Sberbank online payroll project. Salary project in Sberbank. Market Offers

Sberbank salary project is a comfortable tool due to which wages are credited to the accounts of employees. Using such a tool, the client company reduces its costs and labor during the implementation of the procedure for paying salaries to its working personnel. Another company is available with various benefits. Next, we will talk about what constitutes a Sberbank salary project: an instruction for an accountant. We note all the advantages of this system.

Salary project has many benefits for organizations

What benefits can legal entities benefit from the project?

The benefits for various organizations and enterprises are as follows:

- No need to pay if the total amount of the institution’s salary is cashed.

- The banking organization provides for loyal tariffs - and this is not only about servicing the account, but also about other important services. All of them are included in the salary project of the company. The price is set individually for each case.

- The agreement is drawn up according to a simplified scheme. For these purposes, a design contract is specifically used.

- Serious customers have the right to submit an application for installation of an ATM specifically in the building of the institution. Thus, the working staff of the institution will have the opportunity to withdraw their money without leaving the office territory.

How does such a project work

The client company signs an agreement with a banking organization. The document is drawn up using the simplest scheme. An application can also be executed on a remote basis - you can use the online mode.

Immediately after the documents are signed, the company and the banking organization issue plastic cards to employees. Further, each person has a separate account. The project works this way:

- The company's accountant transfers the total salary to a single bank account. The latter is opened in the name of the company that is the client.

- A statement is sent to the office of the banking organization. It reflects information about the wages of each of the employees. For un-workers un is still much easier.

- A credit institution during the time period prescribed in the agreement transfers finances to employees' salary cards (based on the statement provided by the organization).

An important point: it will be better if the client company goes through the registration process in the Sberbank Business Online service specially created for this. It allows the possibility of remote submission of statements, total control over the location of finances on the account of the company.

In order to cooperate with a credit organization, an accountant does not have to go to the department itself.

How is the information provided in the framework of the project in question

Sending salary information can be remote. For this purpose, it is necessary to fill out a form on the banking site with a reflection of all information about the institution. So, the form indicates:

- Full name.

- The total operating time of the institution.

- Amount of workers.

- Amounts included in the monthly wage fund.

- Contact information about the institution.

- Representative.

As soon as documents are issued, the institution receives a personal manager - a specific bank employee who will draw up the documents. The same person will solve all issues arising during the operation of the service contract.

Joining a project requires filling out applications

The Russian Bank has developed a comfortable tool that allows issuing salary cards for citizens. Making them is now much easier and more convenient.

Instructions on register design:

- The program "Register that allows you to open accounts" is downloaded to the computer device. You can download it using the official website of Sberbank.

- The register must be filled out completely. Prescribed information about the staff. Next, click the “Export” button.

- The document must have the appropriate mark - electronic digital signature (EDS).

The last stage is the direction of the Register to a banking organization

The requirements are as follows:

- The card is issued for free, the bank does not need to pay anything for the service.

- To withdraw finances from ATMs (without exceeding the daily limit) is also possible for free.

- The map involves the opening of an overdraft line. The rate is 20% per annum.

- When setting the daily limit for cashing, the type of card is taken into account. If it is a classic, the daily limit is 50,000 rubles. If platinum - 1 000 000 rubles.

- For finance, cashed over the limits, a commission is charged.

The registry of employees in this project has the following lines:

- Personal information about the employee.

- Name of all employees in Latin. This information is recorded automatically - immediately after the facts are reflected in Russian.

- Birthday, place of residence, citizenship.

- Registration address

- Series and ID number.

- Personal code with which a citizen will be identified.

- Contact employee.

- Position held by the employee in the organization.

- Personal email.

- Type of banking product to order.

- Information about the credit institution (what is the name of the branch, what is its code).

As soon as all information about the personnel is entered, the registry is exported. The bank website has a special button for this purpose. Sighting of a document is carried out using electronic digital signature. It is affixed by authorized persons of the institution. Next, there is a departure to the bank.

If the briefing is supplemented by something, Sberbank will develop new services. The client company will be connected to them automatically.

Salary project launch

Pros for employees of the organization:

- It is possible to issue additional cards for relatives and family members.

