PAMM account brokers. List of the best of the best this year. How to choose the best PAMM account? Independent rating PAMM

To choose from the rating a suitable company in Russia, you need to study in detail the principles on which it builds its work. Among the criteria indicating professionalism, it is possible to note the effectiveness of the managers, the duration of work in the market with accounts, the reputation of the PAMM brokers in the medium of the best participants of Forex. We also recommend paying attention to the proposed conditions for the percentage of remuneration and distribution of damages, the effectiveness of the technical and information support for customers and the availability of positive feedback from the exchange professionals.

Our current rating of forex brokers with PAMM accounts 2017-2018 will be useful both for beginners and experienced investors. The best traders with a large investment portfolio and / or the decision to diversify risks also learned the information necessary for themselves.

The goals and objectives of the rating are to provide traders and potential investors of an effective tool to evaluate the work of the best PAMM brokers and assistance in choosing a suitable company. We strive to make Russian trading clear and transparent for everyone. After you have chosen from the rating of brokers with PAMM accounts, it is worth moving to their questionnaires and read reviews. If everything is satisfied with everything, you can proceed to investment and expect profit.

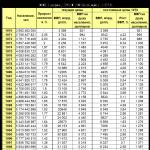

The rating contains information on the PAMM Governing Alpari, based on the entire history of their trade in the broker. The goal of the rating is to highlight the best Alpari Forex traders who deserve confidence and are most attractive to investment in PAMM accounts.

The term of work, the indicators of the average profitability and risk of PAMM-Managing, take into account all the statistics of its trade on all PAMM accounts, including those that are already closed. The number of investors, the amount of investment, the amount of the commission is considered only on open PAMM accounts.

What pamm managers are involved in the ranking?

- working period of at least 2 years;

- there is an open PAMM-account investment in the main rating (not in the sandbox);

- there is a positive PAMM;

- rank manager at least 1.

What PAMM accounts of the Manager are taken into account?

The ranking takes into account all the PAMM-accounts of the manager who were published on Alpari. Even if the trader closed or merged his account, its history is taken into account in the calculation of the ranking of the manager. Those Alpari Forex traders who traded only on non-public PAMM accounts are not involved in the ranking. If the trader traded to alpari under different nicknames, he can combine them in one PAMM account on our website.

How is the rank rank?

The rank of the manager is a summary assessment of its experience and quality management. The rank is considered on a scale from 0 to 5. It takes into account the following PAMM control characteristics:

- work experience

The overall calendar term of the manager on all PAMM accounts. The more experience, the more reason to believe that the manager will cope with any market. The highest score is raised after 3 years of work. - Number of trade (active) days

This is also an assessment of experience, but from the point of view of the significance of the statistical. Only trade experience is taken into account in the form of open transactions on Forex. Transaction waiting time is ignored. The highest score is raised after the accumulation of 600 trading days. - Calmar for all time

The average coefficient of Kalmar (income / risk) for all time on all PAMM accounts of the manager. Indicator of trade quality in relation to income / risk. It is considered an average weighted coefficient for all PAMM accounts, including closed. The more this coefficient, the general, is better than trade of the manager. - Calmar over the past year

Shows what the dynamics of the account has recently. Trade can occur with varying success, Kalmar recently shows how successful the current trade is. - Standard deviation

Shows how stable the results of the manager. The value in percent is the likely variation of the monthly yield around its average value. The average weighted indicator for all PAMM accounts is considered.

Each of the indicators is also ranked from 0 to 5 and with a certain weight is added to the general rank. The term of work and Kalmar for all time have a double weight.

How to choose a control paмма account to make a profit for a long time? What is the PAMM account and PAMM managers the most profitable? How to prevent errors when choosing a PAMM account and not to invest in a permissive project?

After all, the PAMM account today is one of the most favorable types of investment activities. Here the main thing is to correctly realize your capabilities, and how to do it today and tell you today.

How to choose through PAMM rating?

