VAT refund process. How and in what cases is VAT refunded - refund procedure? A package of required documents

Is it possible to return VAT to an individual? In accordance with the Tax legislation of the Russian Federation, on the territory of our country, only foreigners who have made purchases through the Tax free system can receive a refund. In other cases, the VAT refund rule applies only to organizations and individual entrepreneurs. For Russians - individuals, such a refund is available only abroad.

Essence of the question

Almost any citizen, entrepreneur or organization, purchasing goods, works or services, becomes a payer of a special type of fiscal burden - value added tax. This payment is a kind of markup on the actual cost of the purchased product or service. Of course, a number of goods are exempt from taxation, but their number is insignificant.

Despite the fact that in reality all of us are payers of value added tax, according to the norms of the Tax Code of the Russian Federation, only legal entities and individual entrepreneurs applying the general taxation system (OSNO), legal entities and individual entrepreneurs in special modes (STS, UTII, ESHN, PNS) when performing a certain type of operation.

What does the status of a taxpayer give? This condition gives economic entity not only the obligation to calculate and transfer funds to the budget, but also gives the right to a VAT refund. Sometimes taxpayer status is not required for this.

Who can get VAT refund

Usually, a tax deduction arises from its payers - individual entrepreneurs and legal entities. Ordinary citizens, contrary to assurances in some media and on Internet sites, do not have such a right. Tax Code of the Russian Federation does not provide for VAT refund for individuals on a card or in any other way, if such people are citizens of Russia. And there are no exceptions to this rule. You cannot refund VAT on the card natural person for money or for free, the authorities of the Federal Tax Service of Russia simply do not provide such a service. Therefore, all the instructions on the Internet on how to get VAT back on your card legally and safely are traps for gullible citizens whom scammers want to deceive. You should not transfer money to them. You will definitely not receive any real refunds in return for payments made to the budget. But there is still one way how to return VAT to an individual.

How an individual can get VAT back

Unfortunately, VAT refunds for individuals in 2020 are not provided for in the Tax Code of the Russian Federation. Russians are not entitled to return the tax levy paid on goods, works, services purchased on the territory Russian Federation... The Tax Code of the Russian Federation provides for the Tax free () system. This is VAT compensation to a foreign individual for goods and services purchased on the territory of the Russian Federation. However, not all purchases are eligible for a tax refund. The right to compensation arises only upon the purchase of goods and services specified in the list of the Tax Code of the Russian Federation. The amount of tax to be refunded is determined on an individual basis.

Therefore, before applying for a refund, check if the purchased type of product is included in the list of goods on Tax free.

To issue a refund, a special receipt is required. When leaving Russia at the customs inspection point, submit your purchase and fiscal receipt for verification. The customs officer will check the compliance and put a stamp on the check confirming the export of the goods from the country. After that, the foreigner receives the money.

Similarly, it is allowed to refund VAT to Russian citizens who have made purchases outside of Russia. They will receive the money immediately before departure, at the airport on a bank card or in cash. The basis is a stamped receipt for the return from the country where the purchases were made.

You can return VAT tax to the card after the trip by sending the documentation by mail to the address of the intermediary, which is indicated on the receipt. The third method of reimbursement: contact the bank, which is a partner of the intermediary company.

Tax deduction for legal entities and individual entrepreneurs

When selling, the taxpayer includes liabilities in the cost of the goods, work, services being sold. The rate is 10% or 20% (10/110 or 20/120, respectively) of the selling price. All taxpayers have the right to a tax deduction. It is equal to the amount of tax paid as part of the cost of purchased for maintenance economic activity goods, works, services. For example, for the purchase of materials for production.

Individual entrepreneurs and organizations that use special regimes, but are payers of value added tax, are not entitled to reimburse it from the budget.

Consequently, taxpayers are entitled to a tax deduction if they have reporting period the amount of tax payable to the budget exceeded the amount tax deductions... This happens most often when exporting.

