Sale of receivables to a creditor. Procedure, terms and conditions for the sale of receivables (assignment of rights of claim). Possible solutions to the problem

In the overwhelming majority of cases, this is not a disadvantage in the work of the enterprise. This kind debt represents the funds that must be returned to the organization by counterparties. The only case when such a debt does not bode well for the organization is when debtors are not liable for their obligations for a long time.

That is why many companies are not eager to work with deferred payments so that accounts receivable could not be formed. However, if it was not possible to avoid it, then it is worth looking for various possibilities to solve the problem.

Dear Readers! The article talks about typical solutions legal issuesbut each case is different. If you want to know how solve exactly your problem - contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and WITHOUT DAYS.

It's fast and IS FREE!

Implementation accounts receivable is considered to be such a decision. To carry out this operation, you need to know about the cost of sale, about the methods, as well as about the accounting procedure.

Selling value

The sale of this type of debt is carried out not at face value, but at a much lower value. That is why this operation cannot be called profitable for many organizations. This is due to the fact that during the sale process the company may lose a significant amount of funds.

However, quite often, this step is the only way to return at least part of the funds that were transferred to third parties. To determine the company's income from the sale of receivables, it is necessary to deduct from the funds received the cost of services or goods that were sold to debtors with a subsequent deferral of payments.

With this calculation procedure, you can get a loss that can be added to a certain group of expenses, as a result of which the tax base can be reduced. Within this framework, it is important to remember that only 50% from this loss at the time of sale of the debt.

The second part of the loss can be taken into account only after at least 45 days have passed from the date of sale of the debt. Many entrepreneurs are interested in the question of what to do with the interest accrued on the amount of funds that counterparties must return. Within this framework, it is important to rely on the provisions of the current legislation.

The law states that the interest that was attributed to costs in determining the income of the organization cannot be more than 20% ... It should be noted that for transactions that are carried out in foreign currency, you need to apply an average percentage, which is approximately 22% .

Only legal entities... For this, a special agreement must be drawn up, which, without fail, must be drawn up correctly.

Most often occurs in banks and others financial institutionswho are forced to insure against non-return of the issued funds with increased interest.

A sample debt restructuring agreement can be found at.

Special organizations act as a partner in this matter, which buy up the debt on favorable terms for them and independently collect obligations from debtors.

Methods of selling receivables

Assignment

All, without exception, transactions within the framework of this method are formalized using a written agreement. IN this document all the current nuances of joint activities are prescribed. If the assignment is a sale and purchase agreement, then it must indicate the terms, as well as the quantitative indicators of the transferred products or services.

Within this framework, the contract is the most important document that acts as confirmation of the fact that the buyer must pay a certain amount of money in favor of the seller or provide goods and services. The cession procedure is governed by the current legislation, or rather by Chapter No. 24 Civil Code RF.

It should be noted that not all obligations can be transferred to third-party creditors within the framework of the assignment. For example, addresses that are intended for a specific person cannot be transferred. This can be child support, grants, or compensation for certain physical or property damage. The assignment agreement also cannot be concluded in cases where the identity of the new creditor has a rather close meaning to the payer.

After an appropriate decision has been made to sell debt obligations as part of the transfer of rights of claim, it is urgent to find a legal successor. After choosing a special company, an agreement is signed with subsequent certification in the notary office.

The debtor may not be notified of the fact of the transfer of the rights of claim, unless otherwise provided by the original contract. When transferring rights to real estate, it is necessary to go through the procedure state registration.

In the overwhelming majority of cases, the assignment agreement is onerous. It is intended to provide economic benefits to the parties to the transaction. Otherwise, the conclusion of such an agreement may be considered inappropriate.

It is worth noting that not only current and overdue debts, but also those debts that belong to the doubtful group may be subject to the assignment of debt obligations.

Promissory note

The sale of receivables can be carried out using bills of exchange, which are securities containing obligations to pay the amount of funds specified in the document and the accrued interest on it. It should be noted that these obligations are not substantiated by anything.