- Citizens-clients of the project under consideration will have the opportunity to take loans, credit cards. They will also be able to issue mortgages and enjoy other privileges.

- Employees participate in various discount offers from bank partners.

- Any client has the opportunity to become a member of the “Thank you” bonus program from a banking organization.

- Being outside the Russian territory, a bank client will be able to pay for any service using an international bank card.

- If you lose or steal a bank card, just call tech support and it will be blocked. The client will not lose his money.

- Personal savings are available at any time of the day or night. Sberbank ATMs are available throughout the country.

- With the accumulation of money in the card account, a person has the opportunity to receive additional profit - namely, interest accruals from a banking organization.

- Using a mobile bank, you can find out what state the account is in and what operations were carried out on the card. Simply send an SMS notification to the mobile user.

- Thanks to Internet banking, it is possible to make transfers at any convenient time. It is also possible to pay for services, penalties of the traffic police, closing debts. The client does not have to pay for this service.

What points must be taken into account by the client - legal entity, concluding an agreement:

- When concluding such an agreement, the client agrees that he joins the public conditions indicated on the service of the company.

- If changes are made, an additional agreement is not signed with the client.

- If there are any changes and amendments at the legislative level, all customers who have drawn up the design contract are required to adhere to them (without concluding an additional agreement).

Summing up, we can say that the Russian Sberbank regularly improves products for citizens and legal organizations. And the salary project is no exception. In addition, such a project is an ideal option for entrepreneurs without employees.

Using the Sberbank program makes it easier to pay salaries to employees. In addition, it helps to reduce the costs of the institution during this procedure.

Today there is a convenient tool for organizations to pay salaries to their employees on a Sberbank card - Salary project. Instructions, tariffs, connection conditions and benefits of use are discussed below.

The essence of the program - wages are charged on the bank card

The essence of the program - wages are charged on the bank card The implementation of this proposal allows companies to simplify the procedure for issuing salaries. The organization will need to conclude an agreement with a banking institution, while the design scheme is simplified and even includes online circulation. After that, the company, together with the bank, arranges the issuance of cards to its employees and the opening of accounts. An instruction for an accountant created for a salary project in Sberbank explains in detail the conduct of all operations.

To manage accounts, the company is registered on Business Online

To manage accounts, the company is registered on Business Online Without touching the subtleties, the interaction process looks like this:

- The company transfers the total amount of the monthly payment fund to a single account.

- Provides the bank with information about the salary of each employee.

- The banking institution transfers the indicated amounts to the accounts of employees within the designated deadline.

At the same time, the company saves money spent on receiving cash. A large organization may request the installation of a terminal or ATM in an office or on its territory, through which employees can receive cash.

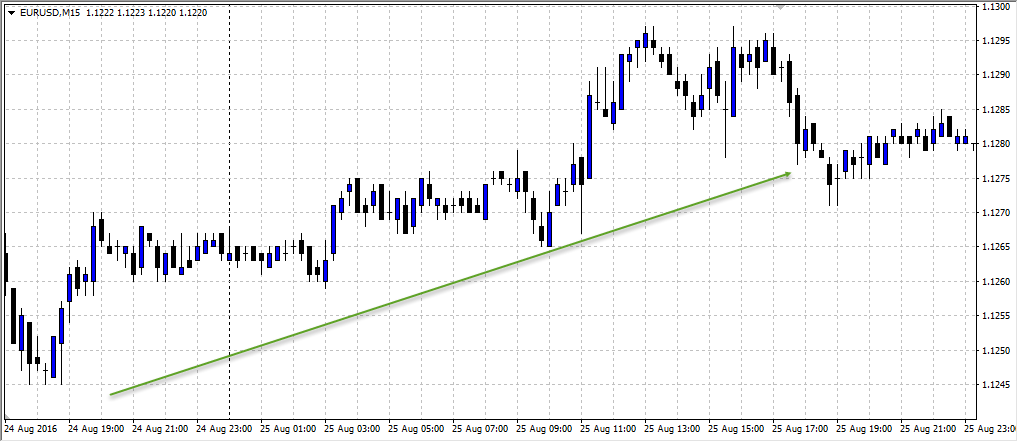

The company is recommended to register with Sberbank Business Online. A salary project, the instructions for working with which are discussed below, while allowing you to file registers remotely, transfer funds and monitor the overall situation on the account. Thus, for the transfer of information and other interactions with the bank, a physical visit to the branch is not required.

