The cost of accounting services for SP and LLC. Accountant services for individual entrepreneurs from the company sbt Accountant for conducting individual entrepreneurs

First 3 days - free

"My Accounting Online"

Convenient online service for small businesses. Do your own bookkeeping - everyone can use the service, because it does not require specialized knowledge.

Reporting and tax calculation

Up-to-date tax calendar with notification system

Automatic download of an extract from Sberbank Business Online

Automatic preparation of instructions for payment of taxes and contributions

Accounting for employees and paying taxes for them

First 3 days - free

"My Accounting Online"

Convenient online service for small businesses. Do your own bookkeeping - everyone can use the service, because it does not require specialized knowledge.

Reporting and tax calculation

Up-to-date tax calendar with notification system

Automatic download of an extract from Sberbank Business Online

Automatic preparation of instructions for payment of taxes and contributions

Accounting for employees and paying taxes for them

First 3 days - free

First 3 days - free

"Accounting for individual entrepreneurs on the simplified tax system 6% without employees"

The online service will help prepare all the documents, you will only have to confirm their sending.

Automatic calculation of taxes and contributions and preparation of instructions for their payment

Declaration on the simplified tax system 6% based on a bank statement

Tax Event Notifications

Ability to add data on your accounts in other banks

Reducing taxes through fixed contributions and advances

Job accountant SP vacancies Accountant SP in Moscow. Vacancy accountant SP from a direct employer in Moscow job advertisements accountant SP Moscow, vacancies for recruitment agencies in Moscow, looking for a job accountant SP through recruitment agencies and from direct employers, vacancies accountant SP with and without work experience. The site of announcements about part-time work and work Avito Moscow job vacancies accountant SP from direct employers.

Work in Moscow accountant SP

Site work Avito Moscow work fresh vacancies accountant SP. On our site you can find a highly paid job accountant SP. Look for a job as an accountant in Moscow, view vacancies on our job site - an aggregator of vacancies in Moscow.

Avito jobs Moscow

Job accountant SP on the site in Moscow, vacancies accountant SP from direct employers Moscow. Vacancies in Moscow without work experience and highly paid with work experience. Vacancies accountant SP for women.

Entrepreneurial activity is impossible without proper accounting and payment of taxes. Entrepreneurs perform these duties themselves or hire an accountant or accounting company. The services of an accountant working at home are most popular with entrepreneurs whose activities have not reached even greater turnover.

An entrepreneur may not understand accounting and tax laws, but it is necessary to have a minimum knowledge in these areas. Entrepreneurial activity implies that the entrepreneur is a bit of a marketer, a bit of a financier, a bit of a personnel manager, and so on. And let all these functions of the entrepreneur be performed by specially hired workers, but in order to control them and find a common language with them, the individual entrepreneur needs to delve a little into their work. The accountant is no exception.

Note! It is desirable for an individual entrepreneur to know: what taxes are subject to his activities, the deadlines for paying taxes and submitting reports. Violation of reporting deadlines and tax payment deadlines will have significant financial consequences.

If an entrepreneur is unlucky with an accountant, then he can be left alone with tax office. Responsibility for tax violations will have to carry IP.

Cases when an accountant failed to submit reports on time, or did not submit them at all, are not rare. It is no secret that many accountants simultaneously keep records of not even two or three entrepreneurs or legal entities and five to ten. In such a situation, it is quite possible to forget something and not be in time. This is partly because the pay for an accountant can be very low and many in this profession take on more work than they can handle. But a little work experience can also play a role. Although, as in any other profession, there are also unscrupulous employees among accountants.

To protect yourself from such troubles, an individual entrepreneur should, as one of the most important documents used in his work, have a calendar of due dates for paying taxes and reporting. And periodically check with him when communicating with an accountant. In addition, such a calendar will be useful for assessing the cost of an accountant's work.

Own stable business requires increased attention and constant concentration. And even if the company represents its interests in the market for a long time, its activities still take a lot of time and effort from the head.

The most responsible duty of an entrepreneur is to keep accounting records and submit reports to the relevant state authorities. In order to get rid of this obligation and not to hire an additional employee, which is also fraught with unnecessary costs, the company "Accounting PROF" offers you accounting services for small businesses in Moscow and the region.

Having many years of experience, our specialists will resolve issues with any volume of IP documentation in the shortest possible time. Accounting services for your business are comprehensive and timely.

Business accounting support includes:

staging

accounting from scratch;

Working with primary

reporting documents;

Planning

accounting policy;

One-time or permanent maintenance

tax and accounting;

Preparation and submission of quarterly and

annual reports;

Recovery

accounting;

Drafting

accounting registers;

Control wages

employees and taxes;

Cooperation with

government bodies;

Representation of the interests of the client

during inspections;

Employee consultations

accounting;

Work control

accounting at all stages, etc.

A complete list of accounting services for individual entrepreneurs in Moscow and the cost is discussed with each client separately, depending on the state of the documents and the amount of work required.

