Investing in cryptocurrency: how to invest money correctly. How to invest in cryptocurrency and what projects are interesting for investment? Cryptocurrency investment course

- Bitcoin vs Ether: which cryptocurrency is better

- Which cryptocurrencies showed the best growth statistics in 2017

- Forecast for 2018: the best cryptocurrencies to invest in

- Which cryptocurrency is better to mine

- Which cryptocurrency is better to trade

Cryptocurrencies became the opening of the outgoing 2017 for millions of people. Although the first digital coin - bitcoin - appeared almost nine years ago, it is only now that it has become a world famous and recognized financial instrument.

Those who invested in bitcoin at the time of its appearance (when more than 1,300 bitcoins were given for the dollar) and saved their coins, have already made a fortune on this, because by the end of 2017 the rate had grown 14 million times and exceeded $ 11,000. But the possibility of earning income in this area is still there, because according to most experts, this is not the limit - over time, bitcoin can grow to $ 400,000.

The status of bitcoin in the legal field has not yet been determined. They are not recognized as a currency or a means of calculation, but are easily converted to rubles at the current exchange rate. The issue of regulating this market is currently being discussed in the Government and, most likely, in 2018, bitcoins will be legalized.

Over the course of a year, the bitcoin rate has grown from 1,000 to 11,000 dollars, and 5 years ago, bitcoin cost only 10 dollars. Ether, dash, litecoin and other coins are growing well. Investments in cryptocurrencies have already made many investors millionaires - it is now the fastest growing investment niche... We will now talk about which cryptocurrencies are worth buying and how to make money in this market.

Bitcoin vs Ether: which cryptocurrency is better

The most famous cryptocurrencies in the world are Bitcoin (BTC) and Ethereum, or Ether (ETH). Bitcoin appeared in 2009 and didn't get much attention at first. Its founder called himself Satoshi Nakamoto, and the world still does not know who was hiding behind this name or pseudonym. Bitcoin has been holding the leadership for 9 years, remaining the most famous and most expensive coin. By the level of cryptocurrency market capitalization and trading volume, the share of bitcoin exceeds 50%.

Ethereum is a coin that appeared on the basis of the platform of the same name, announced in 2014 and launched in 2015. Most of the tokens that are now going to ICO are created on the basis of Ethereum. This coin is considered an example of one of the most successful blockchain projects, because ether tokens have skyrocketed in value thousands of times since the launch of the ICO. In terms of capitalization, for a long time it firmly held the second place, from which it was recently replaced by the bitcoin fork - Bitcoin Cash.

Each of these cryptocurrencies has its own supporters. Those who choose bitcoin say that it will always remain “the number one cryptocurrency” and “digital gold”, especially since a whole infrastructure has been created for bitcoin - many shops, including such giants as Dell, already accept it for payment. Ethereum proponents talk about the huge potential of the Ethereum platform, which, unlike Bitcoin, is more than just a digital coin.

Both cryptocurrencies have great growth potential. It is unlikely that any other coin will be able to overtake bitcoin in terms of main indicators (rate and capitalization) in the coming years, but it is quite possible that over time, ether will claim to be the first in the cryptocurrency market. Bitcoin and ether are so-called “blue chips” - reliable and time-tested digital coins, so these tokens occupy 50 to 80% of the cryptocurrency portfolio of most investors.

Which cryptocurrencies showed the best growth statistics in 2017

Let's take a look at the best cryptocurrencies of 2017 that have surged in value over the past eleven months. Since cryptocurrencies are characterized by high volatility, their rate can sometimes change significantly even during the day, so the numbers below may differ from the current ones.

Bitcoin (BTC) at the beginning of the year it cost about $ 1,000, in November it crossed the psychological barrier of $ 10,000 and reached 11,000. The exchange rate increased 11 times, and in absolute terms, 1 MTC rose by $ 10,000.

Bitcoin Cash (ВТС or ВСС) This is the most famous bitcoin fork, which appeared on August 1, 2017. Everyone who had bitcoins at the time of the fork automatically received the same amount of bitcoin cash. Over the 4 months of its existence, bitcoin cash has added about $ 1,000 in price and is now estimated at about $ 1,350.

Ethereum (ETH), which at the beginning of the year cost about $ 10, is now estimated at $ 425. Thus, the exchange rate has increased 42 times, 1 ETH has risen in price by 415 dollars.

Ethereum Classic (ETS)- Ethereum fork, which at the beginning of the year cost $ 1.2, is now estimated at about $ 25-27. Over the year, the rate has grown by about 20 times.

Ripple (XRP) at the beginning of the year it cost about 0.4 rubles, now it is estimated at 14.4 rubles. The rate of one coin increased by 14 rubles (35 times)

Litecoin (LTS) at the beginning of the year it cost $ 4, at the end - $ 85. The rate has increased by about 24 times, or by $ 80.

Dash (DASH) at the beginning of the year it cost about $ 15, on December 1 it costs $ 780. Growth - more than 50 times, or $ 765 for 1 token.

Monero (XMR)- in January it cost about $ 13, now - $ 180 per coin. The price has increased by about 14 times.

ZCash (ZEC) at the beginning of the year it cost about $ 40, now - about $ 300. Growth - by $ 260, or 7.5 times.

NEO- this young cryptocurrency appeared in the summer of 2017. Then her rate was $ 7, now - $ 35 (5 times growth in 5 months)

For 11 months of 2017, almost all major cryptocurrencies have grown tenfold. And this once again points to the high earning opportunities in this area.

Forecast for 2018: the best cryptocurrencies to invest in

The cryptocurrency rate is influenced by many factors that can be difficult to predict. These actions include:

- Actions of the Governments of different countries (for example, the legalization of cryptocurrency, its recognition as a means of payment, or the prohibition of ICO).

- Significant changes in financial markets (for example, the expected launch of Bitcoin futures)

- Statements of officials, well-known financiers or large market players.

- Speculative cryptocurrency transactions.

- Any other changes that could dramatically change the demand for Bitcoin in one direction or another.

For example, the ban on ICOs in China in 2017 shook the bitcoin rate quite dramatically - however, it soon went up again. And rumors about the launch of Bitcoin futures, on the contrary, increase the value of cryptocurrency in the eyes of people - as a result, the rate goes up. Sometimes, even the statement of a single person with weight in the world of finance can affect the course. For example, the president of JP Morgan bank often allowed himself extremely harsh negative statements about cryptocurrencies and even threatened to fire employees of his company if they were noticed in transactions with bitcoin. After that, JP Morgan, at the time of the price drop, began to buy financial instruments related to the cryptocurrency. And the rumors that turned out to be false about the death of Vitalik Buterin, the founder of the Ethereum platform, caused a drop in the rate of ether.

For example, the ban on ICOs in China in 2017 shook the bitcoin rate quite dramatically - however, it soon went up again. And rumors about the launch of Bitcoin futures, on the contrary, increase the value of cryptocurrency in the eyes of people - as a result, the rate goes up. Sometimes, even the statement of a single person with weight in the world of finance can affect the course. For example, the president of JP Morgan bank often allowed himself extremely harsh negative statements about cryptocurrencies and even threatened to fire employees of his company if they were noticed in transactions with bitcoin. After that, JP Morgan, at the time of the price drop, began to buy financial instruments related to the cryptocurrency. And the rumors that turned out to be false about the death of Vitalik Buterin, the founder of the Ethereum platform, caused a drop in the rate of ether.

Therefore, no analyst can accurately predict the course change in the long term - there are too many unpredictable factors that can change the course in one direction or another, and any forecast has a large degree of error.

However, experts predict further growth in Bitcoin and other digital coins. This is facilitated by:

- Blockchain proliferation. This technology is increasingly being introduced into our lives - in the medical, financial, banking and other spheres. And the blockchain is the backbone of any cryptocurrency.

