America led the rating of countries in terms of external debt. The problem of the external debt of Great Britain External debt of the UK for the year

Levels of debts of the countries of the world

Against the background of an incorrect debt crisis, let's discuss this issue together.

These are the same data recently once again embarrassed the Internet community, tirelessly following the successes or failures of the Russian authorities:

"Russia's foreign debt last year grew by 83 billion $ 408 million, or by 15.4% and on January 1, 2013 amounted to $ 623 billion, $ 555 million as compared with $ 540 billion as compared to $ 540 billion as of January 1, 2012, the bank data is evidenced Russia. " (Pruf)

Horror? Or not? What does it mean? But why we do not hear periodically: and about fiscal cliffs, and about the periodic default of the United States, and about the full bankruptcy of Greece, even calculated, which height will be a mountain of money that is the US government debt.

Each of you probably at least once thought about such a question: and who should they all? Almost every country should, and many of them have already exorbitant amounts (it seems to me no one expects that the debt will be repaid). If you turn to the brainstorm economists, they put forward their theories here, which we still do not understand. Let's try to understand everything together on it easier, so to speak for the average person and on bright examples ...

To begin with, I remind you how public debt arises. The total amount of state obligations on issued and outstanding state loans received by the lender and the percentage of them issued by the state guarantees is public debt.

Each government in its activities strives to ensure that the revenue part of the budget is equal to the expenditure. In real reality, the consuming part exceeds the revenue, resulting in a budget deficit. The most economically developed countries, as a rule, constantly have a deficient budget (from 2-3% of GDP).

To cover the deficit of the government budget, the state appeals to the loan to national banks, as well as the issue of government securities - bonds. As a result, it appears and grows state debtbecause Government bonds and credit are the debt obligations of the state.

Under external debt Understand the obligations of the state arising in foreign currency. It may be loans to the governments of foreign countries, credit institutions, firms and international financial organizations, it can also be foreign investment.

Recently, in particular, a lot talk about the hard situation in the eurozone. Then there "Babak", then. Greece is coming out, it does not come out. Let's look at the mutual penetration of debts to begin in Europe. The data is a bit outdated, but the trend of the campaign and understand the essence of the question will be sufficient ...

This is the official study of the ESCP Europe 2011 on cross-penetration of debts in Europe.

Arrogors show who someone and how much should, the thickness of the shooter - the size of interstate debts, circles with the names of countries - the total amount of debt (the area of \u200b\u200bthe circle is proportional to the size of the country's total duty). Pay attention to England and Italy

But among other things, it is clear that there are both counter-debts. In the modern banking system, this is considered normal - when everything should all. Any intelligent person in such a situation will offer to simplify the picture, making counterbrockery. Well, let's produce them.

At the same time, it is necessary to understand that in reality, debts are impossible - they are issued with different conditions, different repayment terms and so on, in addition, such a netting will be covered or will seriously enhance the working capital of many financial organizations - which will cause a collapse of payments and the following increasing com . There are many different nuances.

But virtually we can make such - purely formal-digital - relatives. Let's look at the result:

It is excellent that France's debt was practically reset. And she should - a lot of Italy, somewhat less Germany, and even less (but also a lot) Spain. In general, if anyone with debts is fine - this is from France.

But who has very big problems - is also visible perfectly, it is England. England should be Germany and Spain giant (and approximately equal) amounts, and she has little and little.

Italy should be a bad position and in Italy - it should be a lot of France, and no one should have anything substantial.

Oddly enough, in Spain, everything is not so hopeless - she must be French and the Germans, but even more it should be the British, and the debts of Portugal are also rather big. Well, the Germans and especially almost Alles Ordnung - Yes, the debt to France is great, but the same England and Spain must be much more.

Of course, the amount of debt itself is not important - its ratio with the country's GDP is important. It was because of this catastrophe ratio was created first in Greece, Portugal and Ireland (PIG). But the main bubble of European debts hid in England. He will also show himself.

