Presentation on the theme of the classical economic school. Classical school of political economy. The main works of T. Malthus

political economy”, originated in the second half of the 17th century. and lasted until the end of the 19th century. Its existence can be divided into three stages.

The first stage lasted from the end of the 17th century to the end of the 18th century. It can be called the period of origin, and its representatives - the forerunners of classical political economy. Their work was not widely known, because the mainstream economic concept continued to be mercantilism. Only in the second half of the XVIII century. The French school of the physiocrats became quite famous, but it had unconditional dominance only within its own country. The second stage, from the end of the 18th to the middle of the 19th century, already represents the complete domination of the classical political economy. The starting point here can be considered the work of the English economist A. Smith "A Study on the Nature and Causes of the Wealth of Peoples" (1776). Since the beginning of the XIX century. Economic science in the face of classical political economy was recognized as an independent science and began to be taught at universities as a separate course. At the same time, during the second period, the creative development of classical political economy continued - new theoretical positions were put forward, within the framework of classical political economy, separate trends appeared that differed both in class sympathies and in theoretical features and discussed among themselves. The last major theorists of the second stage were J.S. Mill, whose final work "Fundamentals of Political Economy" was published in 1848, and K. Marx, whose draft version of "Capital" was written in the late 1850s. The third, final stage of classical political economy, which lasted from the middle to the end of the 19th century, can, like the first, be called transitional. On the one hand, the dominance of classical political economy remained, the corresponding course was taught at universities, but almost no new theoretical ideas were put forward. Beyond the 19th century only Marxism stepped over, which, relying on the methodological principles of classical political economy, began to analyze new phenomena that arose in the capitalist economy in the late 19th and early 20th centuries.

- Size: 1.8 MB

- Number of slides: 55

Description of the presentation Formation of the classical school of political economy The mechanism of the market, or by slides

The formation of the classical school of political economy The mechanism of the market, or the idea of the "invisible hand" Property (John Locke) The pessimism of Thomas Hobbes The fable of the bees by Bernard Mandeville The principle of "Laissez faire, laissez passer" (Adam Smith) not trade The concept of rent (William Petty) Dr. Quesnay and his table - the prototype of the input-output method of the Physiocrats (Francois Quesnay, Robert Jacques Turgot)

● With the advent of classical political economy, economics was recognized as a science. ● This means that economic thought has ceased to be content with knowledge at the level of common sense, tried to see what is inaccessible to the ordinary eye. ● At the same time, the formation of classical political economy was part of another, larger process. In the XVIII century. it was not only about a new science, but also about a new ideology, a reassessment of the very place of economic values in the life of society. Merchants, farmers, industrialists - social strata nurtured by a market economy - have already entered the forefront of history, but in the public mind they still remained the "third estate", people of dubious origin and low-respectable professions. (The third estate (fr. Tiers état), the taxable population of France of the 15th-18th centuries (merchants, artisans, peasants, later also the bourgeoisie, workers). It was called the third, in contrast to the first two estates - the clergy and the nobility, who were not subject to taxes (in The enormity of the task attracted the best minds of the time: philosophers John Locke and David Hume, Adam Smith, financiers Richard Cantillon and David Ricardo, physicians William Petty and François Quesnay, politicians Benjamin Franklin and Jacques Turgot - no other era knows such a concentration of intellect on the problems of the economy.

● A special place in the history of economic thought rightfully belongs to Adam Smith (1723-1790). It was his famous book An Inquiry into the Nature and Causes of the Wealth of Nations, published in 1776, that brought wide public recognition to the new science. Scottish Professor of Moral Philosophy Becomes First Classicalist economics. In the figure of A. Smith, two lines in the development of economic thought symbolically intersected: as a moral philosopher, he absorbed the centuries-old Aristotelian tradition of ethical understanding of economic phenomena; as an economist, he successfully summarized the ideas of his predecessors and contemporaries and became the founder of a new tradition of economic thought, later called the classical school of political economy. Adam Smith; baptized and possibly born on June 5 (June 16), 1723, Kirkcaldy - July 17, 1790, Edinburgh) - Scottish economist, ethical philosopher; one of the founders of modern economic theory.

"Classical political economy" is a generally accepted term, but this does not exclude inconsistencies in its interpretation. These discrepancies are rooted in the heterogeneity of the classical political economy itself, which absorbed different ideological traditions and was focused on solving both ideological and scientific problems. The classical school was formed as a unity of two principles: ● the theory of exchange (market) ● and the theory of production (wealth). Both theories had common origins: they grew out of the ideas of pamphleteers of the 16th-17th centuries. and established themselves in polemics with these ideas, had a similar circle of authors and adherents. Nevertheless, each of the two theories had its own subject area, its own approach to its study, its own lines of demarcation with mercantilism. The exchange theory developed the ideas of market self-regulation as opposed to the practice of state protectionism, thus clearing the way for the ideology of liberalism; the theory of production rejected mercantilism for its reassessment of the role of trade, seeking to reveal its true nature behind the external manifestations of wealth (primarily in trade and money circulation).

● Initially - in the XVIII century. - both theories developed in a common connection, then - even within the framework of the classical school - there were differences (Say's line and Ricardo's line), finally, during the "marginalist revolution" of the 70s of the XIX century. they split up. ● Differences in the periodization of the classical school reflected differences in the assessment of the relative importance of these theories: ● for Marx, the theory of production was the main one, and the key characters were Petty, Quesnay and Ricardo; ● For the Western, especially the Anglo-Saxon tradition, the theory of exchange was more important and, accordingly, the figure of A. Smith, in comparison with which even Quesnay remained in the background. According to K. Marx, the beginning of the classical period is associated with the names of U. Petty and P. Boisguillebert (end of the 17th century), and its completion with the names of D. Ricardo and S. de Sismondi (first third of the 19th century). In Western literature, the standard approach places the "classical school" in the second half of the 18th century. and the first half of the 19th century. : from A. Smith to J. St. Mill (sometimes: from the physiocrats to K. Marx).

The Mechanism of the Market, or the Idea of the “Invisible Hand” The demand for an ideology capable of morally justifying trade and economic activity, removing the stamp of second-rateness from it, affected not only the economy. ● It was a question about a person's place in society, about his rights and freedoms, including rights in the field of economic activity, i.e., first of all, about the right of ownership. The major English philosopher John Locke (1632-1704) played a leading role in developing this problem. Locke put forward the labor theory of property. Each person, he reasoned, is already endowed with property insofar as he owns and disposes of his own body. This is his natural right, given from birth. But, by owning his body, a person thereby owns the work of his body, the work of his hands. ● The application of labor to the products of nature is nothing but their appropriation - this is how property arises. It appears naturally, it is based on a person's own labor. According to Locke, property is a natural human right. Property precedes power, is primary in relation to it, therefore the government, Locke concluded, does not have the right to arbitrarily dispose of what belongs to citizens.

Born August 29, 1632 in the small town of Wrington in the west of England, near Bristol, in the family of a provincial lawyer. In 1646 - on the recommendation of his father's commander (who during the civil war was a captain in Cromwell's parliamentary army) enrolled in Westminster School. In 1652, one of the best students in the school, Locke entered Oxford University. In 1656 he received a bachelor's degree, and in 1658 - a master's degree from this university. 1667 - Locke accepts the offer of Lord Ashley (later Earl of Shaftesbury) to take the place of his son's family doctor and educator and then actively joins political activities. On October 28, 1704, he died of asthma at the country house of his friend Lady Dameris Masham. John Locke (Eng. John Locke; August 29, 1632, Wrington, Somerset, England - October 28, 1704, Essex, England) - British educator and philosopher, representative of empiricism and liberalism. He is widely recognized as one of the most influential Enlightenment thinkers and liberal theorists. Locke's letters influenced Voltaire and Rousseau, many Scottish Enlightenment thinkers and American revolutionaries. His influence is also reflected in the American Declaration of Independence.