First of all, when choosing a PAMM account, you should pay attention to its length of existence, because successful PAMM managers traded over the years.If any PAMM accounts like you, but the time of their life is less than six months, then it should not be hurry, it is better to wait a little and look. Competent PAMM managers on the stock exchanges of Russia will not disappear. Well, if you see that any of them merged, you will thank yourself that they did not invested in a permissive project.

Next, pay attention to the residant level.If PAMM controls merge up to 90% of the deposit, and then some miraculously restore the account and begin to earn money, then experts do not recommend investing in such as such a recovery is a simple luck, which you understand not often.

Some of the experienced investors also recommend paying attention to the percentage of their own funds that PAMM managers invest in PAMM accounts.But many of these criteria are skeptical, since the big proprietary capital of the manager is not proof of its good trade. What we fully agree with.

Then how to choose a manager who really knows how to trade? In this, you will help the rating of the best managers from the alpari broker.

How to choose an account manager for rating?

So, to choose profitable PAMM accounts, it is necessary to explore the rating of the best managers. Consider on the example of one of the largest companies in Russia, providing the possibility of investing in PAMM accounts.

In the statistics of the account, risks are taken into account, also the average profitability, deadlines, and other indicators of all ever-open controls of PAMM accounts, including those that he already closed. But the amount of investments and the number of investors, plus commissions, are taken only on existing accounts.

In the rating of the best managers from our alpari broker, only those who correspond to these conditions are included:

- from 2 years of work on the market;

- there is a real (not in "sandbox") available for investment PAMM account;

- pAMM account has a positive profitability;

- directly the level of control over PAMM account, from 1 and more (maximum rank 5).

PAMM accounts and their alpari managers: how to choose?

So, that first of all when choosing our PAMM account should be studied the ranking of the best managers we know.

To do this, we turn to the advice of experienced investors.

The yield, which was shown to us PAMM managers in past periods, probably such no longer will remain. Although you say: "After all, you do not lie!". The point here is that the figures of profitability are calculated on the method of complex interest, otherwise, the profit is constantly reinvisory. This chip is known to investors, but newcomers are often come across it.

Now consider on the real rate of profitability, one of the leading managers of PAMM accounts.

Approximately two years (point number 1) yield amounted to 500%, in other words per year 250%. And for the second year - increased to 800%, that is, another 300%.

The following aspect - credit shoulder

Here it is necessary to understand that the shoulder size is completely dependent on the size of trading speeds. In other words, the more trader of transactions will be made (increasing their volume over the month), the less our shoulder size.

Suppose: from 1: 500 shoulder can drop to 1:25. Thus, most brokers come, since no one is going to provide large loans for substantial amounts.

What effect does all this affect the investment in the PAMM account?

Leading PAMM managers, over time, begin to attract more investments, due to which the average monthly turns increase, which means the shoulder size will gradually decrease. Etc! That is, if in previous periods it was possible to open the orders of large volumes, then with a decrease, there will be no such possibility.

As you know, in monitoring any PAMM account there is a special tab, which is called "the shoulder used". And according to experienced investors, this information when choosing a PAMM account and finally, its manager can bring a lot of benefit.

Let's consider in the example:

The chart above showed a good profitability, and the drawdowns of a small size, if present, then they are not long. Now we enter the "Used Credit Shoulder" tab and we observe the following:

The lower chart shows the yield that is practically no different from the first graph. The schedule from above indicates the load of the deposit. Black dots, we specifically noted the most interesting moments - the maximum drawdors, accompanied by the maximum loads of our deposit.

This indicates that during the appeal period, when the amount of the deposit decreases, the manager is engaged in increasing positional volumes - an unprofitable strategy.

Next Board - Invest in preparations

If you chose the manager, appreciated and understood its trading methods, as well as confident that he will continue to show good results, to invest in his account - wait for drawings. As you understand, even experienced traders are not insured against appeals, this is the market. But this does not mean that when drawdown, the experienced manager will decay the whole deposit.

Here at the time of the drawdown and should be investing, as long-term climb will follow the drawdown. But most inexperienced investors do not take into account and are invested at the peak of profitability, and come out respectively in drawdowns.

