Investing in the PAMM account. How to choose the best PAMM account? Rating of PAMM accounts

Greetings to you, guests and subscribers! Many of us are trying to answer questions: "What is harder: to earn or save? What is competent: save or spend in time? "

These are very difficult questions and accurate answers to them. There are too many random factors. Who does not know how to save, he will not save, and who did not spend on time, he can lose everything. So is there a reasonable middle? About this and not only read in a new material: the best PAMM site.

Let's limit ourselves to the most simple task: let's see the principles of the formation of the rating in each of these companies and try to find such where the interests of the investor are taken into account.

In the first two companies, the accounts on accounts are even more scarce than Alpari.

By the way, Forex Trend in 2012 was recognized as the best investment broker in the world, in 2013 - the best forex broker in the world, in 2014 - again the best investment broker in the world, and in addition, also the best innovative broker in the world. In 2015, the company ceased to exist.

Meanwhile, Forex Trend and a little later, Panteon Finance created a fundamentally new system of responsibility of the manager before investors. It is known as PAMM 2.0. According to the legend, the world's first pamm-type account manager has become a certain Veronika Tarasov (Veronika), under the control of which there were more than $ 17 million at the peak of profitability (but it is again on legend).

If without a legend, then the absence of a brokerage license from Forex Trend was completely successfully compensated by the scrolling of transactions through Tarika Business Corp: Tar (Asova Veron) IKA and the Skopalino Finance related company, created with the participation of a very real Ukrainian swirl of Veronica Tarasova. We are also interested in the other: what happened to the PAMM 2.0 itself with the format itself and does it have in one form or other of real brokers?

Familiar all persons!

Long-term search for information leads to the fact that at least one such PAMM playground is currently functioning. It is called PrivateFX. By the way, pay attention to the site protocol (HTTPS), which is now very loved by Haiper. The rating of bills from this company looks completely different than what is offered by popular brokers:

We see the state of two rating leaders. KU means the capital of the manager, and ki - the capital of investors. The negative meaning of QU is explained by the fact that at the moment the compensation of investors' losses was more equal capital of the manager and if suddenly investors want to pick up their money, the manager will be in a huge outcome loss.

Both managers risk hard, and the second maximum drawdown is more than 90%, which means absolutely an adventurous management style. Both accounts are very young, so you should not perceive their seriously. Well, what with accounts, the drawdown of which is minimal, and the age is quite serious? Alas, there is not a single account older than 4 weeks!

Moreover, if you analyze the detailed statistics, it becomes clear that the reason is exclusively in the managers themselves who are nervous and seek at least something to "survive", but losing their own and investor money. However…

We read the section "About company": "The PRIVATEFX Group of Companies is founded in 2015 with the participation of the investment company Concorde Capital." It is CONCORDE CAPITAL that is a guarantor of compensation for losses for customers of our old familiar Forex Trend. I hope you caught what I lead to ...

Thus, today there is not a single reliable company that has been successfully promoting Investment format PAMM 2.0. This means that any potential investor is forced to be limited to a classic PAMM option with its absolutely not acceptable rating system.

And then, such characteristics of the account, as a long history with minimal losses and drawdowns, act on the forefront (mathematically profit is not even so important!) And the reputation of the broker in terms of its reliability and access to interbank liquidity. As is known, in Russia such brokers offering PAMM accounts, only 2: and.

All this does not mean that in itself the PAMM 2.0 format is not viable. Alternatively, the experience of the company Forex Club can be brought. So, at one time, the control of PAMM accounts in this company had the right only to 10% remuneration. Thanks to this, the investor of a successful account almost guaranteed profits.

Unfortunately, the managers risked too much so that in these 10% "fit" as much as possible. This caused mass discontent. As a result, April 4, 2016 Forex Club closed the PAMM account service.

Afterword

And what can offer the West? It depends on to understand under the "West". Many companies in Russia, and in Europe, and in the United States are registered in offshore. But some are aimed at customers from the former USSR, while others are not Russian-speaking countries.

