Sources of formation and directions of use of state extra-budgetary funds. Extra-budgetary funds as an element of the budgetary system of Russia: concept, types, meaning, legal basis of activity Formation of the use of extra-budgetary funds

Social off-budget funds began to be created after the adoption of the Law of the RSFSR dated October 10, 1991 No. 1734-1 "On the basics budget device and budget process in the RSFSR "1. Among the state social extrabudgetary funds Of the Russian Federation are currently Pension Fund RF, Fund social insurance RF, Federal and territorial compulsory health insurance funds of the RF. These funds accumulate funds for the implementation of the most important social guarantees: state pensions, the provision of free medical care, support in case of disability, during maternity leave, spa services, etc. The specificity of off-budget funds is a clear assignment of income sources to them and, as a rule, strictly targeted use of funds.

Social off-budget funds are independent financial and credit institutions. However, this independence differs significantly from the economic and financial independence of state, joint-stock, cooperative, private enterprises and organizations. Off-budget social funds organize the processes of using their funds in the amount and for the purposes regulated by the state. The state determines the level of insurance payments, decides on changes in the structure and level of monetary social payments.

Funds of social extra-budgetary funds are currently formed at the expense of the amounts of the unified social tax (contribution) included in the cost of products (works, services). A serious problem for the country is the scale of the evasion of these payments. The indebtedness of payers of insurance contributions to extra-budgetary funds is of a chronic nature. Systematic violation of financial discipline in the payment of insurance premiums leads to an increase in the number of territories in need of subsidies. The Criminal Code of the Russian Federation (Article 199) for evasion of taxes or insurance contributions to state extra-budgetary funds provides for punishment in the form of imprisonment for up to seven years.

The unfavorable situation in the state off-budget social funds was also due to the lack of transparency and serious control over the receipt and use of their funds.

Unified social tax(ESN) entered into force on January 1, 2001 in accordance with Ch. 24 h. 2 of the Tax Code of the Russian Federation. UST taxpayers are:

¨ employers making payments to employees in ; volume including: organizations; individual entrepreneurs; tribal, family communities of the small peoples of the North, involved; traditional industries; peasant (farming) households; individuals;

¨ individual entrepreneurs, tribal, family communities of small peoples of the North, engaged in traditional economic sectors, heads of peasant (farmer) households, lawyers.

Taxpayers transferred to pay the unified imputed income tax for certain types of activities (according to the Federal Law of July 31, 1998, No. 148-FZ "On the Unified Imputed Income Tax for Certain Types of Activities") are not payers of the UST in terms of income, obtained from the implementation of these activities.

Objects of taxation of the UST:.

¨ payments and other remuneration accrued by employers in favor of employees on all grounds, including remuneration under civil contracts on the performance of work (provision of services), as well as under copyright and license agreements;

¨ payments in the form material assistance and others gratuitous payments in favor individuals not related to the taxpayer labor contract either an agreement of a civil nature, the subject of which is the performance of work (provision of services), or an author's or licensing agreement.

The object of taxation is also payments in kind made by agricultural products and (or) goods for children, which are recognized as objects of taxation in terms of amounts exceeding 1 thousand rubles. per employee per calendar month.

For individual entrepreneurs applying a simplified taxation system, the object of taxation is income determined based on the value of the patent.

Tax incentives, provided for the payment of the unified social tax are of a pronounced social character. Thus, organizations of any organizational and legal forms are exempted from paying the UST with the amounts of payments and other remuneration not exceeding 100 thousand rubles during the tax period. for each employee who is disabled of I, II and III groups (regardless of the type of pension received); public organizations of disabled people; organizations, authorized capital which consists entirely of contributions of public organizations of disabled people, in which the average number of disabled people is at least 50%; institutions created to achieve educational, cultural, health-improving, physical culture, sports, scientific, informational and other social purposes, as well as to provide legal and other assistance to people with disabilities, disabled children and their parents, the only owners of whose property are these public organizations disabled people.

Taxable period for UST - calendar year. The procedure for payment of 1 "UST, which provides for advance payments, demanded the introduction of reporting period, equal to one month. With regard to this, the period is the calculation of the tax base and advance payments for the UST. Advance payments are paid monthly simultaneously with the receipt at the bank; funds for wages for the past month. The deadline for their transfer is set no later than the 15th day of the month following the reporting one.

The amount of the UST is calculated and paid by taxpayers separately for each extra-budgetary fund and is determined as the corresponding percentage of the tax base. The calculation of the UST as a whole for off-budget funds is impossible due to the peculiarities and purposes of calculating payments inherent in each fund. UST is charged at appropriate rates to various off-budget funds, depending on the amount of income paid and on the type of taxpayer. Installed four scales of UST rates, built on the principle of regressive calculation and tax payment: the higher the amount of taxable income, the lower the rate and, accordingly, the amount of tax.

Employers making payments to employees (organizations, individual entrepreneurs, individuals) apply a base rate of 35.6% with a tax base for each individual employee up to 100 thousand rubles. on an accrual basis since the beginning of the year. For employing organizations engaged in the production of agricultural products, as well as for clan, family communities of small peoples of the North, engaged in traditional economic sectors, and peasant (farmer) households, a one-time rate of 26.1% is applied. Individual entrepreneurs, tribal, family communities of small peoples of the North, engaged in traditional economic sectors, heads of peasant (farmer) households apply a base rate of 22.8% with a tax base of up to 100 thousand rubles. on an accrual basis since the beginning of the year. The base rate for lawyers is 17.6% with a tax base of up to 300 thousand rubles. on an accrual basis since the beginning of the year.

Taxpayers are obliged to keep records of the amounts of accrued payments and other remuneration, as well as the amounts of tax related to them, for each individual in favor of whom payments were made, on an accrual basis. The amount of the UST and advance payments on it is calculated and paid by taxpayers by separate payment orders to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal and territorial funds of compulsory medical insurance of the Russian Federation.

Pension Fund of the Russian Federation (PFR)- the largest of the extra-budgetary social funds. It was formed on December 27, 1991: no. 2122-1 Resolution of the Supreme Soviet of the Russian Federation. Today the budget, PFR is the second largest after the federal one.

