Restoration of VAT wiring in 1C 8.3. Accounting info. Registration of changes in the destination of the TMC in the current tax period

In previous articles, we considered in detail the implemented in the program 1C: Accounting 8 Revision 3.0 A new methodology for maintaining separate accounting of VAT. Subject this article Also related to separate accounting of VAT and is devoted to the restoration of VAT on real estate. We will consider the detailed example of the procedure for performing this operation in the program 1C: Accounting 8 edition 3.0.

In accordance with para. 4 p. 6 tbsp. 171. Tax Code Russian Federation (NK RF) tax amounts submitted to the taxpayer during contractors capital construction real estate objects (fixed assets), when purchasing real Estate, when acquiring other goods (works, services) for the implementation of construction and installation work, calculated by the taxpayer in the implementation of construction and installation work for its own consumption, adopted to deduct in the manner prescribed by this Chapter, are subject to recovery in the event that these real estate facilities (the main Funds) are subsequently used to carry out the operations specified in paragraph 2 of Art. 170 of this Code, with the exception of fixed assets that are fully accumulated or from the moment of commissioning of this taxpayer passed at least 15 years.

And in paragraph 2 of Art. 170 NC RFUKOVA cases when the tax amounts submitted to the Buyer in the acquisition of goods (works, services), including fixed assets and intangible assets, accounted for in their cost. Namely:

- use in operations for the production and (or) implementation of goods (works, services) not subject to taxation (exempt from taxation);

- use in the operations for the production and (or) implementation of goods (works, services), the place of implementation of which the territory of the Russian Federation is not recognized;

- the acquisition of goods (works, services) by non-taxpayers VAT;

- use for production and (or) implementation of goods (works, services), operations for the implementation (transmission) of which are not recognized by the implementation.

Consider an example.

The organization "Dawn" applies the general regime of taxation - the method of accrual and PBUs 18/02 "Calculation of the income tax of organizations."

Until 2014, the organization carried out operations only recognized by the Taxation Object on VAT. From 01/01/2013 Organization for reference accounting Uses 1C: Accounting 8.

In July 2013, the organization acquired an object of unfinished construction - the building is an administrative value of 35,400,000 rubles, including 18% VAT (5,400,000 rubles). The cost of additional contractual installation and construction work to bring the object to the state of suitable for use is 1 180,000 rubles, including 18% VAT (180,000 rubles).

The acquisition of an object of unfinished construction in accounting is reflected in the debit of account 08.03 "Construction of fixed assets" in correspondence with the credit of the account account 60.01 "Calculations with suppliers and contractors", on the debit of account 19 "VAT on acquired values" is allocated by VAT supplier.

The arrival of objects of unfinished construction in the program is issued with the help of the document's receipt of goods and services with the operation of construction facilities.

The acquisition of contracting construction and installation work is reflected in accounting exactly by the same postings: DT 08.03 - CT 60.01, DT 19 - CT 60.01.

In the program, such an economic operation is issued with the help of the document's receipt of goods and services with the service operation.

Wiring of documents The receipt of goods and services for the acquisition of an administrative building and on contracting installation and construction work are presented in Fig. one.

In the same month, the building was accepted for accounting and commissioned. The initial value of the main funds taken to account is 31,000,000 rubles. The administrative building is used for the organization's management needs, and depreciation deductions According to this facility, fixed assets are related to general expenses.

When making fixed assets to accounting, the actual costs recorded in the account 08 belong to the debit of account 01.01 "Fixed assets in the organization".

For taking into account the building, a document is used as an object of fixed assets in the program with a type of operation.

Wiring of the document Adoption for accounting OS is presented in Fig. 2.

From the Supplier of the building and the contractor, which produced construction and installation work, invoices were received.

The program received invoices was recorded in the relevant documents of the receipt of goods and services.

In accordance with para. 1 p. 6 tbsp. 171 of the Tax Code of the Russian Federation deducts are subject to tax amounts submitted by the taxpayer by contractors during capital construction, assembly, fixed assets, and the tax amounts submitted to the taxpayer when purchasing it objects of unfinished capital construction.