One organization issues another bill, which indicates that it must pay a specified amount of money after a specified time.

A bill of exchange can be of four types:

- percentage;

- discount;

- simple;

- transferable.

Promissory notes contain certain obligations of a company or an individual to pay others a certain amount of funds after the expiration of the time specified in the document. Such a bill can be considered an undeniable confirmation of the existence of debt obligations. Debtors receive promissory notes only after a certain period has expired.

The lender can thus use such obligations to settle accounts with its counterparties. That is why the transfer of a bill of exchange can be considered a sale of receivables and accrued interest.

Factoring

Factoring is the sale of debt receivable in favor of a credit or any other special organization. The main purpose of such an operation is to carry out an additional procedure for financing the company and increase the level of turnover of the corresponding capital.

Within the framework of factoring, buyers of debt obligations can be considered financial agents. It should be noted that the rights and obligations of such agents are prescribed in Article 43 of the current Civil Code of the Russian Federation.

The factoring procedure, like the cession operation, means the transfer of debt obligations to third parties. However, there are also certain differences.

The first difference is that the relevant agents can buy not only obligations for current deals, but also for future ones, which are only in the development stage. It should be noted that within this framework it is impossible to implement the implementation of overdue debts.

The second difference is that during the cession, not only financial, but also other property rights can be transferred. As for factoring, only financial obligations are transferred with it. Another difference is.

That not all companies can use the services of financial agents. Such organizations may include companies with a fairly large number of minor debtors.

The last difference is that the sale of receivables within the framework of the assignment can be carried out by any organization. In the case of factoring, such operations can only be performed by special licensed or credit companies.

Accounting

The cost of realization of obligations, in most cases, is below par. Within this framework, a certain problem arises, which directly relates to the procedure for recognizing losses from the transfer of debt obligations, which was committed as part of the cession procedure. This is required for the deduction of income tax.

When selling debt obligations, the base is determined in accordance with Article 279 of the Civil Code of the Russian Federation. In paragraph 2 of this act there is an indication of the use of accrual methods when calculating the level of income. Thus, the value of the goods and services sold must be deducted from the proceeds from the sale of debt obligations. The amount received is a loss.

This loss is included in non-operating expenses. Part of the amount of the loss relates to such expenses at the time of sale, and part - after the expiration of the period of time established by law. Most often, this period is 45 days.

Example

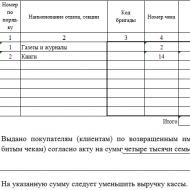

Altair LLC entered into a transaction for the sale of services with VIP LLC. The amount of the agreement was 60,000 rubles, of which 10 000 amounted to VAT. The provisions of the contract assume that payment for the services provided must be made within 90 days from the date of actual sale.

Accounts receivable are part of the assets of the organization. And she can dispose of them at her discretion. For example, sell your receivables to another company. Of course, we are mainly talking about accounts receivable arising in connection with the purchase of goods, performance of work, provision of services. After all, for example, you won't be able to sell your tax overpayment. Why would a company decide to sell its receivables?

Why are receivables being sold?

It is possible that the seller needs money today, and the buyer is expected to pay only in the future. And then the seller can decide to sell his receivables. Particularly “complex” receivables are often sold. These are, as a rule, overdue debts, for which the company took all measures available to it, but could not collect the debt. Such debts are usually acquired by specialized companies that have sufficient leverage over such debtors.

Naturally, the seller will have to pay for receiving today, and not tomorrow, from his accounts receivable. This is usually done so that the receivables themselves are sold at a discount. For example, a customer receivable in the amount of 120,000 rubles can be sold for 100,000 rubles. 20,000 rubles - this is the seller's payment for the prompt conversion of accounts receivable into money.

In civil law, the sale of receivables is called assignment of claim, or cession. The seller selling his receivable is called the assignor, and the person who acquires it is the assignee (Article 388 of the Civil Code of the Russian Federation).

