Reflection in the accounting of the accrual of depreciation of fixed assets. How to calculate depreciation. Depreciation functions

Everyone knows that any property in the process of use and exploitation sooner or later loses its original properties (is depreciated). If it is furniture, but it will eventually become unusable, and if it is equipment for the production of goods, then its technical characteristics will deteriorate as it is used. This means that the initial value of the property being operated should change along with its technical condition. For this, depreciation is calculated, which is carried out by the accounting officer for all fixed assets.

What are fixed assets?

Before we talk about depreciation, it is worth dwelling in more detail on the definition of fixed assets. These include property that is used for more than twelve months for the performance of work, the manufacture of goods, the provision of services, as well as for administrative purposes, namely:

- buildings and constructions;

- equipment, machines;

- measuring and control devices;

- computing and office equipment, vehicles;

- working and breeding cattle;

- perennial plantings;

- tools and production equipment.

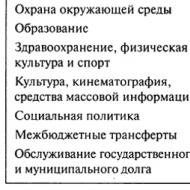

But do not forget that there are also fixed assets for which depreciation is not charged. These include:

- objects of nature management (land, subsoil, natural resources), securities, objects in progress capital construction, financial instruments forward transactions (futures, options, forward contracts);

- property that was purchased with targeted financing;

- forestry and road facilities;

- productive livestock, domesticated wild animals;

- purchased publications;

- works of art;

- fixed assets that were received at no cost.

Depreciation methods

For all fixed assets that are subject to depreciation, the depreciation amount is determined monthly (this is done separately for each item of fixed assets). The monthly depreciation charge is 1/12 of the annual depreciation amount. As for the methods of calculating annual depreciation, today there are several options:

- - depreciation is calculated based on the original cost of the property, which is calculated based on the period useful use property

- - depreciation is calculated based on the residual value of the object at the beginning of the reporting period and the depreciation rate, which is calculated based on the useful life of the object of fixed assets and a coefficient of not more than 3, which is set by the organization itself

- method of writing off the value by the sum of the number of years of the useful life of the fixed asset - depreciation is calculated based on the initial cost and the ratio, the numerator of which is the number of years that remain until the end of the useful life of the property, and the denominator is the sum of the number of years of the useful life

These are the main methods for calculating depreciation, which are often used by both organizations and individual entrepreneurs.

How is depreciation calculated?

Depreciation should be charged from the first day of the month that follows the month the object was put into operation, and it should be stopped on the first day of the month that follows the month in which the object of fixed assets was written off from the balance sheet of the organization. Depreciation is also terminated if the property is removed from the fixed assets on which depreciation is charged. Depreciation methods in this case do not matter.

Often, many managers have a question: how to depreciate fixed assets when production is seasonal? The answer is simple: in this case, depreciation is charged evenly over the period of operation of the organization for the reporting year.

We must not forget that the accrual of depreciation must be suspended if the object of fixed assets is transferred to conservation, the period of which is more than three months, reconstruction, overhaul or an upgrade that will last more than twelve months.

When it comes to housing stock, as well as on objects of non-profit organizations, depreciation of fixed assets is calculated at the end of the reporting year. And the movement of depreciation amounts should be accounted for in a separate off-balance sheet account.

Useful life

Since the accrual of depreciation is directly related to the useful life, it will be useful to clarify what exactly is meant by this concept.

The useful life is the period during which an item of property, plant and equipment brings economic benefits. This period is set by the organization itself when registering fixed assets. But it should be borne in mind that in the case of modernization or reconstruction (as well as technical re-equipment) of an object of fixed assets, the useful life may be revised.

Concerning tax accounting, but in it the useful life is determined according to the number depreciation group to which the item of property, plant and equipment belongs. This classification can also be applied to accounting. But it happens that in the classification the useful life is not established. In this case, the organization must install it independently, guided by several indicators:

- the expected period of use of the object of fixed assets (here the intensity of the use of property matters);

- expected physical wear and tear, which depends on both the upcoming operating mode and natural conditions, the performance of specialized repairs and the influence of an aggressive environment.

Depreciation groups

According to the division into depreciation groups, fixed assets have a certain useful life, namely:

- Group 1 - equipment for gas and oil production, drilling and other tools, small-scale mechanization means, belong to the first group of fixed assets (fixed assets), and their useful life is from one to two years.

- Group 2 - mechanized construction and assembly tools, technological equipment for mechanical engineering, electronic computers, medical tools, household, industrial, sports equipment - useful life from two to three years.

- Group 3 - elevators, tractors, transport equipment for Agriculture, separators, sewing machines, equipment for construction and installation works, transformers, telephones, service dogs, small buses, household appliances, cars, field strength meters - useful life from three to five years.

- Group 4 - metal, wood-metal, film kiosks, agricultural machines, grinders, furniture production equipment, uninterruptible power supplies, welding equipment, radio equipment - useful life from five to seven years.

- Group 5 - heating mains, gas pipelines, livestock complexes, transport equipment, combines, machine tools, buses, cars, trailers, cinema equipment, photographic equipment - useful life from seven to ten years.

- Group 6 - oil wells, lightweight dwellings, bathtubs, trays, washbasins, showers, mixers, siphons, perennial stone fruit plantations - useful life of 10-15 years.

- Group 7 - adobe, frame, wooden, container, panel non-residential buildings, steel and asbestos-cement sewer networks, packaging machines, reed and stringed musical instruments, amplifiers, power supplies - useful life from fifteen to twenty years.

- Group 8 - metal, as well as armored safes, doors, cameras, cabinets, non-residential buildings with any ceilings - useful life from twenty to twenty five years.

- Group 9 - treatment facilities, ceramic sewer networks, storage facilities with stone walls, reinforced concrete columns and ceilings - useful life from twenty-five to thirty years.

- Group 10 - buildings, structures, housing stock, transmission devices, vehicles - useful life is more than thirty years.

