PAMM account rating. PAMM GAP Rating Alpari Rating PAMM accounts

The rating contains information on the PAMM Governing Alpari, based on the entire history of their trade in the broker. The goal of the rating is to highlight the best Alpari Forex traders who deserve confidence and are most attractive to investment in PAMM accounts.

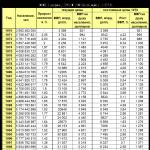

The term of work, the indicators of the average profitability and risk of PAMM-Managing, take into account all the statistics of its trade on all PAMM accounts, including those that are already closed. The number of investors, the amount of investment, the amount of the commission is considered only on open PAMM accounts.

What pamm managers are involved in the ranking?

- working period of at least 2 years;

- there is an open PAMM-account investment in the main rating (not in the sandbox);

- there is a positive PAMM;

- rank manager at least 1.

What PAMM accounts of the Manager are taken into account?

The ranking takes into account all the PAMM-accounts of the manager who were published on Alpari. Even if the trader closed or merged his account, its history is taken into account in the calculation of the ranking of the manager. Those Alpari Forex traders who traded only on non-public PAMM accounts are not involved in the ranking. If the trader traded to alpari under different nicknames, he can combine them in one PAMM account on our website.

How is the rank rank?

The rank of the manager is a summary assessment of its experience and quality management. The rank is considered on a scale from 0 to 5. It takes into account the following PAMM control characteristics:

- work experience

The overall calendar term of the manager on all PAMM accounts. The more experience, the more reason to believe that the manager will cope with any market. The highest score is raised after 3 years of work. - Number of trade (active) days

This is also an assessment of experience, but from the point of view of the significance of the statistical. Only trade experience is taken into account in the form of open transactions on Forex. Transaction waiting time is ignored. The highest score is raised after the accumulation of 600 trading days. - Calmar for all time

The average coefficient of Kalmar (income / risk) for all time on all PAMM accounts of the manager. Indicator of trade quality in relation to income / risk. It is considered an average weighted coefficient for all PAMM accounts, including closed. The more this coefficient, the general, is better than trade of the manager. - Calmar over the past year

Shows what the dynamics of the account has recently. Trade can occur with varying success, Kalmar recently shows how successful the current trade is. - Standard deviation

Shows how stable the results of the manager. The value in percent is the likely variation of the monthly yield around its average value. The average weighted indicator for all PAMM accounts is considered.

Each of the indicators is also ranked from 0 to 5 and with a certain weight is added to the general rank. The term of work and Kalmar for all time have a double weight.

PAMM account - A highly profitable and effective investment service, allowing to extract profits from trading on the currency exchange, not directly involved in it. With the help of such a financial instrument, you can increase the productivity of the portfolio, limiting only trade risks.

The content of the article:

PAMM accounts from alpari - One of the largest projects in the entire post-Soviet space. It was Alpari that created this product and the name of PAMM ( Percent Allocation Managient Module) Is the alpari trademark.

- You can read in a separate article.

Over the past 10 years, many brokers began to offer a PAMM account, but alpari is most of all the highest quality service itself, here you can choose managers for every taste: from dynamic and high-yield, to stable and balanced. True, the abundance does not guarantee profits, so before, not only the rating should be explored, but also the specific indicators of individual managers.

As the Alpari managers rating is drawn up, how to choose the right account, which means technical information about the results of trafficking and what accounts today look the most promising - talk about it below.

List of best PAMM accounts Alpari over the last month

| PAMM account (number) | Profit Loss | % Manager |

|---|---|---|

| Konkord Stable Profi (415171) | 4,1% | 10-20% |

| Kalsarikannit (416226) | 9,7% | 10-25% |

| Cartman_in_da House (427015) | -1,2% | 10-50% |

| FX_KNOWHOW (450950) | 20,2% | 30-45% |

| Celindrjoev v.j. (451520) | 9,7% | 30% |

| Victory_forluck_02 (446503) | 20,1% | 40-45% |

| PROFIT72 (435041) | 49,3% | 15-50% |

| Hipster (452975) | 128,6% | 20-35% |

| SUC 1.0 (433298) | 15,5% | 30-50% |

| Krat.co (449044) | 33,2% | 50% |

| AlpenGold999 (452288) | 78,3% | 50% |

| Lamprechtsofen2.0 (432236) | 6,3% | 20-45% |

| Respek_t (429024) | 30,4% | 15-40% |

| Moriarti (329842) | 5,8% | 20-40% |

| SL TP V (425470) | 5,8% | 0-45% |

Given that, for efficient work, the managers need years of practice, deep knowledge in the economic sphere and uncommon analytical abilities, it is much easier to start earning money by investing in successful traders than to conduct an independent trade.

