank, the income percentage;

- The use of a variety of stock market mechanisms, including options, futures, shares and bonds;

- Additional income in the form of dividends on securities;

- The participation of the investor in the formation of the investment portfolio.

The argument in favor of a negative answer to the question is whether it is worth participating in investments in mutual investments include:

- Relatively difficult, compared with the bank deposit, the investment procedure;

- Higher risk of investments that makes losses;

- The need for professional knowledge in case of its own participation in the formation and management of the investment portfolio.

Today, leaders in terms of funds raised individuals are funds formed with the largest russian banks. These include "Sberbank - the Fund of promising bonds", "Alfa-Capital Bonds Plus", "Raiffeisen - Bonds", "VTB - Treasury Foundation", etc.

Forex and PAMM accounts

Forex is currency market A global scale intended for the exchange and conversion of almost all existing currencies currently. An important feature of this type of investment is the possibility of both the independent participation of the investor in the bargains carried out and the selection of the manager trader, which opens a special PAMM account for accumulating the depositors' funds.

The advantages of investing financial resources in Forex are as follows:

- The relatively available threshold of entry, which is usually equal to the cash equivalent of $ 100;

- The possibility of obtaining high yields;

- Making financial transactions on the Internet online;

- A large number of diverse financial instruments. As an example, one can lead trading carried out using various cryptocurrency.

Important. Trade in the Forex market is an eloquent confirmation of the rule - the higher the possible yield, the higher the potential risks.

The main disadvantage of investments in Forex is the potential to the risk of such investments. In addition, independent participation in the auction requires the availability of special knowledge of the financial market, without which the probability of fund loss increases even more.

It is quite difficult to explain to a non-specialist or the so-called "teapot" principles of the work of the Forex or the features of investing in the securities market. However, for any person, whether it is a student or a pensioner, the mechanism of investment in precious metals is understood, for example, gold.

Today, many banks offer this opportunity. Especially popular is the offer of Sberbank to open the so-called impersonal metallic account. This financial instrument is an account containing information on the number of gold or other valuable metal belonging to the depositor.

The advantages of investing in precious metals are as follows:

- Guaranteed preservation of invested funds, especially during periods of various financial crises, when other financial instruments are much less reliable;

- Understandable investment mechanism;

- The possibility of replenishment;

- High liquidity.

The main disadvantage of investments in metals is the unpredictability of prices in the market. As a result, yield can be as 50% literally in a couple of months and remain zero.

Real estate or construction

The classic embodiment for those who seek to invest money so that they work and create a passive income. Acquisition of real estate, residential or commercial, followed by a lease to be a popular financial instrument capable of not only to preserve, but also increase the funds of the investor. The most significant advantages of investment in real estate include:

- Obtaining passive income by passing housing or rental offices;

- Gradual increase in the price of the asset;

- Ability to use as collateral or to organize your own business.

A serious lack of investment in existing real estate, new building land plot is a high entry threshold. Even the smallest apartment will cost several hundred thousand rubles. Two more important minuses are the low liquidity of the asset, for the implementation of which the time is required at a good price, as well as the need for periodic repairs.

Shares and securities

The acquisition of shares and other types of securities in the stock market is a fairly effective investment option. However, a profile education or attraction of specialists in the person of financial brokers is necessary for stable profits.

One of the widespread investment options in the stock market was described above in the PIF section. These organizations are essentially financial brokers serving at once a large number of customers. The pros and cons of these attachment methods are also generally identical.

Mining and cryptovaluta

Serious popularity in the last 3-4 years acquired numerous cryptocurrency. Their purchase and mining is considered quite a real way to invest in making money to make money both at an ever-growing price and the production of new bitcoins or other less well-known types of virtual coins.

Today, such a way of investing as ICO is extremely demanded. It is the attraction of financial resources required to launch new cryptocurrency. Income from investment depends on the success of the project being launched.

The main disadvantage of this investment option is the high risk of such investments. The markets cryptocurrencies have serious volatility, that is, very unstable. Therefore, large profits can turn into no less significant losses in the days.