VAT sums presented by the supplier when buying a building and a contractor for construction and installation work were adopted to deduct in the third quarter of 2013.

Movement of the document The formation of records of the book of purchases and fragment of the VAT declaration for the third quarter of 2013 for our example are shown in Fig. 3.

Another object of real estate, a production plant value of 29,500,000 rubles, including 18% VAT (4,500,000 rubles), was acquired in November 2006, and adopted to account and commissioned in December. Since accounting in the program was started only in 2013, book value This facility of fixed assets and the amount of accrued depreciation were introduced in the program using the Document ENTER in the Outline of December 31, 2012. The production building is used to produce products, depreciation on this facility of fixed assets refer to the costs of the main production. The amount of VAT filed by the supplier when buying a building was adopted to deduct in the fourth quarter of 2006.

The movement of the document to enter residues is shown in Fig. four.

From July 2014, the organization "Dawn" began production new products, the implementation of which is not subject to VAT. The total cost of sales (shipped) products for 2014 is 80,000,000 rubles, including the cost of products not subject to VAT, - 20,000,000 rubles.

In the situation under consideration manufacture buildingpurchased for the production of products, the implementation of which is subject to VAT, from 2014 the beginning is also used for the production of products, the implementation of which from VAT is released, i.e. For the operations provided for by paragraphs. 1 p. 2 art. 170 NK RF. Consequently, the organization "Dawn" on the basis of para. 4 p. 6 tbsp. 171 of the Tax Code of the Russian Federation arises the duty to partially restore the previously adopted VAT summary of this building.

The administrative building is used for the management needs of the organization ( general running costs) Thus, it is used both for activities taxable VAT and for activities not subject to VAT. Consequently, the organization "Dawn" has a duty to partially restore the previously adopted by the deposit of VAT and administrative building.

In accordance with para. 5 p. 6 art. 171 of the Tax Code of the Russian Federation the taxpayer is obliged at the end of each calendar year for ten years since the year in which the fundamental means put into operation, tax Declaration For the last tax period of the calendar year to reflect the recovered amount of the tax. The calculation of the tax amount to be restored and paid to the budget is made on the basis of one tenth of the tax adopted to deduct, in the relevant share. This share is determined on the basis of the value of shipped goods (performed works, services rendered) transmitted property rights that are not taxable, in the total value shipped for the calendar year. The amount of tax to be recovered is not included in the price of this property, and is taken into account as part of some expenses in accordance with Art. 264 of this Code.

To automatically restore VAT in this situation, the program uses a document Restoration of real estate VAT, which is located in the journal of documents Regulatory operations VAT. This document (Documents) must be formed at the end of the year. Since the reconstituted VAT in an administrative building and a production building in our Example in accounting will refer to different types expenses, we will have to form this document separately for each real estate object.

First I form a document for an administrative building. On the tab Objects of real estate in the upper tabular part, the object (objects) of the real estate, according to which the recovery of VAT is administered - the administrative building. For this you can use the KN. "Add" or use the book. "Fill" -\u003e Selection of real estate objects. The checkbox is set "Used for operations not taxable VAT", indicates the date of the start of use and the share of revenues, not taxable VAT (in our case - 25%).

For each real estate object specified in the upper tabular part, the lower tabular part is filled, where the invoices obtained by this object are specified. Since the receipt, construction and installation work, the resulting invoices, taking into account and deduct VAT on the property, the administrative building is reflected in the program, then the invoice in the tabular part can be selected automatically by the CN. "Selection of invoices". The program calculates the amount of VAT to be recovered for each invoice:

- Admission of the object of unfinished construction

5,400,000 rubles. / 10 years * 25% \u003d 135,000 rubles. - Construction and installation work

180 000 rub. / 10 years * 25% \u003d 4500 rub.

On the Bookmark, the account of the VAT account indicates the account and its analytics to reflect the costs when recovering VAT.

The amount of recovered VAT on an administrative building in accounting can be recognized as a consumption for ordinary species Activities (general expenditures), therefore, as an account of costs, you can choose a score of 26 "general expenses".