Here is one of the excellent examples how to act should not:

In the lower chart, we see the profitability of the account, but on the top there will be a change in funds. It can be noted that in 2011 it begins a sharp infusion of funds as the previous year drawdowns have practically absent, which attracted investors. The growth continued until mid-2011, but at the first more or less serious drawing, most investors from this account came out. That is, the contribution was made at the peak, and the exit to the drawdown.

Thus, they did not earn nothing. Therefore, experienced investors are recommended to invest in the drawdown and leave them at the peaks of profitability.

Do not choose the "Cosmonauts" rating in PAMM

If you are facing the question of how to choose an account manager, then experienced specialists recommend avoiding the so-called "cosmonauts". Cosmonauts, this PAMM managers who could literally in a matter of days show archive high yield. As you understand, this is not professionalism, but simply a banal promotion to access the leading position in the ranking.

Below, you can see one example of such a "space" account:

As you can see, for some 4 months, the manager of this PAMM account has achieved a yield exceeding 4,000%. Well, straight a tale of some kind!

In general, it is necessary to study the rating of the best managers, choose the most likely, understand its shopping principles and of course contact him personally to ask all the nuances. Well, if he is able to answer secretly, motivating the "secrecy" of trading methods, or it will not be able to clearly explain anything at all, then do not rush to invest in his account, but think about it all several times.

As a rule, experimental PAMM managers, even in a few words can explain what methods in the trade are using, as they know that a serious investor will never put its own funds in it is not clear that.

Forex brokers, or as they are often called dealing centers - these are companies that provide intermediary services to their customers at the international interbank currency exchange Forex. Their range of services today is very large.

Approximately 5 years ago, the companies provided for trading only currency pairs, now almost every broker focuses on PAMM investment, options, raw materials, shares, indices, and other top tools.

Broker is an intermediary, without the assistance of which a trader - a natural or legal person cannot trade in the foreign exchange market. Work is carried out through the trading platform, which the broker provides the client when opening a trading account.

The best trading platform in the world is undoubtedly MetaTrader 4. With the help of it more than 80 percent of the traders of the world traded. But now with the emergence of new technologies, earn, you can and without applying any effort. This applies to PAMM investment.

PAMM account is a unique investment system, with which investors can passively earn, trusting their money manager. The PAMM account system works like this:

- The trader opens a PAMM account, replenishes it to a certain amount - this is called the capital of the manager. This capital, the trader risks on a par with the capital of the investor. After that, the trader fills the questionnaire, where all the conditions of cooperation (separation of profits, the percentage of Down Drow, etc.) is indicated.

- The investor analyzes the monitoring of PAMM accounts and views an independent rating of PAMM-sites. Then selects the top accounts and invests;

- Managing trader trades. The work participates both the capital of the manager and the investor money. Profits and losses are divided under conditions. All this happens automatically and proportionally.

Daily trading volumes in the Forex market are the largest among all financial markets in the world. Therefore, investments in the PAMM account is very promising. But in order not to go bankrupt and steadily earn money to monitor all top bills.

PAMM accounts on brokers

Undoubtedly, to make consistently earn at PAMM accounts, you need a good partner (broker). Foreign companies are considered the best brokers, the lion's part of which is registered on various islands. Usually professionals choose them, since these firms have tremendous experience and most of them are very reliable.

Although recently in the West bankrupt and top brokers who have experienced work experience for more than 20 years, for example, EFCO (USA), Sovereign Group (Switzerland) or Alpari (London).

All this makes you think to invest money or not. Most of them provide services only by currency. Speaking about the rating of PAMM accounts Forex, today you can highlight 6 companies whose PAMM accounts are the best:

- Alpari;

- FXPRO;

- RoboForex;

- InstaForex;

- Forex Club;

- Forex4you.

The most authoritative brokerage companies are usually considered to be firms with extensive experiences, with a special license and regulatory authorities. But the presence of a brokerage license and controls does not guarantee the preservation of your money, but this is another plus when choosing a PAMM account.

