What is capital investment in fixed assets. What is capital investment in accounting. Fixed capital investments

3. The concept of capital investments

Investments in fixed assets of an enterprise are called capital investments, and costs are called investment.

Capital investments- these are the costs of creating new, technical re-equipment, reconstruction and expansion of existing fixed assets. In terms of economic content, capital investments are part of the social product, and, above all, the accumulation fund, directed to the reproduction of fixed assets.

V capital investments include construction costs - assembly work, purchase of equipment, tools, inventory, other capital work and costs (design and survey, geological exploration and drilling, the cost of land acquisition and resettlement in connection with construction, training for newly built organizations). Capital investments are reflected in the balance sheet at the actual costs for the developer-investor.

Capital and financial investments complement each other and form a common investment portfolio.

Currently, direct state regulation of investment activities, state support for investment projects is carried out mainly by directing financial resources for the implementation of state targeted programs and for other state purposes. The amounts of appropriations for these purposes are annually included in the volume of state centralized capital investments. Reproduction of fixed capital in an enterprise can be carried out either through direct investments, or by transferring fixed capital objects to founders against contributions to authorized capital, or upon gratuitous transfer to legal entities and individuals.

The main method of expanded reproduction of fixed capital is direct investment (capital investment). Direct investments represent the costs of creating new objects of fixed capital, expansion, reconstruction and technical re-equipment of existing enterprises.

New construction includes construction costs at new sites.

Expansion means construction of the second and subsequent stages of enterprises, additional production complexes and industries, as well as new structures or expansion of existing main-purpose workshops.

Reconstruction is a complete or partial re-equipment and reorganization of an enterprise (without the construction of new and expansion of existing workshops of the main production purpose, except, if necessary, the creation of new and expansion of existing auxiliary and service facilities) with the replacement of obsolete and physically worn out equipment, mechanization and automation of production , elimination of imbalances in technological links and support services.

Technical re-equipment includes a set of measures (without expanding production areas) to raise the technical level of individual production areas, units, installations to modern requirements by introducing new equipment and technology, mechanizing and automating production processes, modernizing and replacing outdated and worn-out equipment with new, more productive ones. The ratio of costs in these areas is called the structure of direct investment. Depending on the intended purpose and composition of capital investments, their sectoral, technological and reproduction structure is distinguished.

Industry structure Is the composition of capital investments by industry and activity (industry, transport, agriculture, trade, procurement, catering, building).

Technological structure capital investment means the ratio of costs by type: construction and installation work; purchase of fixed assets, equipment, machines, tools, inventory; other capital work and costs (design and survey, the cost of purchasing finished buildings from other enterprises and organizations, the maintenance of directorates of enterprises under construction).

Under the reproductive structure understand the distribution of capital investments by type of cost: construction of new enterprises; reconstruction of operating enterprises; technological re-equipment of existing enterprises (modernization and replacement of outdated equipment with new ones, introduction of new equipment and advanced technology).

Work on the construction of enterprises, facilities, structures is carried out either directly by the forces of the enterprise and business organizations carrying out capital investments (economic construction method), or special construction and installation organizations under contracts with customers (contract construction method).

With the economic method construction divisions are created at each enterprise, mechanisms and equipment are purchased for them, construction workers are attracted, and a production base is formed.

Contract method means that construction work is carried out by construction and installation organizations created for this purpose on the basis of contracts with customers. Execution of work under contracts ensures mutual control of the customer and the contractor, contributes to a more efficient, economical use of material, labor and financial resources.

Enterprises group costs according to the technological structure determined by the estimate documentation. The estimated cost of construction is the basis for determining the amount of investment in construction, the formation of contractual (contract) prices for construction, payments for work performed, to reimburse the costs associated with the acquisition and delivery of equipment, and other costs of construction participants provided for by the consolidated estimate of the cost of construction.

To determine the estimated cost of construction at different stages of design, the following estimate documentation is drawn up:

1. With a two-stage design:

a) at the stage of an architectural project: a consolidated estimate of the cost of construction; summary of costs; statement of the estimated cost of construction of facilities included in the start-up complex; object estimate calculations; local estimate calculations (resource estimates); statements of volume and cost of work; resource sheets (as requested by the customer); information block of data (at the request of the customer);

b) at the stage construction project: consolidated estimate of the cost of construction (at the request of the customer); summary of costs (as requested by the customer); statement of the estimated cost of construction of facilities included in the start-up complex; object estimates; local estimates (resource estimates); statements of volume and cost of work; resource sheets; information block of data;

2. for one-stage design at the stage of a construction project: a consolidated estimate of the cost of construction; summary of costs; statement of the estimated cost of construction of facilities included in the start-up complex; object estimates; local estimates (resource estimates); statements of volume and cost of work; resource sheets; information block of data.

At the stage of justifying investment in construction, development estimate documentation is made on the basis of a databank of analogue objects, aggregated cost standards in prices as of January 1, 2006, and in their absence - using resource-estimate standards in the following composition: local estimate calculations; object estimate calculations; consolidated estimate of the cost of construction.

The composition and volume of estimate documentation at different stages of design can be specified in the contract for the performance of design work.

The basis for determining the estimated cost of construction are:

- the customer's assignment for the development of design and estimate documentation;

- design documentation (defective acts on construction objects, for which the development of design documentation is not required);

- decisions made by the investor, customer and provided for in the design documentation, including in the section of the project "Organization of construction" (hereinafter - PIC);

- decisions of government bodies;

- regulatory legal acts of the Republic of Belarus on pricing in construction.

Local estimates (local estimate calculations, resource-estimate calculations) are compiled for certain types of work and costs. The estimated cost, determined according to local estimates (local estimate calculations, resource-estimate calculations), includes the basic wages of workers, the cost of operating construction machines and mechanisms, which includes the wages of drivers, the cost of materials, products and structures, as part of which indicates the transport costs for their delivery, the cost of equipment, furniture, inventory, overhead costs and planned savings.

Object estimates (object estimates) include totals from local estimates(local estimate calculations, resource-estimate calculations) and contain cost indicators: wages, operation of machines and mechanisms, including the wages of drivers, materials, products, structures, including transport costs, overhead costs, planned savings, equipment, furniture, inventory, other costs, total. Object estimates as a whole combine data from local estimates.

A summary estimate of the cost of construction is compiled on the basis of object estimates (object estimates), local estimates (local estimates, resource estimates) and estimates for certain types of costs and is the main document that determines the cost of construction.

In the consolidated estimate calculation, the estimated construction cost is divided into the following chapters:

Chapter 1. "Preparation of the construction site".

Chapter 2. "Main construction objects".

Chapter 3. "Objects of auxiliary and service purposes".

Chapter 4. "Energy facilities".

Chapter 5. "Objects of transport facilities and communications".

Chapter 6. "External networks and structures of water supply, sewerage, heat supply and gas supply".

Chapter 7. "Improvement of the territory".

Chapter 8. "Temporary buildings and structures".

Chapter 9. "Other works and costs".

Chapter 10. "Maintenance of the developer, customer (technical supervision), the cost of designer supervision."

