Basic credit policy type Benefits Disadvantages. Money-credit policy. Advantages and disadvantages of lending to enterprises

Bank loans are one of the most sought-after and common types of borrowed resources. They enjoy not only ordinary citizens, but also enterprises to maintain their financial activities. Benefits bank credit different, but at the same time borrowed money There are significant drawbacks.

W. bank loan There are advantages and disadvantages. At the same time, they depend on the type of loan, which receives a citizen or organization. Much depends on the favorable conditions at a particular moment in which the loan is taken.

Before you take a loan, you need to familiarize yourself with all the advantages and disadvantages.

Among the main advantages bank lending You can allocate:

- small list of documentation required by the Bank (especially with consumer lending);

- the possibility of obtaining in any period of time and for any purpose if the loan is not metering;

- the permissibility of issuing various economic operations, as well as for investment purposes;

- a wide variety of types of loans issued with the possibility of receiving money both short and long time;

- availability for different layers of the population;

- the existence of a non-cash lending system, in which it is possible to make payments through electronic transfers;

- the possibility of repaying the loan ahead of time if there is an agreement about this with the bank;

- the loan price is an integral part production costs organizations, at the expense of which they have the opportunity to reduce taxable profits;

- lending conditions allow citizens and organizations to competently plan their budget, which creates flow control money.

The main advantage of a bank loan is that a citizen can immediately realize his need for anything. This applies to the acquisition of real estate, a car or a trip to rest. The loan acts more attractive alternative to the simple accumulation of money.

Paradoxically, but loans to a lesser extent depend on inflation. It adversely affects the ability of the population to accumulate money, but at the same time makes it easier to pay the loan. Inflation although indirectly, but serves as a positive factor when choosing a citizen in favor of a bank loan.

The bank in the bank has one undeniable advantage relative to another possible alternative option - leasing. The essence of leasing is the financial lease of the leaser of the objector's property. After receiving a loan in the bank, a citizen or organization acquires property and becomes its owner, and not a tenant, as it happens in the case of leasing. But at the same time, the loan creates certain burdens for property owners in the form of the need to pay debt.

Disadvantages of loans

Bank loans have a number of disadvantages, including:

- overgrown interest rates;

- the presence of a system of guarantee and collateral, burdens not only the borrower itself, but also of third-party persons;

- the need to use money only for certain purposes, if the loan is targeted;

- the need to pay the commission of the Bank by the borrower when repaying the loan ahead of time in some cases;

- the action of the bureaucratic system upon receipt of a loan by citizens and organizations;

- the presence of a strict chart of returning loan amount and percent on it;

- strict requirements for recipients, detailed verification of their solvency;

- the presence of additional paid bank services, which the borrower may not be warned in a timely manner;

- the high risk of deception upon receipt of funds, especially when making a long-term bank loan.

The loan helps not spend time on the accumulation of money, and get the desired in short time

Any type of bank loan has three main disadvantages. The first of these is the urgency of debt repayment, the second is the payability of the service for the provision of money in debt, the third is the return, which imposes a burden on borrowers.

Often disadvantageous for borrowers loans taken in foreign currency. When fluctuating a currency exchange rate in which the loan was taken, a multiple increase in the amount of debt and percent on it is possible.

Especially burdensome for borrowers is the requirement of many banks on the need for collateral When providing a loan. The pledge serves as a security measure and a guarantee for paying the entire amount of debt and interest. The deposit has a whole list of risks for borrowers for the following reasons:

- the mortgage property is included in a special registry, prohibiting the owner to dispose of them to fully without the bank's approval;

- pledge property at the request of the bank is insured by the borrower, the borrower himself is also subject to insurance, which increases its additional costs;

- with the insolvency of the borrower, his property, which is pledged, can be implemented to other persons through court, which ultimately means the loss of ownership.

When paying debt, citizens and organizations are significantly overpayed, which is beneficial for the lender. In addition to the principal debt, they pay interest, the size of which is initially overshadowed by the Bank. In some cases, banks are charged from the borrowers for conducting a loan case, for individual debt payments.

The overpayment of loans issued by banks often exceeds the cost of the loan itself.

