Discounting cash flows discount rate. Discounting. Cash flow CF, thousand rubles

Discounted cash flow is ...

Discounted Cash Flow (DCF) is the valuation technique used to calculate investment attractiveness project. The analysis based on the discounted cash flow method includes the use of future cash flows and discounting them (usually the weighted average cost of capital acts as a factor for discounting) to bring these flows to a certain point in time. This approach is used to assess potential investments. If the value of the sum of the given cash flows is higher than the current value of the investment, then such an investment is attractive for investment.

Formula for calculating discounted cash flow:

This model is also called the discounted cash flow model.

Investocks Explains Discounted Cash Flow

There are many different ways calculating cash flows and the corresponding discount rate. Despite the complexity of all sorts of calculation techniques, the purpose of the discounted cash flow analysis is only to calculate money, net income from an investment, adjusted for the time value of money.

Discounted cash flow models are often indispensable and useful, but there is no way to reduce calculations. Building such models is a mechanical job that rarely requires analytics. However, in the conditions russian market, isolating net cash flows can be a daunting task. This is due to the fact that very often in Russian companies, management accounting differs significantly from accounting.

Another important point in the analysis of discounted cash flows is the fact that these models are very sensitive to even minor changes. For example, a small change in the discount rate can lead to a significant change in the final result (company value). Another important technical factor in calculating the DCF is the calculation of the terminal value. Instead of calculating cash flow ad infinitum, the terminal meaning technique is often used. To assess the terminal value, a so-called simple annuity is used, for example, for the next 10 years. Terminal value technique is used only because it is very difficult to realistically forecast cash flows for future periods.

Discounting cash flows Is the reduction of the value of the payment streams executed at different points in time to the value at the current point in time. This is done, for example, when or when assessing the value of a business.

Discounting reflects the economic fact that the amount of money we currently have has aboutmost real valuethan an equal amount that will appear in the future. This is due to several reasons, for example:

- The available amount can be profitable, for example, by being deposited with a bank.

- The purchasing power of the available amount will decrease due to inflation.

- There is always a risk of not receiving the estimated amount.

The meaning of the discounting operation

Let us explain the meaning of the cash flow discounting operation using the following example.

Example

Let's say we have 100 rubles. and put them on a deposit at 5% per annum with an annual interest rate and crediting them to the deposit. Then in a year we will have 105 rubles.

S 1 \u003d 100 + 100 × 0.05 \u003d (1 + 0.05) × 100 \u003d 105

In two years we will have 110.25 rubles.

S 2 \u003d (1 + 0.05) × (1 + 0.05) × 100 \u003d (1 + 0.05) 2 × 100 \u003d 110.25

In three years we will have 115.7625 rubles.

S 3 \u003d (1 + 0.05) 3 × 100 \u003d 115.7625

In n years we will have

S n \u003d (1 + 0.05) n × 100

In general terms, the formula looks like this

S n \u003d (1 + P) n S 0, where

Sn - the sum after n interest accrual periods

P - interest rate for the period

S 0 - initial amount.

This is the formula for calculating compound interest.

Thus, if we can put money on a deposit with the conditions described above, then 100 rubles, which we will receive now, from an economic point of view, are equivalent to 105 rubles. which we will receive in a year are equivalent to 110.25 rubles. received two years later, are equivalent to 115.7625 rubles. received three years later, and so on.

In general terms: the sum S 0 received now is equal to the sum (1 + P) n S 0 received after n years.

The inverse problem often arises: it is assumed that in n years the sum S n will be obtained, it is necessary to find the equivalent sum at the current moment. This is a typical task when developing business plans, calculating return on investment, assessing the value of a business by the amount of expected income (income approach). In other words, the sum S n is known, it is necessary to determine S 0. In this case, by simple transformations, we obtain the calculation formula:

S 0 \u003d S n / (1 + P) n - Discounting formula

This operation is called discounting, it is the reverse of compound interest. Interest rate in this case is called discount rate.

Cash flows

When calculating investment projects and when evaluating a business, deal with multiple inflows and outflows money... Usually they are grouped by some time period (year, quarter, month) and summed up.

The resulting values \u200b\u200bare called cash flows... Cash flows can be positive (the amount of receipts for the period exceeds the amount of outflows) and negative (the amount of outflows for the period exceeds the amount of receipts).

