The economic life of a building is a formula. The life cycle of a property. A. Determination of depreciation of the property

The full cost of reproduction or replacement is the sum of the costs of reproduction (replacement) of the new building at prices valid at the date of the assessment. Therefore, it is necessary to take into account differences in the characteristics of the new property and the valued property.

Wearin the assessment means the loss of utility, and therefore the value of the object of evaluation for any reason. Depreciation (as a loss of value) can be expressed in absolute and relative units. If depreciation is expressed in absolute units (monetary units), then it is deducted from the total cost of reproduction.

V rep \u003d Vp rep - And or V substitution \u003d Vp substitution - And, (6.5)

where SV - the cost of reproduction of the object;

V replacement - the cost of replacing improvements to the facility;

Vp rep - the full cost of reproduction of the object;

VP replacement - the total cost of replacing the object;

And - depreciation of the valuation subject, expressed in monetary units.

If depreciation is expressed in relative units (percent), then the following formula applies:

Vp play \u003d V play ∙ (1 - I), (6.6)

where And is the depreciation of the object of evaluation, expressed in relative units.

There are two ways to determine wear:

lifetime method;

method of dividing into types of wear.

Depreciation, as a loss of value, can be expressed both in relative terms (relative to the total cost of reproduction or the full cost of replacement), and in absolute terms.

Lifetime Calculation of Wear

Depreciation is a function of the time of the object.

Determination of the wear and tear of buildings by the method of life is based on an examination of the structures of the property being evaluated and the assumption that the effective age of the property relates to the typical period of economic life as the accumulated depreciation to the cost of reproduction (replacement) of the building.

When calculating depreciation using the life method, the concepts are used:

Physical life of the building (T n) - the period of operation of the building, during which the state of the bearing structural elements of the building meets certain criteria (structural reliability, physical durability, etc.). The physical life of the object is laid during construction and depends on the capital group of the building. Physical life ends when an object collapses.

Chronological age (T fact) - the period of time from the commissioning of the facility to the date of the assessment.

The effective age (T eff) is calculated on the basis of the chronological age of the building, taking into account its technical condition and the economic factors existing at the date of the assessment that affect the value of the estimated property. Depending on the particular operation of the building, the effective age may differ from the chronological age up or down. In the case of normal (typical) operation of the building, the effective age is usually equal to the chronological.

Fig. 6.1. Periods of life of the building and characterizing them

estimated indicators

The indicators of physical depreciation, effective age and economic life are in a certain ratio, which can be expressed by the formula

And \u003d (T eff / T n) ∙ 100%, (6.7)

where And - wear,% .;

T eff - effective age determined by the expert on the basis of the technical condition of the elements or the building as a whole;

T n - a typical period of physical life.

And \u003d (T fact / T n) ∙ 100%, (6.8)

where T fact is the chronological age.

The use of formula (6.8) is relevant in calculating percentage adjustments for depreciation in the compared objects (comparative sales method), when it is not possible for the evaluator to inspect the selected analogues to determine the indicators used in formula (6.7).

Example.Determine the value of the estimated property. A land plot with a building built in 1980 is estimated. The standard life of the building is 150 years. The market value of the land is determined by comparing sales and is 4.5 million rubles. The total replacement cost of the structure is determined by the comparative unit method at the level of 11.4 million rubles. The evaluation date is January 30, 2010.

Decision.

The chronological age of the building is 30 years. To calculate the wear of the structure, we use the formula (6.8), since the effective age is not given.

And \u003d (T fact / T n) ∙ 100% \u003d 30/150 * 100% \u003d 30%.

To calculate the value of the evaluated object, we apply the formula 6.2.

V \u003d 4,500,000 + (11,400,000 - 0.3 * 11,400,000) \u003d 12,480,000 rubles.

Thus, the value of the estimated property, calculated as part of the cost approach, amounted to 12,480,000 rubles.

Service life is the calendar duration of the functioning of structural elements and the building as a whole, subject to the implementation of maintenance and repair measures.

For trouble-free use of the building, it is necessary to periodically replace (or restore) some structural elements and systems of engineering equipment (for example, floors, wooden floors, water supply systems, etc.). Compliance with the rules of technical operation to a decisive extent determines the implementation of the standard service life of structural elements and the building as a whole. For example, a steel roof is designed for 15 years of service, provided that every 3-5 years it is painted. Violation of this rule halves the life of the steel roof.

