Proposals for improving the appraisal of real estate. Thesis: Real estate appraisal. Determining the market value of real estate within the framework of the market approach

Substituting real data on the cost per square meter of apartments in the city of Novosibirsk in each quarter of 2006, it can be noted that this value falls within the confidence intervals constructed by the model. According to experts, the resulting model adequately describes the current situation in the real estate market. The forecast of growth in the cost of housing by the end of 2006 for certain types of apartments coincides with the real data, since the market growth predicted by experts is 20-30%. An appraiser is constantly faced with the problem of predicting the cost of apartments, this problem is especially acute when conducting appraisals for lending purposes. The correctness of the decision depends on the experience, qualifications of the specialist, as well as on the quality of the collected data on the market of the object being evaluated.

Introduction

After binding, the price lists are sent back to the Gosstroy for their further approval. Currently, the process of developing a new regulatory framework has not yet been completed.

Real estate appraisal based on the new regulatory framework is a very complex and time-consuming task that requires special knowledge and skills. In order for the new regulatory framework to enter the practice of appraisal, it is necessary to carry out a set of works on the development of software and computer systems adapted to solving applied problems of real estate appraisal.

Recently, regional centers for pricing in construction have begun to work actively, firms specializing in the provision of information services have appeared, for example, the NPF "Center for Information Technologies in Construction".

Suggestions for Improving Real Estate Appraisal Methods

When using these editions, it should be remembered that most of their calculations are based on the regulatory framework of the times of the planned economy, indexed according to certain price coefficients and, therefore, the final results of the assessment may have a significant error for the reasons stated above. When using certain indices, it is necessary to carefully study the prerequisites for their calculation.

Recently, it was published and announced as the first in the country awaited by appraisers Regional Construction Costs Guide (RCC-2006). It shows cost indicators by type construction works, aggregated cost indicators (COI) and "information for assessing the required amount of investment in the express option."

In fact, the last definition refers to the estimated cost of analogous objects of modern buildings and structures.

Residential real estate appraisal (3)

In particular, the demand for valuation in order to reflect assets in financial statements in accordance with IAS, US GAAP or Russian standards accounting; assessment of the cost of intangible assets to determine the effectiveness of marketing and brand strategies; appraisal for the purpose of making transactions of sale and purchase, lease of assets, M&A and other transactions for the transfer of ownership and other property rights; valuation for insurance purposes, additional issue of shares or redemption of shares during the privatization of state-owned enterprises; appraisal for the purpose of lending secured by property, etc. According to the results of the research of the rating agency "Expert RA", the most demanded services for the last year and a half were the services for the appraisal of real estate and business in general.

Thesis: valuation of residential real estate

FEDERAL AGENCY FOR EDUCATION GOU VPO "MOSCOW STATE UNIVERSITY OF SERVICE" Faculty: "Institute of Regional Economics and Municipal Management" Department: "State and Municipal Management" Course project. Topic: Improving the methods of real estate appraisal.

Discipline: Management of municipal real estate. Performed by a student of the GRDS 3-2 Group Shevchuk M.V. Accepted by the teacher Dubovik M.V.

Improvement of methods of real estate appraisal

Thus, RCC compilations should become the basic basis for real estate appraisal. However, there are also significant drawbacks of these collections.

The main one is that they do not provide the initial data and basic assumptions of the obtained values of the value of analogs. So, it is not entirely clear what exactly the composition of the equipment is taken into account in the final indicators, what was included in the other costs of the developer, etc.

The joint work of surveyors, analysts and appraisers in the direction of improving the RCC can lead to the creation of an information base so necessary for real estate appraisers. The main direction in the development of appraisal activities is currently becoming the appraisal of the market value of real estate.

This becomes possible due to the fact that our country is accumulating a database on the actual market value of real estate objects.

Abstract: appraisal of residential real estate

Other situations for application: - feasibility study for new construction, - determination of the best and most effective use land, - renovation, - final cost agreement, - institutional and special purpose buildings, - insurance purposes. - method of market comparisons: assessment of the market value of a property based on data on recent transactions with similar properties. It is assumed that a rational investor or buyer will not pay more for a particular property than it would cost to acquire another similar property with the same utility. - income method: the value of the property is determined by the size, quality and duration of the period for obtaining the benefits that the object is expected to bring in the future.

20. methods of cost-based approach to real estate appraisal (improvements).

Attention

Origin · Natural (natural) objects · Man-made objects (buildings) .2. Appointment Free land(for building or other purposes) · Natural complexes (deposits) for their exploitation. · Buildings For housing. For office. For trade and paid services. For industry. · Others. 3.

Scale · Land tracts. · Separate land plots. · Complexes of buildings and structures. · Multi-apartment residential building. · Single-family residential building (mansion, cottage) · Section (entrance). · Floor in a section. · Apartment. · Room. · Complex of administrative buildings · Building · Premises or parts of buildings (sections, floors) .4. Ready for use · Finished objects · Requiring reconstruction or major repairs · Requiring completion of construction. 1.2 Methodology for evaluating residential real estate.

Improvement of methods of real estate appraisal

Thus, the UPVS collections take into account the following cost items: · direct costs; · Overhead costs; · Planned savings (profit); · General site expenses for the allotment and development of the construction site; · The cost of design and survey work; · Costs associated with the production of work in the winter; · Costs of bonus wages; · The cost of maintaining the management of a standing enterprise; · Losses from the liquidation of temporary buildings and structures; · The cost of transporting workers over a distance of more than 3 km. in the absence of public transport; · The cost of paying bonuses to employees for the mobile nature of work. Experienced appraisers in their calculations use their own developments based on corrections of analogs or aggregated estimates.

In the work of P.G. Grabovoy, S.P. Korostelev “Property Appraisal, Part I.

Topic: improving methods of real estate appraisal

Statistical indicators for this model confirmed the significance of the results obtained. Thus, the resulting model very well reflects the dependence of the average cost of apartments on its parameters in the housing market of the city of Novosibirsk (excluding extreme options).

The presented models were implemented in practice in the real estate agencies of the city of Novosibirsk "Zhilfond" and "Amir - Nedvizhimost", which have staff members to assess the cost of apartments for sale, as well as act as collateral in credit agreements. It should be noted that experts highly appreciated the effectiveness of their application. The second important problem that appraisers face is forecasting the cost of an apartment in the future.

Residential property appraisal

Proposals for improving methods of real estate appraisal Conclusion List of used literature and sources Appendix INTRODUCTION Among the elements of a market economy, a special place is occupied by real estate, which acts as a means of production (land, administrative, industrial, warehouse, retail and other buildings and premises, as well as other structures) and an item or object of consumption (land plots, residential buildings, summer cottages, apartments, garages). Real estate acts as the basis of personal existence for citizens and serves as a basis for economic activity and development of enterprises and organizations of all forms of ownership.

In Russia, an active formation and development of the real estate market is taking place, and an increasing number of citizens, enterprises and organizations are participating in real estate transactions.