Conditions and procedure for reimbursement

In what cases the VAT is refunded from the budget, we have indicated above. Now let's figure out how to get a refund from the budget.

Key conditions for reimbursement:

1. The organization or individual entrepreneur applies OSNO. Once again, subjects on other taxation regimes, even if VAT is paid to the budget, are not entitled to claim a refund of value added tax from the budget.

2. The amount of liabilities is less than the tax deduction. Please note that VAT payable is calculated not only on the cost products sold, but also a number of other operations. Full list fixed in the Tax Code of the Russian Federation.

Individuals have the right to refund tax only for goods purchased outside the Russian Federation when they are imported into our country. The list of products and the amount of VAT refund for Tax free should be clarified in advance in the country where the shopping is planned, since compensation for VAT to an individual is provided according to the laws of a foreign state.

There is a Tax free system for foreigners in Russia. They have the right to get advice on how to get VAT back on the purchase of goods in Russia by individuals, right at the airport. In the same place, if there is a check, money will be transferred to them.

How is VAT refunded? Information about this is present in the Tax Code of the Russian Federation, but in the law it is distributed throughout the text and is in the form of norms and regulations. The material contains a step-by-step scheme, adhering to which, each taxpayer will be able to correctly submit documents and ultimately reimburse this tax.

The Tax Code of the Russian Federation provides that everyone who pays VAT has the right to claim a refund of the amounts of this tax previously contributed to the state budget... However, in order to come true VAT refund, a company or individual entrepreneur is required to fulfill 2 conditions:

The amount of tax deductions must exceed the amount of VAT charged for entering into the budget.

The tax payer must submit in tax authority reliable information about the required amount to be returned.

What are the VAT refund schemes?

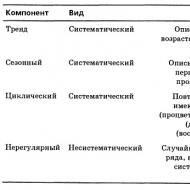

As a result of the analysis normative documents and the instructions of the Federal Tax Service get the following VAT refund scheme(in stages). It is common for all taxpayers, and changes can be made only if the results of a desk audit are negative.

1. Introducing tax return and indicate the amount of VAT required for the refund.

The tax payer prepares a VAT report and submits it to the tax office. The declaration indicates that it is required to return a certain amount of tax from the budget.

2. Tax authorities conduct a desk audit of the submitted data.

The inspectors must carry out this control event 3 months in advance. This period is established by the norms contained in paragraph 1 of Art. 176, art. 88 of the Tax Code of the Russian Federation. As a rule, the IFTS during the check requests a package of documents required to confirm the reporting data that form the amount of the refund. The fact that the tax authorities have such a right can be found in clause 8 of Art. 88 of the Tax Code of the Russian Federation, letters of the Federal Tax Service of Russia dated August 22, 2014 No. SA-4-7 / 16692 and paragraph 25 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57.

3. The tax authorities submit an act to the camerall.

In this document, the inspection specialists indicate whether violations have been found and list them (if any). Everything is done in accordance with paragraph 3 of Art. 176 of the Tax Code of the Russian Federation, art. 100 of the Tax Code of the Russian Federation. The inspection report is handed over to the taxpayer.

If no violations are found, the tax office proceeds to the 7th stage of this scheme.

4. Submitting objections to the act tax office.

The taxpayer may disagree with the conclusions of the inspectors set out in the camerall's act. Such disagreement in accordance with paragraph 6 of Art. 100 of the Tax Code of the Russian Federation is drawn up in the form of written objections to the submitted act. 30 days are given for registration and filing of objections.

5. The tax office decides finally whether to refund the tax or refuse it.

Tax authorities for 10 days, according to the norms of Art. 101 of the Tax Code of the Russian Federation, investigate the taxpayer's arguments in favor of a refund, and then make a final decision: to provide a refund or refuse it (clause 3 of article 176 of the Tax Code of the Russian Federation). A notice of the verdict is issued to the taxpayer within 5 days (clause 9 of article 176 of the Tax Code of the Russian Federation).

The decision to refund can be made in terms of the declared amount.

