Liability insurance management organization. Financial protection management companies. What can violation of the Criminal Code

Organizations entered into an agreement on the management of an apartment building in the framework of the competition (75-PP) or by decision of the owners of housing, we offer a convenient and rapid design of the insurance contract management company.

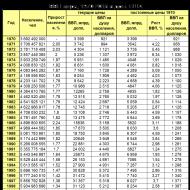

The cost of insurance of the Ukrainian

The cost of insurance of liability management company depends on the sum insured, the year of construction and the region of finding the received (adopted) at home management. Also, it is important, from which material is erected constructive (monolith, panel, brick, wood, etc.).

The above tariffs are not final. To calculate the exact cost, you must send a competitive documentation or a link to the purchase on E-mail. This e-mail address is being protected from spam bots, you need JavaScript enabled to view it.

Registration of the insurance company insurance contract

Primary document flow is carried out in electronic form (in online mode). This approach allows you to work with all regions of the Russian Federation, regardless of the location of the insurance and insurer.

The procedure for designing the contract consists of the following steps:

- sending us competitive documentation (procurement references) and the details of the Management Company;

- coordination of the tariff;

- preparation of the project of the insurance contract;

- coordination of the project of the insurance contract;

- transmission of document originals;

The design process takes 1-2 working days depending on the timing of the tariff and the project of the insurance contract. The delivery of originals is carried out by courier (in Moscow) or express mail (in the regions) after payment of the insurance premium.

Participants of contests for 75-PP

Insurance of the management of management companies - a measure to ensure the fulfillment of obligations under contracts for management of apartment buildings, provided for by Art. 43 Decisions of the Government of the Russian Federation of March 6, 2006 No. 75 "On the procedure for conducting the body local governments An open competition for the selection of a management organization for managing an apartment building. "

From three possible methods Contract Support: Liability Insurance, Related bank guarantee And the deposit is the most profitable insurance. Considering that the way to ensure the fulfillment of obligations is determined by the control company itself, the choice here is obvious.

The benefits of insurance management company:

- cost - insurance costs significantly cheaper banking guarantees;

- time saving is the rapid harmonization of the conditions and the design of the necessary documents;

- efficiency - there is no conclusion money From the company's turnover.

Insurance of the Criminal Code on the simplified system

Together with partners, the department of the methodology of our company has developed and implemented a convenient form of liability insurance for utilities management companies. In the product we offer, a simplified design is provided, namely, the lack of applications and questionnaires, which usually make it difficult to interact between the insured and the insurer. To prepare the insurance contract, we request only a reference to the competitive documentation. Important and profitable termsprovided for in this program. The tariff is from 1% for each year of insurance.

The liability insurance contract lies for the entire period of the management agreement of the apartment building - from 1 to 3 years. Accurate tariff and insurance period are determined after familiarization with the documentation of the competition. Insurance is accepted by the management organizations of all subjects Russian Federation.

Originals of documents are sent to you by express mail.

We will help you insure the responsibility of the management company as quickly and on favorable terms.

1. A specialized depositary is obliged to insure the risk of its responsibility to the Pension Fund of the Russian Federation and the management companies for violations of contracts for the provision of specialized depositary services caused by errors, negligence or intentional illegal actions (inaction) of employees of a specialized depositary or intentional unlawful actions of other persons.

2. Managing companies are obliged to insure the risk of their responsibility to the Pension Fund of the Russian Federation for Agreements of Contracts trust management means pension savingscaused by errors, negligence or intentional unlawful actions of employees of the management company or intentional unlawful actions (inaction) of other persons.

The specified illegal action (inaction) includes crimes in the field of computer information, crimes aimed against the interests of the service in commercial and other organizations, crimes in the field of economics and other offenses.

3. Insurance amount within which the insurer undertakes to pay insurance compensation Upon the occurrence of each insurance case During the term of the contract mandatory insurance Responsibility of a specialized depositary (paragraph 1 this article) There may be no less than 300 million rubles.

Insurance amount, within which the insurer undertakes to pay insurance compensation upon the occurrence of each insured event during the term of the contract of compulsory liability insurance company (paragraph 2 of this article), may not be less:

5 percent of the amount of pension savings transferred to the management of this management company, if the specified amount is not more than 6 billion rubles;

(see text in the previous edition)

300 million rubles if the amount of pension savings transferred to the management of this management company exceeds 6 billion rubles.