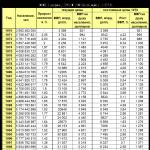

data for 2011

But about the relationship with GDP is very interesting and often for many times. Here we just approach the rating news, which was at the beginning of the post.

In the Economic Report of the European Commission published in the middle of May in 2013. The growth of the public debt is predicted from the overwhelming majority of eurozone states, in particular in Spain, France, Greece, Portugal and Ireland. The analytical information service of the international organization of creditors (WOC) conducted a study of the volumes of the public debt of different countries of the world and forecasts for their increase.

In 2010, the cumulative public debt of the countries of the world exceeded 41 trillion dollars, but at that time an increase in the amount of obligations could be justified by the desire of governments as soon as possible to overcome the consequences of the crisis and return to the pre-crisis levels. According to 2011. Statistical reports have demonstrated the positive dynamics of various economic indicators, including the increase in the GDP of many countries. However, government debts of the 50 largest economies of the world also increased and reached the amount of 55 trillion dollars. The total external debt of these states crossed over 65 trillion dollars. Thus, economic growth last year was due to state affordments, including due to borrowing from no residents.

As can be seen from the table, the leaders of the rating of countries in terms of external debt in most cases occupy the same positions as a year earlier. The foreign debt of the United States according to the results of 2011. It became equal to the amount of GDP, but in the ranking on this US indicator far from leaders. Ireland's foreign debt is almost 11 times more than the volume of GDP, Great Britain - 5 times, the Netherlands and Hong Kong - 4 times. Japan only has an external debt indicator below 50%, but this is probably the only positive moment in the debt situation of this country. The level of Japanese public debt rolls, as shown in the table below.

Compared with the results of 2010. In the top ten, everyone remained in their places, with the exception of Great Britain and China. The latter was able to reduce sovereign debt by 5%, which allowed him to change places with the Great Britain, which debts continue to increase (+ 17%). In addition, in the top ten, the Best State Debt and GDP ratio (25.8%).

The US public debt continues to grow, and its attitude to GDP has already exceeded 100%. But it is necessary to understand that the American economy is the largest in the world, in addition, the United States has opportunities for obtaining emission income. So, even with the continued trend towards an increase in the debt burden, the American economy remains for growth.

Japan with the public debt at the level of 226% of GDP leads in the world

The highest level of debt burden was recorded in Japan, where the amount of public debt to GDP is 226%. The country continues to deal with the consequences of the tsunami mainly through domestic financial injections in national currency, which explains such a high debt rate. Following Japan on this indicator, Greece goes, in third place is Italy, which uses all the possibilities to avoid the fate of Greece. According to 2011. Italy grew by 7%, and France and Germany - by 8% and 9%, respectively. In general, for Eurozone 2011. There was quite successful - economic growth was observed in all countries of the block with the exception of Greece (-1%).

Source: IMF data, WOC calculations

The highest level of debt burden on one inhabitant was also recorded in Japan - 105 thousand dollars. Public debt. In Ireland, which occupies second place, this indicator is lower than double ($ 49.9 thousand). As can be seen from the rating, over the past year, the debt burden in the first twenty rose by more than 10%, with the exception of Sweden and Portugal, where there is a slight decrease in this indicator (by 4% and 2%, respectively).

Russia for all three indicators is in good positions. The level of external debt to GDP in the country does not exceed 30%, its growth for the year amounted to only 6%. The level of public debt is even lower and does not exceed 10% of GDP, and at each Russian accounts for $ 1247. As can be seen from the table below, almost all debt is covered by international reserves.

Source: CIA data, WOC calculations

For several years, the first triple in the ranking in terms of international reserves has not changed, and there remained a rather significant gap between the third and fourth place. But according to the results of 2011. Saudi Arabia overtook Russia and ranked third. Apparently, the Government of this Arab country is increasing the reserve for a black day when oil is over. To get to the second place, Saudi Arabia needs to double the reserve fund. This is possible if oil prices will remain high, and Japan will begin to use gold reserves to solve internal problems.

Forecast of public debt growth in 2012-2015.