If the taxpayer has arrears for this tax or other federal taxes, then a decision is made on the offset.

In the presence of arrears, the taxpayer will be forced to go through the 6th stage of this scheme.

If there is no debt, then you can go to the 8th stage.

6. The tax inspectorate carries out a VAT offset and pays off the debt on it in whole or in part.

The tax authority makes the offset without the participation of the taxpayer. Penalties are not charged if the debt has been formed during the time elapsed from the moment of filing the declaration until the moment of VAT offset. True, this is possible if the declared amount of tax exceeds the amount of arrears.

But it may happen that the tax debt will be greater than the VAT to be refunded. Then the taxpayer will have to pay off the resulting difference.

7. The tax office decides that there are no violations and the declared amount must be returned.

Tax authorities are given no more than 7 days to accept such a verdict.

8. The tax office documents the return.

If during the desk audit no violations were found or there was no debt left after all the offset and write-off measures were carried out, an order for a return is drawn up, which is sent to the Treasury. This procedure provided for by the norms contained in par. 1 p. 8 art. 176 of the Tax Code of the Russian Federation.

9. VAT is transferred from the treasury to the current account of the company or individual entrepreneur.

From the moment of receipt of the order from the tax inspectorate, the treasury is given 5 days to transfer funds to the taxpayer's current account. At the same time, the tax office is notified of this event.

As soon as the funds have been received, the procedure is considered complete.

It may happen that the VAT refund lasted longer than the specified time. Then the taxpayer has the right to claim penalties, which are charged on the refunded amount from the 12th day after the end of the cameral. This procedure is defined in paragraph 10 of Art. 176 of the Tax Code of the Russian Federation.

Then the completion of the entire process will occur only after the final receipt of interest debts on the taxpayer's account.

How is the VAT refund guarantee achieved?

In order to get a guaranteed VAT refund, it is not enough that the amount to be deducted exceeds the accrued tax. For a full guarantee, it is necessary to correctly draw up documents, adequately undergo a desk audit and comply with all the deadlines established by law.

VAT registration for refund - summary

The presented sequence of stages is derived from the tax practice and legislation of the Russian Federation. However, in the event of litigation, when the taxpayer is forced to prove his right to a refund, it can become more complicated.

You can count on VAT refunds from the budget in the following situations.

Situation 1. You transferred more VAT to the budget than you should have. For example, according to the declaration data, the amount of VAT payable was 1,000 rubles, and you replenished the budget (for example, due to an error in the payment order) by 1,500 rubles. Then 500 rubles. - overpayment that can be returned from the budget.

Situation 2. The amount of input VAT accepted in a particular quarter for deduction exceeds the amount of tax accrued for the same period (clause 2 of article 173 of the Tax Code of the Russian Federation). For example, VAT, reflected in line 118 of Section 3 of the Declaration (approved by Order of the Federal Tax Service dated October 29, 2014 No. ММВ-7-3 / [email protected]), amounted to 2,000 rubles, and VAT on line 190 of Section 3 - 3,000 rubles. Accordingly, 1000 rubles. you can return from the budget.

Situation 3. You sold the goods for export and were able to confirm the zero tax rate (clause 1 of article 164, clause 1, 9 of article 165 of the Tax Code of the Russian Federation). Since in this case the VAT calculated at the rate of 0% is equal to 0, then all input VAT related to the export operation can be deducted and claimed for reimbursement from the budget (clause 1 of article 176 of the Tax Code of the Russian Federation).

What you need to do to get a VAT refund

| Situation | What is needed to return (clause 6 of article 78, article 165, article 176 of the Tax Code of the Russian Federation) |

|---|---|

| Submit to IFTS | |

| 1) Submit a VAT declaration to the Federal Tax Service Inspectorate, in which the tax is declared for refund 2) Apply for a tax refund |

|

| 1) Submit a declaration with completed "export" sections for the quarter when the package of documents confirming the 0% VAT rate is collected 2) Submit along with the declaration documents confirming the right to apply a zero VAT rate. Ideally, documents must be collected within 180 calendar days from the date of shipment of goods for export (clause 9 of article 165 of the Tax Code of the Russian Federation). Otherwise, you will have to charge and transfer VAT on export sales at the usual rate. 3) Apply for a tax refund |

You can download the tax refund application form.

