To which account to write off 41 accounts. Accounting for finished products and goods in accordance with the new chart of accounts. What is related to the goods

Inventory account 41 is intended to control the movement and availability of those goods and materials that are acquired by trading companies for subsequent sale. Production (industrial and other) enterprises can also use this account in order to reflect materials, products or other objects acquired not for use in their core business, but for resale. We will figure out how account 41 behaves in accounting - postings with examples can be found later.

Bang. account 41 - entity and subaccounts

41 accounting accounts - this is an active collective account, accumulating data on their own inventories used for sale to customers. In this case, the goods can be any object - from the building, equipment, vehicles and other fixed assets to materials, inventory and land. The main difference is that the goods are not used by the organization for their own purposes (for production, services, etc.), but are resold “to the side” with the transfer of ownership to customers.

Accounting 41 accounts is conducted both in quantitative and monetary terms, with the definition of incoming / outgoing balances, as well as the volume of movement for a specific time period. Goods and materials received by the enterprise under commission, repository, or processing agreements are displayed on the corresponding off-balance accounts - 002, 004, 003.

Subaccounts to 41 accounts:

- 41.1 - is used to display goods and materials in warehouses / pantries of organizations.

- 41.2 - Used by retailers or catering companies.

- 41.3 - here you can generate data on the movement of containers (empty and under goods and materials), both in-house and purchased, except for inventory.

- 41.4 - this subaccount is opened by manufacturing / industrial organizations to account for purchased products.

Analytical accounting for account 41 is organized by materially responsible employees of the enterprise, warehouses, pantries and other places of storage of goods and materials, as well as nomenclature names (varieties, lots, species, subspecies, groups, etc.).

Accounting Postings 41

In accordance with order No. 94n of October 31, 00, correspondence of account 41 is performed by debit for capitalization of goods from suppliers (account 60), accountable persons (account 71), as contributions from founders (account 75), other counterparties (cf. 76). Write-off of goods is carried out on a credit account. 41 in correspondence with accounts - (upon sale), (when used for commercial purposes), 20,, (when spent on own needs), (in the process of transferring from goods to materials), 41 - during internal transfers, etc.

Account 41 - Postings

Thus, we found that 41 accounting accounts are a type of working accounts reflecting data on the goods of the enterprise. In the balance sheet, the balance of this account is entered on page 1210 minus the credit balance at the trading margin on the account. 42. Consider how accountants practically use account 41 — postings are based on typical situations.

Example 1

A trading company sold wholesale goods for 295,000 rubles, incl. VAT 45,000 rubles .; at retail for 35,400 rubles, incl. VAT 5400 rub. The amount of mark-ups on retail through ATT (automated point of sale) amounted to 12,400 rubles .; the cost of the wholesale lot is 217,300 rubles. Postings:

- D 62.1 K 90.01.1 to 295,000 rubles. - reflected shipping in bulk.

- D 90.02 To 68.2 for 45,000 rubles. - VAT is allocated.

- D 90.02.1 K account 41 01 to 217 300 rubles. - reflected the write-off of cost.

- D 51 K 62.1 per 295,000 rubles. - received payment.

- D 50 K 90.01.1 to 35,400 rubles. - Reflected retail.

- D 90.03 K 68.2 at 5400 rub. - Retail VAT has been allocated.

- D 90.02.1 K 41.11 for 35,400 rubles. - reflected the write-off of goods at retail.

- D 90.02.1 K 42 for 12,400 rubles. - reversed margin (this posting is made with the - sign).

Example 2

A trading company uses part of the goods and materials purchased for its own needs - to set an alarm in the office. In this regard, the accountant transfers the cable from goods to materials by the following postings:

- D 41.1.19 K 60 per 170,000 rubles, incl. VAT 18% 25 932.20 rubles. - 1,000 m. Cable as a commodity.

- D 10.1 K 41.1 to 14,406.78 rubles. - 100 meters of cable were transferred to the category of materials.

- D 26 K 10.1 for 14 406.78 rubles. - written off materials for general business purposes.

The account 41 is used to reflect generalized information about the availability and movement of goods that the organization stores in warehouses and bases. In the article, we will talk about the features of accounting for operations with goods in the warehouse, consider typical postings and examples on account 41.