In order to tax for income tax, the amount of restored VAT is included in other expenses related to the production and implementation (PP. 1 of paragraph 1 of Art. 264 of the Tax Code of the Russian Federation). Therefore, as an analyst of account 26, we will create the cost of the cost of the amount of recovered VAT overlooking other expenses.

The filled document Restoration of VAT for real estate for the facility The building is administrative shown in Fig. five.

When carrying out the document, accounting in accounting and tax accounting on the debit of account 26 the costs of restoring VAT, accruem on credit account 68.02 "Value Added Tax" The amount of tax payable to the budget. Except wiring on accounting and tax accountThe document will form records in the sales book (Register of accumulation of VAT sales).

In the wiring formed by the document, unfortunately, the debit of account 26 does not have a division. Therefore, you will have to turn on the manual adjustment mode and specify the required division.

The result of the document Restoration of VAT for real estate after manual adjustment is shown in Fig. 6.

We will form another document Restoration of real estate VAT for a manufacturing building.

On the Playmark Objects of real estate in the upper tabular part, we choose the property object - the production building, we will turn on the "Used for operations not subject to operations" checkbox, specify the starting date of the use and enter the share of revenue not subject to VAT.

The lower tabular part of the accounts will have to be filled manually, since the data on this object of fixed assets were introduced into the program in the form of residues, and there are no invoices obtained by this property in the program. As an invoice, it is advisable to create a document invoice received document (in the sales book reflects the date and number of the invoice) with the document-based document of the calculation document with the counterparty. Manually indicates the invoice amount and VAT rate. The program will automatically calculate the amount of VAT to be recovered:

- 4,500,000 rubles. / 10 years * 25% \u003d 112 500 rub.

On the Bookmark, the account of the VAT write-off, as the production building is used to produce products, as an account of costs, you can select the score 20.01 "Basic production".

Filled document Restoration of VAT for real estate for the facility The production is shown in Fig. 7.

When conducting a document, accounting in accounting and tax accounting on the debit of account 20.01 The costs of restoring VAT, credit on the account of the account 68.02 the amount of tax payable to the budget and will form a record in the sales book.

In the wiring formed by the document, again on the debit of account 20.01 there is no division. Using manual adjustment, we specify it manually.

Wiring of a document Restoration of VAT for real estate after manual adjustment is presented in Fig. eight.

In the formation of a VAT declaration for the fourth quarter of 2014, the amount of recovered VAT will be praised in section 3 in a row with a code 090 of the tax amount to be recovered.

135 000 rub. + 4500 rub. + 112 500 rub. \u003d 252 000 rubles.

The partition fragment of 3 VAT declarations for the fourth quarter of 2014 in part of our example is shown in Fig. nine.

When restoring VAT in cases established by para. 4 p. 6 tbsp. 171 of the Tax Code of the Russian Federation, an Appendix 1 is filled in the tax declaration. 3. For each real estate object and each code of operation, the property is filled with a separate list of this application. We have three sheets.

Appendix No. 1 to section 3 of VAT Declarations For the fourth quarter of 2014, for the administrative building with the Code of the Operation of Real Estate - 1011803 (Purchase) is shown in Fig. 10.

Liked? Share with your friends

Consultation on working with the program 1C

The service is open specifically for clients working with the program 1C of different configurations or on information and technical support (ITS). Ask your question, and we will answer it with pleasure! The prerequisite for obtaining consultation is the presence of an existing Treaty of ITS prof. Exceptions are the basic versions of PP 1C (8 version). For them, the availability of the contract is not necessary.

Each accountant is sooner or later facing advance payments (whether to its suppliers or advances from buyers) and in theory knows that according to the requirements of the Tax Code of the Russian Federation (Article 154, paragraph 1; Article 167, paragraph 1, paragraph 2. 2 ) From the advance, it is necessary to calculate VAT at the date of its receipt. On how to do this in the practice of the invoice for an advance in the program 1C 8.3, is our today's article.