The deterioration of buildings and structures consists in the fact that individual structures, equipment and the building as a whole gradually lose their original qualities and strength. Determining the service life of structural elements is a very difficult task, since the result depends on a large number of factors contributing to wear. Therefore, the standard life of buildings depends on the material of the main structures and are averaged. The current standards (tables 1 and 2) provide for a different number of capital groups for production (4 classes), public (9 groups) and residential buildings (6 groups).

Table 1. Classification of residential buildings by capital

| Building group | Characteristics of the building and structural elements | Building service life, years |

| I | Buildings are stone, especially capital; foundations - stone and concrete; walls - stone (brick) and large-block; floors - reinforced concrete | 150 |

| II | Buildings are stone, ordinary; foundations - stone; walls - stone (brick), large-block and large-panel; floors - reinforced concrete or mixed, as well as stone arches on metal beams | 125 |

| III | Buildings are stone, lightweight; stone and concrete foundations; walls of lightweight masonry made of bricks, cinder blocks, shell rock; floors wooden, reinforced concrete or stone arches on metal beams | 100 |

| V | Prefabricated switchboard, frame, adobe, adobe, half-timbered buildings; foundations - on wooden chairs with rubble pillars; walls - frame, etc .; floors - wooden | 30 |

| VI | Buildings are frame-reed, from boards and other lightweight | 15 |

Table 2. Classification of public buildings by capital

| Building group | Type of buildings, materials of foundations, walls, floors | Building service life, years |

| I | Buildings are frame, with reinforced concrete or metal frames, with filling the frame with stone materials | 175 |

| II | Especially capital buildings, with stone walls made of piece stones or large blocks; columns and columns - reinforced concrete or brick; floors - reinforced concrete or stone arches along metal beams | 150 |

| III | Buildings with stone walls made of piece stones or large blocks; columns and columns - reinforced concrete or brick; floors - reinforced concrete or stone arches along metal beams | 125 |

| IV | Buildings with lightweight (stone) masonry walls; columns and columns - reinforced concrete; floors - wooden | 100 |

| V | Buildings with lightweight masonry walls; columns and pillars - brick or wooden; floors - wooden | 80 |

| VI | Buildings are wooden; walls - timbered or tiled | 50 |

| VII | Wooden frame buildings, panel board | 25 |

| VIII | Lightweight buildings | 15 |

| IX | Tents, pavilions, stalls and other lightweight trade buildings | 10 |

The first capital group of residential buildings includes stone buildings, especially capital ones (stone and concrete foundations; brick walls, large-block and large-panel; reinforced concrete floors), the standard service life of such buildings is 150 years. The introduction of structural elements from materials with a shorter service life into the building leads to a decrease in the standard service life of the building as a whole. So, prefabricated switchboard, frame, half-timbered buildings with wooden floors (the fifth capital group) have a service life of 30 years. The last (sixth) capital group includes lightweight buildings with a service life of 15 years. The standard service life of a building is determined by the predominance of certain structural elements with different service life:

- concrete foundations 100-125 years

- brick and large-panel walls 125 years

- reinforced concrete floors 100-125 years

- wooden floors 60 years

- ceramic tile floors 80 years

- parquet floors 50 years

- boardwalk floors 30-40 years

- wooden rafters and lathing 50 years

- ceramic tile roof 80 years

- asbestos-cement roofing 30 years

- windows and doors in exterior walls 40 years

- elements of engineering equipment systems (valves, gate valves, pipes, etc.) 10-20 years

The service life of the building depends on both the operating conditions and the strategic choice of the designers. It is possible to build a relatively cheap building, but during the entire period of operation, bear significant costs for maintaining it in an acceptable technical condition. And you can build a building in which during the entire service life practically no maintenance and repair will be required, but the cost of such an object will be incommensurably higher than the reasonable costs of technical operation.

Under the physical (material, technical) wear of a structural element or building is understood the loss of the original technical properties under the influence of various factors. Over time, there is a decrease in the strength of materials, the stability of structural elements, the heat and sound insulation, water and air permeability of building envelopes deteriorate, individual elements wear out and rust.

Table 3. Assessment of the technical condition of building structures depending on their physical wear

The accuracy of determining the physical deterioration of a building depends on the approach used and ranges from 1% (based on engineering surveys and laboratory studies) to 5% (according to the results of the survey using simple devices). The physical wear of a particular structural element is determined using special tables, including signs of wear and the corresponding ranges of values \u200b\u200band wear. Physical deterioration of the entire building is defined as the arithmetic average of the wear of individual structural elements, weighted by their specific gravities in the total replacement cost of the object.

