How to start investing from scratch: the secrets of millionaire investors. Investments from scratch for beginner teapots Investing individuals from what to start

Investing even small amounts can effectively increase money. Many people are not solved trying to try this kind of earnings, referring to their incompetence in this matter, as well as in the absence of many thousands of starting capital. Although such indecision is actually the main obstacle to success, because today it is possible to start making money on investments and with $50 in the pocket.

The idea to make money work instead of yourself is really good, but how to implement it, where to start investing a newcomer and how to choose the perfect option? About this and others in detail below.

Why do you want to invest today

The moment will comewhen you do not want to go to work at 7 am, or leave for a month on the journey, but will you allow you to work? And if you get sick and you can not go and make money? In order not to be a slave yourself, it is better to start investing today.

Why is it profitable? The best answer to this question is given Western financiers. They brought the following golden Rule:

A person can not work 24 hours to make money, while money can work on it all 24 hours a day.

And without vacations, sick leave and weekends. Money is working constantly in mode 24/7/365 Therefore, a priori are the most efficient employee.

Many folk investors believe that bank deposits are not an investment, but let's consider an example of a contribution. 1000 rubles under 12% Annual on 50 yearsHowever, all profits will reinvess:

- After a year - 1400 rubles.

- After 4 years - 1570 rubles.

- After 10 years - 3100 rubles.

- After 20 years - 9640 rubles.

- Through Z0 years - 29 960 rubles.

- After 40 years - 93 050 rubles.

- After 49 years - 258 040 rubles.

- After 50 years - 289,000 rubles.

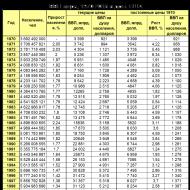

After 50 years awaits you 28900% profit. Let's go on. If under the same conditions we will put $1000 to the securities market, where average yield 20% per annum, then after 50 years we are waiting for us $9 100 440 . If we decide on $ 1,000 monthly, then the result will be $40 000 000 .

If you take as a basis 10 yearsthat is not much ( for example, your child will not have time to grow), and insert $ 1000 under 50% per annum (average percentage of profit c) with reinvest, we will get such a picture:

- 1 year - $ 1,500

- 2 year - $ 2,250

- 3 year - 3 $ 375

- 4 year - 5 062.50 $

- 5 year - 7,593.75 $

- 6 year - 11 390.62 $

- 7 year - 17 085.93 $

- 8 year - 25 628.90 $

- 9 year - $ 3843.35

- 10 year - 57 665.03 $

Everyone has their own opportunities, but imagine if you initially invest a little more, and you will report money over the investment period, the results will grow in geometric progression.

How to start investing from scratch

Before moving directly to investments, it is necessary to clearly decide on the estimated period available to the budget, goals how much money you will take, and how much to reinvest.

Before moving directly to investments, it is necessary to clearly decide on the estimated period available to the budget, goals how much money you will take, and how much to reinvest.

Since the article is not written for oligarchs or professional investors ( they all know), I will make the focus on start from scratch. First of all, it will be necessary to start with the theory - to study and, if possible, relieve the experience of other well-known investors:, etc.

How to start investing from scratch? - First of all, you need to choose a suitable tool. You can allocate the following list:

The appropriate option must comply with both financial capabilities and expected profitability. For example, investing in real estate or land involves a long term and existence of a significant amount, and investments in may require everything 45 dollarsBut in any case it will take a certain starting capital, which should be taken from free money, that is, without loans, not from money on food or payment of bills, without worsening your standard of living.

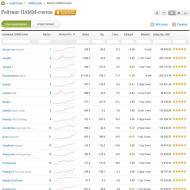

For beginners with minimal capital, it is better to start with investment in PAMM accounts and. At first, it is beneficial because money simply will not lie idle. Also should not be bypass.

So we came to risk diversification: Try never to put all the eggs into one basket, no matter how the tool has been profitable. If you decide to earn a percentage of bank deposits, then put all the money for one account in one currency in one bank.

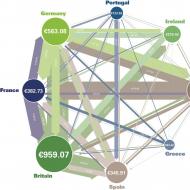

An advanced option of how to start investing with minimal risks, this is the compilation of your own investment portfolio, that is, the distribution of its money between different assets. It can be a purchase of shares of companies from various industries, the acquisition of real estate of various purposes, etc., the main goal is to balance the risks. If several options give a loss, then the profits of the rest will block minus and bring you into profits.

Where would you like to invest money?

Poll Options Are Limited Because JavaScript is Disabled in Your Browser.

What amount to start investing

The amount of investment can start literally with $10 B - what is available to everyone. However, the return on such a sum will be very low, so it is better to prepare a more solid contribution.

According to the majority of financiers, the optimal amount for the start can be considered $500

. President Investment Giant Capital One Investing Ivette Butlerit believes that this figure is not taken from the ceiling.

According to the majority of financiers, the optimal amount for the start can be considered $500

. President Investment Giant Capital One Investing Ivette Butlerit believes that this figure is not taken from the ceiling.