Organization of stock accounting

A warehouse is a room that is specifically designed to store materials and supplies. The organization’s warehouse can be both its integral part and act as an independent structural unit. In the first case, the warehouse is used exclusively as one of the stages of the production process, in the second case, the warehouse can act as a separate object (for example, a point of sale from which the goods are sold).

The technological process in the warehouse consists of several stages:

- acceptance of goods and materials (including preliminary preparation of goods for acceptance).

- placement of goods in warehouses and ensuring its storage.

- preparation of goods for leave from the warehouse and its subsequent leave.

Warehouse accounting at the enterprise can be organized in varietal or batch methods. In the first case, each type of product in the warehouse is considered separately. The basis for accounting for goods is a quantitative-cost accounting card (TORG-28 form), which is compiled upon receipt of goods and materials at the warehouse. In the varietal method, it is possible to account for several goods (for example, uniform in price) in one TORG-28 card.

If the organization uses the batch method to account for inventories in the warehouse, the receipt and movement of goods is reflected in the context of parties. The basis document for these operations is the partion list (form MX-10), which is compiled when a consignment of goods arrives at the warehouse and is filled out as it is written off.

Video lesson. Arrival of goods in 1C Accounting: step-by-step instruction

Practical video lesson on accounting for the receipt of goods in 1C Accounting 8.3. The expert of the site Olga Likina conducts: “Bookkeeping for dummies”, payroll accountant of M.video management LLC. The lesson provides step-by-step instructions for recording the receipt of goods.

Account 41. Reflection of warehouse operations in accounting

To account for the receipt and movement of goods in the warehouse, its write-off use the account 41 (subaccount 41.1 Goods in warehouses). The basis for reflecting the receipt of goods and materials at the organization’s warehouse is a waybill, according to which the supplier has shipped the goods. This transaction is recorded in the following posting:

Dt 41 Ct 60.

Upon receipt of goods from other counterparties:

Dt 41 Ct 76.

One of the operations of inventory control of goods is its internal movement. This operation, as a rule, is common at retailers. For example, goods received from a supplier and capitalized at the main warehouse (wholesale) are moved to a retail warehouse (retail outlet). The basis for the movement of goods between warehouses is an invoice certified by the signatures of persons issuing and receiving goods and materials. If the goods are moved to an automated point of sale, then an entry is made in the accounting:

Dt 41.01 Ct 41.11.

If the goods from the wholesale warehouse arrives at the point where accounting is done manually, then this operation is carried out as follows:

Dt 41.01 Ct 41.12.

When you return the goods to the main warehouse (the goods are not sold or require additional equipment), then the reverse record is recorded in the account:

Dt 41.11 (41.12) Ct 41.01.

All operations on the movement of goods (including internal) are recorded in the appropriate accounting card (TORG-28, MX-10).

When goods are deducted from the warehouse upon the fact of their sale, a consignment note is issued to the buyer, which is signed by the person who shipped the goods and the recipient. Depending on the type of goods released from the warehouse, the following entries are made in the accounting:

- goods were shipped from the warehouse, finished products Dt 45.1 Kt 41.1;

- the container for shipped goods Dt 45.2 Kt 41.1 has been written off from the warehouse;

- write-off of the value of goods under the contract of the commission Dt 45.5 Ct 41.1.

In case of damage or shortage of goods in the warehouse, its value is debited to account 94:

Dt 94 Ct 41.

The basis for such a write-off is an act of the commission, according to which the fact of damage, shortage (including as a result of theft) was established. The obligatory confirming document is the inventory sheet, in which information is recorded on the discrepancy between the actual quantity of goods and the accounting.

Ways of accounting for goods in stock

Organization of accounting of goods in the organization’s warehouse can be implemented in one of two ways:

- reflection of arrival, movement and write-offs are carried out at purchase prices;

- when reflecting operations with goods in the warehouse used selling price.

If an enterprise accounts for goods in a warehouse at the purchase price, then its cost in accounting is equal to the sum of expenses incurred directly for the purchase of goods and materials and possible additional costs (transportation, consulting, commission, etc.).

If the goods are taken into account at the selling price, then their value in warehouse cards, in addition to acquisition costs, contains a trade margin.

