Rating of banks of Russia. RIA Rating Rating Reliability of Banks according to Central Bank

RIA Rating - 28 Jan. The past 2015 for Russian banks was very difficult, which was largely determined by problems in the economy, but at the same time the banking sector showed a rather good ability to adapt to negative macroeconomic conditions and tightening industry regulation. Nevertheless, despite the good adaptive capabilities of banks, these factors could not not affect the growth rate of key indicators and including assets.

Asset growth rates in 2015 decreased markedly compared with the results of past years. At the end of the past year, the assets of Russian credit institutions rose in nominal terms by only 6.9%, against 35% a year earlier and growth by 16% in 2013. The growth rates shown in the past year were among the lowest in the post-Soviet history. Only in 2009, the assets of Russian banks grew worse - by 5%, and during the remaining years in the last 25 years, the nominal growth rates did not fall below 15%. At the same time, the purified dynamics of assets from the oscillations of the ruble exchange rate in 2015 was not at all a negative - -1.6% (+ 18.3% in 2014).

In absolute values, the result was also not very good compared to the past years. Assets for 2015 rose 5.37 trillion rubles (+20 trillion rubles in 2014), which is the worst result since 2010. Thus, on January 1, 2016, the total assets of Russian banks reached 83 trillion rubles, which is 110% of GDP for 2015, against 109% a year earlier and 84.5% in 2013. Despite the continued growth in the ratio of bank assets and GDP in 2015, the contribution of the financial sector in GDP has occurred. Following the first three quarters, the financial sector provided 4.7% of GDP against 5.3% in 2014. In general, on the contribution to the formation of a national product, the financial intermediation industry as a whole and the banking system in particular has fallen at the level of 2012.

A prominent role in the slowdown in the growth rate of banking assets in addition to the recession in the economy was played by large-scale reviews of licenses from banks. In particular, in 2015, almost 100 banks or about 15% of the working ones lost licenses. According to RIA rating, the total amount of assets from banks who have lost licenses, as of January 1, 2015, was 1.2 trillion rubles or 1.5% of the assets of the banking system at the beginning of the last year. Among the banks with a revoked license were 22 banks with assets of more than 10 billion rubles. The largest banks with revoked licenses in 2015 were the Bank Russian Credit, Probusinessbank, Note-Bank, Sat Bank, Svyaznoy Bank, M Bank, Russlavbank, RusStroybank, AMB Bank, Transport, Baltic and Mast Bank.

The largest banks grow faster

RAIA Rating Rating agency conducted a study and prepared the rating of the largest banks of Russia in terms of assets at the end of 2015. The ranking presents data on January 1, 2016 to 716 banks in Russia, which published their reporting according to the form No. 101 on the website of the Central Bank of the Russian Federation in accordance with the indication of the Bank of Russia No. 192-y and the letter of the Bank of Russia No. 165-t. The rating methodology provides for the aggregation of current statements.

According to the results of the study, in 2015, more than 33% of banks have demonstrated negative asset growth rates. For comparison, in 2014, such banks were 35% of the total, and in 2013 - only 29% of banks. Thus, in recent years, the number of banks with negative dynamics was relatively stable and weakly correlate with the average growth rates. This indicates an increase in differentiation - some banks demonstrate rapid growth, while others, on the contrary, are actively folding operations. This conclusion can still be illustrated by the fact that among large banks (TOP-50), the number of banks with negative dynamics was noticeably less - 28%.

The largest banks of the country not only the cup showed a positive trend, but also higher growth rates. According to the results of 2015, the top 50 banks have increased their total assets by 9.2%. For comparison, the following 50 banks are only 5.4%.

The massive review of licenses and the faster growth of the largest banks led to the fact that the concentration of assets in the banking system has grown. At the end of 2015, the share of the largest dozen banks increased by 0.3 percentage points to 66.7%, the share of Top-50 increased much more - by 1.6 percentage points to 87.5%, and the share of the first hundred of the largest banks on January 1 amounted to 93.6%, against 92.4% a year earlier. The scale of licenses of licenses in 2016 continue to remain significant, in addition, will continue, albeit with less activity consolidation of the banking sector. Thus, in 2016, the concentration of assets in the banking system will continue to grow.

Private banks - growth flagships

In 2015, the private Russian banks of Smiths noticeably strengthen their position in the market, winning competition from state banks. At the end of the past year, state banks have increased assets by 7% against 17% of private banks. In terms of economic uncertainty, many private large banks were able to be created at the expense of NPF funds, and in addition, private banks were very actively involved in sanations. All this allowed many of them to show high growth rates and significantly improve their position in the ranking.