- Increasing the level of public confidence. The more people invest in bitcoin, the higher its rate. Since bitcoin is completely decentralized, not controlled by anyone and is not backed by anything, its "security" can be considered the trust of people who "vote" for cryptocurrency in rubles, dollars or any other currency.

- The use of bitcoin in countries where there are problems with the national currency. For example, in Zimbabwe in the fall of 2017, bitcoin was bought (and was in great demand) at a rate of $ 13,000, while the official exchange rate in the world was well below $ 10,000. With the collapse of the financial system of the state, bitcoins became the only alternative that allows the population to save money. In Venezuela, interest in bitcoin is linked to hyperinflation. Since cash settlements in the country are difficult (people would have to carry bags of money with them)

According to various forecasts, in 2018 Bitcoin may grow to 15,000 or even 25,000 dollars. Well-known financial analyst Tommy Lee (brother of Litecoin founder Charlie Lee) considers the price of $ 25 thousand "conservative" for Bitcoin. According to his calculations, this price can be considered fair when investors hold 5% of their savings in cryptocurrency. If this figure is higher, then the rate can reach 100,000 and 200,000 dollars. It is unlikely that this will happen in 2018, but within the next 5-10 years it is quite possible. And the growth of bitcoin “pulls” all other coins from the “top ten” along with it.

When calculating the rate of digital coins, do not forget about the high volatility - at some point, tokens (especially bitcoin) can take off, and at some moments they can lose 10-15% of their price and even more per day, therefore, calculate a certain “average ”The course can be tricky. In addition, Bitcoin grew very actively in the fall of 2017, often adding $ 1000 per week - after that, a slight stagnation or decline is possible. So buying bitcoin now hoping to resell it profitably in a couple of months is quite risky - during this time the rate may rise, or it may remain at the same level or even fall. It is better to consider investing in cryptocurrency as a long-term investment.

Most likely, in 2018, cryptocurrencies will cease to be completely uncontrollable - most states have seriously thought about regulating this market and are preparing appropriate laws. The "legalization" of bitcoins, on the one hand, should help bitcoin to grow in price, on the other hand, after that, the volatility of cryptocurrencies may become slightly lower.

Investing in cryptocurrencies in 2017-2018, it is better to diversify your investments and form a portfolio that will consist of 50-60% of bitcoins and ether, for 20-30% - of other coins related to blue chips (Pipple, Litecoin, Neo , Dash, etc.) and 10-15% from “promising coins” that are risky for an investor.

Which cryptocurrency is better to mine

Long gone are the days when Bitcoin could be mined on a regular computer or even a laptop with a good video card. The explosive growth of interest in this topic has attracted tens of thousands of miners, and the reward has become lower, so now it is profitable to mine bitcoins only on a very large industrial-scale farm. True, there remains an option to invest in cloud mining, but this method should also be taken with caution. Cloud mining is an investment in the productive capacity of someone else's farm, but often these investments are not very profitable for investors, and sometimes fraudsters are hiding under the guise of the owners of the farm. To minimize risks, it makes sense to invest in a real farm that you can see with your own eyes, and not in an abstraction. As for an ordinary home farm of 2-4 video cards, mining bitcoins on such a farm will no longer be profitable.

But on a home mining farm or on a regular computer with a powerful video card, you can mine other coins. In rare cases, you can even mine on a processor (although more often video cards or powerful ic devices are used for these purposes).

The situation in the cryptocurrency market is changing very quickly, and the lists of the most profitable coins for mining are constantly updated. To figure out the best coin for mining, you can use the WhatToMine service.

You will need to drive into the program the type of mining equipment, its capacity and the cost of electricity. After that, the system will calculate your potential earnings from mining a particular cryptocurrency, and you can choose the most profitable coin at the moment.

In 2017, the mining of the following coins showed good results:

- Ethereum

- Ethereum Classic,

- Waves,

- Monero,

- Litecoin.

- Dash,

- Stratic,

- Stellar lumens,

- Ripple

Currency rates are rising rapidly and the situation is subject to change. If you decide to start mining, you need to first assess its profitability so that the cost of electricity does not overlap your earnings.

Which cryptocurrency is better to trade

Another popular way to make money on cryptocurrency is trading on a cryptocurrency exchange. As with any exchange, a trader's earnings (or losses) are determined by the difference between the buy and sell prices.

Cryptocurrencies are traded in pairs on the exchange. On some exchanges (for example, EXMO), you can trade BTC / USD, on some - only in pairs of cryptocurrencies. In 2017, the BTC / ZEC pair was popular at the auction, but since the market situation is changing rapidly, you need to look for a suitable pair at the current time. There is no exact answer to the question of which cryptocurrency is better to trade - more precisely, this answer is constantly changing.

It is also important to remember that beginners never linger with traders. Even if they manage to gain profit in the first days of trading, sooner or later they will lose their money. Trading on the stock exchange is not roulette, but painstaking work that can regularly bring a great income to a trader, but only if you approach the matter professionally.

Investing in digital coins can bring very significant benefits. In recent years, cryptocurrencies have grown much faster than other financial markets, so more and more people are choosing to invest their savings in “digital gold”. If you want to make money on cryptocurrency, diversify your investments and regularly monitor changes in the exchange rate of tokens in order to change the composition of your cryptocurrency portfolio if necessary. Do not rush to sell tokens if the price suddenly goes down. Digital coins are a long-term investment, and after a few years, the value of your portfolio might surprise you.

If you want to know more about investing in digital tokens and learn how to make money in this market, we recommend you go through our free course on cryptocurrencies.

To be honest, it is difficult to find a more profitable direction on the Internet than investing in cryptocurrencies. Are you also interested in this topic? Greetings to everyone who wants to make money on their blog, and now we will figure it out together - is it worth it or not to get involved in cryptocurrencies.

A strong interest in the topic of digital money emerged in 2017. In January of that year, Bitcoin was worth $ 820-960, and in December it crossed the $ 20,000 mark. People started buying up the coin en masse in the hope of hitting a big jackpot from the investment. Bitcoin plummeted in 2018. Now many people doubt whether it is worth investing in cryptocurrency. But those crypto investors who really understand the market continue to make good money. Do you want to know how? Then read the article to the end.

In this article, you will learn:

Is it worth investing real money in cryptocurrency?

Cryptocurrency is a type of electronic money. Now the owners can exchange it for rubles in Yandex Money and Qiwi, Webmoney title units, and then transfer it to the card and cash out. Bitcoin is already used as a means of payment today. For example, you can pay with BTC for goods and services in the following online stores and services of the Russian Federation:

- spbsis.ru - computer equipment (PCs, laptops, video cards, technical accessories, gadgets);

- kokedama.ru - ornamental plants;

- sichkargroup.com - design, marketing.

In the world, people are increasingly paying with cryptocurrencies for flights and hotel accommodation. Digital money is firmly embedded in our daily life, which means it can be considered as an investment.

Why investing in cryptocurrency is a profitable direction now? The main reason is that the coins in the TOP in terms of capitalization grow in the long term. Yes, there are regular drops in the exchange rate, but they are temporary. It is important for an investor to be patient and determine the moment when the token is profitable to sell.

We invite you to see and analyze how the exchange rate of the most popular cryptocurrencies has changed in recent years.