Each of the methods of accounting for goods in the warehouse, consider an example.

Account 41. Accounting for goods at purchase prices

LLC “Factorial” issued a bank loan in the amount of 134 000 rubles. to purchase goods. The cost of the loan amounted to 1750 rubles. LLC “Factorial” purchased the goods from LLC “Magnit” (134,000 rubles, VAT 20,441 rubles) and entered it into the warehouse. Goods and materials were written off from the warehouse upon their sale by Vulkan LLC (203,000 rubles, VAT 30,966 rubles). According to the accounting policy, LLC “Factorial” takes into account inventory materials at the purchase price.

| Debit | Credit | Description | Amount | Document |

| 51 | 66 | Bank loan credited | 134 000 rub. | Bank statement |

| 41.1 | 60 | Purchased goods are recorded in stock (excluding VAT) | 113 559 rub. | Packing list |

| 19 | 60 | The amount of VAT is reflected | 20,441 rubles | Packing list |

| 68 VAT | 19 | Reflected tax deduction | 20,441 rubles | Invoice |

| 91.2 | 66 | Loan expenses included | 1 750 rub. | Bank agreement |

| 90.2 | 41.1 | The goods are deducted from stock in connection with the sale | 113 559 rub. | Sales Invoice |

| 62 | 90.1 | 203 000 rub. | Sales Invoice | |

| 90.3 | 68 VAT | The amount of VAT is reflected | 30 966 rub. | Invoice |

| 51 | 62 | The goods are paid for by LLC “Volcano” | 203 000 rub. | Bank statement |

For other accounts used in transactions, see the following articles: (settlement account), (accounting of settlements with suppliers), account 19, (writing off receivables).

Account 41. Accounting for goods at the selling price

Climate LLC purchased goods (components for air conditioners) at a price of 138,000 rubles, VAT 21,051 rubles. for the purpose of subsequent implementation. Trade margin - 28% (32 746 rubles). VAT on sale - 26 945 rubles. The total margin including VAT is 59 691 rubles. The product was sold by Mercury LLC.

| Debit | Credit | Description | Amount | Document |

| 41.1 | 60 | Components accounted for in stock (excluding VAT) | 116 949 rub. | Packing list |

| 19 | 60 | The amount of VAT is reflected | 21 051 rub. | Packing list |

| 68 VAT | 19 | Reflected tax deduction | 21 051 rub. | Invoice |

| 60 | 51 | Payment made for components | 116 949 rub. | Payment order |

| 41.1 | 42 | Trade margin taken into account | 59 691 rub. | Margin calculation |

| 90.2 | 41.1 | The goods are deducted from the warehouse in connection with the sale (116 949 + 59 691) | 176 640 rub. | Sales Invoice |

| 90.2 | 42 | Storno trade margin amounts | 59 691 rub. | Sales Invoice |

| 62 | 90.1 | Reflected revenue from sales of goods and materials | 176 640 rub. | Sales Invoice |

| 90.3 | 68 VAT | The amount of VAT is reflected | 26 945 rub. | Invoice |

| 51 | 62 | Item paid by “Mercury” LLC | 176 640 rub. | Bank statement |

In conclusion, we emphasize that each of the operations with goods in the warehouse must be confirmed by an appropriate document drawn up in accordance with legislative requirements.

In this article, we will talk about 41 accounting accounts. What types of it exist, how it works, what typical accounting records are reflected in the designated position, and also consider one example in practice.

Definition of a designated category and its classification

In trade relations, the product is the key subject of sale. The very concept of the designated term has a lot of aspects and includes:

- functional purpose;

- aesthetics of both the subject of sale and its packaging;

- harmlessness and safety in application.

Thus, this item of trade is the result of activities, including when it comes to performing work or providing services, which is the subject of sale or exchange.

Within the framework of market relations, everything that can represent the object of a transaction concluded between sellers and buyers is perceived as a designated subject of a transaction.

If we talk about this category in a broader sense, then it refers to tangible and intangible property sold on the market.

As an object of commercial activity, that other product for subsequent sale has the following specific features:

- quality characteristic;

- quantitative;

- valuation;

- range.

The key elements of the designated subject of sale are:

- its physical and consumer characteristics;

- related products;

- trademark;

- appropriate packaging;

- related services;

- warranty period.