Source: IMF data

According to the expectations of the IMF, until 2015. The volume of state debt will continue to increase. Leadership according to this indicator will retain the USA - a bar of 20 trillion dollars. The country will overcome three years. Japan will retain the second place, and by 2015. Its government debt will exceed 15 trillion dollars. Judging by the trends, by 2015. The total debt of the first dozen countries will reach almost 55 trillion dollars, that is, the volume, which today makes debts of 50 states.

We present to your attention, data of the top 10 countries of the world in terms of GDP in 2012, as well as the GDP of some CIS countries in 2012, prepared on the basis of the World Book of the CIA (USA). According to the information presented, the top three did not change leaders, and the first place for the United States, the second for China, and the third for Japan. Russia in terms of GDP rose from 10th place in 2011 to the 9th place in 2012, to overtaken India. In addition to Russia, Ukraine, Kazakhstan, Belarus, Azerbaijan and Uzbekistan entered the top 100 countries of the world with the greatest GDP from the CIS countries.

Countries volume of GDP, US dollars

1. US 15497.321 billion.

2. China 7743.144 billion.

3. Japan 6124,899 billion

4. Germany 3706.970 billion

5. France 2889.708 billion.

6. Brazil 2617.987 billion.

7. England 2603.880 billion

8. Italy 2287.704 billion.

9. Russia 2117.236 billion

10. India 2012.760 billion

32. Ukraine 359,900 billion.

54. Kazakhstan 167.600 billion

61. Belarus 105,200 billion

74. Azerbaijan 65.410 billion

75. Uzbekistan 64,150 billion

And now one more informative picture from Wikipedia! Who is interested, can search for our country.

Under the spoiler table of all countries of the world, sorted by external debt to GDP (in percent)

As we see the external debt, it is not growing much, but the domestic government debt is much stronger.

By the way, here I saw an interesting flash drive. Press the picture below and you can see how the debts of the world have changed in the past and which forecast is waiting for them in the future

But the latest news is the sovereign debt of Italy reached the historical maximum and exceeded two trillion Euro According to the reported report of the Central Bank / Bank of Ditalia, published today /, in October, external debt amounted to 2 trillion 14 billion euros. (link)

Well, in the subject matter, which concerns debts, I cannot bypass the parties the country is the most interesting country in this regard. Remember, not so long ago, in the Internet, everyone looked at curiosity - what the US State Dolg looks like.

Let's remember it.

Well, or here is another US debt!

US debt in real time, for example.

So who should America have such an impressive amount if Europe is all in debt? Let's see..

Let's not deepen what Fed is and why the US should have so much. This topic is still on a huge post, and there and there can not do without the theory of conspiracies :-)

But for example, from which the debt may consist of the example of the Slavs brothers:

If we consider each country separately, you might think that it should be another country. But no, other countries also have to someone ... In fact, it's not a secret for anyone that states should have various banking structures.

Any sensible person wonders: "Why would the state simply not printed the required amount of money?" The most amazing thing is that a clear and clear answer to this question can not give any high-ranking official or a mastist professor of the economy! All of them choir are not a memorized phrase that if you print money - there will be inflation. At the same time, none of them can explain what the difference: take 10 billion cu. In an international bank (sell bonds of a certain foreign investment company) or borrow them from the internal consumer by issuing bonds on favorable terms, the guarantor of which is the state itself with its unable natural resources and land .. after all, the effect for the economy is one - it will fall into it 10 billion. U.E. By the way, money can be removed from the economy at any time, if necessary.

Inflation is determined by the ratio of the amount of money supply and volume of trade, and where did the money mass come from - it does not matter how the proportions of the components of turnover do not matter.

Here is another interesting, but unfortunately not a new diagram of mutual debts. Press on the picture and you can choose a country to visualize mutual debt.

It is absolutely clear that only internal borrowings are economically justified, which do not increase the monetary base and it is absolutely not clear why the people represented by the state should depend on some international banking corporations and pay them.

Unfortunately, it must be recognized that the governments of most developed states have lost the possibility of fully implementing their main function - the control function. Central banks are not controlled by governments, therefore, they cannot be a full-fledged tool to achieve national goals.