After this research work, the following proposals for improving the residential real estate market have been identified. Often a big role in the formation of the cost of 1 sq. m. of living space has a direct influence of the realtor on the buyer or seller. Bad faith and the use of personal interests of employees of intermediary organizations leads to an artificial increase in prices for residential real estate. Thus, the secondary housing market is often simply out of the control of local governments, as it is run by real estate companies. And only a small percentage of the offered apartments on the secondary housing market under the influence of the city administration. Drawing a conclusion from the above, I would like to say that in the conditions of the financial crisis, in this respect, control by local governments is necessary. This is due to a fairly high demand for housing and thus a high percentage of profit from the resale of secondary housing is obtained by small real estate agencies. I would also like to draw close attention of self-government bodies and its structural divisions to the growth in the cost of housing. As the real estate market is in the process of overcoming the crisis and housing prices begin to rise rapidly due to high demand. With the tightening of the terms of auctions for the purchase of land plots for individual residential construction, small companies seeking to obtain high profits without proper fulfillment of the terms of contracts should be squeezed out of the market. Also, on the way to improving the real estate market in Omsk, it is necessary to improve the legal and regulatory framework. This will lead to a decrease in the rate of growth in prices for residential real estate and their equalization with the real needs of the market.

On the way to a perfect real estate market, it is necessary to create services that maintain strict control over this type of documentation. The combination of all the above measures will help the real estate market in Omsk get out of the crisis in the shortest possible time and improve conditions for controlling the turnover of apartments in this market.

Conclusion

In this diploma project, a deep analysis of the current situation on the secondary housing market in Omsk is carried out. At the same time, the natural and ecological state of the city, as well as social and economic factors that have a direct impact on the formation of secondary housing, have been studied.

The capacity of the residential real estate market, supply and demand in the secondary market in the period 2009-2012 was also studied.

A detailed analysis of the proposals on the secondary housing market has been carried out. Possible methods for improving the residential real estate market in the conditions of economic crisis... The prospects for the development of the residential real estate market are considered.

The relevance of the study is emphasized by the fact that the future of cities is largely associated with the development of the residential real estate market. Since the residential real estate market i.e. the housing market is one of the most important markets, it has a direct impact on the life of society, thus the state of other components of the life of society depends on its condition.

The goal of the diploma project has been fully realized. In accordance with the set goal, the following tasks were solved:

Studied the scientific and methodological provisions of the marketing of residential real estate in the city of Omsk;

Considered the legislative and regulatory framework for the development of marketing of residential real estate in cities;

The main directions for improving the residential real estate market have been developed;

The conditions for ensuring the safety of life during the assessment work are considered;

The analysis of environmental solutions in assessing the factors that draw attention to the nature of the city.

FEDERAL EDUCATION AGENCY

GOU VPO "MOSCOW STATE UNIVERSITY OF SERVICE"

Faculty: "Institute of Regional Economics and Municipal Management"

Department: "State and Municipal Administration"

Course project.

Topic: Improving the methods of real estate appraisal.

Discipline: Management of municipal real estate.

Completed by a student

GRDS groups 3-2

Shevchuk M.V.

Accepted by the teacher

M. V. Dubovik

Introduction …………………………………………………………………… .3

I Theoretical part

1.1 Classification of real estate objects …………………………… ..5

1.2 Methodology for appraising residential real estate .............................................. 6

1.3 Housing market ………………………………………………………… 9

1.4 Real estate securities market …………………………… ..13

1.5 Mortgage …………………………………………………………… ..15

II Analytical part

2.1 Modern principles of real estate market analysis …………… 18

2.2 Real estate market research ……………………………… .... 20

2.3 Methods for assessing the market value of real estate …………… ... 26

2.4 Features of different types of assessment …………………………… ... 34

2.5 Influence of factors environment for the cost …………… ... 36

III Practical part

3.1 Practical application of the comparative sales method ……… ..39

3.2 Investment risks and statistics of real estate markets …………… 44

Conclusion …………………………………………………………… ... 47

References ……………………………………………………… .50

Introduction.

The term "real estate" has appeared in Russian legislation since the time of Peter I. However, the current legislative acts have not yet made a clear distinction between movable and immovable property.

Immovable things (real estate, real estate) include land plots, subsoil plots, isolated water bodies and everything that is firmly connected with the land, that is, objects, the movement of which is impossible without disproportionate damage to their purpose, including forests, perennial plantings, buildings, structures. Immovable things also include aircraft and sea vessels, inland navigation vessels, and space objects subject to state registration. Other property may also be classified as immovable by law. So, for example, an enterprise as a whole as a property complex is also recognized as real estate.

In accordance with part one of the Civil Code of the Russian Federation, an enterprise is considered not as a subject, but directly as an object of civil rights.

An enterprise as a whole or part of it can be an object of purchase and sale, pledge, lease and other transactions related to the establishment, change and termination of property rights. The company can also be inherited.

The structure of the enterprise as a property complex includes all types of property intended for its activities, including land, buildings, structures, equipment, inventory, raw materials, products, rights of claim, debts, as well as the rights to designations that individualize the enterprise, its products, work and services (company name, trademarks, service marks), and other exclusive rights, unless otherwise provided by law or contract.

The state body that carries out state registration of real estate is obliged to provide information about the registration made by it and registered rights to real estate objects to any person. This rule will undoubtedly significantly reduce the risk of improper transactions with real estate for participants in civil turnover.

Various forms of ownership: private, joint-stock enterprises, local, municipal and, finally, federal. It is very difficult to determine the effectiveness of one form or another - it all depends on specific situations.

In general, the residential market is much more developed than other segments. And this is understandable. There is already a definite legislative framework governing the processes of privatization of housing, obtaining land for the construction of cottages, etc.

The market of non-residential premises is represented mainly by once purchased or reconstructed premises, converted into offices. But in the course of privatization, more and more objects appear that are leased out or sold at auctions by property funds, i.e. local authorities management. At the second stage of privatization, the real estate market will be replenished with industrial facilities and, to an even greater extent, with retail and service facilities.

After the introduction of the right to private ownership of real estate and the privatization in the Russian Federation, the state ceased to be the sole owner of the overwhelming number of real estate objects, which served as the beginning of the formation of the real estate market.

I Theoretical part

1.1 Classification of real estate objects.

Real estate appraisal is of interest, first of all, for categories of objects that are actively circulating on the market as an independent commodity. Currently in Russia it is:

Apartments and rooms

Premises and buildings for offices and shops

Suburban residential buildings with land plots (cottages and summer cottages)

Free land plots intended for building or for other purposes (in the short term)

· Warehouse and production facilities.

In addition, real estate objects, as a rule, are part of the property complex of enterprises and organizations (in particular, those being privatized) and significantly affects their value. There are other categories of real estate objects, the market for which has not yet formed.

The assessment of an object is influenced by a variety of conditions and their combinations. Here is an example of classification signs.

1. Origin

· Natural (natural) objects.

· Man-made objects (buildings).

2. Purpose

Free land plots (for building or other purposes)

· Natural complexes (deposits) for their exploitation.