Making the initial settings

Ploy B. accounting policy Companies and check whether taxation regime is right here: on us. In the "Taxes and Reports" section in the VAT tab, the program gives us a choice of several options for registration of invoices for an advance (Fig. 1) (this setting is needed to us when we act as a seller).

We may not register invoices for advancement in 1C if:

- advance was credited within five days;

- advance was started until the end of the month;

- advance has been credited until the end of the tax period.

Our right is to choose any of them.

We will analyze the standings of the exhibited advances and advances from the buyer.

Accounting in 1C advances issued.

For example, we take the trade organization LLC "Lutik" (we), which has entered into an agreement with the wholesale company LLC "OPT" for the supply of goods. Under the terms of the contract, we pay an advance payment in the amount of 70%. After that we get the goods and pay for it completely.

In BP 3.0, we make a bank statement "write-off from a calculated account" (Fig. 2).

Pay attention to important details:

- type of payment "Payment by the Supplier";

- agreement (when the goods are credited, the contract must be identical to the banking statement);

- vAT interest rate;

- the advance payment with VAT automatically (other indicators indicate in exceptional cases);

- when conducting a document, we must have a correspondence of 51 accounts with an advance payment of the supplier, in our example it is 62.02. Otherwise, the invoice on the advance payment in 1C will not be discharged.

Having received payment, LLC "OPT" puts us an advance invoice invoice, which we must also spend in your program 1C (Fig. 3).

On its basis, we are entitled to accept the amount of VAT on Advance to the deduction.

Thanks to the check mark "Reflect deduction of VAT in the book of Shopping", the invoice automatically falls into the book of purchases, and when conducting a document, we receive accounting wiring with the formation of an account 76.V. Please note that the code of the type of operation 02 is assigned independently.