Chapter 11. "Training of operational personnel".

Chapter 12. "Design and survey work".

A separate line after the total of Chapters 1 - 12 of the consolidated estimate of the cost of construction provides a reserve of funds for unforeseen work and costs.

A separate line in the summary estimate of the cost of construction includes a reserve of funds for unforeseen work and costs as a percentage of the amount of the estimated cost of work and costs. The reserve of funds for unforeseen work and costs is divided into two parts, one of which remains at the disposal of the developer, customer, and the other is transferred to the disposal of contractors.

Part of the reserve serves to reimburse the costs of contractors arising during the performance of work, in the event of a change on the initiative of the contractor in the methods of production of work, replacement of mechanisms, as well as in the prescribed manner of individual building structures and materials provided for in the design and estimate documentation, without deteriorating technical characteristics.

Part of the reserve of funds for unforeseen work and costs remaining at the disposal of the customer can be spent on: payment additional work caused by the clarification by the customer in the prescribed manner at the stage of the construction project in comparison with architectural project space-planning indicators and technological solutions, clarification constructive solutions, as well as the replacement at the initiative of the customer in the prescribed manner of individual building structures and materials provided for in the working drawings; clarification of the cost in case of revealing in the process of construction works that were not taken into account in the working drawings and estimate documentation; payment for other work and costs that are subject to reimbursement in accordance with regulatory legal acts at the expense of a reserve of funds for unforeseen work and costs.

Expenses are grouped by items: construction works; equipment installation work; purchase of equipment handed over for installation; purchase of equipment that does not require installation, inventory and tools, equipment that requires installation, but intended for a permanent stock; other capital expenditures; costs that do not increase the value of fixed assets.

Costs that do not increase the value of fixed assets are divided into 2 groups:

1st group - these are the costs provided for in the consolidated estimates of the cost of construction.

The 2nd group of costs that do not increase the value of fixed assets are costs not provided for in the consolidated estimates of the cost of construction.

On the basis of the act of acceptance and transfer of fixed assets, completed construction of buildings and structures, installed equipment, completed work on the reconstruction of objects that increase their initial value, are credited to fixed assets. Costs that do not increase the value of fixed assets are deducted from the Capital Investments account from the appropriate funding sources as the work is completed.

Construction work and equipment installation work can be performed in two ways: contractual and economic.

With a contract method works are reflected with the developer at the contractual cost according to the paid or accepted invoices of contractors on the "Capital investments" account.

With the economic method the actual costs of the developer are reflected.

In case of capital construction by contract, the investor-developer and the contractor enter into a construction contract, in which the costs incurred are distributed over the reporting periods. The procedure for concluding and executing construction contracts (contracts) is regulated by the Resolution of the Council of Ministers of the Republic of Belarus dated September 15, 1998. The subject of a contract is construction, reconstruction of an enterprise, building, structure or other facility, construction and other special installation work.

Customers and contractors can be legal entities and individuals of the Republic of Belarus and other states. The choice of a contractor is carried out: for objects for which tenders are held according to the legislation, according to their results; for objects for which bidding is not provided, at the discretion of the customer.

The work contract is concluded in writing by drawing up a single document. Before concluding a work contract, the customer and the contractor may conclude a preliminary agreement that defines the relationship between the parties at the stage of preparation for the construction of the facility. The preliminary contract contains the conditions that make it possible to establish the subject of the work contract, the timing of its conclusion, the obligations of the parties to prepare for construction, as well as other essential conditions the main contract. If such a period is not specified in the preliminary contract, then the work contract must be concluded within a year from the date of the preliminary contract. If the party that has entered into a preliminary contract evades the conclusion of a work contract, then the other party has the right to apply to the court with a demand to compel the conclusion of such a contract.

Obligatory elements of agreement on a construction contract are: the names of the parties and the necessary details ( legal addresses in accordance with the constituent documents or passport data, settlement accounts of servicing banks, account numbers tax office, numbers of certificates of state registration, numbers and validity of the contractor's licenses); form of payment; contractual construction cost; construction object, indicating the availability of a project and an estimate for each construction object; the composition of developers-investors and persons authorized by the investor to implement investment projects for capital construction; forms of investment, including equity capital, borrowed and attracted; the volume of construction in progress at the date of the conclusion of the contract; the developer's costs for the commissioning of the construction object; the inventory value of the object; list of contractors; list of contract works.

The procedure for settlements for completed construction work is determined by the terms of contract bidding or by agreement of the parties and is established by the work contract. Per settlement period a month can be taken, or a period of time required for the construction of an object or performance of construction work, or a completed stage (complex) of construction work.

In the work contract, the parties provide for the payment of advances to the contractor for the performance of construction work planned in the period taken as the estimated one. At the same time, for objects financed from the republican and local budgets, state target budget funds, advances should not exceed 50 percent of the cost of work. Along with the indicated advances, the work contract may provide for the transfer by the customer of one-time (targeted) advances for the purchase of non-standard building structures and products, material resources, the supply of which depends on the seasonality of construction work, as well as for purchases under foreign trade contracts. The specific size, timing and procedure for the transfer of advances are determined in construction contracts, taking into account the nature of the object, construction conditions and other factors.

The customer has the right, with the consent of the contractor, to transfer the advance payment directly to the manufacturers of structures, materials, products or equipment, if the contractor has concluded relevant agreements with them. The cost of construction work payable is determined net of advances previously received by the contractor. The advance payment is considered used if the scope of work stipulated by the work schedule has been completed in full. Advances not used in a timely manner are subject to indexation taking into account changes in the cost of construction and installation work due to inflation. Advances not used intended purpose, are subject to indexation taking into account changes in the cost of construction and installation work due to inflation and return to the customer at his request.

Poorly performed construction work is not subject to payment, is not paid until the defects are eliminated and subsequent construction work technologically related to them. After the elimination of defects, previously poorly performed construction work and subsequent construction work technologically related to them are subject to payment at prices in effect on the date of their execution originally established by the work contract (calendar schedule).

Calculations under a construction contract can be in the form of advance payments for completed work elements or be carried out after the completion of all work at the construction site. The contractual construction cost is calculated on the basis of the cost determined in accordance with the project, i.e. a fixed price and the conditions for its change, indicating the relevant factors, indices and other criteria. Another method of determining the contractual value is based on the terms of reimbursement of the actual cost of construction in the sum of the accepted costs, estimated at current prices, plus the agreed profit of the contractor or the level of profitability of the work, i.e. open price.

The costs of the developer for the construction of the facility include: costs associated with capital costs, including construction work, purchase of equipment, installation of equipment, as well as costs that do not increase the value of fixed assets; costs associated with the commissioning or delivery of the object to the investor; the expected costs associated with construction and its financing, which the developer will incur in accordance with the construction contract after the completion of the construction of the object and its commissioning or delivery to the investor.

When the developer performs contract work on his own, the actual costs associated with the implementation of these works, including the costs of maintaining these divisions, and organizing construction are taken into account. After completion of construction, the developer determines the inventory value of each element put into operation as part of the construction object, which is a separate accounting item in the composition of fixed assets.