(see text in the previous edition)

4. If, under the terms of the contract of compulsory liability of the specialized depositary and the obligatory insurance contract, the obligatory liability of the management company provides for the partial liberation of the insurer from the payment of insurance indemnity (franchise), the amount of such liberation (franchise) cannot exceed the size own funds Insured at the time of the insured event.

5. Specialized depositories and management companies are insuranceing their responsibility by concluding relevant compulsory insurance contracts with insurers that meet the requirements of paragraph 7 of this article, as well as other provisions of the legislation of the Russian Federation.

6. Specialized depositories and management companies that have not entered into agreements of compulsory insurance of their responsibility in accordance with the requirements of this article, are not entitled to produce operations related to investing pension savings. On the conclusion, extension and termination of the contract of compulsory liability of the specialized depositary and managers of the insurers inform central bank Of the Russian Federation in the manner prescribed.

(see text in the previous edition)

7. Mandatory liability insurance of the specialized depositary and management companies (paragraphs 1 and this article) have the right to implement as insurers insurance organizationsresponsible for the following requirements:

1) who have a license to carry out compulsory liability insurance of the subjects of relations to investment in the funds of pension savings issued in accordance with the legislation of the Russian Federation regulating insurance activities;

(see text in the previous edition)

2) having their own funds in the amount of at least 3 billion rubles or the specified compulsory insurance in compacting with other insurance organizations that have their own funds in the amount of at least 3 billion rubles;

8. A compulsory insurance contract for the responsibility of subjects of relations to investment funds of pension savings cannot be concluded with an insurance organization if:

1) the procedures of bankruptcy or sanction in the form of suspending or canceling the license to carry out insurance activities during the last two years;

2) it is an affiliated person of a specialized depositary or management company with which Pension Fund The Russian Federation has concluded contracts in accordance with Article 17 or Article 18 of this Federal Law, or an affiliated face of their affiliates.

"He who wants to wear a crown should put up with her weight." Kim Von

Who are such management companies?

Most often, the management company (CC) is created in the form of LLC. it entitywhich carries out the service of communications of buildings and common property under the contract with the owners of this property in apartment house. It is worth paying attention to that the Criminal Code sounds majestically, but the name is not quite correct, because in accordance with the law, the management company is a company that managing investments. However, in practice, this phrase is applied more widely.

Problems of housing and communal services

Let's answer the question together, what problems today are in the Russian housing and communal services? Undoubtedly, this is:

♦ Unreasonably high rates for housing and utilities services

♦ Low workers qualifications

♦ High Emergency Communication

♦ Wear engineering equipment

♦ Dispatch service non-historical

♦ Eternally inaccessible guide

♦ Expenditure tools for maintenance and maintenance of objects - Closed information

We know with you that this list can be continued. Is it worth it? After all, there is an alternative for such a risky market segment, such as housing and communal services. This alternative is called ...

... Insurance of the responsibility of management companies

The most conflict segment of the market, today, is the segment of housing and utilities. Therefore, it is not surprising that in the epicenter of conflict material relations Suppliers, contractors and residents serviced houses are managers.

But the management company of housing and public utilities in accordance with paragraph 2.3 of Article 161 Housing Code RF is fully responsible to the owners of the premises. apartment house For the provision of all services and execution of works that ensure the proper content of the common property in the house!

It is not necessary to be seven spans in the forehead so as not to guess that sooner or later, several owners of apartments will be presented to the management company Claims or judicial claims to recover damage caused, judicial and other expenses, possibly compensation for moral damage, and more possibly, and fine .

Given the Civil Code of the Civil Code, it becomes obvious that the court will certainly decide on recovery from the management company of funds, in favor of the owner of the housing!

And what is the case with the claims of citizens who are not owners of apartments, but affected by the inaction of the management companies of housing and communal services? For example, in cases of harm to health or death with a random pass, from fallen, for example, from the roof of the icicle or block ice?

Risks responsible management companies

Is it possible to provide a management company to avoid unplanned and uncovered costs of execution of court decisions? Oh, hardly! After all, "a person suggests, and the Lord has" ...

The most phenomenal loophole in such a situation will be the policy of insurance of civil liability management companies. He implies insurance of the following actions and risks of utilities management companies. See if they are covered?

▲ Fire, lightning strike, household gas explosion

▲ Fall on the property of flying objects, their parts and cargo

▲ Explosion of steam boilers, gas pipelines, gas storages, devices, machinery and other technical devices

▲ Hazardous Natural Phenomena

▲ illegal actions of third parties

▲ Property damage by accident hydraulic systems

▲ Electrotechnical equipment breakdowns

▲ velves of machines and mechanisms

These factors are enough? Or do you think that we have covered not the entire spectrum of possible risks? Well, that, then you can easily agree with the insurance company additional risks that you seem relevant.