● Locke is considered the father of Western liberalism, the theorist of constitutional monarchy and the separation of powers into legislative, executive (including the judiciary) and federal (foreign relations), which are in a state of dynamic equilibrium in a properly organized state. ● For this, according to Locke, a political society is created through a social contract, forming a government responsible to the people. Locke was a determined opponent of theories of the divine origin of royalty. Elements of his political philosophy formed the basis of the ideology and practice of the American and French revolutions. ● In colonial America, Thomas Paine, Thomas Jefferson, and John Adams persuaded their countrymen to rise up in the name of life, personal liberty, and the pursuit of happiness - almost a Locke quote, but with one important correction: Jefferson replaced Locke's word "property" with "the pursuit of happiness" . Thus, the main goal of the revolution became a republic based on personal freedom and government with the consent of the governed. James Madison believed that a system of checks and balances was needed to ensure effective self-government and protect the rights of economic minorities. It was reflected in the US Constitution (1787): a balance between federal and regional authorities; separation of powers into executive, legislative and judicial branches; bicameral parliament. Civilian control was introduced over the army and measures were taken to return officers to civilian life after serving. Thus, the concentration of power in the hands of one person became almost impossible.

The social contract Thomas Hobbes (1651), John Locke (1689) and Jean-Jacques Rousseau (1762) are the most famous philosophers of social contract theory. However, they drew very different conclusions from this starting point. Hobbes defended authoritarian monarchy, Locke defended liberal monarchy, while Rousseau defended liberal republicanism. Their work has provided theoretical basis constitutional monarchy, liberal democracy and republicanism. The social contract was used in the Declaration of Independence as a symbol of the observance of Democracy, and was later revived by thinkers such as John Rawls. See Social Welfare Functions (ES, Lecture 43.2) See Pro-Poor Talk, or John Rawls, the Great Fighter for Theoretical Justice (ES, Lecture 43.4) See Social Contract in Action (John Romer, Yale University) , climate problems)

Social contract ● Theories of procedural justice. All the well-being criteria we considered in Lecture 43 took into account exclusively the states of the economy that arise as a result of the process. In contrast, theories of procedural justice emphasize the role of the process of redistribution itself. ● These theories go back to the contract theories of the state in the works of Hobbes and Locke, according to which a person has a natural right to the fruits of his labor, and the state enters into a kind of contract with a citizen. ● In its modern form, this approach is most clearly represented by R. Nozick. According to Nozick, in a society with equal opportunities, that is, in the absence of any restrictions on engaging in a certain profession or receiving education, the role of the state should be minimal - to maintain law and order, to ensure the safety of citizens. With this approach, the state acts as a "night watchman", and its functions are extremely limited. If the state takes actions that go beyond the functions listed above, it inevitably forces citizens to pay excessive taxes and thus violates their individual freedoms. ● Of course, Nozick's approach is one of the extremes. The key role in it is played by the assumption of the validity of the initial distribution (starting point). The fairness of the initial distribution does not mean equality.

The Social Contract ● Nozick himself gives the following example of an unequal distribution of opportunity. A certain person has a talent for playing basketball, while possessing the required physical data. He becomes a successful player and receives a rent for his talent. Is this fair and should the state intervene through progressive income tax withdraw "excessive" income? ● Of course, the current state of affairs is fair - spectators are voluntarily willing to pay more to attend games with the participation of this basketball player, and, assuming the fairness of the initial distribution of talents, the state should not interfere in the voluntary exchange. ● Now let's imagine that we are talking not about the fair distribution of talents, but about the unequal distribution of material and financial benefits. The starting position of the heir to Bill Gates is different from the position of a child in a poor family. It is in situations like this that the theory of procedural justice faces the most serious rejection in society. ● But, by allowing for the possibility of reducing inequality in the initial distribution of goods through forced redistribution, we will move away from the principle of procedural justice. If individuals can voluntarily pay more for an all-star basketball game, why can't they use their money in other ways and turn it into savings for their children and grandchildren?

● It has been shown that, given a possible utility curve, finding the optimal point depends on the specific form of the social welfare function, which reflects a certain value judgment about what distribution of income can be considered fair. Let's combine all the solutions we obtained on one graph (Fig. 10). If we list the discussed criteria in terms of their political coloring, then the theory of procedural justice (R. Nozick) will be placed on the right flank, recognizing any result as fair if the process of achieving this result was fair. It can be thought of as some arbitrarily chosen point K on the utility curve. This K point would reflect Nozick's fair distribution, any government intervention would mean a departure from fairness. The only possible case for improvement is the consent of a rich citizen to a voluntary transfer in favor of the poor (section KL). But the point K we have chosen is Pareto inefficient. Moving to any point of the KL segment would be a Pareto improvement. And if we abandon the Nozick criterion, then moving from point K to another point of this section can be carried out on the basis of state intervention in the process of redistribution. This change, according to the Pareto criterion, will be fair.

Next on our list is the optimum corresponding to the maximum welfare function, point M (a distribution that maximizes the utility of the wealthiest members of society is considered fair). Closer to the left is the utilitarian principle (point B), which postulates that a decision that maximizes the total welfare of all members of society is considered fair. Next comes the Rawls criterion (the welfare of the least well-to-do members of society should be maximized, point R), and the “extreme left” will be the Platonic egalitarian principle (point E), when only an equal distribution of utility among all members of society is recognized as fair. See Public Welfare Functions (ESh, lecture 43. 2)

The justification by John Locke of the "naturalness" of the right to private property was an important, necessary, but not sufficient prerequisite for the establishment of liberal values. The question remained how people would be able to dispose of their natural rights. In the 17th century pessimism prevailed on this score. ● An older contemporary of John Locke, the famous philosopher Thomas Hobbes, proceeded from the premise that people in their behavior follow the principle of “man the wolf”. From this, he concluded that a society in which people are left to their own devices will inevitably turn into an arena of "war of all against all." That is why, Hobbes argued in his book Leviathan (1651), society cannot do without a powerful state - Leviathan (on behalf of a mythological monster), capable of keeping destructive human passions in check. Another well-known thinker of that time, Lord Shaftesbury, pinned his hopes on the moral perfection of man. He contrasted the harmony of nature and disharmony public life believing that only virtuous people can change the situation and overcome this disharmony.

Thomas Hobbes (English Thomas Hobbes) (April 5, 1588, Malmesbury - December 4, 1679, Hardwick) - English philosopher - materialist, author of the social contract theory. Born in the county of Gloucestershire, in a family that was not distinguished by deep education, a quick-tempered parish priest, who lost his job due to a quarrel with a neighboring vicar at the door of the church. He was raised by a wealthy uncle. He knew ancient literature and classical languages well. At the age of fifteen he entered the University of Oxford, graduating in 1608. Hobbes is one of the founders of the "contractual" theory of the origin of the state. Hobbes considers the state as the result of an agreement between people that put an end to the natural pre-state state of "war of all against all". He adhered to the principle of the original equality of people. Individual citizens have voluntarily restricted their rights and freedom in favor of the state, whose task is to ensure peace and security. Hobbes adheres to the principle of legal positivism and extols the role of the state, which he recognizes as absolute sovereign. On the question of the forms of the state, Hobbes' sympathies are on the side of the monarchy. Defending the need for the subordination of the church to the state, he considered it necessary to preserve religion as an instrument of state power to curb the people. [ Sovereign (from French souverain - "highest", "supreme")]

Thomas Hobbes. LEVIATHAN CHAPTER XVII Why some creatures, despite the fact that they have no mind and speech, live in society without any coercive power. Some living beings, such as bees and ants, live, it is true, in harmony with each other (which is why Aristotle ranked them among social creatures), but meanwhile each of them is guided only by his own private judgments and aspirations, and they do not have the ability to speak. by means of which one of them could communicate to the other what he considers necessary for the common good. Therefore, someone will probably want to know why the human race cannot live in exactly the same way. To this I answer: First, people constantly compete with each other, seeking honor and rank, which these creatures do not do, and therefore, on this basis, envy and hatred arise among people, and as a result, war, which among those do not happens. Secondly, among these beings, the common good coincides with the good of each individual, and, being naturally inclined to pursue their own private advantage, they thereby create a common good. But a man whose self-gratification consists in comparing himself with other people can only taste that which elevates him above the rest.