Intangible assets

I would like to say a few words about intangible assets that are accounted for in balance sheet at the residual value. Depreciation charge intangible assets is made using the same methods as depreciation of fixed assets. The method of accrual is chosen and calculations are made for a group of homogeneous intangible assets during their useful life, while the suspension of accrual is possible only when the organization is mothballed.

Useful lives are set for all intangible assets. For example, for licenses, patents, rights, the useful life is the period specified in the contract. But there are situations when the useful life of such assets cannot be established. In these cases, the rates of depreciation deductions must be established based on a conditional period, which should not exceed the period of the organization's activity. In our country, such a period is considered to be twenty years of continuous operation.

Depreciation is not charged on those intangible assets that were received as a result of signing a donation agreement, privatization or purchased for state earmarked funds and appropriations.

METHODS OF CALCULATION OF FIXED ASSETS CUSHIONING

Depreciation can only be accrued in ways that are permitted for use. Currently, depreciation of fixed assets in Russia is carried out in one of the following ways:

· In a linear way;

· By the method of decreasing balance;

· The method of writing off the cost according to the sum of the number of years of the useful life;

· Method of writing off the cost in proportion to the volume of products (works);

· Accelerated depreciation method (increase in the amount of deductions on a straight-line basis).

The application of one of the methods for a group of homogeneous objects of fixed assets is carried out during its entire useful life.

Linear way belongs to the most common. It is used by about 70% of all businesses. The popularity of the linear method is due to its ease of use. Its essence is that an equal part of the cost of this type of fixed assets is depreciated every year.

Annual amount depreciation charges calculated as follows:

where A- the annual amount of depreciation charges; WITH first – On- the rate of depreciation.

For example, a business bought a computer. The cost was 10,000 rubles, the service life was 5 years. Thus, annually we will write off 10,000 / 5 = 2,000 rubles for depreciation:

| Year | Residual value at the beginning of the year (RUB) | Amount of annual depreciation (RUB) | Residual value at the end of the year (RUB) |

| 1 | 10 000 | 2 000 | 8 000 |

| 2 | 8 000 | 2 000 | 6 000 |

| 3 | 6 000 | 2 000 | 4 000 |

| 4 | 4 000 | 2 000 | 2 000 |

| 5 | 2 000 | 2 000 | 0 |

The following should be noted. If the residual value of an asset is equal to zero, it does not mean that the price of the computer has become equal to zero. This computer may have real value, be in working order and serve for more than one year. Zero residual value of a given computer means only that the company fully compensated the costs of its acquisition (Fig. 5).

The linear method is advisable to apply for those types of fixed assets where time, and not obsolescence (obsolescence), is the main factor limiting the service life.

At method of diminishing balance the annual amount of depreciation deductions is determined based on the residual value of an item of fixed assets at the beginning of the reporting year and the depreciation rate calculated on the basis of the useful life of this item:

where From ost- residual value of the object; To– acceleration factor; On- depreciation rate for a given object.

For example, a company bought a machine, the cost of which is 120,000 rubles, and the service life is 8 years. The acceleration factor is 2. Thus, the annual depreciation amount, taking into account the acceleration, is 25% (100%: 8 × 2). The depreciation calculation is presented in the table:

|

Depreciation rate,% |

||||

It should be noted that with this method, the original cost will never be written off. In our example, in Last year accrual of depreciation there is a balance of 12013 rubles. Despite this drawback, the method allows you to write off the maximum depreciation cost in the first years of the asset's operation (Fig. 6). Thus, the company has the ability to most efficiently recover the cost of acquiring an item of property, plant and equipment.

With the method of writing off the cost by the sum of the numbers of years of useful life the annual depreciation amount is determined based on the initial cost of the object of fixed assets and the annual ratio, where the numerator is the number of years remaining until the end of the object's service life, and the denominator is the sum of the number of years of the object's service life:

where WITH first – the initial cost of the object; T rest- the number of years remaining until the end of the useful life; T- useful life.

For example, equipment worth 100,000 rubles was commissioned. The useful life is 5 years. The sum of the life numbers is 15 (1 + 2 + 3 + 4 + 5). The calculation is presented in the table:

|

Residual value at the beginning of the year (RUB) |

Depreciation rate,% |

Amount of annual depreciation (RUB) |

Residual value at the end of the year (RUB) |

|

|

100000´5/15 = 3333 |

||||

|

100000´4 / 15 = 2667 |

||||

|

100000´3 / 15 = 2000 |

||||

|

100000´2 / 15 = 1333 |

||||

|

100000´1 / 15 = 667 |

This method is equivalent to the diminishing balance method, but it makes it possible to write off the entire value of the object without the remainder (Fig. 7).

During the reporting year, depreciation charges for items of fixed assets are charged monthly, regardless of the method of accrual used, in the amount of 1/12 of the annual amount.

At method of writing off the cost in proportion to the volume of products (works) accrual of depreciation deductions is made on the basis of the natural indicator of the volume of production (work) in reporting period and the ratio of the initial cost of the item of fixed assets and the estimated volume of production (work) for the entire useful life of the item of fixed assets:

where A- the amount of depreciation per unit of production; WITH- the initial cost of an item of fixed assets; V- the estimated volume of production.

This method is used where depreciation of fixed assets is directly related to the frequency of their use.

Most often, the method of writing off the value in proportion to the volume of production is used to calculate depreciation for the extraction of natural raw materials.

Suppose the ore reserves of this deposit are 1,000,000 tons. The cost of fixed assets used in ore mining is 16,000,000 rubles.

Depreciation per unit of production 16,000,000 / 1,000,000 = 16 rubles / ton.

If it is supposed to extract 100,000 tons of ore annually, then the annual depreciation will be 16 ´ 10,000 = 160,000 rubles, and with annual production

5,000 t - 16 ´ 5,000 = 80,000 rubles.

Method of calculating depreciation in proportion to the amount of work used mainly for vehicles. Depreciation rates are set as a percentage of the original cost of the vehicle for each 1000 km of run.