· The buildings

For housing.

For the office.

For trade and the sphere of paid services.

For industry.

· Others.

3. Scale

· Land areas.

· Separate plots of land.

· Complexes of buildings and structures.

· Multi-apartment residential building.

Single-family residential building (mansion, cottage)

· Section (entrance).

· Floor in section.

· Apartment.

· Room.

· Summer cottage.

· A complex of administrative buildings.

· Building.

· Premises or parts of buildings (sections, floors).

4. Ready to use

· Finished objects.

· Requiring reconstruction or major repairs.

· Requiring completion of construction.

1.2 Methodology for evaluating residential real estate.

Practical experience indicates: for small residential real estate, it is advisable to carry out valuations according to a simplified procedure, which can only be based on the method of comparison of market sales. The approach to valuation in terms of comparison of sales is based on a direct comparison of the appraised property with other real estate items that have been sold or are included in the register for sale. Buyers often base their value judgments primarily on the properties offered for sale. Appraisers also use this information along with information about properties sold or leased. This approach is based on the principle of substitution, which states: when there are several goods or services of similar suitability, the one with the lowest price is in the greatest demand and is the most widespread. With regard to housing, this means: if it can be seen on the market (which usually happens), then its value is usually set at the cost of acquiring a home of equal degree of attractiveness, which will not take long to implement a replacement.

Mass real estate appraisal is a special approach to simplified appraisal of a large group of similar objects (apartments). Such an assessment is carried out according to a certain method: for the evaluated object, the corresponding set of values of a fixed set of its parameters is determined, and then the value of its evaluation is formed according to the rules unchanged for all objects.

Bulk appraisal has its own specific areas of application. An example of such an appraisal is the appraisal of apartments "according to the Bureau of Technical Inventory (BTI)" based on a cost approach. It is carried out by a government agency and is used to determine taxes and fees. However, the BTI assessment is not focused on market value... Therefore, market information is not required to build it.

The difference between the actual selling price and the market value should be emphasized. The prices are divided into the seller's price, the buyer's price and the selling price.

The seller's price is the amount he receives for himself as a result of the transaction. The buyer's price is the sum of all the costs of buying an apartment. The selling price is the amount of money that the buyer gives to the seller for the apartment.

They differ in the amount of payment for the services of intermediaries and the cost of completing the transaction. An intermediary may or may not be present for both the buyer of the apartment and the seller. The transaction may or may not be insured. The costs of registration of a transaction can be distributed among its participants in different ways. Therefore, the selling price characterizes the apartment as such, and the buyer's and seller's prices are highly dependent on the terms of the transaction. As a rule, if the seller has an intermediary, then his payment is deducted from the selling price and reduces the seller's price, and vice versa, the payment by the buyer for the services of his intermediary increases the buyer's price in relation to the selling price. Similarly, these prices are affected by the payment for the execution of the transaction. Thus, the price of the seller and the buyer can differ significantly (up to 15% or more). But the selling price depends minimally on their specific features of the mechanism of sale and registration of the transaction and is determined by the specifics of the apartment itself. Therefore, it is advisable to model precisely the dependence of the selling price on many parameters of the apartment.

In accordance with its definition, the market value of a property depends on those factors that determine the average or more probable price of its sale in the market under normal conditions of the transaction.

At the first level of classification, they can be subdivided into objective and subjective factors.

Objective factors are considered when determining the market value. As for subjective factors, they are associated with the behavior of a specific buyer, seller or intermediary when concluding a transaction, in part not directly determined by its economic conditions (temperament, awareness, honesty, patience, gullibility, personal likes and dislikes, etc.).

Objective factors are mainly economic determinants, ultimately, the average price level of specific transactions.

Economic factors can be subdivided into macroeconomic and microeconomic. The first include factors related to the general market situation: the initial level of provision of demand for real estate in the region; volumes and structure of new construction and reconstruction; factors of migration; legal and economic conditions transactions; the level and dynamics of inflation; dollar rate and its dynamics. In our conditions, the following long-term factors can also be indicated as part of the group of economic factors:

Differences in the dynamics of prices for goods and services, as well as wage conditions affecting the scale of accumulation Money and the amount of deferred demand;

· The pace and scale of the formation of a new social stratum with opportunities to invest in real estate;

· Development of the mortgage system;

· Development of the system of foreign representations in the region.

Microeconomic factors characterize the objective parameters of specific transactions. Of these, those that describe the object of the transaction (apartment) are especially important. Factors related to the nature of the transaction and the terms of payment are also significant. The main procedures for registration of transactions and their payment have been worked out. Therefore, in the mass appraisal of the market value of apartments, one can and should be guided by the typical (average) nature of the transaction, consider this factor constant and not take it into account when assessing the market value of apartments. Then the market value (average price) of an apartment is assessed on a fixed date and is determined by its parameters (characteristics) as use value.

1.3 The housing market.

The potential for this market is enormous. At least 90 percent of housing in every, as they say, civilized country is bought today in installments.

The housing market in Russia has become especially widespread as a result of the privatization of apartments. Free, as in Moscow, or preferential, as in other cities, the transfer of apartments to private ownership has created new opportunities for owners to deal with this type of real estate.

At the same time, the forms of buying and selling apartments and other types of housing have also developed. Among these forms, the purchase of apartments in installments is becoming more and more widespread. It should be noted that in the West, almost all real estate owned by the population is burdened with debts, the need to pay the cost of housing in installments. In Russia, as a result of privatization, each citizen became the owner of immovable assets (apartments, garden and summer cottages), not burdened with debts. Therefore, Russian citizens find themselves in a much better position in this respect than citizens of other countries.

At the same time, all this will be complemented by the newly opened opportunities for acquiring housing on credit. Briefly, the scheme is as follows.

The apartment itself serves as the material security for the loan. Until the loan is repaid, the buyer is legally only its tenant. The buyer immediately lays out the first installment - about 30 percent; the remaining 70 are paid by the bank with which the corresponding agreement has been concluded with the real estate company.

The bank or its subsidiary company collects documents, deals with the sale and purchase transactions, makes settlements with the seller, etc. Therefore, the size of the commission, for example, in Moscow reaches 13 percent of the market price of an apartment. These costs are justified if the transaction is made with the participation of reliable organizations, since the housing market for last months acquired a certain criminal connotation.

A large number of criminal situations arise in connection with the presence of "left" dollars in almost every transaction, transferred from hand to hand after the completion of the official registration procedure.

"Left" dollars is, as a rule, the difference between the market price of an apartment and the amount at which it was estimated by the BTI. Therefore, one does not need to be a specialist to understand: to eliminate the “leftists”, one has to choose one of two ways: either the conservative way - to bring the BTI's appraisal practice closer to the real conditions of the market; or a radical way is to abandon this practice and switch to other forms of control over the asking price of real estate.

Constantly increasing coefficients bring BTI estimates closer to market prices by leaps and bounds.