Such money forces to collect everyone - from adolescents who receive pocket money from their parents, and family people of middle wealth, which will simply postpone $ 5-10 a week without much harm for the family budget.

At the same time, the return on a successful contribution will be tangible. Confirms her words and the fact that a very large number of brokers prescribe the minimum bar just in the area $500 .

Solidarity with such an opinion and co-founder of the project on microenvestia Robinhood. Vlad Shane. He has a success recipe for a beginner looks at all easy - to find 500-1000 dollars, buy some inexpensive shares on them from " blue chips", eg, Starbucks.and patiently wait for the first dividends for further investment.

You can start investing with almost any amount, as there are both corded on the market and also brokers offer a purchase and from 10 dollars.

CFD and options This is another opportunity to make a profit on stocks, and the second option - also quickly, because each option has a validity period, for example 10 or 15minutes. If in terms of the transaction you will specify the growth of stocks and when closing the option, the promotion will cost more than when buying, you will receive 79% profit.

Look below as we earned on Tesla shares.

We chose stocks Teslafrom the list of assets:

Then indicated the closing time of the option to 22:10 (after 9 minutes):

It remains to make an amount of investment and indicate the main condition, there will be stocks to cost higher or lower at the time closing the transaction. Now for the papers of Tesla, a steady growing trend was entrenched, while the price touched the strong support line, which means that growth will continue, so we indicated in the conditions UP:

If after 9 minutes the value of the shares will be higher than at the time of purchase, we will receive 79% of profits.

It was not possible to wait long and look at the price schedule at the time of the option closing:

As you can see, the cost of papers has grown, and we got 79% from the amount of investment and returned from $ 80 in general $143,2 :

Where to start investing a novice - instructions

Thinking on how to start investing, it is important not to miss the fact that a successful start is extremely important for effective promotion.

In fact, no special secrets are disclosed here. However, there is an opinion that there are no such. After all, even the famous Warren Buffett repeatedly mentioned that even the most ordinary person can be a small state, if it is clearly to see his goal and patiently move towards it, not neglecting with trifles.

Before starting to invest money, it will be useful to familiarize themselves with the advice of people who reached the transcendent vertices in the financial world and have already managed to record their name in history.

Act.

Bill Gates Once he said that most people are not able to achieve their financial goals, not because of their intellectual or physical insolvency, but because they are irrationally spend their time and energy. Conducting routine and monotonous work, they kill their potential, but for some reason they continue to hope for good luck in the form of an inheritance from a long forgotten relative or winning the lottery. At the same time, if they were less than spending on everyday entertainment and invested more, then after 5-10 years later they would have the opportunity to quit their impaired work and make more interesting things.

Discipline.

This habit needs to be developed as soon as possible and maintain it throughout life. The development of discipline will allow you to control your expenses and consistently go to the goal in spite of everything. For example, the richest oilman 50s Harold Hunt Until the latter came to work on an old car and eats a simple home meal, which he brought with him in a paper package. Warren Buffett, even earning the first billions, continued to live in the house purchased in 1958 for $ 31500. The essence of this Council is that everyone who is looking for real investment success must have the power of the will to maintain the standard of living that corresponds to the level of its income. Loss of discipline and wrap the desire to thoughtlessly spend earned, which will inevitably lead to the collapse.

Perseverance.

The path of investment success is a permanent series of lifting and falling. The stories of major businessmen who invested millions in stock and drove everything in one feather, often flashed as an antiprode for novice investors. But you should not be afraid to invest and especially throw this thing after the first failures. With them comes invaluable experience, and by investing gradually and in different projects, the investor is unlikely to stay in Vnaklad.

Even the famous admitted that he was more than once on the verge of full collapse and experienced a strong desire to quit everything and content with residues of luxury. But there were always people who discouraged him and, as you can see now, they were completely right. And the received "kicks" only helped the financier to take off even higher.

If you have found a mistake, please select the text fragment and click Ctrl + Enter..

Many personal financial management techniques recommend spending a certain percentage of investment income, that is, to force money to work. And not passively, as on the deposit in the bank, but with more risk and profitability.

Let's figure out what contribution to the bank and why investments in stock tools (securities, stocks and bonds) are much more profitable.

The bank takes money and invests them into assets. Most of the arrived from the turnover of money depositors, the bank takes himself. You get a fixed rate that often does not cover inflation. For example: inflation in 2015 amounted to 12.91%, and the most profitable deposits in different banks provide only 8.5-9% per annum.

If you are investing in stocks, the impact of inflation on your investments is not so significant because it affects the company's revenue and is taken into account when it is evaluating. Thus, if you buy stocks of reliable companies, inflation does not eat the percentage of the capital invested by you, as in the case of a bank deposit, simply because the company's assessment is given with amendment for inflation.