What is the price of the question?

Of course, you are tormented by doubts, and what is the price of the question? Let's see the insured premium in this form of insurance. You must understand that your responsibility insurance limit you choose yourself.

Suppose, the limit of responsibility was elected to 1 million rubles on one insured event, and the total limit per year, suppose 12 million rubles.

The franchise will also install 10 thousand rubles so that you do not run every time to the insurer in small losses, for example, in 500 rubles.

In this case, the insurance premium will be 45 thousand rubles per year! And live yourself calmly, without fear of ships and other claims of victims. The insurer himself settles all your questions.

It is only necessary to remember that the payment of insurance compensation is carried out by the insurance company on the basis of a written claim to the management company Housing and communal services, from a third party who caused damage or harm. The complaints are usually attached confirming the amount of damage to documents.

In addition to insurance of the management company, it is also possible to further insure the property of the service of the house. Insurance rate, in this case, will be 0.03% - 3% of the amount of the property. How to implement it?

It is legally possible to reasonably insure the property of the Housing and Commarycles serviced by the House of the Criminal Code, in accordance with Article 36 of the Housing Code of the Russian Federation, if in the contract of owners of apartments with the UKHCM or in the minutes of the assembly of apartment owners is the right or obligation of the management company to insure common property in the House.

What is the purpose of insurance of liability management company?

Goals are obvious!

First, improving the quality of services. The higher the quality of the services, the less the cost of insurance, because The risk of an insured event is reduced. After all, to obtain insurance payments, the management of the management company must meet strict requirements, and it stimulates you to increase the professionalism of the workers. In addition, it stimulates more closely to follow the choice of contractors and consumption of funds.

Secondly, the liability insurance of the management company is incredibly guaranteed to raise its own image. By concluding the insurance contract, you will deserve love and respect for the owners of housing, since in the event of an accident, accident or illegal actions of third parties, the issue of damage compensation will be solved uniquely quickly and professionally.

P.S. Believe me, the management company that takes care of the insurance of its risks, deserves more trust than its competitors!

Actual types of insurance in the housing and communal services

2393 views

Housing and communal services is the area of \u200b\u200bthe economy in which many directions and aspects are closely intertwined, from social to political.

Contractor liability insurance

In many regions, long-term financing standards are not respected overhaul Housing Fund; It is not enough (for example, in Moscow - by almost 30%) the maintenance and current repair is carried out; Funds only enough for emergency events. As a result, the general condition is deteriorating and depreciated the depreciation of fixed assets, the reliability of life support systems is reduced, minimum service quality standards are not complied.

To correct the current position in the framework of the housing and communal reform of housing and communal services, a system for attracting contracts and managers has been introduced housing Foundation Organizations on a competitive basis. For contestants - these are firms that have licenses for various types of work in the housing and utilities system and possessing, of course, certain experience in this field. But licenses and experience do not guarantee from events that can suddenly occur and occur during work on maintenance, repair and management of the housing foundation. Often these organizations do not have sufficient funds to cover caused damage, and all the severity of his compensation falls on the city budget, which is very significant amounts.

In our opinion, this problem has one simple solution - the use of insurance. It is insurance protection that is the tool that allows you to transfer the care of the elimination of damage to the shoulders of professionals in risk management - to insurers. In the provisions on the holding of competitions for such work and management of the housing foundation as the main criterion financial Sustainability The contestant needs to introduce a condition for the need for civil liability for causing damage.

In this case, the composition insurance coating In the amount of established limits of the insurer's responsibility, satisfaction of the informed claims of third parties for the person caused by the insured personality damage or property, which caused the result of random errors during repair work and during the warranty operation of the object after repair. For example, it may be claims claimed in connection with the damage caused by the tenants of the upper floors as a result of the roof leakage after replacing soft roof. Errors may allow employees of a contracting organization both during work and as a result of the use of poor-quality or frankly defective roofing material. The need for insurance becomes even more obvious when in the period of operation of the house the contractor may turn out to be insolvent or at all bankrupt, without excluding intentional bankruptcy. Then the damage of the injured person will be reimbursed by the insurer. Liability of the insurer or insurance amount, i.e. the amount within which it covers losses is determined by the estimated cost of the work and can be quite significant. The cost of such insurance, or the insurance premium, is calculated depending on the nature of the facilible object, the species and timing of the work performed, as well as the limits of the liability of the insurer.