All possible taxes have already been deducted from the income for which a citizen once bought an apartment (or other property that can later be sold). Therefore, from any point of view, the sale of property cannot be considered a fact of obtaining additional income; it is only a change in the form of property belonging to a citizen. And levying tax on the amount of such a change is a secondary tax charge on the same income.

Market redistribution of apartments has improved the use of housing stock, stimulated the resettlement of part communal apartments, allowed to partially solve the housing problem.

On the whole, the housing problem not only persists, but also intensifies. This is facilitated by the constant influx of refugees and forced emigrants from neighboring countries to Russia.

Use of apartments for non-residential purposes.

After the privatization of a significant share of the residential sector in cities, the problem of using apartments that are owned for other purposes has become aggravated.

Of course, the use of residential premises owned by citizens and legal entities for non-residential purposes - to accommodate offices, offices, workshops, computing centers etc. - by no means contributes to the solution of the housing problem, since a significant part of the living space is withdrawn from the city-wide fund. However, the ways to combat this limit the freedom of the owner and are often illegal.

Even if the housing inspectorate or the police department is able to establish the fact of misuse of the apartment and, having formalized it accordingly, will present it to the court, then the judges have no legal grounds to satisfy such a claim. In accordance with Art. 6 of the Law “On the Fundamentals of the Federal Housing Policy”, the owner of real estate in the housing sector has the right, in the manner prescribed by law, to own, use and dispose of it, including rent, lease, pledge, in whole and in parts, etc. if this does not violate current norms, housing and other rights and freedoms of other citizens, as well as public interests. Among the obligations of the owner when using the living quarters, established by Art. 4 of the same law, there is no such obligation as the use of a dwelling for its intended purpose. True, here you can apply Art. 7 of the Housing Code of the RSFSR, which establishes that residential buildings and residential premises are intended for permanent residence of citizens.

But at best, taking into account this article on the basis of Art. 48 of the Civil Code of the RSFSR, only a residential lease agreement can be invalidated as not complying with the requirements of the law. But, on this basis, it is not possible to terminate the contract on the transfer of ownership of housing, since no legislative act (and this should be only a law, and not an order of the mayor or a government decree) contains such a legal basis.

The lack of a clear regulatory framework leads to the fact that even the judicial authorities are sometimes unable to figure out who and on what grounds has the rights to a particular object. However, the stable demand for offices, retail and warehouse space, as well as the high cost of such property, which guarantees considerable commissions, attract a large number of intermediary structures. If in 2000 only 42 percent of the respondents were engaged in transactions with non-residential premises, then by now this figure has increased to 70 percent.

1.4 Real estate securities market.

The segment of the real estate market is the most underdeveloped. This reveals both the lagging behind of the entire stock market and the insufficient involvement of real estate itself in the commercial turnover. The real estate market players prefer direct investments so far. The range of securities associated with the use and sale of real estate is also narrow.

First of all, the indisputable advantage of housing bonds is their accumulative nature. They make it possible to gradually accumulate the required amount for the purchase of an apartment, being a certificate of the right to the area of housing indicated in the nominal value.

The fractional parity of bonds in relation to the footage of real apartments allows at any time to stop at that level of living space and comfort, which will be recognized as sufficient or maximum possible. Although it should be recognized that this positive property of housing bonds is somewhat limited by the fact that they give the right to purchase only newly commissioned housing. The rather limited standard of construction and the specifics of new development areas can significantly narrow the circle of those wishing to purchase bonds to solve their housing problems, and this is precisely where their main value lies. If the possibility of purchasing municipal housing with the help of bonds in any area of the city, of any level of comfort and “age”, would be envisaged, then their attractiveness would significantly increase. This could provide an increase in the competitiveness of housing bonds in relation to other, considered to be sufficiently reliable means of payment (currency).

Another undoubted advantage of housing bonds is their anti-inflationary nature: the ability to save money in one way or another from depreciation. Therefore, monthly quotes for the value of housing bonds should include at least tracking the inflation rate. Meanwhile, the mechanism of monthly quotations provided for by the projected form of emission is capable of amortizing only general macroeconomic fluctuations, which are significant on a time scale, but not current changes housing market conditions.

The possibility of changing quotations depending on the timing of receiving housing when bonds are redeemed, say, within the range from 1 to 6 months, could significantly increase both the attractiveness of this stock market instrument and the degree of its liquidity.

Property valuation. Market-based valuation methods help maximize the beneficial use of real estate, this new resource that businesses and citizens have at their disposal. This assessment becomes necessary even when the owners of land and real estate want to mortgage them for a loan. Without a proper assessment, count on attracting additional investments, including foreign ones.

At the first stage of privatization, when creating joint ventures, such assessments were either not made at all, or were made simply by eye. The investor himself determined the price. When it concerned serious objects, Western appraisal firms were involved, which in most cases carried out appraisals in favor of foreign investors, understating the real market value of our assets.

Assessment is also necessary for the secondary issue of shares of privatized enterprises seeking to increase their authorized capital by an amount supported by real material resources. It is the real issue prospectus that will allow investors to avoid mistakes in establishing share prices. Appraisal is also necessary in the division of property, in determining the best commercial use of land and real estate, and in all other transactions related to real estate.

Analysis of the prospects for increasing the value of real estate and its commercial use should be based on a rigorous economic calculation, accurate and professional assessment of the real market value of the property. An appraisal is based on knowledge, experience, the use of strictly defined approaches, principles and methods, as well as procedural and ethical standards, the opinion of a specialist or a group of experts, usually professional appraisers, about the value of the property.

Market value refers to the most likely price to be generated when a property is sold in a competitive and open market, given all the conditions necessary for a fair transaction to occur.

These conditions are:

1. The buyer and the seller act on the basis of typical, standard motives. The deal is not forced on either side.

2. Both parties have full information for decision-making and act in an effort to best meet their interests.

3. The object has been exposed on the open market for a sufficient time, and the optimal moment has been chosen for the transaction.

4. Payment is made at monetary form or agreed financial conditions comparable to paying in cash.

5. The transaction price reflects normal conditions and does not include discounts, concessions or special lending to either party associated with the transaction.

6. The property is in general demand and has marketable utility.

7. The object is rather scarce, in other words, there is a limited supply that creates a competitive market.

8. The object is endowed with the properties of alienation and is able to be passed from hand to hand.

1.5 Mortgages.

Mortgage means the issuance of a secured loan real estate... The classic mortgage object is a land plot. Mortgages open up the possibility of providing buildings, structures, residential buildings, and individual apartments as collateral.

Mortgages are generally inexpensive, the margins of mortgage banks are low, and profits are “made” from large volumes of placed loans. These banks also attract funds at low interest rates, but due to the very high reliability, the mortgage bonds they place are in steady demand.

There are four entities in the mortgage market:

1.the borrower seeking to acquire possibly the best real estate;

2. a bank that seeks to obtain the maximum possible profit by limiting the risk of a mortgage;

3. an investor who seeks to get the maximum profit by investing in mortgages;

4. the government, which must create the legal and economic conditions for the functioning of the mortgage lending system.

Mortgage lending mechanisms must ensure the availability of credit for the borrower, as well as the profitability of lending.