Advantages and disadvantages of lending to enterprises

Lending to enterprises has the following benefits for them:

- free choice of lending scheme;

- minor time spent on attracting money;

- secrecy of the transaction and the minimum risk of disclosing its data to other organizations;

- the action of flexible conditions in the provision of credit banks;

- the lack of taxation of the borrowed funds received by the organization.

Most often, banks value by their customers and are ready to make concessions to permanent borrowers in the form preferential conditions lending. The process of attracting a loan takes 14-60 days. At the same time, the specified period is much less than the period necessary to organizations for the emission of shares or the search for a reliable investor.

Of the flaws it is worth noting high overpayment for credit

Among the minuses loan in the bank are allocated:

- violation financial Sustainability organizations due to the loan received;

- the obligation of the collateral equal to the amount of the requested loan;

- high probability of failure;

- complexity in obtaining money for a long period of time due to the tough policy of the Central Bank;

- high credit rates.

Organizations in every sense it is more profitable to build a business on own meansbecause borrowings should always be returned, paying big percent. But attracted bank funds are the only way to normal functioning of most organizations created.

Credits account for about 10-50% of the total number of all funds that organizations and citizens are taken as loans. Negative issues related to lending are smoothed by the possibility of rapid decision by citizens and organizations of their financial problems. With the right planning of the payment schedule, as well as the calculation of the return rates, the use of the loan can benefit for the borrower.

In contact with

The best loans for this month

For the questionnaire, you must enable JavaScript in the browser settings

Types of monetary policy

Two types of monetary policy are distinguished: 1) stimulating and 2) restraining.

The stimulating monetary politician is carried out during the recession period and aims to "swinging" the economy, stimulating the growth of business activity in order to combat unemployment, the restraining monetary policy is carried out during the boom and aims to reduce business activity in order to combat inflation.

A stimulating monetary policy is to conduct measures to increase money from an increase in the bank. Its tools are: 1) Reduced norm reserve requirements, 2) a decline in interest accounting rate and 3) Purchase by the Central Bank of State Securities.

The restraining (restrictive) monetary policy is to use the central bank to reduce the money supply reduction. These include: 1) increasing the norm of reserve requirements, 2) increasing interest accounting rate and 3) Sale by the Central Bank of State Securities.

Impact of changing money supply for the economy

The mechanism of impact of changing money supply to the economy is called the "Mechanism of the Monetary Transmission" or "money transmission mechanism" ("Money Transmission Mechanism"). The mechanism of the monetary transmission shows how a change in the money supply (change in the monetary market) affects the change in the real volume of output (the situation on real market. market of goods and services).

This mechanism can be represented by the next logical chain of events. If in the economy decline, then central bank Buys state-owned securities → Credit capabilities of commercial banks increase → Banks provide more loans → The money supply multiply increases → The interest rate (loan price) falls → firms with pleasure take cheaper loans → Investment expenses grow → aggregate demand increases → The volume of production is multiplier. (It should be borne in mind that the change in the interest rate is reacting not only by firms by changing the amount of investment spending, but also households that enjoy consumer credit And when he cheaper increases consumer spending, as well as a foreign sector, increasing costs of net exports with a decrease in the interest rate, as it leads to a decrease in the course national currency This country makes its goods relatively cheaper and attractive for foreigners).

Since the impact of stabilization policy occurs in the short term, the graphically the effect of stimulating monetary policy on the economy can be depicted as follows (Fig. 1):

This policy used during the recession is called the policy of "cheap money".

Accordingly, the policy carried out by the Central Bank during the boom ("overheating") and aimed at reducing business activity, is called "politics of expensive money" and can be represented by the next chain of events:

The central bank sells government securities → Credit capabilities of commercial banks decrease → The money supply is multiplicatively reduced → The interest rate (loan price) is growing → Demand on expensive loans from firms fall → Investment costs reduce → aggregate demand decreases → production decreases.

And in that, and in another case, the economy stabilizes.

Benefits and disadvantages of monetary policy

The benefits of monetary policies can be attributed to:

No inner lag. The internal lag is a period of time between the moment of awareness of the economic situation in the country and the moment of adopting measures to improve it. The decision to buy or sell state securities by the Central Bank is made quickly, and since these papers in developed countries are highly qualified, highly reliable and risk, there are no problems with their selling population and banks.

No displacement effect. In contrast to the stimulating fiscal policy The stimulating monetary policy (growth of money supply) determines the decline in the interest rate, which does not lead to displacement, but to stimulate investments and other percentage-sensitive percentage of autonomous costs and the multiplicative growth of the issue.