For the deadlines for filing a VAT return, see.

VAT will not be refunded without a desk audit

In situations 2 and 3, the inspectors will obligatorily conduct a desk check of the VAT declaration, based on the results of which they will decide whether you have the right to a VAT refund (refund) (clause 8 of article 88, article 176 of the Tax Code of the Russian Federation). In accordance with the latest amendments, the maximum period of an in-house audit specifically in relation to a VAT declaration is generally 2 months from the date of its submission (clause 2 of article 88 of the Tax Code of the Russian Federation).

If the inspectors decide that you do not have the right to a tax refund, you can file objections to the act of a desk audit within one month from the date of receipt of this act (clause 6 of article 100 of the Tax Code of the Russian Federation).

If you don't want to wait 2 months (while the check is being carried out), you can try to reimburse VAT on a declarative basis (Article 176.1 of the Tax Code of the Russian Federation). True, it is available only under certain conditions.

VAT refund period

If office check was successful, the tax will be refunded to you in the following terms.

| Situation | The maximum period for return (clause 6 of article 78, clause 2, 7, 8, 11.1 of article 176 of the Tax Code of the Russian Federation) |

|---|---|

| The overpayment arose due to amounts overly transferred to the budget | 1 month from the date of receipt of the tax refund application by the Federal Tax Service Inspectorate |

| The amount of deductions exceeds the amount of VAT charged | - if an application for a refund was submitted before the Inspectorate of the Federal Tax Service made a decision on compensation, then 2 months and 12 working days from the date of filing a declaration with the amount of tax to be refunded - if an application for a refund is submitted after a positive decision of the Federal Tax Service Inspectorate, then 1 month from the date of receipt of such an application |

| Export sales of goods |

If the tax authorities violated the VAT refund deadline

Then, for each day of delay, they must pay interest, the amount of which depends on the amount due to be returned, the period of delay and the refinancing rate of the Central Bank in effect during this period.

Interest is accrued on the day of the actual tax refund (Letter of the Federal Tax Service dated 08.02.2013 No. ND-4-8 / [email protected]).

Don't miss the deadline for VAT refunds

A certain period is set aside for the return (refund) of the tax.

There is no point in contacting the Inspectorate of the Federal Tax Service outside these deadlines - the tax authorities will deny you a VAT refund. And the courts will support them in this (

What is VAT?

VAT is a tax; part of the price for any product, service or work created at any stage of the procedure for the production of a product grid and other things is withdrawn to the state budget. Submitted to the budget in the course of production.

- Primary requirements;

- Specificity of the tax payer;

- Additional questions along the way;

- Ordinal program for reimbursing the state budget.

To apply the right to a VAT refund, the payer needs to correctly calculate the amount of tax deduction, the amount of which will be displayed in the declaration.

Taxpayer requirements for VAT refunds

By reimbursing sum of money, the taxpayer must adhere to latest version Tax Code of the Russian Federation. It, in turn, states that it is necessary to apply tax withholding when filling out the relevant documentation (declaration responsible for paying taxes).

With this in mind, the tax deduction is considered part of the cost that provides for the reduction in tax required to pay.

In order to make it possible to apply the right to a tax refund, the payer is obliged to calculate the amount of the payment as correctly as possible. The amount of the debt will be written in the corresponding declaration.

A tax deduction is the value of VAT that is matched against the documentation with the taxpayer and the services provided.

Including the option of refunding VAT with the help of an institution that independently deals with this issue. Especially when it comes to fulfilling the duties of an agent in charge of tax payments.

Although, in order to return the amount of taxes, the payer must clearly know his rights and confirm this, based on Article 172 of the Tax Code of the Russian Federation.