Discounting cash flow for n-th period is performed by multiplying the payment amount by the discount factor K n:

K n \u003d 1 / (1 + D) n, where

n - Number of the period (step) of discounting

K n - Discount factor at step n

D -

It reflects the rate at which the value of money changes over time; the higher the discount rate, the greater the rate.

- See also:

Cash flow discounting formula

If there is a flow of payments at regular intervals:

CF \u003d CF 0 + CF 1 + CF 2 +… + CF N,

then applying the discounting operation to each payment, we get the formula:

| CF 1 | CF 2 | CF N | |||

| CFd \u003d CF 0 + | ----- | + | ------ | +...+ | ------ |

| (1 + D) | (1 + D) 2 | (1 + D) N |

One of the examples of a discounted flow is (), in which the flow elements are totals (income - expense) at each step of the investment project.

Examples of calculating discounted cash flows

Example 1. Business valuation

Shown below are the cash flows (net income \u003d income-expense) of some business being assessed. The discount step (the period of time during which payments and receipts are summed up) is 3 months. Discount rate 20% per annum.

Note that the total net income is 16,000,000 and the total discounted net income is 11,619,824.

The graphs below show the cumulative total cash flows and discounted flows of the business being valued.

Example 2. Calculation of an investment project

A more complicated case is an investment project. A characteristic feature of investment projects is negative cash flows (losses) at the first stages. Further, the income generated by the project gradually grows and covers the initial costs.

Below are the cash flows (net income) of some investment project. The step of the investment project (the period of time during which payments and receipts are summed up) 3 months. Discount rate 20% per annum.

Note that the total net income is 2,250,000 and the total discounted net income is 775,312.

The graphs below show the cumulative total cash flows and discounted flows of this investment project.

It can be seen that the graph of the discounted net income with each step is more and more behind the graph of the net income.

Discounting cash flows is the main tool for evaluating an investment project. In this article, we will consider the basics of discounting, tell you when to apply the method and give an example of calculation.

Discounting cash flows. Definition.

Cash flow discounting is a way estimates of future cash flows... In other words, it is an attempt to assess the attractiveness of any investment opportunity based on what kind of cash flows they are able to generate in the future.

The essence of the method is based on a simple statement - money "now" is more expensive than money "later" - in the future (see Figure 1). This is due to three main reasons:

- Inflation. The economy is characterized by a gradual rise in prices. For the same amount of money over time, you can buy less and less goods and services.

- Risk. The expected funds may not be received.

- Alternative cost of money. The money in circulation today could have been invested differently, for example, in bank deposits.

What is cash flow

Before discounting, you need to decide on the concept of cash flow. The abbreviation CF is used for its designation. When calculating, cash flow means the amount of income minus operating costs in a separate period... For example, profit before tax from the income statement or net cash flow from operating activities from the cash flow statement.

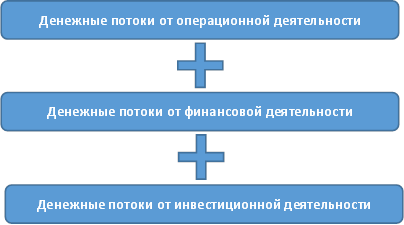

It is advisable from the point of view of representativeness of management information to divide the flow into:

Such a division is not a mandatory rule, but investors and company management will receive full information about how profitable or unprofitable their current activities are. Separately provided information on investment plans will help to adjust them based on the projected financial result and flows from financial activities.

The amount of discounted cash flow (DCF) is affected by the frequency, schedule cash receipts and the length of the time period for which it is stretched. The schedule of cash receipts depends on the type of activity, the characteristics of the project and the methods of its implementation. There are four main types of dynamics of receipt of payments: uniform dynamics, increasing, decreasing and mixed dynamics. Given that projects with the same amount of future payments may have different dynamics of their receipts, the present value of the cash flow for each project will differ.

Discount coefficient

To discount the cash flow, it is necessary to multiply the discount factor and the amount of payments for the corresponding time period. The coefficient is calculated using the formula:

where:

r - annual discount rateit is also often referred to as the "rate of return";

i - number of the time period to which the payment corresponds. Most often this is the number of the year from the beginning of the period in which the project started.

Cash flow discounting formula

CFi is the amount of cash flow received in period i;

n is the total number of periods in which cash flows are received, accepted for calculation.

Choosing a discount rate

For all attempts to objectively substantiate the value of the discount rate or rate of return r, it remains largely a subjective indicator. There are several approaches to determining the discount rate.