Employee Benefits

If the company issued cards to employees at Sberbank, then the owners will automatically receive a lot of benefits in the form of benefits for other banking products

If the company issued cards to employees at Sberbank, then the owners will automatically receive a lot of benefits in the form of benefits for other banking products Employees are issued cards of international format. Thus, they get the opportunity to use them even abroad, manage transfers and carry out operations using remote services. In addition, the card provides such features:

- Issuing an additional card to this account for a relative.

- The ability to apply for a loan, including Target at a lower rate than expected for regular customers.

- Get a mortgage on loyal terms.

- Accumulate points that can be paid at specific points of sale and online stores (Thank you program).

- Enjoy promotions and discounts from Visa and MasterCard.

- If a card is lost, it is blocked, and all funds remain intact. It is allowed to issue a new product with updated codes to an existing account.

- There is a rate for income. To do this, you need to transfer funds to the Savings Account and accumulate them.

How to connect a salary project

Connecting a project takes place in three simple steps

Connecting a project takes place in three simple steps In order for company employees to receive payments on Sberbank cards, the first step will be to submit an application. After sending the application to the credit organization, you need to wait for a certain time necessary for approval. This person will be contacted by a bank specialist who will be assigned specifically to this company.

An application must be filled out either at a branch or on the bank’s website and await a response from managers for further signing of the contract

An application must be filled out either at a branch or on the bank’s website and await a response from managers for further signing of the contract Instructions for submitting information within the project

Application for participation in the program is possible remotely. You will need to fill out a form on the website, in which to indicate general information about the enterprise: name, period of activity, number of employees, monthly wage, address, phone number, contact person.

One of the advantages of the service is the payment of employee earnings online

One of the advantages of the service is the payment of employee earnings online Data entry implies a simplified design. In particular, an accountant or other authorized person will need to fill out the Worker Register. His form is located on the site and contains the following items:

- Surname, name, patronymic of the employee.

- Surname, initials in Latin letters (information appears automatically, after filling in the data in Russian).

- Date of birth, city, country.

- Address (actual and registration).

- Passport data.

- Secret code required for user identification.

- Phone numbers (at least two are required. These can be work, home, mobile, office mobile, etc.).

- Email address

- Employee's position.

- Card Type (Classic, Gold, Platinum).

- Bank codes (branch, branch).

Sample Application Form

Sample Application Form After entering information about all employees, the registry should be “exported” by clicking the appropriate button. After that, an electronic signature is issued and the document is transmitted to the bank.

It is possible to pay salaries to employees not only from the cash desk of the enterprise, but also by transferring funds to a bank account. Especially for these purposes, credit institutions offer their customers a separate service - a salary project. Its essence lies in the fact that the organization transfers funds in one payment, at the same time providing a statement to the bank, which indicates to whom and how much should be paid.

For whom

Bank salary projects are provided for any organizations that officially pay income to their employees. Today, credit institutions have changed their priorities. Previously, banks did not cooperate with small enterprises. Now any organization with a staff of ten or more can join the project.

Conditions

Bank salary projects are served at preferential rates. Issue and maintenance of the card is free. The withdrawal of funds through the terminals of the home bank within the limit is carried out with zero commission. But the restrictions depend on the type of card on which the payroll project is served. Sberbank, for example, set a limit of 50 thousand rubles for Visa Electron, Maestro. and 1 million rubles. for Platinum cards. When withdrawing large amounts, an additional fee will be charged. The time limits for the limit are set according to Moscow time and are valid for all regions.

As part of the Sberbank salary project, an overdraft is provided (the amount of payment in excess of the card balance) with a 20% interest rate and 40% interest for violation of the terms of payment. The cost of monthly maintenance of cash settlement services for organizations is 3500 rubles. There is no monthly fee for an account.

Let us consider in more detail how to connect a salary project through Sberbank.