Investments in PAMM accounts for Alpari and monthly profits

The company was founded in 1998 as a result of the merger of several firms provided in the financial sector. After some time, the Alpari became one of the first brokerage firms in the CIS territory that organized trade in the currency market. And, although the organization is registered under offshore jurisdiction, the Russian related legal entity has several licenses and permits in full compliance with the current legislation, including the license of the Central Bank for trade in the Forex market.

This highlights a broker among a variety of competitors.

Technically, the minimum investment in PAMM account in Alpari is 3 dollars, 2 euros or 90 rubles. Each manager is installed its minimum investment threshold and today this amount does not exceed $100 , In most cases $10 .

To replenish the account, you can use one of the many methods, including bank transfer, electronic money, entering funds through mobile terminals, etc. The withdrawal of funds is similar to methods of replenishment and is made within 1-3 business days.

Based on which algorithm, the alpari broker forms, is a commercial secret, which is not disclosed in favor of investors, so that the managers cannot intentionally work for the sake of high position in the ranking. It is only known that the calculation takes into account the profitability over the last month, the age of the account, the overall profit rate, the amount of funds in the management and performance indicators of the trading strategy.

In the same time, search filter Allows you to cut off accounts for any meaning: from the amount of invested funds and the number of active investors to the ratio of profits / volatility and trade results.

One of the most reliable indicators of profitability in 6 months in comparison with the last and amounts in trust management remain in comparison.

Even despite the average position in the ranking, such accounts deserve attention and detailed analysis. And even you need to be analyzed - to watch and compare their profitability indicators, volumes - in order to determine the stability of trading and expected profits.

pay attention to asterisk aggressive accounting. They reflect the deposit loading schedule and the risks of the manager's transactions. The more asterisks, the higher the danger of deep drawdown. Now let's talk more about how to cut out good bills for the portfolio.

How to choose a pamm account with alpari

Each investor boasts its own criterion for the choice of managers, but still there is a foundation to pay attention to everyone.

1. For a balanced portfolio Choose accounts by age for at least a year. During this time, most of weak trading tactics would have already led a trader to bankruptcy.

For the experimental part of the portfolio, selection of semi-annual and 3-month accounts is allowed, but such solutions should be taken only with regard to all risks.

For the experimental part of the portfolio, selection of semi-annual and 3-month accounts is allowed, but such solutions should be taken only with regard to all risks.

2. Watch for volatility, that is, the variability of the schedule.

If the pamma volatility is below 3%

, he belongs to conservative, 3-6%

- moderate tactic, more 6%

- Risky trading strategy.

If the pamma volatility is below 3%

, he belongs to conservative, 3-6%

- moderate tactic, more 6%

- Risky trading strategy.

3. Maximum drawdown - An indicator that is necessarily taken into account before investing Alpari's accounts in PAMM.

Moreover, the drawdown itself will not give us the necessary information due to improper assessment. Due to the fact that the drawdown can be recorded and as a loss of one transaction, and as from a turn of failures, we cannot say for sure, or a trader is an unbalanced risk amateur, or he simply was not lucky several times in a row. In practice, a high drawdown indicator says to depositors that the manager can bring a large loss, so they try to stay away from such a trader. For a conservative portfolio, do not choose account with drawdown above 30%for risky -. The higher the amount of the transaction in the percentage ratio from the entire deposit, the higher the risk. If a trader, having huge amounts of money in managing, loads deposit on 30-50%

, it must be, he is very confident about the right of his decisions. At the same time, it is extremely dangerous.