Basic source of income FIU - insurance premiums employers and workers. Employers pay monthly insurance premiums simultaneously with receiving funds from banks and other credit organizations for payments to employees for the past month. This period is set no later than the 15th day of the month for which the insurance premiums were calculated. In the same manner, employers calculate and pay compulsory insurance contributions from employees, including employees, and retirees. Insurance premiums to the PFR are charged on all types of earnings (income) in cash or in kind, regardless of the source of their funding, including full-time, non-staff, seasonal and temporary workers, as well as part-time or one-time, casual and short-term work. The list of payments for which insurance premiums are not charged to the PFR is approved by the Government of the Russian Federation.

The main tasks The PFR as an independent financial and credit institution is the accumulation of insurance premiums and the spending of the Fund in accordance with the current legislation.

The following are installed base rates in the part to be credited to the Pension Fund of the Russian Federation, when calculating and paying the UST:

28% for taxpayer-employers (organizations, individual entrepreneurs, individuals);

20.6% for taxpayers-employers engaged in the production of agricultural products, tribal, family communities of small peoples of the North, engaged in traditional economic sectors, peasant (farmer) households;

19.2% for non-employer taxpayers;

14% for lawyers.

In income the PFR budget, in addition to mandatory contributions, also receives: funds federal budget; funds of the Social Insurance Fund of the Russian Federation; income from servicing PFR accounts by banks; penalties and financial sanctions; voluntary contributions from legal entities and individuals.

Funds FIU are sent for the payment of state pensions (by age, length of service, in case of loss of a breadwinner); disability pensions, military personnel; compensation to pensioners; material assistance to the elderly and disabled; benefits for children between the ages of one and a half to six years; single mothers; on children infected with the human immunodeficiency virus; victims of the accident at the Chernobyl nuclear power plant. The FIU finances various programs for social support disabled people, pensioners, children, lump sum payments are made.

Payments of state pensions and benefits occupy the largest share in expenses of the FIU... Along with them, targeted payments of state pensions and benefits are carried out on a repayable basis from the federal budget - interest-free loan The Central Bank RF. These include pensions and allowances for servicemen and citizens equated to them in terms of pension provision, their families; social pensions; payments of social benefits for burial; expenses for the provision of benefits for pension provision of citizens affected by the disaster at the Chernobyl nuclear power plant; expenses for increasing pensions to participants in the Great Patriotic War and widows of military personnel; expenses for the payment of state pensions to citizens who have left for permanent residence abroad; delivery and postage costs of these types of state pensions.

The pension reform program of the Russian Federation, approved in May 1998, in the long term envisages a transition from the current pay-as-you-go mixed system pension provision, since by 2006 the number of workers in Russia will be less than the number of pensioners, which will create unbearable requirements for pension contributions. According to the calculations of the Ministry of Economic Development and Trade of the Russian Federation, by 2010 the employee will give 8-9% to the funded system wages while the old system will play the role of insurance. It is planned to transfer workers from 1950-1955 to the accumulation system. birth and younger, i.e. those who will retire no earlier than 2010. For current pensioners and those who will reach retirement age before 2010, it is planned to retain the pay-as-you-go method, within which pensions will be indexed continuously. According to the calculations of the Pension Fund, by 2010 the average pension will be 2608 rubles.

The transition to a funded pension system should be facilitated by the implementation of the Federal Law of April 1, 1996 No. 27-FZ "On individual (personified) accounting in the system of state pension insurance". Since January 1, 2002 pension contributions will go either to an individual account with the Central Bank of the Russian Federation, or to the accounts of the Pension Fund of the Russian Federation with the Federal Treasury. The question of how to invest the accumulated funds is extremely important. According to the calculations of the FIU, net income without taking into account the inflationary component, received from the investment of funds of the accumulative pension system, will be from 1 to 8% per year. For this, either the issue of special securities with guaranteed profitability and government guarantees, or investments in industry will be used.

The concept of reforming the pension system in Russia envisaged the creation of a three-tier pension system: basic (social) state pension, labor state pension and non-state pension. However, until now, the main burden of all payments lies with the state Pension Fund, which is not capable of solving all the problems of ensuring a decent old age for Russians on its own. Non-state pension funds (NPF) and Insurance companies, who were supposed to become real allies of the state fund, have not yet made a serious contribution to solving this problem.

Social Insurance Fund of the Russian Federation (FSS) p is designed to contribute to the material security of persons who, for a number of reasons, are not involved in labor process... It operates in accordance with the Presidential Decree No. 822 of August 7, 1992 and the Regulations on the Social Insurance Fund, approved by the RF Government Resolution No. 101 of February 12, 1994. The FSS manages the state social insurance funds of the Russian Federation. The funds of the FSS are state property, they are not "included in the budgets of the corresponding levels, other funds are not subject to withdrawal. The budget of the FSS and the report on its implementation are approved by the Government of the Russian Federation, and the budgets of regional and central branch offices of the FSS, reports on their implementation after consideration by the board FSS are approved by the chairman of the FSS.

The main tasks FSS are: provision of state-guaranteed benefits for temporary disability, pregnancy and childbirth, at birth and adoption of a child, for burial, sanatorium treatment and health improvement of employees and their families, as well as the implementation of other expenses provided for by the budget of the Fund for the corresponding year, in the order determined by regulatory legal acts. The mechanism for the formation and use of the majority of the Fund's resources allows about 70% to be left at the disposal of the payers.

After the introduction of the UST percentage of the tax base, subject to enrollment in the FSS, has undergone changes: for taxpayers-employers engaged in the production of agricultural products, as well as for tribal, family communities of small peoples of the North, engaged in traditional economic sectors, and peasant (farm) households, a base rate of 2.9% is applied. For all other taxpayers-employers, the rate of 4% is used (previously, the rate of insurance premiums for all payers was 5.4%).

Non-employer taxpayers do not pay UST in terms of the amount credited to the FSS. Such an exemption is not considered as tax relief, since the norm in force during the period of payment of insurance premiums has actually been preserved, according to which individual entrepreneurs registered as policyholders and paid insurance premiums to the FSS on a voluntary basis. The expenses incurred by the taxpayer for the purposes of state social insurance reduce the amount paid as part of the UST to the FSS.

