Gzhf under the president of the rt personal page contacts. How GZHF arranged fools' day for socialists. The main features of the mortgage

The Government of the Republic of Tatarstan (RT) has developed a special program to provide citizens of this subject of the Russian Federation with housing. It is called "Social mortgage under the President of the Republic of Tatarstan personal page." Its features will be discussed below.

This constituent entity of the Russian Federation also participates in the state program of the Russian Federation for social lending. The Government of the Republic of Tatarstan has developed and adopted its own project, which is significantly different from the all-Russian program.

Financial resources for the implementation of this project come from the federal budget, and are also allocated from the republic's own funds.

Financial resources for the implementation of this project come from the federal budget, and are also allocated from the republic's own funds.

Its implementation is monitored personally by the President and his staff.

Social mortgage under the President of Tatarstan has the following differences from similar programs in other regions:

- the annual mortgage interest is set at 7%;

- applicants must live and work in Tatarstan for a certain period of time;

- square meters are provided only in the state housing stock (primary real estate market).

The social mortgage of Tatarstan provides for two options for participation, as well as the condition for providing a loan from the regional budget.

Affordable housing can be obtained by young and socially unprotected families who, in accordance with the established procedure, are recognized as such that they need to improve their living conditions and do not have their own real estate. The distribution of housing in this case is based on the queue.

Employees of various budgetary institutions and law enforcement agencies who have worked in the republic for a certain time and do not have their own residential square meters can count on receiving an apartment. The distribution of housing in this situation takes place on the basis of a competition.

Employees of various budgetary institutions and law enforcement agencies who have worked in the republic for a certain time and do not have their own residential square meters can count on receiving an apartment. The distribution of housing in this situation takes place on the basis of a competition.

Social mortgage under the President of the Republic of Tatarstan has some differences from other projects, since citizens are offered a special payment mechanism.

First of all, it is necessary to pay attention to the fact that all issues of the cost and repayment of credit obligations are in charge of a specially created legal entity, NGO "GZF under the President of the Republic of Tatarstan".

According to the explanations given by the officials of this organization, the initial payment and subsequent payments are made depending on the price per square meter, as well as the period for which the mortgage was issued.

According to the explanations given by the officials of this organization, the initial payment and subsequent payments are made depending on the price per square meter, as well as the period for which the mortgage was issued.

The cost of residential square meters on the territory of the republic may vary depending on the locality where a low-income family lives or where state employees work. Moreover, the approach to each client of this program is individual.

The initial payment for housing can be paid using a state subsidy (for families with one child - 30% of the cost of an apartment, for those raising two or more children - 35-40%) or maternity capital (the so-called assistance with the birth of children).

NO "GZF under the President of the Republic of Tatarstan" provides grace periods for payment of interest (no more than 6 months). They can be used throughout the entire loan term.

It should be remembered that a mortgage loan in the Republic of Tajikistan is provided for a period not exceeding 28.5 years.

The social mortgage developed by the GZF provides for the use of social assistance at the birth of children to pay the initial payment for an apartment, interest, as well as other mandatory payments.

The social mortgage developed by the GZF provides for the use of social assistance at the birth of children to pay the initial payment for an apartment, interest, as well as other mandatory payments.

In 2018, in the republic at the birth of children in young families, payments will be made, provided for by the all-Russian program to support young mothers and fathers (maternity capital), as well as by a regional project.

The regional program includes the following presidential and municipal payments:

- 30% monetary compensation for housing and communal services (applies to large families, as well as low-income families);

- a one-time material payment at the birth of a baby (regardless of the number of children) in the amount of 20 thousand rubles;

- material compensation for medicines for children under 6 years old (provided for large families).

All these payments can be used to pay off a soft loan.

All these payments can be used to pay off a soft loan.

Large families mean families that have more than two children, including adopted children, and have formalized their status with the social security authorities.

Low-income citizens are citizens who live together, whose total aggregate income is equal to the subsistence minimum or exceeds it by 30-50% (depending on the number of family members).

The preferential terms of social mortgage in Tatarstan provide for a mandatory requirement for employees of various budgetary organizations, low-income, young families, which is that a person must work in the republic for 10 years (this was mentioned above).