Depreciation should be understood as a building mismatch with its functional purpose, arising as a result of changing social needs. With regard to residential buildings, we are talking about the mismatch of architectural and planning decisions with modern requirements, about overconsolidation of buildings, about an insufficient level of landscaping and greening of the territory, about outdated engineering equipment.

There are two forms of obsolescence:

1st form - reducing the cost of construction work as their cost decreases (due to changes in the scale of construction production, growth in labor productivity, etc.);

2nd form - depreciation of a building as a result of the discrepancy of its parameters to the changing requirements of society.

The following negative qualities of the building are meant:

a) layout defects (the presence of walk-through rooms, the small area of \u200b\u200bkitchens and auxiliary rooms, the inconvenient location of the bathrooms, the large number of small rooms and their inconvenient location, etc.);

b) the mismatch of the structural elements of the building with modern requirements (unsatisfactory thermal performance, sound insulation, waterproofing, etc.);

c) the absence or unsatisfactory quality of the elements of the engineering equipment of the building (electricity, water and gas supply, elevators, air conditioners, etc.).

There are two main ways to quantify the moral depreciation of the second form: technical and economic and sociological. The technical and economic assessment method is a system of indicators compiled on the basis of a generalization of the unit cost of structural elements and engineering equipment of various buildings, expressed as a percentage of the replacement cost of the building. The value of such indicators needs regular adjustments. The method of sociological assessment of the second form of obsolescence is based on an analysis of the processes of exchange and sale, purchase and housing. For example, in the process of exchanging more comfortable housing, the owner receives compensation in the form of additional living space. Even in a clearer form, obsolescence is manifested in real estate assessments.

Determination of depreciation is necessary in order to take into account differences in the characteristics of a new property and a real estate property being evaluated.

Wearin the assessment means the loss of utility, and therefore the value of the object of evaluation for any reason.

There are two ways to calculate wear:

Life time method;

The method of dividing into types of wear.

6.3.1. Lifetime Calculation of Wear

The cumulative accumulated depreciation is a function of the time of the object.

When calculating depreciation using the effective age method, the following concepts are used: the physical life of the building, effective age, and the remaining economic life. Consider the periods of the building’s life and the estimated indicators characterizing them (see Fig. 6.2.)

The physical life of the building (VF) is the period of operation of the building during which the condition of the bearing structural elements of the building meets certain criteria (structural reliability, physical durability, etc.). The physical life of the facility is laid during construction and depends on the capital group of the building. Physical life ends when an object collapses.

Chronological age (CV) - the period of time that has passed from the commissioning of the facility to the date of the assessment.

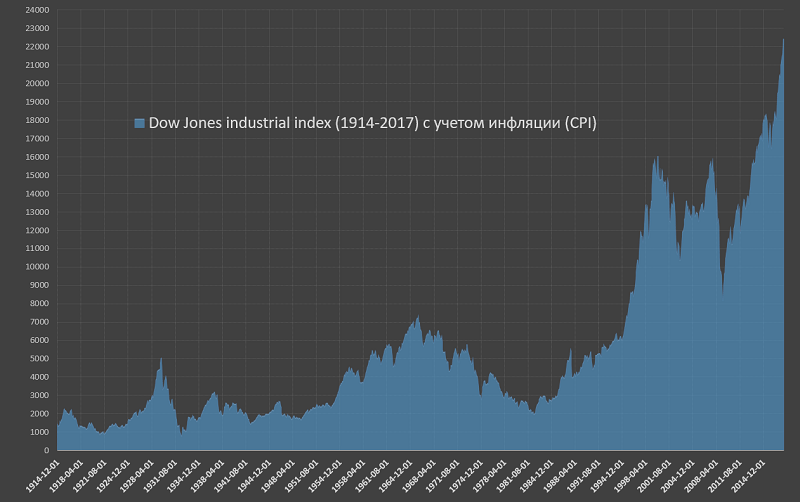

Economic life (EJ) is determined by the operating time during which the object generates income. During this period, ongoing improvements contribute to the value of the property.

The effective age (EV) is calculated on the basis of the chronological age of the building, taking into account its technical condition and the economic factors prevailing at the date of the assessment that affect the value of the estimated property. Depending on the specifics of building operation, the effective age may differ from the chronological age to a greater or lesser extent. In the case of normal (typical) operation of the building, the effective age is usually equal to the chronological.

The remaining economic life (OSEG) of a building is the time period from the date of the assessment to the end of its economic life (Fig. 6.2).