Instruction manual

To activate the service you need to conclude a contract with a credit institution and provide all employees with debit cards. If the organization was previously serviced by Sberbank (opened an account or transferred funds), then it is enough to submit an application for joining the project. Otherwise, you need to provide a full package of documents: an application, a copy of the charter, a certificate from the Federal Tax Service, PF, signature cards, etc.

Most often, the bank reserves the right to change or introduce new options without entering into additional agreements. But in practice, credit institutions at least inform the client in the form of SMS about changes in the terms of service.

Next, you need to get debit cards for all employees at the bank branch. Depending on the conditions of the program, the size of the organization and the position of the employee, both Visa Electron, Maestro, and Visa Gold, Platinum can be provided. Employees of small enterprises must independently apply to the bank for a card. Workers of large and medium enterprises are served by representatives of the bank directly at the place of work.

Vedomosti

The accountant responsible for payroll conducts all calculations in his program (for example, 1C). Further, payroll sheets are sent to the bank through special equipment installed on the PC:

- using an e-mail message with a file and electronic signature;

- through the registry in the Sberbank Online system.

The credit institution is already independently transferring funds to the cards of employees.

Consumer loan

The participant of the salary project gets the opportunity to take advantage of a number of bonuses, one of which is a loan for up to 60 months. The maximum loan amount is calculated individually for each client, based on the size of the salary, length of service, amount of guarantee and other indicators.

Since the credit institution already owns basic information about the plastic holder, the applications are considered for several hours, and the loan itself can be issued directly at the place of work at a reduced rate.

Benefits for Employers

Sberbank salary project allows organizations:

- Simplify the payout process. If the organization has connected a salary project, then the need to recalculate large amounts, transfer funds from the department to the office, and manually pay the salary automatically disappears.

- Sberbank has developed a salary project in such a way that all the work of an accountant is reduced to sending a statement to the bank and transferring the total amount of payment.

- Order a separate terminal and an ATM so that employees can not only withdraw funds, but also pay for services, make transfers right at the place of work.

- The project is very convenient for organizations with a large number of employees. He eliminates the need to store huge amounts of money at the cash desk and line up the workers in line. Payment is made simultaneously to all employees immediately, regardless of their location.

- For small organizations, a salary project allows you to save on the cashier’s salary.

Employee Benefits

- Card holders can enjoy all the advantages of plastics of international payment systems: remotely manage an account via the Internet, participate in promotions and receive bonuses from a credit institution.

- Time saving. There is no need to stand in line for salaries. All funds can be withdrawn at any convenient time through any ATM in the country. Salary cards are serviced by all credit institutions in Russia without a commission.

- You can transfer money between accounts, through self-service terminals pay taxes, mobile communications, the Internet, television, housing and communal services, etc. without a commission.

- Cashless way to pay for goods.

- Activate the Mobile Bank or SberbankOnL @ yn service and track online account movements.

- Customers who have been serviced under the project for more than six months can:

- draw up an additional card of the international payment system for relatives and connect it to your account;

- use overdraft;

- get a credit card;

- apply for a mortgage at a reduced rate and with a minimum package of documents.

What to do with cards of laid-off employees?

Plastic can be returned to the bank, including through an accountant at the enterprise, or continue to use it. In the second case, you will have to contact a credit institution and change the tariff plan to the standard one, since the card holder, and not the employer, will pay for the service.

Special services

Salary cards are used not only for their intended purpose. For example, plastic holders from Pacific State University not only keep funds in the account, but also use plastic as an electronic key. The PNU campus map automates the internal processes of the university. It is used as a pass to the university premises and as a library card.

Market Offers

After the Russian president signed the law at the end of 2014, according to which employees of enterprises can choose a bank to transfer their salaries, credit institutions began to actively develop new programs to attract customers. The employer has no right to refuse this request. According to Art. 131 of the Labor Code of the Russian Federation, an employee can refuse service through a salary project chosen by the organization (Article 131 of the Labor Code of the Russian Federation).

Russian Agricultural Bank OJSC offers a salary overdraft. For registration of the service it is enough to provide a passport in any branch of the bank. Users of the service can at any time receive additional funds in the account in the amount of the average monthly earnings. The size of the limit is calculated in advance for each client and cannot exceed 1 million rubles.

