Regulations and documents. Main banking regulations Other terms of service

1. Working hours structural units Bank, during which the acceptance of settlement documents of clients is made for their execution by the Bank, it is established:

For the Foreign Exchange Department of the Head Office: from 9:00 am to 4:30 pm with a lunch break from 13:00 to 14:00;

For additional and operational offices of the Bank: in accordance with the operating day of each internal structural unit.

from 09.00 to 11.00

Sale by the Bank at the expense of its own funds foreign currency to the client

from 09.00 to 15.30 hours

Sale of foreign currency, including mandatory sale, in cases stipulated by foreign exchange legislation, on the interbank currency exchange on behalf of the client

from 09.00 to 11.00

Purchase by the Bank using its own funds in russian rubles foreign currency at the client

from 09.00 to 15.30 hours

from 09.00 to 15.30 hours

4. Features of cash withdrawal money in

foreign currency through the Bank's cash desks

|

4.1. Cash withdrawal broken down by banknotes at the disposal of the Bank at the time of cash withdrawal of foreign currency is carried out at the established opening hours of the Bank's cash desks in the following order: 4.1.1. For amounts subject to withdrawal and not exceeding 00 US dollars or euros, - withdrawal of funds is made on the current banking day without prior notification from the client; 4.1.2. For amounts subject to and exceeding USD or EUR 00, as well as for any amount in a freely convertible currency other than USD or EUR, funds are issued on the next banking day, subject to prior submission of an application to the Bank by 11 00 hours of the day preceding the receipt of funds at the Bank's operating cash desk. The specified Application for receiving cash in foreign currency can be drawn up by the client both in writing and sent by phone. The telephone number for accepting Applications at the Head Office of Ellipse Bank is set as follows:. |

5. Other terms of service

5.1 Payment for the Bank's services for settlement and cash servicing of the Bank's clients in foreign currency in accordance with these Tariffs is charged by the Bank no later than the business day following the day of the transaction, the provision of the service, except for cases directly provided for by the provisions of individual clauses of these Tariffs.

The provision of services by the Bank, the conduct of operations on behalf of the client are subject to payment by the client in the amount and in the currency established by these Tariffs. In case of insufficient funds in the Client's Account in the currency in which this or that operation was carried out, this or that service was provided, payment for By the Bank, transactions on behalf of the client or the provision of services by the Bank is charged by the Bank in Russian rubles at the expense of the balance of funds on the client's current account in Russian rubles, or in a foreign currency other than the currency of the commission established by these Tariffs ( set payment for the services of the Bank), from another Client Account with Ellips Bank in the equivalent converted using the currency rate of the commission (payment for the Bank's services) to the Russian ruble or using the cross rate of the respective foreign currencies at the official quotations of the Central Bank of the Russian Federation, effective on the day the payment is due.

5.2. Commissions and expenses of correspondent banks are subject to compensation by the client in cases stipulated by the conditions conducting individual transactions by the Bank, no later than the business day following the day the Bank receives the corresponding notification from the correspondent bank in the same currency in which the transaction was performed. In case of insufficient funds in the client's account in the currency in which this or that operation was carried out, the commissions and expenses of correspondent banks are subject to compensation either in Russian rubles at the expense of the balance of funds on the client's current account in Russian rubles, or in a foreign currency other than from the currency of withheld commissions or expenses of the correspondent bank subject to compensation from another Client Account with Ellips Bank in the equivalent converted using the exchange rate of the correspondent banks' commissions to the Russian ruble or using the cross rate of the corresponding foreign currencies at the official quotations of the Central bank Russian Federationeffective on the day of claiming compensation for commissions and expenses of correspondent banks.

5.3. In the absence of client accounts in foreign currency with Ellips Bank, payment for the Bank's services when purchasing foreign currency for Russian rubles in the foreign exchange market on behalf of the client with the subsequent transfer of the acquired foreign currency to the client's account in another bank, as well as payment for foreign currency transfer is charged by the Bank in Russian rubles in a non-acceptance manner no later than the business day following the day of the service (operation) at the expense of funds on the client's current account in Russian rubles in the amount established by these Tariffs, based on the equivalent converted using the rate of the currency in which the payment for the Bank's services is set to the Russian ruble at the quotation of the Central Bank of the Russian Federation in effect on the date of payment.