If you contribute to the bank, you get a fixed bet, allow, 9%. After you have issued a contribution, nothing depends on you. Inflation per year can be 10%, and maybe 15%, and you will receive only 9% per annum.

In addition, you can not withdraw money before the expiry of your contribution, without losing the accumulated interest. It remains to look at the growth of inflation and be content with the fact that for you it is slightly lower than for the rest due to the percentage of the contribution. In fact, the purchasing power of money falls, you lose them.

As for the shares, at the expense of business growth, changes in politics and other factors, they can not only overcome losses from inflation, but also bring significant income. In addition, you can sell them at any time if the forecasts are disappointing and save at least part of their money or even reinvest them into growing assets.

It turns out that investments, on the one hand, a more risky way to preserve and multiply your money, and on the other, on the contrary, more secure.

Here it all depends only on you, more precisely, from your knowledge, investor experience and ability to predict the situation in the securities market. Where to get this knowledge?

Training for those who appreciate their time

Not everyone will agree to visit the trading school. Tired at work, and then go to learn? Yes, and there is a lot of learning.

If you want to learn at home (maybe at work) at any convenient time, there is another option - "Investments 101". This is a free platform for online learning investments with a huge base of free information - courses of different complexity and tools for safe practice. Let us consider in more detail what the platform offers.

Individual training plan

After the mandatory registration, you fall to the main page. You can immediately begin classes - just open the tab "Learning", choose the courses you are interested in and passing them.

But in order not to bother too much information, it is better to create an individual curriculum before learning.

You respond a few questions about your level of preparation that are interested in the topics and the number of classes per week, and the site creates an individual plan with reminders (if you want) so that you receive only useful information and have not missed classes.

Now your main page displays only the courses you need, and two charts on the side show how much percent you have already studied and how much it remains.

Now let's talk about what is the "Investment 101" platform courses.

Courses and tests

On the "Investment 101" website, all courses are distributed from the degree of difficulty - 10 courses for beginners in the "Investment 100" package, 8 classes in the "Investment 200" package and 3 courses for advanced users in the "Investment 300" package.

Studying the "Investment 100" package, you will get acquainted with the basic concepts, the basics of investment and stock trading, special tools - QUIK and MetaTrader programs.

In the packages "Investments 200" and "Investments 300" presented more complex topics. Here you will learn about strategies and tools, technical analysis and risks, learn how to properly compile an investment portfolio and build a trading strategy.

All courses are distributed on topics and are presented in two formats - text and video. Choose how it is more convenient for you to learn. The text is divided into parts and supplemented with visual graphs for better assimilation of information.

After mastering the course, you pass the test to check your knowledge. The number of scored points is reflected on the main page and affects the amount of koins - a prize currency that allows you to pass courses for free.

For example, to go through courses from the "Investment 300" package, you need to accumulate a certain number of koins. Do not be scared, it is not embedded purchases, and the meter of your hard work.

Consistently passing all themes, you get prize koins, with which you can open the courses inaccessible while. Or you can skip a few topics, and in return to invite friends - for this, too, accrue the prize currency.

Another opportunity to pass closed courses is to activate the promotion.

Just enter the Superbroker promotion and receive 2,000 virtual rubles as a gift for the purchase of closed courses "Investments 101".

Thus, you will receive proven information for free and can immediately apply knowledge in practice, not risking your money. This will help you with the tool of the site "Investments 101" "Simulator".

Real Trade Simulator

For registration and confirmation of email you credit 500,000 virtual rubles with which you can start learning.

Below you see quotes. Next to the company name and type of shares are the last price indicating an increase or fall. You can buy any number of shares available on your virtual money, and then follow the price change, sell and buy new ones.

To the right you see the story of your account as a graph and you can quickly assess profit and losses.

You can also go to the card of any company presented in the "Simulator", read about it real facts and see the growth schedule and falling prices for stocks.

So, on the "Investment 101" website you get theoretical base and practical skills. And what's next? When you figure out the principles of the market and learn how to make a profit from your investment, you can easily go to real trading.

How to start a real account

The website "Investments 101" was prepared by the BCS Broker company - an experienced broker with a 21-year experience in financial markets. After passing training, you can online with this broker, moreover, it will take this no more than five minutes.

Learn and try

Contrary to the statements of many companies, investment is not so simple. It is impossible without knowledge and skills to start trading on the stock exchange and earn millions. Like any other thing, investment requires ownership of theory and information, as well as practical experience.

The website "Investments 101" helps to purchase the necessary knowledge base that will help avoid basic investment errors.

Therefore, do not miss classes, try your new knowledge in the "simulator" and approach this profitable investment.

The article covers the main issues of investing from scratch: from the stage, when even there is no starting capital, before the choice of tools and the peculiarities of each of them.

Our main idea is that everyone can become an investor, the main thing is a strong desire and a sequence of actions.

Startup Capital is a key component of any investment. If there is no money, what, in fact, can you invest? Next, let's try to give several recommendations how to create an initial capital. I would like to warn novice investors: do not invest the latest money or the money that are intended to cover compulsory expenses. Gold Rule: Investments use specifically for this purpose.