Accelerated depreciation method. In order to create financial conditions to accelerate the introduction of scientific and technical achievements into production and increase the interest of enterprises in accelerating the renewal and technical development of the active part of fixed assets (machinery, equipment, Vehicle) enterprises have the right to apply the method of accelerated depreciation of the active part of production fixed assets, put into effect after January 1. 1991 year

Accelerated depreciation is a target method faster than the standard service life of fixed assets, the full transfer of their book value to the costs of production and circulation.

Enterprises can apply the accelerated method of calculating depreciation in relation to fixed assets used to increase the output of computer technology, new progressive types of materials, instruments and equipment, expanding the export of products in cases when they massively replace worn-out and obsolete equipment with a new, more productive one.

With the introduction of accelerated depreciation, enterprises use a uniform (linear) method of calculation, while the rate of annual depreciation deductions for full restoration, approved in accordance with the established procedure (for the corresponding inventory object or their group), increases, but not more than twice.

Accelerated depreciation allows you to speed up the process of updating fixed assets at the enterprise; to accumulate sufficient funds for technical re-equipment and reconstruction of production; reduce income tax; maintain fixed assets at a high technical level

Test control

1. The linear method of depreciation is advisable to apply ifWe talked about which items of fixed assets are depreciated in accounting. We will talk about the methods of depreciation of fixed assets in accounting in this material.

How to calculate depreciation in accounting

Depreciation of fixed assets in accounting can be accrued in one of 4 ways (clause 18 PBU 6/01):

- linear method (I);

- diminishing balance method (II);

- method of writing off the cost by the sum of the numbers of years of useful life (III);

- method of writing off the cost in proportion to the volume of products (works) (IV).

Let us show in the table how the annual depreciation amount (G) is calculated for an item of fixed assets in the first three ways (clause 19 of PBU 6/01):

| I | II | III |

|---|---|---|

С - initial or current (replacement) cost of an item of fixed assets (in case of revaluation);

SPI - useful life of an item of fixed assets;

О - the residual value of the object of fixed assets at the beginning of the year;

K - coefficient not higher than 3, established by the organization;

CL - the number of years remaining until the end of the useful life of an item of property, plant and equipment;

ΣЧЛ - the sum of the numbers of years of the useful life of an item of fixed assets.

Depreciation is charged monthly at 1/12 of the annual amount.

With method IV, the amount of depreciation (A) of an item of fixed assets for the reporting period is calculated as follows:

A = PS * O F / O P,where PS is the initial cost of an item of fixed assets;

О Ф - a natural indicator of the volume of production (work) in the reporting period;

О П - the estimated volume of production (work) for the entire SPI of the object of fixed assets.

Synthetic and analytical accounting for depreciation of fixed assets

The peculiarities of accounting for depreciation of fixed assets are briefly presented in the Instructions for the application of the Chart of Accounts (approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n).

Thus, it is indicated that the accounting for the accrual of depreciation of fixed assets is kept on account 02 "Depreciation of fixed assets".

Depreciation is charged on the credit of account 02. At the same time, those accounts are debited, which are associated with the occurrence of depreciation costs. So, for example, the depreciation of the equipment of the main production is reflected in the debit of account 20 "Main production", and the depreciation of fixed assets of a general management nature is reflected in the debit of account 26 " General running costs". If, in particular, the fixed asset is used in the construction of a building, depreciation will be attributed to the increase in the value of such a building, i.e. synthetic accounting depreciation of fixed assets, the posting will correspond to the following: Debit of account 08 "Investments in fixed assets"- Credit account 02.

Analytical accounting on account 02 is carried out for inventory items of fixed assets. In addition, the analytical accounting of the organization should be organized in such a way that it makes it possible to obtain data on the depreciation of fixed assets for managing the organization and compiling accounting statements.

The issues of documenting the accounting of depreciation of fixed assets are reduced to filling out documents confirming the receipt, availability and disposal of fixed assets (for example, acceptance certificates, inventory cards, etc.), as well as their actual use for a specific purpose (for example, orders, estimates, etc.). After all, it is precisely on the basis of the content of these documents that it is possible to confirm the purposes of using fixed assets, and, consequently, the account, on the debit of which the accrued depreciation will be reflected.

We talked about the depreciation of fixed assets in tax accounting in.

Print (Ctrl + P)

1C: Accounting Enterprise 3.0

Regular operation "Depreciation of fixed assets"

To reflect the operations of closing the month in the applied solution 1C: Accounting Enterprise 3.0, the document "Routine operation" is intended.

Depreciation of property, plant and equipment is the process of transferring the value of property, plant and equipment, as it depreciates, to a product or service produced with it over the useful life of an item.

When performing a routine operation Depreciation and depreciation of fixed assets, the depreciation of those objects of fixed assets for which the cost is repaid by means of depreciation is calculated. An exception will be fixed assets for which depreciation has already been accrued within a month, for example, by documents Transfer of fixed assets, Preparation for transfer of fixed assets, Write-off of fixed assets, Operation (accounting and tax accounting).

For organizations applying PBU 18 “Accounting for Income Tax Calculations”, along with depreciation, the calculation of permanent and temporary differences is carried out.

For organizations that pay income tax, depreciation is not reflected in tax accounting, because this transaction does not affect the recognition of income and expenses.

For individual entrepreneur, applying the general taxation regime, in tax accounting, depreciation is calculated only in the part of the paid value of objects.

Accounting fixed assets are maintained in accordance with the Regulations on accounting"Accounting for fixed assets" PBU 6/01 (approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n) (hereinafter referred to as PBU 6/01), Methodological guidelines for accounting of fixed assets (approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n ) (hereinafter referred to as the Methodological Guidelines for Accounting for Fixed Assets), as well as other regulatory legal acts.

Tax accounting fixed assets are maintained in accordance with Chapter 25 of the Tax Code of the Russian Federation.

For more information on fixed asset accounting, see the article “Fixed assets accounting”.