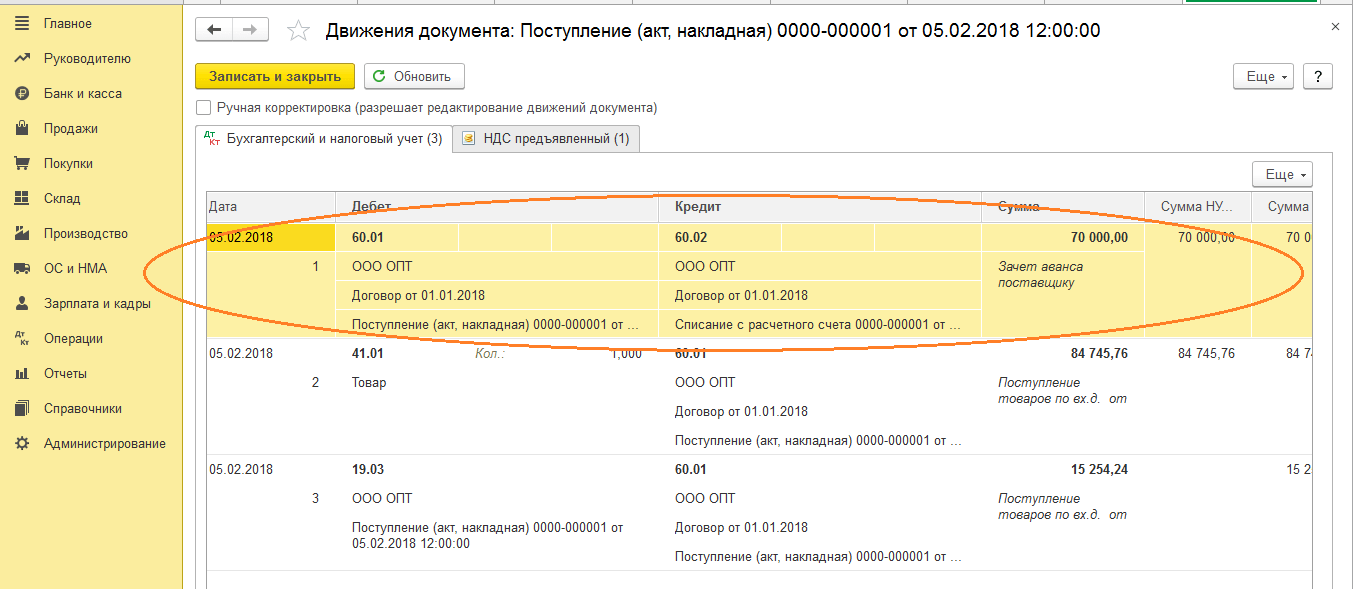

Next month, LLC "OPT" ships the goods to us, we arrive in the program using the document "Arrival of the Goods", register the invoice. Accounting accounts for calculations with a counterparty do not correct, debt repayment "automatically". When conducting a document "Arrival of goods" we must get wiring on the advance payment (Fig. 4).

When making a document "Formation of record book records" for February, we get automatic filling in the "Recovery VAT" tab (Fig. 5), and this amount of the recovered VAT falls into the sales book reporting period with operation code 22.

To reflect the final payment, the supplier can copy and conduct an existing document "write-off from a calculated account", indicating the desired amount.

We form a shopping book, where the sum of our VAT deduction is reflected in prepaid with code 02 and the sales book, where we see the sum of the recovered VAT after receiving the product with the code of the type of operation 21.

Accounting in 1C advances received

For example, we will take a familiar to us to organize Ltdichka LLC (we), which has entered into an agreement with the company ATLANT LLC for the provision of services for the delivery of goods. Under the terms of the contract, the buyer of Atlant LLC pays us an advance of 30%. After that we provide him with the necessary service.

The technique of work in the program is the same as in the previous version.

We make an admission of advance payment in 1C from the buyer with a document "Receipt for a settlement account" (Fig. 6), with the subsequent registration of an advance invoice that gives us accounting wiring By accrual VAT from the advance (Fig. 7).

Register an invoice for an advance payment in 1c can be directly directly from the document "Receipt for a settlement account", and you can use the processing of "Registration of invoices to an advance", which is located in the section "Bank and Cashier". In any case, she immediately falls into the sales book.