5.4. In the absence of the Client's accounts in foreign currency with Ellips Bank, the Bank will charge the Bank in Russian rubles without acceptance for an operation to transfer funds in foreign currency provided by the Bank as a loan to the client's account in another bank on his behalf. on the business day following the day of the foreign currency transfer operation, at the expense of funds on the client's current account in Russian rubles in the amount established by these Tariffs, based on the equivalent converted using the exchange rate in which the payment due to the Bank is established, to Russian ruble at the quotation of the Central Bank of the Russian Federation in effect on the day the payment is due.

5.5. In case of cancellation or revocation of a payment document received by the Bank, the amount collected as payment for the Bank's services, as well as the amount collected as compensation to the Bank for commissions and expenses of correspondent banks, are not refundable.

5.6. When transferring funds received after closing the Account, the payment for carrying out the corresponding operation by the Bank is withheld on the day of transfer.

5.7. In the event of a refund of funds for the transfer due to incomplete or unclear instructions and provided that the reason for such a refund is not erroneous actions Bank, the amount collected as payment for the execution of the said operation by the Bank is non-refundable.

5.8. All commission fees and expenses of correspondent banks, which the Bank bears when executing client orders related to transactions on the latter's Account with Ellips Bank, are compensated by the client at their actual cost for each transaction in cases directly provided for by the provisions of individual clauses of these Tariffs.

5.9. These Tariffs apply to standard banking transactions and services. At the same time, the Bank may, on the basis of a separate agreement with the client, provide on a paid basis additional types of services that are not provided for in these Tariffs, as well as change the size of the tariff rate for a separate operation by agreement with the client.

The rates of these Tariffs are applied only to those operations and services, the execution of which is carried out in the usual procedure for banking practice. If the Bank's performance of a particular operation, the provision of a particular service on behalf of the client requires additional costs or additional volume of work, the Bank reserves the right to charge an additional commission, about which the client will be notified in advance.

5.10. The Bank has the right to unilaterally change, supplement or cancel these Tariffs. Bank rates in new edition (with amendments and additions made) within the period established by the agreement of a bank account in foreign currency between a credit institution and a legal entity (resident of the Russian Federation / non-resident of the Russian Federation), are posted for review on the Ellipse Bank website on the Internet, and are also posted in the premises of the Bank for work with clients.

5.11. The Bank is not responsible for the late notification of customers about changes in these Tariffs in the event that the need for such changes was caused by the requirements of regulatory legal acts of the Bank of Russia or other regulatory bodies.

Business processes and the management system of a modern bank are so complex that one cannot do without their mandatory documentation. Each organization develops its own set of internal regulations, nevertheless, such of them as the regulation on the organizational structure, divisions, job descriptions specialists, credit policy, banking risk management policy, interest rate policy, internal control rules in order to counter legalization (laundering) of proceeds from crime ", and terrorist financing, information security policy, are relevant for most banks.

The main task of internal regulatory documents is to improve the manageability and controllability of organizational, technological and accounting processes and to prevent non-compliance with the requirements of regulatory bodies, as well as incorrect, unacceptable or even dangerous actions for the bank by employees. Internal regulatory documents are approved by the head of the credit institution and are mandatory for all employees of the bank.

Let us dwell in more detail on the description of the most important of the internal documents (such accounting regulations as accounting policy, document processing technology, etc., will be considered separately), presenting approximate options for their design. From a practical point of view, this is important, since there are still no generally accepted and approved standards for the forms of internal regulations of banks, and each of them solves this problem for itself independently, without coordinating the adopted form with similar already existing ones.

More on the topic Regulations and documents:

- 2.5. Regulations for the interaction of participants in the investment process when forming an investment program

which banking professionals often use in their speech

date of publication: 04/26/2013

update date: 10.04.2019

Bankers know very well regulationsthat regulate their activities. These documents are re-read in the bank many times, depending on the complexity of the operations and the appearance of new ones. Moreover, in Russia laws, instructions and regulations are constantly undergoing changes, often very significant, and you have to re-read the documents. And the numbers of these documents are quickly remembered. Behind these numbers stands a whole era of development of banking in Russia and a huge amount of knowledge that regulates the entire range of banking operations.

In this regard, in order to shorten the mention of any normative act in his speech bank employees they call only the number of the document, without using either its name, or about anything it... It is absolutely clear to dedicated specialists about what it is, and what it is, and why it was mentioned.

To introduce the uninitiated into banking, ProfBanking publishes a list of the main documents governing banking and gives a brief annotation to each regulatory act.

If you want to see all documents on banking and their texts, go to the banking library.