This video is walking on the network, there is a suspicion that this is some kind of "viral action", but everywhere there is a grain of truth, you can see ...

01/30/2016 at 22:37 · Pavlofox. · 8 410

Debt of countries of the world for 2015

Economic and political instability, budget deficit forces the government of countries to resort to borrowed funds. Money taken into debt among other states, international funds and investors help increase financial opportunities and replenish the resources of the country. But on the other hand, they increase the risks of manifestation of the economic crisis. External debt is the difference between borrowed funds and interest payments and the principal debt. It is measured in dollars for the convenience of comparison with GDP indicators. In many countries, such a debt was copied decades. It was increased by the global crisis 2007-2008. But the foreign debt of the countries of the world for 2015 broke all records. The leaders among the debtors were among the eurozone countries. The first position holds the largest economy of the world - the United States.

10. Canada | 1.49 trillion. dollars

Opens a dozen countries of the world with the greatest external debt.

The debt of the country began to actively grow during the 2008 crisis. From the time to cover the budget deficit and stimulating the economy, the country owes the world of 1.49 trillion dollars. If we divide this amount, I will have 39 thousand dollars of debt for each Canadian. In 2015, the economic downturn was observed in Canada and the country has decreased in the country. The main position in the economy is occupied by the logging and oil-producing industry. Moreover, oil is mined a much more complex and expensive method, in contrast to the traditional. The fall in oil prices forced industrialists to reduce production costs. First of all, due to the reduction in jobs. The state was forced to resort to loans to ensure social guarantees to the population and stabilize the economic situation.

9. Spain | 1.5 trillion. dollars

On the ninth line of the rating. The foreign debt of this country has achieved the highest value in history. If you divide him per capita, then each will have 31 thousand dollars. And if you divide the debt to percentages, then each will have more than 720 euros and this is despite the fact that the average salary in the country is slightly more than 650 euros. The government allocates more funds to pay off the debt than to combat unemployment and social programs. At the same time, 3% GDP increased and experts predict the same increase in 2016. According to the results of 2015, the overall foreign debt of the country was estimated at 1.5 trillion dollars.

8. Brazil | 1.8 trillion. dollars

Osolled the world about 1.8 trillion dollars. For one largest countries in Latin America, 2015 was marked by an economic decline in production by almost 4%, racing inflation and unemployment. The fall in prices for raw materials (and this is mainly agriculture), the decline in demand from the main trading partner of China, the unfavorable political situation was the prerequisites for the growth of state debt state. Investors are trying not to invest in Brazil bonds. Nevertheless, the country's foreign exchange reserves are strong enough so that there are no problems with the service of external debt.

7. France | 2.3 trillion. dollars

The State debt of another state of the Eurozone is growing - France. For 2015, the loan amount was 2.3 trillion dollars. Low consumer activity, a high unemployment rate of 10.5% and practically no investment inhibit the development of the economy. But do not interfere with building public debt, which for 2015 was slightly higher than 95% of GDP. Each Frenchman must have 34 thousand euros and this debt continues to grow.

6. Italy | 2.5 trillion. dollars

With a debt of 2.5 trillion dollars hit the top ten countries with the biggest loan. The government is not going to stop, increasing the volume of borrowed funds. Thus, she tries to stabilize the economic situation in the country. For each inhabitant of the country accounts for 41 thousand euros of debt, which is more than 130% of GDP. Experts see the problem in an unfavorable climate for a business that has created a state, high-level corruption, in the absence of reforms capable of changing the current structure of power. Despite the fact that Italy is gaining debts to raise the economy, the growth of the latter is not observed.

5. United Kingdom | 2.52 trillion. dollars

Economy UK It is considered one of the most developed in the world. But in 2015 the debt of the country passed the mark of 2.52 trillion dollars. Its main part is short-term loans of commercial banks. Most United Kingdom must be the USA and Germany, France and Spain. Thanks to the large stock of gold assets, experts do not beat the alarm and do not talk about the crisis of the economy. The English pound sterling, being a convertible currency, is firmly holding its position.