Multiplier effect. The monetary policy, like the fiscal policy, has a multiplicative effect of exposure to the economy, and two multipliers operate. The bank multiplier provides the process of deposit expansion, i.e. Multiplicative increase cash, And the growth of autonomous expenses as a result of a decline in the interest rate in the context of the growth of the money supply is multiplicative (with the effect of autonomous expenses) increases the amount of the total release.

Disadvantages of monetary policy are as follows:

The possibility of inflation. Stimulating monetary policy, i.e. The growth of money supply, leads to inflation even in short, and even more so in the long term. Therefore, representatives of the Keynesian direction argue that monetary policy can be used only when overheating (inflationary break) of the economy, i.e. Consider the possibility of conducting only the deterrent monetary policy, and in recession, in their opinion, the stimulating fiscal, not a monetary policy, should be used.

The presence of external lag due to the complexity and possible failures in the mechanism of money transmission. The external lag is a period of time from the moment of adopting measures to stabilize the economy (decision-making by the Central Bank to change the amount of money supply) until the emergence of their impact on the economy (which is expressed in the change in the value of the issue). Purchase and sale by the central bank of government securities are carried out quickly, i.e. The credit capabilities of commercial banks quickly change. However, the mechanism of money transmission is long and consists of several steps, each of which fails.

1) The policy of "cheap money", conducted by the Central Bank, can provide commercial banks with additional reserves, which expands the credit capabilities of banks, but this possibility may not turn into reality. There is no guarantee that with an increase in reserves there will be a corresponding increase in loans issued by commercial banks. In addition, the population can decide not to take loans. As a result, the monetary mass does not increase.

2) The reaction of the money market on the growth of the proposal depends on the type of money demand curve. A serious drop in interest rates will occur only if the demand curve is cool, i.e. If the sensitivity of the demand for money to change the rate of interest is small. If the demand for money is very sensitive to the change in the interest rate (the curve of demand for money is common), then an increase in the money supply will not lead to a significant decrease in the interest rate (Fig. 2. (a)).

3) a significant decline in the interest rate as a result of the growth of the money supply may not lead to a serious increase in investment costs, if their percentage rate change is low (curve investment curve) (Fig. 2. (b))

1) if the sensitivity of investment demand for the rate of interest rate is high, and investment costs have increased as a result of the incidence of interest rate, the growth of total costs may not lead to an increase in real issuance, if the economy is in full-time employment (at the level of potential production), which corresponds to the vertical curve cumulative offer (Fig. 2. (B)).

Thus, the violation in any link of the transfer mechanism can be reduced to no or substantially weaken the impact of monetary policy on the economy.

Moreover, the presence of significant external lag in the monetary policy, i.e. Loading the impact of changing the offer of money on the economy due to multi-stage money transfer mechanism (even if there is no failures in its functioning) can lead to destabilization of the economy. For example, a decision on an increase in the money supply, adopted during the recession, can give its result when the economy will reach the boom, which will cause the strengthening of inflationary processes. Conversely, the sale of state securities to the Central Bank in order to reduce business activity in the conditions of "overheating" of the economy may affect when the economy will be in a deep decline, and it will only aggravate the situation.

The presence of side effects caused by a change in money supply, which also reduce the efficiency of monetary policy. So, if the central bank increases the money supply, then the interest rate falls, i.e. Alternative costs of cash storage are reduced. Under these conditions, the population may prefer to translate funds from deposits into cash, which will reduce the deposit rate (CR coefficient equal to the ratio of cash to deposits (CR \u003d C / D)). At the same time, the drop in the interest rate (loan price) reduces the interest of commercial banks to issue loans, increasing their redundant reserves (Excess Reserves), which affects the value of the redundancy rate (RR coefficient equal to the ratio of reserves to deposits (RR \u003d R / D) and represents the amount The norms of mandatory reserves (UR) established by the Central Bank, and the norms of excess reserves (ER), determined by the commercial banks themselves (RR \u003d UR + ER)). The growth rate of the deposit and reservation rate leads to a decrease in the value of the money multiplier, which significantly weakens the effect of the impact of the monetary pulse to the economy (Fig. 3. (a)). The growth of the monetary base from H 1 BC 2 can lead to an increase in the monetary base from M 1 to M 2, if the multiplier value does not change, and only to M 3, if a decrease in the value of the money multiplier is reduced due to the growth of the deposit rate (as in this case) and / or reservation standards.