There are several types of credit mechanisms that allow, to a greater or lesser extent, to circumvent the fairly high inflation rate that exists in the country.

The first mechanism is fixed rate lending.

The second mechanism is based on loans with a rate adjusted according to the price level in the country, when the lending rate is periodically (approximately once a quarter) revised depending on changes in the price level.

The third mechanism - lending with adjustable deferred payments - was developed by one of the US economic institutions specifically for use in Russian conditions. Its essence is that the borrower must pay no more than 30 percent of the income on the principal debt or loan. The initial payout is relatively low and increases over time. This allows you to postpone the payment of the main part of the debt to a later date. The principle of this mechanism is that two interest rates, one of which is called "contractual" and serves to calculate the amount of debt, and the second - "payment", to calculate monthly payments. These rates are uneven.

The Law of the Russian Federation “On Pledge” establishes a general principle regarding the registration of a mortgage. It must register with the same government agency that is responsible for registering the rights to the property being pledged. This principle implies that mortgages on residential premises must be registered by the housing privatization departments.

“Mortgage” agreements regarding buildings and structures located on land must be registered in the “land list” of the territory in which the property is located, which can also currently be interpreted as registration by local land committees, although at the time the law entered into force could mean local Councils.

The mechanism for the sale of pledged property is established by the legislator as general for both immovable and movable property.

By virtue of Art. 350 of the Civil Code of the Russian Federation, the sale (sale) of the pledged property, which, in accordance with the law, is foreclosed, is carried out by selling at a public auction in the manner prescribed by procedural legislation, unless a different procedure is established by law.

The requirement to sell the pledged property through a public auction is imperative, and if the concept of the rules on pledge is followed, it cannot be circumvented. But if the pledgee nevertheless wishes to acquire the property, which is the subject of the pledge, into ownership without a public auction procedure and is supported by the pledger, then this can be done in accordance with Art. 409 of the Civil Code of the Russian Federation. The article allows the conclusion of an agreement on compensation between the parties, where the creditor states the debtor's obligations as terminated, and the latter, in return for fulfilling his obligation, provides a compensation, that is, in our case, the pledger transfers the real estate to the mortgagee.

II Analytical part

2.1 Modern principles of the analysis of the real estate market.

The success of a business in a market economy is largely determined by the quality of information on the basis of which responsible financial decisions are made. That is why the collection and analytical processing of information, including market information, today are both the subject of a separate study from a scientific and methodological point of view, and the subject of an independent business.

The most illustrative illustration of the above is the example of information support for doing business in the stock market. Scientific theories and schools have been created and continue to improve, which have been repeatedly awarded Nobel Prizes; many works have been written on technical and fundamental analysis, which have become the reference books of stock market specialists. The worldwide practice of in-depth testing of analysts' knowledge for their admission to work with information on the securities market is considered normal. And this despite the fact that in the stock market, in comparison with other markets, the patterns of a perfect market should be identified in the most explicit form in terms of participants' awareness.

The real estate market, in contrast to the stock market, is more than far from perfect in many respects, which determines the specifics of its research. On the one hand, analysts are faced with difficulties, and sometimes the impossibility of correct and unambiguous formalization of economic relationships in the real estate market. On the other hand, it is obvious that there is no prospect of transferring analysis technologies used in other markets to the real estate market in a pure form, since these technologies are adapted for use in a different market environment. In view of the above, high-quality analytical work in the real estate market seems to be a highly complex subject that requires an analyst, in addition to deep theoretical knowledge of real estate economics, constant practice and creative research in research that form professional intuition.

Studying almost a century history of the functioning of real estate markets in the developed countries of the world, one can come to the conclusion that insufficient attention paid to the quality of analytical work is one of the main reasons for most major crises in the real estate markets. A typical example is the crisis in the US real estate market in the late 80s and early 90s. According to experts, excessive and disorderly investment in new construction has led to oversaturation of the market and, accordingly, the lack of demand by the market for a large number of projects for which loans were issued. This situation was based on unrealistic market expectations stemming from the wrong structure of incentives in the analysis, weak analysis methodology and an incomplete amount of data characterizing the current conditions. The structure of incentives that guided developers, appraisers and credit institutions was deformed by the interest of some to get loans, others to justify obtaining a loan, and still others - to place their funds. At the same time, all parties were solving their problems at the expense of unreasonably optimistic expectations.

The use of weak analytical methodology, expressed in inadequate assumptions and procedures, in conjunction with insufficient quality data from local markets, as a rule, resulted in the emergence of unfounded market research and, accordingly, investment decisions based on it. As a result of the crisis, credit institutions formed a stable syndrome of distrust in general to any projects and market research in particular. This, in turn, led to the understanding that real estate analysts in their work should be guided by some general principles that are necessary (but not sufficient) to obtain accurate conclusions and results. On the other hand, there is an urgent need for clear and easily identifiable criteria that determine the relevance of market research to the category of validity.

Considering the prospects for the development of the real estate market in Russia, we can assume that the absence of potential crises is an overly optimistic scenario. However, the consequences of such crises may be less significant if already today, at the stage of active market development, some general principles and

requirements for analytical studies, on the basis of which investment decisions will be made.

Not only the threat of crises, but also current day-to-day problems - increasing competition, reduced opportunities for short-term super-profits, the beginning of the implementation of long-term and capital-intensive projects for the development of commercial real estate, the arrival of foreign investors on the market with high requirements for substantiating decisions, etc. - objectively indicate that the importance of qualitative analysis in the real estate markets of Russia will gain more and more weight in the near future.

2.2 Research of the real estate market for the purpose of substantiating investment decisions.

The ultimate goal of any study of the type under consideration is to measure the ratio of supply and demand for a specific type of product in the real estate market at a specific (usually future) point in time.

The special characteristics of real estate as a commodity, along with the special place of real estate in a market economy, form a fairly wide range of socio-economic information necessary for positioning this commodity on the market. Current and retrospective macro economic characteristics national and regional economies, socio-demographic indicators of regional and local markets, parameters of regional and local real estate markets - these are just general directions in which research should be carried out.

Principle 1. Only information that can truly determine the future productivity of the investee should be selected for analysis.

When following this principle, the main difficulty for the analyst is the absence of standard rules or unambiguous recommendations, according to which the initial information should be formed. It is here that the analyst must show all his knowledge, professional intuition, creativity and practical experience. Moreover, this is where the foundation for the consistency of the research as a whole is laid.

Principle 2. All current and prospective data on which the study is based should be used to quantify the performance of the real estate investment project under consideration.

However, even carefully selected information that is directly related to the subject of assessment is, figuratively speaking, a “heap of bricks” from which the analyst must lay down, according to all the rules of the building art, a solid foundation for analytical research. And here you cannot do without a solid solution that binds the individual elements into a single monolith.

Principle 3. All individual blocks of information selected to justify an investment decision should be linked by a clear logical scheme, ending with the forecast of future market conditions and the corresponding productivity of the project under consideration. The logic diagram must be described explicitly.