Thomas Hobbes. LEVIATHAN CHAPTER XVII Thirdly, these beings, not having (like people) reason, do not see and do not think that they see any Errors in the management of their common affairs, while among people there are many who consider themselves wiser and more able to manage public affairs than others, and therefore strive to reform and renew the state system; some in one way, others in another; and by this they introduce disorder and civil war into the state. Fourthly, although these beings have some ability to use their voice to let a friend know about their desires and passions, they are deprived of that art of speech, with the help of which some people are able to present to others good as evil, and evil as good, and exaggerate or underestimate at will, the visible dimensions of good and evil, bringing anxiety into the soul of people and confusing their world. Fifthly, unreasonable beings do not know how to distinguish between illegality and material damage and therefore, as long as they live well, they live in peace with their associates, while a person becomes most restless just when he is at his best, because then he likes to show his wisdom and control the actions of those who govern the state.

Thomas Hobbes. LEVIATHAN CHAPTER XVII Finally, the consent of these beings is conditioned by nature, while the consent of people is an agreement, which is something artificial. That is why it is not surprising that, in order to make this consent permanent and lasting, something else (besides agreement) is required, namely, a general power to keep people in fear and direct their actions to the common good. Leviath naa (Hebrew ןתת ית וו לל (Chit. livyat naa) “twisted, twisted”) is a monstrous sea serpent, mentioned in the Old Testament, sometimes identified with Satan, in modern Hebrew - a whale.

Thomas Hobbes. LEVIATHAN CHAPTER XVII ON THE CAUSES, ORIGIN AND DEFINITION OF THE STATE This is a real unity embodied in one person by means of an agreement entered into by each person with each other in such a way as if each person said to the other: I empower this person or this collection of persons and convey to him my the right to govern yourself, provided that you in the same way transfer your right to him and authorize all his actions. If this is done, then the multitude of people, thus united in one person, is called the state, in Latin - civitas. Such is the birth of that great Leviathan, or rather (to speak more reverently) of that mortal God, to whom, under the dominion of the immortal God, we owe our peace and our protection. For by virtue of the powers vested in him by every single person in the state, the said person or collection of persons enjoys such an enormous strength and power concentrated in him that the fear inspired by this strength and power makes this person or this collection of persons capable of directing the will of all people to the inner world and To mutual assistance against external enemies.

The Fable of the Bees An alternative solution came from an unexpected quarter. ● Its author turned out to be Bernard Mandeville (1670-1733), a doctor by profession and a writer who first published, in 1705, a small satirical pamphlet, and later an expanded pamphlet, which became known as “The Fable of the Bees, or the Vices of Private Individuals are Good for society". ● Mandeville countered the pessimism of Hobbes and Shaftesbury not with optimism, but with sarcasm. In Basna. . . "narrated about the life of a bee hive, but, like in any fable, it was an allegory about relations in society. Mandeville showed that outwardly prosperous bee swarm was thoroughly mired in vices, that deceit, greed and selfishness flourished in it. Everyone, in an effort to earn money, imposed his services, even if there was no need for them, without understanding the means, not shunning fraud, willingly indulging the weaknesses and base inclinations of clients. ● In the end, the bee swarm complained and turned to the Almighty to deliver them from vices. The Almighty heard the murmuring and delivered the swarm from sins.

● The bees became virtuous, and then the unexpected happened: Compare the hive with what it was: Honesty ruined trade. Luxury is gone, arrogance is gone, Things are not going like that at all. After all, not only the waste was gone, That he spent money without an account: Where will all the poor go, Who sold his labor to him? Everywhere now there is one answer: No sales and no work! All construction sites stopped at once, The handicraftsmen - the end of the orders. Artist, carpenter, stone cutter - All without work and without funds. (Translated by A.V. Anikin: Youth of Science. M., 1971. S. 128.) Mandeville B. Fable about bees. M. : Thought, 1974. (See the prose translation of this fable: THE GROWING HIVE, OR SCAMMERS WHO BECOME HONEST

Bernard de Mandeville (eng. Bernard de Mandeville; 1670, Rotterdam - January 21, 1733, Hackney near London) - English philosopher, satirical writer and economist. Studied at Leiden University. Included in the list of "one hundred great economists before Keynes" according to M. Blaug. In artistic form, M. expressed the idea that extravagance is a vice that promotes trade, on the contrary, greed harms commerce in the satire The Grumbling Hive: Or knaves turn'd honest (1705), reprinted under The Fable of the Bees: Or private vices, publick benefits, 1714, Russian translation 1924). In these works, it is proved in allegorical form that a society that has decided to part with luxury and reduce armaments for the sake of savings will face a sad fate. In 1723, a jury in the English county of Middlesex ruled that the fable was harmful. See Louis Dumont. Mandeville's "Fable of the Bees": Economics and Morality

● When vicious inclinations disappeared, when the desire for luxury disappeared and attempts to deceive a friend stopped, then the bee swarm began to decline. The moral of Mandeville's fable boiled down to the fact that the very nature of contemporary society is such that it is no longer able to live without vice. But the image of the beehive also contained another thought that directly opposed the views of both Hobbes and Shaftesbury: ● When sinful people are left to their own devices, society does not perish at all - on the contrary, it flourishes. Mandeville's pamphlet reflected the realities of life and touched the British public. Many took it as a challenge to public opinion. ● The most complete answer to this challenge appeared more than half a century later. It was given by A. Smith. First, in direct form, in The Theory of Moral Sentiments (1759), then in The Wealth of Nations. There was no direct polemic with Mandeville in the last book - it was a response on a more fundamental level. Smith, as it were, reverses the argument: since the pursuit of private interests provides a public good, then these interests should be recognized as rather beneficial and therefore natural.

Smith believed that each person knows his interests better than others and has the right to freely follow them. For Smith, the laws of the market served as confirmation of the vitality of these liberal convictions: “. . . it is not from the benevolence of the butcher, the brewer, and the baker that we expect to get our dinner, but from their observance of their own interests. Summarizing this idea, Smith wrote that a person pursuing his own interests “often serves the interests of society more effectively than when consciously seeks to serve them." This is the meaning of the famous image of the “invisible hand”, directing a person “to a goal that was not at all part of his intentions”. The idea of the “invisible hand” has become a generalized expression of the idea that government intervention in the economy is usually unnecessary and therefore should be limited. At the same time, the theory of exchange itself, which underlay the principle of the "invisible hand", remained still undeveloped, not going beyond the framework of ordinary consciousness. In essence, this was a representation of the self-regulating action of the mechanism of supply and demand in the market. See (Adam Smith "A Study on the Nature and Causes of the Wealth of Nations" Book 1. Chapter II "On the Cause Causing the Division of Labor" http: //ek-lit. narod. ru/smit 003. htm

● Smith knew that if the demand increases, then the price also increases, and this allows more resources to be directed to satisfy the corresponding needs; and vice versa - if demand falls, then the published sphere will be stimulated by the outflow of resources. However, there was still a long way to go before any rigorous proof that this kind of capital movement could bring the economy into equilibrium. ● It's not just the strength of the arguments: Smith did not really strive for such evidence. This was due to the peculiarities of the way of thinking characteristic of his era. Thus, it is known that Smith was well acquainted with Newton's physics, which served as a model for him in his work on his economic theory. But he followed Newton in his general attitude to science. And this attitude proceeded from the religious idea that the task of science is to cognize the world as a manifestation of divine wisdom and a product of divine creation. ● God could not create something imperfect, so it was redundant for him to prove that society eventually comes to some kind of harmonious state. If it is possible to talk about the justification of the "invisible hand" of the market, then it was rather theological. The idea of the "invisible hand" was an integral part of Smith's religious worldview.