The inconsistency of target landmarks (target dilemma) of monetary policy. The fact is that the central bank cannot simultaneously regulate the money supply and interest rate, since both of these indicators determine the coordinates of the cash market equilibrium. If the Central Bank aims to maintain the interest rate at the same level, since with an increase in demand for money (shift to the right curve of demand for money from MD 1 to MD 2), the percentage rate increases from R 1 to R 2 (Fig. 3. (B )), The central bank should increase the money supply to MS 2, that is, can not control the amount of money supply, and it becomes from the exogenous value of the endogenous value, fully subordinate the purpose of deduction at the constant level of interest rate. Conversely, if the Central Bank places the goal of maintaining the constant value of the money supply, it loses control over the interest rate, since with growth of money (from MS 1 to MS 2 in Fig. 3 (b)), the interest rate will decrease (from R 1 to R 3), and when a reduction in money supply, the interest rate will increase.

As a result, monetary policy can lead to destabilization of the economy. If the central bank for stabilizing the economy puts its task not to control the proposal of money, but maintaining a percentage rate at the same level, then the growth of income (release) during the rise will lead to an increase in transactional demand for money and, therefore, the total demand for money, which is unchanged Money offer will cause an increase in interest rate. To reduce the bet before the initial level, the central bank is forced to increase the offer of money, which as a result can create an additional impetus for economic growth, turning a healthy rise in the inflation boom. During the recession, the policy of maintaining the constant interest rate will lead to the fact that the central bank to prevent the incidence of a percentage rate caused by a decrease in total demand for money as a result of a decrease in business activity should reduce the offer of money, which will have a consequence even greater reduction cumulative demand and strengthening the decline.

Loss by the Central Bank of Control over the proposal of money in the conditions of the dependence of the monetary policy from the fiscal policy of the government. In this case, the offer of money also turns from an exogenous value into endogenous. If the Central Bank's activities are aimed at solving budget problems, i.e. Ensuring the financing of government growth (when conducting a stimulating fiscal policy) or financing deficit state budgetThe monetary policy becomes completely subordinate to solving the problems of fiscal policy. As you know, an increase in government spending and the state budget deficit can be financed by: a) the purchase by the Central Bank of state securities or direct emission of money (the so-called monetization of the state budget deficit); b) buying state securities to the population (internal debt) and c) loans from a foreign sector ( external debt). If for some reason, debt financing is impossible (as a rule, in economies of developing countries and in transition) or is considered inappropriate, the government uses an emission method that, on the one hand, provokes inflation, and, on the other, deprives the central bank independence In determining the directions of monetary policy. Monetary policy becomes a "hostage" solution of fiscal problems.

In addition, the monetary policy of the Central Bank cannot be independent, and the proposal of the exogenous value in an open economy in the regime of fixed exchange rates, since the change in the proposal of the national currency (CBC intervention interventions), especially in the conditions of absolute capital mobility, is subject to the maintenance goal at the constant level currency rate National Monetary Unit.

Bank credit policy - program and direction of actions of a credit institution in the provision of loans to legal and individuals. The credit policy is based on acceptable for financial organization Risk ratio of profitable operations.

Factors affecting credit policies

The Bank's credit policy is determined on the basis of macroeconomic external and microeconomic internal factors.

Her macroeconomic components are the general economic situation in the country; political stability; stage economic cyclewhich state passes; inflation rate and interest rates; state of national currency; Competition in the banking sector. In general, these are the factors for which the credit organization cannot affect independently.

Special place occupy legal questions. So, regulators can have a significant impact on the credit policy of the banking system by sending directives, changes in interest rates, the size of mandatory reserves, etc.

Microeconomic factors affecting credit policies include, above all, the resource base, the cost of attracting money resources, the client base; Bank specialization; Liquidity of the credit institution. The qualifications of staff play not the last role, its readiness to work with various categories borrowers.

Goals and credit policy tasks

The main purpose of the bank's credit policy is to obtain maximum profits at a minimum risk level. Based on the possible ratio of these components, as well as available resources, a credit institution determines the current tasks:

- directions of lending;

- technology implementation of credit operations;

- control in the lending process.