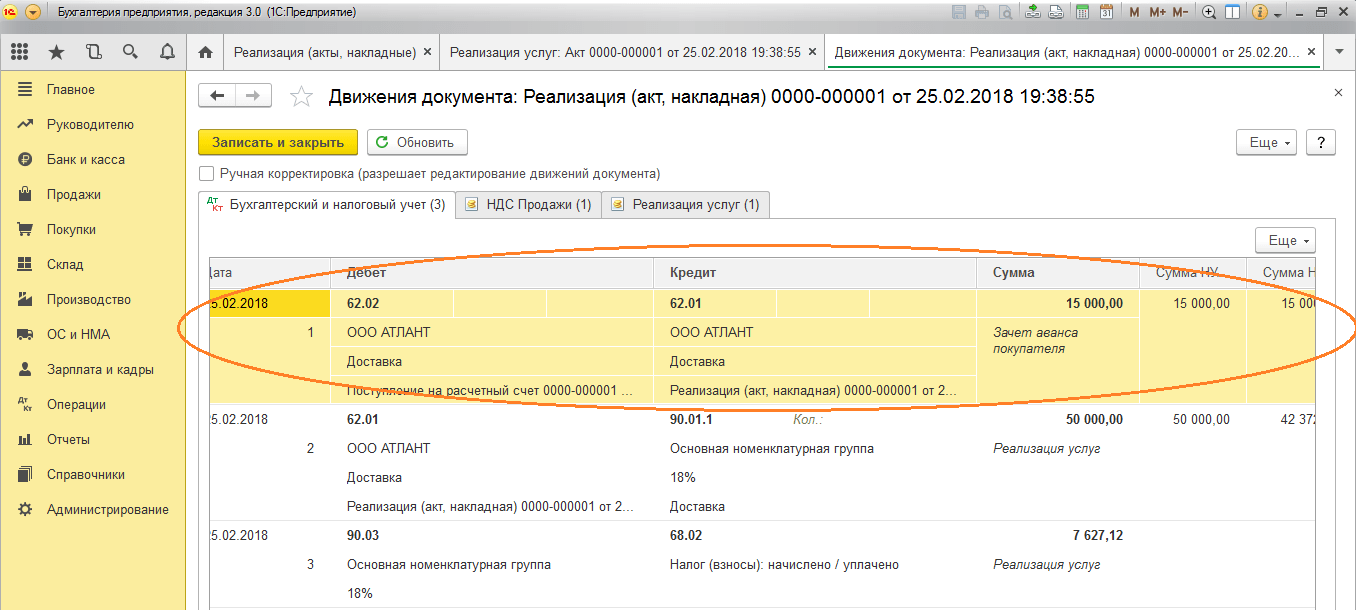

At the time of the document "Implementation of the Service", the buyer's advance will be credited (Fig. 8), and when the document "Formation of purchase book records" (Fig. 9), the amount of VAT from the advance payment will be adopted to deduct, account 76.Av is closed (rice . 10).

To check the fruits of its work, the accountant usually sufficiently form books and sales books, as well as analyze the report "Analysis of VAT Accounting."

Work in 1C with pleasure!

If you have any questions about the invoice for an advance payment in 1C 8.3 - boldly ask them to us on the selected. work 7 days a week and help in the most complex situations In tax and accounting.

2016-12-08T14: 03: 45 + 00: 00

- Recording to the register " VAT Purchase"Provides issued an advance payment to the shopping book.

We form a shopping book

We form a book of purchases for the first quarter:

But the invoice received an invoice:

We look at the final VAT for reimbursement for the 1st quarter

Others economic operations There was no longer ahead of 1 block, which means you can safely form "Accounting analysis on VAT":

VAT for reimbursement for the 1st quarter turned out 13,728 rubles 81 kopecks:

2 quarters

Arrival of goods

We enter the program receipt of the goods from LLC "Supplier" 01.04.2016 in the amount of 150,000 rubles (including VAT):

Create a new document:

The invoice from the supplier will be like this:

In the invoice received from the supplier, the sum of "without VAT" was not allocated a separate line. Therefore, before filling out the tabular part, we set a method for calculating the tax as "VAT in the amount".

We disassemble the wiring and movement of the registers ...

- The previously paid advance payment with the provider in Debit 60.01 in correspondence with a loan 60.02 in the amount of 90,000 rubles.

- 127 118.64 (150,000 per minus VAT) went to the cost of goods (in the debit of 41.01 accounts) in correspondence with our debt to the supplier (Credit 60.01).

- 22 881.36 went to the "incoming" VAT, which we will take a test (debit 19.03) in correspondence with our debt to the supplier (Credit 60.01).

- Recording (with a +, arrival) in this register accumulates our "incoming" VAT (similar to recording to the debit 19 of the account).

We register the invoice received

Together with the summary of LLC "Supplier" handed us the usual invoice of 01.04.2016 in the amount of 150,000 rubles (including VAT).

For its registration we go into the newly created document "Arrival of goods" and at the very bottom:

- We score the number and date of invoice from the supplier.

- Press the "Register" button

We will not disassemble the wiring and movement of this texture in detail, since we have already been engaged in this.

We look at VAT for reimbursement for the 2nd quarter

We again form "analysis of accounting on VAT" (this time for the 2nd quarter):

VAT for reimbursement for the 2nd quarter turned out to be equal to 22 881.36:

Why 22 881.36?

This VAT from the only invoice obtained from the supplier in the second quarter in the amount of 150,000 (including VAT): 150,000 * 18/118 \u003d 22 881.36.

But what is the already accepted for testing VAT in the amount of 13 728.81 for the 1st quarter of the paid Astrase in the amount of 90,000, you ask?

And you will be absolutely right.

After all, VAT from the advance, taken by us in the credit of the 1st quarter, should be accrued (restored) by payment by payment in the 2nd quarter, when the goods received and we received a common invoice from the supplier for the full amount.

It is on this that we record the entry in a gray square in the report on the analysis of VAT:

We make a record in the sales book

To restore the invoice taken in the offset with the advance payment of VAT go to the "VAT Assistant Assistant":

In the document that opens, go to the "Restore Adjustment" tab and click the "Fill" button:

The program found that the advance payment, VAT from which we were taken to the credit in the 1st quarter was credited (the document is a common invoice for the same buyer and the contract) in the 2nd quarter.

