How much do people who work in banks earn? Banking - what kind of profession, salary. Where to study banking

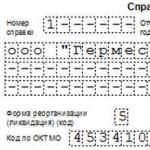

Account for sole proprietorship and LLC.

All of us in childhood dreamed of becoming workers in some interesting profession. Someone wanted to be a military man, someone an astronaut, someone an artist. But on the fingers you can count the children who would have dreamed of working in a bank since childhood. site

Time passed, the children grew up, and now the situation has changed. Banks have become interested in graduates of higher educational institutions and applicants with experience in financial institutions. Yes, and many young economists are very attracted to this work: a modern office, a business suit, a solid salary. It is the salary that ultimately becomes the decisive factor, and specialists submit resumes to banks in the hope of finding a job. site

It's all about prestige

Today, the most demanded positions in the bank are financial analysts, accountants, visitor managers, branch managers, sales specialists, directors and cashiers. Even well-known non-poor people go to work in banks. An example of this is Sergey Matvienko, the son of the governor of the city on the Neva, who until recently worked as vice president of one of the St. Petersburg banks. Dmitry Petrushev, the son of the Secretary of the Security Council of the Russian Federation, worked at VTB24, and then became the chairman of the board of Rosselkhozbank. And this is not a complete list of famous people who work in the banking sector. In addition to the material, you may be interested to read about why a bank account can be blocked. site

How much can you earn

People go to work in a bank primarily because they want to earn above average and even more. At the initial positions, clerks are expected to receive salaries in the range of 15 thousand rubles. However, if you gain experience and an excellent track record, you can get a job with a salary of several hundred thousand rubles a month. According to official data, the largest average salary is issued in Gazprombank - 177 thousand rubles a month. The honorable second place is occupied by VTB - 95 thousand rubles. In third place is Alfa-Bank, which pays employees an average of 94,000 rubles a month. Further on the list is "Unicreditbank", which favors its employees on average 75 thousand rubles and "Bank of Moscow" - 65 thousand rubles. If you are interested in the salaries of members of the board of banks and other high officials, then here they are in front of you: site

- Chairman of the Board: 500 thousand - 7 million rubles;

- Deputy Chairman of the Board: 200 thousand - 3 million rubles;

- Managing director investment bank: 500 thousand - 6 million rubles;

- Head of the trade department: 100 thousand - 4 million rubles.

How to become a bank employee

To get a coveted job in a bank, applicants will need to have a higher economic education, work experience, excellent computer knowledge, sufficient analytical and communication skills. They will also be checked to see if there are any problems with the law. With growth consumer lending requires more and more specialists in the banking sector. Thus, one can predict an increase in the number of bankers in Russia in the near future. This, in turn, is a positive factor. However, not everything is as beautiful as it seems at first glance, recently a number of banks have been left without a license. site

Ordinary inhabitants invariably associate work in the banking sector with high wages. However, this view is only partially correct. The thing is that a banker is a very wide circle of workers occupying a variety of positions. Accordingly, the salary level, for example, of a top manager and a head of a credit department can differ significantly.

Features of the profession

Generally speaking, a banker is a general line of work. The range of duties assigned to a specialist depends on the scale of the company in which he works, as well as on the position he holds. Typically, the work here is as follows:

- servicing clients of a financial institution;

- collection of statistical data and development of options for their improvement;

- forecasting;

- counseling;

- analysis of various information with subsequent decision-making;

- management of subordinate employees.

In order to succeed, a banker must have a certain set of personal qualities, such as the ability to quickly make the right decisions, initiative, communication skills, a constant desire to improve their own professional level, attentiveness, purposefulness, and so on. An important aspect is discipline, as well as the precise fulfillment of all the instructions of the management and the tasks assigned to the employee.

An analytical mind and constant composure are welcome. Given that you have to deal with money, the banking business does not tolerate dishonest employees, so employers pay Special attention such a moment as decency and honesty.

banker salary

Now let's talk about the pay of employees in the banking sector. The spread here is more than wide, since the variety of possible positions is very large. At the lowest rung here are ordinary clerks. As a rule, their salary is 65 thousand rubles. This is, of course, an average figure, but this case the difference, depending on the financial institution, will not be too large. However, do not forget that this is only the very first, initial step. The salaries of top managers are measured by completely different figures - we are talking about a difference of several orders of magnitude.