Own business

Creating your own business is also accompanied by a high degree of risk. However, B. this case The investor independently affects all occurring processes and largely can manage them.

The main advantages of the organization of their enterprise in the form of LLC or IP is the opportunity to engage in favorite business, earning. Among the pleasant bonuses - attracting seinvestors and borrowed capital, which often allows you to get an additional income. The lack of developing its own startup is the high risk and low liquidity of most assets.

Microfinance organizations

Today, the MFO market is much more organized and ordered than 2-3 years ago. This is explained by the tightening of control by the Central Bank. As a result, the number of microfinance organizations has declined sharply, and the remaining companies are quite an interesting option for investments.

The main advantage of investing in MFIs is a higher profitability, several times greater than the usual bank interest. The revolving side of such serious benefits is the riskiness of such contributions. As insurance against the loss of funds, it is recommended to apply only to large MFIs, long and successfully operating in the market.

One of the most accessible options "where to invest in the Internet", and sometimes very profitable, is. Next, you can see in the direction of the creation or ready-made Internet sites (online stores) in order to further earn or resale. Buying a share (Paew) in existing Internet projects also relates to investments, although quite risky, because I do not know to the end, what real objectives are the organizer.

Despite the obvious accessibility, I do not recommend investing in Haip, lending (credit exchange), binary options, sports bets, because Risks are extremely high. As a rule, in the proposed options, it is possible to work using electronic payment systems, such as Webmoney, Yandex.Money, Perfect Money, Qiwi and others.

Where to invest 100,000 rubles (dollars, hryvnia)

First of all it is necessary to determine the risks. If the main goal is to try to keep your savings, more conservative options are suitable, for example, bank deposits, buying precious metals for a long time, investment in antiques. With the amount of 100 thousand dollars, you can add an option with the purchase of real estate.

First of all it is necessary to determine the risks. If the main goal is to try to keep your savings, more conservative options are suitable, for example, bank deposits, buying precious metals for a long time, investment in antiques. With the amount of 100 thousand dollars, you can add an option with the purchase of real estate.

Considering more profitable, but also more risky options "Where to invest 100,000 rubles", you can pay attention to the purchase of companies (Gazprom, Google, Yandex, etc.) ,, trust management). You can get acquainted in more detail with the pros and cons of the above options above the article.

The richest people (video)

Hello, dear readers of the magazine by Issonodrom.ru! Almost every one of us ever thinks about where to invest money so that they work and brought monthly income.

Investment options are actually a huge amount! Not all of them are effective, and even that there are often fraudulent organizations often occur, the only purpose of which to get money and forever hide them. I know about it not to be! 😀

In this publication, I will try to tell you in detail about the most relevant and proven areas for investing in 2020! And of course, in practice we will try to objectively figure out much more profitable and best to invest our money.

You will also learn about where you should not invest your money, whatever they would not lose!

And most importantly, I will share with you my life experience , specific examples and useful advice that will allow you to properly invest money and get a high passive income! 👍

Regardless of what amounts of money you are going to invest: small or large - this article will be most useful for you.

Besides, you will learn:

- What are the investment options, what kind of profitability and which one to choose?

- Where can I find money online?

- How to invest money in order not to turn around?

- And also about where it is better not to invest your money!

Sit go comfortable and we will start! The article turned out a little long, because I tried anything important not to miss. I hope I managed it! 😉

1. What is important to know about investment?

First what you need to know before investing your money somewhere is that it is necessary to invest online free cash ! In no case do not invest money in which you are sharply needed and the more notice the debts, loans and loans.

Absolute guarantee that you will enhance nobody nobody gives! There is always a risk of loss of money, even if it is an investment with a high guarantee (for example, government bonds or bank deposits).

It is always necessary to remember this, because the investment as a profit and losses can bring!

Secondly before investing your money somewhere need to actually appreciate what exist risks and what yield It can be obtained from one or another attachment.

Usually the risk is proportional to income, i.e. The higher the yield, the higher the risks and vice versa. But this rule does not always work.