Table 1"Change in the value of the exchange rate of coins included in the TOP by capitalization"

| Cryptocurrency | Course dynamics |

| Bitcoin (BTC) | It appeared in 2009. In February 2011 it cost $ 1, in July - $ 31. In December 2012 - $ 12, in April 2013 - $ 266, June 2013 - $ 100. As you can see, the course is constantly changing, but it tends to grow. In December 2017, Bitcoin reached $ 20,000, by February 2018 it fell to $ 3,400, then it went up sharply. |

| Ethereum (ETC) | It appeared in 2015. In February 2017 it cost $ 10, in June - $ 350, in November - $ 300. In January 2018 - $ 1,400, April - $ 370, May - $ 740. Again, we see sharp fluctuations in the exchange rate, but with a long-term upward trend. |

| Litecoin (LTC) | It appeared in 2013. In October 2013 it cost $ 3, in November - $ 46. In January 2015 - $ 2.5, July - $ 6. In March 2017 - $ 4, September - $ 73, November - $ 55, December - $ 350. In January 2019 - $ 32, June - $ 141. |

What conclusions about investments in cryptocurrencies can be drawn from the above table? Do not be afraid of a strong collapse of the exchange rate, even if the situation lasts for several months. On the contrary, this is the best time to invest in cryptocurrency. As soon as the rate goes up again, you can sell your assets and make money.

If you doubt whether it is worth investing your savings in cryptocurrency, then you can observe for now, study this topic more widely, and in parallel choose more stable options, here is a useful article that here you will definitely find something suitable.

Investing in cryptocurrency - 4 ways to make money

So, you have chosen to invest in cryptocurrency. Now let's look at where to buy digital coins and how to make money.

Method 1. Buy or exchange at exchange offices

Surely you have visited Sberbank or any exchanger more than once to exchange dollars / euros for Russian rubles. There are also exchange sites on the Internet. Only they offer the purchase and sale of a wider range of currencies, including BTC, ETC, LTC, XRP.

The Bestchange monitoring service will help you find a reliable exchanger with the best investment rate. Information on it is updated every 5 minutes. Using the service is simple:

- Go to the site bestchange.ru.

- In the left panel, in the "Give back" section, select the money for which you are going to buy a crypt for investment. For example, Sberbank rubles.

- In the "Get" section, click on the cryptocurrency you need.

- Examine the list of exchange offices that have appeared on the right side.

Then you need to go to the website of the exchange office, enter your payment details, amount and email address. On most exchangers, exchange is available in automatic mode.

IMPORTANT. Before investing rubles in the exchanger, compare several offers from the Bestchange list. For example, there are points that offer a favorable rate, but charge a draconian exchange commission - 8-10%.

Method 2. Directly exchange cryptocurrency

There are many participants in the cryptocurrency market who would like to cash out Bitcoins and other digital coins with minimal costs. And you get an excellent investment opportunity without intermediaries (exchange offices, stock exchanges). Look for potential cryptocurrency sellers on forums, social networks, and friends.

Advice. Buy cryptocurrency only from a trusted person, preferably someone you know personally, since there are enough scammers on the Internet. Invest a small amount right away.

Method 3. Start trading on exchanges

Exchanges are good because they allow you to buy the necessary cryptocurrency for investment at market value. But they usually charge a commission for depositing and withdrawing funds.

How to make money on the exchange? You can go into trading - speculative transactions. The essence of investment is to buy a coin on a downturn and sell on a rise.

The trader's income depends on the volatility (rate fluctuations), the chosen cryptocurrency and experience, it can reach 50-100% per month of the deposit amount. However, most of the newcomers to this area are losing money. To learn how to correctly determine the entry and exit points of a trade, you need to master a complex area - technical analysis.

Advice. If you have chosen long-term strategies for investing in cryptocurrency, do not store assets in a trader's account, but immediately withdraw them to third-party wallets. The fact is that accounts on exchanges are often hacked, and money is stolen.

By the way, detailed information is available here - if necessary, come and read.

An alternative to self-trading is investing in cryptocurrency funds. There, professional managers will manage your assets. They charge a% commission for their services. In fact, this is the same investment fund (UIF), but working only in the cryptocurrency market. Large and reliable crypto funds are Blockchain Capital, Pantera Capital, The Token Fund.

Method 4. Invest in cloud mining

Today, independent mining using a processor, video card or ASIC is no longer relevant, as the complexity of mining new blocks has sharply increased. When creating your own farm, you can't get away with small investments (the size of investments is calculated in thousands of dollars), but it pays off at least 1-1.5 years or, in general, turns out to be unprofitable.

How do you make money in this case? Consider an alternative investment in cloud mining. With this method, you rent a part of the computing power from a pool of miners or an industrial farm for money, and then you mine cryptocurrency. The return on investment is 1.5-2 times higher than with independent mining. To date, computing power for rent is provided, in particular, by the following projects:

- Hashflare;

- Eobot;

- Nice Hash;

- IQ mining.

As a rule, large sites have profitability calculators that can calculate the potential return on investment in cloud mining. But keep in mind that they overestimate the numbers a little.

What cryptocurrencies to invest in - an overview of 5 investment directions

Novice investors are most interested in the question of which cryptocurrency to invest in in order to make a profit. You can choose one of two paths:

- Invest in new coins

If you invest in a crypto project that will "shoot", then you can get a return on investment of hundreds and thousands of%. For example, as part of the ICO project in 2015, the NEO coin was handed out for free. In January 2017, it cost $ 0.12, and in January 2018 it cost $ 177. The return on investment for the year was 147,500%! - Invest in cryptocurrency from the TOP by capitalization

Experts recommend that beginners choose this particular investment method. TOP coins are of interest to most investors, and therefore grow in the long term. The investment risks are much lower than when buying new coins. Let's consider which cryptocurrency is better to invest in.

Cryptocurrency # 1.

- two-tier architecture that allows for improvements and updates;

- 100% anonymity - not only user data is missing, but also traces of transactions;

- distributed confirmation technology that saves time on transactions.

To date, the capitalization is USD 719 million. Course 1 DASH = 79.8 $.

How to Invest in Cryptocurrency - 6 Concrete Steps

The loose style of investing in cryptocurrency leads to quick loss of money and frustration. Successful activity requires a clear plan, knowledge and patience. We suggest that you familiarize yourself with the step-by-step investment instructions. It will help you avoid major mistakes and earn profits.

Step 1. Choose a cryptocurrency for investment

When choosing a cryptocurrency for investment, you should not be guided by the current rate. A cheap coin is capable of showing impressive growth in a short period of time. For example, at the beginning of 2018, Binance Coin (BNB) cost $ 8.4, and today its rate is $ 21.73 (+ 258%).

It is better to invest money based on the size of capitalization and interest from other investors. If a cryptocurrency is actively discussed in the media and the professional community, then it has a future.

NOTE. If you are thinking, in 2020, then, in addition to the cryptocurrencies already listed in the article, such leaders of capitalization as Bitcoin Cash, EOS, TRON, Cardano, NEO, Stellar deserve attention.

Step 2. Choose an investment method

How to invest in cryptocurrency? Medium-term investments are more suitable for novice investors - buying coins and implementing a buy and hold strategy. This method is not as risky as investing in startups, cloud mining or trading. It also does not require professional knowledge.

It is more profitable to buy coins on a cryptocurrency exchange than in an exchange office. You can store a small amount or unpopular tokens directly on it. But if you sent large investments (from $ 500) to purchase tokens, it is better to immediately withdraw funds to your wallet. So that the money is not stolen.

It is interesting. Another profitable line of business is interest-bearing investments. What is it? You can lend digital coins at interest to traders (on Poloniex) or a cryptocurrency exchange (on Yobit). Also, borrowed money is required by miners to create cryptocurrency mining farms. People place ads "Looking for an Investor" on the Internet (in particular, on the site start2up.ru). You yourself can leave an offer to potential borrowers: "I invest in your project."

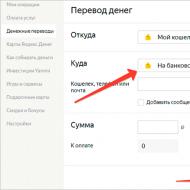

Step 3. Create and top up the wallet

To invest in cryptocurrencies, you need to register with one of the popular payment systems. By replenishing your account in them, you will be able to buy tokens in exchange offices and on exchanges in the future. Payment systems Yandex Money, Qiwi, Advanced Cash, Payeer, Internet banking "Sberbank" are suitable.