In practice, all products are divided into the following groups:

- material - material group, which includes property having a physical embodiment;

- a group of intangible goods, where you can include various services and consultations.

Organization of stock accounting

All products for subsequent sale, as a rule, are combined into a specific accounting group, which is assigned a specific generic name, for example, inventory items.

Accounting for objects of sale in a warehouse occurs at their real cost. To reflect products in stock, 41 accounts and its sub-accounts are used in accounting. If the organization carries out trading activities in retail, then the need arises for the application and 42 accounts.

41 accounts for accounting records

The designated position is intended to summarize the data on the stock and movement of goods and materials that were purchased for further sale.

Those organizations that conduct trading activities in this account also take into account both acquired containers and packaging of their own production.

The corresponding sub-accounts can be opened for this account, for example:

- 1 - products for sale in warehouses;

- 2 - products in retail;

- 4 - purchased products.

Products for further sale and packaging delivered to the warehouse are reflected in the debit part of the account and on the credit part of account 60 at their purchase price. If the record is maintained by an organization engaged in retail sales, then when reflecting goods at their selling price, an entry is made in the debit part 41 and the credit part 42 of the position. In this case, the difference between the purchase price and the sale price is reflected. The organization’s expenses for procurement and transportation are shown in debit 44 and credit 60 of the item.

Basic accounting records

In accounting, typical records for this item are as follows:

Kt 15 - the adoption of the balance of products at the discount price;

CT 60 - accounts payable to suppliers for products for resale;

CT 68 - allocation of accrued VAT to the cost of production;

Kt 71 - accounting of products purchased by an accountable person for resale;

Kt 73 - accounting of goods that were reimbursed by individuals, etc.

Case study

In order to see how 41 accounts work in practice, let's analyze one of the cases. Suppose a certain organization acquired 95 packs of paper, which it intends to sell in the future. The total purchase price was 8,270 rubles, the amount of VAT - 1,241 rubles. At the same time, 7 packs of paper were used for the organization’s own needs.

For these operations, the accounting service made the following entries:

Kt 60.01 - 7 029 p., Posting of goods to the warehouse;

Ct 60.01 - 1 241 p., VAT accounting;

Kt19.03 - 1 241 p., VAT deductible;

Ct 41.01 - 7 029 p., The movement of goods from wholesale to retail warehouse;

CT 42 - 2 609 p., Accounting for trade margins;

CT 41.11 - 604 p., Write-off of goods for the needs of the office;

CT 42 - write-off of goods for the organization’s own needs.

Conclusion

Thus, the accounting of goods in stock intended for resale is of great importance from the point of view of summarizing information about incoming goods and margins, which subsequently affect the formation of the final financial result.

This page is an appendix to.

Account 41 “Goods”

Account 41 “Goods” is intended to summarize information on the availability and movement of inventory acquired as goods for sale. This account is used mainly by organizations engaged in trading activities, as well as organizations providing catering services.

In organizations engaged in industrial and other production activities, account 41 “Goods” is used in cases where any products, materials, products are purchased specifically for sale or when the cost of finished products purchased for packaging is not included in the cost of goods sold, and be refunded by buyers separately.

Organizations engaged in trading activities, on account 41 “Goods” also take into account purchased containers and containers of their own production (except for inventory that is used for production or household needs and accounted for on account 01 “Fixed assets” or 10 “Materials”).

Goods accepted for safekeeping are recorded on the off-balance account 002 “Inventory accepted for safekeeping”. Goods accepted for commission are recorded on off-balance account 004 “Goods accepted for commission”.

To account 41 "Goods" can be opened sub-accounts:

- 41-1 “Goods in warehouses”;

- 41-2 “Goods in retail trade”;

- 41-3 "Container under the goods and empty";

- 41-4 "Purchased products" and others.

On subaccount 41-1 “Goods in warehouses”, the presence and movement of inventories located at wholesale and distribution bases, warehouses, in pantries of organizations providing public catering services, vegetable stores, refrigerators, etc. are taken into account.

On subaccount 41-2 “Goods in retail trade”, the presence and movement of goods located in organizations engaged in retail trade (in stores, tents, stalls, kiosks, etc.) and in cafeterias of organizations engaged in catering are taken into account. The same sub-account takes into account the presence and movement of glassware (bottles, cans, etc.) in organizations engaged in retail trade, and in buffets of organizations providing catering services.