But in any case, who does not risk, he does not earn. It is always necessary to risk meaningfully! 😉

In order for you to solve for yourself or not to invest in a particular investment option, each of them we will analyze based on the following most key parameters:

- yield,

- risk,

- payback period,

- minimum investment.

And also consider all the pros and cons of each investment option.

Thirdly to reduce risks, it will be logical diversify Your investments, i.e. Distribute the entire amount of investment on the part depending on the risk and insert into different assets.

For example, you can distribute this:

- conservative portfolio (bonds, real estate, precious metals ...) - 50% of all means;

- moderate portfolio (PIFES, stocks, business projects ...) - 30% of all means;

- aggressive portfolio (Monetary market, cryptocurrency ...) - 20% of all means.

❗️What:

It is not necessary to invest all the money only in the tools with a very high yield, as in this case and the risk of losing your money will also be very high!

And many people opposite seek to receive maximum incomeBut at the same time completely forget about risk. And as a result, due to greed, nothing remains.

Investments are primarily risk management! First of all, you need to take care of not losing money. Profit is the second thing.

Yes, and if you still have little or yet there is still no experience in investing, then start investment with minimum sums And avoid high-range assets.

Read this article to the end, because at the end of the article you will learn about other important investment rules! 👇

2. Where to invest money in 2020 - the top 15 profitable investment options

So let's finally consider the options and determine where it is profitable to invest money so that they bring income!

I will immediately share with you on my personal example with one pretty favorable investment that allows you to get much more than ordinary bank interest. 😉

PAMM-account "ARSLANOV FUND" and its profitability

Another PAMM account, in which I invested, "", the largest account in Alpari, in its management is more than 155 million rubles!

Although it shows not such a yield (respectively, it is more conservative, with less risks), as the previous one, but in no less, for 5 years, it brings investors "clean" every year about 60-80% . Agree very good! 😀

Another plus of PAMM accounts is that the minimum amount of investment is practically not limited here, you can begin at least 3,000 rubles.

For other PAMM accounts, while I only look after, in my opinion, these two bills are currently the most reliable for long-term investment. If something changes, I immediately update information about this in the article.

However, though in this way, it is possible to earn quite significant amounts, nevertheless you should not forget about risks. Nevertheless invest in PAMM accounts no more 25-30% from total amount Your investment (while also distribute risks among accounts, do not invest only in one account, the minimum choose 2 bills).

More than more about this form of investment will still be painted below in the article, so be sure to read to the end.

And now we consider individually each of the options where money can be invest.

Option number 1: Bank deposits / cumulative accounts

DESCRIPTION: The easiest and most accessible embedding for all is the usual bank deposits (deposits). In Russia, the annual interest rate on them is on average from 4% to 8%.IN last years Rates on deposits are steadily falling down and will likely continue to fall in the future.

How to make money on the growth of shares - the example of Google

So for 3 years of the company of the company Google rose by more than 100%!

For these purposes, the so-called "individual investment accounts" (IIS) will be suitable, which, for example, can simply be opened in the same (this link can be investing 1 month without commission). By the way, they have a very convenient application for investment and a rather low commission, I use it.

But the same if you investigate money for at least 3 years, you can get a deduction on personal income tax (13%), i.e., in fact, taxes from income will not need to pay! Such preferential conditions The state was developed to support and develop investment in the country.

But naturally, there are many nuances that need to be considered when investing in stock. There are always risks and everywhere - you should not forget about them!

The biggest risk for stocks (for those who put on their height) are financial crisis ! During the rest of the time, the shares are generally growing and showing good yield.

In addition, it is necessary to understand that the price of stocks depends very much on the actions of speculators, rather than from the real financial situation of the company in the market.

Also as an option, you can invest money in a group of shares, i.e. So-called indexes (they show the economic situation in the country), for example:

- RTS (50 largest companies in Russia),

- S & P500 (500 US largest companies),

- NASDAQ (100 high-tech US companies).