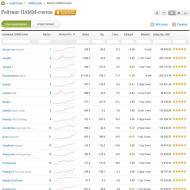

Credit policy in working with legal entities

As a rule, the credit policy of banks when working with legal entities is aimed at the development long-term relationships With borrowers. At the same time, the determined customer selection criteria are based for cooperation. The following requirements are usually imposed: transparency of the company's income schemes, sustainability and business profitability, successful experience in various economic conditions, availability of equity, the possibility of providing security.

When interacting with small business and individual entrepreneurs The identity of the head, his reputation and credit history play not the last role.

Credit policy for individuals

Based on credit policies, bank employees build their work with retail clients, choose this or that model of scoring, develop credit products.

At the same time, based on credit policies, the bank can focus on such segments as retail lending in trading networks (POS-lending), car loans when interacting with dealers, provision of mortgage loans, etc.

Credit policies are determined by the requirements for borrowers: age, minimal work experience, income level and other indicators.

In addition, it affects the offered bank products: Secured or unsecured, target or non-target loans, credit times, etc.

Based on the credit policy, the Bank defines interest rates corresponding to the risk of a borrower. At the same time, the credit policy of various banks can seriously differ. Thus, some financial institutions are guided primarily to the provision of loans at sales points - for example, Home Credit Bank, Russian Standard, etc. Alpha Bank is also noticeable in this market. A number of credit institutions are actively involved in express lending: OTP Bank, National Bank "Trust", etc.

Interest on this kind of loans is higher, but at the same time banks take higher risks.

Others credit organizationsOn the contrary, focus mainly on customers with large balances on accounts. So, for example, the subsidiaries of foreign credit institutions - Citibank, Raiffeisenbank, etc., often come.

Implementation of the Bank's Credit Policy

The Bank's developed loan policy is the general main activities. Its further implementation is to make up the relevant instructions and other documents regulating the conduct of certain operations that determine the criteria for assessing customers and the stages of interaction with them.

Credit policy is not something and forever defined in the bank. It should be reviewed depending on the changing economic conditions.

Money-credit policy - A complex of interrelated activities undertaken by the Central Bank in order to regulate the aggregate demand by the planned impact on the state of the loan and money circulation.

Monetary policy can be aimed at stimulating loan and monetary emissions. In this case, takes place credit expansion.A central bank adheres to such a policy in the conditions of a decline in production and an increase in unemployment, seeking to revive the market conjuncture. On the contrary, in the case of an economic lift, wanting to prevent overheating of the economy, the central bank holds back the loan and limits cash emissions. Then takes place credit restriction.

The important task of the Central Bank in the field of monetary policy is monetary control in order to prevent inflation or reduce its pace. The basic question for such regulation is how much money is necessary for conversion, and what principles should be guided during monetary policy.

All monetary policy tools can be divided into two groups: common tools affecting the monetary market as a whole; and selective tools intended to regulate specific types of loan or lending to individual industries, large firms.

Common monetary policy tools Central Bank are: operations on the open market, percentage and interest rate (discount) policy based on the change in the accounting rate; Establishing the norm of mandatory reserves for commercial banks.

We give a brief description of the main monetary tools.

Operation Operations - It is a purchase and sale by the Central Bank of State Securities

Salesecurities to commercial banks and others financial institutions The central bank leads to a decrease in the reserves of commercial banks. Accordingly, the possibilities of commercial banks on providing loans to their customers decrease. As a result the offer of money decreases.

Purchasesecurities in commercial banks give the opposite result: reserves of commercial banks and their ability to issue loans expands the offer of money is growing.

Open market operations are effective in those countries where there is a capacious market of government securities.

Accounting percentage (discount) policy The central bank is to regulate the size of the interest rate (discount), in which commercial banks can borrow reserves from the Central Bank.

If the central bank raises the official accounting rate Commercial banks reduce the volume of borrowing, which, in turn, leads to a decrease in reserves, increase interest rates and reduce credit operations.

Lowering a bid. The Central Bank creates the conditions for increasing reserves and reduce interest rates, and the amount of credit operations is growing.