VTB24 offers salary card holders preferential property insurance programs with a discount of 10% to 15%. In addition, there is a list of partners, when paying for goods by non-cash payment, the client receives bonuses on the card in the form of a refund of part of the funds. The number of assigned points also depends on the particular store and the amount of the purchase.

"RSB" accrues 10% on the balance of own funds on the salary card. In addition, money from a card without a commission can be withdrawn at all ATMs in Russia. Similar conditions are offered to its customers by Renaissance Credit OJSC.

Raiffeisenbank OJSC offers an individual salary project. Its essence lies in the fact that an employee of the company can apply to the bank for a card, provide the details of the payment instrument to the accounting department, and after two transfers of funds from the organization’s account receive the status of a payroll project participant.

Clients of Tinkoff Bank OJSC get the opportunity to withdraw funds from an account at any ATM for 99 rubles without interest. per month. But OJSC “Aymanibank” set a limit on interest-free withdrawal of funds from the account within the amount of 3,000 rubles.

We consider in the article the conditions and tariffs for a business for a salary project in Sberbank. We will analyze the types of cards for employees of IP and LLC, the procedure for filling out the application and the contents of the contract. We have prepared for you a step-by-step instruction for submitting an online application and collected feedback.

Features of the salary project in Sberbank

Sberbank's salary project is the best solution for legal entities, which allows you to charge employees money on bank cards of the largest Russian bank. Cooperation with Sberbank of Russia in the framework of the salary project greatly simplifies the procedure for paying salaries.

Why Sberbank needs a salary project is a question that does not require a long search for an answer, since it is equally beneficial to both the company and its employees. The project program assumes, in addition to the usual capabilities, special services - a simplified payroll procedure, the use of plastic cards of international payment systems, etc.

What is the salary project of Sberbank is not difficult to understand. This is, first of all, a modern and quick way to transfer salaries. Its design will allow the organization to reduce the burden on accountants and reduce the circulation of paper media. The costs of transportation and cash withdrawal are reduced, and the attractiveness of the enterprise as an employer is also increased.

The question of how to make a salary project is quite simple. If a company or organization previously cooperated with a bank, then to join this system it is enough to submit a corresponding application. If there was no cooperation with Sberbank, your company’s specialists need to find out how the salary project works using the bank’s website, and then collect and provide the necessary package of documents.

Now we find out who these are the participants in the salary project. On the one hand, the employer company is here, on the other, its employees. Today, more than 35 million Russians use salary cards. And for employers - this is the most acceptable and convenient way of calculating with the team. Being a member of this system, company employees also have their own benefits.

The benefits of a salary project in Sberbank

A company that has entered into an agreement with Sberbank on a salary project (which is possible if the minimum wage fund level is met) receives many advantages:

Simplification of the procedure for issuing salaries. During the use of payment cards, it is not necessary to consider large amounts in the department and worry about transporting cash to the organization’s office, store, keep records and issue money manually.

The accounting function is reduced to filling out and sending to Sberbank a settlement sheet with a list of employees and the amounts that need to be transferred to their payment cards.

For a small business, as well as an individual entrepreneur with a small cash flow, the Sbera salary project is a great opportunity to reduce the cost of maintaining a cashier. Extra money can be directed to business development.

The ability to use the services of a salary project without opening a current account.

The benefits for employees who choose the non-cash option of receiving a salary are also quite obvious:

- Calculation of salaries on the card allows the employee to save time, since he can cash out money at any time.

- Servicing of wage cards with the help of ATMs without a commission throughout the country.

- You can withdraw any amount of cash at a convenient time.

- Transferring money to another card is also carried out without commission.

- With a salary card, you can pay for any purchases, including via the Internet, as well as utility bills, tax deductions, etc.

- Operations can be controlled by connecting the Mobile Bank application.

- When using a salary card for more than 6 months, you can quickly get a credit card. Mortgage and consumer loans are issued at reduced interest rates.

- You can manage payments, bills and deposits remotely using the Internet.

- The owner of a banking product may receive an additional payment card to the main account for his relatives.

- You can use an overdraft with this card - a short-term loan for the amount specified in the agreement, with subsequent payment at a specified time without charging a commission.