Contractor costs under the construction contract include all actual costs associated with the use of material and labor resources, fixed assets and intangible assets, as well as other types of resources.

The financial result of the developer for activities related to construction, is formed as the difference between the amount of funds for its maintenance, included in the estimates for objects under construction in this reporting period, and the actual costs for its maintenance. If the calculation is carried out at the contractual cost, then the financial result also includes the difference between this cost and the actual costs of building the facility, taking into account the costs of maintaining the developer.

Contractor's financial result depends on the accepted forms of determining income. Income can be determined for individual work performed and for the construction object.

When determining income as individual works are completed on structural elements or stages, the method "income at the cost of works as they are ready" can be used. When determining the income after the completion of all work at the construction site, the method "income at the cost of the construction site" is applied. The choice of the method for determining the financial result is a task financial service contractor.

6 "Transfer of young animals to the main herd";

7 "Purchase of adult animals", etc.

The debit of account 08 reflects the actual costs of the developer included in the initial cost of fixed assets, intangible assets and other relevant assets.

The formed initial cost of fixed assets, intangible assets, etc., taken into operation and executed in the prescribed manner, is debited from account 08 "Investments in non-current assets" in the debit of accounts 01 "Fixed assets", 03 "Profitable investments in tangible assets", 04 "Intangible assets", etc.

The balance on account 08 reflects the amount of the organization's investments in construction in progress, unfinished transactions for the acquisition of fixed assets, intangible and other non-current assets, as well as the formation of the main herd.

When selling, transferring gratuitously and other transactions with investments recorded on account 08, their value is written off to the debit of account 91 "Other income and expenses".

Analytical accounting on account 08 is maintained:

For the costs associated with the construction and acquisition of fixed assets - for each item of fixed assets under construction or acquired; at the same time, the construction of analytical accounting should provide the ability to obtain data on costs for:

Organizations, business associations, public organizations and other legal entities of all forms of ownership;

International organizations, foreign legal entities;

Individuals - citizens Russian Federation and foreign citizens.

Customers (developers) can be investors, as well as other individuals and legal entities authorized by investors to implement investment construction projects.

Capital investments can be financed by:

Investor's own financial resources;

Borrowed financial resources the investor or the funds transferred to him (bond loans and other funds);

Attracted financial resources of investors (received from the sale of shares, share contributions of labor collectives, citizens, legal entities);

Funding for capital investments in construction projects and facilities can be carried out both at the expense of one or at the expense of several sources.

Depending on the type of financing for new construction, the customer (developer) may use various accounting options, there are (or not) grounds for application tax incentives, different forms of statistical reporting and primary documents are used.

Accounting for construction costs and sources of financing from the customer-developer in the case of a contract method of work. According to the Regulation on accounting, the current costs of manufacturing products, performing work and providing services and costs associated with capital and financial investments are accounted for separately.

Developers, when fulfilling construction contracts, must ensure the formation of information about accounting objects according to the following indicators:

Construction in progress;

Completed construction;

PBU 13/2000 does not apply to budgetary organizations which, in terms of accounting for budgetary funds, are guided by the Instruction on accounting in budgetary institutions, approved by order Ministry of Finance of Russia from 01.01.01, N 107n, as well as to non-profit organizations.

In PBU 13/2000, an uncontested option was adopted: recognition of the received state aid as the income of the organization.

Clause 5 of this Regulation discusses the conditions for accepting budget funds for accounting, including in the form of resources other than monetary funds.

To do this, the organization must have confidence that:

PBU 13/2000 applies to budgetary funds that are to be recognized in accounting provided for specific purposes. commercial organizations(except for credit), after January 1, 2001. For previously received budgetary funds, this Regulation is valid in the part relating to the periods after January 1, 2001;

The organization will fulfill the conditions for the provision of these funds;

The funds indicated will be received.

The fulfillment of the listed conditions can be justified by the following documents: target program, decree, decision, agreement, contract, etc .; approved budget schedule, notification of budget allocations, limits budget commitments; an act (invoice) of acceptance and transfer (for example, fixed assets - form N OS-1, equipment - form N OS-14); a plan for the transfer of land and structures; other documents confirming the transfer of ownership, use and disposal of assets to the organization.

The procedure has been established for recognizing in accounting the received state aid as the income of the organization on non-current assets erected at the expense of budgetary funds and subject to depreciation, in accordance with the current rules: recognition occurs at the time the depreciation deductions are accrued.

In accordance with clause 9 of PBU 9/99 "Income of the organization", the amounts recorded on account 86 "Target financing" are written off for an increase financial results organizations, that is, to account 91 "Other income and expenses" as non-operating income.

During the term useful use objects of non-current assets, the amount on account 98 "Deferred income" shall be attributed in the amount of accrued depreciation over the useful life of non-current assets for which, according to the current rules, depreciation is charged.

3. Construction accounting in an economic way

Many organizations build fixed assets on their own, without involving contractors. Accountants of such organizations have questions: how to take into account the costs of the construction of fixed assets, are "own" construction work taxed with value added tax or not? Let's try to answer these questions.

The peculiarities of accounting in organizations conducting construction in an economic way are due to the fact that, on the one hand, capital investments are made, the accounting of which is regulated by the Regulation on accounting for long-term investments, approved by the letter of the Ministry of Finance of Russia dated 01.01.01, N 160, and on the other hand, the cost of construction and installation work is formed directly in the organization making capital investments. Therefore, when taking into account the costs incurred, one should be guided by the Typical guidelines on planning and accounting for the cost of construction work, approved by the Ministry of Construction of Russia on December 4, 1995 N BE-11-260 / 7.

The prime cost is formed directly on account 08 "Investments in non-current assets" (and not on account 20 "Main production", as in specialized contractors).

Structural divisions created to carry out construction and installation work in an economic way, as a rule, are not allocated to a separate balance sheet (although with large volumes of construction it is advisable to allocate an accountant specifically to account for the operations of this division). This means that the expenditure of material, monetary and the use of labor resources will be reflected in the same balance sheet as operations in the main activities of the organization.

As we have already said, the costs of building fixed assets in an economic way are formed on account 08. The following postings are made in the accounting of the organization.

The question arises about the procedure for calculating VAT when accounting for construction operations in an economic way.

Until January 1, 1999, the Ministry of Finance of Russia and the Ministry of Taxation of Russia had a unanimous opinion on this issue - the tax should be charged on the entire volume of construction and installation work performed in an economic way, and included in the indicator of sales of products (works, services).

With the entry into force on January 1, 1999, of the first part of the Tax Code of the Russian Federation, the opinions of the Ministry of Finance of Russia and the Ministry of Taxes and Duties of Russia were divided.

The Ministry of Taxes and Duties of Russia is of the opposite opinion, guided by the provisions of Article 454 of the Civil Code of the Russian Federation and Article 39 of the Tax Code of the Russian Federation. According to this opinion, from January 1, 1999, construction and installation work carried out in an economic way should not be included in the volume of sales of products and, therefore, there is no need to charge VAT and other taxes on the volume of sales of products, since there is no such. (This opinion of the Ministry of Taxes and Tax Collection of Russia expresses when answering specific questions of organizations.)