Principle “Laissez faire, laissez passer” ● In Russian transliteration: “lesse fair, lesse passe”. From French: allow, do not interfere, "let everything go as it goes". ● The words of the French economist and farmer Vincennes de Gournay (1712-1759) from a speech he delivered (1758) at a meeting of physiocratic economists (supporters of free trade). In it, he argued that for the prosperity of crafts and trade, the government should not interfere in the sphere of entrepreneurship. ● The state is given the role of a "night watchman" - establishing the rules for the interaction of economic agents in the market and monitoring their implementation, but not an independent market entity. ● modern science considers the Laissez-faire principle to be an ideal mental construct that does not occur in the real world, but which is the basis on which the micro economic theory. Criticism ● Classical economists did not disclose the process of achieving

equilibrium state economy, the state of equilibrium itself was investigated. At the same time, according to the cobweb model (which shows how the market comes to equilibrium from a disequilibrium position through successive iterations, changing the price and quantity), there are such disequilibrium market conditions that do not ultimately lead to equilibrium. ● On the other hand, the principle of non-intervention is criticized for being somewhat asocial. In cases where, as a result of objective economic reasons value drops sharply wages, the economy will gradually come to a new equilibrium, but it will have fewer people offering their hands on the labor market. ● Supporters of the idea of Laissez-faire, however, believe that maintaining these jobs with government subsidies will cause an unfair reduction in the income of the productive part of the population through increased taxes. Development of the idea ● The first and second welfare theorems together respond to the most fair criticism of the classical economic school and, accordingly, the Laissez-faire principle, that is, economists have shown the mechanism and conditions for achieving efficiency through competition in the market. But the concept itself has ceased to be used in a professional environment.

● Subsequently, modern theory focused on market failures and state failures In the course of studying microeconomics, we became convinced of the existence of market failures, that is, situations where the interaction of people maximizing their utility functions does not provide some theoretically possible Pareto improvements. When the "invisible hand" of the market does not work quite satisfactorily, there is a temptation to resort to the help of the state (the public sector of the economy). However, it should be remembered that people with the same selfish interests act in the sphere of making and implementing political decisions, as well as those who act as sellers and buyers in the market. Their rational behavior, realizing their own interests, does not necessarily ensure the highest efficiency of the functioning of the public sector.

The Secret of Wealth ● What was then the task of Smith as a scientist? To answer this question, we will have to turn to another part of the intellectual heritage of the classical school - to where and how the classics of political economy sought the foundations for explaining the phenomena of economic life. ● Their claims to create a scientific theory in the economy - let's emphasize this again - were by no means connected with the "invisible hand" of the market. ● Economics was born from the desire to understand and explain the mystery of wealth. ● The creators of the new science could not be satisfied with the explanation that wealth is money, and its source is trade. This view looked logical as long as trade was seen as a kind of “cold war” for wealth-gold: ● whoever sells goods and earns money gains wealth, ● who buys goods wastes wealth. ● On the contrary, if trade is a mutually beneficial and voluntary business, if a trade transaction is just a change of owners of the relevant goods, then the money received from such a transaction cannot be a source of wealth.

● The richer the country, the more it creates a product. Let us recall Pushkin's famous "economic stanza" from "Eugene Onegin", in which the conflict of views on the nature of wealth is concisely and accurately expressed: gold or "a simple product" is the hero of the poem:. . . was a deep economy, that is, he knew how to judge how the state is getting richer, and how it lives, and why it does not need gold when it has a simple product. ● It was about the realization that the source of wealth should be sought not in trade, not in exchange, but in production itself, that it is the development of production that is the basis of the economic well-being of the nation. One of the pioneers of this view was the Englishman William Petty (1623-1687), in whom we find the famous formula "Labor is the father and the active principle of wealth, the Earth is its mother". Labor and land are the two sources of wealth. Petty even explained how to distinguish between the contributions of each of these sources:

● if we compare the product of uncultivated land with labor and a similar product grown on cultivated land, then the first can be considered "pure product of the land", and the increment of the product in the second case - "pure product of labor". ● This analysis leads Petty to explain the “mysterious nature. . . cash rent": if a farmer who works exclusively with his own hands ". . . he subtracts from the harvest the grain he used for seeding, as well as all that he consumed and gave to others in exchange for clothing and to satisfy his natural and other needs, then the remainder of the grain constitutes the natural and true land rent of this year. ● By defining rent as the excess of a product over the cost of creating it, Petty provided a new explanation for the nature of wealth - an explanation around which the theory of classical political economy soon began to build. ● Petty's innovative spirit was clearly manifested in his "Political Arithmetic", written in the 70s of the 17th century. and published posthumously in 1690. Statistics and econometrics have their genealogy from this book. See The Glorious Sir William Petty (A. V. Anikin) See ESH. Lecture 36

● Using scarce and fragmentary data, Petty showed miracles of ingenuity in an effort to quantify the economic phenomena of his time. He made the first attempts to estimate the value national income, velocity of circulation of money, demographics. William Petty (William Petty; English William Petty; 1623 - 1687) - English statistician and economist, one of the founders and pioneers of classical political economy in England; engaged in trade, served in the Royal Navy, studied medical sciences, read physics and anatomy at Oxford; in 1658 he was a member of parliament.

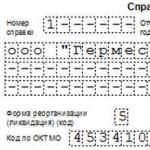

Physiocrats The first scientific school of economic thought is the school of physiocrats (from the Greek physiocracy - the power of nature). The name of the school reflects the central idea of the natural power of the earth as the main factor in wealth. Physiocrats themselves called themselves "economists" - so in the middle of the XVIII century. for the first time a term appeared that heralded the birth of a new profession. The physiocrats-"economists" were a scientific school in the narrow and strictest sense of the word: it was a group of people united by common ideas and led by a teacher-leader. ● This leader was Francois Quesnay (1694-1774) - the court physician of the French King Louis XV. Quesnay's circle, students and propagandists of his ideas, belonged to the elite of the then French society. One of his followers is Jacques. Turgot (1727 -1781) in the first years of the reign of Louis XVI even became the Minister of Finance of France and tried to put the ideas of the Physiocrats into practice. ● The doctor's imagination helped F. Quesnay create the famous Economic Table (1758), in which economic processes were presented but analogies with blood circulation in a living organism.