For example, the salary of the chairman of the board of a bank today is from 500 thousand to 7 million rubles. The work of his deputy is also very well paid. On the one hand, the salary in this position is about 2 times less than that of the head, but 2 points must be taken into account. Firstly, figures from 200 thousand to 3 million rubles a month are more than a decent salary, and there are also various bonuses. Secondly, the level of responsibility of the deputy is always lower than that of the boss.

A solid salary today and the managing director of an investment bank. The amount of remuneration for this position ranges from 500 thousand to 6 million rubles. The heads of the trade department also earn very well. With a minimum salary for this position of 100 thousand rubles, which is quite good for the Russian Federation, up to 4 million rubles. Such a wide range is due to the presence of a number of additional determining factors.

Here are some more official statistics. In particular, the level of the average salary in Gazprombank is 174 thousand rubles. VTB is in second place in this indicator. In this financial institution, the average salary is 156 thousand rubles. Well, the Bank of Moscow closes the top three leaders in terms of average wages in the banking sector. On average, its employees receive 129 thousand rubles a month. Unicredit Bank (121 thousand rubles) is also in the top five. In fifth place was RF "Alfa-Bank" with average salary employees at 98 thousand rubles.

Most in-demand jobs in banking

I would like to pay closer attention to one more point. Currently the most in-demand positions in banking Russian Federation are cashiers, accountants, visitor managers, and financial analysts. At the same time, the more high level remuneration - the more requirements are presented to the applicant for a particular vacancy. Among the top management of Russian banks, one can often meet the children of influential Russian officials- the most striking example here is Dmitry Patrushev, son of the Secretary of the Security Council of the Russian Federation. Previously, he worked at VTB, and later moved to Rosselkhozbank, becoming the chairman of the board of this financial institution.

I would like to pay closer attention to one more point. Currently the most in-demand positions in banking Russian Federation are cashiers, accountants, visitor managers, and financial analysts. At the same time, the more high level remuneration - the more requirements are presented to the applicant for a particular vacancy. Among the top management of Russian banks, one can often meet the children of influential Russian officials- the most striking example here is Dmitry Patrushev, son of the Secretary of the Security Council of the Russian Federation. Previously, he worked at VTB, and later moved to Rosselkhozbank, becoming the chairman of the board of this financial institution.

Mostly, employers make it a prerequisite for applicants for a particular position to have a higher economic education. A clerk can be hired without work experience. As a rule, "people from the street" are not suitable for higher and more responsible positions. The employer can be understood - he needs a result here and now. Therefore, preference is given to either experienced employees from the outside, or an internal reserve. It is probably not even necessary to talk about such a moment as confident possession of a PC. The banking sector today is high-tech, and computer skills are a must, even for a clerk.

Today there is a very fashionable and prestigious specialty - banking. What is this profession? Let's try to understand the actual issue.

Description of the profession

The meaning of the word has Italian roots. "Banker" from the word banco - "table", respectively, a banker is a person who works at a table. But today he is a multifaceted specialist, he is distinguished by a propensity for forecasting. He also has an analytical mind.

Currently, specialists in banking are incredibly in demand. Therefore, it is relatively easy for them to find a job. They are waiting investment organizations, financial institutions, credit organizations, exchanges, Insurance companies etc.

Work in a bank depends on what position the employee occupies. For example, a financial institution specialist will be consulting clients, analyzing indicators, forecasting, etc.

Many big banks in their structure they can have up to 10 divisions with certain functions. The key areas are:

- lending;

- investment activities;

- Treasury Department.

After completing your studies in the specialty "banking", you get a set of knowledge in the field of financial circulation, standard operations, economic forecasting, accounting. The mandatory program also includes the study of the essence and functioning of credit operations, etc.

Who is ready to become a banking specialist

People with good mathematical abilities and an analytical mindset can become a banking specialist. The person involved in this business knows how to put everything on the shelves, then analyze and systematize the information received. You need to be focused all the time and pay a lot of attention to detail. Of course, a person who knows banking should love economic disciplines. What is a profession without an interest in economics? In addition, a banker usually has a good memory and a drive to get things done.

Also, a person who is preparing to become a specialist in banking must be a professional and have healthy ambitions. Often these qualities are the main trump card when applying for a job. Purposefulness is also greatly appreciated, as difficulties will arise every day. The employee must be able to overcome them and want to move on.

When a young specialist is hired, he almost always goes through a small training course. Therefore, it is necessary to be trained, to strive for new knowledge. Some banks, by the way, after training conduct an exam and only after that they decide whether or not to hire a specialist to work in a bank.