On the other hand, taking into account the economic downturn and the increased uncertainty regarding banking business marginality, as well as the requirements of Basel III to restrict the risks, many foreigners fold the banking business in Russia. According to the results of 2015, the assets of foreign banks decreased by more than 2%, therefore, the share of foreign banks in the assets of the Russian banking system dropped below 8.5%, although several years ago exceeded 10%.

Banks of the first dozen have changed places

In the top ten banks there were noticeable changes - only four banks out of 10 at the end of 2015 retained their places. Despite noticeable changes in places inside the top 10 banks, in general, the composition of the largest banks on assets in 2015 did not change. Rosselkhozbank rose to 2 places in the ranking at the end of the year (from 8 to 6), which was a consequence of the growth of assets from this bank by 22% per year (the most significant increase in the first ten), and the largest number of positions lost the bank of Moscow, dropping from 6 On the 8th place due to the reduction of assets by 22%.

For one position, two banks added: the private bank "FC Opening" rose from the fifth place for the fourth, and the State Bank of the NCC as of January 1, 2016 took the 9th place (10-17-17). On the 1st line in the ranking in the top ten, VTB 24 and UniCredit Bank fell.

In the first hundred banks, 6 credit institutions have demonstrated asset growth rates by more than 2 times a year. Another 25 banks assets in 2015 increased by more than 20%. At the same time, in 9 banks in the top 100 assets decreased by more than 15%.

The highest rates of assets in 2015 Among the top 100 largest banks were at the express Volga sanufactured bank, the assets of which increased 3.1 times, which allowed the bank to rise in the ranking of 59 seats per year. The second in the rate of growth of assets among large banks has also become a century-rising bank (assets for the year increased by almost 3 times, +30 places in the ranking). At the same time, the third on Dynamo became Sovcombank (an increase in assets by 139%, +21 place in the ranking), which sanctifies the Bank "Express Volga". The fourth rates of growth became the Crimean RNB Bank (assets rose 2.4 times, + 58 seats per year in the ranking in terms of assets).

The weakest Dynamka in the first hundred banks was at PJSC Akb "Metallinvestbank" - a reduction in assets by a third per year, which led to the loss of 18 places in the ranking. Also about a third of the assets declined to LLC "EIC-ES BI-SI Bank (PR)" (-17 seats at the end of the year).

It is worth noting that among 6 banks in the top 100 in terms of assets with the worst dynamics, three foreign banks specialize in retail. At the CCF Bank and OTP Bank for 2015, the assets decreased by more than 22%, and the Rusfinance Bank slightly less than 20%. This led to the fact that the CCF Bank left the number of the top 20 largest banks in the country, and the bank and Rusfinance Bank lost over the year in the ranking of 10 and 9 seats, respectively. The reasons for the negative dynamics of this triple of banks, apparently, were as follows: first, the weak dynamics of retail lending, on which these banks are specialized; secondly, as already mentioned above, the requirements of Basel III on the risks for foreign banks; as well as securitization and sale of parts of portfolios by banks. In 2016, retail banks will be able to show a little better dynamics against the background of the recovery of the consumer lending market.

2016 - without shocks, but without optimism

According to RIA rating, the coming year as a whole will be relatively difficult for Russian banks, although the shock events will most likely be avoided. According to RIA rating, in 2016, it is possible to revoke licenses in 75-95 banks, which will reduce the nominal increase in assets by 2%, and in a coupe with activity in the M & A sector will continue to increase the concentration of assets.

The growth of corporate lending in 2016 will hold back to the preservation of crisis phenomena in the economy and will be somewhat lower than in 2015. At the same time, the retail market in 2016 will show noticeable progress, which will be a consequence of the stabilization of the market of non-community lending and the development of mortgage lending.

In general, according to experts, RIA rating, 2016 will be somewhat better than the previous one even with a negative development scenario, and the nominal assets will be within 5-9%. However, the increase in currency revaluation is quite likely to be close to zero.

This rating is not a base for unambiguous conclusions about the reliability and (or) financial stability of banks included in the rating. RAIA Rating Rating Agency is not responsible for the consequences of any interpretations of this rating and decisions taken on it.