The amount of taxes (contributions) credited to the state off-budget FSS is determined on the basis of actuarial calculations for each type of social risk in accordance with the legislation of the Russian Federation on compulsory social insurance. At the same time, the total burden on the payroll cannot increase the marginal rate of the consolidated tariff established by law.

Decree of the Government of the Russian Federation of March 19, 2001 No. 201 approved lists of medical services and expensive types of treatment in medical institutions of the Russian Federation and medicines, the amount of payment of which at the expense of the taxpayer's own funds is taken into account when determining the amount of social tax deduction.

Since 2000, the Federal Law of July 24, 1998 No. 125-FZ "On compulsory social insurance against accidents at work and occupational diseases". Insurance rates for compulsory social insurance against industrial accidents and occupational diseases are established in it for groups of sectors (sub-sectors) of the economy in accordance with the classes occupational risk. Insurance payments are carried out in connection with the death of the insured and to pay additional expenses of the insured for his medical, social and professional rehabilitation.

Compulsory Medical Insurance Fund of the Russian Federation (MHIF) occupies a significant place in the structure of social extra-budgetary funds. The health insurance system was introduced by the Law of the Russian Federation of June 28, 1991 No. 1499-1 "On health insurance of citizens in the Russian Federation", which was introduced in full since January 1, 1993. Compulsory health insurance is an integral part of state social insurance and is designed to to provide the citizens of the Russian Federation with equal opportunities in obtaining medical and pharmaceutical care provided at the expense of compulsory medical insurance in volumes and on conditions corresponding to compulsory medical insurance programs. The financial resources of the MHIF are in the state ownership of the Russian Federation, are not included in the budgets, other funds and are not subject to withdrawal.

For all payers of the UST; of both employers and non-employers has been established flat base rate in the amount of 3.6% in terms of the amount credited to the MHIF, of which:

0.2% is transferred to the Federal Compulsory Health Insurance Fund;

3.4% to the territorial compulsory health insurance funds.

The exception is taxpayers-employers employed in the production of agricultural products, tribal and family communities of the indigenous peoples of the North, employed in traditional economic sectors, and peasant (farmer) households, applying a rate of 2.6% (0.1% in the Federal MHIF and 2.5 % to the territorial MHIF).

The basis of the MHIF's income is made up of insurance premiums - over 95% of the total volume of income.

Funds Compulsory Health Insurance Fund used for payment medical services provided to citizens, financing of targeted medical programs, measures for the training and retraining of specialists, for the development of medical science, for improving the material and technical support of health care and other purposes.

Lack of experience in organizing the functioning of off-budget funds and the difficult economic situation in the country have caused significant shortcomings in their activities. The UST was introduced in order to increase the efficiency of the use of extra-budgetary social funds, the application of more reasonable rates of receipts to funds, the improvement of the methodology for their calculation, a policy of greater transparency of funds and responsibility for the targeted use of funds,

It is expected that the introduction of a unified social tax will significantly simplify the procedure for the formation of funds from social extra-budgetary funds, reduce document circulation, and strengthen control by the tax authorities, since the mechanism for monitoring and collecting contributions from the tax authorities is much better than that of funds.

The allocation of off-budget funds is due to several reasons:

1) the need to allocate special monetary resources for the purpose of their more efficient and strictly targeted use;

2) the need to identify special and at the same time stable financial sources to meet the special needs of the state;

3) the need to find additional funds to meet public needs, which cannot be fully financed from the budget, but which are the basis for expanding the scope of government activities in the field of military spending, scientific research, social payments to the population, etc.

Extrabudgetary funds allow to overcome the residual principle of financing social and other expenses. They also make it possible to unload the budget, taking on part of its expenses, thereby solving the problem of financing the budget. Having a strictly targeted direction for the use of funds, off-budget funds make it possible to increase the resources mobilized by the state. Of course, this can be done by increasing taxes, but, as a rule, the increase in taxes is negatively perceived in society. But if there is an increase in rates to extra-budgetary funds, then this is perceived more calmly, since the majority of citizens receive income from extra-budgetary funds.

Off-budget funds are a financial category and part of the public finance system. At the same time, extrabudgetary funds have a number of features. In particular, in Russia:

1) draft budgets of state extra-budgetary funds are submitted simultaneously with the draft of the corresponding budgets for the next financial year;

2) the budgets of state extra-budgetary funds are considered and approved in the form of federal laws simultaneously with the adoption of the federal law on the federal budget for the next financial year;

3) off-budget funds are introduced by state authorities and have a strictly targeted orientation. Their spending can be carried out exclusively for the purposes determined by the legislation of the Russian Federation, in accordance with the budgets of the funds, approved by federal laws or laws of the constituent entities of the Russian Federation;

4) the income of state extra-budgetary funds is formed at the expense of compulsory contributions, as well as voluntary contributions from individuals and legal entities;

5) insurance contributions to funds and the relationship arising from their payment are of a tax nature. Contribution rates are set by the state and are mandatory;

6) the monetary resources of off-budget funds are in state ownership. They are not included in the budgets, as well as other funds and are not subject to withdrawal for any purpose not directly provided for by law;

7) spending of funds from extra-budgetary funds is carried out by order of the Government or a specially authorized body (board of the fund).

8) insurance contributions to funds and legal relations arising from their collection are of a tax nature, i.e., like taxes, payments and fees, they are established by the state on the principle of mandatory withdrawal from payers, their calculation, withholding and transfer are regulated by tax legislation ;

9) subventions can be made from funds to attract additional funds to finance investment projects and programs.

Actions to create extra-budgetary funds were due to the desire of the central authorities:

Strengthen the control of the representative bodies of power over the targeted use of state funds for social protection of the population;

Transfer the execution of the budgets of extra-budgetary funds from the sphere of state executive power to the governing bodies of specially created funds;

To create a clear mechanism for the formation and use of targeted off-budget funds, to compare the values of the sources of these funds with the amounts of funds used by them;

To remove the burden from the central budget, from which previously a subsidy for social protection of the population was given.

Off-budget funds are a set of monetary distribution and redistribution relations, as a result of which funds are formed financial resources that are not in the budget and have, as a rule, special purpose.

Functions of extrabudgetary funds

Extrabudgetary funds perform distribution and control functions.