4. Germany | 2.6 trillion. dollars

Set up in a step from the top three of the largest ardities of the world. The amount owned by the country is estimated at 2.6 trillion dollars.

But despite the relatively large debt, Germany's economy remains stable. As for the ratio of debt and GDP, the country has the highest indicator for these criteria in the world - more than 80%.

3. China | 3.1 trillion. dollars

(PRC) is the world's largest lender and, as not paradoxically, it is also one of the main debtors according to the 2015 data. But China is considered a "good" debtor, since its huge reserves of gold and currency provide timely debt payments. The sum of the debt of the PRC was at the beginning of 2016 3.1 trillion dollars.

2. Japan | 12.2 trillion. dollars

- One of the most scrupulous countries in terms of finance has become one of the largest ardals in the world at the end of 2015. Its debt to date is 12.2 trillion dollars, and he is growing more and more every day. Over the past year, its amount increased by more than 1.4 trillion dollars. Very strongly on the country's economy, an accident was reflected at the Fukushim nuclear station after the 2011 Tsunami. The state was forced to increase debt to eliminate consequences.

1. USA | 19.75 trillion. dollars

occupy the first line of the ranking. The most developed economy and one of the largest countries has the largest external debt, which is estimated at 19.75 trillion dollars. This figure only says that the Americans do not save, and their costs sometimes exceed income.

The main investors of the United States are China and Japan. These countries at any level of debt of the United States will buy their bonds so that America can pay for their goods to pay their products. Russia is also among the top ten largest lenders of America.

What else to see:

At the same time, in the near future, government debt obligations as a snow whom will be able to post all on their way. These are the conclusions of the organizers of the study of the World Creditors' Organization (WOC).

The State debt of the world continues to increase, and, according to the latest estimates, countries are increasingly not easy to reduce its volume, but at least stabilize, the study said. According to the preliminary results of 2012, the total debt of all states of the world exceeded $ 55 trillion. Most of this volume (75%) constitute the obligations of the entire seven developed economies of the world - countries G7. For the previous year, they not only did not make facilitated the situation, but also increased their debts by 5%. In general, the volume of debt of developed countries grew by 12% and is 110% of their total GDP.

In developing countries, the situation is not so critical: For 2012, the total amount of government debt increased by 1% and with respect to GDP is 34%. The greatest increase is celebrated in the countries of the Middle East and North Africa, where government debts increased by 5%. In other regions, the increase is 1-2% of the level of the previous year.

State Debt of Key Regions of the World

| Regions | Public debt volume (Public Debt), $ billion, 2012 | Public debt (Public Debt), $ billion, 2011 | The change | State Dolg / GDP, 2012 |

|---|---|---|---|---|

| The developed countries | 46539 | 41715 | 12% | 110% |

| G7 | 42261 | 40398 | 5% | 129% |

| European Union | 14316 | 14458 | -1% | 89% |

| Developing countries | 9329 | 9234 | 1% | 34% |

| Asia | 4114 | 4017 | 2% | 32% |

| Latin America and Caribbean | 2812 | 2817 | 0% | 49% |

| Middle East and North Africa | 798 | 757 | 5% | 27% |

| CIS | 362 | 357 | 1% | 14% |

Sources:Woc IMF, CIA.

Leaders have not changed

If we consider all countries of the world as a whole, there were no significant changes in the leaders. The first two lines of the rating are occupied by the United States and Japan, who have $ 16 trillion. and $ 14 trillion. respectively. Thus, more than half of the global sovereign debt falls on these two countries. Then there are countries whose state debt ranges from $ 1 trillion. up to $ 3 trillion. After Japan, who has state obligations almost 3 times higher than its own GDP, the most difficult situation looks like in Italy. At the end of 2012, sovereign duty in relation to GDP amounted to 126%. However, experts note that the situation in this country is more stable than its southern European neighbors, since government bonds have long repayment dates and mainly belong to internal investors.