Also do not forget to study the history of the company - it is of great importance.

Before choosing a PAMM account, to start learning the rating and monitoring of all accounts, then go to their official sites, find out the reputation, read the reviews. On the Internet there are a huge amount. And most importantly, look at the trading conditions.

Now many brokers reduce spreads, reduce the minimum deposits and offer many different bonuses for new investors.

Analysis of pamm sites

Alpari is the leader among all forex brokers not only on classical trading, but also by PAMM accounts. The company constantly employs about 2 thousand PAMM accounts. PAMM account rating is updated daily. Trade conditions are one of the best on the market.

The average profitability of the PAMM account in Alpari is about 15% per month. Alpari's PAMM accounts accounts monthly undergo an independent audit.

NORDFX is an international brokerage company providing its customers with online trade in currency, cryptocoluts and precious metals. For 10 years of work in NordFX, more than 1 million bills were opened, and the company itself became the owner of a plurality of prestigious awards. Clients are offered three types of accounts - Fix, Pro and Zero. The minimum deposit is from $ 10 to $ 100. Accounts can be open both in USD and in Bitcoins or Ethericums.

In addition to online trading, among the services of this broker, portfolio investments in the promotions of leading global brands with a guarantee of attachment protection up to 100%, as well as the newest automatic copying platform for RAMM trading signals with the level of permissible risk. The minimum deposit for the RAMM-Managing $ 50, for the investor - only $ 10.

FXPRO. The company operated on the market since 2006, registered in Cyprus, regulated by the FCA (non-state company - is engaged in regulating financial activities in the UK). PAMM-accounts of this company in our ranking rank second place. Since this service appeared quite recently, and is not yet promoted.

RoboForex. Unlike other companies, RoboForex has its own investment system. It is called the RAMM account. Its basic principle is copying transactions. That is, you do not invest money in the manager, but just buy signals from him. All this is done automatically.

PAMM-BUTTER FOREX BROKER INSTAFOREX - are the best in Asia. The company has more than 1 million clients worldwide. The advantages of investing InstaForex are transparency, independent rating, deposits from $ 1, high yield and safety.

Forex Club is one of the oldest brokers in the Russian market. The broker is good, but unfortunately a year after year loses its appeal.

Forex4you - the Forex market has 9 years. The company has two ways to invest. The first is the copy of the transactions, the deployment is called Share4you and the second is confidential PAMM management. In principle, the conditions are not bad. The main thing is to properly invest and rationally distribute money.

... which is such a service as PAMM.bills. You want to get an additional income ... it does not spoil. from statistics, the volume of trade with a broker using PAMM.bills, 20 times more intermediary PAMM.bills Do not use …

All about the market Forex ...

Signals Zulutrade and PAMM-account Alpari - what to choose?

on Forex. Services Zulutrade \u003e\u003e\u003e Benefits PAMM.—bills Alpari: ● Simple and convenient ● Connection diversification ... ● Trader PAMM.—bills Profit from positive trading. Weak investment B. PAMM.—bills: ● Main ... from the supplier. And last. PAMM.—bills You have more statistics Trade and suppliers ...

All about the market Forex ...

Analysis of PAMM accounts. It's so cool.

I decided to analyze how well to invest PAMM.—bills. Judging by the advertising - it is generally ... with statistics We see that 10 466 is registered in the system. PAMM.—bills. Playing ... such a recession - PAMM.bills It appeared relatively recently. Grow oldest bills 1056 days ...

Analysis Read more ...

PAMM account rating. Results for 3 months.

Result: -44.61 ... But still for this statistics I can't make a conclusion ...

Analysis Read more ...

Evaluation calculations for PAMM account, January. All Forex models do not merge!

... ranking PAMM.—billsI chose himself. This time I will summarize the profitability of these bills .... Screens to return these PAMM.bills, Upper December 15, Lower ...

15 bills, Nine months showed minor changes (less than 5%). statistics for others …

Analysis Read more ...