The percentage rate mechanism was effectively acted at the beginning of the 20th century. In the future, the use of this instrument of monetary policy gave a smaller result. This was facilitated by the actions of banking monopolies, which established interest rates on a collusion, and not under the influence of the market. Internationalization economic Life Also reduced the effectiveness of accounting and interest policy: a decrease in the accounting rate can lead to an outflow of capital from the country.

Setting the norm of mandatory reserves Commercial banks are also used by the central bank for direct impact on the value of bank reserves. This tool allows you to quickly affect the financial situation.

The monetary policy of the Central Bank is presented in two types:

The policy of "cheap" money. It is held during the recession period in order to stimulate investment and expansion of production.

Central Bank Increases Money Proposals by:

Reduce the norm of mandatory reserves;

Discount rate reduction;

Buying on the open market of government securities.

The policy of "expensive" money is carried out during the period of inflation in order to reduce the aggregate demand.

The central bank at the same time reduces the money supply by way:

Increasing the norm of mandatory reserves;

Increasing the accounting rate;

Sales on the open market of government securities.

The effectiveness of monetary policy. The question of whether credit and monetary policy is capable of ensuring full-time without accelerating inflation, remains open. This is explained by the fact that the use of monetary policy for this purpose has its pros and cons. Consider them.

TO advantages of monetary -credit Policy It is usually referred to as its faster action compared to the fiscal policy and the fact that monetary policy is less subject to political pressure than fiscal.

The disadvantages of monetary-credit Policy It is that it is less effective in part of the prevention of a decline than in curbing inflation. It is also noted that its positive effect can be absorbed by changes in the speed of circulation of money and the fact that it does not always lead to a significant change in the cost of investment in the economy.

conclusions.

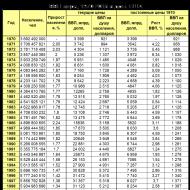

1. Monetary system - This is a form of organization of money circulation.

2. The money supply resulting in the country is conditionally divided into monetary aggregates (M 1, M 2, M 3, L), differing in the degree of liquidity.

3. The demand for money is the interest rate function. The demand for money is determined by transaction and speculative motifs.

4. The offer of money is relatively stable and determined by the state.

5. The monetary market forms an equilibrium interest rate.

6. Motion form cash capital Is a loan on the principles of repayment and payability. Credit system Includes banks and other credit and financial institutions that are financial intermediaries.

7. Banking system - Two-level, includes the Central Bank and commercial banks. Commercial banks exercise passive I. active operations In order to extract banking profits.

8. The Central Bank carries out monetary policy through the accounting rate, the norms of mandatory reserves, operations on the open market.

Questions for repetition

1. Name the main functions of money.

2. What are the components of the money supply? Do they differ in the degree of liquidity?

3. What depends on the demand for money for transactions and the demand for money from the assets?

4. What are the consequences of increasing money in the economy with part-time?

5. Why is there an intermediate goal in carrying out a monetary policy?

6. Show what happens if the Central Bank increases the rate of mandatory reserves.

Credit policy tools conducted by the Central Bank of the country.

Goals and monetary policy tools.

Credit-money policy GOS-V. Changes in a change in the money supply (amount of money in circulation) in order to change the demand, price level in the national economy, the volume of national production and employment.

The main goals of monetary policy are:

1. + stimulating loan and cash emissions with economic stagnation (cheap money policy);

2.- Detection of a loan and monetary emission in inflation (policy of expensive money).

The change in the money supply is carried out mainly, not by increasing or reducing cash emissions, but through the impact on the volume of commercial lending.

Credit-money policy It is carried out by regulating the money supply in circulation.

Act threethe main tools that allow the central bank to influence the monetary offer in the country:

1. Replacement of reserve standards: Part of the money Bank stores at the Central Bank on the account.

2. The performance of the purchase and sale of government securities on the open market. The State Securities of the Central Bank increases the monetary proposal in the country, and the sale - reduces.

3. Installation of the account (refinancing rates). The percentage, under which the central bank issues a loan to other banks. Such loans do not require compulsory reservation. The low rate allows the bank to give loans to the people, also under low rates. And vice versa.

Advantage The efficiency of its influence on the economy.