And now his VAT needs to be restored to pay through the sales book - otherwise we would have been taken to the VAT offset from the advance twice:

We carry out the document "Formation of records of the sales book" through the "Conduct and Close" button:

![]()

We disassemble the wiring and movement of the register registers of the sales book record ...

- We restore VAT from the advance payment issued in the 1st quarter to debit 76.VD (VAT on issued by the advances) in Credit Credit 68.02.

There are two VAT recovery options.

Restoration of VAT, which was previously paid. In this case, the amount of VAT is returned to the account of the payer's organization.

Restoration when the organization - the payer must pay the tax that the budget presented to reimbursement.

Both variants have one term, but the opposite value. You can see the difference in the analysis of VAT from the advances when we get and when we list. When receiving an advance from the counterparty, obligations to pay for VAT with the amount listed. Also, from the sale of sales goods arises the obligation of VAT payment. From the received advance payment, the VAT refund is provided for reimbursement (recovery). When listed the advance payment, the supplier also has the ability to reimburse VAT from the specified amount, on this basis decreases total amount tax. Subsequently, after the goods received, it will be necessary to list VAT to the budget (so as not to repeat the reimbursement). We offer to disassemble in detail how the recovery of VAT with a received advance payment, which listed the buyer's counterparty.

The program independently recognizes the received payment as an advance and will form the necessary wiring:

Please note that VAT accounting is created by the "invoice" document. You can form it either when an advance payment on the P / C is received or by means of special processing at the end of the accounting period (month).

Create an invoice issued on the basis of an admission to the current account:

Check wiring:

When creating a document "Implementation", the advance must automatically form. You can check on posting implementation:

The document "invoice", created by implementation, does not create any posting, but reflects the VAT movement on other important accounting registers.

The process of restoring VAT is reflected through the document "Formation of purchase book records":

At the same time filling the tab "The received advances" in 1C occurs in automatic mode. It reflects all the amounts of incoming advance payments that can be submitted to the restoration of VAT:

Checking wiring:

To track the results of regulatory operations of VAT accounting, through the formation of the reports "Book of Sales" and "Book of Shopping":

If you go to the report "Book of Sales", then one counter-charged buyer will reflect two records for the accounting period (month) for the admission of advance and the established implementation:

If you view the report "Shopping Book", the same counterpart will appear here, and the entry will compensate for it advance payment In the sales book.

The same amount will be reflected in all records. From this it follows that the payment of VAT to the budget will be disposable. Through the formation of the report "Reverse Saldovaya Value" you can check the closure of the account 76. AB (VAT in advance and prepayments):

With advance payments of suppliers, the recovery of VAT in the program 1C 8.3 occurs in a similar way. IN this case Documents should be formed in order:

Write off from the current account.

An invoice invading received from the supplier.

Purchase Invoice.

Invoice for invoice.

The difference from the previous version is only the fact that the recovery of VAT occurs according to the document "Formation of record book records".

In the document "Book of Shopping", records of the advance payment and receipt are affected:

And in the "Book of Sales" a record of the recovery of VAT is displayed:

VAT with advance payments to suppliers is taken into account on account 76.V. (VAT on advance and prepayments issued), the movement in which can be viewed in a ruble-salad statement:

A few more nuances when VAT can restore:

When selling products in retail (without VAT), intended for sale with a rate of 18%. In this case, it is necessary to restore (return to the budget) VAT according to the material that is used in production.

When recognizing tax Inspectorate An invalid or lost document "invoice" of the supplier.

There are also inverse situations when an organization can restore the previously paid VAT. To reflect in the 1C program available typical document "Restoration of VAT":

This document is essentially corrective for the book of shopping and books of sales, depending on the assignment of the recovery of VAT. For example, the amount of the recovered VAT can be written off at the expense of costs:

In this case, the recovered VAT will be reflected in the "Book of Sales" document on an additional sheet.

