The most profitable acquiring for IP. Acquiring for individual entrepreneurs - what is it, how to choose a profitable offer The best offers for acquiring

Merchant acquiring- this is a kind of service for accepting payments by bank cards using POS-terminals in trade and service enterprises (TSP). The main difference from other types of acquiring (mobile and when paying via the Internet) is that a separate device (terminal or imprinter) works with the card, printing paper receipts to confirm the operation (some mobile terminals already can print fiscal receipts, but this is rather an exception to rules, since most reporting documents are sent to the client by mail or by phone in the form of SMS). Due to the fact that such a payment scheme is used most often in offline stores (supermarkets, offices, retail outlets, etc.), acquiring is called "trade".

Payment by bank card through the terminal is characterized by a high degree of transaction security for both the merchant and the buyer, as well as a shorter transaction processing time compared to mobile terminals or payment via the Internet.

The payment system is responsible for processing, providing guarantee obligations to both parties of the transaction (buyer and seller). The bank that provides the merchant acquiring service is a member of such a system (national, for example, Russian "MIR" or international, such as VISA or MasterCard), as is the bank that issued the card to the owner.

Types of POS-terminals for acquiring

Conditionally terminals for receiving payment from bank cards can be divided into the following groups:

Modular. Here, the individual functions are distributed to different hardware units. To combine them into one system, you often need a computer or other device responsible for the operation of application software (smartphones or tablets are also suitable for these tasks). The modular approach allows you to build complex POS systems under a full range of tasks solved by the cash module. Examples of individual blocks:

Modular. Here, the individual functions are distributed to different hardware units. To combine them into one system, you often need a computer or other device responsible for the operation of application software (smartphones or tablets are also suitable for these tasks). The modular approach allows you to build complex POS systems under a full range of tasks solved by the cash module. Examples of individual blocks:

Autonomous. These are devices that are a monolithic system of all the necessary blocks. That is, such terminals already have their own card reader, printer, pinpad, etc., and can work completely autonomously. But to include them in single system accounting of a trade enterprise can be equipped with interfaces (for example, for connecting to a cashier's workplace or to an available network with Internet access). Standalone POS terminals can be divided into the following subtypes:

Autonomous. These are devices that are a monolithic system of all the necessary blocks. That is, such terminals already have their own card reader, printer, pinpad, etc., and can work completely autonomously. But to include them in single system accounting of a trade enterprise can be equipped with interfaces (for example, for connecting to a cashier's workplace or to an available network with Internet access). Standalone POS terminals can be divided into the following subtypes: - Stationary. Most often they do not have a built-in battery or its capacity is designed for a short battery life, the interfaces for accessing the Internet are mostly wired: RG-45 (LAN), RS-232, etc. But to ensure uninterrupted communication, they can be equipped with built-in GPRS modems.

- Portable / portable. They can work for a long time even without external power. Equipped with a built-in modem for 2G/3G/4G communication and/or other interfaces for wireless connection: Wi-Fi, Bluetooth, etc.

- Specialized. This is mainly embedded equipment, which is used in self-service devices. In turn, such terminals can be autonomous or modular. Private types of specialized POS-terminals include the following:

- Devices with signature capture.

- Equipment with biometric identification(by fingerprints, face, etc.).

- Embedded POS-terminals (for vending machines, for self-service checkouts, etc.).

- Software. Before the widespread introduction of contactless payments, the only alternative to terminals was Internet acquiring. But NFC modules in smartphones and on bank cards made possible another type of payment - without a terminal at all. The NFC module of the smartphone acts as a reader. The application of the bank and its servers are responsible for all other operations.

- Mobile terminals(m-POS). They can be called modular devices rather than stand-alone ones, since they are structurally composed of only a reader and a pinpad (sometimes even just a reader). And a third-party device (smartphone or tablet with an application installed on it) is responsible for the calculations. Banks or special services offer them as a separate solution with their own tariffs and a separate agreement.

. Here, the POS terminal can be included in another monolithic or composite device. The online cash register is able to take over all the functions of the cash register module. The base set already has:

. Here, the POS terminal can be included in another monolithic or composite device. The online cash register is able to take over all the functions of the cash register module. The base set already has: - Computing device. Usually this is a tablet based on a popular operating system with a special software(with the ability to install an additional one if necessary).

- fiscal storage. Compliant with the requirements of 54-FZ (capable of exchanging data with OFD).

- Receipt printer.

All terminals can be classified according to technical parameters:

- type of readable cards (magnetic stripe, with a chip, contactless);

- type of connection (wired/wireless and in terms of specific technologies: LAN, 2/3G, Wi-Fi, etc.);

- additional features (interfaces for connecting auxiliary equipment, integration with cash registers and information systems enterprises).