Disadvantages Inefficiency during deep depression

Cheap money policy It is carried out with a decrease in the values \u200b\u200bof real GDP and the growth of unemployment, it is aimed at raising the level economic activity and employment by expanding lending to business entities. This is possible when the cost of loans is cheated, i.e. reducing their interest rates

Politics of expensive moneyThe Central Bank sells government securities, increases reserve standards and refinancing rates. As a result of the reduction in the amount of money in economic circulation, interest rates increase, and the number of people wishing to take expensive loans will significantly decrease.

| Cheap money policy | Politics of expensive money |

| Problem: recession, unemployment | Problem: Inflation |

| Central Bank should buy securities, lower the rate of mandatory reserves or interest rate | Central Bank should sell securities, increase the rate of mandatory reserves or increase the interest account |

| Money offer increases | Money offer is shrinking |

| Interest rate Reduced | Interest rate increases |

| Investment expenses are increasing | Investment expenses are reduced |

| Real CHDP increases in the amount of multiple investment increase | Real CHDP is reduced by the amount, a multiple decrease in investment |

| Unemployment is shrinking | Inflation is shrinking |

43. Commercial Bank: concept, types, functions.

Bank - The Economic Institute engaged in the involvement and placement of monetary resources. Commercial banks Prest. sob. The main "nervous" centers of the monetary system. Sovr. commercial Bank Yawl. Credit and financial institution of a universal nature. In the early stages of the development of banking, commercial banks served mainly trade, led to transportation, storage and other operations related to TOV. exchange.

Functions of commercial banks - it is first of all accumulating indefinite deposits (maintaining current accounts) and payment checkswritten on these banks as well providing loans entrepreneurs. These credit institutions Also carry out calculations and organize a payable turnover on the scale of the entire national economy. On the basis of their operations, credit money arise (checks, bank bills). At the turn of the 80-90s. The active introduction of commercial banks in different countries In the insurance business. As a result, customers of commercial banks can use the services of the widest range.

Commercial banks can classify:

1. At the form of ownership. Depending on the ownership of capital allocate:

State banksIf the capital of the commercial bank belongs to the state. Distinguish two types of state banks - central bankswho carry out their operations and policies in accordance with the requirements of the economy, not to make their goal. State commercial banks produce servicing branches of the economy whose lending is unprofitable to private capital, ensuring the state policy in the field of lending to the economy, having an impact on investment, intermediary and calculated operations.

Joint-stock banks are the most common form of ownership of banks at the moment. The capital of such banks is formed by the sale of shares. Open joint-stock companies distinguish (OJSC) and closed joint-stock companies (CJSC). In the first case, the shares are sold to everyone, in the second - distributed only among the founders or other, pre-a certain circle of persons. The main constituent document of joint stock banks is the Charter.

Cooperative (mutual) banks whose capital is formed by the implementation of PAEV. There are rare in practice.

Municipal banks are formed at the expense of municipal ownership or in the management of the city.

Mixed banks, when the bank's own capital unites different forms of ownership.

Joint banks, or banks with participation foreign capitalif they are authorized capital Belongs to foreign participants or branches of banks in other countries. For example, in Russia in 2008, there were 202 banks with the participation of foreign capital.

In accordance with Federal law №395-1 "On banks and banking activities»Banks in Russia can be created as a society with limited or more responsibility, joint-stock company (open or closed).

2. By character economic activity There are emission, commercial, specialized banking institutions. The issuing bank exercises the issue of banknotes, respectively, the authority of the country's central bank is in the role of the issuing bank. Commercial banks are credit organizations that produce credit and settlement services for industrial, shopping and other enterprises and organizations, the population. Specialized banking institutions are engaged in lending a certain type of activity (for example, mortgage, investment, savings, sectoral and other banks).

3. In terms of credit issued loans, short-term banks are distinguished - issues loans for up to three years, and long-term lending - issue long-term loans (Over three years, for example, mortgage).

4. Economic signs are distinguished depending on the serviced industry - industrial, trade, agricultural banks.

5. Banks are divided into local (regional), federal, republican and international.

6. The size of large, medium and small banks are highlighted.

7. In terms of volume and variety of operations, banks are divided into universal (perform all types of operations) and specialized (mortgage, investment, innovative, savings and other banks). The list of operations performed is determined by the license.

8. According to the presence of the branch network, banks are distinguished with branches and without branches. For example, in the Russian Federation, according to the results of 2008, there were 809 branches of Sberbank of Russia - the extensive branch network itself.

Despite the existing various types of commercial banks, they all have in their composition authorities who manage their activities.