Moreover, the drawdown itself will not give us the necessary information due to improper assessment. Due to the fact that the drawdown can be recorded and as a loss of one transaction, and as from a turn of failures, we cannot say for sure, or a trader is an unbalanced risk amateur, or he simply was not lucky several times in a row. In practice, a high drawdown indicator says to depositors that the manager can bring a large loss, so they try to stay away from such a trader. For a conservative portfolio, do not choose account with drawdown above 30%for risky -. The higher the amount of the transaction in the percentage ratio from the entire deposit, the higher the risk. If a trader, having huge amounts of money in managing, loads deposit on 30-50%

, it must be, he is very confident about the right of his decisions. At the same time, it is extremely dangerous.

In the details of the trading accounts you can see complex economic indicators: coefficients Squid, Sharpe, Sortino and Schwagger.

In addition to inconsolable financial terms, they show how often the trader takes the right decision. After all, in the end, all trade in the market comes down to a simple choice - sell or buy. If the low values, it means that the managing accepts incorrect solutions, that is, uses hazardous strategies. The higher the indicators, the greater the likelihood that the trader conducts a fundamental analysis of the market.

In addition to inconsolable financial terms, they show how often the trader takes the right decision. After all, in the end, all trade in the market comes down to a simple choice - sell or buy. If the low values, it means that the managing accepts incorrect solutions, that is, uses hazardous strategies. The higher the indicators, the greater the likelihood that the trader conducts a fundamental analysis of the market.

6. Means in management. Logic is simple: the more people trusted to the manager and, the more money they got him, the more reliable this PAMM.

The control capital in this case is not its number today, but only the amount made when opening an account as a guarantee. A manager can withdraw this amount only after the liquidation of PAMM.

The control capital in this case is not its number today, but only the amount made when opening an account as a guarantee. A manager can withdraw this amount only after the liquidation of PAMM.

The most important, but also the most complex selection criterion. The paradox is that, the higher the monthly yield, the higher the risks in trade. The more stable and breakless chart of profits, the higher the danger to get on Martingale and another lottery. Here the hard filters are not recommended, the main thing is that the bill goes into a confident and stable plus.

In fact, there are no bad strategies if they make a profit, so someone will lose money on one strategy, and someone only earn money on it - each trader chooses a strategy specifically for itself and if it brings fruit, then the result will be stable arrived.

How to open a PAMM account in Alpari - Instructions

In order to open your own trading account, it suffices to read the instructions specified in the section "". To begin with, we open a page with a personal account data page and fill the necessary fields with accurate and reliable information.

Important! Fill the fields in accurately according to your passport data. The company's employees at a certain moment of your activities may ask to send a copy of the passport and will drain the information from the on-site.

After making data, you must confirm the phone number and email address. Then download the terminal MetaTraderThrough which trade transactions are directly carried out. Here you can open a demo account to verify the effectiveness of a speculative strategy, as well as start trading on the stock exchange with real money, after replenishing the score through the site.

The terminal has an account opening function using which you will receive a unique account identification number and password that is better to immediately save in a safe place. It also gives a password to view without the right to control. It is needed so that your investors make sure that the reality of operations. Now you can start trading on Forex.

As said Paul Tudor Jones, one of the most well-deserved world traders:

"You will need only a few minutes to deal with how to work on the stock exchange, but you may not have enough life to learn how to work on it successfully."

BUT) Divide the portfolio with multidirectional accounts. That is, not only choose managers selling with different currency pairs, but also assemble in the account portfolio of different style, different tactics, different philosophy. This will allow diversify assets and reduce risks.

B) Use the investment calculator for economic modeling.Do not allow profitability to ride 2%, in this case, add aggressive pamm to the list of assets. Do not allow profitability to translate for 10% - so there is a big danger to drain one of the accounts.

Conclusion

Saving the results of our analysis, we note that the alpari account investment in PAMM can be safely regarded as an effective financial instrument. The company that has created a reputation and proven broker's reputation for 20 years, guarantees the return of funds from your deposit and minimizes non-trap risks.

Even in the formation of a simple conservative portfolio, you can 2-5% per month. Such prospects for slow, but stable earnings give Pammams a huge advantage over a bank deposit and government bonds.