The most important question, without an answer to which investments are impossible: where to get the starting amount? One of the simplest ways: accumulate. To postpone from its monthly income 20 percent in Cubia (and better on a bank deposit, which is already some investment in itself). The accumulative period requires patience: listed 20 percent needed carefully according to the schedule and do not touch the accumulated money. Most often, it is an impatience that is the main obstacle to the path of the novice investor.

Any "superfluous", unforeseen money in the budget, is also well or partially directed to the formation of investment capital. Savings, patience and accuracy are the features of a successful investor. Those who are accustomed to easily get rid of money, unfortunately, will not become investors if they do not change the views on financial discipline. Once again: Cash discipline is a necessary condition, without which success in the investment sphere is impossible.

The "Rule of Four Envelopes" works well. Divide the entire month budget for 4 parts (for each of the weeks of the month). During the week, you can spend only the amount that lies in the appropriate "envelope", it is impossible to climb the budget of the next week. And if there is savings, it goes to the fifth "envelope" (actually, in the piggy bank). This piggy bank receives the obligatory 20 (less or more) percent of all income per month. At a certain point in the fifth "Envelope", the coinage amount is formed, which can already be invest in some project.

The "chip" of 20 percent is that without this money you can live almost with the same quality as with them. Their shortage in the budget is little felt, and the money accumulates.

Another way to find the necessary capital is the realization of property. Anyone from unnecessary things, equipment, furniture to garden sites and cars. Sale of something unnecessary along with accumulation is also good sources of money for initial capital, even if small.

How much money is needed? Types of investment

The answer to the question depends on where exactly we will invest. Tools mass. Therefore, to determine the desired amount, you need to plan in advance and the investment scheme (it, of course, can change in the process).

Also, the choice of the instrument depends on the goal with which investment is underway. It can be:

Long-term investment with a goal of a large purchase;

Long-term investment in order to accumulate to the retirement to the pension;

Investing in order to no longer work, but to live on income from capital;

Continuing to work, get an increase to the main income;

Investment in the future of children (education, housing, etc.)

Goals can be much more, and we have given - intersect. Consider more Investment technology. Suppose the "zero" stage was passed and some amount gathered.

On average, you can invest, having an initial capital of only $ 500. But it is possible and much less. To try yourself on a new field, learn how financial instruments work, even 1000 rubles can be enough. This is the minimum average deposit amount into a bank deposit, aft, bonds, etc. Of course, income in absolutely expression will be almost impaired, but most importantly start. At the first stage, it is not even necessary to think about the amount of profit, and most importantly - practice, gaining knowledge and experience. As we said, the stage of capital accumulation can already be combined with investment. Do not keep money under the pillow, but invested in assets with high reliability (say, government bonds).

Tip: Start investing with reliable tools. They are small, but do not require experience: they can use everything. Investment models with high rapid profit have the opposite direction: high risk. In addition, they need to learn how to use what time is required.

In the initial investment process, prepare the amount that can be invested in something risky. It is recommended to use with such a goal no more than 5-10 percent of the investment portfolio.

Basic investment methods

For a novice investor who does not want to risk needed, there are several ways for relatively reliable investments. This, in addition to a bank deposit: Bonds, shares of large enterprises, mutual investment funds. In addition, a number of investors will be interested in currency or precious metals. It is also possible to play the cryptocurrency market, where there are high-income prospects, but there are a lot of dangers.

Let's start with ways that are characterized by quite high reliability. It is very simple for a beginner of such a way as investing in a diet investment fund. Many of them have a very low value of the share, it is attractive.

Pytes are in many large banks. They are very different in yields and markets on which they work, as well as at risk levels. In the illustration it can be seen that one of the Pyves of Gazprombank (their more than shown) worked "in minus". (Abbreviation NAV means "Cost of Clean Assets").

It is interesting to see how much you can earn, say, on investments in Sberbank Pyp. The picture is next.

Only a part of working mutiings. It can be seen that they are all "in the plus", except for one. And the Fund "Global Internet" leads with very high indicators.

It can be seen that the FIF is invested in the fields that grow rapidly and continue growth in the coming years. At the same time, the Bank warns: investments in this fund are associated with high risk. Despite this, you can recommend novice investors to try such attractive financial instruments such as mutual funds.

And if you want to buy promotions directly? This is also a fairly available tool. Securities are bought through a broker. As an example, consider Sberbank's proposals, which carries out brokerage services of the population (individuals). There are similar structures in many other banks, you can ask them, just going to the official website.

In Sberbank there are investment portfolios for both experienced and beginner investors with different levels of risk.

To start buying securities, you need to open a special brokerage account, which will help to make the bank you choose. Often many operations can be performed via the Internet.

Choosing a broker, beware of scammers. Check the license of the Central Bank, the official website, the real office and the phone.