But the majority of citizens who decide to use the program are interested in the question of how this period is calculated.

But the majority of citizens who decide to use the program are interested in the question of how this period is calculated.

The calculation mechanism is as follows. A person provides his work book or other document confirming his experience in enterprises, in budgetary organizations of Tatarstan. If the applicant left the republic for a while, then returned, the length of service will be considered only based on his work in the republic.

For example, the total experience of a citizen is 20 years, of which 10 years in enterprises, in budgetary organizations of Tatarstan. It falls under the social mortgage program.

You need to know that if a person working at an enterprise located in the Republic of Tatarstan was sent on a long-term business trip to another region, he is credited with experience in the Republic of Tatarstan.

According to the Resolution of the Government of the Republic of Tajikistan, the following citizens receive the right to social mortgage lending:

According to the Resolution of the Government of the Republic of Tajikistan, the following citizens receive the right to social mortgage lending:

- young families where parents are under 35 years old, they have been living and working on the territory of the republic for more than 10 years;

- low-income families, whose income does not exceed 30-50% of the required subsistence minimum for each member;

- parents with many children, as well as those who have dependent children with disabilities; guardians and adoptees;

- employees of various budgetary organizations who have worked in the republic for more than 10 years.

They all need to improve their living conditions.

To implement the project, a state housing fund was created under the President.

It is formed with the help of construction companies that are engaged in the construction of housing in various localities of the region. For this, construction companies are required to create part of economy-class residential premises in each apartment building and transfer them to the state housing fund.

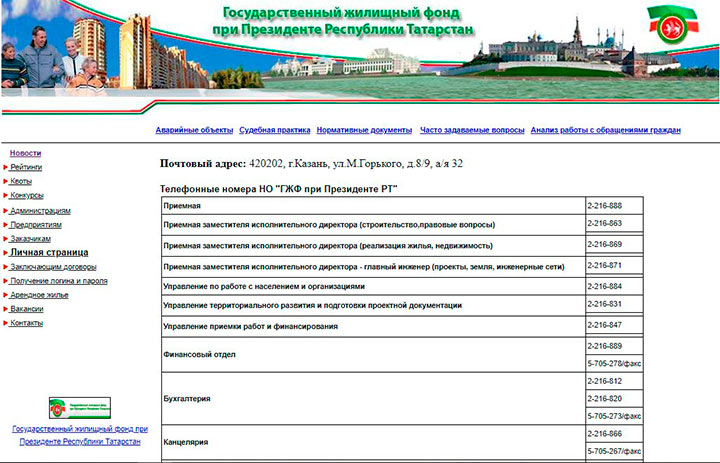

The state housing fund for social mortgages under the President of the Republic of Tatarstan is managed by a special institution, NGO "GZhF under the President of the Republic of Tatarstan."

The state housing fund for social mortgages under the President of the Republic of Tatarstan is managed by a special institution, NGO "GZhF under the President of the Republic of Tatarstan."

As you know, the cost of any housing in our country is significant, and often its purchase is not available to the general population.

Based on these economic realities, as well as for the implementation of the mortgage program in Tatarstan, a non-governmental organization "GZhF under the President of the Republic of Tatarstan" was created.

The purpose of its existence is the registration of all citizens in need of housing on the territory of the republic, verification of the submitted documents, queuing and issuance of residential real estate.

The objectives of the BUT are as follows:

- accumulation of federal, regional budgetary funds allocated for social housing programs;

- accumulation of funds that are paid by citizens in need of housing, repaying mortgage loans;

- redemption of residential premises from construction organizations and their transfer to citizens.

To implement this program, each registered participant has his own personal page on the President's website.

The principle of operation of the NGO "GZhF under the President of the Republic of Tatarstan" is that this organization accumulates not only budget funds, but also contributions that are paid by those in need of better housing conditions and public sector employees.

The principle of operation of the NGO "GZhF under the President of the Republic of Tatarstan" is that this organization accumulates not only budget funds, but also contributions that are paid by those in need of better housing conditions and public sector employees.

There are representative offices of this organization in every locality. After the appearance of a dwelling, its value is determined and, in the order of priority, it is given to the family as a mortgage. Moreover, the price per square meter should not exceed 40-50 thousand rubles. It is transferred to public sector employees on the basis of a special competition.