Technology operation scheme

Only an individual entrepreneur or a legal entity that has concluded an acquiring agreement with a bank can accept non-cash payments.

The organization for receiving payments is as follows:

- The cashier asks the client about the method of payment, if the payment will be made from the card, the buyer is provided with the terminal of the acquiring bank or the cashier asks to transfer the card to him.

- The card is rolled with a magnetic stripe, inserted with a chip or applied to the POS-terminal display (only for cards with NFC - contactless payments). The device requests authorization (entering a PIN code, providing documents with signature verification, etc.).

- If authorization is successful, the acquiring bank blocks the purchase amount on the card account with the issuing bank. If there is not enough money, the payment is interrupted.

- If the limit allows you to make a purchase, a positive response is returned. A check (slip) is printed on the debiting of funds, the buyer picks up the goods.

- The acquiring bank confirms the successful purchase to the issuer, the funds are finally debited from the cardholder's account in favor of the acquirer.

- The transaction between banks is closed by clearing files.

- The amount is transferred to the account of the enterprise (legal entity or individual entrepreneur) with the frequency specified in the acquiring agreement.

Mobile payments through POS-terminals are somewhat different (a smartphone is used instead of bank cards, for example, Apple Pay, Samsung Pay etc.). Card data is stored in encrypted form. The application installed on the smartphone requests for each new purchase a unique code (token), which is transmitted to the terminal instead of a number real card via NFC. After checking the issued token with the data of the real card on the servers of the tokenization service provider, the payment is made in the usual mode, as from the account of a regular bank card. With this approach, the security of each individual mobile payment transaction is increased.

Mobile payments through POS-terminals are somewhat different (a smartphone is used instead of bank cards, for example, Apple Pay, Samsung Pay etc.). Card data is stored in encrypted form. The application installed on the smartphone requests for each new purchase a unique code (token), which is transmitted to the terminal instead of a number real card via NFC. After checking the issued token with the data of the real card on the servers of the tokenization service provider, the payment is made in the usual mode, as from the account of a regular bank card. With this approach, the security of each individual mobile payment transaction is increased.

How to choose

To do right choice bank for merchant acquiring, it is necessary to take into account many factors:

- average check amounts

- turnover per month

- terms of rent, purchase or connection of own terminals (including models supported by the bank),

- what current account the service works with (a number of banks connect acquiring only for withdrawals to accounts opened in their own network, some can withdraw to third-party accounts, but with their own additional commission, etc.),

- penalties for non-profitability,

- supported payment systems (many banks avoid systems that are not widely used in Russia, such as JCB, China UnionPay, AmericanExpress, DinersClub International, etc. And their use in your business model may be mandatory, which will fundamentally affect the approach to choosing an acquiring bank) ,

- RKO tariffs (if the account will be opened in the acquiring bank),

- equipment maintenance cost.

Do not bypass the issue of technology for accepting non-cash payments, depending on the scope of the enterprise. So, in the restaurant business, portable terminals will be preferable, stationary models can be installed in a supermarket, in a delivery service or a taxi, accepting payments will help organize mobile acquiring, etc.

Only after a detailed analysis and calculation of all components, you can make the most optimal choice.

Merchant acquiring is the acceptance of non-cash payments at retail outlets or enterprises. The use of bank cards for payment is carried out using special devices - POS-terminals or imprinters that print checks confirming payment. Acquiring ensures the security of transactions for all participants in the payment process (both the buyer and the seller of goods and services). It saves time as transaction processing is faster (compared to cash). All guarantees for the security of payments are borne by payment systems. These can be national payment systems, for example, “MIR”, or international ones, such as “VISA”, “MasterCard”. Banks providing acquiring services and issuing plastic cards from which payments are made are also part of such a system.

Payment procedure in merchant acquiring

Only individual entrepreneurs and legal entities who have specialized equipment and have entered into an agreement for the provision of acquiring services with the bank. In general, the payment procedure includes several stages and is as follows:

- the seller specifies the payment method with the buyer and, when choosing a non-cash payment, provides the client with a terminal for reading a bank card;

- authorization of the card occurs through a magnetic strip, an electronic chip or by applying the card to the display of the terminal (if a plastic card has such a function);

- upon successful authorization of the card by the acquiring bank, the required amount is blocked on the card account in the issuing bank. If there is a shortage of funds, payment is not made;

- if there are enough funds on the account, the operation is confirmed and the terminal issues a receipt confirming the payment for services or goods. At the same time, money is debited from the account only after the transaction is confirmed to the issuer by the acquiring bank;

- enumeration Money to the entrepreneur's account is made within the time specified in the agreement governing the relationship between entrepreneurs and acquiring banks. As a rule, they are from one to three days.