IMPORTANT. Problems may arise with Webmoney. On cryptocurrency exchanges, it is not possible to deposit funds from the wallets of this payment system, and exchange at points is available only through transit currencies (you will have to pay a huge commission).

You will also need a wallet in which you will store the cryptocurrencies themselves. Most of the holders of top coins are registered in the Blockchain system. To enter the wallet, a password and ID are used. Be sure to write them down on paper after registration, keep them away from prying eyes and do not lose them. In addition, we advise you to immediately enable two-factor identification and SMS confirmation in the security settings.

For more information on how to register and verify a wallet on the Blockchain, see here:

Cryptonator, Exodus, Electrum virtual wallets are also popular among digital money holders. Top coins can also be stored on accounts of Advanced Cash, Payeer payment systems.

Step 4. Buy cryptocurrency on the exchange

One of the main tasks of an investor is to choose a reliable exchange for investments. We advise you to make a purchase of cryptocurrency on one of the platforms listed in the table below. They have a lot of positive feedback from investors.

table 2"The best exchanges for investment"

| Name | Description |

| EXMO | The largest exchange in the CIS countries. Has a Russian-language, intuitive interface and round-the-clock support service. A huge list of cryptocurrencies in the listing. The commission for depositing funds is 2.95-4.45%, for withdrawal - 0-1.5%. |

| Poloniex | This American exchange has been awarded a high reliability rating. Has all popular coins in the listing. Provides the opportunity to earn extra money on loans at interest. There are no fees for depositing and withdrawing funds. The main disadvantages of the exchange are the lack of a Russian-language interface and mandatory account verification. |

| Binance | The leader in terms of daily trading volume. The exchange website can be switched to the Russian version. There are more than 200 cryptocurrencies in the listing. The exchange does not work with fiat money, but since 2019 it has become possible to deposit funds using a plastic card (for example, Visa Sberbank). |

Buying cryptocurrency is a matter of a couple of seconds. For example, on the Exmo exchange, it is enough to find the “Quick exchange” tab at the top, indicate the currencies you want to exchange and the required amount.

Step 5. Constantly monitor the market situation and analyze

Having received cryptocurrency in your portfolio, take your time to relax. Investment strategies in the stock and cryptocurrency markets differ significantly.

So, you can buy shares of top companies and forget about investments for 5-10 years. Most likely, securities will rise in price by tens (hundreds)%. But cryptocurrencies have high volatility, and this is a sin not to take advantage of. As soon as you see a sharp rise, don't wait, sell the coin and take profits. Since the collapse will follow in the future. Buy again on a downturn. In fact, the best investment in cryptocurrencies is the golden mean between trading and long-term investing.

Advice. Check the exchange rate of coins every day.

Here👉 I talked about how profitable - this also applies to cryptocurrencies, be sure to go read.

Step 6. Sell cryptocurrency at a favorable moment

And how to make a profit by identifying the very best moment? Study technical analysis. If you do not have time for this, then determine in advance the condition under which you will exchange crypto for fiat money. Let's say the rate grows by 20% from the initial one (at the time of investment).

3 tips for a beginner on how to invest in cryptocurrency correctly to make money

At the end of the article, we present a list of tips that will help reduce investment risks. Check out this section even if you are already making money in the cryptocurrency market.

Advice 1. Don't put all your eggs in one basket

It is not worth investing in any one cryptocurrency, even if it is Bitcoin. If the coin is unprofitable, you will lose 100% of the investment amount. Or miss out on the potential profit that new, less popular tokens can provide.

Tip 2. Keep your cool

After reading an ad “I am looking for an investor” somewhere, do not rush to give away the money. Search the Internet for reviews about the company and the organizers of the project. Make sure there is a real product behind the big promises.

Be patient when investing in cryptocurrencies. If you see a drop in the rate, do not drain the deposit, fixing a loss. Most likely, after a certain period of time, the value of the coin will recover.

Tip 3. Improve your investment education

When investing, don't rely on intuition alone. Read expert articles, news and forecasts, watch professional investor channels on Youtube. Check out the history of creation and the benefits of different cryptocurrencies. Over time, you will learn to understand the market and become a successful investor.

Conclusion

Investing in cryptocurrencies is a promising but high-risk form of making money on the Internet. Today, digital coins are an excellent speculation tool due to their high volatility. With the right approach, they are able to bring the investor hundreds of% of profit per year. In the future, changes in rates will depend on the policy of states in relation to the cryptoindustry.

I started investing in cryptocurrencies over a year ago. Following the advice: “Never invest in what you don’t understand”- I started reading more and more about cryptocurrencies to get an idea of them before jumping into the cryptocurrency world. Today, I still do not fully understand cryptocurrencies, since this is a rather large-scale field. But I learned enough to get on my feet. When I started my research, the large number of blogs and videos available on the web were either very superficial or too deep. They were either too specialized or too general. After spending almost a year studying, I am writing this article so that newcomers like myself find it useful and learn enough to start their own research.

The article consists of a series of questions and answers. They are structured according to the learning path I have traveled. Most newbies will likely follow the same path, so I found this to be a reasonable order.

Before you start reading the article, stock up on coffee or beer. The article will be long. It took me more than two days to write it. I went through all the issues that I had to face. If you are familiar with something, you can skip the relevant questions and move on to the next. So, let's begin.

What is cryptocurrency?

A digital currency, where a crypto-based code controls the creation of currency units and the verification of funds transfer transactions. The cryptocurrency is not supported by the government or any country. Accounting is carried out on a distributed basis. Think of it as a distributed ledger where you can't change the order of transactions.

You can call them people's money. Money created by the masses for the masses and controlled by the masses.

Such money has a number of advantages over. For this reason, many banks and governments resist the adoption of cryptocurrencies. Cryptocurrencies take away control from centralized authorities, be they governments or central banks.

What is Fiat Currency?

Government-backed currencies are called fiat currencies. Thus, most of the currencies we are used to, such as USD (US dollar), GBP (British pound, or pound sterling), AUD (Australian dollar), CNY (Chinese yuan), JPY (Japanese yen), INR (Indian rupee) and etc. are all examples of fiat currencies. I didn’t come across the term “fiat” until I became interested in cryptocurrencies.

Fiat currencies are plentiful. They are centralized. Central authorities can invalidate existing money with a stroke of the pen. India has recently held. Currency can be printed arbitrarily, which leads to inflation. Inflation is the robbery of the poor and the gullible without their knowledge. Commercial transactions require intermediaries such as Visa and MasterCard. You have to pay a commission to the banks to store your own money, whereas they earn interest by lending your money. If you want to transfer money abroad, you need to get permission from the authorities and pay huge fees to companies like Western Union. You pay a commission as a percentage, whereas ideally there should be a flat commission per transaction. The amount shouldn't matter.

Fiat is devoid of the characteristics of hard money. Cryptocurrencies make up for most of these shortcomings. In addition to all these benefits, they are also distributed, which is a great benefit in itself, since you don't have to trust any third party. And we have the opportunity to use this type of money called cryptocurrencies thanks to blockchains.

Blockchain is the technology behind cryptocurrencies. In fairness, it should be noted that cryptocurrencies are just one of the uses of blockchain. Blockchain is an irreversible (sequential chain), immutable and distributed ledger of transactions. Immutable ledgers are the backbone of many valuable transactions. We can talk about finances, accounting in governments and international diplomacy, and in general about any important accounting.

Bitcoin is the first peer-to-peer electronic money. Bitcoin has solved an important electronic money problem known as. While there are many resources to read about Bitcoin, it is definitely worth starting with. Bitcoin is a pioneer among cryptocurrencies. Most other cryptocurrencies owe their origins to Bitcoin, which has proven that it is possible to build a secure, decentralized mechanism for storing and transferring value over the Internet.