Reimbursement of VAT is a very time-consuming and difficult process that requires special attention and focus.

This refund format can be explained only as variations in payment government subsidies... They have an impact both on the progressiveness of business in the country and help to increase the supply of the import commodity net.

Basic rules for VAT refunds in the Russian Federation

VAT is refunded in relation to the rules that were established by 21 chapters of the Tax Code of the Russian Federation. Considering this, it is worth paying attention to these payments so as not to confuse anything and return the overpaid tax amount... This is due to the fact that the order of payment of funds differs significantly from them.

The first option provides for a refund by the payer of taxes paid by suppliers, while advances are refunded, your money is returned.

Applying for a refund taxable period should take place in parallel with the issuance of the declaration.

If at the end of the verification of the relevant documentation no errors are found, then the Federal Tax Service will take the application for consideration as quickly as possible.

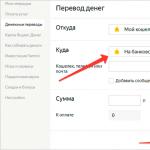

Regarding the application form, the legislation allows you to submit it by e-mail, if you comply with all the requirements, namely an enhanced digital signature.

When an application is submitted to a taxpayer, the most top-notch nuances are necessarily indicated, taking into account the individual account details when it comes to refunding money.

In the event that the applicant wants the amount to be transferred in the future, then a specific percentage of tax from the amount paid should be calculated.

When submitting an application, you should also focus on the tax payment period in which the refund amount will appear.

VAT refunds: who can benefit?

VAT refunds can be made by both firms and private entrepreneurs who are in the process of taxation and are officially considered taxpayers.

Regarding businesses and individual entrepreneurs that the UPS chooses, it is worth saying that they do not have the right to deal with the payment of taxes.

There are various types of VAT refunds, there are 4 in total:

- return of internal tax investments;

- import tax refunds;

- export return;

- tax refund in the process of performing some specific acts.

The tax is refunded in various ways:

- according to the general order;

- as quickly as possible;

- automatically.

The specificity of the taxpayer is as follows:

The VAT payer is obliged to be registered with the general system.

The laws require clear specific conditions, which in turn give a guarantee to the taxpayer that he will in any case receive the right to withhold taxes, namely:

- purchased products that are based on tax refund conditions. It is imperative to keep records in the accounting department;

- suppliers are required to pay for the entire list of goods;

Individual

As for an individual, the legislation of the Russian Federation allows tax refunds. But there is one condition, this is the purchase of foreign products, after which the taxpayer must return to Russia.

Entity

As mentioned earlier, private entrepreneurs can also use tax withholding if they wish. If they are considered taxpayers. Considering this factor, all the nuances that arise during this process are equally treated as legal entities, and to SP.

Tax refund program

When an applicant wants to get his money back, he should be aware that he will have to provide the following documentation:

- bank statements;

- initial documents;

- registration logs;

- book of sales and purchases;

- copy of the commission agreement;

- specific invoices.

How are VAT refund documents processed?

It happens that an institution uses an operational tax refund method, as stated in Article 176 of the Tax Code of the Russian Federation.

The taxpayer may well want to make the payment in the future. For this, there is a detailed sequence of actions. Until the verification process is completed, there will be no tax refunds.

There is one important condition, which indicates that in order to issue a preferential treatment, it is necessary to pay, starting from ten billion rubles in tax for three years before submitting the declaration itself.

Given this, the amount will be calculated for such types of taxes as:

- profitable tax;

- collection of excises;

- Severance tax;

The benefit regime applies in the same way. This happens with institutions that have a guarantee from the bank that taxes will be refunded.

This is argued by the fact that if the application written by the payer is refused, the budget money will be returned due to the fact that there is a guarantee.

Although, the legislator decided to stipulate several basic requirements for it, given:

- The warranty will be valid for at least eight months from the date of submission of the declaration;

- The tax deduction number must be covered by the appropriate amount to be refunded.

The application is submitted in order to apply the operational method after five days, this is considered the deadline from the date of filing the declaration. Documentation should include details bank card the one who will receive the money.