On subaccount 41-3 “Container under the goods and empty”, the presence and movement of containers under goods and empty containers (except for glassware in organizations engaged in retail trade, and in buffets of organizations providing catering services) are taken into account.

On sub-account 41-4 “Purchased products”, organizations engaged in industrial and other production activities using account 41 “Goods” take into account the availability and movement of goods (in relation to the procedure provided for accounting for inventories).

The posting of goods and containers that arrived at the warehouse is reflected in the debit of account 41 “Goods” in correspondence with account 60 “Settlements with suppliers and contractors” at the cost of their acquisition. When an organization engaged in retail trade records goods at selling prices, at the same time this record is recorded on the debit of account 41 “Goods” and the credit of account 42 “Trade margin” on the difference between the acquisition cost and the cost at selling prices (discounts, wraps). Transportation (for importation) and other expenses for the procurement and delivery of goods are charged from the credit of account 60 “Settlements with suppliers and contractors” to the debit of account 44 “Sales costs”.

The receipt of goods and containers can be reflected using account 15 “Procurement and acquisition of material assets” or without using it in the manner similar to the accounting for the relevant operations with materials.

Upon recognition in accounting of the proceeds from the sale of goods, their value is debited from account 41 “Goods” to the debit of account 90 “Sales”.

If the proceeds from the sale of dispensed (shipped) goods for a certain time cannot be recognized in accounting, then until the recognition of the proceeds, these goods are recorded on account 45 “Goods shipped”. Upon their actual vacation (shipment), a record is made on the credit of account 41 “Goods” in correspondence with account 45 “Goods shipped”.

Goods transferred for processing to other organizations are not debited from account 41 “Goods”, but are accounted for separately.

Analytical accounting of account 41 “Goods” is carried out by responsible persons, names (grades, lots, bales), and, if necessary, by places of storage of goods.

Account 41 “Goods” corresponds with the accounts:

| debit | on loan |

| 15 Procurement and acquisition of material assets 41 Products 42 Trade margin 60 Settlements with suppliers and contractors 66 Settlements on short-term loans and borrowings 67 Settlements for long-term loans and borrowings 68 Settlements for taxes and fees 71 Settlements with accountable persons 73 Settlements with staff for other operations 75 Settlements with founders 80 registered capital 86 Target financing 91 Other income and expenses |

10 Materials 20 Main production 41 Products 44 Costs to sell 45 Items shipped 76 Settlements with various debtors and creditors 79 Internal calculations 80 registered capital 90 Sales 94 Deficiencies and Losses from Damage to Values 97 deferred expenses 99 Profit and loss |

Goods - property owned by the organization and put up for sale. At the same time, the type and cost do not matter. The goods can be both real estate and small items. Account 41 in accounting is used to reflect information about the availability of goods and their sale.

general characteristics

"Goods" - an inventory account of the material assets of the enterprise. Novice auditors ask the question: "Account 41 in the accounting asset or liability of the organization?" The answer is not as complicated as it might seem. You need to understand that the account itself does not apply to an asset or liability. But the goods accounted for in account 41 can be easily identified in the funds or sources of the organization. An asset is a property right of a company, in other words, everything that belongs to it. Goods are tangible property, which means that they are accounted for in the asset.

Based on the answer received, how can you describe account 41 in accounting? Active or passive? Or maybe active-passive? There should be no doubt, account 41 in accounting is active. The receipt of goods is displayed in debit, and their write-off and sale in credit. At the end of the reporting period, only a debit end balance is generated.

Account 41

The “Goods” account is used by enterprises in the trade, supply and marketing sectors, as well as those specializing in catering. In addition to goods, the account takes into account packaging produced independently or purchased. In industry, an invoice is used only if materials or products are purchased for a separate sale.

Depending on the policy of the company, goods are recorded at the selling, accounting or purchase price. When using sales prices, the difference between the cost of goods and wraps (discounts) is displayed on account 42.

The goods accepted for storage under responsibility and for the commission are recorded on accounts 002 and 004. Account 41 in accounting has its own sub-accounts for grouping goods of similar purpose.