The distributive function is expressed in the redistribution of a part of the national income through off-budget funds in favor of either social strata of the population or individual sectors of the economy in order to ensure their development.

The control function is manifested in informing society about the deviations that have arisen in production or social processes.

Classification of extrabudgetary funds

From the moment of their inception, off-budget funds have been divided into two large groups in terms of their economic content:

1) social funds, which include the Pension Fund, Social Insurance Fund, Mandatory Health Insurance Funds.

2) economic funds: road funds, etc.

Depending on the legal status, extra-budgetary funds are distinguished:

1) owned by the federal government - federal funds;

2) regional funds created by the decision of the representative bodies of the constituent entities of the Federation and local self-government bodies.

According to the method of formation, the funds are divided into:

1) funds allocated as part of budgets;

2) funds with autonomous management;

By the nature of their use in the material sectors of the national economy, there are funds:

1) technological development;

2) funds to support industries;

According to the sources and the mechanism for the formation of resources, off-budget funds are distinguished, which are formed at the expense of deductions:

1) from the wage fund and having a tax character,

2) at the expense of deductions from the cost of manufactured products or their cost according to the approved standard.

The sources for the formation of extra-budgetary funds are:

Voluntary contributions from legal entities and individuals;

Special targeted taxes and fees established for the respective fund;

Funds from the budget;

Deductions from the profits of enterprises, institutions, organizations;

Profit from commercial activities carried out by the fund as a legal entity;

Loans received by the fund from the Central Bank of the Russian Federation or commercial banks.

The execution of the budgets of state extra-budgetary funds is carried out by the Federal Treasury of the Russian Federation. Control over the execution of budgets is carried out by bodies that ensure control over the execution of budgets of the corresponding level budget system RF.

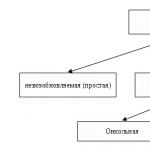

The composition of extrabudgetary funds is shown in Scheme 1.

Extrabudgetary funds

Social

Economic

Federal and territorial road funds

Pension Fund of the Russian Federation (PF RF)

Social Insurance Fund of the Russian Federation (FSS RF)

Production fund of the mineral resource base of the Russian Federation

Compulsory Medical Insurance Fund of the Russian Federation (MHIF RF)

Financial regulation funds

Russian Fund for Technological Development and sectoral off-budget R&D funds

Housing Investment Fund

Scheme 1. Composition of off-budget funds.

Since 1992, more than two dozen extra-budgetary funds have been operating in Russia. The emergence in Russia in the 90s. special extrabudgetary funds was a relatively new phenomenon. Before that, there were no extrabudgetary funds as such. In the USSR, instead, there were two types of budget: ordinary and extraordinary. The ordinary budget was formed from traditional, relatively constant income and was used to finance the costs associated with the implementation of the main functions of the state. The emergency budget actually served as special funds. It was not approved, published and kept secret, since the budget system of the USSR provided for the existence of one state budget... At the expense of the emergency budget, the state debt was paid off, losses caused by natural disasters were covered, etc. In addition, at the expense of his funds, the deficit of the ordinary budget was covered.

Target budgetary funds began to be created in Russia during the transition of the country to new economic relations. The RSFSR Law "On the Fundamentals of the Budgetary Structure and Budgetary Process in the RSFSR" dated October 10, 1991, for the first time provided the government with the opportunity to form targeted budget funds that have the right of an independent legal entity and are independent of the budgets of the relevant government bodies.

In the 90s. off-budget funds were created at different levels of government - federal, the level of the constituent entities of the Russian Federation and the local level. The main reason for their creation was the need to allocate costs that are extremely important for society and provide them with independent sources of income. The leading role among them was taken by social extra-budgetary funds.

Simultaneously with the social funds, other extra-budgetary funds were created. In the late 90s, having exhausted the positive resource from the functioning of a number of off-budget funds, the Government of the Russian Federation decided to consolidate them into the budget, while retaining some autonomy of these funds. They were included in the budget as separate items, i.e. transformed into targeted budget funds. Social funds retained the status of off-budget funds and were officially approved by legislative acts.

In the complex of ongoing socio-economic reforms, the most important place is given to insurance medicine. The transition to it is due to the specifics of market relations in health care and the development of the sector of paid services. Health insurance allows each person to directly compare the necessary health care costs with their own health. It is necessary to measure the need for medical care and the possibility of obtaining it regardless of who makes the costs: directly by an individual, an enterprise, an entrepreneur, a trade union or society as a whole.

Compulsory health insurance funds represent monetary funds, intended to finance the state-guaranteed medical care to the population.

In accordance with Art. 1 of the Law of the Russian Federation of June 28, 1991 No. 1499-1 "On medical insurance of citizens in the Russian Federation" compulsory health insurance Is an integral part of state social insurance, which provides all citizens of the Russian Federation with equal opportunities in obtaining medical and pharmaceutical care. The law defines the legal, economic and organizational foundations of health insurance for the population in the Russian Federation. The law is aimed at strengthening the interest and responsibility of the population and the state, enterprises, institutions, organizations in protecting the health of citizens and new economic conditions and ensures the constitutional right of citizens of the Russian Federation to medical care. This law also introduced health insurance. Its purpose is to guarantee citizens in the event of insured event receiving medical assistance from the accumulated funds and financing preventive measures.

Speaking about the health insurance system, it is necessary to distinguish between voluntary and compulsory health insurance, since the latter is part of social insurance and is financed from targeted taxation, included in the cost of production, and payments from the budget, and voluntary health insurance is financed from the profits of employers or personal funds. citizens.

The main principles of organizing insurance medicine are:

- 1) a combination of the compulsory and voluntary nature of health insurance, its collective and individual forms;

- 2) universal participation of citizens in compulsory health insurance programs;

- 3) delimitation of functions and powers between the Federal and territorial compulsory health insurance funds;

- 4) ensuring equal rights of the insured;

- 5) free provision of treatment and diagnostic services within the framework of compulsory health insurance.

Territorial compulsory health insurance funds are beginning to play the role of the central financing organization in insurance medicine as economically independent non-profit structures. They enter into legal and financial relations either with citizens (individuals), or with enterprises, institutions, organizations ( legal entities, insurers), insurance organizations, as well as healthcare facilities. At the same time, territorial funds control the volume and quality of medical care provided.