Many novice investors, having received the first profit from their own investment and earning a few percent of the deposit, they are "in all grave", raging accounts for all the remaining money and investing in aggressive accounts. It is impossible to do this.

Increasing popularity among Russians is the trust management of funds through the PAMM account. But before attributing his money to a broker, investors want to make sure of his position in the finance market. Would you like to know what players now exist on the market, as far as they are stable and what results are shown? Yes? The same opinions are adhered to the rest of the investors, therefore, this rating of PAMM-brokers was compiled.

Here are the main criteria for which PAMM account brokers are compared:

- Market work

- Yield

- Number of customers

- Conditions for opening a bill

- Ease of work in the broker system

- Transparency of operation and information about broker

- Geography of work

- Customer reviews

Another important point: We are interested only in the domestic market or at least companies that officially offer services to Russian citizens.

Brokers providing investing in PAMM accounts in the Russian Federation for today more than 30. I analyzed most of them and came to the conclusion that not many are worthy of attention. In some too small, the choice of PAMM accounts, in other very sluggish managers. And some of them were not even brokers at all, but the most real pyramids (for example, MMCIS, Panteon Finance). A distinctive feature of the pyramid is a large number of PAMM accounts showing exceptionally positive trend. Naturally, it can not be, and graphics are simply drawn. Anyone, even the most steep trader, necessarily drawdors.

Best in my opinion, PAMM brokers providing PAMM accounts in Russia

Number 1 in the PAMM-Broker Rating 2018:

The minimum investment is usually from 10USD or 500 rubles, which is quite a bit. But I personally do not advise you to open an account on 10USD. The fact is that too small initial investment from the point of view of domestic legislation "substitute" the client itself. On our Russian law, no one responds for them. And since the ultimate (grew by profits) the amount of law into the calculation is not taken, then the conditions of Alpari in this regard are protected. Customers celebrate that it is convenient to choose the currency of the account: euro, the American dollar or ruble.

As for profitability, it depends on the speed of the managing and its analytical qualities. In general, users (managers and investors) argue that after going to Alpari from other brokers, they began to earn more. If you are interested in the average size of the spread, it is not a secret, the indicator is 0.5 points on the main pair of the euro / dollar. And all the profit, both the investor and the manager it is easy to cash out.

Number 2 in the Rating of Trust Brokers:

Number 3 rating of the best PAMM brokers in 2018:

Number 4 in the PAMM-Broker Rating 2018:

Number 5 in the ranking of the best PAMM brokers:

Dukascopy. Good Swiss company. If my memory does not change, since 2011 has become a bank. We note it in the list just because there are Russian customers who expressed extremely enthusiastic. They invest major amounts and can afford to hire a translator, assure documents from the notary and constantly through the native speakers to maintain communication with the manager. By the way, Ducascopy does not publish statistics for PAMM accounts. Pamma selection occurs through a representative of the company.

The minimum contribution from 5000USD + costs on the same translator, lawyer, notary, sending documents. In general, only very large players can afford to work with him. The newcomer does not stand there.

I do not quite understand why the company is positioning, in fact, trust management, as a PAMM service. And also, I think to invest it is still better to choose the company "closer".

These were the best PAMM Brokers at the moment.

We are objective, the leader is visible immediately by the number of customers, the size of funds invested by them in development, and positive reviews. In Russia, the obvious leader is one - "". And judging by the fact that the company takes care of updating the work platforms, the palm of the championship will turn out again very soon. Join success.

Sincerely, Alexander Ivanov

Greetings, dear colleagues investors and all who are interested in the world of finance! In general, I do not really like to write on this topic, but the reviews about previous issues on this topic did not leave me ...

At the turn of the XX and XXI centuries, it was often possible to hear that Russian scientists became speculators from lack of money. I would venture to assume that very soon we will witness the birth of a new thesis: "The introduction of information technologies has turned Russian speculators to scientists."

Do you doubt? Then this article is for you: the best PAMM accounts.

We are looking for and found

The diversity of sampling criteria and the availability of all information is critical for investors. Let's see what the leader of the rating is stability.