How the sale of receivables is reflected in accounting with the assignor and the assignee, we told in our separate.

And what are the features tax accounting under an assignment agreement?

Tax accounting of the sale of receivables from the assignor

The assignor, upon assignment of the right of claim under contracts, except for loan (credit) contracts, determines tax base for VAT. It is calculated as the difference between the amount receivable for the assigned right and the amount of the assigned claim (clause 1 of article 155 of the Tax Code of the Russian Federation).

Of course, it is unlikely that the debt will be sold for more than the amount that will be received when it is repaid. If the debt is sold for it par value or even less, there will be no VAT payable. But regardless of whether VAT will be payable upon assignment of a claim or not, the assignor must issue an invoice to general order within 5 calendar days from the date of signing the contract of assignment of the right of claim and transfer one copy of the invoice to the new creditor. In this case, even if VAT payable by the assignor does not arise, complete section 7 tax return no need for VAT.

As for income tax, on the date of signing by the parties of the act of assignment of the right of claim, the assignor recognizes income from the exercise of the right in the amount of the fee that is due to be received from the assignee, excluding VAT accrued on the sale of such right (clause 1 of Art. 249, cl. 5 article 271 of the Tax Code of the Russian Federation). In turn, the cost of the assigned right (including VAT) is the expenses of the assignor, which reduce his income from the exercise of the right (clause 2.1, clause 1 of article 268 of the Tax Code of the Russian Federation).

And if the receivables are sold below their cost, then on the date of assignment of the claim in non-operating expenses the organization needs to recognize the loss from the assignment of the claim. So, if a debt worth 156,000 rubles was sold for 150,000 rubles, a loss of 6,000 rubles occurs (150,000 rubles - 156,000 rubles). But such a loss will not always be taken into account in full.

If the due date for the assigned claim has already arrived, the loss is recognized in full (clause 2 of article 279 of the Tax Code of the Russian Federation).

But if the debt is sold before the due date has come for it, the amount of the recognized loss is taken into account in the manner prescribed by paragraph 1 of Art. 279 of the Tax Code of the Russian Federation.

Tax accounting of the sale of receivables from the assignee

VAT presented to the assignee by the assignor upon assignment of the right of claim may be accepted for deduction by the assignee on the basis of the invoice issued by the assignor (clause 2 of article 171, clause 1 of article 172 of the Tax Code of the Russian Federation).

With regard to income tax, the costs of acquiring the right will be taken into account by the assignee only when the acquired right is canceled or when it is resold further.

The economic crisis has led to the fact that many enterprises have lost their solvency. At the same time, they have formed a large amount of receivables.

Some business entities decide to sell it to third parties in order to get out of a difficult situation. As practice shows, it is often sold at a price that is significantly lower than the nominal value.

What it is

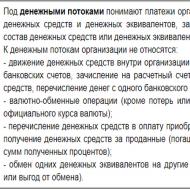

The wording "accounts receivable" means the amount of money owed, which is subject to mandatory payment by one legal entity or natural person to another.

As a rule, it is formed over the course of several months due to the violation by the debtor or the creditor of the deadline for the fulfillment of obligations that are provided for by law or agreement.

The definition of the term "delay" is established by the provisions of civil law, which regulate the relations of economic entities. According to generally accepted rules, the debtor is liable to the creditor for losses incurred by him as a result of delay and the impossibility of fulfilling obligations.

Liability for delay is assigned to:

- prescriptions of regulatory legal acts;

- the terms of the current agreement, which were established by interested parties when it was signed.

Losses incurred as a result of delay are not subject to compensation if a penalty, that is, a penalty, is charged for it. As a rule, the presence or absence of a delay, its timing and limitation are key factors credit history... It is estimated based on current delinquencies represented by overdue payments for one year.

The norm was introduced by the world banking practice. It should be noted that in some countries, for current overdue payments, delinquencies of the current and past fiscal year... For example, in the UK, Switzerland, France.