Merchant acquiring connection

To connect acquiring, you need to send an application to the bank, collect a package of documents, purchase, connect and configure the necessary equipment. In total, the entire connection process consists of six stages.

After successfully completing all the stages of connection and system configuration, acquiring is ready to work.

Rights and obligations of the parties to the acquiring agreement

When concluding an agreement for the provision of acquiring services, each party has certain rights and obligations. Thus, the acquiring bank must:

- install the necessary equipment to accept non-cash payments;

- train the client's employees to work with acquiring equipment;

- provide technical support for the implementation of acquiring equipment at an enterprise or outlet, as well as advice to a client on issues related to working in the system;

- check the solvency of bank cards;

- to carry out timely transfer of funds to the client's account (in accordance with the terms of the agreement);

- provide consumables for acquiring equipment.

Individual entrepreneurs and organizations have the right to demand that the bank fulfills all the above conditions. At the same time, they are also subject to certain requirements from banking organizations, which they must ensure:

- a place to install equipment for acquiring;

- acceptance of bank cards for payment;

- payment of commission fees for acquiring operations. The commission is charged by the bank from the seller of goods or services and depends on their value.

In more detail, the conditions for the provision of services are prescribed in the agreement between the bank and the organization.

Tariffs of banks for acquiring

In order to choose a favorable acquiring tariff, a company or an entrepreneur must take into account factors that affect both the cost of service and the convenience of using a cashless payment system. Below is a list of the main ones:

- Bank requirements for the turnover of the company. The percentage of the commission that the bank takes for operations on the terminal depends on this amount. It is important to pay attention to the conditions under which minimum percentage and make sure the company can meet them. Otherwise, the organization expects either an increased percentage, or the bank may charge a fine for non-compliance with the requirements.

- Conditions for the provision of acquiring equipment. It can be buying a terminal or renting it. This important point, since not all banks work with equipment purchased from third parties.

- It is also important to consider in which bank the current account is opened and serviced. individual entrepreneur or organizations. Some banks provide merchant acquiring services only if you open a current account with their organization. If there are no such requirements, it is worth clarifying whether an additional commission is charged for transferring funds to another financial institution.

- The date of receipt of money to the company's current account. Different banks have different terms. As a rule, the transfer of funds is carried out within 1-3 days.

- The term of connection to the acquiring system. It is worth making sure that the bank can quickly connect and configure the equipment. There are cases when it can take several weeks from the application to connection.

- Support for less common payment systems. All banks support international payment systems (VISA, MasterCard) and national system"PEACE". But not all banks can accept payments from foreign systems (for example, "American Express"). This factor is especially important to consider when working in tourist areas.

- Service Tariffs settlement and cash services. Relevant for those banks where you can connect acquiring only together with opening a current account of the same bank.

- Service cost. It includes Maintenance, consultations, calling a master, replacement of consumables, etc. In many banks, services are provided free of charge, which makes their offer more profitable.

- Training and coaching of the client's employees. Not all banks provide this service.

To choose the most optimal tariff, it is necessary to take into account all these factors. For clarity, below is a comparative table with tariffs and commissions of the main banks. It will allow you to preliminarily identify banks with more favorable conditions.

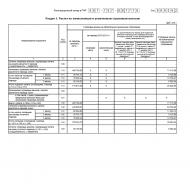

Comparative table of tariffs

|

Bank's name |

Payment systems |

Equipment cost |

The size of the commission from the amount of turnover of funds |

Restrictions on the amount of payments on the terminal |

The term for the transfer of funds |

Connection term |

|

|---|---|---|---|---|---|---|---|

|

Rent (price per month) |

Acquisition |

||||||

|

Bank module |

Visa, MasterCard, World |

from 1,500 to 2,000 rubles |

from 16,000 to 27,000 rubles |

from 1.6% to 1.9% |

50,000 rubles per operation, 250,000 rubles per day |

1 business day |

up to 7 working days |

|

Tinkoff |

Visa, MasterCard, World |

Is free |

from 1.59% to 2.69% (the bank also offers prepaid rates) |

1 business day |

from 1 business day (if you have a current account in the same bank) |

||

|

Sberbank |

Visa, MasterCard, World, Union Pay |

from 1700 to 2200 rubles |

|

1 business day |

from 1 working day |

||

|

Point Bank |

Visa, MasterCard, World |

from 1,200 to 2,000 rubles |

from 12,000 to 20,000 rubles |

from 1.3% to 2.3% |

within 2 hours after surgery |

up to 7 working days |

|

|

Visa International, MasterCard Worldwide, China UnionPay, American Express, JCB, WORLD |