Alpari.

If you click on the title, the PAMM Account Indicators page will open. Annual yield of 93% with a maximum drawdown of 15%. The ratio of these indicators equal to 6.2, "income / risk" is called here. Strictly speaking, it is this indicator that is called the Kalmar coefficient, but for the convenience of investors in it, the Commission of the Manager is taken into account, therefore the published value of the coefficient is less than 1.

The only disturbing moment at the rating leader - the credit shoulder exceeded 200 several times, and its maximum value is 317, which indicates serious averaging of open positions. By honor of the manager, this style of trade was characteristic only for the early stage:

From all points of view, an interesting account for investment. However, in the thematic section of the forum of investors MMGP.ru (investment in PAMM-account) is not even represented.

So far, take it note, but let's try to find something worthy for comparison. In the same branch, if you consider messages from managers and feedback 2016, there is an account on Alpari called Robot_Conservative.

Its manager with Nick Profit Trader gives such information: a trading strategy is based on the grid principle and applies, transactions are made by a trading robot. It is also noted that drawdown should not exceed 20-25%. Is it so, we will now find out. We look at the familiar rating on Pammin. This is the score:

The huge July drawdown only miraculously did not reduce the entire previous work. Unfortunately, the trade style is too aggressive and this account is clearly not a candidate for investment.

Now it's interesting to see what you can find on the PAMM sites from other forex market brokers. The most popular platforms provide and.

By logic, the thumbnail with the image of the profitability schedule should provide basic primary information for analysis. Since the most beautiful schedule has the score of BGAL01, from it and start. Click on its number to go to a page with detailed information. And on it something clearly not that:

And at the same time almost the same schedule profit as a percentage:

For example, removal from the account is not taken into account. In this case, the increase in profitability will be the result of capital recovery on the background of a temporarily reduced base. Be that as it may, but the complete absence of detail displays the PAMM account from InstaForex beyond consideration. Go to FXOpen broker.

PAMM Rating accounts This broker is perfectly structured. The restoration factor is also taken into account (the ratio of absolute arrived to the maximum drawdown), and the Sharpe coefficient, and the Kalmar coefficient.

However, the abundance of numerical information is accompanied by graphic miniatures only in the common version of the rating. In the extended version of the graphs no longer. Sort the accounts in the order of reducing the coefficient of Kalmar, since this parameter will soon give a sufficient objective picture yield / risk:

On 1 place in the rating of the value of this coefficient, the expense of space is the expense of space, and with a large margin from competitors. Let's get acquainted with it more. An unambiguous minus is that the score is extremely young. It was created on 03/18/2016. For such a short time, it is impossible to score statistics sufficient to make an investment decision. However, let's see the detail of the account.

The profitability schedule is interesting because the right scale shows the yield of the score itself, and the left is the yield for investors. A very visual presentation of information that is worth awarded to other forex brokers providing PAMM site.

Such a scatter of yield values \u200b\u200bis explained by a high percentage of the manager's remuneration reaching 50% of the profits. The red point marked the date with which the reception of investments begins. Thus, the most active growth in profitability has emerged at the previous period. But what you can learn from the drawing schedule:

Judging by very high maximum values, the manager can use the Martingale strategy. Unfortunately, a description of the trading system, at least in general, on this site is not provided. As for the indicators of other accounts in this ranking, their investment yield is even lower than bank interest on deposits. Alas, practically the perfect worker of the PAMM service is overlapped by the lack of effective managers.

So, according to the quality of reporting information on PAMM accounts from the considered brokers, Alpari leads, with the reservation, what is being done through the company's partner. But when analyzing the invoice on the website Pammin.ru, the Alpari site automatically opens. InstaForex generally does not make it possible to conduct a detailed analysis, and in a perfectly completed FXOpen rating there was not a single interesting account.

Stop alpari. The Stability account has already been considered a very decent yield (even taking into account the manager's remuneration) with quite permissible maximum drawdown and is suitable for investment:

Afterword

This little study is interesting for us even not so much what competent and reliable managers began to appear, how much the information available for the investor in the PAMM site gradually turns into a full-fledged professional toolkit. This allows you to hope that the PAMM accounts in the Russian Forex have a great future.