Professional brokers provide the opportunity to invest not only in the stock market, but also in any markets in the legal field. The novice investor is also available currencies, precious metals, and many other financial instruments.

You can invest without having enormous means, opening an individual investment account. So, with the help of an online calculator "Finam" investor will determine its possible income depending on the amount and validity period.

It can be seen that even with very modest investments, as a result, a rather substantial income "comes out". At the same time, the nested amount does not disappear.

How much can you make money on the stock market? Everything is pretty unpredictable. Let's look at the statistics.

Figures suggest on reflections. In general, it can be seen that there are leaders whose shares are growing, and stably, at large time intervals. For example, this is the same "Sberbank", as well as Yandex. Inheritance prospects depend on market elements. But in general, we can say that the shares of actively developing large companies will be income in the results of long time periods.

Let us now turn to the prospects for investing in currency. It would seem that it would be easier: went to the bank, bought dollars and euros in the exchanger and wait for the profit. Let's look at the statistics.

Peaks of oscillations 2015-2016. Coming and there is a tendency to stability. In such conditions, it is realistic to get substantial profits, only if you invest very large amounts and sell the cost-effective dollars and euros on time. It is better to do with the help of professionals, that is, to resort to the services of brokers, what we were told above.

Another simple investment method is cryptocurrency. Although be prepared for risk. The strongest oscillations are observed at Bitcoin, the price of which will take off, it collapses within 50 or more percent.

Finally, let's say about investments in precious metals. Prices here are also not happy with positive dynamics. A beginner investor will have to wait a long time for a long time. In addition, attachments will be needed quite serious.

Some beginners are interested in trading on Forex and other ultra-high risk tools. Dictated by this desire to "promote money" as quickly as possible and overnight become rich.

Exchange trading. Is it possible to quickly become a millionaire?

Many have heard that hundreds and thousands of interest can be easily earned on the stock exchange, get rich in a very short time. Such cases are, but success accompanies only experienced players who know a lot can have modern trading instruments. Moreover, such traders on the stock exchange "spin" very significant amounts. From nothing you can not do something. You need to be prepared for the fact that at the initial stage of investment will bring rather modest fruits. And only over time, the increasing amounts will already please the eye and there will be something serious for them.

System and competent trade on the stock exchange with the use of automation is able to bring 10-30 percent per month. This is a very good income if on the deposit is really a serious amount. With this percentage of profits, it is quite realistic to live by a safe life. You need to "just" to invest a significant amount. Let's say, from a deposit of 500,000 rubles will be "drip" quite a worthy income.

But the way to get a percentage exist more, and they are pretty simple. It is necessary to purchase experience, knowledge, technology, increasing the deposit. If they are aimed at super profits, you need to be prepared and super-losses: these are the real laws of the financial market.

For a beginner game for Forex - a very risky business. The probability of the loss of the deposit is huge, and if the money was accumulated long labor, there is a danger to quickly stay at the broken trough, losing the benefits of long work. It may be seriously demotivated, and a person will no longer want to believe in the possibility of financial success. In addition, the trader is a special character, it takes the calculation and strong nerves. If you are present, try forex in demo modes, then with small deposits. This is a really working, but complex tool. On our site you will find a lot of useful materials that will help you learn to modern successful trading.

PAMM-account

Private case of chase per random is superfluous is a PAMM account. Percent Allocation Management Module, Pamm - percentage distribution control module is just a mechanism for simplifying money transfer to management. By itself, he does not guarantee high profits. Everything, as elsewhere depends on the manager. We do not recommend blessing to emotions and get all the money into one rapidly growing account. Perhaps the manager plays a strategy that will change the rapid drop. Or he is just lucky while driving, but luck is not forever. If you want to take a chance, invested in PAMM, choose stable, do not invest in a whole one-only account.

Binary options

Such a tool is a rather a gamble game, and not a serious way to increase capital. Many organizers do not have licenses for financial activities, but have ... to gaming. And the firms are recorded on distant offshore islands. Problems are possible with the derivation of earned funds.

But try to risk in small means - this is a personal choice of everyone, suddenly lucky. But as the main tool for the promotion of capital is categorically not recommended.

The key to success: diversification

Golden Standard: Do not fold all the eggs in one basket. Make basic investments, 50-60 percent, in the system with high reliability, and percentage 10 - in anything risky. The rest is in the tools with medium risks. Manage investments, and success will not make himself wait.

Not so long ago, we wrote that it is necessary to begin to put our finances in order with compilation and only after that it is to be determined how and where to invest. The author of this material Catherine Baeyeva today tells how to start investing from scratch and avoid common miscarriage errors. Catherine is a certified tutor in financial literacy under the program of the Ministry of Finance, and its expert level is confirmed by positive reviews of satisfied customers who, after its consultations, work successfully with investments.

Common Investment Myths

Myth number 1: Currency and Real Estate - Best Investment Objects

When people find out that I am a financial adviser, the first questions you ask: "What will happen to the dollar? Is it time to buy? " The following question is the following: "Will the property prices for real estate grow?"