- Salary card users are regularly covered by promotions and special offers from Sberbank partners.

Benefits for the Accountant

Using a salary project greatly simplifies the work of the accountant of the enterprise. And in general, the payroll system, as well as other payments through Sberbank, is quite simple. The accounting department of the company gets access to the personal account on the bank's website to perform all the procedures remotely. Entrance to the salary project is carried out by entering the login and password after connecting the service for the company.

Any accountant will understand within a few minutes how to work with a payroll project. If necessary, you can use the instruction 1C for the accountant to correctly fill out all the documents.

Before sending information to Sberbank, an authorized person must fill out an electronic register. The form can be downloaded from the website. In the personal account of the user assigned to the project, there is all the necessary information on how to add or include an employee in the register, how to transfer wages, how to establish the necessary type of enrollment, etc. In addition, the registry contains personal and passport data of company employees, address of their registration and residence, position, type of bank card used and other information.

After entering the information, the document is subject to export. An electronic signature is generated on the file and it is transmitted for processing to the bank online.

Sberbank salary project for entrepreneurs

There are several clarifications from the Ministry of Finance that IP cannot accrue and pay salaries to itself. But quite often, a salary project for entrepreneurs without employees is used to reduce the percentage when transferring funds from an account of an individual to a physical card. faces (in fact, of the same person). That is, in the framework of servicing small businesses, Sberbank of Russia allows the transfer of IP income through a card that is used for a salary project.

According to reviews, for entrepreneurs without employees, such transfers reduce the commission to 0.3%. Using the capabilities of Sberbank Online for small businesses, an individual entrepreneur forms a register for admission, indicating “other payments” for the purpose of transfer, thereby minimizing the commission for the procedure.

Tariffs

The following conditions are provided for clients of a salary project:

Tariffs for a salary project (for the use of bank cards and their maintenance) can be found in the section of the same name, in the “Useful to Know” tab on the organization’s official website.

Tariffs for the employer are different. The cost for organizations provides for the accrual of interest on a salary project, which is calculated according to two main tariff plans.

Sberbank salary project for legal entities

The terms of the salary project for legal entities imply a set of the following proposals:

- Settlement and cash services.

- Transferring money to a card.

- Cash withdrawal.

- Remote service.

Tariffs

The percentage of the salary project and the tariffs for the employer are calculated in two categories:

- "Premier" - used in the case of payroll of 5 million rubles per month.

- “First” - with the annual maintenance fund - 50 million rubles.

Each tariff involves a package of services, as well as a preferential commission for operations under this package. How much it costs to service legal entities within the framework of the service depends on the chosen tariff. The cost of the Sberbank First service package for an organization is 10,000 rubles. per month. The price of servicing the Premier package is free of charge with the total balance on the last day of the month at 2,500,000 rubles or more.

Individual salary project of Sberbank

Sberbank's individual salary project for individuals has many features and advantages. The card user may not worry about the safety of funds in case of loss. There is no need to carry large amounts of cash.

It provides free access to a mobile bank, with which you can conduct any payment transactions and transfers. Additionally, with the help of the service, you can not only store, but also increase cash, and also participate in various bonus programs.

Cards for Sberbank salary project

As part of the salary project, several types of cards are issued: Visa Classic / Master Card, Visa Gold / Master Card Gold / Mir Zolotaya, Visa Classic Aeroflot, Visa Gold Aeroflot, Mastercard Platinum / Visa Platinum.

Below you can find out how much the annual maintenance fee for Classic Visa and other cards costs:

Advantages of the Golden Card: receiving discounts and privileges from partners of the bank, a high degree of protection of savings, using funds not only in Russia, but also abroad. Card replacement is free of charge in standard mode. You can attach a card to a salary project, if it was drawn up at Sberbank, by entering your full name employee and his current account in the statement on the transfer of funds.

Sberbank Business Online

Sberbank Business Online is a remote service system that allows you to generate and send payment papers using the Internet, receive data on the transfer of funds to accounts, and interact with staff. The question of how to use the system is quite simple. It is required to make one visit to the bank, where you need to fill out the appropriate application and activate the service. The system does not require the use of special software.