A positive customer perception of a market research report that lacks a logical framework can only be if:

a) the analyst takes advantage of the customer's ignorance, or

b) the customer is initially supportive of the results.

On the other hand, building a convincing and obvious logic diagram is a demonstration of the analyst's superior professionalism.

Continuing the reasoning about the need to build a logical framework for research, we will consider another principle that concretizes the content market analysis.

Principle 4. The content of market analysis should be reduced to a discussion of the factors that make up the basic relationships for determining the performance of a commercial property.

In accordance with this principle, the analyst in the course of the study must formulate the basic relationships that determine the performance of a commercial object, and then identify the hierarchy of parameters-arguments, the functions of which are the factors included in the main expression for performance.

Let us illustrate a practical approach to the implementation of this principle with the following simplified example.

Let the criterion for the performance of the project under consideration be the net operating income (NOI) in a specific period of the future. Then, by definition, the main expression for determining performance will have next view:

NOI = PGI-V & L + M-FE-VE, where

PGI - Potential Gross Income,

V&L - losses from underutilization and non-payments.

M I - other income.

FE - fixed operating expenses,

VE - variable operating expenses.

Consider the procedure for identifying the parameters that determine the expected values of the main factors.

Potential gross income is determined by the rental rate, which in turn is a function of the current rental rate, as well as trends in the ratio of market supply and demand over time.

The projected utilization of a property is a function of the cumulative market capacity, demand parameters, market absorption rate and growth of the real estate absorption area. For projects, the predicted utilization determines two indicators - the utilization level and the time schedule for market absorption to this level.

The growth in the area of absorption of real estate is determined either by an increase in the number of jobs (employment level), or by population growth. In turn, an increase in the area of absorption leads to the need for new real estate.

It should be noted that employment growth and population growth in one case can be directly related, for example, with the opening of new jobs and the influx of new able-bodied people. In another case, population growth can grow without an increase in employment, for example, due to an increase in the arrival of retirees or an increase in the birth rate. Qualitative analysis involves the use of several sources of information that provide historical trends and forecast of the growth of the area, with subsequent comparison of the data. The segmentation of the growth of the area is also mandatory, for example, by age groups, sex, family size, etc. The absence of the listed positions in the study should be attributed to the unjustified choice of data for use in the analysis.

Demand parameters are determined by such specific indicators as area (office or production) per one workplace, spending on purchases per capita, the number of apartments or houses per capita, etc. The demand parameters are used to calculate the amount of required real estate, which corresponds to the growth of the real estate consumption area. For example, applying the average purchase cost measure to population growth predicts an increase in retail sales, and thus the need for additional retail space. When analyzing the housing market, population growth segmented by age, income, size or family composition is converted into segmented demand. A consistent analysis of demand parameters involves the study of historical trends, the current state and forecasting their likely value in the future. Moreover, a consistent analysis measures the change in demand not only due to new growth in habitat, but also due to changes in the existing structure of population and employment. For example, with economic recovery, growing companies require large areas, and changes in the demographic situation towards an increase in people of retirement age will require an appropriate type of housing.

The signs of the failure of the analysis of demand parameters should include, first of all, taking into account constant values, as a rule, which are characteristic of the moment of the analysis, as well as ignoring changes in the existing structures of population and employment.

The absorption rate, also called the market penetration rate, is determined by the share of total market demand that the project in question is projected to absorb in competition with other projects. After the analyst has estimated the total increase in potential demand, it is necessary to determine the critical parameter for the project - the share of total demand that the project under consideration can probably claim.

In theory, absorption coefficient is a complex function of many factors. As a first approximation, it can be defined as the ratio of the area of the evaluated object to the total area (including the area of the object) of the competitive proposal at the time of its launch on the market. This approach, as a minimum, should be present in every market research claiming solvency.

It should be noted that when determining the absorption coefficient, the most important conditions are detailed segmentation of demand and competitive supply. At the same time, one should not lose sight of the duration of competing projects launched in the implementation, the volume and duration of projects being prepared for implementation. The first sign of a flawed study here is the use of any "mean" data.

Losses due to generally accepted discounts and incentives for tenants in the market are also a factor that should not be overlooked when forecasting potential gross income.

Other income, although, as a rule, represents a small component of the revenue part, nevertheless, it should be predicted taking into account the likely preferences of potential consumers in the light of their ideas about lifestyle, level of service and per capita expenses to obtain this level, etc. .d.

Fixed and variable costs are traditionally considered more specific when forecasting. However, this formulation of the question is only partially true for the conditions of Russia. For example, real estate taxes (today these are property taxes, land taxes) and land rent due to unregulated legislation may present unexpected "surprises" to a potential investor in the future. Therefore, a sound market research should include variant forecasting of these positions.

A similar situation is observed with most of the variable costs. Analysis of the market for utilities, most of which are provided by natural monopolies, unstable tariff policy require a quantitative substantiation of the indicators taken into account. At the same time, it is important to use market information on resource consumption, obtained on the basis of readings of control and measuring equipment. In the absence of market analogues in terms of resource consumption, it is more preferable to calculate them according to standards, rather than using invoices issued by utility suppliers.

2.3 Methods for assessing the market value of real estate.

There are three main methods for assessing the market value of real estate:

1.comparison method

2.expensive method

3. method of capitalization of income.

The primary valuation method is the Sales Benchmarking Method (SEA). This method is applicable when there is a market for land and real estate, there are real sales, when it is the market that forms prices, and the task of appraisers is to analyze this market, compare similar sales and thus obtain the value of the appraised object. The method is based on comparing the object offered for sale with market analogues. It is most widely used in the West (90 percent of cases). However, this work requires an already formed land and real estate market.

The sales comparison method is used when there is a sufficient amount of reliable market information on transactions for the sale and purchase of objects similar to the one being assessed. In this case, the criterion for the selection of objects of comparison is the same best and most efficient use.

SAP method can also be called direct sales comparison approach, sales comparison method, market information market method.

The sequence of application of the SAP method is as follows:

1. Highlights recent sales of comparable properties in the relevant market. Sources of information are: the appraiser's own dossier, the Internet, an electronic database, real estate firms, real estate broker dossiers, archives credit institutions (mortgage banks), Insurance companies, construction and investment companies, territorial insolvency and bankruptcy departments, territorial departments of the State Property Committee, etc.

An important point when using the SAP method is to agree on the comparison results of the appraised real estate. Arithmetic averaging of the received data is not allowed. The accepted procedure is to examine each result and make a judgment on the extent to which it is comparable to the property being valued. The smaller the number and size of the amendments made, the more weight this sale has in the process of finalizing the approval.

The units of comparison are the meters traditionally developed in the local market. To evaluate one and the same object, several units of comparison can be applied simultaneously.

The elements of comparison include the characteristics of real estate objects and transactions that cause changes in real estate prices. The elements subject to mandatory accounting include:

· The composition of the transferred property rights;

· Conditions for financing the purchase and sale transaction;

· terms of sale;

· Time of sale;

· Location;

· physical characteristics;

· Economic characteristics;

· The nature of use;

· Non-real estate value components.