The social mortgage under the President of the Republic of Tatarstan, as well as the personal page of the citizens of Tatarstan, were created in order to notify the program participants about the movement of the queue, all payments that they made, as well as the amount of accumulated funds, including those received as a state subsidy.

Each participant receives a personal code to enter the office, login and can track all events related to his presence in the program.

When the accommodation is received, when entering their page, a person can specify what payment to make this month, the balance for repayment, and other financial information. This innovation saves time, helps a young family to receive the necessary information without leaving home. But only those citizens who are allowed to participate in the program can create an office.

In the context of modern economic realities, the Government of the Russian Federation is developing new mechanisms to support vulnerable and needy segments of the population. The governments of the republics, territories and regions do not stand aside and, in turn, create programs of benefits and subsidies at the local level. Most of the programs are designed to enable different segments of the population to improve their living conditions. An example of such a successful program is the social mortgage under the President of the Republic of Tatarstan.

Social mortgage in Tatarstan replaced the program of resettlement of owners of residential premises recognized as emergency or dilapidated, which ended in 2004. The social mortgage program allows borrowers to purchase housing on more favorable terms than the national average, which became possible thanks to the participation of the State Housing Fund under the President of the Republic of Tajikistan (GHF).

Social mortgage in the Republic of Tatarstan allows the borrower:

- Reduce the amount of the down payment to 10% of the cost of the dwelling. At the same time, the initial payment has a maximum amount limit - no more than 30%. In addition, when considering each individual borrower, the GZF may decide on the possibility of not providing an initial payment (for example, if the borrower is a single mother and meets all the necessary criteria). We are already talking about the possibility of taking out a mortgage without a down payment in 2019.

- With an average mortgage interest rate of 7.4%, social mortgage allows you to become the owner of a residential property, having received a mortgage at 7% per annum.

- The maximum term of a social mortgage cannot exceed 28 years and 6 months. The loan agreement allows the borrower to fully repay the loan ahead of schedule, without penalties and fines.

- If during the period of validity of the mortgage agreement the first-born appears in the family, the borrowers will receive 200 thousand rubles for the partial repayment of the debt obligation. Upon the birth of a second child and receipt of maternity capital, which has been extended until the end of 2021, the borrower can use the maternity capital to repay the mortgage.

- This type of mortgage loan under the President of the Republic of Tatarstan is unique in that the borrower can pay not only in cash, but also with labor or products of the subsidiary farm. In the event of a difficult life situation, the borrower may not be afraid of losing his home - each specific case is considered by the GZHF and a convenient solution for the borrower and lender is developed (deferred payment);

- If the borrower pays part of the amount, he is obliged to pay the rent for the remaining part of the dwelling (deferred payment of the mortgage loan does not relieve the borrower of the obligation to pay the rent).

When receiving the opportunity to purchase an apartment under the program, the borrower must comply with some restrictions:

- For 10 years, the borrower has no right to change the place of work of his own free will (dismissal by the decision of the employer or redundancy are not taken into account). If the condition is violated, the balance of the mortgage loan is recalculated with the loss of all benefits and an increase in the interest rate relative to the original by 2 times.

- If the borrower took advantage of the preferential mortgage as an employee of the public sector, he loses the right to use any other program to support public sector employees (for example, Resolution of the Government of the Russian Federation of January 27, 2009 No. 63).

In this connection, before applying for a social mortgage, it is necessary to calculate all types of possible benefits and subsidies and choose the most profitable one for the borrower.

Who can get a social mortgage

The following groups of citizens can count on receiving a social loan under the President of the Republic of Tatarstan:

- Public sector employees (doctors, teachers, law enforcement officers, etc.);

- Citizens living in residential premises recognized as emergency, as well as citizens with living space that is less than the norm (less than 18 square meters per person). To obtain the “needy” status, a citizen must contact the Social Service at the place of residence;

- Employees of commercial enterprises that are investors in the construction of residential complexes participating in the program. This category of citizens has no restrictions on the total area of housing, while the rest cannot apply for apartments with an area exceeding the standards:

- 1 person - 33 sq.m .;

- Family of 2 people - 44 sq.m .;

- Family of 3 or more - at the rate of 18 sq.m. for each subsequent family member.