The procedure for calculating depreciation of fixed assets

In accounting the cost of fixed assets recorded on the balance sheet of the organization is repaid by means of depreciation, unless otherwise established by PBU 6/01 (clause 17 of PBU 6/01).

Items of fixed assets, the consumer properties of which do not change over time, are not subject to depreciation ( land; objects of nature management; objects classified as museum items and museum collections, etc.) (paragraph 5, clause 17 PBU 6/01). There are other exceptions and peculiarities, for more details see clause 17 of PBU 6/01.

Accrual of depreciation deductions for an item of fixed assets starts from the first day of the month following the month of accepting this item for accounting, and is made until full repayment the cost of this object or write-off of this object from accounting (clause 21 PBU 6/01).

During the reporting year, depreciation charges for items of fixed assets are charged monthly, regardless of the method of accrual used, in the amount of 1/12 of the annual amount (clause 19 of PBU 6/01).

The accrual of depreciation charges on fixed assets is carried out regardless of the results of the organization's activities in the reporting period and is reflected in the accounting records of the reporting period to which it relates (clause 24 of PBU 6/01).

During the useful life of an item of fixed assets, the accrual of depreciation charges is not suspended, except for cases of its transfer by decision of the head of the organization to conservation for a period of more than three months, as well as during the restoration period of the item, the duration of which exceeds 12 months (clause 23 PBU 6/01 ).

For profit tax purposes fixed assets are subject to depreciation, which are recognized as depreciable property in accordance with paragraph 1 of Art. 256 of the Tax Code of the Russian Federation. In turn, the depreciable property is divided into depreciation groups in accordance with its useful life (clause 1 of article 258 of the Tax Code of the Russian Federation).

In some cases, depreciation on fixed assets is not charged or the fixed asset is not depreciated at all. The list of such cases is given in clause 2 of Art. 256 of the Tax Code of the Russian Federation.

In addition, fixed assets are excluded from the composition of the depreciable property:

- transferred (received) under contracts for free use; transferred by decision of the management of the organization to conservation for more than three months;

- under the decision of the management of the organization for reconstruction and modernization for more than 12 months (clause 3 of article 256 of the Tax Code of the Russian Federation).

Accrual of depreciation on objects of depreciable property starts from the 1st day of the month following the month in which this object was put into operation (clause 4 of article 259 of the Tax Code of the Russian Federation).

The amount of depreciation for tax purposes is determined by taxpayers on a monthly basis (clause 2 of article 259 of the Tax Code of the Russian Federation).

Amounts of depreciation accrued on depreciable property are included in

the corresponding expenses (direct, indirect, non-operating, expenses for the creation of new objects of depreciable property, etc.), depending on the purpose for which the depreciable property is used.

The procedure for recognizing depreciation for profit tax purposes depends on the purpose for which the fixed assets are used.

By general rule the amount of accrued depreciation refers to the costs associated with production and (or) sales (clause 2 of article 253 of the Tax Code of the Russian Federation). At the same time, the amounts of accrued depreciation on fixed assets used in the acquisition, construction and manufacture of new fixed assets form the initial cost of these fixed assets (clause 1 of article 257 of the Tax Code of the Russian Federation), and used for geological exploration of works of a preparatory nature - are taken into account in the development costs natural resources(Clause 1 of Art.261 of the Tax Code of the Russian Federation).

Methods (methods) of depreciation of fixed assets

Depreciation of fixed assets in accounting is accrued in one of the following ways (clause 18 PBU 6/01):

1. Linear method.

2. Method of diminishing balance.

3. Method of writing off the cost by the sum of the number of years of useful life.

4. The method of writing off the cost in proportion to the volume of products (works).

The application of one of the methods for calculating depreciation for a group of homogeneous objects of fixed assets is carried out during the entire useful life of the objects included in this group (clause 18 of PBU 6/01).

When calculating depreciation by the above methods, depreciation charges for fixed assets are charged during the reporting year on a monthly basis in the amount of 1/12 of the annual amount (clause 19 of PBU 6/01). For fixed assets used in organizations with a seasonal nature of production, calculated in accordance with the chosen method of depreciation, the annual amount of depreciation deductions is accrued evenly during the period of operation of the organization in

the reporting year (clause 19 PBU 6/01).

If an object of fixed assets is accepted for accounting during the reporting year, the annual amount of depreciation is considered the amount determined from the first day of the month following the month of accepting this object for accounting, until the reporting date of the annual financial statements (clause 55 Methodical instructions for OS accounting).

Accrual of depreciation on depreciable property in tax accounting is carried out using one of the following methods (clause 1 of article 259 of the Tax Code of the Russian Federation):

1. Linear method.

2. Non-linear method.

The depreciation method is established by the taxpayer independently for all objects of depreciable property (with the exception of objects for which depreciation is always charged on a straight-line basis) and is reflected in accounting policy for tax purposes (clause 1 of article 259 of the Tax Code of the Russian Federation).

Unlike accounting, the taxpayer can change the depreciation method from the beginning of the next tax period... At the same time, he has the right to switch from the non-linear method to the linear depreciation method no more than once every five years.

Regardless of the depreciation method established by the taxpayer in the accounting policy for tax purposes, the straight-line depreciation method is applied to buildings, structures, transmission devices, intangible assets included in the eighth to tenth depreciation groups, regardless of the period of commissioning of the corresponding facilities (clause 5.2. 3 article 259 of the Tax Code of the Russian Federation).

One of the main indicators used in calculating the amount of depreciation is the useful life of an item of fixed assets. For more information on how the useful life is determined, see the subheading “Useful life of property, plant and equipment” in the article “Accounting for fixed assets” and the article “Useful life of property, plant and equipment” in the Corporate Income Tax directory.

Linear way

The annual amount of depreciation charges in the linear method is determined based on the initial cost or the current (replacement) value (in case of revaluation) of the fixed asset item and the depreciation rate calculated based on the useful life of this item.

A = C / T,

where:

A

–

annual depreciation amount (rubles);

WITH - initial or replacement (current) cost of the fixed asset (rubles);

T- useful life of the item of fixed assets (in years).