1. The first method takes into account inflation, the minimum level of profitability and the risk from doing business.

r \u003d Inflation rate + Minimum rate of return × Risk

The rate of return for the least risky is used as the minimum level of return. financial instrumentssuch as government securities... This approach assumes that an acceptable level of return can be income that exceeds the inflation rate prevailing in the period under consideration, by the amount of the minimum income, adjusted for.

2. The next most common way is the "WACC model". This approach is based on calculating the Weighted Average Cost of Capital and assumes that investments in new project should be more efficient already existing business. The disadvantage of this approach is the lack of consideration of the degree of risk for the project.

The weighted average cost of capital takes into account the ratio of equity and borrowed money... Accumulated retained earnings are considered as own funds, and the amount of short-term and long-term bank loans is considered as borrowed capital.

In this case, the rate is calculated as follows:

R d – interest rate on attracted loans and credits;

Wd is the share of loans and credits;

T is the income tax rate;

R e - cost equity capital;

W e - share of equity.

How to estimate a company's value using the discounted cash flow method

See how to assess and avoid blunders.

3. Capital Assets Pricing Model (CAPM). This method is used in a stable economy and in the presence of open information about the profitability of companies. IN in this case the discount factor takes into account the average and risk-free level of profitability of companies in the market and the level of risk for a specific project.

The risk level β is defined as a value from 0 to 1, where 0 is a complete absence of risk, and 1 characterizes high level risk.

r br - risk-free level of return on capital;

r cf - the market average level of capital profitability;

β is a risk factor.

The factor is defined as the regression coefficient between the level of profitability of the company in question and the average level of profitability in the market. Some countries publish index guides for large companies.

4. In Russia, the methodology is used in accordance with the Regulations approved by the Decree of the Government of the Russian Federation of November 22, 1997 No. 1470

r br - key rate of the Bank of Russia

i is the inflation rate set by the RF Government for the current year.

P is the level of risk, which is determined according to Table 1.

Table 1. Risk level

|

Risk level |

Objective of the project |

P, percentage |

|

Increasing production efficiency by changing technology |

||

|

Ensuring the growth of sales of already manufactured products |

||

|

Development and promotion of new products |

||

|

Very tall |

Investments aimed at the development of innovations |

Calculation algorithm

The process of calculating discounted cash flow is divided into stages:

- Determine the planning horizon. As a rule, planning horizons of 3, 5 and 10 years are used.

- Prepare a cash flow forecast. Based on the forecast for sales and expenses financial statements are prepared, from where the figures necessary for the calculation are taken.

- Determine the rate of return, taking into account the time factor and the degree of risk for the project.

- The sums of the cash flow for each time period are brought to the start of the project by multiplying them with the discount coefficient.

- Find the total discounted cash flow by summing.

DCF-model, from the financial director of the World Class fitness club chain, will help evaluate an investment project in 30 minutes.

Example of calculating discounted cash flow

As an example of calculation, we will use a project related to increasing the volume of sales of existing products.

The discount rate is calculated according to the method established by the Government of the Russian Federation. Key rate Bank of Russia 7.75%. The projected inflation rate is 5.5%. The project risk level is applied at 10%.

Table 2. Example of calculating discounted cash flow

|

Period no. |

Discount rate, r |

Discount coefficient |

Cash flow CF, thousand rubles |

DCF, thousand rubles |

|

Total |

5 000,00 |

2 825,11 |

Discounting is widely used when evaluating investment projects to make a decision on the investment of funds. The most commonly used indicators are:

- NPV - net present value;

- IRR - Internal Rate of Return;

- DPP - discounted term payback.

For the example considered above, with an investment level of 2 million rubles. the discounted payback period is 6 years (see Figure 2).

Figure 2. Discounted cash flow

Adjustments and sensitivity analysis

The result of discounted flows is adjusted for the value of assets and liabilities that did not participate in generating cash flows, but which significantly affect the value of the business as a whole. Examples of such assets may be non-core assets, shortage or excess of working capital, market value of debt (depending on the type of value being assessed).

If a cash flow for invested capital was used, then the result of the calculation reflects the value of all capital invested in the business: both equity and debt. To estimate the cost of equity, the result is reduced by the amount of net debt. Net debt is equal to the sum of loans and borrowings less cash and cash equivalents.