Arbitration courts adhere to the same opinion, considering claims of taxpayers against tax authorities... At the same time, VAT accrued on the volume of construction and installation work and paid to the budget is not refundable.

Since January 1, 2001, in connection with the entry into force of part two of the Tax Code of the Russian Federation, the following procedure for calculating VAT for construction in an economic way has been determined. Construction and installation works are subject to value added tax (Article 146 of the Tax Code of the Russian Federation) at the time the object is accepted for accounting, that is, if the object is not created as a result of the work, VAT does not need to be charged.

According to article 159 of the Tax Code of the Russian Federation, value added tax is charged on the cost of construction and installation work performed for own consumption, calculated on the basis of all actual expenses of the taxpayer for their implementation. By virtue of Article 171 of the Tax Code of the Russian Federation, the tax amounts presented to the taxpayer for goods (work, services) purchased by him for construction and installation work are subject to deductions.

Thus, when registering an object completed with capital construction, an organization must charge VAT on the cost of construction and installation work performed on its own and deduct this tax when filling out a tax return.

4. Documenting the movement of capital investments

According to the album unified forms primary accounting documentation, the main document for taking into account the costs of the developer for construction in progress is a certificate of the cost of work performed and costs (form N KS-3).

Help in the form N KS-3 is also used for settlements with the customer for the work performed and is filled in in triplicate: the first copy - for the contractor; the second copy - for the customer (developer, general contractor); the third copy is sent to the address of the financing organization, it is presented only at the request of this bank.

This certificate is prepared on a monthly basis by a specialist of the organization that performed construction and installation work, overhaul of buildings and structures, and other contract work in the reporting period.

The cost of work and costs in the certificate in the form N KS-3 is indicated in the contractual prices at which the customer's settlements with the contractor are carried out.

Documents on acceptance of the completed construction of an object (buildings, structures, their queues, launch complexes) when they are fully prepared in accordance with the approved project, the work contract (contract) is an act of acceptance of the completed construction of the facility (Form No. KS-11) and an act of acceptance of the completed construction of the facility by the Acceptance Commission (Form No. KS-14). These documents also serve as the basis for the final payment for all work performed by the contractor.

These acts are drawn up in the required number of copies and signed by representatives of the contractor (general contractor) and the customer or other persons authorized by the investor, respectively, for the contractor ( general contractor) and the customer.

Acceptance of objects is drawn up by the customer and members of the acceptance committee on the basis of the results of examinations, inspections, control tests, measurements and documents of the contractor, confirming the compliance of the accepted object with the approved project, norms, rules and standards, as well as the conclusions of the supervisory authorities.

Only after registration of these acts, construction objects are taken into account as part of fixed assets.

CONCLUSION

To account for the costs of increasing non-current assets of durable use (for a period of more than 12 months), the active account 08 "Investments in non-current assets" is used. This account is intended to collect information on the capital costs of the developer for fixed assets, as well as on the costs of forming the main herd of productive and working livestock (except for poultry, fur animals, rabbits, families of bees, service dogs, experimental animals, which are accounted for as part of funds in turnover).

Thus, on account 08 "Investments in non-current assets" all expenses for the acquisition of fixed assets and construction and installation work carried out by an economic or contractual method are taken into account.

Construction, as a form of capital investment, is carried out in two ways:

1) contracting, in which construction and installation work is carried out by a specialized contractor, and the functions of the customer are performed either directly by the investor or by a specialized organization;

2) economic, in which both the functions of the customer and the functions of the contractor are performed by the investor himself. At the same time, in the organization making capital investments, specialized structural units(capital construction departments).

The construction of any object must be carried out with the permission of the owner land plot and (or) buildings, structures and in compliance with urban planning, building codes and rules.

Accounting for construction costs and sources of financing from the customer-developer in the case of a contract method of work. According to the Regulation on accounting, the current costs of manufacturing products, performing work and providing services and costs associated with capital and financial investments are accounted for separately.

The object of accounting for the developer is the costs of a construction object, incurred in the performance of certain types of work on objects erected under the same project or construction contract.

Construction by an economic method differs from contract construction in that there is no separate economic entity performing construction under a contract with a developer. In this situation, the developer and the investor are one person.

Many organizations build fixed assets on their own, without involving contractors. Accountants of such organizations have questions: how to take into account the costs of the construction of fixed assets, are "own" construction work taxed with value added tax or not? Let's try to answer these questions. According to the album of unified forms of primary accounting documentation, the main document for taking into account the costs of the developer for construction in progress is a certificate of the cost of work performed and costs (form N KS-3) Only after these acts are drawn up, construction objects are taken into account as part of fixed assets.

LIST OF USED LITERATURE

1. Rules (standards) of auditing activities - M: " Modern economics and law ”, p.

2. Baryshnikov and the audit methodology - M: UNITI-M, p.

3. Bychkova activity: theory and practice - SPB: Lan, p.

4. Gutsait –M: "Modern Economics and Law", p.

5. Terekhov - M: UNITY-M, p.

6. Kochinev-M: "Modern Economics and Law", p.

7., Goloshchapov - SPB: Lan, p.

8. Burtsev audit - M .: INFRA-M, p.

9. Sweets of the Russian audit - M: UNITY-M, p.

10. Terekhov and audit - M: UNITI-M, p.

11., Zvezdin and control: Tutorial- M .: ID FBK-PRESS, 2003.

12. Fundamentals of auditing: Per. from English - M .: Audit, UNITI, 1995.

13., Gazaryan in audit. - M .: Finance and Statistics, 2001.

14. Voropaev of internal control of the organization. Accounting. 2003. N 9.

15. Fundamentals of audit: Textbook. Ed. prof. ... - M .: Publishing house "Accounting", 2000.

16., Starovoitova: Textbook. - 2nd ed., Rev. and add. - M .: ID FBK-PRESS, 2002.

17. Kochinev. - SPb .: Peter, 2002.

18., Sotnikova. - M .: Masterstvo, 2002.

19., Suits. - M .: INFRA-M, 2000.

20. Robertson J. Audit. - M .: KPMG, Auditing firm "Contact", 2001.

Since the beginning of 2014, the legal and regulatory framework that defines the specifics of capital investments in state (municipal) property has been significantly updated. Amendments to the RF BC entered into force, a number of resolutions of the RF Government were adopted, and amendments were made to other regulations governing the process of capital investments. What are the conditions for obtaining earmarked funds for construction and acquisition of real estate now? What should the institutions of physical culture and sports take into account when spending these funds?

Legal basis for changes

Amendments to the Budget Code have already approved not a temporary, but a permanent mechanism for making capital investments, and the changes primarily affected budgetary and autonomous institutions. In relation to them, in the past three years, the decrees of the Government of the Russian Federation have been in force, which determined that federal accounting and management institutions must make budget investments in the manner prescribed for recipients of funds. federal budget... Similar regulations were approved at the level of constituent entities of the Russian Federation and municipalities.Now the Budget Code has two main ways financial security construction or purchase real estate- by providing a state (municipal) institution with budgetary investments ( Art. 79 BC RF) or subsidies for capital investments ( Art. 78.2 BC RF). Truth, clause 1 of Art. 79 BC RF leaves room for the third option - when the authority itself makes budget investments, and the institution is transferred to operational management of an already finished object.