Where to give apartments in Tatarstan

The conditions for a social mortgage are made up of many factors, the main of which is the purchase of residential premises in certain residential complexes. Apartments on preferential terms are provided in houses under construction of those developers who are participants in the program. The list of residential complexes is available on the GZF website and on the websites of developers, as well as on the websites of banks participating in the program.

Comprehensive development is a mandatory criterion for the construction of residential square meters, so the borrower gets the opportunity to purchase new housing in an area with developed infrastructure.

Since the list of residential complexes is limited, it is possible to purchase an apartment with the help of social mortgage funds only in large cities.

Kazan

The list of possible borrowers for obtaining a social mortgage in Kazan corresponds to the general list. If a citizen fully meets the requirements of the program, he needs to collect a complete package of documents:

- Borrower's and family members' passports;

- Confirmation of the “needy” status;

- Proof of child benefits and birth certificates;

- A copy of the marriage certificate;

- Copy of education diploma;

- Application form.

After submitting all documents to the GZF and a positive decision by the City Housing Commission in relation to the borrower, the citizen has to wait for the appearance of a suitable apartment. The most demanded today is the Salavat Kupere microdistrict, designed to solve the housing problem of 14 thousand families.

In addition to social mortgage, branches of large banks on the territory of Tatarstan offer to use a number of programs to improve living conditions.

Naberezhnye Chelny

In Naberezhnye Chelny, the same groups of citizens are included in the list of possible borrowers under the social mortgage program. The main condition for obtaining the opportunity to participate in the program is documentary confirmation of the family's status as needy. The total cost per square meter of housing includes child benefits.

Residential complexes located on the outskirts of the city are more popular, since the cost per square meter is lower here than in the central districts of the city, and the ecological situation is much more comfortable. The most popular are the "Yalshek - 2" district, the construction of which is underway, and "Complex 63".

Residents of Naberezhnye Chelny also have the opportunity to take advantage of the "Building the Future" program, which allows them to purchase their own housing on favorable terms.

Partner banks

The number of banks participating in the program is limited, since not many are present in certain localities.

The program involves not only banking organizations of the Republic of Tatarstan, but also partner banks operating throughout the Russian Federation:

- Sberbank;

- AK Bars;

- Rosbank;

- Kara-Altyn.

For the current period, the social mortgage agreement in Tatarstan is concluded by the borrower directly with the representative office of the State Housing Fund under the President of the Republic of Tatarstan. In the partner bank of the program, the borrower opens an account to which he undertakes to transfer the minimum amount every month during the billing period, which is formed from at least 11% of the cost of 1 sq. meters of housing area. GZF has the right to terminate the agreement unilaterally if the borrower fails to fulfill its payment obligations.

In addition to social mortgages, banks of the Republic offer borrowers to improve their living conditions by taking part in the "Young Family" program. The main criterion for the borrower is the age of the spouses (at least one of them must not be older than 35). This program allows you to purchase housing at a lower interest rate (on average from 7.4%) both in new buildings and in the secondary housing market.

The creation of the non-profit organization "State Housing Fund under the President of the Republic of Tatarstan" is determined by the Decree of the President of the Republic of March 30, 1995 No. 213. The main idea of creating the organization is to search for and attract extra-budgetary funds for the development of housing construction in the Republic and the creation of an opportunity to purchase their own housing for citizens of the Republic of Tatarstan.

The initial task of the GZF was the implementation of a program for the resettlement of citizens of the Republic from housing that did not meet the required standards (dilapidated, emergency). In addition to the construction of residential premises, the Foundation was engaged in the construction of socially significant facilities (clinics, schools, kindergartens and other facilities). Upon completion of the program in 2004, the Foundation switched to the implementation of the program formulated in the Law of the Republic of Tatarstan dated December 27, 2004, No. 69-ZRT.

The housing stock under the President of the Republic of Tatarstan creates conditions under which housing becomes more affordable for potential owners, and the construction of residential areas is beneficial for commercial developers. The balance is achieved by providing the developer with commercially successful land plots in exchange for the developer allocating 50% of the housing stock for social mortgages. The developer has the right to sell the remaining 50% at the market price, thereby receiving a financial profit.