So, PAMM accounts are characteristic of the Russian Forex. The classic West invests in perfectly into other tools: and. This is a completely different world: rigid, intellectual and narrow-profescy. Subscribe to the news of my blog and conquer the real shopping areas of Russia and the West!

The task of good PAMM site is to combine the oncoming interests of investors and traders with the help of comfortable, simple and safe mechanisms. Quality PAMM playground effectively solves all organizational, technical, as well as documentary issues.

How to choose a pamm broker

To select a suitable broker, criteria are important as the experience of its work on the market, the level of profitability, the minimum amount for the PAMM account and the minimum amount of investment. Today we will look at best PAMM SITE 2018The list includes the most efficient, income brokers. They are the best according to numerous reviews.

| № | PAMM playground | Year of discovery PAMM. |

Bills | Minimum investments |

Maximum yield |

|---|---|---|---|---|---|

| 1 | 2008 | 3926 | 50.00 USD. | 85390.6% | |

| 2 | 2010 | 741 | 1.00 USD. | 2994.71% | |

| 3 | 2011 | 123 | 1.00 USD. | 1095.36% | |

| 4 | Akmos. | 2010 | 339 | 1.00 USD. | 602.40% |

| 5 | 2011 | 111 | 1.00 USD. | 331.13% | |

| 6 | FXOpen. | 2010 | 180 | 1.00 USD. | 116.24% |

PAMM platform, 2018 rating

10. Akmos.

The year of the founding of AKMOS - 1995, since 2010 offers investments in PAMM accounts, to the PAMM site rated recently. The company is a pioneer among domestic brokerage services. The minimum for opening a PAMM account is not set. The minimum amount for PAMM investment is 1 USD.

The site works since 2010. The company in the Czech Republic is registered, however, user support centers are located in the Russian Federation and Ukraine. Minimum for opening a PAMM account - 100 USD. The minimum amount for PAMM investment is 1 USD.

The site works since 2010. A distinctive feature of Pantheon Finance is an extremely clear method for the investor to diversify investments to minimize risks. Minimum for opening a PAMM account - 1 USD. The minimum amount for PAMM investment is 10 USD.

The site has been operating since 2007. Aforex is a licensed member of the SRO "Center for the Regulation of Financial Instruments and Technologies". Minimum for opening a PAMM account - 100 USD. The minimum amount for PAMM investment is 1 USD.

The brand belongs to the company E-Global Trade & Finance Group, providing brokerage services in the global network. Companies are open in 6 countries of the world. Minimum for opening an account - 100 USD. Minimum for investment - 1 USD.

The site works since 2009. One of the missions of the company's popularization of the stock market among the widest layers of the population of the Russian Federation. Minimum for opening a PAMM account - 20 USD. The minimum amount for PAMM investment is 10 USD.

Minimum for opening a PAMM account - 300 USD, the minimum amount of PAMM in investment is only 50 USD.

Decided to try a new investment tool for yourself? Explore the rating of PAMM accounts with reference to its type of work: conservative, moderate or aggressive. In the new material of your blog, give answers to questions, according to which principle such ratings are being built, how the coefficient of the account comfort is calculated and why this indicator is extremely important.

What is the principal, except for the term of work and the size of the average profit? Why drawdown gives the investor not only financially, but also psychologically? Who chooses aggressive accounts, and what is the point in this? Answers to these questions, as well as other important aspects regarding the rating of PAMM accounts and how to work with each of the existing species - further.

What is a PAMM account?

For Investors, PAMM is not a new abbreviation, in fact, this is a popular investment mechanism that allows you to make a profit and works exclusively on the principle of distribution between all depositors and the leader: it is divided both profit and losses.

The Alpari's PAMM investment was brought to the Russian market for almost 10 years ago, and today its trading turnover has already exceeded $ 7 billion.

Attracts such a way of attachments by the fact that the client does not need to do anything: it is enough to choose an account that managing and regularly make a profit. But this direction, like others for passive income, is also associated with risk. In order for investments in PAMM accounts as efficient as possible, it is necessary to approach in detail the choice, studying important parameters, one of which is the rating.