Account 41 in accounting - subaccounts

The accounts of analytical accounting facilitate the process of grouping and evaluating the results of the financial activities of the organization. For the account "Goods" the accountant uses sub-accounts:

- 41.1 - for accounting for goods in storage facilities;

- 41.2 - for the accounting of goods intended for retail trade;

- 41.3 - to account for containers under goods or empty;

- 41.4 - to account for purchased products.

Subch 41.1 is used to control the movement of stocks of goods in the warehouses of the enterprise. Public catering uses it to account for products located in refrigerators and other food storages.

Subch 41.2 is used for retail accounting. Catering chains additionally use it to account for glassware. Subch 41.3 helps keep track of containers under goods and empty. Subch 41.4 are used to account for the availability of goods and their movement, applying the accounting procedure similar to inventories.

Correspondence

Account 41 in accounting is a method of monitoring and describing the process of purchasing and selling goods, which leads to correspondence with most of the main accounts. Account 41 is debited in the posting with accounts:

- settlement operations (60, 63, 68, and 71-78);

- capital assets (80, 88);

- stocks (14);

- production accounting (20, 23, 26, 29, 37);

- product (42);

- accounting for cash transactions (50).

The account "Goods" corresponds to a loan with accounts:

- assets (06);

- stocks (10, 13, 14);

- production and commodity accounting (20, from 43 to 46);

- accounting for cash transactions (58);

- accounting calculations (62, 63, from 76 to 79 except 77);

- capital assets (80, 84, 87, 89)

In the process of compiling quotes, do not forget that account 41 in accounting - active.

Reception at cost

The company in the accounting documents determines the procedure for accounting for goods received. Posting at actual cost involves the use of supplier prices indicated in accounting documents. In addition, the cost may include payment for the services of transport companies and the procurement process. The nature of the accounting for these expenses has the right to determine the organization itself.

When auditors in practice arrive for the first time in goods, a serious question arises: "To open account 41 in accounting with or without VAT?" Violation of the wiring can lead to problems with the transfer of tax, it is worth sorting out. If the delivery company issues an invoice, then VAT must be allocated, only to a separate invoice. The arrival of the goods should be made at cost minus tax.

Account 41 is debited in accounting with VAT payable with credit. 60, after which the amount of tax is allocated and transferred to the budget.

Case Study

You can more clearly trace the sequence of accounting operations by considering a specific case. We have the following initial data: the company acquired borrowed funds in the amount of 480,000 monetary units (hereinafter referred to as units). All the money spent on the purchase of goods (of which the tax - 80 000 units.). During the use of the loan, the borrowing bank accrued interest in the amount of 60,000 units. The accounting policy of the company governs the accounting of interest on the operating expenses account. Implemented the implementation of the entire consignment of goods for 720,000 units. (of which the tax is 120,000 d. units).

| Dt | Ct | Amount, p. | Operation Characteristic |

| 51 | 66 | 480 000 | loan amount transferred to the bank account of the company |

| 41 | 60 | 400 000 | goods are capitalized (excluding tax) |

| 19 | 60 | 80 000 | vAT is allocated from the amount of the cost of purchased goods |

| 68 | 19 | 80 000 | VAT is transferred to the state budget |

| 91.2 | 66 | 60 000 | reflected the accrual of bank interest on a loan |

| 90.2 | 41 | 400 000 | the price of the goods for sale is debited |

| 62 | 90.1 | 720 000 | |

| 90.3 | 68 | 120 000 | accrued tax for goods sold |

| 51 | 62 | 720 000 | payment received from buyer |

A good example of the process of posting goods at the enterprise clarifies the situation, and one does not have to choose whether to open account 41 in accounting with or without VAT. No matter what the cost of the goods, VAT on account 41 does not include.

Sales Price Accounting

If the organization makes the posting of goods at the subsequent sale price, then there is a need to use account 42. Sch. "Trade margin" takes into account income from the sale of goods and VAT.

The accountant performs such quotes with correspondence of accounts 41 and 42:

- Dt 41 Kt 42 - the mark-up on the received goods is reflected.

- Dt 90.2 Kt 42 - deducted the amount of the margin when making a sale.