Bitcoin is the first peer-to-peer electronic money. Bitcoin has solved an important electronic money problem known as. While there are many resources to read about Bitcoin, it is definitely worth starting with. Bitcoin is a pioneer among cryptocurrencies. Most other cryptocurrencies owe their origins to Bitcoin, which has proven that it is possible to build a secure, decentralized mechanism for storing and transferring value over the Internet.

At this stage, you just need to know that double-spending is the risk that digital currency could be spent twice. If the same money can be spent twice, the currency loses its value and will not be safe. Bitcoin solved this problem and, as a result, created the prerequisites for a completely new world order.

Who Invented Bitcoin or Who Is Satoshi Nakamoto?

Can I keep my funds on my own and not on exchanges?

The whole point of cryptocurrencies is decentralization. But the funny thing is that trading today mostly takes place on centralized exchanges. And so it will be until distributed exchanges get better. While there are interesting projects like Kyber Network and Switcheo working to bring distributed exchanges to the masses, I believe that a distributed version of Binance could really turn the tide.

Thus, most of my friends use centralized exchanges for trading, after which they transfer funds to their personal wallets if they do not trade cryptocurrency for some time and plan to hold it for a while.

What is a wallet?

A cryptocurrency wallet stores public and private keys used to send and receive cryptocurrency funds. This can be compared to opening a bank account.

A cryptocurrency wallet stores public and private keys used to send and receive cryptocurrency funds. This can be compared to opening a bank account.

Who creates the wallet for me?

How about commissions on exchanges?

When trading on exchanges, there are two types of commissions you should be aware of: trade commission and withdrawal fee.

Different exchanges have different trading fees. On Robinhood and Cobinhood, the trading fee is zero. Binance gives a 50% discount on trading fees if you pay with BNB. Likewise, Kucoin gives a special discount if you have KNC in your account.

We cannot consider in detail the commissions on all exchanges here. You should familiarize yourself with them. However, if you want to know how much you spent on commissions, Cointracking has a handy report.

In terms of withdrawal fees, I noticed that Kucoin is usually lower than Binance. While Binance has high withdrawal fees, Kucoin does not require KYC if you withdraw less than 2 BTC per day.

What is KYC?

KYC stands for Know Your Customer(lane - "Know your client"). Many exchanges, especially in those countries where governments are unfriendly to cryptocurrencies, go through the KYC procedure. This means that you need to provide details about your identity and place of residence in order to open an account on the exchange or to trade / withdraw more than a certain amount. A number of popular members of the crypto community are opposed to KYC, as cryptocurrencies should be completely free from governments.

Is it worth trading only bitcoin, or does it make sense to trade altcoins as well?

Bitcoin has the highest liquidity. If you do not want to risk trading with low liquidity, then you are better off trading bitcoin. In addition, since Bitcoin has existed since 2010, it has the most historical data.

Altcoins have relatively low liquidity. Altcoins are extremely volatile and many good altcoins can generate very good returns. With this in mind, many are actively trading altcoins.

What is the relationship between the price of bitcoin and altcoins?

The connection between bitcoin and altcoins can be summarized in the following four sentences:

- When the bitcoin price is stable or rising slowly, altcoin prices rise rapidly.

- When the price of bitcoin rises rapidly, altcoin prices fall rapidly.

- When the price of bitcoin drops, altcoin prices fall rapidly.

- When the price of bitcoin drops rapidly, altcoins crash.

This interesting connection between bitcoin and altcoins can be explained by the following observations.

- Bitcoin is still the flagship of cryptocurrencies. He is the leading cryptocurrency.

- Bitcoin and altcoins are competing for a share in the capitalization of the cryptocurrency market. Therefore, when there is no inflow of new funds, money moves either from Bitcoin to altcoins, or in the opposite direction.

- When the outlook is positive and there is no inflow of new funds, money moves from Bitcoin to altcoins.

- When the outlook is negative, but there is no outflow of funds, money moves from altcoins to Bitcoin.

- When the outlook is negative and funds are withdrawn from cryptocurrencies, both Bitcoin and altcoins suffer. In this scenario, altcoins suffer more. It is in such cases that altcoins lose 90-95% of their price.

What is Satoshi?

Satoshi Is currently the smallest unit of bitcoin that can be recorded on the blockchain. It is equal to one hundred millionth bitcoin (0.00000001 BTC). It was named after the creator of Bitcoin, Satoshi Nakamoto.

Should you strive for an increase in Satoshi or Fiat?

If you believe that Bitcoin is waiting and are optimistic about its long-term prospects, then looking for an increase in Satoshi is the best approach. If you are a trader and you only care about how to make more money, then you may be best suited to search for Fiat growth. I look at both. As a rule, I periodically calculate my profit in fiat. If my total portfolio does not fall below a certain amount in fiat, I usually track my portfolio in satoshi, as I believe in the long-term prospects of Bitcoin.

Where is Bitcoin Margin Trading Possible?

Margin trading is akin to buying on a credit exchange. Different exchanges offer different leverage. 10x leverage means that for every dollar you have, you can buy $ 10 worth of bitcoins. While this increases your bottom line tenfold, it can also bankrupt you. Since exchanges lend money to you, they liquidate your positions (forcefully sell your bitcoins) when the price drops below a certain level. Do not engage in margin trading if you do not understand the risks involved.

Margin trading is possible on Bitmex and Bitfinex. Although margin trading is also possible on Poloniex, I personally don't like this exchange. I have studied the information on margin trading, but have not done it yet.

How to Short Bitcoin?

Short sale (selling bare or shorts) bitcoin is selling bitcoins that you don't have in order to buy them later. Thus, it can be beneficial if you SELL EXPENSIVE and BUY CHEAP... If you are confident that the price of bitcoin will decline, then short sell bitcoin.

What is Ethereum?

What is Ethereum?

Ethereum is programmable money. It is a smart contract platform. Ethereum is of interest to many. Money and programming are two powerful concepts. When combined, the consequences and possibilities are endless. Ethereum was the first in the cryptocurrency world to do this.

What are smart contracts?

What is ICO?

stands for Initial Coin Offering (trans. - "initial coin supply")... This is similar to an Initial Public Offering or IPO of securities. The ICO accepts funds from interested parties, after which ERC20 tokens are distributed to them according to the amount they have invested.

stands for Initial Coin Offering (trans. - "initial coin supply")... This is similar to an Initial Public Offering or IPO of securities. The ICO accepts funds from interested parties, after which ERC20 tokens are distributed to them according to the amount they have invested.

How to participate in the ICO?

Ethereum ICOs are still the most popular. However, there are other platforms such as, etc. that help to conduct ICO and create your own token. Most ICOs do not accept funds directly from exchanges. To participate in an ICO, as a rule, you need to transfer funds from your wallet so that ICO tokens can be received on the same wallet.

To participate in an Ethereum ICO, you can create an Ethereum account using Myetherwallet. You can transfer Ethereum tokens from the exchange to your Ethereum wallet address. After that, open the ICO site you are participating in and follow the instructions. As a rule, you need to transfer ether from your wallet to the target ICO wallet. Read the instructions carefully to understand what gas is and how much GWEI you need to charge for your transaction.

What is Airdrop?

ICOs are banned in a number of countries, including the United States. Therefore, most projects today use the Airdrop approach. We had this topic. If you have an Ethereum wallet, Ethereum projects can drop tokens to your address. That is, they simply transfer tokens to your account. Yes, you get free money. What does it give them, you ask? For them, this is a way to spread information about the project, which, in turn, will increase the value of tokens. Isn't it cool?

Ethereum is just one of the blockchains known for using Airdrop. Other projects like NEO, Stellar and EOS also allow ICOs and airdrops. Create a wallet in each of them. Who knows, maybe you will get money for free, which will turn out to be valuable later.

Should I invest in or trade cryptocurrencies?