In the first two cases, institutions should apply the norms Federal Law dated 05.04.2013 No. 44-FZ "On the contractual system in the field of procurement of goods, works, services to meet state and municipal needs" (hereinafter - Federal Law No. 44-FZ). When making capital investments, state institutions act as a state (municipal) customer (by virtue of p. 5, 6 tbsp. 3 of this law), and budgetary and autonomous institutions are either customers ( clause 7 of Art. 3, h. 4 tbsp. 15), or endowed with the powers of the state and municipal customer in accordance with h. 6 art. 15.

It turns out that with regard to state-owned institutions of physical culture and sports, there is only one way to finance capital investments - through budgetary investments. But in relation to budgetary and autonomous institutions of physical culture and sports, both methods can be used: the provision of both appropriate targeted subsidies and budget investments. Let us consider in more detail the features of financial support in both cases.

Budget investment

According to clause 2 of Art. 79 BC RF budget investments in objects of state property of the Russian Federation or a constituent entity of the Russian Federation, municipal property are carried out in accordance with the procedure established, respectively, by the Government of the Russian Federation, the supreme executive authority of the constituent entity of the Russian Federation, and the local administration. The necessary package of documents has been adopted at the federal level. Among them - Decree of the Government of the Russian Federation of 01/09/2014 No. 13 , which approved the Rules for the implementation of capital investments in objects of state property of the Russian Federation at the expense of the federal budget (hereinafter - Rules No. 13). Similar regulations are beginning to be issued in regions and municipalities.The mechanism by which institutions can be provided with budgetary investments is as follows. First, the relevant authority determines the object of capital construction (real estate) and decides on the implementation of these investments. At the same time, the estimated cost of the object may include the funds necessary for the preparation of project documentation, the performance of engineering surveys, etc. ( Resolution of the Government of the Russian Federation of April 30, 2008 No. 324 as amended by from 01/09/2014).

After making a positive decision and communicating the limits of budgetary obligations to the institution, it carries out the procurement in accordance with Federal Law No. 44-FZ and concludes a state (municipal) contract. According to Clause 10 of the Rules No. 13 the contract is paid within the allocated limits or within the funds provided for by acts (decisions), for a period exceeding the validity period of the budgetary commitments limits approved by the institution.

As stated in Clause 9 of the Rules No. 13 , the costs associated with budget investments are carried out in the manner prescribed by budgetary legislation, on the basis of government contracts. In turn, the latter are:

a) government customers who are recipients of federal budget funds (this includes government agencies);

b) organizations to which the founding body has transferred the powers of the state customer (this includes budgetary and autonomous institutions).

Note that delegation procedure is now additionally regulated in the Budget Code. According to p. 4 his Art. 79 a state or local government body has the right to transfer free of charge to the subordinate BU and AU its powers to conclude and execute a state (municipal) contract on behalf of a public law entity. For this, the founder and the institution must sign a corresponding agreement.

Such an agreement can be concluded in relation to several objects of capital construction (real estate) and must contain the following conditions:

- the purpose of the budget investments and their volume, broken down by year in relation to each object. The name of the object, its capacity, cost, construction time (reconstruction, including with elements of restoration, technical re-equipment) or acquisition should also be indicated;

- the rights and obligations of a budgetary or autonomous institution to conclude and execute state (municipal) contracts on behalf of the founding body;

- responsibility of the BU or AC for non-performance or improper performance of the delegated powers;

- the founding body's right to carry out inspections of compliance by a budgetary or autonomous institution with the terms of the delegation of authority agreement;

- the responsibility of the control unit or the control unit to maintain budget accounting, preparation and presentation of budgetary reporting as a recipient of budgetary funds.

One more point is essential. A budgetary (autonomous) institution of physical culture and sports, which has been delegated the powers of a state or municipal customer, must conclude a state (municipal) contract on behalf of a public law entity represented by the founding body ... The Ministry of Finance and the Federal Treasury have repeatedly pointed to this in their letters (see, for example, p. 4.1.1 Letters of the Ministry of Finance of the Russian Federation No. 02-02-005 / 58618, Federal Treasury No. 42-7.4-05/5.1-897 from 31.12.2013(hereinafter - Joint letter)).

Capital investment subsidies

As in the case of budget investments, the procedures for granting subsidies for capital investment should be developed at the federal, regional and municipal levels (clause 2 of Art. 78.2 BC RF). At the federal level, this issue is regulated by Rules No. 13 and the Rules for Decision Making on Granting Subsidies from the Federal Budget for Capital Investments in Capital Construction Projects of State Property of the Russian Federation and Acquisition of Real Estate Objects in State Property of the Russian Federation, approved By Decree of the Government of the Russian Federation of 09.01.2014 No. 14 (hereinafter - Regulation No. 14).According to the above-mentioned regulations, the authority must make a decision on the granting of the subsidy in question. It should be borne in mind that these funds are not financed, for example, the development of project documentation and the implementation of engineering surveys, a state examination and verification of the reliability of determining the estimated cost of the object ( Clause 7 of the Rules No. 14 ). The named works can be taken into account when forming the estimated cost only if there is an appropriate decision of the authorized authority.

Further, the recipient of budgetary funds, providing the subsidy (this is usually the founding body), and the budgetary (autonomous) institution must sign an agreement. By virtue of paragraph 4 of Art. 78.2 BC RF it can also be concluded in relation to several objects and, in addition to describing the subject of the contract, the rights and obligations of the institution, should contain, in particular, the following provisions:

- the condition for the autonomous institution to comply with the provisions of Federal Law No. 44-FZ when using the subsidy;

- autonomous institution duty to open personal account in the Federal Treasury body (financial body) to record operations for the receipt and use of subsidies;

- the terms (the procedure for determining them) for transferring the subsidy, as well as provisions establishing the obligation to transfer the subsidy to the personal account of the institution;

- the right of the recipient of budgetary funds, providing the subsidy, to carry out inspections of the compliance of the BU or AC with the terms of the agreement;

- the procedure for the return of the BU or AC of the unused residues of the subsidy in the absence of a decision by the recipient of budgetary funds providing the subsidy on the direction of these funds for the same purposes;

- the procedure for the return of the amounts used by the BU or AU, in the event that, based on the results of inspections, the facts of violation by the institution of the goals and conditions determined by the agreement are established;

- suspension of the provision of a subsidy or a reduction in its volume in connection with a violation by the BU or AC of the condition on co-financing of capital investments in the object of state (municipal) property from other sources (if this condition is provided for by the agreement);

- the procedure and terms for submitting reports on the use of subsidies by BU or AU;

- cases and procedure for amending the agreement (including when the recipient of budgetary funds decreases the previously announced limits of budgetary obligations for the provision of subsidies), as well as early termination of the agreement.