How to calculate depreciation of fixed assets in a linear way in the program

Decreasing balance method

The annual amount of depreciation charges in the diminishing balance method is determined based on the residual value of the fixed asset at the beginning of the reporting year and the depreciation rate,

calculated on the basis of the useful life of this object and the coefficient set by the organization independently, but not higher than 3.

A = OS x GA,

where:

A- the annual amount of depreciation (rubles);

OS- residual value of fixed assets at the beginning of the year (rubles);

GA- the annual depreciation rate, which is determined by the formula: GA = (100% / T) x K,

where: T- useful life of an item of fixed assets, TO Is the acceleration factor.

Example conditions: initial cost (WITH)- 100,000 rubles, useful life (T)- 5 years, acceleration factor (TO) – 2.

1. Calculate the annual depreciation rate (GA): (100%: 5) x 2 = 40%

.

Year Annual amount Accumulated Amount Residual value

1st year 100,000 x 40/100 = 40,000 40,000 60,000

2nd year 60,000 x 40/100 = 24,000 64,000 36,000

3rd year 36,000 x 40/100 = 14,400 78,400 21,600

4th year 21 600 x 40/100 = 8 640 87 040 12 960

5th year * 12,960 100,000 0

* The specificity of depreciation by the diminishing balance method is that the amount of depreciation accrued by the end of the useful life of the object is always less than its value by the amount of the balance, which can be as close to zero as possible, but is not equal to it. PBU 6/01 does not provide for a direct rule on the method of writing off the under-depreciated balance.

According to clause 7 of the Accounting Regulations “Accounting policy of organizations” PBU 1/2008, if according to specific issue in regulatory legal acts methods of accounting have not been established, then when forming an accounting policy, the organization develops an appropriate method based on the provisions on accounting, as well as International standards financial statements... Thus, the procedure for writing off non-redeemable upon accrual

depreciation in the manner of a decreasing balance of a part of the cost of an object, the organization sets independently and fixes it in the accounting policy.

Alternatively, the organization can fix in the accounting policy that in the last year of the asset's use, the remaining under-depreciated part of the cost is added to the amount initially calculated for this period of depreciation.

Method of writing off the cost by the sum of the number of years of useful life

The annual amount of depreciation deductions when the cost is written off by the sum of the number of years of useful life is determined based on the initial or current (replacement) cost (in case of revaluation) of the fixed asset and the ratio, in the numerator of which is the number of years remaining until the end of the useful life of the object , and the denominator is the sum of the numbers of years of the useful life of the object.

A = C x Sum NTost / Sum NT,

where:

A- the annual amount of depreciation (rubles);

WITH- the initial or replacement (current) cost of the fixed asset (rubles);

NTost amount- the sum of the numbers of years that remain until the end of the useful life of the object;

NT sum- the sum of the numbers of years of the useful life of an item of fixed assets.

An example of calculating depreciation using the method of writing off the cost by the sum of the number of years of the term

useful use (clauses “c” clause 54 of the Methodological Guidelines for Accounting for Fixed Assets):

Example conditions: initial cost (C) - 150,000 rubles, useful life (T) - 5

years.

1. Calculate the sum of the number of years of useful life (NT): (1 + 2 + 3 + 4 + 5) = 15.

2. We calculate the annual depreciation amount:

Method of writing off the cost in proportion to the volume of products (works)

The annual amount of depreciation deductions for the method of writing off the cost in proportion to the volume of production (work) is determined based on the natural indicator of the volume of production (work) in the reporting period and the ratio of the initial value of the fixed asset item and the estimated volume of production (work) for the entire useful life of the item of fixed assets.

A = Votch x C / Vterm,

where:

A- the amount of amortization for the reporting period (rubles); Votch- the volume of products manufactured (work performed) using a specific object of fixed assets in the reporting period; WITH- the initial cost of the fixed asset (rubles);

V time- the planned volume of products manufactured (work performed) using a specific item of fixed assets for the entire useful life of the item of fixed assets.

Neither PBU 6/01 nor the Methodological Guidelines for Accounting for Fixed Assets specifies how the monthly amount of depreciation deductions is determined when the cost is written off in proportion to the volume of production (work).

In our opinion, the monthly amount of depreciation deductions when the cost is written off in proportion to the volume of production (work) can be calculated based on the natural indicator of the volume of production (work) per month and the ratio of the initial cost of the fixed asset object and the estimated volume of production (work) for the entire useful life. use of an item of fixed assets.

In addition, when calculating depreciation in this way, regulatory acts on accounting do not regulate the procedure for accounting for products (works) manufactured (performed) in the month when the object of fixed assets was put into operation. In our opinion, this volume of production (work) should be taken into account when calculating the first depreciation for an item of fixed assets.

After modernization, reconstruction or revaluation of an item of fixed assets, for which depreciation is charged by writing off the cost in proportion to the volume of products (work), depreciation is calculated based on the natural indicator of the volume of products (work) in the reporting period and the ratio of the residual value of the asset increased by the amount of costs for modernization, reconstruction, the amount of revaluation (or reduced by the amount of the markdown), and

the estimated volume of production (work) for the remaining useful life of the facility.

Linear method in tax accounting

When using the straight-line method, depreciation is charged on an item-by-item basis. The procedure for calculating the amount of depreciation when applying the straight-line accrual method is defined in Art. 259.1 of the Tax Code of the Russian Federation.

With the straight-line method, the amount of depreciation accrued for one month in relation to an object of depreciable property is determined as the product of its original (replacement) cost and the depreciation rate determined for this object.

The depreciation rate is calculated based on the useful life of the depreciable property, determined by the taxpayer independently in accordance with the Classification of fixed assets included in depreciation groups (approved by the RF Government Decree of 01.01.2002 No. 1). The depreciation rate is calculated using the formula:

K = 1 / N x 100%,

where:

TO- depreciation rate as a percentage of the original (replacement) value of the depreciable property;

N- the useful life of the object in months during which the organization plans to operate a specific object of fixed assets.