Only you yourself can answer this question. But I personally believe that everyone should invest at least a small part of their investment in cryptocurrencies. There will be many blockchains and cryptocurrencies in the future. It is best to get to know them before they gain widespread popularity. And if you can make good money at the same time, that's great.

Finally

Over the past year, I have also encountered many other questions. But these questions are very specific. So I'll keep them for other articles. I believe that the issues discussed in this article provide an overview and take the first steps in the world of cryptocurrencies.

It's an interesting world. There are many projects in it that solve very interesting problems. It has many programmers breaking down technology barriers and empowering human interaction. When humanity is able to communicate seamlessly, align goals, increase efficiency and empower, no challenge is too big and no individual contribution is too small. We are truly living in a special time. Cash rewards are just a nice side effect. Even when I was losing money on cryptocurrencies, I didn't get too upset because I felt I was contributing to the growth of something that would be revolutionary in the coming years.

If you've read this far, that's really great. Thank you for taking the time to read this article. I hope the article has answered at least some of your questions, and you are now one step closer to investing in cryptocurrencies.

Hello dear readers of the business magazine site. Today we will talk about profitable investments that can bring a solid income with the right investment of their money.

Recently, there has been an active debate about the prospects for electronic money. It is difficult to imagine the modern world without computers, cards and new technological advances. Therefore, the question becomes relevant, in which cryptocurrency is it profitable to invest in 2019 in order to make money on it.

Many experts are actively debating the prospects for these investments, we will consider the different opinions of financiers on this issue and decide whether it is promising to invest in a crypt.

In this article, you will learn:

- What determines the rate of cryptocurrencies and how to predict it.

- Why cryptocurrency cannot replace regular money.

- Opinions of famous financiers for 2019 and BTC in general.

- Investing Tips for 2019

- Which crypto to choose for long-term investments.

- Reliability rating.

The first part is a theoretical basis on the basis of which further conclusions will be built. Without fundamental knowledge of the industry, it will be difficult to make the right choice for a large investment.

What awaits cryptocurrency in 2019: expert opinion

Before any investment, you first need to analyze in detail the potential profit and risks. For starters, you need yourself and pricing. Thanks to them, it will be much easier to make the right choice.

An expert, before expressing his opinion, always analyzes all the fundamental foundations of the object under study. For a better understanding of the further conclusion, we recommend that you familiarize yourself with the theoretical part in this section.

In this section, we will talk about the theoretical part, on the basis of which professional analysts from the next section drew conclusions. Only by understanding all the fundamentals can you come to the correct personal opinion and start investing.

Differences between cryptocurrency and other money

To understand which cryptocurrency to invest in, you must first figure out how the ruble or dollar differs from Bitcoin, ETH and other altcoins.

- No taxes. The entire cryptosystem is built in such a way that there is no single control and each of the network participants is its computing power. Therefore, you do not need to pay taxes, as is done in fiat currencies.

- High reliability. All cryptocurrencies are based on blockchain technology. As a result, the accumulated funds cannot disappear without a trace or be stolen. While in the banking system, all reliability directly depends on physical security in the bank vault and terminals.

- Ease of operation. To start a bitcoin wallet, you need to spend 2 minutes on registration and after that you can use your funds all your life until death. While in the bank you need to collect documents, confirm your identity, sign contracts and much more.

- Anonymity. Thanks to simplified registration, each cryptocurrency user does not verify his identity. Therefore, no one can find out to whose name the account is tied.

- Does not depend on the state. One of the main advantages of virtual money is its independence from the policy of any state or other currency of the world. Therefore, the money earned can be used in any country and part of the world, there is no need to exchange it every time you spend your holidays abroad.

- Out of control. The modern banking system cannot exist in the context of the promotion of blockchain technologies. No person or organization can influence the actions within the blockchain and therefore cannot control or steal them.

What determines the rate of bitcoin and other currencies

Like any other market relationship, it obeys the laws of supply and demand. The rule is pretty simple: the greater the demand, the higher the price.

Fiat or fiduciary money- paper, symbolic and unsecured currency. The par value is established and guaranteed by the state.

One day, a pizza seller agreed to play a simulated game and exchange virtual money for a real product. Then he received 10,000 tokens for 2 pizzas, this was the main pricing, conditionally then these 10 thousand coins cost $ 50.

In those days, the world was shocked by the shock news: "unlimited wealth on a video card, $ 50 per day on a computer, or how to become a millionaire without doing anything." The public became keenly interested in this method of earning and those around them began to invest their real money in the purchase of virtual currency in the hope of making money on it. Because of this, there was a sharp demand, with a low number of proposals.

Consequently, the price crawled up, and by July 2017, one coin could already get $ 3,000. Therefore, the once comic game turned into a serious commodity-money relationship.

Now let's analyze how the bitcoin rate is formed and what it depends on:

- Fundamental analysis. Once one of the largest exchanges collapsed, because of this, many traders lost confidence in the reliability of their savings, as a result, they began to drastically change tokens for fiat money. The price continues to fall until a correction takes place - speculators invest their funds in buying in order to resell assets later at a higher price.

- Activities of large investors. There are always big players on the market, they have huge funds and they are also called pumps. At the moment the price falls, they begin to gradually buy up the currency and increase its value. Inexperienced investors are led to this artificial price increase and begin to invest their funds. At its peak, the pumper sells all of its assets and the market crashes sharply.

- Miners and traders. They exist and they are the first collectors of currency. They need real money to pay for electricity, buy new equipment, and so on. They decide to sell their coins and from that create small fluctuations. Traders act as amplifiers, they look at these smallest fluctuations and invest their funds, increasing the trend.

Someone throws a small pebble into the ocean (), and behind it each trader throws a small sand shavings. And thus, because of one seemingly insignificant fluctuation, the state of the market can drastically change.

Is it possible to predict the course of a cryptocurrency

Another difficulty for the analysis is the lack of any attachment of the course to material resources. In fact, the cryptocurrency exists exactly as long as the holders believe in its capabilities. Therefore, pricing largely depends on the opinions of others, and any negative or positive news can seriously affect demand.

It is rather difficult to predict the fall and rise in prices over the course of a day. Over the past 24 hours, the price has dropped by almost 5%. On the 24th at 9:35 am, one of the major players decided to drain, so the decline began.

Hourly analysis will not show any high forecasting results. It is best to follow Western and European news and follow the general trend throughout the day.

Large sums of money have already been invested in bitcoin, so we can say that some part of the demand will always remain. A complete depreciation is unlikely to occur, if only due to active demand from fraudsters and unscrupulous entrepreneurs.

Advice: Make predictions in several passes: for a day, for a week and for a month... This method is perfect for long-term investments and will allow you to quickly adjust your strategy when the market fluctuates.

The best moment to invest money

As you know, the best moment for investment is the emergence of strong demand. A similar situation may arise in the near future with the following options:

- Legalization of settlements in the country using crypto money.

- Investing in large companies and banks such as Sberbank, Samsung, Apple, Asus etc.

- The emergence of services in everyday life for the crypt: shops, cafes, food, etc.

If one of these opportunities is realized, then there will be a demand for currency among the ordinary population. As a result, the price will go up.

The main thing is not to delay until the last peak. Remember that there will always be large players on the market who will stop the rise even at an unexpected moment. stop the price rise.

Potential risks of investing in cryptocurrency

The majority of investors are young entrepreneurs who are not particularly good at analyzing and predicting the course. They mostly trust public opinion and news. Therefore, one bad news about technology can radically change the situation in the market.

The greatest risk is the volatility of the exchange rate.... Many of the young investors put in millions and burned out. All of this is due to sharp market crashes and rises.

Why cryptocurrencies won't replace real money: 4 factors

Many are interested in a similar question, because the largest of the currencies is positioning itself as a future replacement for paper money. They are trying to attract attention to themselves and win the trust of market players, but is this really so?

Unfortunately, in the near future, cryptocurrency counterparts will not be able to replace paper-based settlement tools for a number of significant shortcomings of decentralized systems.