If you do not want to personally invest in investment, that is, the option to entrust money by professional manager. About how I invested in the Governors for Alpari, I have already mentioned at the beginning of the article! For more information about this direction, I will definitely tell you a little lower in this article!

Insert the same in stocks can be easily through.

OUTPUT: With competent management of the action, it is capable of bringing good yield, several times exceeding interest rate on bank deposits. But at the same time they relate to risky assets.

| Yield: | Risk: | Payback: | Minimum attachments: |

|---|---|---|---|

| 15-100% per annum (change in stock price + dividends) | Depends on the strategy | 1-7 years old | from 5-10 thousand rubles |

| (⭐️⭐️⭐️ - medium / high) | (⭐️⭐️ - medium / high) | (⭐️⭐️ - average) | (⭐️⭐️⭐️ - Low) |

| Pluses and ➖ Minuses: | |||

| (+ ) With minimal / moderate risks, it is possible to obtain a relatively high yield. | (+ ) High liquidity - at any time the action you can quickly sell and get money in your hands. Low input threshold. | (- ) Knowledge requires. The uncontrolled risk and "flirting" with the market can lead to significant losses. | (- ) In the case of the crisis, the shares may also fall in price in a short time. |

Option number 4: PAMM-account, PAMM-portfolios, trust management and structural products

DESCRIPTION: But this method is usually suitable for those who have no experience and time to understand all nuances of trade on financial markets (stock markets, forex, oil, gold ...).That is, in this case, you trust your money traders - those who are professionally engaged in trade in financial markets.

All you need to distribute the initial amount of investment on the part (preferably at least 3-5) and invest in various managers.

PAMM-account "MoriArti", its profitability for 5 years amounted to 135464% (click to increase)

💡 In this PAMM account (trader) invested over 2.5 million dollars His profitability for 5 years amounted to over 135 thousand percent.

However, it is necessary to take into account that despite the fact that in the past, the bill / portfolios showed a good profitability, in the future there is always a possibility that they will be unprofitable.

Therefore, I repeat Do not invest everything in one trader! Distribute funds at least among 2-3 reliable managerswho trade profitably for a long time. If the accounts are relatively new (less than 6 months), then share the initial investment among 5-10 traders.

Constantly monitor the situation and gets rid of accounts / portfolios, which for a long period bring losses. This is the whole secret of investment!

Read more about what PAMM account is and how they work can view the free tutorial of the webinar from their work professionals:

Go to the Alpari website and you can get acquainted with PAMM accounts.

With a larger initial capital, you can work with large stock exchange brokers (for example, Finam and BCS), which also provide various confidential management strategies.

✅For example, on fines in trust management can be given from 300 thousand rubles. There are dozens of diverse strategies: conservative, moderate and aggressive.

Of course, both brokers and managers also cannot be 100% guaranteed that you will receive income.

Immediately I want to tell you a few words about the so-called "structural products", because they are also directly related to the confidence-management. Income here, as a rule, is not as possible to give a PAMM account, but nevertheless structural products Can bring significantly more than bank interest and bonds.

They are also intended for beginners who want to increase their money. Structural products can bring yield to 100-200% per annum with minimal risks (risk is rigidly limited, there is protection of capital - usually you risk only 10% of your investments).

The essence of structural products is that you also invest money in stock markets (more precisely in specific shares, futures ...), which experts expected will grow or fall in the future.

Invest in such products as a rule maybe from 3000 dollars (some brokers have a minimum threshold above) and for a term from 3 months.

I will give an example of trust management - the leader of trade turnover on the Moscow Stock Exchange with the maximum reliability of AAA.

✅BCS offers investments in Gazprom's shares with sustained yield 10% per annum (Even if the price of them falls) and 100% protection of capital. In the case, if the price of shares is grown, then you can get 14% per annum .

So there are only 2 options: you will get either 10% or 14%. Consider that there are no risks, except for the company's actual bankruptcy. But this is extremely unlikely that company number 1 in the entire brokerage market in Russia went bankrupt, it is similar to the fact that Sberbank will announce bankruptcy. Therefore, in this regard, the risks are practically absent.