The amount of depreciation charges accrued for one month for a separate depreciable object is determined by the formula:

A = C x K,

where:

A- the amount of depreciation deductions for one month;

WITH- the initial (replacement) cost of the depreciable object;

TO- depreciation rate as a percentage of the original (replacement) cost of the depreciable property.

Accrual of depreciation on a straight-line basis begins from the first day of the month following the month in which the object was put into operation (clause 4 of article 259 of the Tax Code of the Russian Federation), and stops from the first day of the month following the month when the fixed asset was removed from the composition depreciable property for any reason (clause 5 of article 259.1 of the Tax Code of the Russian Federation).

When determining the depreciation rate and the amount of depreciation deductions, it should be borne in mind that the initial cost of fixed assets may change in cases of completion, retrofitting, reconstruction, modernization, technical re-equipment, as well as partial liquidation of fixed assets (clause 2 of article 257 of the Tax Code of the Russian Federation). As a result of these events, the useful life of an item of fixed assets may also change (clause 1 of article 258 of the Tax Code of the Russian Federation).

If the useful life of an item of property, plant and equipment changes, then

The taxpayer continues to charge depreciation on an item of fixed assets based on the new depreciation rate, i.e. taking into account new term useful use, and the replacement cost of the object, i.e. the original cost, increased by the cost of the modernization.

Non-linear method in tax accounting

When using the non-linear method, depreciation is not charged for every item

depreciable property, and for the depreciation group as a whole. The procedure for calculating the amount of depreciation when applying the non-linear accrual method is defined in Art. 259.2 of the Tax Code of the Russian Federation.

In order to calculate the amount of depreciation deductions for one month, the taxpayer needs to determine:

- on the first day of each month - the total balance for each depreciation group (subgroup), i.e. calculate the total residual value of depreciation property items included in a specific depreciation group (subgroup) in the manner prescribed in Art. 322 of the Tax Code of the Russian Federation;

- the depreciation rate established for the depreciation group in paragraph 5 of Art. 259.2 of the Tax Code of the Russian Federation.

The total balance of each depreciation group (subgroup) in accordance with paragraph 4 of Art. 259.2 of the Tax Code of the Russian Federation is monthly reduced by the amount of accrued depreciation for this group (subgroup).

The amount of depreciation charged for one month for each depreciation group (subgroup) is determined by the formula (clause 4 of article 259.2 of the Tax Code of the Russian Federation):

A = B x k / 100,

where:

A- the amount of depreciation charged for one month for the corresponding depreciation group (subgroup);

B- the total balance of the corresponding depreciation group (subgroup);

k- depreciation rate for the corresponding depreciation group (subgroup).

Depreciation begins on the 1st day of the month following the month in which this facility was put into operation (clause 4 of article 259 of the Tax Code of the Russian Federation).

In case of commissioning of new objects of depreciable property, their initial cost increases the total balance of the depreciation group (subgroup), which includes the objects put into operation. The increase in the total balance is made from the 1st day of the month following the month in which the new facilities were put into operation (clause 3 of article 259.2 of the Tax Code of the Russian Federation).

In cases of completion, retrofitting, reconstruction, modernization, technical re-equipment, as well as partial liquidation of fixed assets, the initial cost of fixed assets changes (clause 2 of article 257 of the Tax Code of the Russian Federation). After reconstruction (modernization, technical re-equipment, partial liquidation) in the total balance of the corresponding depreciation group (subgroup)

the amounts by which the initial cost of the specified objects changes are taken into account.

Since, with the nonlinear method, the depreciation rate does not depend on the useful life of each object (set for the group as a whole), the change in the useful life of a particular fixed asset as a result of modernization (reconstruction, technical re-equipment, etc.) does not in any way affect the depreciation rate set for the group the object is included in.

When objects of depreciable property are retired, depreciation for which is accrued by a non-linear method, the total balance of the corresponding depreciation group (subgroup) is reduced by the residual value of such objects at the date of disposal (clause 10 of article 259.2 of the Tax Code of the Russian Federation).

***

When calculating depreciation, it should be borne in mind that for the purposes of Chapter 25 of the Tax Code of the Russian Federation from

of depreciable property, fixed assets are excluded (clause 3 of article 256 of the Tax Code of the Russian Federation):

- transferred (received) under contracts for free use;

- transferred by decision of the management of the organization to conservation for more than three months;

- under the decision of the management of the organization on reconstruction and modernization

lasting over 12 months; - ships registered in the Russian International Register of Ships for the period of their stay in the Russian International Register of Ships.

When the object of fixed assets is reopened, the reconstruction or modernization is completed, the contract for gratuitous use expires, depreciation on this object begins to be charged in the manner that was in effect until its preservation from the first day of the month following the month in which the object was reopened, the end of reconstruction or return from contract

free use respectively.

According to Art. 259.3 of the Tax Code of the Russian Federation, taxpayers in some cases have the right to apply special increasing (decreasing) coefficients to the main depreciation rate. The decision to use special coefficients should be reflected by the taxpayer in the order on accounting policy for tax accounting purposes.

Accounting for depreciation of fixed assets on accounting accounts

The procedure for recognizing depreciation in accounting depends on the purpose for which the fixed assets are used.

As a general rule, depreciation is recognized as an expense for common types activities (Clause 5 and Clause 8 of the Accounting Regulations “Organization Expenses” PBU 10/99, approved by order of the Ministry of Finance of Russia dated 06.05.1999 No. 33n) (hereinafter - PBU 10/99).

At the same time, depreciation for an item of fixed assets leased out, the income from which the organization recognizes as other income, is recognized as other expenses (clause 11 of PBU 10/99), and depreciation for an item of fixed assets that is used in the acquisition, construction and manufacture of new fixed assets, forms the initial cost of these fixed assets (clause 8 PBU 6/01).

Depreciation is subject to recognition in accounting regardless of the intention to receive revenue, other and / or other income (clause 17 of PBU 10/99) and is reflected in the accounting records of the reporting period to which it relates (clause 64 of the Methodological Guidelines for Accounting for Fixed Assets) ...