Sensitivity analysis is the calculation of the values \u200b\u200bof the subject of assessment, depending on the change in any key factor or a group of factors. An example of such a factor would be a product price forecast. Since the discounted cash flow method contains a high degree of uncertainty, it is useful for investors and company management to understand how cash flows will change if any of the assumptions deviate from the reality. Sensitivity analysis aims to give users more full information the financial boundaries of business opportunities and threats.

Technically sensitivity analysis is performed different ways, one of which is the use of the "DATA TABLE" command in the MS Excel environment.

Calculation example

Let's give an example of calculating the value of the Betta company and analyze the result for sensitivity to the discount rate (table 3).

Table 3. DCF calculation

|

DCF calculation result |

|||||

|

thousand roubles. |

|||||

|

Cash flow to invested capital |

|||||

|

Residual value (post-forecast growth - 3%) |

|||||

|

Discount rate (WACC) |

|||||

|

Discounted cash flows |

|||||

|

The amount of discounted cash flows |

|||||

|

Non-core assets |

|||||

|

Net debt |

|||||

|

Excess own working capital |

|||||

|

Total cost of equity |

When carrying out the sensitivity analysis, we use the "DATA TABLE" command (Table 4).

Table 3.

|

Change in discount rate |

||||||

Note that the result of evaluating the cost of equity (PV) significantly depends on the discount rate. When the rate changes by 3 points, the company “loses” more than 30% of the value. The strong dependence on the cost of capital and the assumptions made during the forecast period are the main disadvantages of applying the discounted cash flow method. Nonetheless, DCF remains the most popular method for valuing companies, projects and a range of assets and liabilities.

Conclusion

The discounted cash flow method is a popular attractiveness assessment tool investment decisions... First of all, its application helps interested market participants to deepen their understanding of the business and provides an informed opinion about its likely value.

However, when assessing, one should remember that there is a factor of subjective risk assessment, which inevitably affects the accuracy of assessing investment attractiveness.

Discounted cash flow represents the financial flows associated with various projects and adjusted for how they are distributed over time and potential interest on investment. It is very important to take into account the time aspect, since most investment projects are characterized by the fact that the main costs or outflows of funds occur in the first years, and the income from them, that is, cash inflows, will be distributed for many years to come.

Economic significance

The cost of the company's operation depends on the main factors, which are the value of assets on the market, as well as the amount of income that is obtained as a result of the effective implementation of activities at the current time. The goal of potential investors is to get a very specific profit from their capital. Therefore, the profitability of the functioning of the organization is a very important point not only for owners, but also for investors, therefore it is taken into account during the implementation of appraisal works in order to determine the value of the business.

The discounted cash flow method has become one of the most frequently used in assessing these characteristics. This approach is relevant due to the fact that the process of managing cash flows for all parties is incredibly important: it can be used to manage the value of a business, increasing the financial flexibility of the company itself. Discounted cash flow is able to match income and expenses taking into account depreciation and depreciation, accounts receivable, capital investments, changes in the structure of the company's working capital. That is why many people use this method for calculations.

How to use?

Empirical data have shown that discounted cash flow is in a certain relationship with the value of an enterprise in the market, but profits in the accounting sense do not correlate well with market value, because the former can not always serve as a determining factor in the value of an enterprise.

When using this method, the cost is calculated in a certain way. The analysis and forecasting of gross income, investments and expenses, calculation of financial flows for each reporting year, discount rates are calculated, and then the available cash flows are discounted, and the residual value is calculated. After all this, it is required to sum the present values \u200b\u200bof future cash flows with the residual value, adjust and verify the results obtained.

Different calculation options

The discounted cash flow method allows you to use two types to calculate the value of an enterprise: own and investment capital... If we are talking about equity capital, then the most important indicator is the degree of value of the obtained data for the company manager, since the company's need to raise funds is taken into account. In practice, debt-free cash flow is used by investors to finance mergers, acquisitions or acquisitions by raising new funds from borrowers.

The calculation of the discounted cash flow for the capital of the company is done in a special way. Depreciation and changes in long-term debt are added to the net profit for a certain period, and capital investments for the period and the increase in the company's working capital are subtracted from the amount received. It is important to understand that cash flows are projected for the next 5 years. The probability that there will be certain deviations from the forecast is high; therefore, a whole range of forecasts is made: optimistic, pessimistic and most probable. For each, the weighted average profitability is calculated and a specific weight is put down. The cash flow for equity and debt capital can be nominal or real. The present value of the cash flow is determined at the end or mid-year. In the latter case, the result will be more accurate and therefore preferable.