As physician to Madame de Pompadour, he gained access to the court and in 1752 became physician to King Louis XV of France. People of the most diverse parties converged in his salon - D'Alembert, Diderot, Duclos, Marmontel, Buffon, Helvetius, the Marquis Mirabeau, Turgot; Adam Smith also visited him, imbued with respect for him. Quesnay began economic research in his declining years. His first articles on this subject were published in Diderot's Encyclopedia, in 1756, under the headings "Fermiers" and "Grains". In 1758 he printed an "Economic Table" with explanations. Franco Ken aa ea, June 4, 1694, Mer, near Paris - December 16, 1774, Versailles) - the famous French economist, the founder of the physiocratic school. The son of a farmer, he learned to read and write only at the age of 12. At the age of 17 he left for Paris, where for several years he worked as an engraver's assistant and at the same time received an education. In 1710 he began to study medicine. Energetic and industrious, in 1718 he received the degree of Doctor of Surgery and became chief physician of the hospital in Mantes. The local aristocracy began to use his services;

● Quesnay showed that the basis economic life constitutes a constantly recurring circulation of the social product and money income. The product produced by the different classes of society is exchanged and distributed among them in such a way that each class has everything it needs to continue its activities again. ● The economic table was the first experience of modeling economic processes, and the image of the economy as a cycle of product and income largely predetermined the nature and direction of the development of political economy. ● Quesnay's economic table models the distribution of the annual product among three classes of society: landowners, rural producers (farmers) and urban producers. ● Agriculture, according to the teachings of the Physiocrats, is the only industry where a "pure product" (produitnef) is created - a source of social wealth. The choice of an annual product as an object of analysis is tied to the annual cycle of agricultural production. ● The Physiocrats considered the work of the townspeople unproductive: they called artisans, industrialists, merchants a barren or sterile class, that is, a class that does not produce a “pure product”.

● The Physiocrats, of course, did not deny that useful goods were produced in cities; the logic of their reasoning was that people who do not work on the land can only transform the source material given to them, for example, raw materials supplied by agriculture. Citizens can feed themselves by exchanging their products for the goods they need, but they do not have the conditions to participate in the creation of new wealth. ● In his Economic Table, Quesnay assumes that the agricultural product is 5 billion livres per year and is divided into three parts: ● 2 billion is the "net product"; ● I billion is a part of the product that is used to reimburse the “initial advances” (inventory and buildings) spent during the year, and the remaining ● 2 billion is the income of the farmers themselves, covering the costs of “annual advances” (primarily seeds and livelihoods). ● It is also assumed that urban artisans and industrialists produce 2 billion livres, which exactly covers their expenses for the purchase of livelihoods and raw materials.

● The idea that part of the social product should go to the renewal of "initial" and "annual advances" and, moreover, that such renewal is an indispensable condition for the creation of a "clean product" and the normal course of economic processes is one of the main theoretical achievements of Quesnay . It was about understanding the economic role of capital and, accordingly, about introducing concepts into scientific circulation, which later terminologically became fixed as “fixed and circulating capital” . The process of circulation of the annual product develops, according to Quesnay, as follows. The first step: having received after the sale of their product a "net income" (2 billion livres), the farmers transfer it to the landowners in the form of rent for the use of the land. The second step: landowners with this rent buy food - from farmers (1 billion) and manufactured goods - from the sterile class (1 billion). Third step: with the money raised from the sale of their goods to landowners, the sterile class (townspeople) buys food from farmers (1 billion).

Finally, the fourth step, the farmers buy equipment from the barren class to replace the worn-out equipment for 1 billion livres, which, however, is returned to the farmers for the raw materials from which the townspeople produce their goods. ● As a result of all these interactions, by the beginning of the new agricultural year, the situation returns to its starting point: ● farmers have the working capital necessary to continue working, as well as 3 billion livres to pay rent and replace fixed capital, the barren class has the means of subsistence and raw materials to continue its production. ● The role that Quesnay gave in his model to landowners corresponds to the function of the heart in the circulatory system. This is a kind of "valve", pushing money through the channels of the economic cycle. Connected with this is one of the most important practical conclusions that Quesnay draws on the basis of his table: if landowners do not spend their rent in full, then public product will not be fully implemented, farmers will receive less income and will not be able to provide the same volume of production next year, and hence pay rent at the same level.

● In matters of economic policy, the Physiocrats, like Smith later, advocated limiting government intervention in the economy and lowering customs duties. ● It is believed that it was during these discussions that the famous slogan of economic liberalism "laissez / faire, laissez passer" was born - the demand for freedom of action for entrepreneurs and free (without imposition of duties and fees) movement for their goods. ● For the sake of truth, it is worth mentioning that France at that time was a country of industrial protectionism, and under these conditions, the demand to reduce taxes and duties could be not only a matter of principle, but also an expression of the interests of landowners and agricultural producers. The concept of the Physiocrats, which assigned a special role to agriculture in creating a “pure product”, focused rather on a change in priorities in economic policy than to abandon active politics altogether. There is no doubt that the activities of the Physiocrats contributed to the establishment of the principles of liberalism, but to consider them consistent liberals would probably be some exaggeration. See François Quesnay's theory of reproduction. Blaug M. PHYSIOCRACY

More about Quesnay's table ● Quesnay taught economic thought to distinguish between two categories of costs: one-time and current. With regard to agricultural labor, Quesnay calls them, respectively, "initial advances" and "annual advances." ● The first is what needs to be spent immediately and for many years to come. In order to manage the land, you need to buy livestock, a plow, a harrow, and seeds. . . Build cowsheds, sheds. . . Dig ditches, lay pipes. . . Hire workers. . . In fact, we are talking about the creation of farm capital. "Initial advances", according to Quesnay, are investments, or capital investments. They contain investments in both fixed and circulating capital. Before you invest this amount in land, you need to have it. ● "Annual advances", according to Quesnay, are constantly required expenses for housekeeping: for the maintenance of livestock, wages of workers, repair of equipment, buildings and structures. . . These are the costs of production that make up the cost of the product. They do not need to attract additional money from outside, they are reimbursed in the price of the product of production when it is sold. ● Before, of course, people felt the difference between investment and production costs. But their clear separation and the identification of the economic difference between the two categories is the indisputable scientific merit of Quesnay.

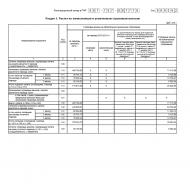

Economic Table Dr. Quesnay did not have a doctorate in economics. He was a doctor. The first article written by the young François Quesnay was devoted to the technique of bloodletting. He knew of Harvey's discovery of the circulatory system, which operates independently of mind or desire. Perhaps this later gave him a brilliant idea about the circulation of social products and the counter circular flow of income, moreover, both flows move without the participation of the state. Corresponding ideas were formed by Quesnay in the form, as he called it, of the "Economic Table" (see Fig. 12-1). This Quesnay invention may at first seem difficult to understand. In fact, everything is very simple there, if you understand it in order. Postulates of the Economic Table ● Quesnay's Economic Table is, of course, a chart. And like any scheme, it greatly simplifies reality in order to show the most important patterns. Here are the simplifications: 1) prices are unchanged throughout the year; 2) all income is spent on consumption (this means that investments do not grow over the years); 3) purchases and sales within each class are not taken into account; 4) foreign trade is not taken into account; 5) all land is cultivated by farmers who lease it from owners;

6) there is no distinction between farmers and their wage-workers, between industrialists and their workers. ● Such preconditions are quite acceptable. The author can then refuse any of them, while the scheme will become a little more complicated, but the general patterns will not change because of this. ● What does Quesnay's Economic Table show? ● It shows how the total social product is distributed among the classes; ● what are the incomes of the three classes of society; ● how income is exchanged for products between classes; ● how each class is reimbursed. ● What the Table shows is called the process of social reproduction (during the year). ● If the scheme took into account the investment of some part of income (capital increase), it would show expanded reproduction. In this form, it shows simple reproduction (the capital of society remains constant).