Main regulations governing banking:

395-1 - main the federal law about banks and banking, gives the concept of “ credit organization"," Bank "," non-bank credit organization "," banking group "," bank holding "," banking operations "," deposit "," depositor ", sets the minimum authorized capital bank, qualification requirements for bank managers, contains the rules on the registration of credit institutions and their licensing, as well as the grounds for revoking the bank's license, especially the reorganization and liquidation of banks. This law, of course, should be known to every bank employee.

Federal Law No. 395-1 dated 02.12.1990 "On Banks and Banking Activities"

86-FZ - the law on The central bank Of the Russian Federation, establishes the functions of the Central Bank of the Russian Federation, describes the governing bodies of the Bank of Russia, reporting requirements for the Bank of Russia, determines monetary unit Russia, basic tools and methods monetary policy, the right of the Central Bank of the Russian Federation to carry out certain operations, and also concerns the norms of banking regulation and banking supervision. Every bank employee should know this law.

Official details of the regulation:

Federal Law No. 86-FZ of July 10, 2002 "On the Central Bank of the Russian Federation (Bank of Russia)"

579-P - Chart of accounts accounting in the bank and the rules for reflecting transactions in the bank's accounting (until April 03, 2017, Regulation No. 385-P was applied, but it was canceled).

Official details of the regulation:

Regulation of the Central Bank of the Russian Federation No. 579-P dated February 27, 2017 "On Chart of accounts of accounting for credit institutions and the procedure for its application »

Take training on the video course "Fundamentals of accounting in a bank"

to once and for all understand banking and all accounting terms

153-I - the most important document on the rules for opening and closing all types of bank accounts opened by individuals, legal entities, entrepreneurs: current, settlement, correspondent and other accounts. The instruction also applies to accounts for keeping records of deposits (deposits) and deposit accounts of courts, divisions of the bailiff service, law enforcement agencies and notaries. The instruction contains a list of documents required for opening each account, requirements for conducting a client's legal case, drawing up a card with sample signatures and a seal imprint.

Official details of the regulation:

Instruction of the Central Bank of the Russian Federation No. 153-I dated May 30, 2014 "On opening and closing bank accounts, deposit accounts, deposit accounts"

161-FZ - the law on national payment system... This law is a new round in the development of the settlement system in the Russian Federation. It establishes the legal and organizational framework of the national payment system, regulates the procedure for the provision of payment services, including the implementation of the transfer of funds, the use of electronic means of payment, the activities of the subjects of the national payment system, and also determines the requirements for the organization and operation of payment systems, the procedure for exercising supervision and observations in the national payment system.

Official details of the regulation:

Federal Law No. 161-FZ of June 27, 2011 "On the National Payment System"

383-P - The Regulation of the Central Bank of the Russian Federation, establishing the rules for the transfer of funds by credit institutions in rubles of the Russian Federation through bank accounts and without opening bank accounts. Regulation No. 383-P was developed on the basis of Law 161-FZ "On the National Payment System" and establishes the following forms of cashless payments: settlements by payment orders; by letter of credit; collection orders; by checks; direct debit; in the form of an electronic money transfer.

Money transfers can be executed by orders in the form of: payment order, collection order, payment request, payment order. The forms of these documents are given in the annexes to Regulation 383-P.

Official details of the regulation:

Regulation of the Central Bank of the Russian Federation No. 383-P dated June 19, 2012 "On the rules for transferring funds"

180-I - one of the most important Instructions of the Central Bank of the Russian Federation, establishing the methodology for calculating the mandatory ratios of banks. The instruction sets 12 mandatory standards, each of which must be observed by the bank on a daily basis (until July 28, 2017, Instruction No. 139-I was applied, but it was canceled).

Official details of the regulation:

Instruction of the Central Bank of the Russian Federation No. 180-I of June 28, 2017 "On mandatory standards for banks"

595-P - Regulation that regulates the rules for participants in the payment system of the Bank of Russia (PS BR). In addition, Regulation 595-P introduced a new structure of the BIK and the procedure for its assignment, but for existing banks the BIK remains the same.