RIA RATING. - This is a universal rating agency of the media group Mia "Russia today"specializing in the assessment of the state of companies, regions, banks, industries and credit risks. The main activities of the agency are: assigning credit ratings and ratings of reliability to banks, enterprises, regions, municipalities, insurance companies, securities, other economic objects; Economic studies in the financial, corporate and public sectors.

Mia "Russia today" - An international media group, whose missions is an operational, weighted and objective lighting of events in the world, informing the audience about various views on key events. RIA Rating as part of Mia Russia today enters the line of information resources of the Agency, including: RIA News , R-Sport , RIA real estate , Prime , InoSMI . Mia "Russia Today" leads in citement among the Russian media and increases the cite of its brands abroad. The agency also occupies a leading position in citement in Russian social networks and a blogosphere.

The Central Bank (CB) of the Russian Federation announced a list of reliable banks in 2015 in Russia, together occupying 60% of the market. The rating was made up on the basis of several criteria, among which the size and volume of deposits, as well as the number of transactions between banks. And the most important indicator is the adequacy of equity; Simply - the more money from the bank, the more reliable. For ordinary depositors, this means that the risk of bankruptcy for these banks seeks to zero.

We present you the top ten in which they entered the most reliable banks of Russia for 2015, according to the Central Bank.

10. PJSC Promsvyazbank

Founded in 1995. According to the mid-summer of 2015, Promsvyazbank's assets numbered 1 trillion rubles, and own capital - 123 billion rubles. According to the latter, Promsvyazbank is among the largest banks in the world.

9. JSC "UniCredit Bank"

UniCredit Bank appeared in Russia in 1989 as part of the UniCredit Financial Group. Throughout Russia, there are 103 branches of the bank, which serve more than 1.6 million individuals.

8. Bank of Moscow OJSC

This bank was founded in 1995 as a joint-stock commercial Moscow Municipal Bank was privatized in 2011. The main stake package belongs to the VTB Bank (PJSC). The organization serves more than 9 million individuals and 120,000 persons legal.

7. Alfa Bank JSC

Founded in December 1990, in 2004 he suffered a crisis to shareholders even had to help the bank with personal funds. According to the end of 2014, the bank's own capital is 216.6 billion, and assets - 2.4 trillion rubles.

6. PAO Bank "FC Opening"

This is the head establishment of the Opening Banking Group, which occupies the first line of the list of the largest private banking groups of Russia. Provides investment services and specializes in servicing large and medium-sized corporate clients. At the end of 2014, the Assets of the FC Opening Banking Group and Khanty Opening Bank and Khanty were 2.6 trillion rubles, and their own capital - 157.8 billion rubles.

5. PJSC "VTB 24"

The bank is formed on the basis of Guta-Bank, who has not been tested by the 2004 crisis. Subsequently, he joined part of the VTB North-West Bank, TransCreditBank. The only shareholder of VTB 24 - JSC Bank VTB (it ranks second ranking the largest banks in Russia). At the moment, only Sberbank is inferior in the amount of deposits of individuals.

4. OJSC "Rosselkhozbank"

Russian Government Bank represented by the Federal Property Management Agency, which owns 100% of the shares, was established by order of V. V. Putin in 2000 to serve the needs of agro-industrial production. The partner of the Golden Autumn is the largest Russian agro-industrial exhibition of Russia.

3. Bank GPB (AO), Gazprombank

The bank was established in 1990. According to data for December 2014, his own capital amounted to 439 billion rubles, and assets - 4,768.5 trillion rubles. However, in 2014 Gazprombank entered the sanctions list of the US Department of Finance. Funny curiosity is connected with this bank: in 2008, due to the internal mistake, one of the branches randomly listed at the expense of a simple police officer from Tomsk 4 billion rubles. That money returned.

2. OJSC "Bank VTB"

Founded in 1990 with the participation of the State Bank and the Ministry of Finance of the RSFSR to serve the foreign trade of the state. In 1998, transformed into JSC (the state represented by the Central Bank of the Russian Federation still owns 60.9% of the shares). The Bank provides support for several national national-level sports organizations (for example, Dynamo club in Moscow). It is part of the Bolshoi Theater Cheretellic Council and sponsors the Mariinsky Theater.

1. OJSC Sberbank of Russia

Headed the rating of reliable banks of Russia 2015. This green logo in Russia is known to everyone, since Sberbank is the oldest credit institution in the Russian Federation. Originated from the system of state labor savings box office, which appeared in the USSR in 1922. In the market of private deposits Sberbank, 50.5% belongs. He also owns 30% of all loans issued in Russia.