Determination of building wear by the life method is based on an examination of the structures of the property being evaluated and the assumption that the effective age of the property relates to the typical period of economic life as the accumulated wear and tear to the cost of reproduction (replacement) of the building.

The indicators of physical depreciation, effective age and economic life are in a certain ratio, which can be expressed by the formula

And \u003d (EV: VF) 100% \u003d [EV: (EV + OSF)] 100%, (6.4)

where And - wear,%;

EV - effective age determined by the expert on the basis of the technical condition of the elements or the building as a whole;

VF - a typical period of physical life;

OSFZH - the remaining period of physical life.

And \u003d (XB: VF) 100%, (6.5)

where And - wear,%;

VF is a typical period of physical life.

Application of the formula 6.5. It is also relevant when calculating percentage corrections for depreciation in the compared objects (comparative sales method), when it is not possible for the appraiser to inspect the selected analogues to determine the indicators used in formula 6.4.

The percentage of deterioration of the elements or the whole building calculated in this way can be translated into value expression (impairment):

O \u003d CB (I: 100), (6.6)

where And - wear,%;

SV - the cost of reproduction (replacement cost).

Example.

A large industrial property complex is subject to assessment. The assessment date is April 1, 2005.

Consider the calculation of depreciation for several warehouses from this property complex, built in accordance with the same project, used to store building materials. In accordance with the documentation for the evaluated warehouses, the physical life is 75 years (VF \u003d 75 years).

The effective age is determined by the appraiser in accordance with the technical condition of the objects of assessment, the data for calculating depreciation and calculating depreciation are shown in the table.

This method of calculating depreciation is applicable for mass valuation, when valuing real estate as part of the assets of an enterprise when evaluating an enterprise (business).

The disadvantage of using the lifetime method for assessing accumulated depreciation is the presence of only one factor that determines the amount of depreciation (the ratio of effective age to physical life). To eliminate this drawback, various types of cost reduction factors are considered and the decomposition method into types of depreciation is applied.

Forex classes - it's great for you to prepare for successful work in the Forex market!

6.3.2. Calculation of wear by dividing by type of wear

The most common is breakdown method.

Dependence is subdivided into physical, functional, and external (economic), depending on factors that reduce the value of real estate. Physical and functional wear can be removable and irreparable. Economic depreciation is usually unrecoverable.

Depreciation is considered removable if its elimination is physically possible and economically feasible.

The sum of all possible types of depreciation is the accumulated depreciation of the property.

Physical deteriorationreflects changes in the physical properties of the property over time (for example, defects in structural elements). Physical deterioration can occur under the influence of operational factors or under the influence of natural and natural factors.

There are four main methods for calculating physical depreciation:

Expert;

Normative (or accounting);

Cost;

Method for calculating the life of a building.

The most accurate and most time consuming way is expert.It involves the creation of a defective statement and the determination of the percentage of wear of all structural elements of a building or structure.

Example.

Table 6.2 defines the wear of individual structural elements of the building by the expert method.

Normative methodthe calculation of physical depreciation is based on the use of various regulatory instructions at the intersectoral or departmental level. In valuation practice it is used extremely rarely.

Cost methodconsists in determining the costs of restoring the elements of buildings and structures. By inspection, the percentage of wear of each building element is determined, which is then translated in value terms. The cost method is used to determine removable physical depreciation.

A conditional example of calculating physical depreciation using the cost method is given in table. 6.4.

This method allows you to immediately calculate the wear of the elements and the building as a whole in value terms. Since the calculation of impairment is based on the reasonable actual costs of bringing the worn-out elements to a practically new state, the result of this approach can be considered quite accurate. The disadvantages of the method are the obligatory detailing and the accuracy of calculating the costs of the repair of worn-out building elements.

Lifetime Methodused to calculate physical wear and tear, this method is discussed in detail in section 6.3.1. of this manual.

TO functional wear include the decrease in property value associated with the mismatch of design and planning decisions, building standards, design quality, manufacturing materials with modern requirements for these positions.

The amount of disposable wear is defined as the difference between the potential value of the building at the time of its assessment with updated elements and its value at the date of the assessment without updated elements (the difference between the cost of reproduction of the building and its replacement cost).

Reasons for functional wear:

Disadvantages requiring the addition of elements;

Deficiencies requiring replacement or modernization of elements;

Super Improvements.

The disadvantages that require the addition of elements are elements of the building and equipment that are not present in the existing environment and without which it cannot meet modern operational standards. Depreciation due to these items is measured by the cost of adding these elements, including their installation.