Forex-My PAMM accounts?

… , PAMM.—bills In reality in the forex market or not?! For interest, he decided to see statistics "Leaders ...

year in the form of 2 million. Maybe in this score Account is taken into account "Investors"?!

Analysis Read more ...

Exclusively. Tomorrow we will start with a PAMM account account.

... forecast. Tomorrow we will launch a robot PAMM.—score! We decided to give him a small deposit ... Justice, now fight PAMM..

You do not talk about the website and hosting ... Think of our PAMM. For investment, this time will be small statistics. Everything …

Analysis Read more ...

Why after March 11, 2016, the indicators of the famous anonymous PAMM-account TRUSTOFF?

from 971% to the present -27%, see statistics Below or at http: // www ... Public PAMM. Leaders eliminate possible manipulations with anonymous PAMM.—bills and attract investors to PAMM.—bills True existing traders.

The main conditions of participation are: PAMM.—score …

Analysis Read more ...

Restricting PAMM-account loss on Forex

choose PAMM.—score, Analyze "from" and "earlier." In addition, we must PAMM. ... (manager score) can also lose all hope and just "drown", PAMM.—score. That is why it is better ...

it's all score was lost. Investing B. PAMM.—bills - very difficult. Restriction ...

Investing in PAMM account

remove funds S. bills Investor. Also mechanism PAMM.bills Allows you to send a piece ... So. Investing myths in PAMM.bills: 1.

on the PAMM.bills You can earn about 10% per month ... Words about positive sites PAMM.bills. Mechanism itself PAMM.bills Very useful and useful ...

Conditions and definitions

Where to open a PAMM account for forex trading?

PAMM service is a product that is able to satisfy the inquiries of any investor who wants to earn at Forex without independent trading.

All you need is to choose suitable conditions for a successful manager and simply get your passive income from Forex Trading, without understanding, in all the principles and nuances of trade.

Therefore, today we will talk about how to use this service correctly and where it is best to open a PAMM accounts that the result of such investments coincided with expectations.

Open PAMM account for forex?

According to its principle, this account is a percentage distribution module, that is, a certain mechanism with which the method of private investment on Forex has been implemented on the trading platform of the broker.

Similar words, this is an investment account that is managed by a successful trader, taking investors in their own trading and receiving weekly interest from earned profit.

Thus, traders who already have sufficient experience for profitable activities can attract investors and earn much more than trading exclusively on their own money.

At the same time, investors, absolutely not able to trade independently, can invest in the one who is engaged in this at the professional level.

At the same time, each of each - with successful trading operations, the manager receives his commission percentage, and the rest of the income is distributed in the percentage ratio between investors in proportion to their investments.

How to choose a pamm account

Any forex broker, which provides this investment product on its trading platform, there is a rating of managers.

And here you should realize that the managing invested means is a trader that earns on Forex, trading independently. And the more professional skills, the activity will be less risky, and your investments are more profitable.

Thus, choosing a suitable manager, you should pay attention not only to the profit, which the trader earned during the PAMM account management, and in the risks that were present in its trade.

That is, first of all, you need to compare the profitability indicators and trading drawdowns of the manager in a complex with a number of additional criteria, and only then make a decision, it is worth investing or not.

Now about everything in order:

Time of existence of accounting

Pay attention is only on those accounts that work for more than a year, that is, it is necessary to invest in the manager who has already proved its own effectiveness.

After all, the market always changes and many strategies cease to work, so often those who per month have received over 15% over time, do not withstand market dynamics. The "experience" of accounts for more than 1 year is an indicator that the trader is able to receive income under any market conditions.

Profitability

It should be borne here that it is easy to earn more than 150% of the governor's profit is unrealistic. The profitability of the PAMM account over 150% is the indicator that the trader uses aggressive trading systems in a complex with averaging tactics and without insurance orders.

Of course, the profitability of such an account may be fantastic, but it increases the risk that tomorrow he can fully merge, because if the trader neglects the risk management, then this account does not live for a long time. Therefore, you should choose the option, with an annual yield of no more than 100%.