The insurance contract is the entire scope of work under the contract, and the insurance premium is paid simultaneously with the act of opening the object. If work is performed more than a month, the Contractor may be given the possibility of installment of the insurance premium. The amount of the award, as well as the deadlines and the procedure for its introduction are determined when concluding an insurance contract. Insurers under this contract are contractors, and beneficiaries - customers under the contract, carrying out the management of the housing foundation, as well as in advance indefinite third parties affected by the damage caused. The beneficiary may be given the right to directly appeal to the insurer for the payment of compensation within its responsibility.

Account management liability insurance

Insurance in the housing and utilities system is not exhausted only by the insurance of contractors' liability. No less significant importance is the activities of another subject of this market - private managers. Since 1997, the Government has begun a gradual transition to a competitive selection of private companies to manage the housing fund and licensing this activity. Private firms will come to replace the State DEZ, Rau, ZEK and Dz, which will be legal responsibility for damage caused by the personality and property of third parties, primarily the residents of the area in which they work. Therefore, when conducting competitions for the best management company in typical conditions, it is also necessary to include the requirements for the provision of financial guarantees of damage compensation as insurance Polisa.. In this case, the insurer will be interested in reducing the probability of the occurrence of the insurance event, financing warning events.

In the future, the role of the management company in collaboration with the insurer increases to the coordination of all insurance activities in the area (adoption and approval target programsaimed at reducing livelihood risks in the area). Means collected by the insurer for these programs are also used to finance investment projects of this municipal district.

Civil liability insurance of owners and tenants

Another object of insurance in the field of housing and communal services should be the civil liability of owners and owners (tenants) of residential and non-residential premises. Recently, a large number of new housing owners appeared as a result of privatization. At the same time, the amount of damage caused during repair and redevelopment work in privatized and acquired new apartments. Installation of new plumbing equipment, the transfer of internal partitions and the demolition of ventilation boxes often lead to a significant loss of owners of neighboring apartments and submitting lawsuits. The same applies to tenants of non-residential premises located on the first floors of residential buildings and in separate buildings of the municipal fund.

Illiterate exploitation of electrical and engineering networksViolation of fire safety rules lead to fires and other tragic consequences. The liability insurance of tenants as an indispensable condition in the lease agreement would increase their responsibility for the operation of premises, and would also restore damaged objects without attracting additional funds from the city budget.

The area of \u200b\u200bapplication of insurance protection, which is not directly related to the housing sphere, but in direct interaction and incoming in the infrastructure of the district, was the operation of gas stations and garage complexes in the area. At the same time, significant damages may be caused by the objects of municipal property, as well as the life, health and property of citizens. Being places of increased danger, gas stations and garages require special discipline of operation. And although there are various standards and rules, fires and explosions still occur there due to elementary negligence and neglect by these rules, leading to significant material losses and even, unfortunately, the death of people.

Insurance of civil liability of owners of petrol stations and garage complexes at the conclusion of rental contracts land plot It will help to solve this problem at the level of the municipal district.

Mortgage insurance

Mortgage as one of the few available housing acquisition systems has a number of characteristic risks, to reduce which and is designed mortgage insurance.

First of all, this is the insurance policy of the laid real estate. This policy provides the protection of interests both the lender and the borrower and guarantees a stable amount of security for one of them, and for the other - the lack of burdensive costs for restoring the subject matter of the pledge or the need to further guarantee the obtained loan.

No less important is the civil liability insurance of the borrower to third parties for damage caused by their property interests. Practice shows that the offensive of responsibility to third parties leads not only to financial losses creditor of the loan, but also serious complications for the bank due to the impossibility of fulfilling the obligations of obligations credit Treaty.

For the performance of the system, the life and health of the pledger is also important. Credit fundsIssued by the Bank are compensated from providing the insured for this agreement in case of loss of working capacity and from part of funds received by relatives after his death. The loss of guaranteed income may be associated with other circumstances, such as dismissal. This problem is also solved by purchasing the appropriate insurance product.

The special interest of creditors also raises losses related to the non-fulfillment by the borrower of their payment obligations.

Listed insurance products The entire variety of forms of application of insurance in the field of housing and communal services are not exhausted, confirming the need for its wider implementation.

A.K. Kruglov, Head of the Insurance Department of CJSC RuxO