Subscribe to my blog news and increase your professional level!

Such passive earnings, as an investment in the financial market, enjoys great popularity. Not all entrepreneurs can become reliable and highly profitable traders, but many of them have the opportunity to invest free cash in the best PAMM playgrounds. Due to the periodic applications of legislative and regulatory changes in the regulation of the International Monetary Market, brokers and the PAMM account rating undergoes revision.

The difference between top companies and random intermediaries is the ability to first adapt their investment products to updated trade conditions. Among which it is worth allocating: limited algotrading, mandatory licensing, ban on the provision of bonuses and the distribution of advertising. Work with such harsh requirements for only reliable and prosperous organizations.

The basic concept of PAMM accounts rating

The concept of PAMM-account is quite new in the investment market, therefore is in the stage of active development. Currently, several thousand managers and dozens of brokers operating in the sphere of PAMM investment provide their services on the Russian Financial Exchange. To determine the mediator experience and excellent professional skills or belongs to the category of outsiders, it is necessary to refer to the rating, which contains only in demand and successful managers from all platforms.

You can find a relevant list of recognized forex brokers on any investment site. With it, there is a chance to make a choice of PAMM accounts for investment. Due to comparative analysis, you can estimate the relevance and truthfulness of the performance of the managing performance. The main financial instrument of such an assessment is the rating. All accounts registered on the brokerage platform fall into its registry. Using multiple key parameters, you can compare several control modules that are suitable for investor requests.

The formation of the rating occurs through the enhanced asset growth rates without the participation of risk indicators and the level of drawdown. In addition, the organization of the rating does not take into account the age of the account, however, without this data, an experienced contributor will not expose their capital. It is worth noting that complicating the process of choice can be the popularity of PAMM-sites, because the higher their demand, the greater the requirements and criteria for comparison.

What are the evaluation parameters exist

Most often, the sites are presented a PAMM account rating, compiled by default. At the same time, the main criterion for the formation of the list is the amount of profitability that assortes from brokers providing high profits to minimal dividends. Going into the "PAMM account rating" tab at the top of the table, the control modules with maximum income are always displayed. However, it is not necessary to think that such accounts are the best, because the profitability indicator is only one of the list of criteria that are used to analyze the rating.

Among other filters, it is worth highlight the following parameters:

- maximum drawdown percentage;

- age age;

- capital investment;

- the total size of the management assets.

Also, for a specific site, additional indicators may apply that the broker uses in monitoring. Each of the above criteria has unique characteristics and the ability to change the situation in the investment process. For example, yield is a parameter characterizing the percentage of profits earned for a specific time period of the existence of a PAMM account.

The maximum drawdown is the cost of the cost of a trading account, which is permissible for the manager during trade. With this parameter, pamme can be selected with a minimum risk level, thereby reduce the likelihood of draining cash during the implementation of the investment process. The depositor must consider the following pattern: the lower the size of the maximum drawdown, the less investment is at risk. The age of the account displays the time period of its existence within the brokerage site. With this parameter, the investor can choose PAMMAM with the longest history of work.

The parameter of the capital investment makes it possible to determine the total amount of investment, as well as the likelihood of fund financing by other clients. Therefore, if this module is in demand among other investors, it means that it is of great popularity. The impressive amount of investment in PAMM causes confidence from the depositors. Another important criterion is the capital of the manager, which displays the amount of the trader's personal funds invested by him for subsequent trade. Such a parameter allows the client in the rating to select PAMM, in which the manager was invested the maximum amount of own money.

How to choose a PAMM account for investment

When selecting an effective broker, there are no specific aspects that the account must meet. This is due to the fact that the site, which will be for one depositor the ideal option, can absolutely not suit another investor. A set of criteria may differ depending on the tasks, strategies and goals that the entrepreneur pursues.

Despite this, experts were able to compile a standard list of conditions that should be considered when choosing a PAMM account:

- the existence of a positive history of the site;

- availability of a license or certificate for the provision of brokerage services;

- non-public rating;

- involvement on the platform of only qualified and reliable managers working on a positive result;

- minimum investment size for opening an account;

- the ability to effectively form PAMM portfolios and their management;

- time investment interval;

- the fact of the presence of fines and taxes for the initiation of cash from the account.