The amount of depreciation is accumulated on the credit of account 02 “Depreciation of fixed assets” during the entire period of use of the fixed asset. Monthly amount depreciation is included in costs.

For example, depreciation can be reflected in the following transactions:

- Dt 20, 26, 44 ... (and other cost accounts) Kt 02 - the amount of accrued depreciation for the main

means used for the production and sale of products or for the management of the organization; - Dt 08 Kt 02 - the amount of accrued depreciation on fixed assets used in the construction, manufacture of new fixed assets;

- Dt 91 Kt 02 - the amount of accrued depreciation on fixed assets leased, if the rent generates other income.

Analytical accounting of the accrued depreciation on account 02 “Depreciation of fixed assets” is carried out for individual inventory items of fixed assets.

The amount of accrued depreciation charges for fixed assets is also reflected in the tax accounting registers.

Depreciation is an orderly decrease in the initial cost of an asset over its useful life. This is a characteristic of the depreciation of property, wholly owned by the organization, in monetary terms. One of the fundamental stages of fixed asset accounting is depreciation. Accrual methods under IFRS are divided into 4 types, each of which will be discussed in detail.

Accrual rules

The deduction of a part of the amortized cost begins in the month following the acceptance of fixed assets for accounting. Termination occurs after the accumulation of the full value of the OS from the first day of the new month.

The total period of depreciation charges depends on:

- operational period;

- premature elimination of the OS;

- full accumulation of funds until the end of the term of deductions.

Usually depreciation payments last the entire life of the property. With the termination of deductions, fixed assets can be written off, sold for spare parts / materials or remain in use.

Depreciation deductions are terminated if:

- sale, liquidation of the object;

- conservation for more than one quarter;

- reconstruction or modernization for more than a year;

- loss of property due to emergency situations, natural disasters;

- provision of OS to another organization for temporary possession or use.

Regardless financial result economic activity the company is depreciated on a monthly basis.

Fixed assets without depreciation

Recall that fixed assets are the property of an organization that has been used for more than a year to carry out economic, administrative, production and sales activities. In the list of fixed assets there are also those for which depreciation is not provided. These include:

- natural resources;

- securities;

- objects of forward transactions;

- property acquired with targeted financing;

- means of road, forestry;

- livestock kept for the purpose of obtaining agricultural products;

- purchased buildings;

- museum exhibits and works of art;

- OS received free of charge.

Fixed assets of non-profit organizations are not subject to depreciation, regardless of their type.

Determination of useful life

Depreciation is determined taking into account the period of possible operation of the object. Methods for calculating depreciation of fixed assets do not depend on the period of service: for each method, determining the duration of use will be the first step in calculating the depreciation amounts to the monthly write-off.

The useful life of an operating system is considered to be the period of service of an object that generates income for the company. It is necessary to determine the operational life of the property during the registration of the OS. The accountant makes a conclusion about the useful life on the basis of:

- expected service life, based on the manufacturer's declared technical characteristics;

- expected wear and tear during the period of use;

- restrictions on the use of the OS.

The operational period must be determined by the time the facility is put into operation.

Depreciation: methods of calculating depreciation of fixed assets of an enterprise

According to IFRS, there are two main ways to calculate depreciation: linearly and non-linearly. The linear method of calculating depreciation of fixed assets assumes a gradual and even accumulation of the amount of depreciation over the entire period of use. It looks like this: every month the organization transfers the same amount on credit to account 02.

The non-linear depreciation method is subdivided into 3 methods:

- diminishing balance;

- cumulative;

- industrial.

The amount to be depreciated according to non-linear methods will differ with each new month.

The linear method of calculating depreciation of fixed assets is universal for any type of property of the organization and is used both in production and in trading companies... Usually, the linear method is preferred in cases of using those operating systems that bring benefits gradually and evenly.

Characteristic of uneven write-off of the amount of depreciation

Non-linear methods of depreciation are more specialized. According to the objects of fixed assets, the most suitable is determined:

- A reduced balance is relevant in cases where it is known that the maximum load on the OS will be in the first years of use, or the equipment is purchased for production purposes new products... Situations involve obtaining the maximum benefit during the first period of operation, when it will be more rational to pay the largest part of the depreciation.

- The cumulative method is very similar to the balance reduction method. It directly depends on the amount of the numerical value of the years of use of the property and allows you to pay the main part of the depreciation at the beginning of the use of the object. Both methods are most often used in production and for those operating systems whose service life, as a rule, exceeds one decade.

- The production method involves writing off the amortized cost in proportion to the products manufactured, works performed, services. The amount of deductions depends on the intensity of the use of fixed assets in the production process. It's more complicated but optimal way calculate depreciation to achieve a balance of income and expenses of the enterprise.

The use of certain methods for calculating depreciation is regulated by the organization.

Depreciation in equal installments

The straight line method for total depreciation is the easiest to calculate. The formula characterizes the linear method for calculating depreciation of fixed assets:

A = (C os × H a) ÷ 100%, where:

- A is the amount of depreciation.

- Ts os - book value OS.

- H a - depreciation rate in years.

The resulting amount shows the depreciation of fixed assets in monetary terms for one operational year. For convenience, the resulting value is divided by the number of months, determining the amount of deductions for each of them.

Consider an example: an enterprise commissioned in February a lathe worth 200 thousand rubles, the service life of which is estimated at 15 years. The accountant made the calculations:

- Determined by H a = 1 ÷ 20 × 100% = 5%.

- The calculated amount of annual depreciation in rubles: A year = (200,000 × 5%) ÷ 100% = 10,000.

- Calculated the amount of monthly depreciation in rubles: A month = 10,000 ÷ 12 = 833.

The organization will make deductions from March 1 in the amount of 833 rubles. on account 02 credit (accrual of depreciation of fixed assets in a linear way). The example shows in an accessible way how to use the method and how easy it is to use.