Personal page

Upon approval of obtaining a social mortgage under the President of the Republic of Tatarstan, the borrower can wait for proposals for suitable apartments from the Housing Fund, or can create a personal page on the GZF website. It will display the borrower's rating, which depends on the amount of the accumulated amount for the proposed housing. An important criterion is the degree of need of a particular family.

When ready-made options for apartments appear, the possibility of obtaining housing is higher for those program participants whose rating is higher. Practice has shown that getting an apartment based on a rating is faster.

The long-term beneficiary of the social loan program left amid high-profile scandals.

Stories with the termination of the contract with the socialist and the increase in the cost of housing in Innopolis were the last things that will be remembered by the GZF of the era Talgata Abdullina... Honored Economist of the Republic of Tatarstan came to the State Housing Fund under the President of the Republic of Tatarstan in 1997. GZF was created two years earlier - in 1995, in Tatarstan, they began to implement a program to resettle residents from dilapidated housing. At that time, out of 5.5 thousand houses, 1.5 thousand were over 100 years old. Then the idea appeared to create the State Housing Fund, to which the commodity producers of the republic would contribute 1% of their proceeds.

Since 2005, the Fund has launched a social mortgage program. Note that up to this point the organization was called the State Off-budget Housing Fund under the President of the Republic of Tatarstan, but was transformed into a non-profit organization State Housing Fund under the President of the Republic of Tatarstan (GZHF), which has no membership and does not aim to make a profit.

Work within the framework of the social league program caused a lot of criticism from the residents of the republic, and then from the authorities. The GZF canceled the preliminary protocols for the selection of apartments, a square meter of housing was becoming more expensive. There were complaints about the delay in the construction of facilities being built by the Foundation.

For example, in the spring of 2015, the quality of houses built by the State Housing Fund of the Republic of Tatarstan became the object of criticism from the Kazan authorities. Then, at one of the apparatus meetings, the chairman of the city committee of housing and communal services spoke Iskander Giniyatullin... He said that the residential building at 44 Chelyuskin, built in 2004, had “overgrown” with cracks on the facade for 10 years. There were also other construction defects.

A year later, in 2016, the Foundation unilaterally revised its terms of the competition, according to which housing was distributed among those on the waiting list. GZF again put up for auction the previously drawn square meters of housing. The community members, who dreamed of an imminent move to new buildings, took to the streets, mass and single spontaneous rallies began. Only after the intervention of the President of Tatarstan Rustam Minnikhanov The scandal over the revision of the "rules of the game" was leveled, and Talgat Abdullin made a statement to reporters that there would be no more changes in the distribution system of apartments.

Abdullin scolded not only with social workers, but also with contractors. GZhF did not have a relationship with Kamgesenergostroy and PSO Kazan. The Goszhilfond criticized these companies for their slowness, poor performance and excluded them from the construction of facilities.

The collapse further weakened Abdullin's position. GZhF turned into a defendant to the bankruptcy trustee of TFB - the Deposit Insurance Agency. The climax was the DIA's demand to return a block of shares of the State Housing Fund to Ak Bars Bank in the amount of 9.8 billion rubles. GZF acted as a pledger under loan agreements of Tatfondbank with several companies associated with the former chairman of the board of the TFB Robert Musin... The shares of Ak Bars Bank acted as collateral. By the way, Talgat Abdullin was closely associated with ABB - for four years he was the chairman of the board of a financial organization.

As a result: 20.4% of Ak Bars Bank shares owned by GZF were arrested as part of a criminal case on fraud in Tatfondbank. At the same time, the arrest was subsequently lifted by the Supreme Court of the Republic of Tatarstan. However, scandals seemed to haunt Abdullin's organization. GZhF filed a lawsuit against the company in the Arbitration Court of the Republic of Tatarstan in the amount of 7.2 billion rubles. Curiously, the Fund owns a block of shares in the developer, and now they say that Talgat Abdullin will take the post of head of ABD, pushing Marata Shagitova.