The Federal Compulsory Health Insurance Fund is designed to provide financial sustainability the entire system on the basis of equalizing the conditions for financing individual activities in the field of compulsory health insurance.

The main tasks of the Federal and regional funds in the compulsory health insurance system are:

ensuring the implementation of the Law of the Russian Federation "On Compulsory Medical Insurance of Citizens of the Russian Federation";

ensuring the rights of citizens provided for by the legislation of the Russian Federation;

achieving social justice and equality for all citizens;

participation in the development and implementation of state financial policy;

ensuring its financial stability.

In the budgetary legislation, compulsory health insurance funds are defined as monetary funds, while in the Law of the Russian Federation "On health insurance of citizens of the Russian Federation" Federal and territorial compulsory health insurance funds are defined as independent non-profit financial institutions. The activities of the Federal Fund as an institution are carried out in accordance with its Charter, territorial funds - in accordance with the provisions on funds approved by the executive bodies of the constituent entities of the Russian Federation.

TO legal acts regulating the formation and use of compulsory health insurance funds (as well as other extra-budgetary funds) include tax code RF, the Budget Code of the RF, legislation and regulations in the field of health care and health insurance, laws on the budgets of the respective funds and their implementation.

Income part Since 2001, the Federal Mandatory Health Insurance Fund has been formed by:

deductions from the unified social tax (since 2005, the basic rate of the unified social tax has been changed from 0.2% to 0.8%);

deductions from the single tax under a simplified taxation system;

deductions from agricultural tax;

deductions from the unified tax on imputed income;

income from the placement of the Fund's temporarily surplus funds and the rationed stock;

voluntary contributions from legal entities and individuals.

Expenses Federal Compulsory Health Insurance Fund go to:

for alignment financial conditions activities of territorial compulsory health insurance funds;

financing targeted programs;

computerization of the compulsory health insurance system;

expenses for the maintenance of the staff of the Federal Compulsory Medical Insurance Fund.

Income territorial funds are formed at the expense of:

deductions from the unified social tax (the basic tax rate since 2005 has been changed from 3.4% to 2%);

deductions from the single tax for special taxation regimes;

receipts from territorial budgets as insurance premiums for the non-working population;

income from the placement of temporarily vacant Money and rationed safety stock;

receipts of funds from the Federal Compulsory Medical Insurance Fund to equalize the financial conditions for the activities of territorial funds;

receipts from the Pension Fund of the Russian Federation for compulsory medical insurance of non-working pensioners (since 2003)

Expenses territorial funds are associated with the financing of the territorial compulsory health insurance program (up to 92% total amount costs), including the costs of running the business of medical insurance organizations, the performance of management functions by territorial funds (branches), for the formation of a standardized insurance stock; as well as financing of selected activities in the field of health care.

Federal Law of the Russian Federation No. 165-FZ of 10.12.04. "On the Budget of the Mandatory Medical Insurance Fund for 2005" approved the budget of the Mandatory Medical Insurance Fund for 2005 in terms of revenues in the amount of 88,991.7 million rubles, expenses in the amount of 88,991.7 million rubles (see Appendices 5 and 6).

Payers of insurance contributions to compulsory health insurance funds are:

enterprises, organizations, institutions;

branches and representative offices of foreign legal entities;

peasant (farming) households;

citizens engaged in self-employment without forming a legal entity;

citizens engaged in private practice in accordance with the established procedure;

citizens using the labor of hired workers.

Compulsory health insurance payments unemployed population are carried out by the executive authorities, taking into account the territorial programs of compulsory health insurance within the funds provided in the respective budgets for health care.

In economic and social terms, the transition to insurance medicine in Russia is an objective necessity, which is due to the social insecurity of patients and workers in the industry, as well as its insufficient technical equipment. Low wages of medical personnel due to the lack of budget funds, leads to social insecurity of public health workers.

Unsatisfactory provision of medical-industrial complex facilities with equipment and instruments, medicines, a high degree of wear and tear of the existing medical equipment caused their low organizational and technical level. The planned management methods used in our country assumed centralized management as national economy in general, and in its individual branches, including healthcare.

Thus, it can be said that in the conditions of a crisis state of health care, great importance should be attached to the social significance of health insurance, the search for additional opportunities restoration of the health of citizens. In the context of the expansion of the medical services market, insurance organizations can take on a significant share of long-term lending to the budgetary sector of the economy.

The health insurance system as one of the sectors market economy, forms own structure financial resources and costs, enters into financial relations with other entities financial market... Formation insurance market medical services should be based on a universal legal framework. It is necessary to develop, in particular, the economic and legal requirements for the creation of any insurance organizations; criteria for assessing the possible scope of insurance operations, based on the organizational and legal status of an insurance medical organization; the size of fixed capital, reserve funds.

As practice shows, the effectiveness of insurance increases by meeting the growing demand for medical insurance services even for a short period of action of its regional species. The task of insurance organizations is to provide health insurance more flexible, convenient and advantageous shape.

An important aspect of the development of compulsory health insurance is the development of a scheme of interaction between an insurance medical organization and a medical institution. Such interaction in the conditions of market relations can be based either on a contract or on a joint venture agreement. At the same time, an insurance medical organization acts as a customer, and a medical and prophylactic institution acts as an executor.

A significant drawback of the contract is the unpreparedness of medical institutions to work in the new organizational and legal conditions. To eliminate the shortcomings of the contractual form of the contract, it is advisable for the transitional period to accept the contract on joint activities as the basic contract. However, a joint venture agreement has rather limited applicability. Therefore, with the development of insurance medicine, the improvement of the mechanism economic activity medical institutions will create prerequisites for the transition to proper contracting agreements between medical insurance organizations and medical institutions.

polls studied in the topic: off-budget funds of the Russian Federation and their purpose, the procedure for the formation and use of funds from off-budget funds of the Russian Federation.

Extra-budgetary funds are funds of funds formed outside the federal budget and territorial budgets. Funds from off-budget funds have a strictly targeted purpose and are intended for the implementation of the constitutional rights of citizens to pensions, social security and insurance, health care and medical care. Funds mobilized into off-budget funds allow the state to implement social policy.