- Dt 41 Kt 42 - write-off of the discounted value of the goods due to the extra charge made earlier.

- Dt 91.2 Ct 41 - the difference between the mark-up and the discounted value is written off (in cases where the mark-down exceeds the mark-up amount).

- Dt 44 Kt 41, Dt 44 Kt 42 - goods and their trade margin are written off for the needs of the enterprise.

- Dt 94 Kt 41, Dt 94 Kt 42 - the amount of shortage / damage to the goods and its trade margin have been written off.

An example of accounting at the selling price in an enterprise

Suppose a contingent company performed the following business operations: purchased goods worth 12,000 rubles (including VAT 2,000 rubles). The established margin rate is 30%. The accountant performs the following calculations:

- (12 000 - 2000) × 30% \u003d 3000 p. - the amount of the margin on the goods.

- (10,000 + 3000) × 18% \u003d 2340 p. - Calculated VAT for the sale value at the rate of 18%.

- 3000 + 2340 \u003d 5340 p. - calculated the total margin for the goods, including VAT.

The process is described by the following accounting entries:

| Dt | Ct | Amount, p. | Operation Characteristic |

| 41 | 60 | 10 000 | the goods are capitalized and accepted to the warehouse excluding VAT |

| 19 | 60 | 2 000 | VAT is allocated from the amount of purchased goods |

| 68 | 19 | 2 000 | vAT deduction completed |

| 60 | 51 | 12 000 | the debt to the supplier has been repaid from the bank account |

| 41 | 42 | 5 340 | goods margin recognized |

| 90.2 | 41 | 15 340 | written off the amount of goods for sale |

| 90.2 | 42 | 5 340 | extra charge deducted from the cost of goods |

| 62 | 90.1 | 15 340 | revenue from sales of goods recognized |

| 90.3 | 68 | 2 340 | accrual of VAT on goods sold |

| 51 | 62 | 15 340 | buyer repaid goods receivable |

The expenses incurred during the delivery of goods from the supplier on transport and other services are credited with account 44 (Dt 44 Kt 60). If at the end of the reporting period, the goods paid by the company are still not delivered, the accountant posts the Dt 41 Kt 60, but no posting is made to the warehouse. When the goods arrive at the disposal of the company, the amount of VAT is deducted and the cost of the goods is listed in the debit account. 60.

Features of shipment of goods to customers

In cases where the contract for the supply of goods between the buyer and the manufacturer determines the transfer of ownership of the goods and liability for them, account 45 is used. At the moment when the goods are actually shipped to the buyer, the transaction is carried out: Dt 45 Ct 41. After holding this quote, it is believed that the rights and responsibility for the goods are the buyer.