At the same time, in percentage ratio, the most significant increase in the public debt among the considered countries was recorded in Kazakhstan. The indicator in this country has grown more than a third (+ 32%), raising Kazakhstan for the 58th place in the overall ranking in terms of public debt. The greatest increase in financial obligations among developed countries is marked in Spain and Australia. At the end of 2012, the debt in these countries increased by 23% and 19%, respectively.

China continues to reduce its public debt, but very slow pace. At the end of 2012, the debt decreased by 6%. At the same time, the year earlier the government repaid another 5% of its obligations. It fell by 8% of the national debt and in Greece, which can be explained by the write-offs on which lenders went in 2012. Financial liabilities decreased and in Hungary - a decrease of 15% provided the country of 42nd place in the overall ranking.

| Place in 2012. | Place in 2011. | Country | Public debt volume, $ billion, 2012 | Public debt, $ billion, 2011 | The change | State Dolg / GDP, 2012 |

|---|---|---|---|---|---|---|

| 1 | 1 | USA | 16730,5 | 15536,3 | 8% | 107% |

| 2 | 2 | Japan | 14148,9 | 13476,9 | 5% | 237% |

| 3 | 3 | Germany | 2888,7 | 2881,5 | 0,3% | 83% |

| 4 | 4 | Italy | 2611,2 | 2640,7 | -1% | 126% |

| 5 | 5 | France | 2440,0 | 2387,9 | 2% | 90% |

| 6 | 6 | Great Britain | 2175,1 | 1977,4 | 10% | 89% |

| 7 | 7 | China | 1770,9 | 1886,1 | -6% | 22% |

| 8 | 9 | Canada | 1579,3 | 1483,8 | 6% | 88% |

| 9 | 8 | Brazil | 1569,7 | 1619,0 | -3% | 64% |

| 10 | 11 | Spain | 1267,7 | 1032,3 | 23% | 91% |

| 11 | 10 | India | 1202,6 | 1123,0 | 7% | 68% |

| 12 | 12 | Netherlands | 547,0 | 547,6 | -0,1% | 68% |

| 13 | 13 | Mexico | 520,3 | 506,3 | 3% | 43% |

| 14 | 14 | Belgium | 492,0 | 502,1 | -2% | 99% |

| 15 | 15 | Greece | 462,9 | 501,3 | -8% | 171% |

| … | ||||||

| 26 | 25 | Russia | 222,9 | 221,3 | 1% | 11% |

Sources:Woc IMF, CIA.

One duty for everyone

On the issue of public debt per resident in the leaders is still Japan. For each resident of the country there are more than $ 110 thousand. The consequences of the tsunami and accidents at NPPs in Fukushima will have a negative impact on the economy of the rising sun. Ireland goes for Japan ($ 53.9 thousand per resident), which is almost caught up with Singapore and the United States. In these countries, $ 53 thousand public debt accounts for each resident. At the same time, the pressure on the residents of Qatar increased significantly: now each of them accounts for more than $ 37 thousand, which is 19% higher than a year earlier.

In Russia, in general, the situation with the public debt is stable. At the end of 2012, its volume grew by 1% and does not exceed 11% of the GDP level. As for the debt per capita, then for each resident there is a little more than $ 1.5 thousand.

| A place | Country | State debt per 1 inhabitant, $, 2012 | State Dolg for 1 Resident, $, 2011 | The change |

|---|---|---|---|---|

| 1 | Japan | 110875,1 | 105373,8 | 5,2% |

| 2 | Ireland | 53992,8 | 50585,1 | 6,7% |

| 3 | Singapore | 53435,9 | 52994,6 | 0,8% |

| 4 | USA | 53229,0 | 49804,4 | 6,9% |

| 5 | Norway | 49438,7 | 48246,3 | 2,5% |

| 6 | Canada | 45347,6 | 43086,6 | 5,2% |

| 7 | Belgium | 44549,8 | 45854,0 | -2,8% |

| 8 | Italy | 42879,6 | 43557,5 | -1,6% |

| 9 | Greece | 41313,1 | 44783,4 | -7,7% |

| 10 | France | 38474,8 | 37827,0 | 1,7% |

| 11 | Qatar | 37506,5 | 31793,9 | 18% |

| 12 | Switzerland | 36240,8 | 37446,2 | -3,2% |

| 13 | Austria | 36035,6 | 35992,4 | 0,1% |

| 14 | Germany | 35323,3 | 35234,9 | 0,3% |

| 15 | Great Britain | 34490,5 | 31565,3 | 9,3% |

| … | ||||

| 47 | Russia | 1570,8 | 1554,1 | 1,1% |

| 51 | China | 1308,1 | 1399,8 | -6,6% |

Sources:Woc IMF, CIA.