Investments are designed for a period of 3 months, which is also quite convenient. As a result, this option is an excellent alternative to the deposit, the rates on which is now significantly lower. The only minus is that the minimum amount of investments is 300 thousand rubles.

OUTPUT: Trust management combines convenience, moderate risks and middle / high yield. Particularly suitable for newcomers.

| Yield: | Risk: | Payback: | Minimum attachments: |

|---|---|---|---|

| from 15% to 200% per annum and higher | Depends on the type of strategy: conservative, moderate, aggressive | 1-8 years old | from 500 rubles |

| (⭐️⭐️⭐️ - high / average) | (⭐️⭐️ - medium / high) | (⭐️⭐️⭐️ - High) | (⭐️⭐️⭐️ - Low) |

| Pluses and ➖ Minuses: | |||

| (+ ) Turning the funds from the most efficient control / strategies, you can get a good average profitability. Fits beginners. | (+ ) The minimum amount for investment (especially in the PAMM account) is quite low. You do not need to engage in trading yourself. | (- ) Relatively high risks compared to bonds and bank deposits. | (- ) It is difficult to predict yield, as there may be unprofitable periods. Periodically need to monitor the managers. |

Option number 5: Bonds

DESCRIPTION: What do you think the money is investing large banks? Main in bonds! Yes, they give a small income, but with a high guarantee and reliability. Especially if you take government bonds.

As well as bank depositsBonds are considered one of the simple tools for investing. But in contrast to bank deposits, the bond rate is significantly higher.

For those who do not know, the bond if it is simple, it is a debt. Only as borrowers can act as large companies and the state.

☝️ By the way, Sberbank, and other banks sell national government bonds.If we invest for 3 years, then you can only get the yield on them 8.5% annualh. .

I agree, not very much, but the rate is already exactly better than most of the bank deposits available at the moment. Moreover, further deposit rates can decrease.

You can also consider bonds of major reliable companies - the rates will be higher on them! For example, on Sberbank bonds, the average yield is approximately 9,2%-12,2% annual (depends on the period).

At the same time, large funds can be inserted into bonds, since the security of funds will be higher here than for example in bank deposits, where only 1.4 million rubles are insured.

I also note that there are bonds, the yield on which can be dozens and hundreds percent . But such bonds have a low credit rating (for this they are called " garbage bonds"). Although they are able to bring quite high income, they are a very risky kind of investment.

Bonds as well as stocks can be bought without the need to pay income tax (if they purchase them for more than 3 years).

OUTPUT: Bonds are suitable for those who strive to receive an average yield with a relatively high guarantee.

| Yield: | Risk: | Payback: | Minimum attachments: |

|---|---|---|---|

| From 7% to 15% per annum (in a risky from 30% to 100% and above) | Depends on bonds (according to state - very low) | 7-12 years old | from 10 thousand rubles |

| (⭐️⭐️ - medium / low) | (⭐️ - Low) | (⭐️⭐️ - medium / low) | (⭐️⭐️⭐️ - Low) |

| Pluses and ➖ Minuses: | |||

| (+ ) Optimal yield in combination with low risks. At any time, you can sell bonds without losing income. | (+ | (- ) Relatively not high yield compared with shares and some other assets. | (- ) There is a risk of bankruptcy of the Issuer (especially related to low rating bonds). The lower the credit rating, the less trust in it. |

Option number 6: Forex

DESCRIPTION: Forex - essentially this is the currency market, where you can buy / sell one or another currency.

DESCRIPTION: Forex - essentially this is the currency market, where you can buy / sell one or another currency.

This can be done both through banks and online with the help of specialized brokers (where by the way, the commission is 10 less).

Example!

For example, you purchased 10,000 dollars at the rate of 57 rubles / dollar - in the end you invested in dollars 570,000 rubles. After a time, the course reached 60 rubles for 1 dollar, and you sold dollars.As a result, after the exchange, you received 600,000 rubles, and the income was compared to 30 000 rubles (Of these, the broker commission is approximately 600-800 rubles).