Maximum drawdown

Not more than 20% are considered an acceptable drawdown of Invest Account.

A high level of drawdown is an indicator of using managers to a transaction for more than 2% of the amount of capital, or applying "grid" strategies and systems with martingale. This option is not for us, because if the trader constantly risks steeply, then his deposit will soon "leave the copper pelvis" or simply grafts losses.

Stability of trade

Account exists for a long time without a unprofitable week?

He is also not worth trusted. The point is that usually such indicators are among traders who traded without stops, and unprofitable transactions averaged that it is fraught with unpleasant surprises in the form of a serious drawing or complete "plum". Therefore, on a series with high yield, the trader must have an unsuccessful week that will be an indicator that the manager does not "fly."

Therefore, with the overall profitability of the PAMM account, there must be rare small weekly decides.

Capital manager

In the rating, you can often see managers with a large amount of funds - this means that the trader is confident in his abilities. But you can also meet a deposit where the manager threw a permissible minimum, and the entire profit quickly displays - that is, the entrepreneur is not sure of his skills and tries to avoid losses. Therefore, to trust the trader, which, on a number of depositors' money, manages its own major capital.

Forex brokers with PAMM accounts

Today, the PAMM-investment service can use more than 10 Brokerage companies working in RuNet - Forex 4 You, Instant Forex Trading, Alpari Broker, Fibogroup, PrivateFX.

In this regard, you should be guided by the classical criteria for selecting the operator:

- the presence of regulation is of course almost everyone has offshore, but it is better that it was CYSEC

- payment policy of the company - the forums are better to ask how the company displays funds

- the absence of over bonuses - if the company offers huge bonuses, then a broker is sinking and trying to attract customers

- broker reviews - Common reviews should also be positive

By choosing several reliable dealers, it is worth assessing their conditions.

Since the principle of work of PAMM accounts, each forex broker is almost the same, then everything will depend on the amount of funds you have. In addition, other investment conditions are shown in the Offer of the Manager, which can be different on each account.

For example, the Alpari's well-known company allows you to invest an amount from $ 10, which is available today.

In addition, the dealer also offers "wholesale" investment in PAMM-portfolios, which consist of several accounts (minimum investment of 100 US dollars).

The company has already submitted an application for a license of the Central Bank, which increases its reliability rating.

Also, excellent conditions offers privatefx broker. Here, it is possible to become an investor with the amount of $ 20 for a period of 1 week.

In addition, the operator proposes to invest in indexes, in which investor funds are distributed from 3 to 10 PAMMM - the minimum amount from $ 100, for rows from 2 weeks.

Since investment is the main activity of the broker, on its trading platform you can find a lot of professional managers.

Another broker with excellent conditions - InstaForex . The minimum amount of investments in PAMM-account is from $ 10, while you can use the advanced tool for analysis.

This broker also will also be licensed by the Central Bank of the Russian Federation, which allows it to be considered as a potential option.

Risks in investment in PAMM account

Investing, on a number of financial trading itself, is a risky activity.

To reduce the risk level, follow a number of several simple rules:

- Diversify risks - invest immediately into several accounts. So that your profits do not depend on the success of only one person, select 5-7 best managers, and distribute your investments between them. In this case, even if the 1-2 trader lose your capital, due to the profits of other entrepreneurs, you will easily block all losses.

- Invest in strategy with which you can significantly reduce drawdowns and maximize the resulting income.

- Competently choose the managers - do not chase for mega yield, and choose the optimal ratio of all parameters.

Thus, this service is one of the most attractive, for modern investors.

And most importantly - to competently approach this issue and carefully analyze the work of the account and the most brokerage company before investing your funds.

Oleg Novoseltsy, released the site editor

Investing in PAMM-Forex (Forex). Assessment of the best PAMM-2018 services, reviews and options.

What is a PAMM account?

PAMM-account Forex - This is an account transferred to trader trading in accordance with the conditions specified by the PAMM account service for the account of a specific broker and a dealer who will trade on this account.