Basic Rules

The transaction for the assignment of receivables is made on a reimbursable basis. Its documentation must be drawn up properly in writing in accordance with the norms of legal acts. must be certified by a notary public. It introduces the main provisions providing for mutual cooperation of the parties to the transaction, their rights and obligations, responsibility.

For example, it is necessary to indicate the volume of production, the date of payment and the transfer of the right of claim, if the transaction is carried out on the basis of a sale and purchase agreement.

The sale and purchase transaction is formalized by the assignment agreement of the right of claim, that is, the cession.

It involves:

- the assignor who is the creditor;

- enterprise - a debtor with a receivable;

- assignee - a person who has redeemed the lot with the right to claim.

The assignee is vested with the right to demand payment of receivables, penalties and penalties. The conditions are stipulated by the original contract that serves as the basis for the issuance credit funds... The title deed confirms the buyer's legal rights to claim payment of the receivable. A number of documents are attached to the assignment agreement.

These include:

- loan agreement;

- loan repayment schedule indicating the term for making monthly installments;

- mortgage, if any property was pledged;

- official paper on the surety, if it was appointed at the request of the bank;

- payment slips for the paid sum of money.

The legislator has established the impossibility of its application to targeted payments, which include payments intended for a specific person. For example, alimony payments, compensation for damage to life and health, grants.

The specifics of the sale of receivables

To date, various companies have emerged that acquire liabilities for receivables. They are interested in receiving certain benefits for themselves, therefore, they are checking the feasibility of the upcoming transaction. In the course of its implementation, current, overdue, doubtful obligations are acquired.

Feature of the deal

The legislator has provided for the rule on the sale of receivables in the provisions of civil law. Its implementation is carried out in the course of the assignment of the right of claim, which is commonly called cession. It implies the replacement of one creditor with another, as a result of which there is a transfer of rights and obligations.

The procedure in accordance with the norms of civil law is carried out without the consent of the debtor. During the cession, the transition is not only envisaged monetary obligationsbut also property. At the same time, any person can buy accounts receivable, regardless of whether they have a license.

Important details

If the company has decided to sell the receivables, then it must decide on the person who will act as the legal successor. The debtor shall be notified of the execution of the assignment transaction if his notification is provided for in the original agreement. But it is better to notify him so that the funds are transferred to the right person.

If the debt is paid to the creditor in full, then the obligations are regarded as canceled regardless of the conclusion of the assignment agreement.

It is subject to mandatory registration to be legally binding.

What is the threat of bankruptcy

In the course of the event, the property of the enterprise is sold in order to pay off its debts at the expense of the proceeds. In some cases, accounts receivable are presented together with the property at the auction. The property is being sold by an external manager appointed arbitration court in the manner prescribed by the legislator.

Accounts receivable are put up for sale in the form of a specific lot, indicating the name of the company and the amount owed.

The external manager acts with the consent of the creditors when organizing the auction, which considers the issue of bankruptcy at the first meeting. It makes a definite decision to approve the actions of the external manager regarding the sale of the property of the bankrupt company.

If the lot is sold, then the full amount of money for it is received on the current account of the debtor during one month. The term is counted from the day of the auction closing. If a source documents are absent, then the receivables put up for auction in connection with the bankruptcy of the enterprise are established on the basis of reconciliation of mutual settlements with the creditor.

purpose

As a rule, the sale of receivables under the assignment transaction scheme is carried out for a specific purpose. The seller, as a result of its sale, to receive additional financing for the restoration of production, contributing to the return of its solvency.

If a economic activity properly organized, then his sales volume increases, capital turnover increases.

As for the buyer, he will receive a commission for the money that was provided to the debtor.

Sales by factoring

Factoring is one of the most popular ways to sell accounts receivable. Questions regarding its application, conditions and grounds, rights and obligations of participants acting as agents are provided for in the instructions of Article 43 of the Civil Code of the Russian Federation. It notes that the transaction implies the assignment of the right of claim to third parties.