Yesterday (October 11 - Ed.) President of Tatarstan Rustam Minnikhanov instructed to investigate the situation with the termination of the social mortgage agreement by the State Housing Fund. It's about a mother with many children Elvira Sadkina... The state housing fund under the President of the Republic of Tatarstan unilaterally terminated the social mortgage agreement with the woman for the construction of a three-room apartment in the Salavat Kupere residential complex. The mother of many children believes that in this way the GZF “punishes” her for her “active civic position.

The last nail in Abdullin's ambitions was hammered by the State Housing Fund. Moreover, before that, the GZHF regularly received claims regarding shortcomings in the construction of housing in the city. It is interesting that in the Fund itself, the information about the increase has not been denied. This was done by representatives of the Ministry of Communications of Tatarstan in response to a request from the KazanFirst editorial office. The reports of the increase in the rental price were called a mistake.

Meanwhile, Rustam Minnikhanov appointed the new head of the State Housing Fund Marat Zaripova, who previously served as head of the RT State Committee on Tariffs. It is curious that the transfer of Zaripov to another position is taking place against a not very positive informational background.

The State Committee on Tariffs of the Republic of Tajikistan has always been a separate “state within a state” within the system of state authorities of the republic, with its own rules of operation and the absence of any control over their activities. This was due to the specifics of federal legislation in the field of tariff regulation. As an example, we can recall the history of 2012, when the fact was revealed that the State Committee, by its decision, laid in the tariffs for heat "Tatenergo", then still headed, overstated costs for the purchase of gas. It was about the withdrawal of billions of rubles from "Tatenergo" collected from consumers of the republic through tariffs for heat.

At the time when Marat Zaripov was at the head of the State Tariffs Committee, the launch in Russia of a system of public control over the activities of natural monopoly entities. Tatarstan President Rustam Minnikhanov supported the federal initiative, so the republic actually became a platform for testing the entire structure of this system.

As a result, both the State Tariffs Committee and the decisions made by it fell under independent control. As the interlocutors of KazanFirst in the government of the republic, who wished to remain anonymous, note, as a result, alternative opinions appeared on many decisions of the State Committee and serious omissions of the department began to be revealed. On the other hand, in the past few years, the State Committee and personally Marat Zaripov himself have become open to the media, unlike their predecessors.

The Government of the Republic of Tatarstan (RT) has developed a special program to provide citizens of this subject of the Russian Federation with housing. It is called "a personal page under the President of the Republic of Tatarstan." Its features will be discussed below.

Social mortgage in the Republic of Tatarstan

This constituent entity of the Russian Federation also participates in the state program of the Russian Federation for social security (,). The Government of the Republic of Tatarstan has developed and adopted its own project, which is significantly different from the all-Russian program.

![]() Financial resources for the implementation of this project come from the federal budget, and are also allocated from the republic's own funds.

Financial resources for the implementation of this project come from the federal budget, and are also allocated from the republic's own funds.

Its implementation is monitored personally by the President and his staff.

Social mortgage under the President of Tatarstan has the following differences from similar programs in other regions:

- the annual mortgage interest is set at 7%;

- applicants must live and work in Tatarstan for a certain period of time;

- square meters are provided only in the state housing stock (primary real estate market).

Conditions for participation in the program

The social mortgage of Tatarstan provides for two options for participation, as well as the condition for providing a loan from the regional budget.

Affordable housing can be obtained by young and socially unprotected families who, in accordance with the established procedure, are recognized as such that they need to improve their living conditions and do not have their own real estate. The distribution of housing in this case is based on the queue.

![]() Employees of various budgetary institutions and law enforcement agencies who have worked in the republic for a certain time and do not have their own residential square meters can count on receiving an apartment. The distribution of housing in this situation takes place on the basis of a competition.

Employees of various budgetary institutions and law enforcement agencies who have worked in the republic for a certain time and do not have their own residential square meters can count on receiving an apartment. The distribution of housing in this situation takes place on the basis of a competition.

Features of mortgage payments

Social mortgage under the President of the Republic of Tatarstan has some differences from other projects, since citizens are offered a special payment mechanism.