Career growth

The launching pad for successful professional growth is the higher profile

Banking career most often begins with positions such as:

- customer service employee;

- assistant accountant;

- clerk, etc.

As a rule, a novice specialist has a low level. At the same time, there is an opportunity to go up the career ladder. But for this you need to make some effort. It can take as little as one year to become a middle manager. If an employee has certain abilities and aspirations, he can get the position of branch manager, deputy head, bank director.

Font A A

The number of banks in Russia, according to the CBR, for 2019 is decreasing every month. At the same time, bankers remain a sought-after category of workers, and universities annually graduate young people with a degree in Banking and Finance and Credit. We found out what bankers do and how much they get.

Modern bankers in their qualities have gone far from the first representatives of their guild. They are no longer just usurers and money changers. These are people with higher education and a flexible analytical mind, who know how to go towards their goal, they are constantly improving and learning. Their best representatives: the founders of banks, well-known financiers and experts, have contributed to the fact that this profession is currently prestigious. These are bank employees who are engaged in financial transactions, forecasting, analytics, and risk management.

Experienced banker Sergey Mammadov told how to enter the profession and succeed in it:

The professional skills of banking specialists are in demand in any field where there is money turnover.

Bank employees have professional slang: for example, “plastics” are cards and employees of the relevant department, and “consumables” are an account cash warrant.

Career growth among bankers is not fast, however, it is realistic to grow to a manager and higher.

The specifics of the work and duties of a banker

The duties of a bank employee depend on the department where he works, on the specialization of the education received, on his position. There are a number of areas where bankers are involved:

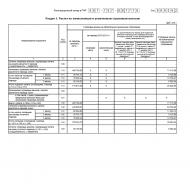

| Direction of activity | Duties |

| Lending | Receiving applications, checking the solvency of the borrower, maintaining credit history, control of the reliability and safety of collateral, refinancing |

| Investments | Analysis of projects for long-term investments, control financial condition invested projects |

| Securities | Sale and purchase valuable papers on the stock exchange and on the market, issue of own bonds |

| Treasury Department | Operations on foreign exchange market, speculation on changes in exchange rates |

| Funds | Trading stocks and bonds on the stock market |

| Plastic cards | Issuance of debit credit cards, installment cards, selection of cards for the client |

| Bank operations | Working with customer accounts and payments, transfers, credits, receiving money |

| Reporting | Collection of information on all activities of the bank and preparation of a report for the required period |

| Economic analysis | Analysis of the state of the markets, risk assessment; forecasting |

| Insurance | Calculation of the sum insured and insurance premiums, cooperation with insurance companies |

How much do middle and top managers earn in a bank

Employees working in the above departments belong to the middle management. The top management is represented by department and bank managers and the board of directors. Their wage depends on the efficiency and profitability of the bank or department. Most of all, workers of the lower segment are in demand: cashiers and tellers who work with people.

Income in Moscow

The level of salaries in Moscow, according to the job site HH.ru, depending on the position, in rubles per month:

- Loan specialist - from 40,000;

- Senior manager - 70,000;

- Department head corporate lending – 130 000-180 000;

- Operator - 25,000-50,000;

- Treasurer - 55,000;

- Credit analyst - 120,000-150,000.

According to the Trud.com portal, the commercial director earns the most in 2019

Salary in the regions

In other cities of Russia, the demand is mainly for lower and middle-level employees, according to information taken from job search sites HH.ru and Trud.com. This is reflected in the average figures that employees earn in the bank.

For September, 2019 most of all open vacancies for bankers in the Moscow region

Average salaries in the regions:

- St. Petersburg - 46000;

- Yekaterinburg - 40300;

- Voronezh - 39000;

- Saratov - 33000;

- Khabarovsk - 35000;

- Stavropol - 27000.

What is the salary of bankers abroad

Foreign banks their employees are paid more than Russians. Thus, the average monthly income of bank employees in different countries according to the portal "Wages of the World" is (income is indicated in rubles):

- Germany - 314,917;

- Italy - 183,989;

- New Zealand - 186,020;

- Switzerland - 633,442;

- Egypt - 51,710.

The first bank was founded by an association of money changers in Italy and was called the "Bank of St. George".

Alexander Shimilevich talks about his work in Canadian bank:

Bankers are always in demand, especially in a crisis and even in the face of a reduction in the number of banks. Any novice specialist can climb the career ladder. However, their wages in Russia cannot compete with European countries.