The information field around us forms a somewhat distorted look at where the money can be investing that the purchase of dollars or apartments seems to be quite understandable "running", but the purchase of shares or bonds is something insecable risky, accessible units.

In fact, everything is completely wrong. If you buy dollars, then only buy more solid than the Russian ruble, currency, which is nevertheless also subject to inflation, i.e., $ 100 today you can buy more products than $ 100 tomorrow (especially if it is Tomorrow in 20 years). Buying an apartment, you most often get a low-equity asset (an asset that cannot be quickly sold at a market price), with a high input threshold (the cost of the apartment is always a significant amount). Complete to the apartment you always get a headache from the ownership of the apartment: repair, timely payment of utilities, search for tenants and a lot more.

Myth 2: It is necessary to start investing from large sums

The second most popular myth on how to start investing, that it is only for the rich: "That's when I have $ 1 million, then I will start." Yes, the apartment is 10 thousand rubles or 1 thousand rubles you, of course, do not buy, but you can start investing with thousands of rubles. Open brokerage account and buy shares on the Moscow Stock Exchange can be from any amount.

It is also quite real to deal with anyone (there would be a desire), and it's right to start with small amounts, gaining experience. The main thing is to immediately choose the right source of information. This is not easy.

Myth 3: big yield

Investing is perceived as some sacrament, available only to the chosen. And these favorites earn 1000% percent per year. People come to me who want to invest 1 million rubles and get 40% from them without risk per year. It is impossible: choose either a big risk or low yield without risk. But the opposite is also not always true: there may be a low expected profitability and high risk. Just for an inexperienced investor, this high risk does not lie on the surface.

Here is a benchmark for profitability in the American market, which is more stable than Russian. The numbers are very approximate, you only need to understand their order. So, for a conservative investor, the yield of 4% per year will be normal, an investor with a moderate attitude to risk, 10% for an aggressive investor can expect 6-8% per year. So, if someone somewhere offers you 10% guaranteed income in dollars without risk, then this risk you can simply not see and not understand.

Myth 4: A small investment period is possible

People confuse speculation and investment, requests like "I want to invest for a long time - for three months, for half a year" cause a smile.

Investing is for a long time, three or five years, no less. It is on this time that the competent approach can expect positive results from this activity. All that is less than this term, with a rare exception, is a game in a casino, where you put on black or red. The most extreme option when you go to play casino (oh, invest) on credit.

For example, if you buy dollars in the summer in the hope that the dollar will grow up in the fall. But playing a casino on credit is absurd, but to put on the fact that the dollar will grow, no. And this is things  one order to say analysts there.

one order to say analysts there.

If you do not yet have the opportunity to invest for a long time, there is no reserve fund in the amount of 3-6-month expenses lying on the deposit in a reliable bank, then do not start investing. Start forming this fund. And if you still have loans, first extinguish them. And then you can begin to learn the investment process.

Myth 5: very terrible risk

People do not want to risk when they reflect where you can invest. They want income to be guaranteed. This is played by many fraudsters who offer "as if guaranteed income", only these guarantees do not cost anything and will not work. If the yield is really guaranteed (conditionally risk), it will always be lower than the expected yield at moderate risk in investing.

What is the risk? This is the ability to maximize the yield of an asset, for example, shares or bonds.

We buy a share for 100 rubles, in the future it can cost 90 rubles, and 110 rubles, and 1000 rubles. And if we open a deposit (provided that the bank is alive, we will get a deposit plus the accumulated percentage. At long intervals (5+ years), the expected portfolio yield with a moderate and aggressive degree of risk is always higher than the expected profitability of the conservative portfolio. A conservative way is when we leave money on the deposit.

At long intervals for conservative tools, the risk of loss of profitability due to inflation increases. Because of this, a conservative fixed-yield tool becomes more risky than an aggressive tool with a non-fixed, but higher expected profitability. Thus, without investing funds in more aggressive tools, we are much more risking not to get a higher yield than investing. Ultimately, after all, the goal is to earn more, that is, the most effectively use your capital. But all this is possible with the right approach and competent selection of investment tools.

Myth 6: Yes Magic Tablet

We are accustomed to believe in the "magical" pills, that someone invented a way that is guaranteed, very quickly and effortlessly get rich. So does not happen.

On this demand there are two types of suggestions: When you are promised to teach this miracle for some huge money (the training earns on learning) and when you give you advice for free where to invest (in this version, the adviser receives a commission for selling you a particular investment Product, and of course assures you that this product is the best that only is). Unfortunately, in our culture it is not customary to pay for the advice really competent and useful. I am surprised by people who have several million, but at the same time they expect that someone will give them a competent advice for free and are surprised that the competent advice is worth it is worth the money. But it is worth keeping in mind that a paid advice is not always a qualified advice. The only way out is to understand a little in this important issue.