2. Verification of information about transactions: confirmation of the transaction by one of the main participants (buyer or seller) or an agent of a real estate company; identification of the terms of sale.

If there is a sufficient amount of reliable market information, it is allowed to use the methods of mathematical statistics to determine the value by comparing sales.

3. Adjustment of the cost of comparable objects.

Adjustments can be made in three main forms: in monetary terms, percentages, and general grouping.

Sales price adjustments for comparable items are made in the following order:

· First of all, adjustments are made related to the terms of the transaction and the state of the market, which are carried out by applying each subsequent adjustment to the previous result;

· Secondarily, adjustments are made that relate directly to the property, which are made by applying these adjustments to the result obtained after adjusting for market conditions, in any order.

Quantitative and qualitative methods are used to determine the values of adjustments, depending on the availability and reliability of market information. The justification for the adjustments to be taken into account is mandatory. The final decision on the value of the result determined by the sales comparison method is made based on the analysis of the adjusted sales prices of the comparison objects that have the greatest similarity to the object of assessment.

The cost estimation method is practically not applicable to land. It can be used only in exceptional cases, the valuation of land is inseparable from the improvements made on it. It is believed that land is permanent and non-expendable, and the cost method is used to evaluate man-made objects. When valuing using this method, the value of land is added to the cost of improvements (buildings, structures), and land is valued separately by other methods.

The cost method of real estate appraisal is implemented in the following sequence:

· Determination of the cost of a plot of land;

· Determination of the replacement or replacement cost of buildings and structures;

· Determination of the amount of accumulated depreciation of buildings and structures;

· Determination of the market value of real estate using the cost method, as the sum of the value of a plot of land and the replacement or replacement value of buildings and structures minus accumulated depreciation.

The choice of the method adopted for calculating the cost of new construction improvements should be appropriately justified. The use of replacement cost is advisable in cases where it is difficult to determine the cost of erecting an exact copy of a building due to outdated types building structures and the construction methods used to create the subject of assessment.

The costs corresponding to the replacement or replacement cost for real estate appraisal purposes are calculated as the sum of direct costs, indirect costs and the entrepreneur's profit.

Direct costs include the following costs directly related to construction:

· The cost of materials, products and equipment;

· Wages of construction workers;

· The cost of construction machines and mechanisms;

· The cost of temporary buildings and structures, safety measures, transport and storage costs and other costs, normatively accepted in the local market;

· Profits and overheads of the contractor.

Indirect costs include costs associated with the construction of a building, but not included in the cost of construction and installation work.

· The cost of design, technical supervision, geodetic control;

· Payment for consultations, legal, accounting and audit services;

· The cost of financing construction;

· Administrative and other expenses of the developer.

The amount of indirect costs is determined taking into account the tariffs prevailing in the market for works and services for these items.

An entrepreneur's profit is an established market norm that encourages an entrepreneur to invest construction project... The amount of profit is determined by the method of expert assessments based on market information.

The use of the cost method is necessary when analyzing new construction; reconstruction of buildings; assessment for tax purposes; to identify excess profits in real estate appraisal; when evaluating for insurance purposes; assessing the impact of natural disasters; assessment of special buildings and structures.

In the context of the transition to market conditions, the cost method is decisive in the assessment, since the application of other methods requires extensive market information, which is absent due to an undeveloped market. However, it should always be remembered that construction costs are only the basis of the market value and most often are either more or less than it.

For example, the market value of an elite hotel in an unfortunate location (on the outskirts of a city) will be less than the cost method. In turn, the market value of a gas station complex at a certain stage may be higher than construction costs.

In the conditions of the emergence of the market, when there is a reorientation of production to new technologies, it may seem that the property has no value at all. For example, if an enterprise produces products that no one needs and its production areas do not lend themselves to reconstruction for new production, then the market value of such real estate tends to zero. The use of the costly method will lead in this case to the wrong orientation of potential buyers.

At present, in Russia, this point is often taken into account when incorrectly evaluating the fixed assets of enterprises, since their revaluation is carried out mainly according to the cost method and the appraiser should remember that book value fixed assets of enterprises does not correspond to their market value.

The next valuation method, which is applicable specifically for Russia, is the valuation method based on the analysis of the most efficient use of real estate, and this analysis is associated with determining the type of use that will bring the owner the maximum income, i.e. income capitalization method.

The income capitalization method when assessing the market value of real estate is implemented in the following sequence:

· Forecasting future income;

· Capitalization of future income.

The future income generated by the property is divided into two types: income from operating (maintenance) activities as a result of commercial lease relations and income from reversion.

Operating (operating) income is projected by drawing up a reconstructed (hypothetical) income statement. Reversion income is projected:

· Direct assignment of the absolute value of the reversion;

· The appointment of the relative change in the value of real estate for the period of ownership;

· Using the terminal capitalization ratio.

Capitalization of future income into present value can be performed:

· Method of direct capitalization;

· Method of capitalization at the rate of return.

The initial premise of the direct capitalization method is the constancy and infinity of the capitalized income. In the direct capitalization approach, the present value of the future income stream is defined as the ratio of the annual income attributable to a property or interest to the capitalization ratio for that property or interest.

To calculate the cost of full ownership, the total capitalization ratio is determined based on market data. Depending on the availability of the initial information, the following applies:

· Analysis of comparative sales;

· Calculation using the debt coverage ratio;

· Equipment of the investment group.

The initial premise of the method of capitalization at the rate of return is the limited period of income receipt. In the method of capitalization at the rate of return, the final number of future cash flows is recalculated into the present value at a specific value of the rate of return corresponding to the risk of investment in this type of real estate.

When calculating the present value without taking into account financing conditions, the capitalization method at the rate of return is formalized either in the form of an analysis of discounted cash flows, or in the form of calculated capitalization models.

The discount rate used in the analysis of discounted cash flows and taking into account both systematic and non-systematic risks is determined by:

By separating similar items from market data on sales;

By the method of alternative investments in financial market;

The method of monitoring the real estate market.

Recently, the demand for the services of appraisers and their professional training in Russia has begun to grow rapidly. This is also due to recent events in the financial sector, when attempts to create a mechanism for lending through credit insurance failed: banks lost a lot on fake insurance. In the case of real estate, which is taken as collateral by the bank when issuing a loan, losses are almost impossible. Thus, real estate and capital markets become inseparable components of the economy as a whole.

Naturally, there was a lot of interest from banks in such operations. And they all need a qualified appraisal of real estate, carrying out insurance at the real value of real estate.

The assessment is also necessary in the framework of regional tax policy. All over the world, the basis of the local taxation system is the tax on real estate, due to this tax, about 70 percent of the local budget is formed. Of course, with the development of the market itself, with the advent of real values a transition to a taxation system is possible that would stimulate the development of the real estate market and ensure, at the same time, replenishment

local budgets. This explains the unconditional interest in the assessment shown by local administrations.