Today, one of the prestigious specializations is banking. What is this profession? What qualities should a person who has decided to devote himself to the world of finance have? Where can I get necessary knowledge and become a high-class specialist? Is it possible to choose the profession of "banking" after the 9th grade? We will cover all the details in this article.

Profession "banking": description

Perhaps it is worth starting with a definition of this concept. Because there are still people who ask: "Banking is what kind of profession?" Many of them are too superficial about this issue. It is believed that a banking specialist is a profession of a narrow profile. In fact, this is a completely wrong statement.

Let's see what the word "bank" means? Translated from Italian - table. In ancient Rome, it was for him that money changers carried out commodity-money exchanges. It turns out that a banker is a specialist who spends most of his working time at his desk and is engaged in economic and financial activities. Already in our time, a banker began to be called a person who worked in a bank - a place where money is stored.

And what is really behind the profession of "banking"? It is not necessary for a person to work in a bank. The scope of activity can be very wide: exchanges, all kinds of companies and firms, investment organizations, financial institutions and other institutions. He can be a cashier, financial inspector, economist, accountant, etc. The main thing is that he will always have to deal with finances, in whatever organizations he works. And for this you need to have the necessary skills and abilities, which we will talk about later. But first, let's take a little trip into the distant past.

A bit of history

It will be very interesting to know when banking was born. What kind of profession - we already know. The first bankers in ancient times were moneylenders. People who gave loans at favorable interest rates appeared in the 7th century BC.

Ancient Greece occupies a special place in the emergence and development of banking. The most popular transactions that were carried out here are grain operations. It could be borrowed at huge monetary interest, which was several hundred times higher than the real amount. If a person could not pay off the debt, then not only he himself, but also members of his family became the property of the creditor.

The first bank appeared in the 16th century in England. And when did banking appear in Russia? This happened a little later. Large banking systems originated in Russia at the end of the 18th century. More than one work of art has been written about this. We can find an example of banking relations in F. M. Dostoevsky's novel "Crime and Punishment". One of the characters who economic activity, was an old money-lender.

Advantages and disadvantages of the profession

If you love banking and have decided to become a good specialist in this field, study all the pros and cons of this job. Let's do it together. So, the advantages of this profession:

- demand;

- high wages;

- prestige;

- many banks have a good bonus fund;

- there is an opportunity for career growth;

- you can earn an excellent reputation very quickly;

- obtaining invaluable life experience;

- acquire financial literacy.

Flaws:

Required professional qualities

In order to become a good banker in the future, you need to:

- Be good at counting.

- Strive to acquire new knowledge and skills. Bankers, as a rule, never stop at getting just one education. Many of them have multiple diplomas.

- Have a good memory.

- To be a very attentive person and constantly work on the development of this important quality for a bank employee.

- Ability to analyze and organize information.

- Learn how to complete any task, no matter how difficult it may seem.

- Be able to work in a team.

- A person cannot know everything. But he must be able to acquire the necessary knowledge. Because now you have to do it all the time.

- Know how to overcome difficulties.

- Love economics.

If you have all the necessary qualities, and most importantly, that you dream of studying banking, be sure that you have chosen a good and interesting profession.

Requirements

Employees of the financial sector should know and be able to do the following:

Where are specialists trained?

Many students graduating from high school are concerned about issues related to banking. What is this profession? Where can you get it? Is it necessary to have a high school education? If you decide to master this profession, then you will need to choose such specialties as:

- "Banking".

- "Economy".

- "Finance and credit".

You can enter the specialty "banking" after the 9th grade. For example, we give several options: "Moscow Commercial Banking College", "Moscow Credit College", "Siberian Polytechnic College" and others.

There are a great many institutions of higher education that train financiers in Russia. There are specialized higher educational institutions, and there are separate faculties at institutes and universities. Let's name some of the most prestigious and well-known places: Financial University under the Government of the Russian Federation, MGIMO, Higher School of Economics. But there are other institutions that provide a qualitative theoretical basis.

How much do professionals earn?

When choosing a profession "banking" salary is one of the important factors. A competent specialist with a good reputation can earn up to $1,000 per month or more. True, not everyone gets that much. bank employees. The salary of some does not exceed 200-300 dollars. But with due diligence and skill, over time, any employee can start earning much more.

A few words in conclusion

We hope that this article will be useful to many people. And first of all, she will be able to answer the question: "Why did I choose the profession" banking "?". After all, despite all its complexity, it is very interesting and promising. If you feel that working with finance is your calling, then feel free to choose an economic education.