First of all, it is necessary to pay attention to the fact that all issues of the cost and repayment of credit obligations are in charge of a specially created legal entity, NGO "GZF under the President of the Republic of Tatarstan".

![]() According to the explanations given by the officials of this organization, the initial payment and subsequent payments are made depending on the price per square meter, as well as the period for which the mortgage was issued.

According to the explanations given by the officials of this organization, the initial payment and subsequent payments are made depending on the price per square meter, as well as the period for which the mortgage was issued.

The cost of residential square meters on the territory of the republic may vary depending on the locality where a low-income family lives or where state employees work. Moreover, the approach to each client of this program is individual.

The initial payment for housing can be paid using a state subsidy (for families with one child - 30% of the cost of an apartment, for those raising two or more children - 35-40%) or maternity capital (the so-called assistance with the birth of children).

NO "GZF under the President of the Republic of Tatarstan" provides grace periods for payment of interest (no more than 6 months). They can be used throughout the entire loan term.

It should be remembered that a mortgage loan in the Republic of Tajikistan is provided for a period not exceeding 28.5 years.

Help with the birth of children

![]() The social mortgage developed by the GZF provides for the use of social assistance at the birth of children to pay the initial payment for an apartment, interest, as well as other mandatory payments.

The social mortgage developed by the GZF provides for the use of social assistance at the birth of children to pay the initial payment for an apartment, interest, as well as other mandatory payments.

In 2020, at the birth of children in young families, payments will be made in the republic, provided for by the all-Russian program to support young mothers and fathers (maternity capital), as well as by a regional project.

Provides for the following presidential and municipal payments:

- 30% monetary compensation for payment of housing and communal services (for example, provided, as well as low-income people);

- a one-time material payment at the birth of a baby (regardless of the number of children) in the amount of 20 thousand rubles;

- material compensation for medicines for children under 6 years old (provided for large families);

![]() All these payments can be used to pay off a soft loan.

All these payments can be used to pay off a soft loan.

Large families mean families that have more than two children, including adopted children, and have formalized their status with the social security authorities.

Low-income citizens are citizens who live together, whose total aggregate income is equal to the subsistence minimum or exceeds it by 30-50% (depending on the number of family members).

Work experience at least 10 years

The preferential terms of social mortgage in Tatarstan provide for a mandatory requirement for employees of various budgetary organizations, low-income, young families, which is that a person must work in the republic for 10 years (this was mentioned above).

![]() But the majority of citizens who decide to use the program are interested in the question of how this period is calculated.

But the majority of citizens who decide to use the program are interested in the question of how this period is calculated.

The calculation mechanism is as follows. A person provides his work book or other document confirming his experience in enterprises, in budgetary organizations of Tatarstan. If the applicant left the republic for a while, then returned, the length of service will be considered only based on his work in the republic.

For example, the total experience of a citizen is 20 years, of which 10 years in enterprises, in budgetary organizations of Tatarstan. It falls under the social mortgage program.

You need to know that if a person working at an enterprise located in the Republic of Tatarstan was sent on a long-term business trip to another region, he is credited with experience in the Republic of Tatarstan.

Who can get a home loan in the Republic of Tajikistan

![]() According to the Resolution of the Government of the Republic of Tajikistan, the following citizens receive the right to social mortgage lending:

According to the Resolution of the Government of the Republic of Tajikistan, the following citizens receive the right to social mortgage lending:

- young families where parents are under 35 years old, they have been living and working on the territory of the republic for more than 10 years;

- low-income families, whose income does not exceed 30-50% of the required subsistence minimum for each member;

- parents with many children, as well as those who have dependent children with disabilities; guardians and adoptees;

- employees of various budgetary organizations who have worked in the republic for more than 10 years.

They all need to improve their living conditions.

Housing fund under the President of the Republic of Tatarstan

To implement the project, a state housing fund was created under the President.

It is formed with the help of construction companies that are engaged in the construction of housing in various localities of the region. For this, construction companies are required to create part of economy-class residential premises in each apartment building and transfer them to the state housing fund.

![]() The state housing fund for social mortgages under the President of the Republic of Tatarstan is managed by a special institution, NGO "GZhF under the President of the Republic of Tatarstan."