The initial conditions of the Economic Table Quesnay accepts the following initial data: 1. Initial advances of the productive class (not included in the flows) - 10 billion livres 2. Annual advances of the productive class - 2 billion livres 3. Annual product of the productive class - 5 billion livres per including: industrial raw materials - 1 billion livres food - 4 billion livres ● The table shows the end of the harvest. If we deduct annual advances from the finished product, 3 billion livres remain, which go to the market (including: raw materials for 1 billion and food for 2 billion). Of these, one billion must repay a share of the original advances, and the remaining two represent a net product. At this initial moment ● the barren class (industry and commerce) has 2 billion worth of goods, ● and the landowners have in cash 2 billion (this is what they received last year from the productive class as rent).

Sales of products, income and expenses ● Now the movement begins (see Figure 12-2). ● Landowners buy food from farmers for 1 billion. This means an exchange: the first receive grain, etc. for 1 billion, and the second - this amount in money. ● Another 1 billion in money the landowners give to the barren class, and in return receive manufactured goods from them for that amount. ● The sterile class exchanges all this money for food, resulting in farmers receiving another 1 billion. ● This second 1 billion farmers give back to the sterile class, receiving industrial goods for this amount in return. ● Barren class now has 1 billion on hand. This money, in exchange for raw materials for handicraft production, goes to the farmers, from whom they remain. ● The exchange is completed, the entire social product is sold, all income is distributed. What happened in the end? Landowners bought 1 billion worth of food and 1 billion manufactured goods for consumption. The sterile class sold its products for 2 billion, and received in exchange: food - for 1 billion and raw materials - for 1 billion. The productive class sold food for 2 billion and raw materials for 1 billion. It received manufactured goods for 1 billion for this. and 2 billion in money

These last 2 billion - the monetary value of the net product - came to the owners of the land as rent. That's all. We see now why the landowners, who do not create a pure product, were not assigned to the barren class. Spending their income on food and raw materials, they, according to Quesnay, perform an important economic function, participating in the sale of the product of both the productive and barren class. The Significance of Quesnay's Economic Table ● Prior to Quesnay, we do not see economic writers viewing a country's economy as a cohesive whole in which everything is interconnected. No one thought about the fact that social reproduction has certain, moreover, balanced proportions. No one imagined the structure of the economy as a circular flow of products and income. ● Note one interesting feature Tables. If the doctrine of barrenness of the industrial-merchant class is abandoned, its income must be the sum of the wages of workers and the profits of entrepreneurs.

Quesnay's table as an input-output table ● Input-output model or inter-industry balance model (input-output analysis or interindustry analysis), - the study and empirical measurement of structural relationships between production sectors within the economy (economy). The analysis technique was developed by Wassily Leontiev (b. 1906) to measure the amount of factors of production required by various industries to achieve a given level of output. ● Each sector of the economy needs inputs produced by other sectors to produce output, whether raw materials, intermediate products and services, or labor resources. The relationships between branches of production, or sectors, are not linear, but complex. ● In other words, one sector does not produce, say, coal for other sectors, regardless of the coal industry's demand for resources produced by other sectors. Coal is the end product for the coal mining industry, but it is also a resource for the power industry. ● At the same time, the coal industry needs resources (including electricity) to produce coal. This simple example demonstrates the complexity of the economy. See Daniel A. Graham. Cost Method - Release and Linear Programming

Modern concept of wealth ● wealth (wealth): Anything that has a market value (value) and can be exchanged for money (money) or good, can be considered as wealth. ● It includes physical goods and assets (assets), financial assets, skills, abilities, i.e. everything that can generate income. All these elements are regarded as wealth when they can be bought and sold in commodity or money markets (market). ● Wealth can be divided into two main types - tangible wealth, embodied in physical and financial assets, called capital, ● and intangible wealth, called human capital. All types of wealth have a basic property, consisting in its ability to generate income (income), which is a return on wealth. ● Thus, wealth is a stock and income is a flow. ● The present value of the income stream is the value of the wealth stock. See: Capitalization (lecture 38) Inequality and its measurement (lecture 44. 2)

The circulation of money and economic goods in its modern form Consumers sell their resources in order to buy goods on the market and satisfy their needs. Producers buy resources to sell the goods they produce and make a profit. Through the price system in the market of goods and services, it is determined what to produce, and in the resource market - how to produce. Factors of production are inputs, including labor services, land, machinery, tools, buildings, and raw materials used to produce goods and services. Households earn income by selling raw materials and labor services, renting out their land and means of production (machines, tools and buildings). Although most of the land, buildings, and equipment in the economy are owned by firms, all firms are ultimately owned by households. In other words, they sell the services of their factors of production to firms and use their income, which consists of wages, rents, and profits, to buy goods and services produced by firms.

Economic rent as part of the income of the factor Each factor of production - labor, capital, entrepreneurship - corresponds to a certain type of income - wages, interest, profit. Income from land is traditionally called rent. However, in modern economic theory there is the concept of economic rent as a component of income from any other factor. Any factor of production in some sphere of its application is kept by the fact that it receives payment for its services that covers its opportunity cost, i.e. its income at the best alternative use. Otherwise, he would move to another area, since there he will receive more revenue for the services provided. The lowest payment for the services of a factor, sufficient to keep it in a given field of application and prevent a transition to another, is called the retaining income. Economic rent is the excess of payment for the services of a factor over retaining income. On fig. the supply and demand lines of some factor of production are shown. The area of the figure OAEF E corresponds to retaining income, the area Ap E E corresponds to economic rent. Economic rent is in the factor market analogous to producer surplus in the commodity market. It shows how much the payment of the factor is higher than the amount that is enough to attract him to this area.

Homework: ● Write in your own words a short essay (2-3 pages), where you need to note the main and incomprehensible, while knowing the meaning of the terms used. The essay serves as material for a short presentation at the seminar. In electronic form, sent to the address: hse 111. 116. [email protected] com ● Essay Topics for Presentation 03: 1. Adam Smith. From the book: “A Study on the Nature and Causes of the Wealth of Nations” (chapters 1-3): http: //seinst. ru/page 383/ 2. Thomas Hobbes. Leviathan, ch. 17 On the causes, origin and definition of the state 3. John Locke. The second treatise on government (ch. 7-9): http: //www. freedom. ru/library/classic/two_treatises/ 4. The Fable of the Bees (Bernard Mandeville) 4. The Glorious Sir William Petty (A. V. Anikin, ch. 3) 5. A. V. Anikin. The youth of science. Doctor Quesnay and his sect 6. E. M. MAYBURD. GL. 13. GENIUS TIPS 7. JUSTICE (LECTURE 43. 0 -5): HTTP: //MIKHAILIVANOV. ORG/SE 5/THE_CONTENT_OF_THE_FIFTH_EDITION_OF_THE_JOURNAL_THE_SCHOOL_OF_ECONOMICS. PHP ● Be able to answer questions for the seminar

Questions for the seminar: ● The mechanism of the market, or the idea of the “invisible hand” ● Property (John Locke) ● The pessimism of Thomas Hobbes ● The fable of the bees by Bernard Mandeville ● The principle of “Laissez faire, laissez passer” (Adam Smith) ● The social contract and welfare criteria ● Wealth is the result of production, not trade ● The concept of rent (William Petty) ● Dr. Quesnay and his table - the prototype of the input-output method ● Physiocrats (Francois Quesnay, Robert Jacques Turgot)