Reserves will not save

In the question of international reserves, China boasts China itself. Over the past year, the country has increased the volume of MP to $ 3.5 trillion., Which is 3 times more than national debt. The second place holds Japan, which reaches $ 1.3 trillion. However, this is enough for the coverage of only 10% of public debt. The third place firmly assured the Saudi Arabia, which continues to build up its reserve funds. Russia, which is now ranked fourth, in the near future they can "move" the United States, who also build up a reserve fund. However, it should be noted that in case of acute necessity, most countries do not have enough "piggyback" to cover all their debts.

| A place | Country | The volume of international reserves, $ billion | Backup coating of public debt |

|---|---|---|---|

| 1 | China | 3549 | 200% |

| 2 | Japan | 1351 | 10% |

| 3 | Saudi Arabia | 626,8 | 1749% |

| 4 | Russia | 561,1 | 252% |

| 5 | USA | 537,267 | 3% |

| 6 | Taiwan | 391 | 195% |

| 7 | Brazil | 371,1 | 24% |

| 8 | Switzerland | 330,585 | 114% |

| 9 | Korea, Republic | 319,2 | 82% |

| 10 | Hong Kong | 299,6 | 348% |

| 11 | India | 287,2 | 24% |

| 12 | Singapore | 253,3 | 88% |

| 13 | Germany | 234,104 | 8% |

| 14 | Algeria | 190,5 | 1078% |

| 15 | Italy | 173,3 | 7% |

Sources:Woc IMF, CIA.

Pesssimism becomes reality

With steadily increasing pressure, the forecasts of the rapid explosion "debt bubbles" are increasingly. Countries that are so crushed by debts cannot find opportunities to repay their obligations and are forced to occupy even more to pay interest on current loans. For most developed economies, as well as for countries in which the ratio of the public debt to GDP exceeds 60-70%, the point of non-return seems to be already passed. Therefore, sooner or later they will repeat the fate of Greece or Cyprus, experts say. However, in this case, to take funds to "salvation" will not have anyone.

However, on the basis of the forecast of the growth dynamics of the public debt relative to GDP, there is some decline in this indicator in the second half of the current decade. However, the optimists of the IMF still make a bet on an increase in GDP, and not for a real decline in public debts.

In general, experts are increasingly inclined to a pessimistic scenario: in a short time, the crisis of public finances, which in its power and consequences will repeatedly exceed the financial crises of past years.

Forecast of public debt dynamics in relation to the GDP of key regions of the world

Sources:WOC., IMF, CIA.

Currently, many Russians are interested in information regarding external debt not only of our state, but also other countries of the world. Whose foreign debt is the smallest, and who has the greatest? Our experts will help to deal with these issues.

External debt

Before drawing up the rating of the countries of the world largest and the size of external debt, this concept should be considered. It is established primarily at the legislative level. So, in our country there is a budget code, according to which the foreign debt of any country in front of other states is understood as financial credit debt in foreign currency.

In the economic terms, this concept is considered in the form of a total monetary obligations that the borrower must be returned to a certain period of the Leices state. In the amount of such credit debt, the loan itself will be included, and interest for its use requiring payments. For the country, this amount of debt includes liabilities:

- international banks;

- governments of other countries of the world;

- private banks that belong to foreigners.

External debt distinguish between two types:

- The current (one you want to return to foreign creditors this year, that is, in 2019).

- The general state (accumulated over several years along with unpaid interest, it should be reimbursed in subsequent years).