Functional wear can be removable and unrecoverable. Disposable functional wear is most often calculated using the cost method.

The disadvantages that require replacement or modernization of elements are positions that still perform their functions, but no longer meet modern standards (water and gas meters and fire fighting equipment). Depreciation on these items is measured as the cost of existing elements, taking into account their physical deterioration minus the cost of returning materials, plus the cost of dismantling existing ones and plus the cost of installing new elements. The cost of returning materials is calculated as the cost of dismantled materials and equipment when used at other facilities (the residual value to be added).

Superimprovements are the positions and elements of the structure, the presence of which is currently inadequate to the modern requirements of market standards. Disposable functional wear in this case is measured as the cost of reproduction of the positions of super-improvement minus physical wear, plus the cost of dismantling and minus the liquidation cost of the dismantled elements.

An example of superimprovements is the situation when the owner of the house, adapting it for himself, made some changes for his own convenience (investment value), not adequate from the point of view of a typical user. These include redevelopment of the useful area of \u200b\u200bthe premises for specific use, due to the owner’s hobbies or occupation. Disposable functional wear and tear in such a situation is determined by the current cost of bringing the changed elements to their original state.

In addition, the concept of superimprovements is closely related to a segment of the real estate market, where the same improvements can be recognized as appropriate for a particular segment, or redundant from the point of view of a typical user.

Table 6.5 provides an example of calculating the functional and acceptable wear and tear.

Unrecoverable functional wear is caused by outdated space-planning and / or structural characteristics of the buildings being evaluated relative to modern construction standards. A sign of irreparable functional wear is the economic inexpediency of the cost of eliminating these shortcomings. In addition, it is necessary to take into account the prevailing market conditions at the date of the assessment for adequate architectural compliance of the building with its purpose.

Depending on the specific situation, the cost of unrecoverable functional wear and tear can be determined in two ways:

Capitalization of losses in rent;

The capitalization of excess operating costs.

To determine the necessary calculated indicators (rental rates, capitalization rates, etc.), adjusted data for comparable analogues are used.

In this case, the selected analogues should not have signs of an assessment of the fatal functional wear identified at the object. In addition, the total income brought by the property complex as a whole (building and land) and expressed in rent, must be accordingly divided into two components. To allocate part of the income attributable to the building, you can use the investment balance method for the building or the analysis method of the ratio of the value of the land plot and the total sale price of the property complex. In the example below, this procedure is considered performed in the process of preliminary calculations (table. 6.6).

Impairment caused by unrecoverable functional depreciation due to an outdated space-planning solution (specific area, cubic capacity) is determined by the method of capitalization of losses in rents.

Calculation of irreparable functional wear by capitalizing the excess operating costs necessary to maintain a building in good condition can be done in a similar way. This approach is preferable for assessing the fatal functional deterioration of buildings that differ in non-standard architectural solutions and in which, nevertheless, the rent is comparable to the rent for modern facilities and taxes, in contrast to the value of operating costs.

An example of determining the value of functional depreciation by the method of capitalization of excess operating costs is presented in table 6.7.

External (economic) wear- depreciation of the property due to the negative environmental impact of the property: location, market situation, easements imposed on the specific use of real estate, changes in the surrounding infrastructure and legislative decisions in the field of taxation, etc. Although external wear and tear cannot be eliminated in most cases, it can sometimes resolve itself due to a positive change in the surrounding market environment.

The following methods can be used to assess external wear:

The method of capitalization of losses in rent;

The method of capitalization of excess operating costs;

Pair sales method;

Lifetime Method.

External depreciation is estimated using the method of capitalization of losses in rents and the method of capitalization of excess operating losses by the same method as the calculation using the functional wear methods discussed above. In the case of evaluating the external wear and tear, it is necessary to identify losses in rent due to signs of external wear or excessive operating costs caused by signs of external wear and tear.

The pair sales method is based on the analysis of available price information for recently sold similar objects (pair sales). At the same time, it is assumed that the objects of pair sales differ from each other only in the identified depreciation and correlation with the object of assessment. A similar approach to the calculation of external wear is shown in table. 6.8.

Example.It is necessary to evaluate the external depreciation caused by the decrease in the investment attractiveness of the office building due to the construction of a clothing or food market in its immediate vicinity. Let the pair sale of objects A and B of a similar purpose be revealed on the real estate market. The cost of land in this area is 30% of the total value of a typical property.