After granting a capital investment subsidy, a budgetary (autonomous) institution selects a contractor or seller of a finished property in accordance with Federal Law No. 44-FZ. However, not a state (municipal) contract is signed with the winner, but civil contract - on behalf of the organization itself (clause 4.1.2 of the Joint Letter). Moreover, by virtue of paragraph 5 of Art. 78.2 of the Budget Code of the Russian Federation, such an agreement must include a condition on the possibility of changing the size, and (or) the timing of payment, and (or) the amount of work in the event that the recipient of budgetary funds decreases the previously announced limits of budgetary obligations for the provision of subsidies. And the contractor has the right to demand from the BU or AU compensation for the actual damage incurred, directly caused by changes in the terms of the specified contract.

Capital investment process

The chosen method of financing will determine the specifics of spending the allocated funds.When implementing budgetary investments, state institutions, as well as budgetary and autonomous institutions, which have been delegated the powers of a state (municipal) customer, must be guided by the regulatory framework applicable to recipients of budgetary funds. The expenses of institutions related to the execution of the state (municipal) contract will be subject to authorization in accordance with the Order of the Ministry of Finance of the Russian Federation dated 01.09.2008 No. 87n, and in relation to those not used at the beginning of the next fiscal year the balances of the limits of budgetary obligations for the execution of these government contracts, it is necessary to apply the provisions of the Order of the Ministry of Finance of the Russian Federation of 19.09.2008 No. 98n.

Based on the data of budgetary accounting, institutions spending budgetary investment funds should form for reporting period and to submit to its superior manager (chief manager) of budgetary funds or to the authority that delegated authority, budget reporting provided for recipients of budgetary funds by Order of the Ministry of Finance of the Russian Federation dated 28.12.2010 No. 191n.

In turn, the use of capital subsidy funds should be guided by other documents. In this case, the authorization of expenses and the collection of unused balances are carried out according to the same rules as in relation to subsidies for other purposes (orders of the RF Ministry of Finance dated July 16, 2010 No. 72n and dated July 28, 2010 No. 82n). And operations related to the construction or acquisition of an object are reflected in the accounting (financial) statements of budgetary and autonomous institutions in accordance with the Order of the Ministry of Finance of the Russian Federation dated March 25, 2011 No. 33n (by type of activity 6 “Subsidies for capital investments).

Now let's summarize the main differences between the two ways of making capital investments in the form of a table.

| Parameter for comparison | Budget investment | Capital investment subsidies (for BU and AC) | |

| Allocated to state customers (CU) | According to the delegated powers (for BU and AU) | ||

| Basis for capital investment | State (municipal) contract | Delegation of powers agreement, state (municipal) contract | Subsidy agreement, civil contract |

| Party to the contract | State (municipal) customer on behalf of a public law entity | State (municipal) customer (authority that transferred powers) on behalf of a public law entity | Institution |

| Opening an account | Personal account of the recipient of budgetary funds (CU) | Personal account of the recipient of budgetary funds (authority) for the delegated powers | Separate personal account of the institution |

| Authorization of expenses, return of unused balances | As for recipients of budgetary funds | Similar to subsidies for other purposes | |

| Reporting type | Budget reporting | Accounting (financial) statements | |

| Type of statistical reporting on purchases | For recipients of budgetary funds - form 1-contract | For BU - form 1-contract; for AU - form 1-purchase (section 4) |

|

Conclusion

As you can see, the mechanism for making capital investments has changed least of all for state institutions of physical culture and sports. The main innovation for them is that when purchasing within the framework of budgetary investments, since 2014 it is necessary to be guided by Federal Law No. 44-FZ (instead of Federal Law No. 94-FZ of 21.07.2005, which has expired).For budgetary and autonomous institutions, the mechanism for providing a subsidy for capital investment will be more familiar, since in this case earmarked funds spent according to the rules already applied in relation to subsidies for other purposes. But with the implementation of budgetary investments, accompanied by the transfer of powers of the state customer, the changes will be the most significant. BU and AU will need not only to conclude state and municipal contracts, but also to keep budget records, as well as draw up budget reporting.

Capital investments represent a set of costs for the reproduction of fixed assets and the improvement of their qualitative composition - the creation of new ones, the expansion and modernization of existing ones.

In accounting, capital investments accounted for separately from current production costs... This is stated in clause 6 of Article 8 of the Federal Law dated November 21, 1996 No. 129-FZ "On Accounting".

Types of capital investments

Capital investments in the enterprise include:

- Buildings and constructions;

- Inventory that is necessary in the process of activity;

- Machines and equipment that are used to carry out activities at the enterprise;

- Cars, thanks to which are carried out by the company.

The main difference between capital investment and other expense items is that their use remains unchanged for one year or more. If investments are used for less than one year, then they cannot be classified as capital and cannot be formalized according to this accounting entry... If financial costs are incurred for the modernization or restoration of buildings or equipment, then such financial transactions can also be considered capital.

Features of some types of capital investments

Consider the features in the form of a table:

| Capital investment type | Feature Description |

| Building | This type includes not only the erected new buildings, but also those that will be used in the production process, as well as the real estate that they plan to expand. Capital investments also include costs that are associated with the restoration of damaged buildings, regardless of the amount of costs. Construction costs are divided into production and non-production: production - these are those premises that are associated with the production process; non-production facilities - office premises and utility facilities. |

| Equipment | If equipment is purchased, then with accounting capital investment must clearly identify the property being purchased. Equipment that requires installation during installation is classified as requiring installation. This category includes technological or other equipment, the installation of which is carried out at a permanent place of operation. Equipment that does not require installation includes standing machines, cars, and other equipment that moves. |

| Intangible assets | This category includes licenses, trademarks or permits acquired on a reimbursable basis for the extraction of natural resources. |

Capital investment accounting

In accounting, capital investments are accounted for separately from current production costs. This is stated in clause 6 of article 8 of the Federal Law of 21.11.1996 N 129-FZ “On Accounting”.

In order to reflect information on the costs of objects, which will then be accepted in accounting as fixed assets and intangible assets, account 08 “Investments in non-current assets” is used. This account reflects those expenses that the buyer actually paid, and then they will amount to the initial cost of fixed assets or intangible assets.

Sub-accounts are opened for account 08 to account for the corresponding costs:

- “Acquisition of land plots”;

- “Acquisition of objects of nature management”;

- “Construction of objects of fixed assets”;

- “Purchase of items of fixed assets”;

- “Purchase of intangible assets”.

According to clause 8 of PBU 6/01, the initial cost of the purchased fixed assets is formed by the aggregate of the costs of their acquisition, creation and construction (net of VAT and other reimbursable taxes). In this case, accounting is carried out on an object-by-object basis.

The accounting entry in this case looks like this:

Dt 08 Kt 60.

How to form the initial cost of fixed assets, the company independently forms the rules, this is discussed in clause 26 guidelines on accounting of fixed assets (order of the Ministry of Finance of Russia dated 13.10.2003 No. 91n). According to the rules, the initial cost of an asset is the actual cost of producing it.

Important!!! The procedure for accounting and the formation of capital costs for the production of fixed assets must correspond to the procedure that is determined to account for the costs of the corresponding types of products produced by the company.