Discount rate

In the process of determining the discount rate, it is required to understand that it is considered as the lower limit of the profitability of investments sufficient for the investor to see the feasibility of investing his funds in the company, especially when taking into account the possibility for alternative investments that involve obtaining income from a certain degree of risk. Risk here means the likelihood of inconsistency of expectations with the actual results obtained, as well as loss of property due to bankruptcy of the enterprise, economic or political factors, as well as events of a different nature.

What to do next?

When the discounted net cash flow is calculated, it is necessary to identify the amount of business income that will occur in the post-forecast period. The calculation is based on the fact that the residual value is the present value of the cash flow received after a discrete forecast period. It includes the cost of all streams financial resources in all periods that remained outside the framework of one forecast year. The residual value can be calculated using one of the methods.

For the valuation method net assets it is required to use the residual value as the residual value book value at the end of the period. For a profitable enterprise, this method is inappropriate.

To assess the liquid value, it is required to calculate its indicator for assets at the end of the forecasting period. There is a set of factors that affect the market value. Here we can distinguish low attractiveness due to inappropriate appearance, sectoral factors and territorial distribution.

findings

For completeness of the assessment for the operating enterprise, you can use both discounted cash flow, and market or cost. With this, you can avoid a certain amount of subjectivity by making the business assessment as accurate as possible.

Discounting from the English "discounting" - casting economic values for different periods of time to a given period of time.

If you do not have an economic or financial education, then this term, most likely, is not familiar to you and it is unlikely that this definition explains the essence of "discounting", but rather confuses it even more.

However, it makes sense for a prudent owner of his budget to understand this issue, since each person finds himself in a situation of "discounting" much more often than it seems at first glance.

Discounting - information from Wikipedia

Description of discounting in simple words

What Russian is not familiar with the phrase “know the value of money”? This phrase comes to mind as soon as the queue at the checkout comes up, and the customer looks at his grocery basket again to remove the “unnecessary” product from it. Indeed, in our time you have to be prudent and economical.

Discounting is often understood as economic indicator, which determines the purchasing power of money, their value over a certain period of time. Discounting allows you to calculate the amount that you need to invest today in order to receive the expected return over time.

Discounting - as a tool for predicting future profits - is in demand among business representatives at the stage of planning the results (profit) from investment projects. Future results can be announced at the beginning of the project or during the implementation of its subsequent stages. To do this, the specified indicators are multiplied by the discount factor.

Discounting also "works" in the interests an ordinary personnot associated with the world of big investments.

For example, all parents strive to give their child a good education, which, as you know, can cost a lot of money. By the time of admission, not everyone has financial capabilities (cash reserve), so many parents think about a "stash" (a certain amount of money spent by the cashier family budget), which can help out in the X-hour.

Let's say in five years your child graduates from school and decides to enter a prestigious European university. Preparatory courses at this university cost $ 2,500. You are not sure if you can carve out this money from the family budget without infringing on the interests of all family members. There is a way out - you need to open a deposit in the bank, for this, for a start, it would be good to calculate the amount of the deposit that you should open in the bank now in order to get 2500 per hour x (that is, five years later), provided that the maximum profitable interest that can offer a bank, say -10%. To determine how much future spending (cash flow) is worth today, we make a simple calculation: Divide $ 2,500 by (1,10) 2 to get $ 2,066... This is discounting.

Simply put, if you want to know what the value of the amount of money you will receive or are going to spend in the future, then you should "discount" this future amount (income) at the rate of interest offered by the bank. This rate is also called the "discount rate".

In our example, the discount rate is 10%, $ 2500 is the amount of payment (or cash outflow) in 5 years, and $ 2066 is the discounted value of the future cash flow.

Discounting formulas

It is customary all over the world to use special English terms to denote the current (discounted) and future value: future value (FV) and present value (PV)... It turns out that $ 2,500 is FV, \u200b\u200bthat is, the value of money in the future, and $ 2066 is PV, that is, the value at a given point in time.

The formula for calculating the present value for our example looks like this: 2500 * 1 / (1 + R) n \u003d 2066.