# 1. Speculation and exchange rate volatility

The majority of owners of ETH, BTC, LiteCoin, etc. assets consider their investments only for the purpose of obtaining material profit. They are engaged in speculation and from that, the price per day changes many times.

There is no permanence, so no state will use crypto as its primary currency. The simplest example, when the oil price began to fall, the ruble fell in price gradually. This fall lasted for a whole year, and during this time the state managed to somehow insure itself.

Imagine a situation where a fixed salary of 1,000 coins is paid at work. But due to the constant leaps, one day you can buy 100 loaves of bread and 50 cartons of milk, and in another month it will only be enough for 25 loaves and 1 can of milk. Plus, under such conditions, the currency after a couple of years will be in the possession of a limited number of people who will control the entire situation in the state and the world. Moreover, it will be impossible to punish them or somehow prove their guilt.

No. 2. Insecurity

Quite often, this argument is argued that the dollar is also not tied to anything and is completely dependent on the trust of asset holders. However, this statement is not entirely true. The United States has a strong economy, advanced IT achievements, military production, trade relations with other countries, and many other factors. The same applies to Russia, Ukraine, Belarus and other countries.

Investors' confidence is built on the basis of many political and economic factors. Bankers do not need to withdraw their money from the country if it has an excellent economy and in the near future the invested funds will increase.

Due to the lack of security, it will be impossible to predict the movement of the rate and the price can change dramatically in an unknown direction during the day.

No. 3. Unable to track payments

Imagine a situation, corrupt officials decided to buy bitcoin. They stole multibillion-dollar assets from the state budget and transferred them to their account. And then they scattered them in other wallets. The banking system can somehow track this operation and interrupt it at the initial stage.

And with the crypto-fierce, this will not work, and all the deceived people will be left without their savings. The state will not be able to compensate for the costs, which undermines its confidence on the part of citizens.

No. 4. Low transaction speed

One operation in a decentralized network takes from 1 to 10 minutes. In everyday life, this is a very long period of time and it will be problematic to pay in supermarkets with this system. Long queues will appear, and it will take up to 10 minutes to pay for even the smallest purchase. While it takes about 5 seconds for a modern bank.

From the above arguments, we can conclude that in the next 10-50 years, electronic currency will not be able to replace paper money. Even if some state decides to use it as a national currency, then soon everything will come down to legal regulation and centralization.

What cryptocurrency to invest in in 2019: advice and opinions of financiers

Because of the above reasons, we can conclude that the crypto market is best viewed as one of the ways to invest and nothing more. Let's consider what famous financiers think about this.

Andrey Movchan (director of the program "economic policy")

The financier considers the crypto market as one of the risky ways to invest. He offers to buy the crypto after its next failure. You should invest in large projects like BTC and ETH, since other programs are almost never talked about in the media and ordinary people hardly invest their money in these futures.

When the "cryptocurrency rush" passes in the world, small currencies will immediately depreciate and disappear. Bitcoin, on the other hand, will gradually slow down and you can be in time to close your positions.

Oleg Safonov (director of BCS Ultima)

There is no legislative regulation in Russia. Without fundamental knowledge about reliable storage methods, risk assessment, the principles of the system, you should not invest in this area. Plus, the government is extremely wary of citizens' investment in crypto.

The majority of experts believe that a large-scale economic bubble will form on the crypto market in the foreseeable future ( artificial growth, for no good reason). At some stage, it will burst, the only question is who will launch this process and when. This story is reminiscent of the dot-com crash. And the more the consequences will be, the more crypto money is introduced into the global market.

Mikhail Mashchenko (analyst of the social network for eTORO investors in Russia and the CIS)

2018 will continue to amaze with the dynamics of the cryptocurrency market and its infrastructure. Enthusiasts predict up to $ 100,000 per coin at the end of 2018, sounds unrealistic. At such a high price, it will be difficult to maintain the current demand. All hope remains for an increase in institutional capital.

It is almost impossible to predict the price movement, but if we use regression, we will get an approximate rate of 32 thousand by May and 70 thousand by December, does not sound plausible.

2019 will be a great period for the dawn of altcoins(ETH, LTC, RIPPLE, etc.), this is due to the high cost of the cue ball. The bubble is growing in size due to active publicity. But also people will soon find out about the active growth of alternative coins like Etherium and Litecoin, why not take a closer look at them.

Gleb Zadoya (analyst at analytics online)

It is necessary to strictly separate blockchain and cryptocurrencies. The technology itself has a high potential and it will certainly be used, as happened with the computer and the Internet. Analysts say that the resulting bubble will inevitably burst.

Obviously, there is a bubble, it must burst. The question is, at what stage before sobbing we are now, at the beginning of this process or near its apogee.

Cryptocurrency charts and perspectives

From the above words, one can come to general conclusions:

- Cryptocurrencies are a financial bubble that is bound to burst. It's just a matter of time.

- In 2018-2019, altcoins like ETH, Litecoin, Ripple, etc. will be actively developed.

- It is better to withdraw money as soon as you make a profit. At least 10% of the profit is already a good indicator.

- Investing in a crypt is very risky and therefore, it is recommended that you first fundamentally analyze the situation before making large investments.

Let's consider the charts of each of the popular currencies separately. We will use information from investing.com .

1. Bitcoin

On the annual chart, we can see regular growth until December 2017. This month there is a sharp drop in prices. Large investors decided to cash out their assets, so the price plummeted.

Most likely, there will be a second wave of decline due to the following reasons:

- Tightening of the attitude towards the cue ball on the part of large countries. The emergence of pressure from the authorities in the United States and Russia.

- Non-scalability of the system. The block size is still 1 MB, which is absolutely not enough to carry out a large number of transactions.

Likely soon the rate will fall until a new wave of buying begins. Now it is difficult to predict any movement for the whole year. In March, presidential elections are to be held in the Russian Federation, and accurate predictions can be made from the attitude of the authorities to the crypt.

Bitcoin growth chart for 2 years.

The market always suffers corrections, this can be seen on the chart, in the form of red candles. Similar changes occur every year, the last one was in the summer of 2017 and is repeated at the beginning of 2018. Asset owners are now selling their coins and the price goes down. However, a new wave of speculators is growing on the market, they are slowly buying tokens and will gradually increase the price and create a new trend. Therefore, in 2019, it can still grow to previous indicators and even overtake them.

There are serious unrest in the market now, but they can be compared June-August 2017... If we superimpose the graphs on top of each other, we can get a clear picture. In 2017, there were the same fluctuations, except that at the beginning of 2018 the difference in prices reaches almost 2 times. This indicates a positive development of the exchange rate and a possible repeated rise in prices.

2. Etherium

Ethereum is originally a full-fledged blockchain platform for creating decentralized technologies. And the asset in the form of Etherium coins is only an internal means of internal settlement.

The platform has created a universal language for building decentralized systems. The entire system operates on the basis of smart contracts, thanks to which blockchain technology can be used in many areas. Many large companies like Microsoft, Acronis, VTB, Sberbank, UNISEF and others are interested in these developments. Therefore, unlike the cue ball, there is at least some kind of security on the part of large companies. But still, this cannot be called a 100% guarantee of demand for services, large enterprises can at one point abandon technology and introduce their own.

In any case, prices are constantly growing, and after the adjustment at the beginning of 2018, a price upward trend begins. In addition to this, Ethereum has a more accurate and competent estimate of the price from the side of the audience. Therefore, the rate is not so prone to sharp drops and adjustments. Therefore, the market will gradually grow with the emergence of new projects based on the Ethereum network.

Plus, a number of other nuances make ETH a much more promising main investment. There are far fewer traders with the desire to make a profit like “a million a day”, and the news fund is much calmer. Therefore, we recommend investing in this particular project.