For self-created assets, accounting entries will look like this:

Dt 08 Kt 10, 02, 07, 10, 23, 26, 60, 69, 70, 71, 76 ...

Assets that are created independently include equipment that requires installation, or it is simply impossible to operate it without preliminary installation. Such assets are reflected on account "07". And the postings will be as follows:

Dt 07 Kt 15, 23, 60, 71, 75, 76, 79, 86, 91.

If the property is transferred for installation, then the equipment will be transferred from account 07 to account 08, and the transactions will look like this:

Dt 08 Kt 07.

The process of creating a new object can take a very long time. This is due, in particular, to the step-by-step method of accepting work, the long-term implementation of trial operation, which is carried out until the planned design parameters are achieved, and many other specific objective factors that take place in construction.

This entire process may require large capital expenditures, in which case the enterprise will simply be forced to apply for borrowed funds. Consequently, the interest paid borrowed money will increase the book value of capital investments in assets:

Dt 07, 08 Kt 66, 67.

IMPORTANT! This rule applies only to the interest that was accrued before the asset was accepted for accounting. After this event, interest is charged to operating expenses (clause 11 of PBU 10/99).

After all capital expenditures for the object are fully collected on account "08", it is considered ready for operation, and its value is transferred to account "01":

Dt 01 Kt 08.

List of wires in accounting for capital investment

Let's consider the postings using an example. So:

The company acquired a warehouse in March 2017 under a sale and purchase agreement, the value of which was RUB 1,184,000 (including 18% VAT - RUB 180,000). To purchase this premises, the company took out a loan from the bank in the amount of 500,000 rubles at 15% per annum for a period of one month. A month later, the company returned the borrowed funds to the bank and paid the due interest for using the loan. The interest was 6,250 rubles.

In April 2017, the company incurred the cost of registering ownership of the purchased warehouse in the amount of RUB 8,000. And in April the premises were already put into operation.

Consequently, the following entries were made in accounting:

| Wiring name | Amount in rubles | Debit | Credit |

| March 2017 | |||

| Reflection of the value of the warehouse as part of capital investments | 1 000 000 | 08 | 60 |

| VAT charged to the buyer | 180 000 | 19 | 60 |

| Received borrowed funds from the bank | 500 000 | 51 | 66 |

| Warehouse cost | 1 180 000 | 60 | 51 |

| April 2017 | |||

| Payment for state registration of ownership of a warehouse | 8000 | 76 | 51 |

| Inclusion in the actual costs of the acquisition of property, plant and equipment | 8000 | 09 | 76 |

| Interest debt | 6250 | 08 | 66 |

| Return of borrowed funds to the bank | 500 000 | 66 | 51 |

| Transfer of accrued interest to the bank for using the loan | 6250 | 66 | 51 |

| Warehouse put into operation | 1 041 250 | 01 | 08 |

Investments and capital expenditures

Investment is a relatively new term for our economy. Within the framework of the centralized planning system, the concept of "capital investment" was used. The concept of "investment" is broader than the concept of "capital investment". Investments include both real and portfolio investments. Real investments are investments in fixed and working capital. Portfolio investments - investments in securities and assets of other companies.

In the Federal Law "On investment activities in the Russian Federation carried out in the form of capital investments" dated February 25, 1999 No. 39-FZ, the following definitions are given to the concepts of "investment" and "capital investment":

« Investments - cash, securities, other property, including property rights, other rights that have a monetary value, invested in objects of entrepreneurial activity and (or) other activities in order to make a profit and (or) achieve another positive effect. "

« Capital investments- investments in fixed assets (fixed assets), including the costs of new construction, expansion, reconstruction and technical re-equipment of existing enterprises, the acquisition of machinery, equipment, tools, inventory, design and survey work and other costs. "

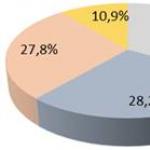

Based on this definition, investments in working capital cannot be considered capital investments. By direction of use capital investments are classified into production and non-production. Production capital investments are directed to the development of the enterprise, non-production - to the development of the social sphere.

Capital investments are distinguished according to the forms of reproduction of fixed assets:

A) for new construction;

B) for the reconstruction and technical re-equipment of existing enterprises;

C) for the expansion of existing enterprises;

D) for the modernization of equipment.

By funding sources distinguish between centralized and decentralized capital investments.

In the most general sense, an investment or capital investment means a temporary refusal of an economic entity to consume the resources (capital) at its disposal and the use of these resources to increase its well-being in the future.

The simplest example of an investment is spending money on the acquisition of property with significantly less liquidity - equipment, real estate, financial or other non-current assets.

The main features of investment activity that determine approaches to its analysis are:

Irreversibility associated with the temporary loss of the consumer value of capital (for example, liquidity).

Expectation of an increase in the initial level of welfare.

Uncertainty associated with attributing results to a relatively long term perspective.

It is customary to distinguish between two types of investments: real and financial (portfolio). In the further presentation of the material, we will mainly talk about the first of them.

It should be noted that in the case real investment the condition for achieving the intended goals, as a rule, is the use (operation) of the corresponding non-current assets for the production of some products and their subsequent sale. This also includes, for example, the use of the organizational and technical structures of a newly formed business to make a profit in the course of the statutory activities of an enterprise created with the attraction of investments.

Investment project

If the volume of investments turns out to be significant for a given economic entity in terms of influence on its current and future financial condition, the adoption of appropriate management decisions should be preceded by the planning or design stage, that is, the stage of pre-investment research, ending with the development of the investment project.

An investment project is a plan or program of measures related to the implementation of capital investments and their subsequent reimbursement and profit.

The task of developing an investment project is to prepare the information necessary for an informed decision-making regarding the implementation of investments.

The main method for achieving this goal is mathematical modeling of the consequences of making appropriate decisions.

Budgetary approach and cash flows

For modeling purposes, an investment project is considered in a time base, and the analyzed period (research horizon) is divided into several equal intervals - planning intervals.

For each planning interval, budgets are drawn up - estimates of receipts and payments, reflecting the results of all operations performed in this time interval. The balance of such a budget - the difference between receipts and payments - is the cash flow of the investment project at a given planning interval.

If all the components of the investment project are expressed in monetary terms, we will receive a series of cash flow values that describe the process of implementing the investment project. In the enlarged structure, the cash flow of an investment project consists of the following main elements:

Investment costs.

Proceeds from product sales.

Manufacturing costs.

At the initial stage of the project (investment period), cash flows are usually negative. This reflects the outflow of resources that occurs in connection with the creation of conditions for subsequent activities (for example, the acquisition of non-current assets and the formation of net working capital).

After the end of the investment and the beginning of the operating period associated with the start of operation of non-current assets, the value cash flow tends to become positive.

Additional proceeds from the sale of products, as well as additional production costs incurred during the implementation of the project, can be both positive and negative values. In the first case, this may be due, for example, to the closure of unprofitable production, when the decline in revenue is offset by cost savings. In the second case, the reduction of costs as a result of their savings in the course of, for example, equipment modernization, is modeled.