On this demand there are two types of suggestions: When you are promised to teach this miracle for some huge money (the training earns on learning) and when you give you advice for free where to invest (in this version, the adviser receives a commission for selling you a particular investment Product, and of course assures you that this product is the best that only is). Unfortunately, in our culture it is not customary to pay for the advice really competent and useful. I am surprised by people who have several million, but at the same time they expect that someone will give them a competent advice for free and are surprised that the competent advice is worth it is worth the money. But it is worth keeping in mind that a paid advice is not always a qualified advice. The only way out is to understand a little in this important issue.

You will learn who are investors and what they earn what to do to become a successful investor and what start-up capital needed for this. And we will tell about the main mistakes of novice investors and how to act to prevent them.

Rates on deposits in Russia are falling, and even the deposit is already considered profitable under 6%. Such conditions do not suit? Then this article is for you.

Elena Zaitseva, financial consultant and practicing investor. I will talk about the profitable and affordable options for placement of funds and the ladies detailed instructions, how to start successfully investing from scratch.

Read to the end - the bonus will be a review of the main mistakes of beginners, because of which the profit is lost.

1. Who are investors

In the image of the investor, is a businessman with a million capital? This stereotype. Even if you invested only 1,000 rubles in Gazprom shares, you are already an investor.

Investor is a person who places cash in various assets. His goal is to increase the embedded amount.

Investments include any financial investment, even opening a bank deposit. But only deposits will not bring big income, there must be different tools in the portfolio.

Invest funds can be in:

- securities;

- the property;

- precious metals;

- antiques;

- cryptocurrency;

- companies offering microloans;

- startups (venture investments);

- currency, etc.

Some investors place money and unusual objects. For example, one of my customers is investing in collectible wines, the other in cars.

The error is that for investment it is necessary to make a specialized education or in-depth market knowledge. These factors give an advantage, but it is possible to start to invest in simple tools without them.

Investor can be each. But for profit, not only money is needed, but also a well-thought-out strategy.

2. Most Popular Investment Tools

Directions for attachment of funds set. They differ in profitability, risk level, payback period, reliability, etc.

Among professional tools are popular:

- Bank deposits - Classic contributions are almost risk, but their profitability is hardly overlapsing inflation.

- Bonds - Securities with maximum reliability, returns from investments at 8-12%.

- Shares - Give the investor the right to receive part of the company's profits belong to investments with an average and high level of risk.

- PIFES. - Already grouped on various signs of the assets portfolio, the profitability of the acquired share is proportional to the profit of the entire Fund.

- The property - purchased for subsequent resale or rental.

- Precious metals - Invest in bars, coins or impersonal accounts.

Below in the table comparing the reliability and profitability of these tools:

| № | Tool | Risk level | Level of profitability |

| 1 | Bank deposits | low | low |

| 2 | Bonds | low | average |

| 3 | Shares | high / middle | high |

| 4 | PIFES. | high / middle | high / middle |

| 5 | The property | middle | middle |

| 6 | Precious metals | middle | middle |

Usually in the investor's portfolio from 3 tools. Such an approach minimizes risks and increases the effectiveness of investments.

Read more about choosing tools for investment See this video:

3. How to become an investor - where to start

Investment activity is associated with increased risks. In order for the likelihood of losing money to be minimal, prepare for their placement in advance.

Regardless of the selected investment direction, you will have 5 basic steps. Step-by-step instructions below.

Step 1. We study the basic concepts and laws of the economy

The market is cyclic. No tool grows and does not fall constantly. The higher the potential yield, the greater the risk you accept. These and other market laws are the base you need to know.

Ways to get the necessary information enough:

- special literature - for example, the books of Robert Kiyosaki, Alice Schröder and Bodo Shepher from year to year are included in the top of the best;

- trainings and webinars - there are many proposals for beginners, including free;

- consultation of practicing financiers - specialists are ready to share their knowledge and experience for remuneration.

It is important to think about the information received and not take everything on faith. Some of it is unreliable and does not benefit, and harm.

Step 2. Preparing psychologically

The market is difficult to predict. For example, you were counting on profits, and the price of the asset fell greatly. In such a situation, it is important to keep control of yourself and make a right decision.

Be prepared for difficulties. Think out the action scenario in unforeseen circumstances. So when you are not confused when they are not confrmed and do it right.

Step 3. Collect the starting capital

If there are no free tools for investment, then concentrate on the formation of capital.

Regularity and financial discipline are essential of success in accumulation of funds.

Place a plan for postponing money on start-up capital and do not depart from it under any circumstances.

Increase income. So you reach the goal faster. For example, arrange to part-up or sell unnecessary things.

Take the time and optimization of expenses. Carefully analyze spending. Be sure to have articles that can be reduced or excluded without prejudice to the quality of life.

Step 4. Learning the Investor Dictionary

When reading books, analysis of documentation or viewing video tutorials you will come across new terms and concepts. If there are too many too, you just do not understand the broadcast.