Literature: Thomas Hobbes. LEVIATHAN. CHAPTER XVII ON THE CAUSES, ORIGIN AND DETERMINATION OF THE STATE AV Anikin. The youth of science. Paradoxes of Dr. Mandeville B. Mandeville. The Fable of the Bees A. V. Anikin. The youth of science. Dr. Quesnay and his sect Theory of reproduction Francois Quesnay. Adam Smith. "A Study on the Nature and Causes of the Wealth of Nations" ECONOMIC RENT (economic rent) - the definition of "ESh". Lecture 36. Economic rent Stocks and flows - wealth and income: Capitalization (lecture 38) Inequality and its measurement (lecture 44. 2) Daniel A. Graham. Cost Method - Release and Linear Programming Jacques Turgot. Praise for Vincent De Gournay A. V. Anikin. Thinker, minister, person: Turgot E. M. MAYBURD. GL. 13. GENIUS TIPS M. BLAUG. PHYSIOCRACY

Terms: Glossary of basic terms (see also: Glossary of Economics and Mathematics Guide for Economists for terms, as well as names and terms)

Presentation on the topic: Classical political economy. general characteristics and stages of development. A. Smith and D. Ricardo

1 of 13

Presentation on the topic: Classical political economy. General characteristics and stages of development. A. Smith and D. Ricardo

slide number 1

Description of the slide:

slide number 2

Description of the slide:

Classical school: origin, development, macroeconomic theories In the XVII-XVIII centuries, capitalist relations were established in European countries, and this became the starting point for the onset of the conditions of "full laissez faire" - economic liberalism. Since that time, a new theoretical school of economic thought has been born, called classical political economy. After the coup d'état of 1688, England turned into a constitutional monarchy, a compromise was finally reached between the landowners and the bourgeoisie, but the mercantilist ideology of the English government had not yet been overcome: the state still protected monopolies, assigned import duties and export premiums, and regulated guild activities by limiting the number of employees in each occupation. A new ideology was needed to change economic policy. This task was undertaken by the brilliant economists, the founders of classical political economy, the Englishman William Petty (1623-1687) and the Frenchman Pierre de Boisguillebert (1646-1714). These authors condemned the protectionist system that hindered the freedom of enterprise, they emphasized the priority of liberal economic principles in creating national wealth in the sphere of material production.

slide number 3

Description of the slide:

Representatives of the new school were also distinguished by the fact that they re-formulated the method and subject of study of economic theory. The sphere of production was put forward as the subject of study of the "classics". Method of study and economic analysis acquired new features through the introduction of the latest methodological techniques, which quite successfully provided deep analytical results, a lesser degree of empiricism. Classical economists saw the task of economic science in studying not really occurring events, but only those forces that, in some, not quite understandable way, predetermined the emergence of real phenomena. Classical economists emphasized that the conclusions of economics are ultimately based on postulates drawn as much from observable "laws of production" as from subjective introspection. K. Marx believed that the "classics", in the works of their best authors A. Smith and D. Ricardo, did not allow slipping on the surface of economic phenomena at all. According to him, "the classical school investigated the production relations of bourgeois society." Classical political economy in its teaching investigated the analysis of the conditions of free economic activity only in the capitalist system.

slide number 4

Description of the slide:

There are four main stages in the development of classical political economy. First stage. It begins at the turn of the 17th - early 18th centuries, when in England, thanks to the work of W. Petty and in France, P. Boisguillebert, signs began to form, the beginnings of a new, alternative to mercantilism, doctrine, which would later be called classical political economy. In their writings, the first attempts were made to costly interpretations of the cost of goods and services (by taking into account the amount of labor time and labor spent in the production process). They emphasized the priority importance of liberal economic principles in the creation of national (non-monetary) wealth in the sphere of material production.

slide number 5

Description of the slide:

Second phase. This period is entirely attached to the name and work of the great scientist-economist Adam Smith, whose brilliant creations became the most significant achievements of economic science throughout the last third of the 18th century. on his theoretical research are largely based and modern concepts about the product, its properties, about money, wages, profits, capital, etc. The third stage. The chronological framework of this stage covers the entire first half of the 19th century, during which in developed countries, especially in England and France, there was a transition from manufactory production to plants and factories, i.e. to machine and industrial production. During this period, such economists as D. Ricardo, T. Malthus, N. Senior, J.B. Say, F. Bastiat and others, each of these authors, following the "father" of classical political economy, Adam Smith, left very noticeable traces in the history of economic thought. Fourth stage. The last period of classical political economy falls on the second half of the 19th century. and is due to the works of J. S. Mill and K. Marx, who took it upon themselves to codify the best achievements of the "classical school". At the fourth stage, the formation of a new, more progressive direction of economic thought, “neoclassical economic theory”, has already begun. However, the popularity of the theoretical views of the "classics" remained quite impressive, because they sympathized with the working class and were turned to socialism and reforms.

slide number 6

Description of the slide:

A. Smith and D. Ricardo Adam Smith's merit in the formation of classical political economy is that he codified it and formed the basis for future generations. Even in The Theory of Moral Sentiments, he introduced the famous principle of the "invisible hand" and continued to develop his ideas in the "Study on the Nature and Causes of the Wealth of Nations". Here Smith devoted himself entirely to studying the development of the economy in society and ways to improve its well-being, while applying completely new methodological methods of analysis and supporting the concept of economic liberalism. He recognized the importance of laws operating in a market economy and advocated free competition. He argued that the fate of each economic entity is predetermined, and frugality is the main factor in increasing profits. Main ideas: the theory of competition, the principles of market regulation, the labor theory of value and the study of factors of production, the study of money as a medium of exchange, the law of inverse proportionality between salary and profit David Ricardo: the labor theory of value, the theory of wages, the theory of capital, the theory of profit, the theory of money. Ricardo believed that value does not consist of wages, profits and rent, but is decomposed into them or - the source of rent is not the special generosity of nature, but the applied labor.

slide number 7

Description of the slide:

The birth of liberal reformism and the emergence of socialism The representative of the emerging liberal reformism was Jean-Baptiste Say (1767-1832). Say's main work is the Treatise of Political Economy, which had 3 sections: production, distribution and consumption. Two main ideas in the work of Zh.B. Seya: The theory of production factors: the three factors of production - labor, capital and nature (land) - correspond to three basic incomes: labor creates wages, capital - interest, land - rent. The sum of these three incomes determines the value of the product, and each of the owners of this or that factor receives the reward or income created by the corresponding factor of production as a certain share of the value of the product. Thus, the factors of production are considered by Say as equal sources of value. Three-factor theory has played an important role in the development of economic science. Subsequently, factor analysis of production (the production function method) was developed from it, the meaning of which is to find a profitable, optimal combination of production factors for certain competitive cases.

slide number 8

Description of the slide:

Say's identity or market law related to the problem of overproduction crises. Periodic crises of overproduction, accompanied by depression, which then turns into a new upsurge, began to be detected and then regularly repeated starting from the 20s of the 19th century. Say's law of markets, which states that production is always equal to consumption, excluded the possibility of a general overproduction of the mass of commodities. The crisis of overproduction, according to Say's law, occurs not because the total amount of goods on the market exceeds the total amount of money, but because some goods are produced less than necessary. The resulting structural discrepancy is inevitably leveled as a result of the movement of goods and combinations of prices. Say's postulate, which is that production always generates demand, products are bought for products, despite subsequent criticism, remains a fundamental postulate of the theory of the liberal direction in economic science at the present time.

slide number 9

Description of the slide:

John Stuart Mill (1806-1873) - English economist, representative of the late classics, who summarized the main achievements of this school. According to Mill, there are irremovable, immutable laws in production, the appearance of which can be compared with the actions of the laws of nature. Another type of law operates in the area of distribution. These laws can be changed by people in accordance with the requirements of justice and the common good. Therefore, the laws of distribution must be considered separately from the laws of production. Mill also explored the theory of exchange. The theory of production is reduced, as in all classics, to the study of three factors, each of which increases in accordance with its own specific patterns.