The cost of professional appraisal services varies greatly depending on the types of objects being appraised, the complexity of the work and, of course, on which specialists are involved in the appraisal. Usually, the cost of services is measured either in hours multiplied by the hourly rate, or depends on the size of the object, but is never tied to its cost.

2.4 Features of different types of assessment.

Valuation for the purpose of buying or selling and classification of real estate.

When appraising real estate that is to be bought or sold on the open market, the market value or realizable value is used as the valuation base for all classes and categories of real estate. At the same time, for specialized real estate, in most cases, the determining method of calculating the cost will be the cost method based on market data.

When evaluating real estate for sale for a limited period of time, when real estate is put on the open market for sale in a period significantly shorter than the adequate marketing period for this type of real estate, the cost of limited sales is used as the basis for the valuation for all classes and categories of real estate.

For the selection of an appropriate valuation base, the purpose of the valuation work and the characteristics of the property being valued are of decisive importance.

In general, the classification of the main purposes for which real estate is appraised is as follows:

1. Appraisal for buying or selling;

2. Appraisal for sale for a limited period of time;

3. Valuation of land and buildings for their use as secured loan obligations;

4. Assessment for the preparation of accounting and financial statements;

5. Evaluation for inclusion in the prospectuses of Funds, stock exchanges;

6. Assessment to resolve issues in the merger and acquisition of the company;

7. Score for pension funds, insurance companies, real estate management trust funds.

In practice, there may be other valuation goals, while their formulations and, accordingly, possible valuation bases must be agreed by the client and the appraiser.

After clarifying the purpose of the appraisal, it is necessary to establish to which class and category the appraised property belongs.

For valuation purposes, two classes of property are distinguished:

Specialized

· Non-specialized

Specialized property is one that, due to its special nature, is rarely, if ever, sold on the open market to continue its existing use by a single owner, unless it is sold as part of its using business.

Examples of specialized property are:

1. Museums, libraries and other similar premises that belong to the public sector;

2. Hospitals, specialized medical facilities and leisure centers for which there is no competitive market demand from other organizations wishing to use these types of properties in the area;

3. Schools, colleges, universities and research institutes for which there is no market competitive demand from other organizations;

4. Standard property in special geographic areas and in locations remote from the main centers of business, located there for the purpose of manufacturing or conducting business.

Non-specialized property is all property other than that which falls under the definition of specialized property. In other words, it is one for which there is general demand, with or without possible modernization, and which is usually bought, sold or leased on the open market in order to use it for existing or similar purposes, or as unoccupied property for a single holding, or (whether it is busy or free) as an investment or for development.

When appraising real estate occupied by the owner for use in the activities of the enterprise (business), the following is used as the basis for appraisal:

· Market value at present use - for non-specialized real estate, including real estate, valued on the basis of its commercial potential.

· Residual replacement value - for specialized real estate.

Non-specialized and specialized properties, in turn, are classified into categories depending on the purpose of ownership. A similar classification principle is used for both valuation and other purposes.

2.5 Influence of environmental factors on cost.

Environmental factors, both unfavorable and favorable, are included in a set of factors usually considered in making assessments. Several factors have an impact on a particular type of property and will directly affect the estimates of the appraiser, where they should be taken into account in relation to market data obtained on comparable and unaffected by such factors real estate. In other cases, all real estate in a given region will be affected by these factors.

Relevant environmental and pollution factors generally include the following categories:

· Natural factors such as radon or methane, air pollution or noise;

· Technogenic factors of pollution as a result of production activities in the past or present on this land, or as a result of ingress from neighboring areas;

· Pollution factors in the form of electromagnetic and other fields;

· Pollution factors when using materials from secondary raw materials.

All classes of real estate are susceptible to the impact of environmental factors on value, but properties offered for sale or as collateral for loans are especially sensitive to these factors.

The scope of works on real estate appraisal does not include works on environmental audit of real estate. In cases where the appraiser has reason to believe that environmental factors can significantly affect the cost, he should inform the client about the need to engage a professional environmental expert.

The evaluator should inform the environmental expert of the context of his research, including the current and potential future use of the site, which will translate into value based on best and most efficient use. In general, an environmental expert should answer the following questions:

· Whether the source of pollution or hazard can be successfully and economically eliminated;

· If the pollution or hazard cannot be completely eliminated, can they be isolated or closed to make the property suitable for a given use for a certain, even limited period;

· Is it possible to mitigate the effects of pollution or hazards in any way;

· What is the most effective means of pollution control and means of its regulation;

Where it is possible to eliminate the source or eliminate the effects of pollution, an assessment can be made taking into account the corresponding estimated costs of such disposal or elimination.

III Practical part.

3.1 Practical application of the comparative sales method.

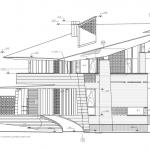

At the end of 2000, cottage construction began in the Podolsk region. Low-rise residential complexes- rows of semi-detached cottages with common walls with neighboring houses of the same type. The word "condominium", which denotes property created and developed by the labors of like-minded neighbors, is not very popular. Therefore, to designate exotic dwellings for us, built on the principle of "common walls and a roof - your yard", the English word "town house" has taken root in Russian everyday life.

Yet, for example, the market value of a cottage using the comparative sales method.

The total area is 120 sq.m., the cottage has 6 rooms, 3 bedrooms, a bathroom, a shower room, a finished basement. No garage available at the date of appraisal. Land area - 1000 sq.m.

For the analysis, we will use data on five sales of comparable properties in the same area.

Table # 1.

| Object number 1 | Object number 2 | Object no. 3 | Object no. 4 | Object no. 5 | |||

| Selling price | 65000 | 78000 | 56000 | 70000 | 54000 | ||

| Ownership | complete | complete | complete | complete | complete | ||

| Terms of financial nancing | non-market, overpriced by 3000 | non-market, overpriced by 8000 | market | market | market | ||

| Terms of sale | market | market | market | market | market | ||

| Market conditions (time) | 2 weeks | 6 weeks | 1 year | 1 year | 1 year | ||

| House area | 120 sq.m. | 145 sq.m. | 120 sq.m. | 145 sq.m. | 120 sq.m. | ||

| Land area | 10000 sq.m | 12000 sq.m | 10000 sq.m | 12000 sq.m | 10000 sq.m | ||

| Number of rooms | 6 | 7 | 6 | 7 | 6 | ||

| Of bedrooms | 3 | 3 | 3 | 3 | 3 | ||

| Bath | 1 | 1 | 1 | 1 | 1 | ||

| Shower | 1 | 1 | 1 | 1 | 1 | ||

| Basement | not finished | not finished | not finished | not finished | finished | ||

| Garage | there is | there is | there is | there is | No | ||

As can be seen from the initial data, the objects of comparison differ from those estimated by the terms of financing, time of sale and physical characteristics.

The amount of the adjustment for financing terms is determined by comparing the selling price of objects with market and non-market financing. At the same time, loan payments are discounted at the market% rate. In our example, the adjustment values are defined at 3000 for object # 1 and 8000 for object # 2.

Since all comparable properties have market conditions of sale, no adjustment for the terms of sale is required.