In this case, the account is under the control of the investor, it can at any time withdraw funds that are transmitted to trading, and, moreover, the investor can make and remove money from his PAMM account. For a trader, the trader receives a certain percentage of profits defined by the proposal. In addition, depending on the type of PAMM account account, the trader may need to use part of its personal assets for trading and ensure the maximum amount of the account.

How to choose the best PAMM account for forex?

What criteria the investor usually chooses a PAMM account and forex investor? Of course, it is, first of all, high yield. It is large quantities as a percentage of profits that are usually misleading people and cause speed. Here is the main error of the investor, which makes many of the loss of your money, not having enough time to feel the forest in their hands.

Of course, good income is good, but yield should be evaluated only in the long run.

Many trading traders use high-risk strategies, such as Martingal. Such strategies can significantly increase transfer, but they can also immediately drain them.

Before choosing a PAMM account for investing in Forex, check the merchant trading for a long period of time (from one year ahead) whether it has a strong deposit drawdown and what is the average income for a longer period. It is possible that the trader now came to the wave, and his store brings high profits, but if earlier there were long negative trading periods, then the risk is high that problems will begin again, this time with your money.

It will be even better if you diversify your investments.

they invest money on various PAMM accounts with different levels of risk and profitability. For example, one third of the funds on a very beneficial PAMM account, which brings a high percentage of profits, but ultimately has a dangerous fall of the deposit. Another third of assets in the middle PAMM-risk and the remaining third of PAMM are the most stable in long-term trade statistics, but have moderate average income.

You can develop your own investment strategy that will bring you a permanent profit.

Most importantly, you spend time and analyze the statistics of trading various traders before you decide.

How to choose PAMM services for investment?

Recently, the creation of PAMM services has become a fashionable phenomenon for brokers, many of them, but if you spend a less serious analysis of these services, most of them are not suitable for less serious investment.

At first glance, it is difficult to determine the quality of PAMM service, and as a result, the investor pays for the error of choice for lost money, missed benefits and lost time.

The main reasons for which PAMM service is not suitable for successful investments:

- The non-octotic technical part and the PAMM functionality that do not allow fully monitoring and evaluating the quality of trading traders for the right choice between investments.

- Lack of opportunities to protect investment capital in the event of trade in non-profit traders, the impossibility of choosing the risk of investment.

- The lack of experienced and successful traders who trade with this broker and are interested in collecting funds to trade among investors.

- The policy of the intermediary (retail seller) was aimed at the speedy removal of depositors' money, and not with the desire to increase the profitability of PAMM.

These are not all reasons, but it suffices to understand that you must be responsible for choosing a PAMM service for successful (profitable) investments.

The following are PAMM-agents that checked the time and completed most of the requirements for investing in Forex.

Investing is very interesting, if you come to this with the mind. Success and stable profit!

Rating Packages and Foreign Investment Services

AMARKETS PAMM account (Amarkets).

PAMM-SERVICE AMARKETS is a modern investment system that opens the doors for financial markets for everyone.

With your help you get the opportunity to make money in the Forex market without any special knowledge and experience. No independent store!

Assessment of PAMM accounts on amarkets.

PAMM-account Forex4you (Forex per year).

PAMM-SERVICE gives you the opportunity to take advantage of one of the most profitable markets in the world - Forex, while you do not need specific knowledge about how such a market works.

In addition, you do not have to participate directly in the trading process. PAMM-SERVICE FOREX4YOU allows you to invest your money in trading with successful merchants.

PAMM account Alpari.

Alpari PAMM account service, one of the oldest investment services of this kind in the CIS market.

Alpari PAMM accounts are used to provide trusted services to lead traders in many countries. Over the past years, such a confidential office prepared by Alpari specialists received many prestigious awards and awards.

The service is constantly developing and in many respects is one of the best PAMM services in the world.

Display PAMM-account Evaluation Alpari (Alpari)

See also commercial alarm services and trust management.