In the USSR, social protection of the population was implemented through the state budget of state social insurance, which, in turn, was an integral part of the state budget of the entire country.

In accordance with the Law of the RSFSR "On the Fundamentals of the Budgetary Structure and Budgetary Process in the RSFSR" in 1991 the funds allocated for social security and social insurance were withdrawn from the state budget and on their basis extra-budgetary funds were created.

The state extra-budgetary funds include:

Pension Fund of the Russian Federation;

Social Insurance Fund of the Russian Federation;

Federal Compulsory Health Insurance Fund.

The sources for the formation of off-budget funds are:

Mandatory payments established by the legislation of the Russian Federation, constituent entities of the Russian Federation, as well as decisions local authorities authorities;

Voluntary contributions from legal entities and individuals;

Income received from the placement of temporarily free funds;

Other income provided for by the relevant legislative acts.

The main source of funds for state extra-budgetary funds is the unified social tax. This is a federal tax, it goes to the federal budget, and then, in accordance with the approved rates, is distributed between the funds and the federal budget.

The budgets of state off-budget funds of the Russian Federation are considered and approved by the Federal Assembly of the Russian Federation in the form of federal laws simultaneously with the adoption of the federal law on the federal budget for the next financial year.

The Pension Fund of the Russian Federation (PFR) was created on the basis of the resolution of the Supreme Council of the RSFSR dated December 22, 1990, in order to government controlled finances of pension provision of citizens. The task of the Pension Fund is targeted collection and accumulation of funds for the payment of pensions and benefits for children, as well as the organization of their financing.

The bulk of the income of the Pension Fund of the Russian Federation comes from payments for the unified social tax of employers and individual entrepreneurs. In addition to mandatory contributions, the PF RF may receive funds from the federal budget for targeted financing of payments of state pensions and benefits; income from the capitalization of a part of the temporarily idle funds of the Pension Fund and from servicing the accounts of the Pension Fund by commercial banks; interest and fines; voluntary contributions from citizens, etc.

Funds concentrated in the Pension Fund of the Russian Federation are directed to:

1) payment in accordance with the legislation in force on the territory of the Russian Federation, interstate and international treaties state pensions;

2) payment of benefits for the care of a child over one and a half years old;

3) the provision of material assistance by the social protection authorities to the elderly and disabled citizens, etc.

According to the new pension model, contributions to the Pension Fund, which in aggregate amount to 28%, are divided into three parts: 14% are sent to the federal budget and used to pay the basic state pension (the guaranteed minimum is now 450 rubles); 8-12% of wages are the insurance part of the labor pension and are transferred to the Pension Fund of the Russian Federation (together with the basic part, it must be at least 600 rubles, but not exceed 50% average salary for the entire time of labor activity); from 2 to 6% are directed to the fund for the formation of the "funded component of the labor pension"

Thus, the size of the pension in the new pension model is determined primarily not by the length of service of the employee, but by his real earnings and the amount of contributions to the Pension Fund made by the employer. This should stimulate workers, and after them employers, to abandon all kinds of "gray" salary schemes and to bring hidden parts of salaries out of the shadows, thereby increasing the proceeds of funds for the payment of pensions to today's pensioners.

The State Social Insurance Fund is a centralized fund of monetary resources of national purpose, distributed both in territorial and in sectoral sections.

This fund is created by the insurance method with the obligatory participation of enterprises and persons engaged in entrepreneurial activity.

The sources of the foundation are: deductions from compulsory payments for the unified social tax; income from investment of temporarily free funds of the FSS and their capitalization; appropriations from the budget; voluntary contributions from citizens; other receipts.

The funds of the Social Insurance Fund are directed to:

1) payment of benefits for temporary disability, pregnancy and childbirth, at the birth of a child, for caring for a child until he reaches the age of one and a half years, for burial;

2) sanatorium-resort treatment and health improvement of employees and their family members, as well as for other purposes of state insurance provided for by law (partial maintenance of sanatorium-preventoria, sanatorium and health camps for children and youth, medical nutrition, travel expenses to the place of treatment and rest and back, etc.);

3) the provision of state-guaranteed benefits for temporary disability, pregnancy and childbirth, at the birth of a child, for caring for a child until he reaches the age of one and a half years, for burial, sanatorium treatment and health improvement of employees and their families, as well as other goals of the state social insurance;

Compulsory medical insurance funds of the Russian Federation were created in 1991 in accordance with the Law of the RSFSR "On Compulsory Medical Insurance in the RSFSR" dated June 28, 1991.

The funds of the fund are intended for financing medical care and other services by insurance organizations in accordance with compulsory medical insurance contracts. Such funds were created at the federal and territorial levels.

Compulsory health insurance is designed to meet the needs for medical and drug assistance provided in the amount and in accordance with targeted programs within the framework of state policy.

MHIF funds are formed from deductions from mandatory payments for the UST; income from investment of temporarily free funds of the FSS and their capitalization; appropriations from the budget; voluntary contributions of citizens, etc.

History of the FIU

On June 12, 1990, the Declaration on State Sovereignty of Russia was adopted. Since that time, the countdown of the new history of the country and the reorganization of all state institutions has been carried out. It is noteworthy that the first proving grounds for radical modernization of the socio-economic structure new Russia became the spheres of education and social security. Already on November 20, 1990, the federal law "On State Pensions in the Russian Federation" was adopted. This law laid the foundation for the formation in Russia of a new type of pension system, completely autonomous from the all-Union budget of the USSR, which ceased to exist at the end of 1991. The new pension law in Russia was recognized as quite radical for its time, taking into account the acute political and socio-economic crisis throughout the post-Soviet space. All the systems of personal, sectoral, regional and other social benefits and differentiated pension supplements that were previously in force in the country were canceled. Instead of them, a unified pension system of Russia was established. In accordance with Article 1 of the Law “On State Pensions in the Russian Federation”, the main criterion for differentiating the conditions and norms of pension provision was “labor and its results”. Accordingly, instead of the previous ramified and multi-level pension system, only two types of pensions were established: labor and social . At the same time, all foreign citizens (including residents of other republics the former USSR), as well as stateless persons permanently or temporarily residing in the territory of the Russian Federation.