Traders whose goal is to work and manage large investments, should also take into account the trading conditions. In addition, when comparing trading on brokerage accounts with trade in PAMAMA, it should be borne in mind that not all forms and classification of products are available for such brokerage sites.

PAMM account rating: His features and secrets

With enviable regularity, the rating of the best PAMM sites undergo changes in the light of improving the characteristics of certain accounts or increase their demand. When drawing up a list, the broker relies on positive and negative customer feedback, personal experience and expert analysis of various indicators. Among the features forming the demand of PAMM accounts, it is worth noting the following parameters:

- Lowability. This aspect is characterized by the convenience of using the platform for investors and traders. Understatell, customers will prefer the Internet portal, which has special services and a mobile application.

- Transparency of work. Broker, providing 100% security guarantees, has a depositor to himself. This characterizes it as a reliable mediator excluding all sorts of fraudulent fraud on the site.

- Leadership. A large number of users attracted indicates the popularity of the platform. In the formation of demand, the number of managers in the rating and depositors, as well as the availability of medium and total investments.

- Implementation of services. Another important indicator is the lack of negative reviews from customers and complaints in competent services.

Also the best control PAMM accounts are formed in the top table under the influence of such a factor as an expert analysis. However, the data will be reliable and honestly estimated only in the absence of an interest from a specialist in awarding the leading position of a specific broker.

In addition to the characteristics, the counting rating has a number of secrets having a mutually exclusive nature. For example, it is impossible to find a platform, which simultaneously hosts the highest profitability and minimum drawdown. There is no such situation in modern realities, because it is always necessary to donate something: count on high income due to maximum risks or get small dividends with a minor level of danger to conclusion of transactions.

In addition, to have a significant impact on the amount of profits can use by some traders in the trading system of hard mani management, stop-loss. Consequently, the averaging, Martingale and Lok will ultimately lead to low yields that will differ significantly from many other PAMM accounts.

In another situation, the presence of minimal drawing indicates that the broker takes the toughest measures to eliminate unprofitable transactions. That is why, when choosing his investor, it can be confident that this manager will never get the entire account of the account. Accordingly, trusting him, the maximum indicator of losses with minimal drawdown in one investment period will be from 1% to 5%.

List of the best risk bills

- Conservative PAMM rating "A".

It includes sustainable and secure accounts that are characterized by the presence of low risks and small, but stable profit over a certain time. To get to the category "A" PAMMAM must meet such conditions as:- efficiency and age of the account - more than 1 year;

- maximum drawdown - less than 25%;

- the limit of the loan shoulder is less than 30%;

- the worst month is less than 10%;

- Approximation per day - less than 3%;

- no need to use Martingale and other specific trade tools.

- Pamm's rating with a moderate risk of "B".

This group belongs to accounts whose managers want to get a maximum profit by increasing the risks. Their peculiarity is to use various methods of increasing yield, without exposing the investor's money loss in the amount of more than half of the total contribution. The "B" category includes PAMM accounts, possessing such parameters:- profitability and age of the account - over 1 year;

- maximum drawdown - less than 50%;

- limit leverage - no more than 60%;

- the worst month is less than 20%;

- Approximity per day - within 6%;

- exclusion of the application of Martingale and other tactics of trading.

- Risky Pamm's rating "C".

The group consists of accounts that cannot be forgotten and to earn money must constantly take appropriate measures. Before the managers, the task is to earn the maximum amount of profit, without considering the potential risk of losing money in a partial or full size. To get into the category "C" can accounts that meet such requirements as:

- efficiency and time of the account of the account - over 1 year;

- not applying management strategies.

Thanks to the separation of the above-described groups, the client of the brokerage platform has the ability to quickly decide which investment approach is closer and more affordable. For investors who wish to preserve their capital from regularly growing inflation, a conservative tactic of action is suitable, and depositors pusing the goal of gaining impressive profits, the aggressive type of ideology will be likely.