In some cases, the method of comparative analysis of sales allows you to determine the total accumulated depreciation, as a rule, of a typical valuation object. The average difference between the adjusted replacement cost and the market price of each of the analogues (excluding the value of the land) will be the cost expression of the accumulated depreciation. In domestic practice, the considered methods of calculating the external depreciation based on the elements of a comparative analysis of sales are inapplicable in many cases due to the high complexity and lack of the necessary and reliable information base.

Reasons for demolition:

The need for redevelopment;

Expansion of transport highways.

The technical condition of demolished buildings should be taken into account, which in many cases would allow them to operate for a rather long period of time.

Example.The building, previously withdrawn from the housing stock and now adapted for administrative needs, is subject to assessment. The building is in municipal ownership. Physical deterioration of the evaluated building, according to the BTI, at the time of the assessment is 40%. The technical condition of the building, location, and developed infrastructure indicate a rather high commercial attractiveness of the object from potential investors. However, according to the redevelopment plan for the above reasons, the building is subject to demolition after five years from the date of the assessment.

When examining the object, the expert identified the following indicators:

1) the effective age of the building being evaluated is 30 years;

2) the remaining economic life is 60 years.

Percentage of accumulated depreciation excluding action. external factor is calculated by the formula:

I \u003d EV: (EV + OSEG) 100 \u003d (30:90) 100 \u003d 33%.

The percentage of wear, taking into account the action of an external factor:

And \u003d (30/35) 100 \u003d 86%.

The accumulated depreciation calculated in this case in the amount of 86% is due to the action of a predominantly external factor. The proportion of possible accounting for the other types of wear in this result is extremely small, which allows us to consider the result as external wear. A sharp reduction in the remaining economic life of the building leads to a decrease in investment attractiveness and, as a consequence, a landslide drop in the probable selling price. In such cases, the purpose of the assessment is to calculate not the full ownership of the building being evaluated, but short-term rental rights for the remaining economic (physical) life, provided that the potential investor considers any benefit from this acquisition.

After calculating the cost of reproduction (replacement cost), as well as the accumulated depreciation, the value of the land plot and the valued property as a whole are determined. (t. 6.9).

Approaches and methods to the assessment of land are discussed in chapter 7 of this training manual.

To increase the accuracy of the calculation procedures, both for determining the replacement cost and for calculating depreciation, a reasonable compilation of several methods for calculating these indicators is necessary.

Methods for calculating the value of land are presented in chapter 7.

Depreciation suggests that effective age expressed as a percentage reflects a typical economic life, just as the percentage of accumulated depreciation reflects total costs reproduction, i.e.

The economic life (SEZ) of a school without major repairs is 60 years.

The reserve includes such elements of the building and equipment whose service life is less than the predicted economic life of the building. These elements include

Economic life 277

A) the lease term is shorter than the economic life of the assets

EZH - the economic life of the object

This method is quite simple and logical, but its significant drawback is the subjectivity of the definition. effective age and economic life.

Economic life

Remaining economic life

The term of an economic life is a time period during which an object (building) can be used making a profit. During this period, improvements contribute to the value of the property. The economic life of an object ends when the improvements made cease to contribute to its value due to the general obsolescence of the object.

Lifetime Method. Percent physical wear when applying this method, it is calculated as the ratio effective age to the term of economic life.

Using NPV criteria is considered the most correct meter investment performance . However, the application absolute indicators at project analysis with different initial conditions (initial investments, terms of economic life, etc.) can lead to difficulties in making managerial decisions.

This inequality reflects the fact that economic life fixed assets , especially their active part, should be shorter than their normative useful life , which is usually characteristic of successfully developing organizations. Thus, fixed assets must be written off and replaced with new ones before the end of their useful life, since new fixed assets characterized by higher productivity, environmental friendliness, more low cost for repairs, let out more competitive products . Negative tax consequences (VAT and income tax) at write-off of fixed assets Until the end of the regulatory period, its useful life does not arise either. For organizations in difficulty, on the contrary, an excess of economic life is characteristic fixed assets over their standard period of use, which leads to the operation of fully depreciated fixed assets . This conclusion does not apply to real estate (buildings and structures), according to which the economic life on average corresponds to the accounting useful life.

The criteria for recognizing a financial lease are, in particular, rental period (if it makes up most of the economic life ( useful life) asset, despite

The economic life of an asset is the period of time during which improvements contribute to the value of the site.

TS - a typical period of economic life, years. In a modified form, the formula is as follows

Example 3 Assessment Object has an economic life of 60 years (a more perfect design and design features than in examples 1,2), a chronological age of 20 years effective age - 12 years (modernization completed and no negative