In this article, we will talk about the restoration of VAT and the reflection of this operation in 1C 8.3 on the example of the configuration of 1C enterprise accounting.

Often, the term itself "Restoration of VAT" Calls questions. Let's try to explain it. If short, then Restoration is an operation, reverse receiving deduction VAT, i.e. According to the already received will once deduct the adjustment, reducing this deduction or completely canceling it. If someone is more clear, then you can theoretically, we can say that we will cut the deduction on VAT in whole or in part depending on the situation. But here's just a term "Storn" In this case, it does not apply, but say that "We need to restore VAT."

To speak in more detail, then upon receipt of materials, goods, OS, etc. incoming VAT is often tax deductionwhich during the receipt reduces the amount of tax to pay. In order to apply such a deduction, several conditions must coincide, for example:

- Properly decorated SF;

- Received values \u200b\u200bare used in activities taxable VAT;

- Recipient of values \u200b\u200bis a VAT payer, etc.

Now imagine the situation when all these conditions were performed at the time of the acquisition of values, and the deduction was adopted. After some time, the conditions changed, and it turned out that it was impossible to deduct. Here in this case and make the recovery of VAT.

Another option when you need to restore VAT, is the prepayment by the buyer's supplier. By making a prepayment, the buyer can use deduction on VAT, forming in accounting wiring 68.DS - 76.V. When the buyer receives a shipment by such an Advance, it will deduct the receiving positions with the posting 68.DS - 19. Then it turns out that one shipment will be two deductions. This situation is impossible, so the first deduction must be restored.

The list of situations where VAT should be restored, given in the NK, Art. 170 p.3. And although the practice of court decisions suggests that this list is closed, nevertheless tax authorities Often requires to restore VAT and in other cases, for example, when the embezzlement of property. Here, the company itself must decide whether the tax will be restored or will not do this (in this case it is not necessary to do without court sessions).

Since the recovery of VAT always leads to an increase in the tax amount to payment, 68.DS will always be in the CT wiring, and options are possible, depending on the situation. Reflect such operations follows Shopping book.

Consider the most common cases of VAT restoration.

VAT restoration on the example of configuration 1C: Accounting

Now from theory to practice. Consider two options how to reflect the recovery of VAT in 1C accounting.

Example 1. The most common case of VAT restoration. The buyer performed a prepayment for the batch of goods, both counterparty VAT payers. Prepayment amount 118000 rub., Incl. VAT 18000. A few days after the prepayment, the organization received material values in the amount of 94400 rubles, incl. VAT 14400 rub.

Accounting for advance payments in 1C is well automated. By payment, correct wiring was automatically formed.

If at this moment to form Book of shopping, We will have two deductions of one delivery.

VAT is restored. To do this in the menu Operations Select item

It offers to twist the documents and form the regulatory operations - the formation of purchase book records and sales.

We are interested in pressing a button. Complete the document, The table part will be formed automatically.

We watch wiring. The program automatically restores VAT by analyzing the amount of the advance and subsequent shipment. In our case, delivery is less than paid advance payments, restore the amount in the amount equal to the shipment received from the supplier.

Example 2. In the 4th quarter of the received batch of materials from Example 1, the VAT should be restored from the amount of 40000 rubles, the calculated amount of VAT is 7200 rubles.

In this case, the program cannot automatically determine which period and volume should be restored by VAT. Therefore, create an appropriate document Recovery VAT. It is in the section

Press the button Create From the list of options, choose a document on the restoration of VAT.

In order for VAT does not "hang" on account 19, it must be written off. The document can be created on the basis of admission.

The default is offered to adjust the entire amount of admission, we should adjust it.

On the tab Account write-off Indicate the score 91.02.

Pay attention to the value of the expense directory. Here you can set the parameter whether costs are taken to calculate the income tax or not.

If accepted, wiring will be the following:

Another frequent example, with which many enterprises may encounter - change the amount of delivery due to the price adjustment and (or) the number of shipped positions, resulting in the need to restore VAT. Such operations lead to the appearance of correction invoices, the order of reflection of which we will consider in detail in another article.