Using independent resources that make up the rating, you can see the comfort coefficient - a conditional concept that is the ratio between the drawdown time and the entire working period of the account.

Rating the best PAMM accounts

Immediately, I note that today there is no universal, 100% guaranteeing rating success, which would focus on future yield with ideal accuracy. As a rule, the hierarchy is based on profitability - the average for a certain time, but this form does not include:

- the number and size of the sidelines;

- term of the work;

- trade method.

An objective rating of PAMM accounts from all sites is updated regularly, and at the same time note that Alpari did not just launch the established work of such an investment, but also offered an interesting ranking attempt to conservative and aggressive accounts. Over time, this formula has also replenished the category of moderate risks. What the indicators say in each category - we learn later.

Conservative bills

This direction is quite popular for many depositors, and is characterized by such aspects:

- the size of the maximum drawdown is not more than 25%;

- work throughout the year;

- without the use of toxic trade methods, in particular, Martingale;

- the minimum annual profit rate is 10%.

This PAMM strategy investment is designed for those who are used to getting stable, but not large amounts.

Moderate risks

The principle of work traders is to squeeze the maximum from the market, but due to increased risks. At the same time, the loss of the deposit (and the actual drawdown) should not exceed 50% ideally. The main indicators of a moderate account, such factors can be considered:

- work up to 1 year;

- refusal toxic trading methods;

- minimum profits in the worst months no more than 20%.

Sometimes a moderate account can under the progress of subjective factors, including the mood or trader strategy, immediately become aggressive or at all go into the category of conservative working on the principle of the old proven truth "quische - you will go further."

Risky accounts

Such a form of investments is pretty snorkeling nerves, but choosing exactly the moment, you can earn good. It is important to feel the very moment, and secondly, to stop your gusting of greed. Among investors there are those that often use a conservative or moderate strategy, but periodically they wake up the desire to work on an aggressive account. What distinguishes such PAMM accounts against the rest of the rest?

- Do not use Martingale and other toxic tools for trade (yes - yes, just like that!).

- Work up to 1 year.

- Strong oscillations of profits and drawdowns.

Please note that there is no maximum drawing indicator, because, in fact, it can be absolute, as the account completely merges. At the same time, it is impossible to determine the average income, because it is a fairly floating concept.

PAMM Rating Alpari accounts

The traditional hierarchy for conservative and aggressive bills is quite popular, understandable, but, it is not ideal. We are dealing with statistics, which is known to be stubborn. But at the same time floating percentage of drawdown and profitability, the garter for seasonal oscillations gives its shade. The rating available for the assessment on the company Alpari's company is quite understandable.

We see the name of the account, place, total yield, and besides this we can look at it for a certain time (entire working period, 1 year, 1 month, today, indicator), the amount of investments. By clicking on the "Return" position, the program will calculate, after which time you will return the attached amount. According to the same principle, the PAMM rating of Alpha Forex accounts is drawn up as one of the key figures in the brokerage market.

This monitoring additionally presents an indicator of successful transactions and conclusion limitations. Who else is such ratings? In most cases, brokerage companies themselves, but there are also a number of independent services with talented authors, which, with the help of personal observations and software, offer us this statistic. And what is important - regularly updated! If you take into account only a hierarchy for profitability, you can work exclusively with tops on the upper positions, but it is impossible not to say that somewhere in the middle or end of the list there are successful traders, which is not enough time to get into leaders.