Official details of the regulation:

Regulation of the Central Bank of the Russian Federation No. 595-P dated 06.07.2017 "On the payment system of the Bank of Russia"

507-P - the regulation on the FOR (FOR - the reserve of required reserves): how to calculate the amount of required reserves, the procedure for regulating the FOR, the procedure for compiling and submitting to the Bank of Russia the calculation of required reserves

Official details of the regulation:

Regulation of the Central Bank of the Russian Federation No. 507-P dated 01.12.2015 "On the obligatory reserves of credit institutions"

590-P - one of the most important and complex regulations of the Bank of Russia; establishes the procedure for classifying loans by quality categories, taking into account the financial position of the borrower and the quality of debt servicing, determines the boundaries of the amount of the estimated reserve as a percentage of the principal amount, the specifics of the formation of the reserve for loans on portfolios of homogeneous loans, the procedure for writing off bad debts by the bank. Required document to work with loans, discounted bills, securities for transactions with deferred payment or delivery, factoring requirements (until July 14, 2017, Regulation No. 254-P was applied, but it was canceled)

Official details of the regulation:

Regulation of the Central Bank of the Russian Federation No. 590-P of June 28, 2017 "Regulation on the procedure for the formation by credit institutions of reserves for possible losses on loans, on loan and equivalent debt"

611-P - a document on the classification of other (not related to loans under 590-P) elements of the calculation base in order to form a reserve for possible losses.

Official details of the regulation:

Regulation of the Central Bank of the Russian Federation No. 611-P dated October 23, 2017 "On the procedure for the formation of reserves for possible losses by credit institutions"

4927-U - did you know that each commercial Bank provides the Bank of Russia with several dozen different reports on its activities on a quarterly, monthly, ten-day, daily basis? This document establishes reporting forms for credit institutions. A very voluminous regulation. Contains not only the forms of reports, but also the order of preparation and presentation of each report.

Official details of the regulation:

Bank of Russia Ordinance No. 4927-U of 08.10.2018 "On the List, Forms and Procedure for Compiling and Submitting Reporting Forms for Credit Institutions to the Central Bank of the Russian Federation"

646-P- establishes a methodology for determining the amount of a bank's capital, taking into account international approaches to increasing the stability of the banking sector (Basel III) The amount of equity (capital), determined in accordance with Regulation 646-P, is used to determine the values \u200b\u200bof mandatory ratios, as well as in other cases when the indicator of the credit institution's equity is used to determine the value of prudential standards of activity.

Official details of the regulation:

Regulation of the Central Bank of the Russian Federation No. 646-P dated 04.07.2018 "On the methodology for determining the equity (capital) of credit institutions (" BASEL III ")"

178-I - sets the size (limits) of open currency positions, the methodology for calculating them, and the specifics of overseeing their compliance.

Official details of the regulation:

Bank of Russia Instruction No. 178-I of December 28, 2016 "On setting the size (limits) of open foreign exchange positions, the methodology for calculating them, and the specifics of supervising their compliance by credit institutions"

148-I - a normative act concerning issues of issuing shares and bonds commercial banks, preparation of a prospectus of securities, registration of securities issue by banks.

Official details of the regulation:

Instruction of the Central Bank of the Russian Federation No. 148-I of December 27, 2013 "On the procedure for issuing securities of credit institutions on the territory of the Russian Federation"

135-I - a large and complex normative act concerning the issues of state registration of banks and issuing licenses to them. This document is well known to the bank's legal service and the bank's management. Describes all types of banking licenses, general requirements to the founders of the bank, to the list of documents submitted to the Central Bank of the Russian Federation for obtaining licenses, to the opening and closing of branches by banks, to the reorganization of the bank.

Official details of the regulation:

Instruction of the Central Bank of the Russian Federation No. 135-I dated 02.04.2010 "On the procedure for the Bank of Russia to make a decision on state registration of credit institutions and issuance of licenses for banking operations"

242-P - a document on internal control in the bank, what is the need for an internal control system in the bank, how to organize it.

Official details of the regulation:

Regulation of the Central Bank of the Russian Federation No. 242-P dated 16.12.2003 "Regulation on the organization of internal control in credit institutions and banking groups"

115-FZ - federal law aimed at creating a mechanism for combating money laundering and financing of terrorism. To the unusual functions that banks have, this law added one more - the function of mandatory control over dubious transactions with the obligation to submit information about them to Rosfinmonitoring. Since the adoption of the law in 2001, a lot has changed in the work of banks: full-fledged internal services have appeared, dealing only with issues of countering legalization, voluminous internal documents of the bank have been written on countering legalization, questionnaires have been developed for clients, for beneficiaries, special software systems and communication channels have been introduced ...

Official details of the regulation:

Federal Law No. 115-ФЗ dated 07.08.2001 "On Counteracting the Legalization (Laundering) of Criminally Obtained Incomes and Financing of Terrorism"

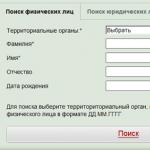

499-P - this is the procedure for identifying clients in order to comply with the provisions of Law 115-FZ.