The term is understood as a transaction in which receivables are directly sold to a bank or credit institution. This kind of operation is carried out by a factor that extracts from the enterprise a commission from the principal amount of the payment in a certain amount, calculated as a percentage.

The method allows you to sell current and planned liabilities for money in the course of the assignment of the right to claim them.

In addition, it is quite possible to apply it to transactions that are not actually concluded. But you cannot sell overdue debt using this method.

Factoring is performed:

- with the right of recourse, the seller of the receivable is liable to the buyer if the debt is not repaid;

- without recourse, the bank or lender purchases the receivable, as a result of which there may be risks of loss if the accounts turn out to be doubtful.

Not all businesses can afford to carry out factoring, because a license is a prerequisite. If they have an uncountable number of small counterparties who owe them, then they are also deprived of the possibility of applying the method. The same applies to firms with a narrow specialization, engaged in the manufacture of exclusive products.

Sale of promissory notes at a discount

The legislator allows transactions with receivables using a bill of exchange. It means a security that contains obligations to pay a sum of money and interest charges to it at a specific date.

Types of promissory notes:

- transferable;

- plain;

- percentage.

As a rule, it is not justified by any additional official documents. In the course of a financial transaction, one person transfers to another a bill of exchange indicating the amount and term of payment. Any bank either credit institution when performing financial transactions, it records it together with the percentage established on it, which is called a discount.

The term “discounting” refers to a financial transaction in the course of which a promissory note is sold to be received. To determine the amount of income, the bank deducts interest from the amount intended for the redemption of the promissory note. The holder of the bill puts on it an inscription about its transfer, and then gives it to the bank, which is endowed with the right of recourse to the seller.

If the holder of the bill is unable to pay it, then the responsibility is transferring its rights to security the person is the endorser. He must pay the sum of money to the bank personally, since he is responsible not only for the existence of the right, but also for its implementation. In addition, it has a contingent liability for the cash amount of the disclosed promissory note disclosed in the financial statements.

Finally, it should be noted that a contingent liability is understood as a potential liability that can become an actual liability. This situation arises if the receivable is not settled by its buyer.

Sale of receivables in bankruptcy proceedings has nuances that distinguish it from similar operations in a more familiar enforcement proceedings... Read more about these nuances in the article.

How is the assessment and collection of receivables carried out according to general rules?

Let us clarify right away that in this section we only consider the collection of receivables (hereinafter referred to as DZ) within the framework of enforcement proceedings. For management and analytical purposes, other assessment methods can also be used.

Having received information about the presence of the defendant's DZ (within the framework of ordinary enforcement proceedings), the bailiff must determine:

- Reality of debt to be collected (Article 76 of the Law "On Enforcement Proceedings" dated 02.10.2007 No. 229-FZ (hereinafter - Law No. 229-FZ)). In this case, the following are excluded from the total volume of the detected remote sensing:

- DZ for which the limitation period has expired;

- DZ for which the debtor has been liquidated or is in the process of liquidation;

- DZ related to the debtor in respect of which the bankruptcy procedure has been initiated;

- DZ of debtors who are not residents of the Russian Federation and are incorporated in a country with which the Russian Federation has not concluded international agreements on legal assistance.

- Debt liquidity. The most preferable is the debt of buyers and customers of the defendant, according to which the following conditions are simultaneously fulfilled:

- DZ arose for goods deliveries already carried out and work (services) performed;

- DZ is short-term and revolving (that is, payments are made on it)

- The estimated value of the debt. Moreover, the bailiff determines this value in advance and rather approximately, in order to be included in the inventory. As a rule, the value is taken as the face value of the debt amount.

For further actions with DZ, it must be assessed with the involvement of professional appraisers (Art. 85 of Law No. 229-FZ). The estimated value of DZ obtained in this way will be used in the collection process. Law No. 229-FZ provides for 2 options for the implementation of DZ for the purposes of ordinary enforcement proceedings (Art. 76):

- Instructions to the debtor to transfer the debt to the account of the FSSP subdivision in the OFK - this option is possible only with the consent of the claimant.