Getting rid of risks

While small business accounting services are a fairly mature, progressive phenomenon, some business owners struggle to get by. on your own, which often leads to loss of control, fines and penalties.

Convenience of cooperation with us:

The service of our company assumes full responsibility for accounting;

We release you from the burden of communicating with government agencies during on-site inspections;

We provide, if necessary, full reporting on our activities to the client upon the first request;

We follow the innovations in the legislative sphere and adjust our work in time according to the changes;

Reducing to zero human factor– dismissal / illness / decree / vacation of a staff accountant;

We are involved in the process of document management at any stage of the company's activities, etc.

The cost of accounting services for individual entrepreneurs in Moscow

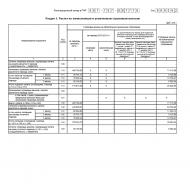

| Basic rate* | Simplified tax system / UTII | General system taxation |

|---|---|---|

| "Zero" reporting (no activity) | 1500 rubles/year | 1500 rubles/quarter |

| From 1 to 50 operations | 3000 rubles/month | 6000 rubles/month |

| From 51 to 100 operations | 5000 rubles/month | 8000 rubles/month |

| From 101 to 150 operations | 7000 rubles/month | 10000 rubles/month |

| From 150 to 200 operations | 10000 rubles/month | 15000 rub./month |

| From 201 or more transactions | by agreement | by agreement |

Sole proprietors are not required to Accounting, however, this does not exempt them from tax accounting. There are many aspects and rules that should be known to every entrepreneur who decides to keep records of transactions on their own. These are the filling features tax returns, the deadlines for their submission, the rules for accounting for income and expenses, the use of cash registers (if any) and maintaining cash accounting, contracts, etc.

Recall that not all IPs work on simplified system taxation, some prefer the main. And that means more reports, taxes, and other accounting responsibilities.

But even the simplest accounting takes time and knowledge. That is why many entrepreneurs trust us to manage their bookkeeping, including accounting for all business transactions with making entries in KUDIR and forming required documents, filling out reports and submitting them via the Internet to regulatory authorities.

Popular tariffs for IP

Price for IP accounting service

| Number of operations | Simplified (USN 6%) | Simplified (USN 15%) | General system (OSNO) |

|---|---|---|---|

| up to 20 operations per month | from 1333 rubles/month | from 3000 rubles/month | from 10000 rubles/month |

| up to 40 operations per month | from 1333 rubles/month | from 6000 rubles/month | from 20000 rub./month |

| up to 100 operations per month | from 1333 rubles/month | from 12000 rubles/month | from 30000 rub./month |

| from 100 operations per month |

Price negotiable |

||

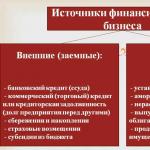

IP accounting options:

- On one's own. An entrepreneur can keep records himself and then fill out and submit declarations. But this option has a drawback: the risk of errors in calculating the taxable base, which can lead to fines and penalties. In addition, in this case, the entrepreneur has to spend a lot of time trying to understand the key accounting issues.

- "Incoming" accountant. This option suits many, but it also has risks. What if an accountant you know suddenly falls ill, moves away, or finds himself very busy and unable to help you anymore? He has no obligation to you. You will have to urgently look for another specialist or try to delve into the accounting yourself, risking making mistakes due to ignorance of all the subtleties. For example, an incorrectly completed declaration will simply not be accepted, and if accepted, then later this will entail certain problems.

- Outsourcing. This is when your accounting becomes our business, our concern. One of our accountants will deal with tax and personnel records, if necessary, advise you on tax issues and more. In this case, we take on all the financial risks associated with the work. That is, even if an error creeps in somewhere in the report, we will correct it ourselves and send an updated declaration ourselves. Although mistakes in our business are rare. After all, true professionals work for us.

A complete list of accounting services for individual entrepreneurs:

- Doing tax accounting in KUDIR, paperwork in transactions with goods or property. Actually, this is the “accounting” of the IP.

- Maintaining cash discipline according to the latest innovations. In particular, maintaining cash book, registration of orders and all transactions related to cash.

- Formation tax reporting and its delivery (in electronic form via the Internet). If there are employees, it is also necessary to form the so-called "salary" reporting (to the tax, FSS, PFR).

- Personnel accounting. When hiring someone, sole proprietors, like companies, are required to comply with the requirements Labor Code. Including with regard to the need to pay "pension" taxes and contributions to various funds. Personnel records also include registration of hiring, dismissal, vacations, sick leave and business trips.

What determines the price of accounting services for individual entrepreneurs?

In many ways, the price is determined by the following factors:

- the presence or absence of employees in the IP;

- the applicable taxation system (OSNO, USN);

- the number of transactions per month.

If you, like many entrepreneurs, think that accounting is not for you, or you simply don’t have time for it, write to us or request a call back. The manager will answer all questions in detail and advise on tariffs.