The application implements a convenient and intuitive interface. User instructions are available for download on the bank’s website. Here you can learn how to make a payment, how to transfer money and perform other financial transactions. A new version of the 2017 system is currently in effect. Login to Sberbank Business Online is carried out on the account of the client of the bank by entering a special password.

In the following figure, you can see what the login looks like.

It’s easy to figure out how to connect a salary project to Sberbank Business Online. The service has a special application form for activating the service remotely.

After connecting, it is easy to understand where in the Sberbank Business Online to find the section “Salary project”. The application will add a special field “Salary project”. You need to familiarize yourself with the rules of this service, after which it can be used to pay employees.

Remote Service Rates

Updated tariffs are valid from 01.10.2017 and apply to all users of the system.

Package of documents for the Sberbank salary project

Let's see what documents are needed for the design of a service. To implement non-cash payroll in the company, first of all, you need to fill out an application form for connecting to the service. In addition, it is necessary to provide copies of the statutory documents in case the company has not previously cooperated with the bank, and also enter into an agreement to provide this service.

On the official website of Sberbank there is everything necessary for the proper execution of a package of documents. For subsequent payroll, we recommend filling out the register indicating the details of the employees to whom the transfer will be made. A sample register of the salary project is also on the official website of the bank.

Sberbank salary project agreement

The basic conditions for the provision of services within the framework of salary projects are prescribed in a special offer agreement. They are formed for each specific organization individually, taking into account all the essential factors and characteristics of the client. The form of ownership does not affect the procedure for processing the document. A sample agreement can be downloaded on the official website of the bank.

Application for a salary project of Sberbank

An application for joining a card to the service can be filled out remotely by downloading its form on the bank’s website or by submitting an online application. In the document, the client prescribes the necessary details, including the legal address, bank account number (if available at Sberbank), the number of the contract for the provision of bank services within the framework of this project, the number of employees, the amount of monthly payroll, etc.

How to open a salary project in Sberbank

You can become a member of the system according to the developed scheme. IP, LLC and other entities can connect to the program. The main condition: a wage fund - at least 5 million rubles every month. Otherwise, connection is not possible. What you need to open a salary project: prepare and submit to the bank a package of documents, fill out an application by visiting the department of salary projects or on the bank's website.

If you are a client of the bank, you can always get in touch with a personal manager or contact him by phone hotline. The specialist will tell you how to switch to a salary project and answer all related questions as part of joining the service.

Online application

Opening a salary project involves visiting the official website of Sberbank: sberbank.ru. Here you need to find the section that matches the form of your company, click on "Salary project". This section provides the “Leave a request” tab. It is necessary to fill in all the proposed fields, after which the application for conclusion is sent for consideration.

The bank manager will contact you within 24 hours to conclude an agreement on crediting funds to individuals with or without reservation.

How to disable the Sberbank salary project

Sberbank's salary project has pros and cons, therefore, each client, having assessed the advantages and disadvantages of the service, has the right to refuse it unilaterally out of court. To do this, you need to terminate the contract previously concluded with the bank by notifying the other party in writing or by sending a notification via the remote service system 15 calendar days before the date of the alleged termination of cooperation. After paying for all banking services under this agreement, the Salary Project service will be disabled.

Sberbank's salary project is a modern convenient tool for paying salaries and crediting them to employees' accounts in the shortest possible time. A banking tool will help a client company reduce financial costs and labor costs in the process of paying funds to employees. At the same time, the company will be able to take advantage of preferential connection conditions and evaluate the benefits of banking technologies.

What is the advantage of “Sberbank Salary Project” for legal entities

- There is no need to pay for the cashing of the total amount of the enterprise’s salary;

- Sberbank has provided flexible rates for servicing an account, crediting funds to a customer’s card, as well as providing other services as part of the company's salary project. Cost is discussed individually;

- The procedure for concluding a contract is simplified. A construction contract designed for these purposes will help;

- Large customers can request to install a Sberbank ATM directly at the premises of the enterprise. Employees will be able to withdraw funds without leaving the territory of the enterprise.

How a salary project works

After signing the documents, the company together with the bank will arrange for the issuance of plastic cards to employees, as well as opening accounts for each employee. The principle of the project is as follows:

- Company accounting transfers the total amount of wages (monthly fund) to a single bank account opened in the name of the client company.