slide number 10

Description of the slide:

The law of the increase of labor is the law of the increase of population, unlimited by nature. But the development of culture, diverse needs, and comfort of life is gradually becoming a limiter to population growth. Poverty and the fear of poverty are also powerful deterrents to population growth. The growth of capital depends on the frugality of the population. The main incentive here is a high rate of profit, but much also depends on the character of the person, on the traditions of society. If traditionally the propensity to save and accumulate is strong (as in England, Holland), then a low profit and interest are enough to stimulate savings. Thus, writes J. Mill, the second condition for the increase of capital lends itself to an increase that does not have any definite limits. The situation is different with the third factor of production - land. Limitation land areas and the fertility of the land sets the limits for increasing production. Here J. Mill refers to the law of diminishing returns on investments of capital and labor in land, formulated in the writings of D. Ricardo. However, J. Mill also sees countertrends that oppose the law of diminishing returns on investments in land. This is the progress of knowledge and technology, "the process of civilization."

slide number 11

Description of the slide:

Theory of value. J. Mill divides all goods into three groups. Goods, the quantity of which cannot be increased; the value of these goods is determined by their usefulness and rarity. Goods, the quantity of which can be increased by the application of labor and capital at the same cost per unit of goods; the value of these goods is determined by the cost of production. Goods, the quantity of which can be increased by the application of labor and capital, but not with fixed, but with increasing costs per unit of goods. These are the products of agriculture and the mining industry. The cost and price of these goods are determined by the marginal (maximum) cost of their production.

slide number 12

Description of the slide:

Utopian socialists Socialism is represented by the works of Thomas More, Robert Owen, Claude Henri de Rouvroy Saint-Sismondy, Francois Marie Charles Fourier. They criticized capitalism, demanded the abolition of private property, the reorganization of production, distribution, consumption and the elimination of the opposition between mental and physical labor. The most famous work of T. Mora was "The Golden Book is as useful as it is funny, about the best structure of the state and about the new structure of utopia." The first part provides a critique of contemporary Morus social orders, the second gives a system of an ideal social order. R. Owen believed that a person should not be reproached for his ignorance and other vices, since a person is a product of the environment and his shortcomings are a consequence of the vices of the existing society. He was the founder of factory legislation. He shortened the working day at the factory he ran, raised wages, changed living conditions, organized a system of educational and educational institutions for children and adults .. The economic crisis of 1815-1817. gave rise to his critical attitude to the capitalist mode of production. R. Owen put forward a plan for the organization of labor communes, settlements - communities without private property, clergy and authorities. He advocated the creation of a communist society without revolutionary ideas.

slide number 13

Description of the slide:

K. Saint-Simon promoted the ideas of equality, fraternity and freedom. Saint-Simon paid great attention to the debunking of the capitalist system, predicted its inevitable death, and proposed a program for creating a just social system based on the principles of association. He proposed to unite mercenaries and employers (the bourgeoisie) into a single group of industrialists. According to Saint-Simon, every social system is a step forward in history. The history of development goes through 3 phases, respectively: theological - the period of domination of religion (covers slave-owning and feudal societies), metaphysical - the period of the collapse of the theological and feudal system, positive - the future social system as a natural result of previous history. The future was to be based on the scientific and planned organization of large-scale industry, while maintaining private property. C. Fourier was fond of philosophy, tried to explain the problem of happiness and combine the happiness of one and many. He was interested in the organization of labor, evaluating its effectiveness by the degree of freedom of labor. In his opinion, bourgeois society is so contradictory, so anti-human that it must inevitably - the sooner the better - be eliminated, replaced by a society of social harmony, prepared by all previous history.

Classical political economy

is a direction in the development of economic thought,

based on the principles of non-intervention of the state in

economic practice that originated in the period

approval of the market economy as

dominant mode of business.

relations (landlessness

peasants)

2. Bourgeois revolution at the head

with Oliver Cromwell (15991658) and the subsequent

turning England into

constitutional monarchy.

3. A compromise has been reached between

landowners and the bourgeoisie.

4. A decisive role in politics

began to play economic

the interests of the bourgeoisie.

Causes

classical

political economy in

England English statistician and

economist, William Petty

(1623-1687)

These authors condemned

protectionist system,

that held back freedom

entrepreneurship. Imi

priority

the importance of liberal

business principles in

creation of a national

wealth in the field

material production.

French economist Pierre de

Boisguillebert (1646-1714) Stages in the evolution of classical political economy

The first stage (from the end of the 17th century to the beginning of the second half of the 18th century) - the substantiation of ideas

free trade and enterprise: the economic teachings of W. Petty and P.

Boisguillebert. Features of the interpretation of the categories of wealth, money, value,

income.

Wealth, according to W.

Petty, form not only

precious metals and stones,

including money, but also land,

houses, ships, all goods.

So wealth

created in the field

material production,

(and not in circulation).

W. Petty did not count money

wealth of the country and wrote,

that it is necessary not to accumulate them,

and put into circulation.

The cost was determined

labor expended, and

namely, labor

spent on mining

silver as money

material. The second stage (the period of the last third of the XVIII century) - A. Smith:

the formation of political economy as a science. The teachings of A. Smith and

his work An Inquiry into the Nature and Causes of Wealth

peoples".

The Economics of Adam Smith (1723-1790)

Key Ideas:

1. The source of wealth is the product of the combined labor of all

spheres of production, representatives of various types of labor

and professions (“the annual labor of nations”).

2. A prerequisite for the growth of wealth is the division of labor.

3. Labor theory of value - "labor is

the only universal, as well as the only exact

measure of value." Different types of labor are equivalent.

4. The concept of the "invisible hand"

5. The state performs the role of a "night watchman", and not

regulator of economic processes.

Prerequisites for the second stage:

The rapid development of capitalism through

foreign trade, government

loans, development of colonies.

Creation of large centralized

manufactures and capitalist farms.

The process is ongoing

dispossession of peasants, growing

the number of employees.

England is turning into an industrial-agrarian country. Disadvantages of the teachings of A. Smith

1. I did not understand the essence of money as a universal equivalent, that money

act as a social form of wealth. money only

medium of exchange, a fleeting intermediary facilitating exchange

goods.

2.The cost of the goods did not include the transferred cost. Considering

that the accumulation of capital is the transformation of profit into

additional salary, saw the benefits of workers in the accumulation

capital.

3. Linked the concept of "productive" and "unproductive"

labor with the concept of capital.

4. "Productive" labor is paid from profits on capital,

"Unproductive" labor does not create profit. The third stage (the first half of the 19th century) - the development of political economy in the works

economists D. Riccardo, J. B. Say, T. R. Malthus. Theories of value, capital,

income, reproduction. "Iron" law of wages D. Ricardo.

The teachings of J. B. Say. The theory of three factors of production, the theory of income, cost.

The Law of Markets by J. B. Say, or the Concept of Crisis-Free Economic Growth.

Teachings of T. R. Malthus. Theory of population.

Makes a distinction between

cost and

material

wealth. Premise

increase in wealth

productivity growth

labor. The cost depends

not from abundance, but from

difficulty or ease

production.

The population is growing in

geometric

progressions, but the means

existence in

arithmetic effect

waning law

fertility of the earth

Overproduction

goods and economic

crises are impossible. What Smith and Ricardo have in common:

1. There are three main classes in society

(landowners, entrepreneurs, workers) and

three types of income: rent, profit, wages

pay.

2. Supporters labor theory cost

3. Supporters of economic liberalism