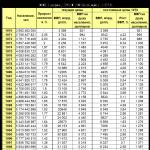

| PAMM account | Profit Loss | % Manager |

|---|---|---|

| A0-HEDGE (345423) | 3,8% | 17-35% |

| Eternity (312978) | 3,6% | 25-50% |

| Second Way (349145) | 4,1% | 20-30% |

| Movingup (372549) | 3,6% | 25-30% |

| Savgroup Pamm Invest (343217) | 0,3% | 10-35% |

| Cyborg01 (363961) | 24,5% | 20-40% |

| EUR INTERCEPTOR (377956) | 3,8% | 50% |

| stani-Wunderbar: 359373 | 3,9% | 20% |

| sameyl: 375772. | 4,3% | 10% |

| TRAVGUST: 370276. | 4,7% | 20% |

As a result, I want to clarify that the rating is not a panacea or a guarantee that the chosen manager will bring you a profit from each transaction, but this is a tool that allows you to make decisions where to invest your funds. Always evaluate the current indicator of profitability and drawdowns. I wish you strategically correct solutions that will bring a stable profit.

To choose from the rating a suitable company in Russia, you need to study in detail the principles on which it builds its work. Among the criteria indicating professionalism, it is possible to note the effectiveness of the managers, the duration of work in the market with accounts, the reputation of the PAMM brokers in the medium of the best participants of Forex. We also recommend paying attention to the proposed conditions for the percentage of remuneration and distribution of damages, the effectiveness of the technical and information support for customers and the availability of positive feedback from the exchange professionals.

Our current rating of forex brokers with PAMM accounts 2017-2018 will be useful both for beginners and experienced investors. The best traders with a large investment portfolio and / or the decision to diversify risks also learned the information necessary for themselves.

The goals and objectives of the rating are to provide traders and potential investors of an effective tool to evaluate the work of the best PAMM brokers and assistance in choosing a suitable company. We strive to make Russian trading clear and transparent for everyone. After you have chosen from the rating of brokers with PAMM accounts, it is worth moving to their questionnaires and read reviews. If everything is satisfied with everything, you can proceed to investment and expect profit.

The rating contains information on the PAMM Governing Alpari, based on the entire history of their trade in the broker. The goal of the rating is to highlight the best Alpari Forex traders who deserve confidence and are most attractive to investment in PAMM accounts.

The term of work, the indicators of the average profitability and risk of PAMM-Managing, take into account all the statistics of its trade on all PAMM accounts, including those that are already closed. The number of investors, the amount of investment, the amount of the commission is considered only on open PAMM accounts.

What pamm managers are involved in the ranking?

- working period of at least 2 years;

- there is an open PAMM-account investment in the main rating (not in the sandbox);

- there is a positive PAMM;

- rank manager at least 1.

What PAMM accounts of the Manager are taken into account?

The ranking takes into account all the PAMM-accounts of the manager who were published on Alpari. Even if the trader closed or merged his account, its history is taken into account in the calculation of the ranking of the manager. Those Alpari Forex traders who traded only on non-public PAMM accounts are not involved in the ranking. If the trader traded to alpari under different nicknames, he can combine them in one PAMM account on our website.

How is the rank rank?

The rank of the manager is a summary assessment of its experience and quality management. The rank is considered on a scale from 0 to 5. It takes into account the following PAMM control characteristics:

- work experience

The overall calendar term of the manager on all PAMM accounts. The more experience, the more reason to believe that the manager will cope with any market. The highest score is raised after 3 years of work. - Number of trade (active) days

This is also an assessment of experience, but from the point of view of the significance of the statistical. Only trade experience is taken into account in the form of open transactions on Forex. Transaction waiting time is ignored. The highest score is raised after the accumulation of 600 trading days. - Calmar for all time

The average coefficient of Kalmar (income / risk) for all time on all PAMM accounts of the manager. Indicator of trade quality in relation to income / risk. It is considered an average weighted coefficient for all PAMM accounts, including closed. The more this coefficient, the general, is better than trade of the manager. - Calmar over the past year

Shows what the dynamics of the account has recently. Trade can occur with varying success, Kalmar recently shows how successful the current trade is. - Standard deviation

Shows how stable the results of the manager. The value in percent is the likely variation of the monthly yield around its average value. The average weighted indicator for all PAMM accounts is considered.

Each of the indicators is also ranked from 0 to 5 and with a certain weight is added to the general rank. The term of work and Kalmar for all time have a double weight.