- A statement with the salary of each employee is provided to the Sberbank branch.

- Sberbank credits the transferred funds to employees' salary cards within the period specified in the agreement (according to the statement of the enterprise).

Important! The client company is recommended to register in the service "". There you can remotely submit statements, independently control the location of funds in the company's account. To interact with a banking institution, an accountant does not have to visit a branch of Sberbank.

How to submit information within the framework of the Salary project? Instructions for the accountant

You can send salary information remotely. To do this, fill out a form on the website of Sberbank, where all the information about the enterprise is indicated:

- Full title.

- The total period of activity.

- The number of employees.

- The size of the monthly wage fund.

- Address and telephone numbers of the enterprise.

- The contact person.

After receiving the documents, a certain bank employee will be assigned to the organization, who will be involved in paperwork and resolving issues that arise during the servicing of the client company.

Sberbank of Russia has developed a convenient tool for issuing salary cards for individuals. The registration process has become as simple and convenient as possible.

Instructions for registering:

- The file “Register for opening accounts” is downloaded to the computer. It is downloaded only from the official website of Sberbank of Russia.

- In the Register all fields are filled. Provides information about employees. The Export button is clicked.

- An electronic digital signature (EDS) is affixed to the document, the Registry is sent to Sberbank.

Conditions:

- Sberbank card issuance, annual maintenance cost - free of charge.

- Cash withdrawal from ATMs within the daily limit is free of charge.

- An overdraft line with a rate of 20% per annum opens on the card. In case of delay - 40% per annum.

- The daily withdrawal limit is set based on the type of card (Classic, Gold, Platinum). Classic card suggests a daily limit of 50 thousand rubles. Platinum - 1 million rubles.

- For funds withdrawn in excess of the established limit, a commission is charged.

The employee register in the payroll project contains the following fields:

- Personal data of the employee (full name).

- Name of each employee in Latin. This information is filled in automatically after indicating the information in Russian.

- Date of birth, city of residence, country.

- Registration address and actual place of residence.

- Passport data (series, number).

- The secret code by which the person will be identified.

- Phone numbers of the employee (at least two).

- The position that the employee occupies in the enterprise.

- Email address (personal).

- Type of bank product being executed - Salary project (Classic, Gold, Platinum).

- Information about the bank (, branch code).

After entering information about employees, the registry is exported. For this, there is a corresponding button on the Sberbank website. The document is endorsed by electronic digital signature of authorized persons of the enterprise and sent to Sberbank.

If changes are made to the instructions, Sberbank will develop new services, the client company will be automatically connected to them.

Indisputable advantages for employees of the institution:

- You can apply for additional bank cards for relatives and loved ones.

- Individual customers of the Sberbank salary project will be able, credit cards, to take advantage of mortgage lending and car loan offers on preferential terms.

- Employees take part in special offers with discounts that come from Sberbank partners.

- Each client will be able to participate in the bonus program "".

- During their stay abroad, bank customers will be able to pay using an international bank card around the world, where products of international payment systems are accepted.

- , just make one call to the hotline or to the nearest branch of Sberbank and the plastic will be blocked. Client funds will remain safe.

- You can access your own funds around the clock. Sberbank has the largest.

- By accumulating funds in the card account, the client will be able to receive additional income in the form of interest from Sberbank.

- The service "" allows you to receive information about the status of the account and any movements of funds by sending SMS messages to the client’s mobile phone.

- Internet banking () will allow you to make transfers at any time of the day, pay for services,. Internet banking is provided to customers free of charge.

What you need to know for a client company before signing an agreement!

- By signing a cooperation agreement, the client agrees to join the public conditions indicated on the company's website.

- If the conditions for the provision of the Salary Project service are amended, an additional agreement with the client is not signed.

- Any legislative changes and technological improvements are implemented for all customers who have signed the Design Contract. In this case, the additional agreement is not signed.

Sberbank of Russia is constantly improving products for private clients and partner companies. This also applies to the Salary project. Using the program from Sberbank will significantly simplify the process of paying salaries to employees, as well as reduce the costs of the enterprise, to ensure this process.