To assess the magnitude of the external debt of a separate state, specialists working in the field of economy and finance use the relationship between credit debts to foreign creditors and the gross domestic product of the debtor's country itself. In this case, GDP (gross domestic product) is a macroeconomic indicator representing the total amount of all that the country has earned a year on produced products and services.

External debt performance

Experts argue that foreign debt is reflected not only on the economic sphere of the borrower country, but also can lead to long-term political dependence. This is determined by the critical level of overall debt indicators:

- The solvency of the country (the ability to fully fulfill all the obligations assumed at the expense of its own resources), which includes:

- dependence on export goods;

- attitude to state GDP (i.e., to the main base of home resources);

- repayment of debt due to state budget revenues.

- Liquidity (the ability of existing assets, such as securities, to rapid sale at market prices), taking into account:

- term of duty (short-term or for a long period of time);

- sufficiency of international reserves;

- monitoring the risks of non-missing debt.

- Indicators for the Gosseltor, namely:

- influence of tax revenues for public debt;

- changes in foreign currency rate to home.

Thanks to these indicators affecting almost all spheres of the economy, it is possible to calculate how quickly the debtor will return funds borrowed from other countries of the world. For example, about the safe level of debt shows the rating of debt to export income, not exceeding 200% (if this indicator will be higher than 275%, then the external debt may be partially written off as unpaid).

In relation to local GDP, the critical debt level will be considered from 60% (according to the calculations of the IMF) and from 80-100% (according to the calculations of the World Bank). The excess of this limit figure suggests that the repayment of financial debts from other countries of the world is due to the repayment of resources. Instead of the production of goods and services for the internal needs of the state, their production is underway for export trade.

Also, to predict the return of debt obligations with interest should be considered:

- the ratio of these obligations (they may be due to a number of preferential conditions);

- degree of openness of the external capital market;

- real exchange rate mode;

- the likelihood of economic crisis.

If access to its own and international reserves is limited in the country, then any solvency can also be speech. Therefore, many developing states have difficulties with the refund of cash loans. They are on the payment of external debt there is all profit from the internal production, and the current costs of their own activities are taken from new credit revenues.

Positive aspects of the external debt of the state from countries of the world

It would seem that credit financial debt to other countries for the state does not carry anything good in itself - it is an ineffective use of money received on credit, maintenance of credit obligations, economic dependence on the creditor country leading to a change in political relations between states. But experts of the economy and finance and external debt find positive parties:

- any foreign loan improves the economic situation of the borrower country;

- the influx of foreign capital helps in the development of certain areas of the economy (for example, transport, energy, etc.);

- the general budget of the state is restored.

But these positive aspects begin to work only in case of effective distribution of borrowed funds.

Rating countries of the world by external debt

Experts working in the global banking system annually calculate all possible prospects for repaying external debt for the countries of the whole world. Also in the sphere of their activities includes the preparation of rating tables on external debt with the miscalculation of the percentage of the debt of this type to nominal GDP. For 2019, the top 10 countries of the world, who have the smallest foreign debt:

| The name of the country | External debt (million dollars) | External debt to GDP (%) |

| USA | 16 893 000 | 101 |

| Great Britain | 9 836 000 | 396 |

| Germany | 5 624 000 | 159 |

| France | 5 633 000 | 188 |

| Netherlands | 3 733 000 | 309 |

| Japan | 2 719 000 | 46 |

| Spain | 2 570 000 | 165 |

| Italy | 2 684 000 | 101 |

| Ireland | 2 357 000 | 1060 |

| Luxembourg | 2 146 000 | 3411 |

As a result of the analysis of these tables, it can be concluded that countries that do not have external debt, surprisingly small quantity - only three (Brunei, Macau and the Republic of Palau), unlike other states that should almost all of the world.

There are countries that are both borrowers and lenders in relation to each other. So why will they not make their financial debts going on? But it depends not only on the political relationship between them, but also on the conditions of the loan loan - the maturity, interest payments, etc., etc., the mutual debt can not only reset the debt, but also seriously affect the working capital of state financial companies. This situation in turn can lead to the crisis of the economy of both states.