The occurrence of crisis significantly reduced the level of confidence in the banking system. SMP Bank, Sberbank, VTB, Gazprombank, Rosselkhozbank and Vnesheconombank).

Thus, by the beginning of 2015, even the leaders of the banking market came out with losses in the loan portfolio, reduced stability and marking indicators and the mark "trash can" rating.

In January of this year, deposit insurance agencies, together with the government, amounted to a preliminary list of 27 banks, which will receive a power in the form of gravity due to the bonds of the federal loan. Below is a rating of reliability of banks that also claim to receive state-owned. The most reliable banks of Russia were the subsidiaries of foreign banks:

VTB, VTB24, Rosselkhozbank and Gazprombank were only in the 2nd reliability group (while in 2014 were in the first group).

Relatively reliable banks are those that have fallen into a group of reliability V.

The loan organizations that have a default on banking obligations have been included in the SCC reliability group. In the group, for the second year there is a fundServisbank. Yuda also hit the rising bank, which is now under a sanation.

In addition, if the bank has no rating, it means that it is currently least reliable. As a rule, those credit organizations remain without ratings, the founders of which do not disclose their real indicators (which indicates the closure of the bank and the opacity of the business). Also, banks were included in the rating of unreliable banks: "Russia" and SMP-Bank (victims of international sanctions last year).

The rendered reliability rating of Russian banks 2015 is based on the opinion of such authoritative international agencies as Moody's, Standard & Poor's, Fitch, "National Rating Agency" and several well-known print publications.

1. Sberbank of Russia. At the highest stage, the Sberbank of Russia is traditionally located. This bank is leading the volume of operations with individuals and overtakes other financial institutions according to this indicator. The indicator of sufficiency of equity from Sberbank is 12.4%, which is quite a lot.

2. Bank VTB. The second place in the ranking of the reliability of Russian banks 2014 is the Bank VTB. This bank in terms of assets is inferior only to Sberbank, at the same time, the indicator of sufficiency of its own assets is superior to this indicator of Sberbank and is -15.16%. It should be noted that VTB Bank includes several powerful subsidiaries such as "Bank of Moscow", VTB24 and others. It is important that the subsidiaries of VTB holds high reliability indicators.

3. Rosselkhozbank.In third place is Rosselkhozbank. The assets of this bank are at least 800 mb. rubles. According to Yuri Trushka, which is the chairman of the Board, 80% of the funds of the Bank's loan portfolio fall on the agricultural sector. Also, the state allocated a bank to subsidia for support for agriculture, in the amount of 45 billion rubles.

4. Bank of Moscow. The fourth place at the Bank of Moscow, which is the structure of VTB and the leading capital bank. Like neither periodoxal, growth in reliability, this bank is obliged to financial crisis, which allowed him to get a portfolio of mortgage lending and strengthen its position in the suburbs. The state controlled 44% of the shares of this bank.

5. VTB24.In the fifth place is another branch of VTB Bank - VTB24, a division working with individuals. They do it quite successfully and ranked second after Sberbank in terms of operations in the retail segment. Only during the past year, the amount of the loan portfolio increased almost twice. In this regard, VTB24 was forced to take a subordinated loan from the "head" structure of 15 billion rubles.

6. UniCredit Bank. In the sixth place in the ranking of the reliability of Russian banks 2014, the largest European banking group operating in Russia is located. Owned by the European Association of Banks UniCredit. The difference from others, during the crisis, this bank continued to demonstrate high growth rates, gain staff and open new branches.

7. Alpha Bank. At the seventh place, one of the most successful private banks - the share of their own capital is 11.76%. Specialized international rating agencies Alfa Bank assigned a rating of BB ++. Also marked reliability, high quality service and a stable forecast for the future. More detailed .

8. Gazprombank. Gazprombank is located in the eighth place. Bank assets make up 1745 billion rubles. Recently, the Bank has significantly increased the number of corporate clients (45 million) and Piz clients. Persons. (3 million). Also, Gazprombank has significantly strengthened positions in the domestic and international market and the bank became leading in the corporate finance sector.

9. Rosbank. Ninth place in Rosbank. This is a private banking structure belonging to the Western Societe Generale Association. Rosbank has a consistently high reliability rating assigned to him by authoritative international agencies and on forecasts he will remain. The size of equity and assets allow you to confidently hold Rosbank in the top ten leaders among Russian banks.