Technically, the task of investment analysis is to determine what the cumulative total of cash flows will be at the end of the established research horizon. In particular, it is fundamentally important whether it will be positive.

Profit and amortization

V investment analysis the concepts of profit and cash flow, as well as the related concept of depreciation, play an important role.

The economic meaning of the concept of "profit" is that it is a capital gain. In other words, it is an increase in the welfare of an economic entity that controls a certain amount of resources. Profit is the main goal of economic activity.

As a rule, profit is calculated as the difference between the income received from the sale of products and services at a given time interval, and the costs associated with the production of these products (services).

It should be specially noted that in the theory of investment analysis the concept of "profit" (however, like many others economic concepts) does not coincide with its accounting and fiscal interpretation.

In investment activities, the fact of making a profit is preceded by the reimbursement of the initial investment, which corresponds to the concept of "amortization" (in English, the word "amortization" means "repayment of the main part of the debt"). In the case of investment in non-current assets, this function is performed by depreciation deductions. Thus, the justification for the fulfillment of the main requirements for a project in the field of real investments is based on the calculation of the amounts of depreciation and profit within the established research horizon. This amount, in the most general case, will be the total cash flow of the operating period.

Cost of capital and interest rates

The concept of "cost of capital" is closely related to the economic concept of "profit".

The value of capital in the economy lies in its ability to create added value, that is, to make a profit. This value in the corresponding market - the capital market - determines its value.

Thus, the cost of capital is the rate of return that determines the value of managing capital over a certain period of time (usually a year).

In the simplest case, when one of the parties (seller, lender, lender) transfers the right to dispose of capital to another party (buyer, borrower), the cost of capital is expressed in the form of an interest rate.

The value of the interest rate is determined based on market conditions (that is, the availability of alternative options for using capital) and the degree of risk of this option. Moreover, one of the components market value capital turns out to be inflation.

When calculating in constant prices, the inflationary component can be excluded from the interest rate. To do this, you should use one of the modifications of the well-known Fisher formula:

Where r- real interest rate, n- nominal interest rate, i- inflation rate. All rates and inflation rates in this formula are given as decimal fractions and must refer to the same time period.

In general, the amount of the interest rate corresponds to the share of the principal amount of the debt (the principal) that must be paid at the end of the billing period. These types of bets are called simple bets.

Interest rates that differ in the length of the billing period can be compared with each other through the calculation of effective rates or compound interest rates.

Payment effective rate is carried out according to the following formula:

![]() , where e- effective rate, s- simple bet, N- the number of periods of interest accrual within the considered interval.

, where e- effective rate, s- simple bet, N- the number of periods of interest accrual within the considered interval.

The most important component of the cost of capital is the degree of risk. It is precisely because of the different risks associated with different forms, directions and periods of capital use that different estimates of its value can be observed in the capital market at any given time.

Discounting

The concept of "discounting" is one of the key concepts in the theory of investment analysis. The literal translation of this word from English ("discounting") means "reduction in value, markdown".

Discounting is the operation of calculating the present value (the English term "present value" can also be translated as "present value", "present value", etc.) of monetary amounts related to future periods of time.

The opposite of discounting - calculating the "future value" of the original amount of money - is called accretion or compounding and is easily illustrated by an example of how the amount of debt increases over time at a given interest rate:

![]() , where F- future, and P- the modern value (initial value) of the amount of money, r- interest rate (in decimal), N- the number of periods for calculating interest.

, where F- future, and P- the modern value (initial value) of the amount of money, r- interest rate (in decimal), N- the number of periods for calculating interest.

The transformation of the above formula in the case of solving the inverse problem looks like this:

Discounting methods are used when it is necessary to compare values cash receipts and payments spaced over time. In particular, the key criterion of investment efficiency - net present value (NPV) - is the sum of all cash flows (receipts and payments) arising during the period under consideration, reduced (recalculated) at one point in time, which, as a rule, is chosen the moment the investment begins.

As it follows from all of the above, the interest rate used in the formula for calculating modern value is no different from the usual rate, which, in turn, reflects the cost of capital. In the case of using discount methods, this rate, however, is usually called the discount rate (possible options: "comparison rate", "barrier rate", "discount rate", "reduction factor", etc.).

A qualitative assessment of the effectiveness of an investment project largely depends on the choice of the discount rate. There are a large number of different methods to justify the use of this or that value of this rate. In the most general case, you can specify the following options for choosing the discount rate:

The minimum return on an alternative capital use (for example, the rate of return on reliable market valuable papers or the rate of the deposit in a reliable bank).

The current level of return on equity (for example, the weighted average cost of capital of the company).

The cost of capital that can be used to implement a given investment project (for example, the rate on investment loans).

The expected level of return on invested capital, taking into account all the risks of the project.

The above options for rates differ mainly in the degree of risk, which is one of the components of the cost of capital. Depending on the type of the chosen discount rate, the results of calculations related to the assessment of investment efficiency should be interpreted.

Investment project appraisal tasks

The main purpose of evaluating an investment project is to substantiate its commercial (entrepreneurial) viability. The latter assumes the fulfillment of two fundamental requirements:

Full reimbursement (payback) of the invested funds.

Obtaining a profit, the amount of which justifies the abandonment of any other way of using resources (capital) and compensates for the risk arising from the uncertainty of the final result.

It is necessary to distinguish between two components of the commercial viability of an investment project, its necessary and sufficient conditions, respectively:

Economic efficiency of investments.

Financial viability of the project.

An economic assessment or an assessment of the effectiveness of capital investment is aimed at determining the potential of the project under consideration to provide the required or expected level of profitability.

When performing investment analysis, the task of assessing the effectiveness of capital investments is the main one that determines the fate of the project as a whole.

The financial assessment is aimed at choosing a project financing scheme and thereby characterizes the possibilities for realizing the project's economic potential.

When performing the assessment, an economic approach should be followed and only those benefits and losses that can be measured in monetary terms should be considered.

Investment project appraisal stages

The development cycle of an investment project can be represented as a sequence of three stages (stages):

Formulating a project idea

Grade investment attractiveness the project

Choosing a project financing scheme

At each stage, their own tasks are solved. As you move through the stages, the idea of the project is refined and enriched with new information. Thus, each stage is a kind of intermediate finish: the results obtained on it should serve as confirmation of the feasibility of the project and, thus, are a "pass" to the next stage of development.

At the first stage, the feasibility of the project is assessed from the point of view of marketing, production, legal and other aspects. The initial information for this is information about the macroeconomic environment of the project, the expected sales market for products, technologies, tax conditions, etc. The result of the first stage is a structured description of the project idea and a timeline for its implementation.

The second stage turns out to be decisive in most cases. This is where the investment efficiency is assessed and the possible cost of the attracted capital is determined. The initial information for the second stage is the schedule of capital investments, sales volumes, current (production) costs, the need for working capital, and the discount rate. The results of this stage are most often presented in the form of tables and indicators of investment performance: net present value (NPV), payback period, internal rate of return (IRR).

The computer model "PROJECT MASTER: Preliminary Assessment" corresponds to this stage of project evaluation.