The state housing fund for social mortgages under the President of the Republic of Tatarstan is managed by a special institution, NGO "GZhF under the President of the Republic of Tatarstan."

Goals and objectives of the organization

As you know, the cost of any housing in our country is significant, and often its purchase is not available to the general population.

Based on these economic realities, as well as for the implementation of the mortgage program in Tatarstan, a non-governmental organization "GZhF under the President of the Republic of Tatarstan" was created.

The purpose of its existence is the registration of all citizens in need of housing on the territory of the republic, verification of the submitted documents, queuing and issuance of residential real estate.

The objectives of the BUT are as follows:

- accumulation of federal, regional budgetary funds allocated for social housing programs;

- accumulation of funds that are paid by citizens in need of housing, repaying mortgage loans;

- redemption of residential premises from construction organizations and their transfer to citizens.

To implement this program, each registered participant has his own personal page on the President's website.

Sources of financing

![]() The principle of operation of the NGO "GZhF under the President of the Republic of Tatarstan" is that this organization accumulates not only budget funds, but also contributions that are paid by those in need of better housing conditions and public sector employees.

The principle of operation of the NGO "GZhF under the President of the Republic of Tatarstan" is that this organization accumulates not only budget funds, but also contributions that are paid by those in need of better housing conditions and public sector employees.

Today the Prime Minister of the Republic of Tatarstan Alexey Pesoshin introduced the new head of the non-profit organization "State Housing Fund under the President of the Republic of Tatarstan" (GZHF RT). It was Marat Zaripov.

Recall that today the Decree of the President of the Republic of Tatarstan (UP-723 of October 12, 2018) was signed on the appointment of Marat Rivgatovich Zaripov to the position of executive director of the non-profit organization "State Housing Fund under the President of the Republic of Tatarstan".

In addition, today the Decree of the President of the Republic of Tatarstan (UP-721 of October 12, 2018) was signed on the release of Abdullin Talgat Midkhatovich from the post of executive director of the non-profit organization State Housing Fund under the President of the Republic of Tatarstan.

Alexey Pesoshin thanked Talgat Abdullin for his work as executive director of the GZhF RT.

In turn, Talgat Abdullin noted that for many years, the close-knit team of the GZhF RT carried out painstaking work in terms of providing citizens with housing. He recalled that over the years, more than 160 thousand families received apartments. Talgat Abdullin noted that such serious and significant programs as the resettlement of citizens from dilapidated housing, provision of housing for citizens living in dilapidated houses, as well as a social mortgage program and others are being implemented in the republic.

Executive Director of the non-profit organization "State Housing Fund under the President of the Republic of Tatarstan" Marat Zaripov assured that the work would continue and wished everyone success.

For reference:

In 1994 he graduated from the Kazan Agricultural Academy with a degree in economics and management in the agro-industrial complex.

Labor activity:

1989-1994 - student of the Kazan Agricultural Academy, Kazan;

1994-1994 - economist of the lending department of the Joint-Stock Commercial Bank "Meta-Impex", Kazan;

1994-1995 - service in the ranks of the Armed Forces of the Russian Federation;

1995-1996 - economist of the lending department of the joint-stock commercial bank "Meta-Impex", Kazan;

1997-1999 - Leading Economist, Head of Sector, Head of Division of the Department for Trust Fund Management of the Ministry of Finance of the Republic of Tatarstan, Kazan;

1999-2000 - Deputy Director of the Treasury Department of the Ministry of Finance of the Republic of Tatarstan, Kazan;

2000-2001 - Acting Head of the Federal Treasury Department of the Ministry of Finance of the Russian Federation for the Republic of Tatarstan, Kazan;

2001-2004 - Head of the Federal Treasury Department of the Ministry of Finance of the Russian Federation for the Republic of Tatarstan, Kazan;

2005-2012 - Head of the Department of the Federal Treasury for the Republic of Tatarstan;

2012-2018 - Chairman of the State Committee for Tariffs of the Republic of Tatarstan;

Since October 12, 2018 - Executive Director of the non-profit organization "State Housing Fund under the President of the Republic of Tatarstan".

Academic degree, title: "Honored Economist of the Republic of Tatarstan", candidate of economic sciences.

He is married and has three children.