In addition, filing an application forces the taxpayer to have obligations such as refunding the funds he has received. This will happen if the check results in a refusal.

Other requirements

Registered persons who are taxpayers who have not performed taxation operations for twelve months, but no more, cannot refund the tax.

Step-by-step VAT refund scheme

The basic ordinal concept of a tax refund consists of the following:

- it is initially necessary to submit an appropriate declaration;

- camera check;

- the body of the Federal Tax Service must make a decision on the refund of VAT.

- the money must be transferred to the taxpayer from the Federal Treasury.

Additionally, the tax refund can include:

- when the stage of verification by the camera begins, all kinds of explanations are provided regarding the amendments to the documents;

- The Federal Tax Service must decide to submit a protest against the tax audit act;

When the FTS approved the tax refund, then:

- begin to dispute over the decision made by the Federal Tax Service;

- the same process is accepted for consideration in an arbitration court;

- production is started by performers.

In order to make it clear how the disputes go, the bodies that deal with tax issues should contemplate a diagram that will depict all the step-by-step actions.

Automatic tax refunds carry items such as:

- the institution cannot go through the bankruptcy process;

- the tax payer is engaged in procedures that have a specific weight during the year and in aggregate accounts for about forty percent of the total amount of supplied products;

- tax invoices foreshadow the amount to be returned at about 10 percent;

- the standard salary increased 2.5 times over the year;

- the taxpayer has no arrears in payments;

- the number of employees who are officially employed in any institution is 20 people per year.

How is the declaration filed?

If you pay attention to the generally accepted rules, then the declaration must be submitted to the authorities responsible for taxes.

In the case when a taxpayer is faced with the issue of VAT refund for a certain fixed period of time, then the declaration indicates:

- the amount of taxes, which is determined depending on the amount of products sold;

- the amount of VAT that must be fulfilled by default;

- the amount of taxes that must be presented as a result.

VAT is also paid under the STS, based on article 346.11 of the Tax Code of the Russian Federation, according to the standards of which, organizations that work on the STS are not recognized as VAT payers, in addition to situations when:

- products are imported to Russia;

- tax referred to in article 174.1 of the Tax Code of the Russian Federation.

In addition, VAT under the simplified tax system must be paid to tax agents for all services performed. You will have to move along the same lines when you need to issue your invoices, on which VAT will be clearly expressed.

Cases in which "simplified" are regarded as agents can be clearly seen in 161 of the Tax Code of the Russian Federation. So it is said about the export of products abroad, the performance of sale and purchase transactions and the lease of state property.

How do you issue an invoice with VAT instead of documentation without VAT?

There are situations when the “simplified person”, at the request of the buyer, has to issue an invoice, where VAT will be clearly indicated, despite the fact that the agent is not really obliged to do this.

The final stage of the tax refund process

Upon completion of the results of the inspection using the camera, the tax authority will be forced to determine for itself one of the decisions, on the basis of which it will either refund VAT or refuse to return it. This is indicated in the order of the Federal Tax Service of 2007.

Terms for which you need to return tax

Terms can vary from 3 to 12 days. There is a separate situation for each term. For example, a period of three days implies an automatic mode, a period of 5 days is responsible for an accelerated VAT refund scheme, and a 12-day period is considered general order as standard.

To complete the results, it is required to refund the tax in the most ordinary situation for a period of a week, and to send money, the taxpayer will be assigned a period of 5 days.

Based on the results of how the Federal Tax Service will consider the application, the applicant will be sent back the amount that must be returned or refused to be returned.

If no violations were found, the tax inspectorate will send a notification to the bank in order to receive a guarantee from the bank.

For operations for the export of goods, as well as for international transportation and many other services and work related to foreign economic activity, the legislator has established a VAT rate of 0%, provided submission to the tax authority of a certain set of documents confirming the export operation.