- Implementation of DZ at the auction - the option is used if the claimant did not agree to wait for the debtor to transfer money to the bailiffs account or if the debtor decided not to pay the bailiffs. When putting up for auction, the starting price will be the amount of debt announced for this by the appraisers. As a rule, this is not the entire denomination of the DZ, but a certain percentage of it, calculated taking into account the chances of actually receiving money.

NOTE! Although the first option of collection seems to be more expedient - the bailiffs' account is supposed to be credited with the face value of the debt - it has a negative aspect. The debtor may not fulfill the requirement to transfer funds to the FSSP account within a reasonable time, and neither the bailiffs nor the claimant have any leverage over him. This is one of the reasons why, when implementing DZ in bankruptcy proceedings, only the sale of debt at auction is considered..

What are the characteristic features of the implementation of DZ can be identified in bankruptcy proceedings?

Bankruptcy proceedings and related procedures for satisfying creditors' claims are regulated not by Law No. 229-FZ, but by the Law “On Bankruptcy” dated 26.10.2002 No. 127-FZ (hereinafter referred to as Law No. 127-FZ). The main difference from the settlement of debt issues in enforcement proceedings is the fact that the debtor company usually has not one, but quite a few creditors. According to the provisions of Law No. 127-FZ, in bankruptcy proceedings, the maximum possible settlement of the claims of all creditors should be ensured. For this, the property and property rights of the debtor enterprise are subject to a special sale procedure - through tenders, with the distribution of the proceeds among the creditors in accordance with the accepted sequence.

Traditionally, it is believed that the sale of property at auction allows you to get the highest possible price for it. In fact, this is not the case with respect to DZ - the starting price of DZ put up for auction usually does not exceed 40% of its face value.

IMPORTANT! In bankruptcy proceedings, for the implementation of DZ, its assessment is also required. The bankruptcy commissioner (by analogy with the bailiff in enforcement proceedings) is obliged to determine whether the debtor enterprise has property and property rights (including DZ) for the purpose of their further sale at auction.

At the same time, other options for the implementation of DZ in bankruptcy proceedings are limited:

- it is impossible to oblige the debtor to directly pay the debt to the creditors of the debtor enterprise (this contradicts the provisions of Articles 111, 139 of Law No. 127-FZ);

- DZ cannot simply be sold directly to the buyer (even with the consent of the meeting of creditors) - this is the conclusion of the courts (see, for example, the resolution of the 3rd AAC dated 13.01.2012 No. A33-8866 / 2009k14).

It is possible to look for a buyer on the DZ only after the DZ has not been sold at two consecutive auctions. In this case, the search for buyers should take place through a public offer.

IMPORTANT! In some cases, if the nominal value of the DZ for the last balance before the date of the competition did not exceed 100,000 rubles, a simplified implementation procedure is allowed in accordance with the external management plan (clause 4 of Article 111 of Law No. 127-FZ).

In addition to complying with the requirements of Law No. 127-FZ, the consent of the meeting (committee) of creditors is required in order to decide on the implementation of DZ by auction.

DZ trades are conducted electronically. Anyone can become a bidder by registering accordingly on a specialized website (with registration of an EDS) and making a deposit for the corresponding lot.

The winner of the auction signs with the organizer of the auction:

- protocol on the results (evasion of the winner from signing will cancel his winnings and the deposit);

- an agreement on the purchase of debt at auction (the agreement is then submitted for state registration);

The proceeds from the sale of DZ funds are directed to meet the claims of creditors in accordance with the priority established by law No. 127-FZ (Art. 134-138).

Outcomes

The sale of DZ in bankruptcy proceedings has its own characteristics. This is due to the fact that the implementation of DZ in the course of enforcement proceedings is regulated by Law No. 229-FZ "On Enforcement Proceedings", and similar actions in the course of bankruptcy proceedings are regulated by Law No. 127-FZ "On Bankruptcy".