The forex can be traded both yourself and give money to the management of professional traders (it will be written in detail in the next section of the article).

With independent trading, the currency is very important to have trade experience and z. on the foreign exchange market . We climb into the currency market just like that, in the hope of light profit, it is not worth it (and when it was exactly done), as this usually leads to serious losses.

It is important to note that with personal trading you need to follow the verified trade StrategyOtherwise, trade is likely to turn into a casino and lead to a well-known sad result.

But the other side, if you follow the risk (managing), manage emotions and trade exclusively on the strategy, then you can really earn at Forex. But it needs to be trained!

Although it is possible to start on Forex with minimum amounts - from $ 1, still need more or less serious investments (preferably from 100 thousand rubles), because even if you get to increase the initial deposit for 10% for a month (which is very good), then the profit will not be so big.

As for me, so one of the most effective trading strategies on day bars is a price action. A lot of articles are written on it on the Internet - who is interested to read!

Among reliable brokers can choose for example, alpari or roboforex.

OUTPUT: The forex market is more unpredictable than the stock market, which means more risky. Nevertheless, when used by investing, you can get high income. For those who are not ready to seriously study, this option is not suitable - it is better to consider PAMM investment. About it speech will go Below! 👇

| Yield: | Risk: | Payback: | Minimum attachments: |

|---|---|---|---|

| from 15% to 100% per annum | Depends on the strategy (initially has a high risk) | 1-7 years old | from 100 rubles |

| (⭐️⭐️⭐️ - high / average) | (⭐️⭐️⭐️ - high / medium) | (⭐️⭐️⭐️ - High) | (⭐️⭐️⭐️ - very low) |

| Pluses and ➖ Minuses: | |||

| (+ ) If there is an effective strategy, you can get a high yield. | (+ ) Low entry threshold and availability. | (- ) High risks, especially for beginners. You can lose significant money in a short time if you do not manage the risk. 99% of newcomers losing his money. | (- ) Learning is required: Special knowledge and experience, as well as the ability to manage emotions. There is no guarantee that in one or another period will receive a profit. |

Option number 7: Your / Partner Business

DESCRIPTION:

And this, in my opinion, one of the most profitable ways of investing, which can bring you not one hundred or even a thousand percent income!

DESCRIPTION:

And this, in my opinion, one of the most profitable ways of investing, which can bring you not one hundred or even a thousand percent income!

Of course, in most cases, business requires personal presence. But on the other hand, a business can automate the process or simply to invest in someone's business at the development stage.

As an option, you can buy a ready-made business or open a franchise business (in this case, the risks will be much lower).

At the same time, even if you have a small initial capital, you can still open your business. Many people opened a profitable business practically without investments or with minimal investments, so the money here is not the most important, the main thing is desire and desire! 😀

I myself started a successful business from full zero! By the way, if you turn to statistics, then amongmill 70-80% - These are entrepreneurs who started a business from scratch!

Estate attention:

You can turn your hobby into a business and never in life no longer work, but to do your favorite thing! Perhaps this is the most preferred option!As spoke of Confucius:

« Choose your own job in the soul, and you do not have to work for a single day in your life!«

And about how to find your favorite work / Case - read.

If you still do not have a stable source of income, then first think about creating a business, let him even be small. The main thing in this matter is not to be afraid make the first step!

Think, maybe you always wanted to open your car service, hairdresser, sporting goods store or handmade goods store?

Here are some more useful tips:

- Start with a small (and with minimal investments) and gradually develop your business. At the initial stage of business development, do not invest big money immediately.

- Choose a niche with minimal competition - it is easier to start in them.

- If you have a small initial capital, then it is possible to try business in the service sector.

I will also give you several options from my experience, as you can start a business with minimal investments, I think you will be interested! 👇

Examples!

It is easy to start your business and on the Internet. For example, you can provide services or sell products through ads (the most popular - Avito). I just started with that! 🙂By the way, it is now very popular products from China, where the markup can reach up to 500-3000%. Including such goods are successfully sold through the Internet (single-page).