Official details of the regulation:

Regulation of the Central Bank of the Russian Federation No. 499-P 10/15/2015 "On the identification by credit institutions of customers, customer representatives, beneficiaries and beneficial owners in order to counter the legalization (laundering) of proceeds from crime and the financing of terrorism"

39-FZ - the main regulatory act on the securities market and activities professional participants the securities market; the law establishes the concepts of “equity security”, “share”, “bond”, “issuer's option”, “issuer”, “registered equity securities"," Documentary form "," non-documentary form "," state registration number of the issue "," public offering of securities "," listing of securities "," brokerage activities "," dealer activities "," securities management activities ", "Depository activities" and others.

Official details of the regulation:

Federal Law No. 39-ФЗ dated April 22, 1996 "On the Securities Market"

Geneva Convention or (Bill of Exchange) - an international normative act concluded in Geneva in 1930, which entered into force for the USSR in 1937 and extends to Russia by succession. Refers to special bill of exchange legislation and establishes uniform norms and requirements for the registration of bills and bill circulation for states that have acceded to the Convention. Despite the fact that promissory notes in Russia are regulated not so much by the Geneva Conventions as by the Decree of the Central Executive Committee and the Council of People's Commissars of the USSR dated August 7, 1937 No. 104/1341 "On the introduction of the provision on the transfer and promissory note», Practically repeating the norms of the Geneva Convention, to work with bills you must know both documents very well.

Official details of the regulation:

645-P- the rules for the issuance and execution by banks of certificates of deposit and savings certificates, also includes the requirement for the mandatory registration of the conditions for issuing savings and deposit certificates of credit institutions with the Bank of Russia.

Official details of the regulation:

Bank of Russia Regulation No. 645-P dated 03.07.2018 "On savings and deposit certificates of credit institutions"

ProfBanking has prepared free mini-tests especially for you:

173-FZ - the law on the monetary policy of Russia, introduces the concepts of "domestic securities", "foreign securities", "residents", "non-residents", " currency operations"And enshrines the basic principle of foreign exchange legislation:" everything is prohibited, except for what is directly permitted. " The law is very important for banks, since banks are entrusted with the function of agents of foreign exchange control.

Official details of the regulation:

Federal Law No. 173-FZ of 10.12.2003 "On Currency Regulation and Currency Control"

177-FZ - the law on insurance of deposits in banks, defines the basic principles of insurance of deposits, participants in the insurance system, which deposits are insured, an insured event, the amount of compensation for deposits in a bank, the competence of the Deposit Insurance Agency, requirements for banks participating in the deposit insurance system, the procedure for calculating and payment by banks of insurance premiums to the Agency's account with the Bank of Russia.

Official details of the regulation:

Federal Law No. 177-FZ of 23.12.2003 "On Insurance of Deposits in Banks of the Russian Federation"

630-P - determines the order of maintenance cash transactions banks with cash rubles in the implementation of banking operations and other transactions, the procedure for working with questionable solvency banknotes Bank of Russia banknotes, insolvent banknotes of the Bank of Russia, the presence of signs of forgery which does not raise doubts among the cashier of a credit institution, and also establishes the rules for storing, transporting and collecting cash in credit institutions in the territory of the Russian Federation.

Official details of the regulation:

Bank of Russia Regulation No. 630-P dated January 29, 2018 "On the procedure for conducting cash transactions and the rules for storing, transporting and collecting banknotes and coins of the Bank of Russia in credit institutions on the territory of the Russian Federation"

View the texts of the current regulations

by banking in our

2054-U - establishes the procedure for conducting cash transactions in authorized banks with banknotes of foreign states.

Official details of the regulation:

Ordinance of the Central Bank of the Russian Federation No. 2054-U dated August 14, 2008 "On the procedure for conducting cash transactions with foreign currency in cash in authorized banks on the territory of the Russian Federation"

266-P - establishes the procedure for issue on the territory of the Russian Federation bank cards credit institutions and the specifics of carrying out transactions with payment cards, the issuer of which may be a credit institution, foreign bank or a foreign organization.

Official details of the regulation:

Regulation of the Central Bank of the Russian Federation No. 266-P dated 24.12.2004 "On the issue of payment cards and on transactions performed with their use"

In an accessible language about the work of a modern commercial bank:

main distance course ProfBanking

A REAL PEARL IN THE SEA OF BANKING COURSES