Of course, the recording can be stopped and see the meaning of the word. But if this is offline training or live ether? Better, if the basic terms you will learn in advance. This will facilitate the perception of information.

Step 5. Choose a style that is interesting

Decide for the purpose of the permissible level of risk. Want to earn, but are not ready to lose money? Choose a conservative strategy. Potential profits are more important than possible risk? You will fit an aggressive style.

Think about the timing. For example, if you want to get after a year or two, choose bonds and promotions. If they are aimed at the long term - consider real estate.

4. What start-up capital need

It is not necessary to start with millions of investments. In fact, the numbers are more modest. For example, it is enough to have 5,000 rubles to buy intrinsics, and 1,000 will be enough for the acquisition of shares.

For investment, you do not need big starting capital. But the more nested amount, the higher the potential return.

Start with 50-100 thousand rubles. This amount is enough to understand the basic rules of the market in practice, and in case of success, the yield will be tangible. But do not insert the entire capital at the start. When the experience is not enough, the risk of losing the maximum investment.

Start with small amounts by placing them in different tools. So you will find optimal options for investments. And then, when confidence appears, increase the volume of investments.

5. 5 of the Rules of Successful Investor

"Magic pill", swallowing which anyone will become a successful investor does not exist. Even experienced traders are mistaken and lose consuming amounts.

But some effective techniques I will name. Read the selection of 5 proven ways to succeed in investing.

Rule 1. Diversify risks

In other words, do not fold all the eggs in one basket. Suppose in the portfolio there will be 3-4 or even more assets. So you minimize the risks.

If only one tool in the portfolio, then its fall will lead to a loss. When the assets are several, the negative yield according to one of them is not as critical.

Diversify correctly. For example, if you invest money in stock and bonds of Sberbank, then with the Issuer's ineffective activity you will not satisfy the yield of both tools.

Choose unsecurs with each other. Alternatively, one part of the funds will place in bonds, and open an impersonal metallic account to another.

Rule 2. Place a clear goal

Do not invest in earnings some kind of virtual amount of money. Let your goal be digitized and tied to a specific period. But think well - is it possible to achieve a task?

Already there is an understanding, why are you striving for? Then suck the steps to achieve the goal.

Example:

You want to earn 300 thousand rubles per year. This is at least 25 thousand rubles per month. With start capital of 1 million rubles, yield must be at the level of 30%. Sunday which tools are able to lead to such a result.

Regularly check the actual results with the planned. With discrepancies, you must make adjustments. So you will always see the actual situation.

Rule 3. Look for like-minded people

It is familiar to thinking that investment is individual activity. But communication with like-minded people will not hurt experience.

Not necessarily to meet with "colleagues" live. Use the Internet features. Thematic groups and forums are a storehouse of useful and valuable information.

But not just take the knowledge, but also give up - share your ideas. Try to use financial terminology, it will emphasize your professionalism and possession.

Rule 4. Do not stop after the loss

Transactions that make a loss instead of expected returns are inevitable. But it is their analysis that gives experience for further success.

Do not stop investing after the loss of funds. Just make the right conclusions and move on.

Rule 5. Constantly stay

It is believed that the best investment is to invest money. Constantly raging knowledge of knowledge, you expand your capabilities.

Come to your learning with the mind, and you will be more expected to be spent.

But carefully analyze the information received. Not all webinars and trainings, especially free, are made accredited and qualified investors. Often they bring harm instead of the desired benefit.

6. Main errors of beginner investors and how to avoid them

In conclusion, I will talk about 4 major bugs of beginners in investing and ladies tips, how to prevent them.

Read carefully - this selection is valuable because it is compiled based on real experience.

Lack of starting capital

50-100 thousand rubles for obtaining experience. But it will be difficult to earn 1 million from them.

When you find suitable tools, you will need greater capital. Let by this point he will already be assembled. Otherwise, it will have to spend time on its formation, and the situation on the market will change during this time - probably the selected tools will lose their investment attractiveness.

Pursuit of fast money

Any tool promises fast and high earnings? Remember that big income is associated with an increased risk.

Do not strive to earn quickly. It is better to form a strategy that will provide you regular income for a long time.

Lack of knowledge about the selected tool

Do not invest money if the principle of the instrument is unclear to you. Otherwise, in a critical situation, you will not be able to quickly make the right decision. Almost always such investments bring a loss.

Do not hurry. Get as many information about the new investment method. Insert the money only when you fully understand the tool.

Use of backup or borrowed tools for investment

For investment, send only your free funds.

If you invest the target money or means from the "airbag", then with an unsuccessful attachment you will easily lose financial stability and / or do not reach the target target.

Investing on credit is even worse - with the loss you will not only have yourself without money, but also get into debtors.

7. Remember

- The greater the expected yield, the higher the risk of investments.

- Place money in different tools that are not related to each other.

- Do not invest backups, target and credit money.

- Invest only in the instruments, the principle of which you understand.

I wish you a successful start!