10. Promsvyazbank. In the tenth place in the ranking of the reliability of Russian banks is Promsvyazbank. The national rating agency assigned to the bank an individual AA + credit rating, but at the same time, international rating agencies did not appreciate Promsvyazbank at the same level. Nevertheless, in recent years, the Bank's activities have noted in the growth of transactions in the factoring market.

The Central Bank of Russia has established its criterion to assess the reliability of banks - the sufficiency of equity.

Own capital supports the sustainability and reliability of the bank, ensures its obligations to depositors and creditors. Own funds serve as a reserve to cover the obligations of the Bank. It is believed that the more the bank's own capital, the more reliable. When decreasing the size of own funds (capital) is lower than the established minimum value, the Central Bank has the right to withdraw the license from the bank.

To assess the reliability of banks of the Central Bank of the Russian Federation introduced a standard for the adequacy of own funds (capital) H1.0. This is the main standard that, at the request of the Central Bank, is obliged to comply with all banks of Russia.

The average value of the valuability of equity of equity is established by the Central Bank of the Russian Federation in the amount of 10 - 11%. If a commercial bank, this "reliability standard", according to the Central Bank, becomes low, for example, less than 2%, then the Central Bank of the Russian Federation recalls the license.

Given the ratings of the reliability of banks, the data of the Central Bank and other parameters, you can choose the most stable and stable bank for the deposit, where to invest your money so that they are not only kept, but also worked for the future.