General discounting formula: PV \u003d FV * 1 / (1 + R) n

- The factor by which the future value is multiplied 1 / (1 + R) n, called the "discount factor"

- R - interest rate,

- N - the number of years from a future date to the present.

As you can see, these mathematical calculations are not that difficult and not only bankers can do it. In principle, you can give up all these numbers and calculations, the main thing is to grasp the essence of the process.

Discounting is the path of cash flow from the future to the present day - that is, we go from the amount that we want to receive after a certain amount of time to the amount that we need to spend (invest) today.

Life formula: time + money

Let's imagine another situation that is familiar to everyone: you have "free" money, and you came to the bank to make a deposit of, say, $ 2,000. Today, $ 2,000 put in the bank at a bank rate of 10% will cost $ 2,200 tomorrow, that is, $ 2,000 + interest on the deposit 200 (=2000*10%) ... It turns out that in a year you can get $ 2,200.

If we represent this result in the form of a mathematical formula, then we have: $2000*(1+10%) or $2000*(1,10) = $2200 .

If you deposit $ 2,000 for a period of two years, then that amount converts to $ 2,420. We calculate: $ 2000 + interest that came up in the first year $ 200 + interest in the second year $220 = 2200*10% .

The general formula for increasing the contribution (without additional contributions) in two years looks like this: (2000*1,10)*1,10 = 2420

If you want to extend the term of the deposit, then your deposit income will increase even more. To find out the amount that the bank will pay you in a year, two or, say, five years, you need to multiply the deposit amount with a multiplier: (1 + R) N.

Wherein:

- R Is the interest rate, expressed as a fraction of one (10% \u003d 0.1),

- N - indicates the number of years.

Discounting and accrual operations

Thus, you can determine the amount of contribution at any time point in the future.

Calculating the future value of money is called "build-up."

The essence of this process can be explained by the example of the well-known expression "time is money", that is, over time monetary contribution is growing at the expense of an annual interest rate. The whole modern banking systemwhere time is money.

When we discount, we move from the future to the present day, and when we “build up,” then the trajectory of the movement of money is directed from today into the future.

Both "chains of settlements" (discounting and accumulation) allow you to analyze possible changes in the value of money over time.

Cash flow discounting method (DCF)

We have already mentioned that discounting - as a tool for predicting future profits - is necessary to calculate the assessment of the project's effectiveness.

So when evaluating market value business, it is customary to take into account only that part of the capital that is capable of generating income in the future. At the same time, many points are important for the business owner, for example, the time of receipt of income (monthly, quarterly, at the end of the year, etc.); what risks may arise in connection with profitability, etc. These and other features affecting business valuation are taken into account by the DCF method.

Discount coefficient

The method of discounting cash flows is based on the law of "falling" value of money. This means that over time, money "gets cheaper", that is, it loses in value compared to its current value.

It follows from this that it is necessary to start from the assessment at the current moment, and all subsequent cash flows or outflows to relate to the present day. This will require a discount factor (Kd), which is necessary to bring future income to present value by multiplying Kd by the payment streams. The calculation formula looks like this:

where: r - discount rate, i - number of the time period.

Formula for calculating DCF

The discount rate is the main component of the DCF formula. It shows what size (rate) of profit a business partner can count on when investing in a project. The discount rate takes into account various factors, depending on the subject of valuation, and may include: inflationary component, assessment of capital shares, return on risk-free assets, refinancing rate, interest on bank deposits and not only.

It is generally accepted that a potential investor will not invest in a project, the cost of which will be higher than the real value of the project's income in the future. Likewise, the owner will not sell his business at a price that is less than the estimated value of future earnings. Following the negotiations, the parties will agree on a market price that is equivalent to the current value of the projected income.

The ideal situation for an investor is when the internal rate of return (discount rate) of the project is higher than the costs associated with finding financing for the business idea. In this case, the investor will be able to “earn” as banks do, that is, accumulate money at a reduced interest rate, and invest it in a project at a higher rate.

Discounting and investment projects

The method of discounting cash flows meets the investment motives of the business.

This means that the investor investing in the project acquires non-technical or human resources in the form of a team of highly qualified specialists, modern offices, warehouses, high-tech equipment, etc., and the future flow of money. If we continue this thought, it turns out that any business "releases" the only product on the market - money.

The main advantage of the method of discounting cash flows is that this valuation method, the only one of all the existing ones, is focused on the future development of the market, which contributes to the development of the investment process.