Etherium must be viewed from a long-term perspective. It is growing at a much slower pace, but with a constant increase. Over the course of a year, its rate will definitely jump up. This will happen due to the constant volatility of BTC and the disappointment of investors with losses.

On the chart for half a year, you can see stable growth and further correction. At the beginning of 2018, some investors cashed their amounts, but the rate again changes the trend and begins to grow. In the next month and year, the trend is likely to go up.

Compared to BTC, there are much more prospects here. ETH can already be seen as an investment in a young and promising company. After all, they create and distribute their own programming language and platform for developers. This is at least some kind of own product, for which there will certainly be a demand.

3. Ripple

One of the options for altcoins, the main idea is not to fight the banking system, but to improve it through new technologies. They do not oppose their coins against generally recognized money, but offer to use them when converting into other currencies. Thanks to this process, it is possible to reduce interest rates, increase the reliability of payments and greatly speed up the transfer process in different currencies.

Various banks have invested in the company itself (IDG Capital Partners, Camp One Ventures, UAE National Bank, Nomura Trust, IRIX Bank, etc.). Ripple complements the banking system, so there will be demand from bankers for it in the near future.

On the charts, you can clearly see a sharp jump in the rate and its further correction. On February 19, the candlestick pattern shows the beginning of a bullish reversal (rise in price) after the correction. Plus, if you look at the daily and weekly fluctuations, you can see the balancing of supply and demand.

The graph of the fall of the currency by February 2018.

In January - March 2018, Ripple will be testing for interbank Asian transfers. And if the tests are successful, then the course will definitely rise in price to $ 5 and even more. Plus, Ripple has a lot of investments planned for 2018 from foreign banks.

According to Ripple's plans, it may well reach a price of $ 5-10 with successful tests and signing contracts with Asian banks. Plus, against the news background, after successful transactions, traders and other major players will surely join Ripple. Therefore, a lot depends on the test results.

4. Litecoin

One of the varieties of altcoins. In general, it is no different from BTC, except for the caching function. For 2018, the company has prospects for development, because Bitrefill has officially announced its cooperation with LTC. Other cellular companies are likely to follow suit.

The year began with adjustments as expected. But since the rate, like with Bitcoin, does not depend on any indicators, it will be difficult to predict its movement. We can make an assumption that many of the investors will invest in LTC against the background of the overpriced BTC.

5. BTC cash

One of the bitcoin forks. The separation from the main currency took place on August 1, 2017. The main reason for the emergence of a new branch was the block limitation of 1 mb in the bitcoin network. This limitation freezes the network at high loads and a queue appears on transactions. The peak of this situation was in May 2017, then some users had to wait for the translation for several days.

The developers proposed a solution to remove the restriction. Many miners have proposed removing the restrictions, this would increase the profitability of crypto miners, without raising taxes. But the Bitcoin developers rejected the idea, because it would leave small players from the network, centralization appeared, which contradicts the ideas of the original idea.

On July 20, 2017, more than 95% of miners voted in favor of the idea of increasing the block size. August 1 was SegWit2x protocol implemented, opponents of this innovation decided on the same day to abandon the new protocol and they created their own fork of BTC Cash. It uses blocks of 8 MB. The innovations had a positive effect on user confidence and the miners transferred their capacities to a new fork.

If you look at the graphs, then it will be problematic to say something unambiguous. It can be seen that there was an adjustment after a sharp jump (it occurs on all cryptocurrencies at approximately the same time). An uptrend seems to be emerging now, but there is no guarantee that it will last long.

Conclusion: what cryptocurrency is it best to invest in rubles

Based on all the above arguments, we can conclude where to invest money. According to the forecasts of most experts, the cue ball will still grow against the backdrop of news and active infrastructure development. However, its price is not guaranteed by anything, so it is difficult to make accurate predictions.

Ripple and ETH are the most promising, as bankers and large IT manufacturers are showing an active interest in them.

By the level of reliability, we will place the cryptocurrency in the following order. The advantages of each of them were described above.

- Etherium;

- Ripple;

- Litecoin;

- BitcoinCash;

- Bitcoin.

Received a profit of at least 10% and immediately cash out the income, otherwise you can lose everything. Better then open a couple more deals for the same amounts, it will be safer.

Investing in cryptocurrency is more popular today than ever. With a competent and accurate approach, the way of making money has a huge perspective. The current situation with the cryptocurrency market causes concern for investors, but experts are encouraging with good forecasts for 2019. Novice crypto investors want to know where to invest and which coins are the most promising.

Before investing in cryptocurrencies, beginners want to know how profitable it is and whether it is profitable at all. The answer is simple: if it doesn't generate income, there would be no hype around digital coins. For investments in cryptocurrencies to be profitable, you need to have information and be able to analyze the market trend.

Nuances that every investor should understand:

- Cryptocurrencies are the brainchild of modern technologies. Coins represent a small fraction of the blockchain mechanism. Tokens are an adjacent product of the platform, not pieces of paper that rustle in their hands. Before investing in cryptocurrency, it is important to evaluate the prospects and original ideas of the whole platform. For example, smart contracts have made an incredible breakthrough in the world of technology, it is clear that projects will develop. Ethereum cryptocurrency is a promising project that will bring profit.

- Price growth rate. When entering the market, start-up companies sell tokens for a meager cost. With the development of the platform, the price of coins also rises. Sometimes the course takes off sharply, and sometimes you have to practice the strategy of waiting. It all depends on interest in the platform, successful PR move, how much the team is working on the project. It is impractical to buy the first tokens that come across at a low price: first you need to get acquainted with the company, the product that is offered, evaluate its future prospects, and only then invest. The price of startups is negligible, and the profit can be quite good.

- Decentralization. The anonymity of digital money is legendary. Some states are desperately fighting virtual currency, calling it a hotbed of corruption and fraud. Tracking down crypto holders is nearly impossible. Transactions are recorded in the block, but users do not leave personal data. No one can trace the sender or recipient of a cryptocurrency. The owners of even large virtual amounts do not pay taxes, which opens up wide horizons for investors.

- Market expansion. New projects appear almost every day, demand money for development and are looking for investors. Over the 10 years of blockchain technology existence, thousands of types of coins have appeared, and this is not the limit. If the user does not find a suitable project for investment, it is worth waiting. Perhaps the idea will appear in the near future.

The main thing is to adequately assess the possibilities. There are always risks in investing, but if you develop a competent strategy and strictly adhere to it, you can reduce both risks and increase profits.

Investment types

Before investing money in cryptocurrencies, you should familiarize yourself with the types of investment, which will allow you to navigate the initial payment:

- Invest in cryptocurrency as a project... The main profit from digital coins is from the creators. The Bitcoin code is open to everyone, thousands of new projects have been created on the basis of BTC. Anyone with knowledge and capabilities can engage in their own development. It is unlikely that something will work out alone, you need a strong team. To simplify the task, you can simply invest in a promising ICO project.

- . Better than buying coins is just mining them. Many cryptocurrencies are mined using a simple computer. The method will not bring big income. You need good equipment, which, with the right approach, will pay off in 3-4 months. Popular coins have tightened mining conditions. Now, to obtain them, farms are needed, which cost a lot of money.

- It differs from the classical mining of crypt in that it does not require the purchase of capacities: the equipment is provided by remote services. Users pay rent and the server mines coins. The price depends on the type of cryptocurrency. The most expensive rent for.

- Long-term investment in cryptocurrency. It involves the purchase of coins at the ICO stage and their further sale after the rise in the rate. Some investors keep digital coins in their accounts for years, and then make a profit that is thousands of times higher than the initial investment. A careful approach is needed: even tough analysts will not predict with 100% probability the market trend for several months in advance. For example, in mid-June 2017 it was about three thousand dollars, and already at the end of the year it reached $ 20 thousand. One can only imagine what profit the investors who invested in BTC received on time.