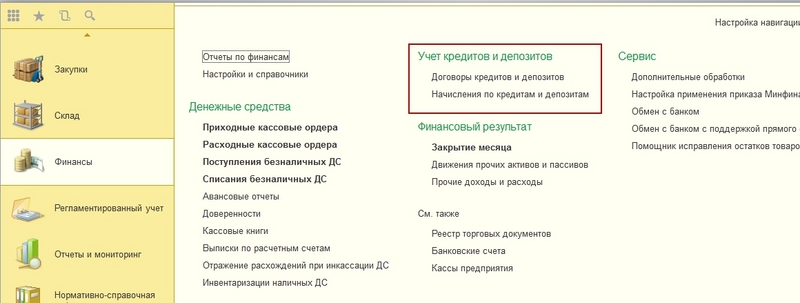

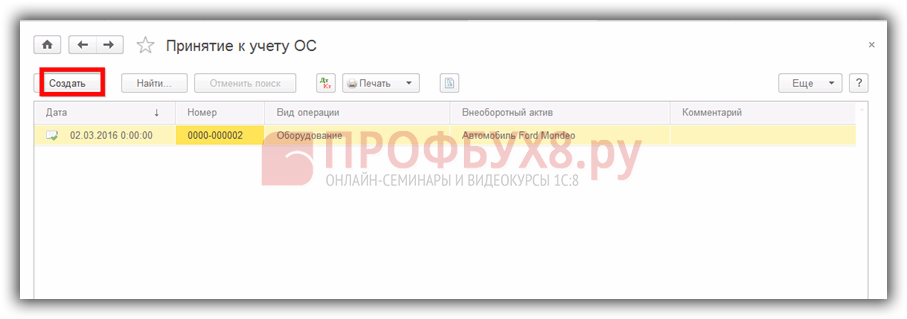

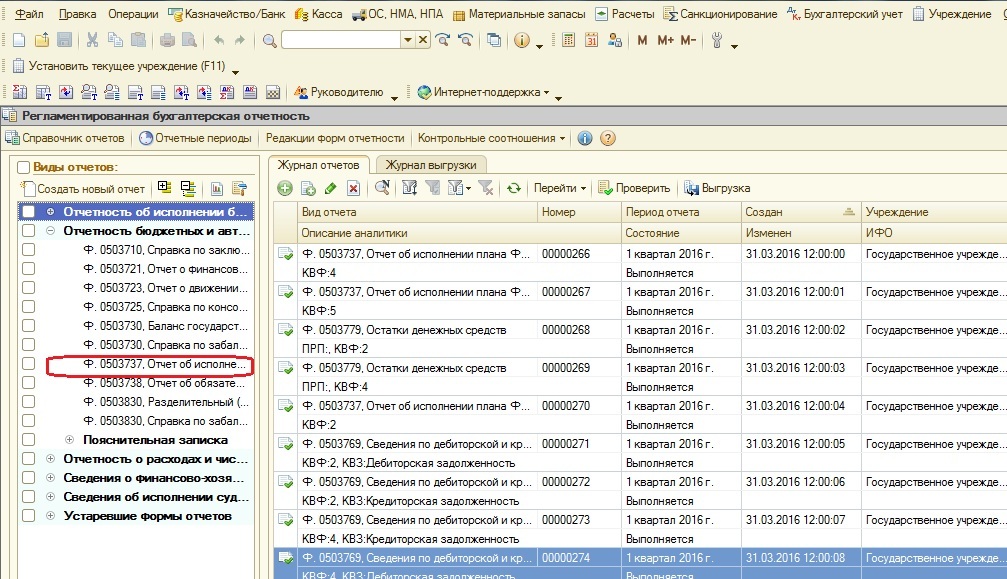

Accounting for goods in 1C

Commercial and industrial enterprises use commercial accounting programs to simplify the work of auditors. This reduces time and allows you to visually assess the assets and liabilities of the company. Account 41 in accounting 1C corresponds with the same accounts as in the classic version.

For capitalization of goods, it is necessary in the main menu to select the item "Purchases" sub-item "Receipt (acts, invoices)." The product filling form will open. Consider an example of the implementation of retail transactions through 1C. You must perform the following actions in the program:

- Indicate the date of arrival or date in the supplier’s document.

- Choose: counterparty - supplier, contract - main, warehouse - retail.

- Fill in the tabular part without nomenclature.

- Indicate the amount of goods without VAT and post a document.

Reflection of revenue and accounting margins in 1C

After completing all the previous paragraphs, the "Products" account and its quotes will open. To reflect the proceeds from retail trade, you need to open the item "Bank and cashier" sub-item "Cash documents" in the main menu of the program and create a new receipt order as follows:

- Identify the type of operation: "retail revenue".

- Fill in the fields: date, amount of payment (select "excluding VAT").

- Post a document.

After viewing the postings made to the account, go to the "Operations" sub-item "Closing the month". In the menu that opens, select the closing month and the item "Calculate the trade margin on the goods sold." Account entries will indicate that the mark-up has been deducted. Returning to the "Closing the month" menu, select the "Write off trade margins on goods sold" item, after which the report of the trade margins on sold goods for the selected month will open.

An example of the total accounting of goods was considered using the program 1C: Accounting 8.3 (rev. 3.0).

Knowledge consolidation

Having carefully studied all the information presented and summed up, you can identify the key points of the characteristic and accounting of the account. 41:

- goods are among the assets of the enterprise;

- account 41 - active, inventory;

- upon receipt of the goods, the account is debited excluding VAT;

- the sale of goods leads to the write-off of amounts from account 41;

- trading margin is reflected by the posting Dt 41 Ct 42.

Regardless of how accounting is carried out at the enterprise (in 1C or in writing), knowledge of the properties of account 41 will simplify the work of a novice accountant.