Balance reduction method

By applying this way, the organization will pay the same monthly payment which will decrease every year. The method is designed to pay most of the amount at the beginning of the asset's operational life.

Depreciation on is calculated using the formula:

A = (C rest × H a × K us) ÷ 100%, where:

- With rest - the difference between the initial cost and the accumulated amount of depreciation, that is, the residual price of the asset.

- H a - depreciation rate.

- K us - accelerating factor set by the organization (but not more than 3).

Depreciation calculation using the declining balance method

Consider the methods of calculating depreciation of fixed assets. We will calculate examples of the decreasing balance using the following data:

The enterprise put into operation a computer worth 200 thousand rubles, the service life of which is estimated at 8 years. The organization speeds up the payment by 2 times. You want to find out the amount of annual depreciation for the first 4 years. We carry out calculations:

- The value of H a is determined = (1 ÷ 8) × 100% = 12.5%.

- For the first year, the organization will pay: A = (200,000 × 12.5% × 2) ÷ 100% = 50,000.

- The residual value for the second year will be: 200,000 - 50,000 = 150,000. Depreciation for the second year: А = (150,000 × 12.5% × 2) ÷ 100% = 37,500.

- The residual value for the third year will be: 150,000 - 37,500 = 112,500. Depreciation for the third year: A = (112,500 × 12.5% × 2) ÷ 100% = 28,125.

- The residual value for the fourth year will be: 112,500 - 28,125 = 84,375. Depreciation for the fourth year: A = (84,375 × 12.5% × 2) ÷ 100% = 21,094.

The company will continue the calculations until the last, eighth year, in which it can pay monthly the amount of depreciation until the amortization cost is completely written off or divide the residual value in equal shares for the last year of repayment.

Cumulative depreciation calculation

The amount of annual depreciation, as in the method of reducing the balance, will be different. The cumulative method is used for rapidly aging and wearing out equipment and in cases where it is planned to obtain the greatest benefit precisely at the initial stage of operation. But, unlike the method of reducing the balance, you cannot set a specific acceleration factor.

In the calculation of each other, non-linear methods of calculating depreciation of fixed assets are very similar. Formulas differ only in the use of specific values, but in general they contain all the same data. Cumulative annual depreciation is calculated using the formula:

A = (C first × N l) ÷ N C. l, where

- From the first - the book value of the fixed assets.

- N l - the number of years before the end of the operational period.

- N s.l - the sum of the values of the numbers of years of the entire period.

The calculation is based on the service life: the remaining period for the calculated year and total amount numbers of years. It is worth noting that the denominator of the formula will not change. For example, if you need to calculate depreciation for 6 years, the sum of the numbers will be 21 (each of the numbers from 1 to 6 was added in turn).

Calculation by the cumulative method for example

Let's calculate the annual depreciation using the initial data: the company has commissioned equipment worth 140 thousand rubles. The service life is 5 years. Calculate annual depreciation for the first 3 years. We perform actions:

- In the first year, the company will pay: A = (140,000 × 5) ÷ 15 = 46,667 rubles.

- Depreciation for the second year will be: А = (140,000 × 4) ÷ 15 = 37,333 rubles.

- Depreciation for the third year will be: A = (140,000 × 3) ÷ 15 = 28,000 rubles.

The remaining years are calculated according to the same principle. To calculate the amount of monthly deductions, the annual depreciation is divided by the number of months.

Production method of depreciation write-off

The application of the calculation method is possible only for property directly used in the production process or in the performance of work (services). Deductions and the remainder of the value of fixed assets directly depend on the production process, which allows you to minimize the formation of an accounting loss.

To determine the amount of depreciation, use the following formula:

A = (About sp.f. × C first) ÷ About, where:

- About pr.f. - the actual volume of manufactured products.

- From the first - the price of the fixed asset in the balance sheet.

- About - the estimated volume of production for the entire established operational period.

Consider an example with the following data: a trade organization purchased a car worth 200 thousand rubles for the distribution of products. The estimated mileage will be 400 thousand km. The actual mileage values are given for January - 4 thousand km, February - 9 thousand km, March - 2 thousand km. Calculate depreciation for the specified three months.

We carry out calculations:

- We find the initial cost of the OS in terms of one kilometer traveled: A = 200,000 ÷ 400,000 = 0.5 rubles / km.

- Depreciation for January will be: А = 4000 × 0.5 = 2000 rubles.

- Depreciation for February will be: A = 9000 × 0.5 = 4500 p.

- Depreciation for March will be: A = 2000 × 0.5 = 1000 rubles.

The depreciation for the remaining months will be calculated in a similar way. Due to the fact that the service life is expressed in the estimated volume of products, it is necessary to revise and adjust the value in time.

Depreciation and accounting

Regardless of what methods of calculating depreciation of fixed assets are used in the enterprise, account 02 is used in accounting. It is credited every time the amounts are transferred. In this case, accounting accounts are debited production costs and count. 44.

After the end of depreciation or as a result of liquidation, the sale of fixed assets is reflected in the fixed assets account by posting Дт "Depreciation of fixed assets" Кt "OS". Account sub-account 02, collecting information about the deductions of this property, is closed.

Differs from buh methods. accounting tax accounting of depreciation of fixed assets. Depreciation methods are limited to two - linear and non-linear, and do not have a deep economic sense... The linear method is identical to the method of the same name in accounting and is charged on each OS separately.

The non-linear method involves the accrual of depreciation for a group or subgroup of similar assets. Calculate the amount by the formula:

A = (B sum × H a) ÷ 100%, where

- B sum - the total balance of the OS group at the beginning of the month.

- H a - depreciation rate (established by the Tax Code of the Russian Federation for each group of fixed assets).

The existing ones are indicated in the Tax Code of the Russian Federation.

The most important characteristic of an organization's property is depreciation. Methods for calculating depreciation of fixed assets allow the company to choose the most acceptable indicators of fixed assets (which includes depreciation) - the basis of financial reporting and the result of the company's activities.