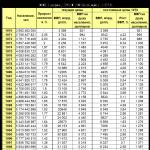

| № | Name of the bank | Equity on 09/01/2015, million rubles. |

| 1 | OJSC "Sberbank of Russia" | 2 535 918,6 |

| 2 | VTB Bank (PJSC) | 1 105 036,8 |

| 3 | Bank GPB (JSC) | 619 908,4 |

| 4 | OJSC "Rosselkhozbank" | 287 541,0 |

| 5 | ALFA-Bank JSC | 267 568,1 |

| 6 | VTB 24 (PJSC) | 246 108,2 |

| 7 | PJSC Bank "FC Opening" | 236 472,4 |

| 8 | JSC "Bank of Moscow" | 171 366,5 |

| 9 | JSC Unicredit Bank | 168 231,3 |

| 10 | PJSC "Promsvyazbank" | 155 840,2 |

| 11 | Raiffeisenbank JSC | 124 142,5 |

| 12 | PJSC Rosbank | 117 863,1 |

| 13 | OAO "MOSCOW CREDIT BANK" | 113 974,9 |

| 14 | JSC "AK BARS" Bank | 61 841,9 |

| 15 | PJSC "Khanty-Mansiysk Bank Opening" | 61 371,0 |

| 16 | PJSC "Bank" Saint-Petersburg" | 57 500,7 |

| 17 | PJSC Bank "Ugra" | 56 947,6 |

| 18 | OJSC "AB" Russia " | 55 661,5 |

| 19 | PJSC "BINBANK" | 54 743,9 |

| 20 | LLC "HKF Bank" | 54 361,2 |

| 21 | Bank NCC (JSC) | 52 181,7 |

| 22 | JSC KB "Sitibank" | 50 594,9 |

| 23 | JSC "Norda Bank" | 44 375,5 |

| 24 | OJSC "URALSIB" | 42 169,7 |

| 25 | Ing Bank (Eurasia) JSC | 41 305,3 |

| 26 | JSC AKB "Novikombank" | 40 675,6 |

| 27 | PJSC AKB "Svyaz-Bank" | 39 346,2 |

| 28 | PJSC Bank Zenit | 35 543,4 |

| 29 | JSC "Globeksbank" | 35 106,7 |

| 30 | PJSC "Sovcombank" | 33 732,1 |

| 31 | JSC "SME Bank" | 33 235,6 |

| 32 | PJSC "MDM Bank" | 30 677,4 |

| 33 | Akb "Absolut Bank" (OJSC) | 29 360,4 |

| 34 | TKB Bank PAO | 28 971,1 |

| 35 | JSC "OTP Bank" | 28 333,3 |

| 36 | LLC "VERPROMBANK" | 27 928,0 |

| 37 | PJSC KB "Ubrir" | 26 697,5 |

| 38 | PJSC CB "East" | 26 396,2 |

| 39 | Akb "Peresvet" (JSC) | 26 196,9 |

| 40 | AKB ROSEVROBANK (OJSC) | 25 679,8 |

| 41 | JSC AKB "Centrocredit" | 25 284,2 |

| 42 | Bank "Revival" (PJSC) | 24 212,7 |

| 43 | JSC "Tinkoff Bank" | 23 403,3 |

| 44 | JSC "Minb" | 23 271,8 |

| 45 | OJSC "AIKB" Tatfondbank " | 22 229,8 |

| 46 | PJSC MTS-Bank | 20 983,3 |

| 47 | LLC "Rusfinance Bank" | 20 855,2 |

| 48 | RNB Bank (PJSC) | 20 346,8 |

| 49 | PJSC "RGS Bank" | 19 793,5 |

| 50 | "Network Bank" LLC | 19 705,3 |

| 51 | JSC "Credit Europe Bank" | 19 042,8 |

| 52 | LLC Bank "Avers" | 18 503,8 |

| 53 | JSC "SMP Bank" | 18 193,5 |

| 54 | AKB "RUSSIAN CAPITAL" (PJSC) | 17 987,4 |

| 55 | JSC ABB "Avangard" | 17 829,0 |

| 56 | KB "Renaissance Credit" (LLC) | 16 616,8 |

| 57 | Bank "TAU" (OJSC) | 16 183,1 |

| 58 | JSC "KB Deltacredit" | 14 908,9 |

| 59 | JSC "SKB-Bank" | 14 414,4 |

| 60 | "Asia-Pacific Bank" (OJSC) | 14 206,9 |

| 61 | LLC "EIC-ES BI-SI Bank (RR)" | 14 105,9 |

| 62 | LLC "Doyce Bank" | 13 905,9 |

| 63 | "BNP Pariba Bank" JSC | 13 794,1 |

| 64 | CJSC "Bank Credit Swiss (Moscow)" | 13 274,6 |

| 65 | Credit Agrikol Kib JSC | 13 267,6 |

| 66 | Bank Union (JSC) | 13 065,2 |

| 67 | AO Roseximbank | 13 061,4 |

| 68 | OJSC "MBSP" | 12 937,7 |

| 69 | CJSC "Commercial Bank (Eurasia)" | 12 523,6 |

| 70 | JSC AKB "Eurofinance Mosnarbank" | 12 506,3 |

| 71 | PJSC "Zapsibcombank" | 12 232,6 |

| 72 | KB "Loko-Bank" (CJSC) | 11 553,4 |

| 73 | JSC "SMBSR Bank" | 11 252,7 |

| 74 | "Note-Bank" (PJSC) | 11 170,6 |

| 75 | JSC "Bank Intesa" | 11 134,3 |

| 76 | JSC Bank "National Standard" | 10 659,0 |

| 77 | JSC "Toyota Bank" | 10 318,8 |

| 78 | JSC KB "Center-Invest" | 10 168,7 |

| 79 | JSC AKB "International Financial Club" | 10 032,2 |

| 80 | NGO CJSC NRD | 9 911,0 |

| 81 | LLC "Volkswagen Bank Rus" | 9 576,9 |

| 82 | KB Intercommerce (LLC) | 9 144,3 |

| 83 | PJSC AKB "METALLENVESTBANK" | 8 979,4 |

| 84 | PJSC "Metcombank" | 8 926,9 |

| 85 | KB "BFG-Credit" (LLC) | 8 915,5 |

| 86 | JSC "PH Bank" | 8 837,6 |

| 87 | PJSC "Bank BFA" | 8 792,8 |

| 88 | Akb "Investorgbank" (PJSC) | 8 420,7 |

| 89 | CJSC "CISB" | 8 379,1 |

| 90 | LLC "Exobank" | 8 285,8 |

| 91 | JSC KB "Rosinterbank" | 8 068,9 |

| 92 | KB "Rab" (CJSC) | 7 779,4 |

| 93 | Akb "Finprombank" (PJSC) | 7 596,9 |

| 94 | Bank "VDRR" (JSC) | 7 539,8 |

| 95 | AKB "VPB" (CJSC) | 7 527,5 |

| 96 | KB "MIA" (JSC) | 7 387,8 |

| 97 | KB "Kuban Credit" LLC | 7 378,4 |

| 98 | OJSC "Chelyabinvestbank" | 7 374,4 |

| 99 | Jay Endi Bank (JSC) | 7 314,4 |

| 100 | AKB "TPBK" (Moscow) (CJSC) | 7 225,8 |