At the first stage, the pension system for Russian citizens continued to function on the basis of the pay-as-you-go scheme of the Soviet period. The pension budget was replenished from deductions from the general wages fund of enterprises. But in the context of the transition to a market economy, which was accompanied in the early 90s by mass unemployment and bankruptcy of many large (budget-forming) enterprises, further support of the consolidated pension system became impossible. To fulfill the social obligations of the state, it was necessary to search for more perfect financial mechanisms that would meet the new economic realities.

These tasks were assigned to a new financial institution - Russian Pension Fund (PFR), which was founded on December 22, 1990. For the first time in the country, an autonomous off-budget system for financing social payments and the formation of sources of pension capital was created. During 1991-1992. branches of the Pension Fund of Russia were created in all constituent entities of the Federation.

The PFR funds were formally separated from the federal budget, but at the same time remained the property of the Russian Federation. This governance structure pension funds was not typical for foreign pension models, but it was she who played an important role in the further development of the social insurance system in Russia. Including providing a certain degree of protection of pension capital during periods of financial and economic destabilization.

The first PFR budget was formed in the context of an acute non-payment crisis. Therefore, one of the first practical steps of the newly created financial institution became an attraction borrowed money v commercial banks in the amount of 6.6 billion rubles. Thus, the Pension Fund solved the problem of paying off the arrears of the union and republican budgets for the payment of pensions and social benefits for 1991.

Already at the first stage of the PFR's work (in 1991-1994), despite numerous difficulties, the work of the pension system was stabilized. The number of Russian pensioners has increased due to the extension of new conditions of pension provision to creative workers, clergymen, individual entrepreneurs and other categories of working citizens who, for various reasons, were not included in the country's pension system until 1990.

A sharp deterioration in the macroeconomic situation and an increase in inflation in the first half of the 1990s. led to a sharp decline in the real purchasing power of pension payments. In order to prevent the impoverishment of pensioners, the Russian government decided to regularly index pensions, giving priority to supporting the poorest citizens. In November 1993, a fixed compensation supplement was introduced to all pensions, comparable to the minimum old-age pension. This increased the income of pensioners in real terms. Already at the beginning of 1994, the growth of pensions in Russia outpaced the growth of wages, and the average pension exceeded living wage pensioner. In addition, recipients of labor and social pensions for the first time lost their leadership in the list of the poorest categories of Russian citizens to incomplete families with children and large families.

The modernization of the social protection system and the improvement of the living standards of the most vulnerable part of the population became one of the priority goals of the subsequent social reforms of the government, which were carried out with the direct participation of the Pension Fund of Russia. In the course of a whole range of radical reforms of pension and social security implemented in Russia over the past 25 years, the functions of the Pension Fund have expanded significantly. In addition to the payment of labor and social pensions, the Russian Pension Fund collects insurance contributions as part of the compulsory pension insurance system for citizens; payment of all types of benefits to privileged and low-income categories of citizens; issuance of state certificates for family (maternity) capital to each family at the birth of a second and subsequent child; implementation of the program of state co-financing of pensions; formation, investment and payment of funds of the funded part of the pension capital of participants in the social insurance system and many other functions.

In 2014, the pension and social security system in the Russian Federation numbered more than 41 million pensioners, which is more than half of the economically active population Russia (over 75 million people). About 16 million people took part in the program of state co-financing of pensions. More than 5 million families with children received certificates for family (maternity) capital, while more than 90 percent of them used lump sum(the equivalent of about $ 10,000) to improve housing conditions.

At present, the Pension Fund of Russia, on the basis of international agreements, carries out pension payments in 109 countries of the world. Among foreign countries with which the Russian Federation has concluded agreements on mutual pension provision, the largest number of recipients of Russian pensions live in the Republic of Belarus, Latvia, Bulgaria, Estonia and Ukraine. At the same time, of all the countries with which the Russian Federation does not yet have such agreements, the largest number of Russian pensioners live in Germany, Israel, the USA, Canada and Finland.

But the reform of the pension system in the Russian Federation is still far from complete. In 2013, the Russian Pension Fund launched a new Strategy for the Long-Term Development of the Russian Pension System. One of the key objectives of the Strategy is the development of a three-tier pension system model based on compulsory pension insurance, corporate pension systems and voluntary pension insurance. It is this model, which is being implemented in Russia since January 1, 2015, that will be able to ensure the greatest balance of the country's pension system in the long term.

I. Social extrabudgetary funds.

When creating social extra-budgetary funds, the task was set to "unload" the budget from a significant share of social expenditures, which were financed within the budget with great difficulties. Subsequently, having exhausted the positive resource from the functioning of a number of off-budget funds, the Government of the Russian Federation decided to consolidate them into the budget, while maintaining a certain autonomy of such funds. The creation of state social extra-budgetary funds is primarily due to the need to insure social risks that are inevitable in a market economy.

Social off-budget funds are created on the basis of the relevant acts of the supreme authorities, which regulate both the activities of social off-budget funds, and indicate the sources of their formation, determine the procedure and direction for the use of monetary funds.

Social off-budget funds are a form of redistribution and use of financial resources that are attracted by the state to finance some public needs that are not included in the budget.

All off-budget social funds (with the exception of the Employment Fund) have the status of state non-profit financial and credit institutions. They are managed (with the exception of compulsory health insurance funds) at the federal level, and regional and local offices are subordinate to the central apparatus of the funds.

The main social extra-budgetary funds include:

§ Pension Fund of the Russian Federation (PF RF);

§ Social Insurance Fund of the Russian Federation (FSS RF);

§ Compulsory Medical Insurance Fund of the Russian Federation (MHIF RF);

§ State Employment Fund of the Russian Federation (now part of its functions are performed by federal Service on labor and employment of the Russian Federation (Rostrud)).

The property and funds of each of them are state property, are not subject to withdrawal to the budget and are in operational management management bodies of funds. The main source of income for all funds is the compulsory insurance contributions of employers, calculated as a percentage of the accrued wages, and citizens pay insurance contributions to the Pension Fund. Funds' budgets and reports on their implementation are approved annually in the form of a federal law. The funds independently collect insurance premiums, fines and penalties for their incomplete or untimely transfer, while using the rights granted to the bodies of the State tax service... The funds independently (on the basis of approved budgets) produce and spend funds. Funds are allowed to deposit temporarily surplus funds at the Central Bank institutions and invest in state securities... Control over the execution of the Funds' budgets is exercised by their audit commissions, formed either by the executive bodies of state power (the State Employment Fund), or by the highest collegial bodies of the funds themselves (the Pension Fund). In addition, mandatory annual audits are provided for almost all funds (except for the State Fund).