At the same time, the taxpayer is given the right to deduct VAT that was charged to him when purchasing goods, works, services involved in export operations or paid when importing goods into the territory of the Russian Federation. As a result, the amount of VAT refund may be generated.

Are there any risks involved?

Potential risks are in the area of VAT deduction confirmation. If the right to a tax refund is declared in the VAT declaration, the tax authority has the right to demand from the taxpayer documents confirming the legality of the application of tax deductions (clause 8 of article 88 of the Tax Code of the Russian Federation). Especially carefully the tax authority checks the reality of the commission business transaction on the acquisition of goods (works, services).

When conducting an audit, the tax authorities, as a rule, request information from supplier counterparties to verify the reality of the transaction. A relationship with an unreliable counterparty can be one of the reasons for refusing VAT refunds. To reduce risks, you need to carefully approach the verification of your counterparties and paperwork.

VAT refund procedure (what is necessary for this)

Speaking simple language the right to a VAT refund arises when the amount of VAT deductions becomes more than the amount of the calculated tax. Most often this happens during export operations (as a result of the application of the 0% rate). However, in the domestic market, a situation is possible when the amount of deductions exceeds the VAT on sales.

To refund the VAT indicated in the declaration, you must submit an application for the refund or offset of VAT. At the request of the inspection, you need to be ready to submit a full set of documents confirming the amount of deductions declared in the declaration. On the basis of the declaration, the inspectorate conducts a desk audit and, if it does not reveal any violations, makes a decision on VAT refunds.

To return the entire amount of VAT declared for refund, the taxpayer must not have tax arrears. Otherwise, the refundable VAT will be credited against the specified amount, and only the unrequited part can be returned to the taxpayer.

What documents are required for VAT refunds?

If the VAT declaration contains transactions subject to VAT at a rate of 0%, then in order to confirm the zero VAT rate, simultaneously with the submission of the declaration, the taxpayer must attach a package of documents confirming the right to a zero tax rate. The list of such documents is given in article 165 of the Tax Code of the Russian Federation and depends on the type of foreign economic operation.

The list of documents that confirm the legality of the claimed deductions, and therefore the amount of VAT to be refunded, is indicated by the tax authority in the Requirement for the submission of documents. As a rule, the tax authorities demand:

- contract;

- source documents;

- invoices;

- sales book;

- shopping book.

What is the term for VAT refund?

To check the declaration the tax authority is assigned 2 months... But in the event that the inspectors find signs indicating possible errors and violations, the in-house inspection of the VAT declaration can be extended up to three months on the basis of the decision of the head (deputy) of the Federal Tax Service Inspectorate (clause 2 of article 88 of the Tax Code of the Russian Federation).

If no violations are found, within 7 working days after completion of verification the tax authority decides on the refund.

Wherein the term of the actual tax refund will depend on the moment you send your application for a refund:

- if such submit an application before making a decision on reimbursement, for example, together with a VAT declaration, then the inspection will have to make a decision on the return (offset) simultaneously with the decision on the VAT refund. The next day, she will send an order to the Treasury for a tax refund, and the Treasury will return the tax within five working days to the taxpayer's account ( Clauses 7 and 8 of Article 176 of the Tax Code of the Russian Federation).

- if the application will be submitted after the decision has been made for a refund, then the inspection will have another month to return ( clause 11.1 of article 176 of the Tax Code of the Russian Federation).

Now there is also possibility of accelerated VAT refund, before the completion of the verification of the declaration - on the basis of the declarative procedure (Article 176.1 of the Tax Code of the Russian Federation). This opportunity can only be used by taxpayers who meet certain requirements, including total amount taxes paid for the last 3 years (at least 2 billion rubles), or subject to the provision of security in the form bank guarantee or surety of a "very respectable" taxpayer.

Most the right way to avoid problems and make the VAT refund procedure the most comfortable - contact the professionals. Lawyers of Pravovest Audit LLC have many years of experience in supporting VAT refunds. They will help you in forming a set of documents and interacting with the inspection, they will competently guide you through all the stages of VAT refunds.