Incomes of social extra-budgetary funds are formed from:

Mandatory payments established by the legislation of the Russian Federation;

Voluntary contributions from individuals and legal entities;

Other income provided by law.

The collection and control over the receipt of income of social extra-budgetary funds is carried out by the Ministry of Taxes and Duties.

The main source of income for social extra-budgetary funds is the unified social tax (UST) (insurance premium). Its payers are employer organizations of all forms of ownership, and the taxable base is all payments accrued by the employer in favor of the employee on all grounds. The tax is levied at a regressive rate. The legislation provides for some benefits for the payment of UST.

There are also social extra-budgetary funds for intersectoral and sectoral purposes, the purpose of which is to provide financial support to specific institutions, projects, development and stimulation of production. The Ministry of Science and Technology of the Russian Federation registers social extra-budgetary funds formed by federal ministries and other federal executive bodies, organizations, and also maintains a register of these funds.

Social off-budget funds are formed at the expense of deductions from enterprises and organizations in the amount of up to 1.5% of the cost of products, works, services sold, and the amounts deducted are included by organizations in the cost of products.

Creation of independent social extra-budgetary funds in Russia in the 90s. played a positive role, since it allowed, first of all, to remove the dependence of collateral social sphere from the budget, the deficit of which negatively affected the industries financed in estimated order... The residual principle of financing the social sphere was actually minimized. However, the allocation of funds to independent off-budget funds did not solve all the problems. Today funds for social programs everything is also missing.

II. Economic off-budget funds

The economic off-budget funds in the Russian Federation include departmental (sectoral, intersectoral) funds and funds for territorial (regional) development. They are created at the federal level by the decision of the bodies of the Federal Assembly of Russia, by presidential decrees, government decrees, and at the local level - by the decision of the legislative (representative) authorities of the constituent entities of the Russian Federation of local self-government.

The procedure for the formation of off-budget funds and control over the use of the funds of these funds before the entry into force of the Budget Code of the Russian Federation were determined by the Law of the Russian Federation of April 15, 1993. No. 4807-1 "On the basics of budgetary rights for the formation and use of extra-budgetary funds of the representative and executive bodies of state power of the republics. The Russian Federation, the autonomous region, autonomous regions, territories, regions, cities of Moscow and St. Petersburg, local authorities ".

Off-budget economic funds are created at the federal level to finance the costs of scientific research and experimental development (R&D), stabilization and development of the economic sector, social and material and technical support of individual departments (fiscal, law enforcement). The terms of their existence in the Russian Federation, unfortunately, are extremely short, which is largely predetermined by the inconsistency and contradictions of the state's socio-economic policy.

Such extra-budgetary R&D funds were formed through voluntary contributions from enterprises and organizations, regardless of ownership, in the amount of up to 1.5% of the cost of goods sold (works, services) with the attribution of these costs to the cost of products (works, services) and were created in agreement with the Ministry of Science and the technical policy of the Russian Federation, which is entrusted with control over targeted use funds of the above funds. The largest in terms of accumulated financial resources Among the off-budget R&D funds is the Russian Fund for Technological Development.

V last years there was a tendency to liquidate off-budget funds. This happens at all levels of the budgetary system and applies to all types of off-budget funds, both economic and social.

V Federal law dated December 27, 2000 No. 150-FZ "On the budget for 2001" the above-mentioned federal targeted budget funds were generally liquidated (abolished), with the exception of the Fund of the Ministry of the Russian Federation for Atomic Energy.

Among the off-budget funds, the largest was and remains the Monetary Fund. It has existed since October 1995, when the Moscow City Duma approved the Temporary Regulation on its formation and spending of the Fund's foreign exchange funds, which are intended primarily to finance large investment programs of the city and ensure import purchases of equipment.

Various extra-budgetary funds for social and economic purposes are currently operating in the Russian Federation. The most important of them are: health funds, road funds, regional development funds.

Health care funds as a kind of off-budget social funds are created in Russia in accordance with the Law of the Russian Federation "On Health Insurance of Citizens in the RSFSR", which came into effect on January 1, 1993.

The funds of the health care fund are intended for:

* financing of measures for the development and implementation of target programs approved by the Government of Russia and other government bodies;

* providing professional training of personnel;

* research funding;

* development of the material and technical base of health care institutions;

* subsidizing specific territories in order to equalize the conditions for the provision of medical care to the population under compulsory health insurance;

* payment for expensive types of medical care;

* financing of medical institutions providing assistance for socially significant diseases;

* rendering medical assistance in case of mass diseases, in zones of natural disasters, catastrophes and other purposes in the field of public health protection.

Health care funds are formed in insurance medical organizations at the expense of funds received from insurance premiums.

Road funds are established as earmarked funds in many states. On the territory of Russia, they were formed on January 1, 1992 in accordance with the Law of the Russian Federation "On road funds in the RSFSR". Their funds are formed mainly from special taxes and fees in accordance with the specified Law.

These include federal and territorial taxes on the sale of fuels and lubricants, paid by enterprises of all forms of ownership and citizens selling these materials. Taxes are set as a percentage of the sales of fuels and lubricants. A tax is also levied on vehicle owners at certain rates calculated for the displacement of the vehicle's engine.

The main areas of use of funds received in road funds are the repair and reconstruction of highways, as well as the construction of new highways and local roads, and other road infrastructure facilities.

The Russian Fund for Technological Development and sectoral non-budgetary R&D funds were created in accordance with the Decree of the President of the Russian Federation "On urgent measures to preserve the scientific and technical potential of the Russian Federation" dated April 27, 1992, No. 1426. Extra-budgetary funds of ministries, departments and associations are created by agreement with the Ministry science and technical policy of the Russian Federation.

In its Coursework I would like to present in more detail information about the State social extra-budgetary funds operating on the territory of the Russian Federation.