|

from 5,000 to 41,500 rubles |

from 1.6% to 2.7% |

1 business day |

3 to 5 days |

||

|

Alfa Bank |

Visa, MasterCard, World |

|

from 15,000 to 30,000 rubles |

from 1.9% to 2.1% |

1 business day |

|

|

|

Promsvyazbank |

Is free |

during the current business day |

up to 10 working days |

||||

|

Is free |

from 17,500 to 31,900 rubles (in installments) |

from 1.35% to 1.8% |

up to 7 working days |

||||

|

Vanguard |

Visa, MasterCard, World |

from 200 to 750 rubles for 48 months (further free of charge) |

|

from 1.7% to 2.4% |

1 to 3 days |

|

|

|

VISA International, Mastercard Worldwide, American Express, Union Pay, MIR |

|

|

1.69%+1499 rubles per month |

1 business day |

|

||

|

Raiffeisenbank |

Visa International, MasterCard Worldwide, World and American Express |

Is free |

|

1-2 weeks |

|||

|

VISA International, Mastercard Worldwide, American Express, China Union Pay and WORLD |

|

from 1.65% to 2.6% + 2,600 rubles per month |

1 business day |

up to 5 business days |

|||

|

Russian Standard Bank |

Visa International, MasterCard Worldwide, China UnionPay, American Express, JCB, WORLD, DISCOVER, Diners Club |

|

from 17,600 to 30,000 rubles (there is an installment plan) |

|

1 to 3 days |

2 business days |

|

A banking service that allows companies to accept money non-cash payment(via a bank card). This option is in demand in the world and is gaining popularity in Russia. According to statistics, it is easier for customers to spend "non-cash" money, which is beneficial for the store and financial institution.

The main difficulty is the choice of the acquiring bank. LLC representatives are looking for the cheapest service, but end up with high commissions or expensive RKO. To protect against errors, it is important to know the selection criteria and acquiring rates for companies. But more about everything.

General provisions

When choosing the best acquiring, you need to understand what is included in the service, what equipment or software is required by the LLC. To accept payments from bank cards, you will need:

- processing center - an intermediary that provides communication between the client and the bank (its tariffs affect the final costs);

- imprinter - a device for the design of slips designed to create an impression payment card(rarely used today)

- POS-terminal - a device for reading data from "plastic" and providing communication with a credit institution;

- cash solution - a device for simplifying the process of reading information from a card;

- PinPad - an additional panel through which a PIN code is entered.

Some banking organizations offer customers mobile acquiring (Alfa-Bank, VTB24 and others). The peculiarity of this service is the ability to pay using the application on the phone.

Communication with the bank is provided through a telephone call, Ethernet cable, wireless network or GSM. When choosing, you need to take into account the characteristics of the business.

Acquiring selection criteria for LLC

When looking for an acquiring bank, you need to pay attention to the tariffs (about them will be discussed below) and additional criteria:

- Staff briefing. A bank employee must teach the principles of working with equipment, the algorithm of actions, the rules for revoking authorization, checking the originality of a card, and so on. After training, an act is issued with the signature of the store employees. Some banks conduct training on acquiring for LLCs, where they talk in more detail about mistakes, document flow features, increasing sales and solving other problems.

- Loyalty programs. To attract customers, many offer Additional services. A person spends money in a store, gets points, and then uses them to buy any goods.

- Way of informing. To control operations, LLC receives statements by mail or data in the form of SMS messages. Plus - an express notification, which implies informing about failures in the work of a banking organization.

- Maintenance. It is recommended that the personnel of the banking organization carry out work 24/7. In the event of a breakdown, repairs must be made within 24 hours.

To this list, you can add expenses, acquiring rates for LLCs and additional expenses - equipment installation (rent, purchase), connection fees, repair fees, and more. The tariff often depends on the company's turnover, the presence of a processing center at the bank and an acquiring license.

The cheapest acquiring for LLC: tariff overview

Despite the above criteria, acquiring rates for LLC representatives remain the main parameter. For convenience, we summarize the information in a table.

| Bank | Commission,% | Equipment price | Conditions |

| Point Bank | 1,3-2,3 | Individual conditions | The lender offers several packages, the price of which includes a POS terminal, its delivery and setup. |

| Tinkoff | 1,79-2,69 | 18.5 tons and higher | You can use the service in the complex. Some RKO packages involve acquiring. |

| Modulbank | 1,5-1,9 | 20-27 tr. (loan for 12 months is available). | Quick connection, transfer of the POS-terminal into the possession of the client. |

| VTB | 1,8-3,5 | 8-41.5 t. | No turnover limits, support 24 hours a day. |

| Sberbank | Up to 2.5 | 1.7-2.2 tons per month (installment plan) | Personal conditions for clients, it is possible to transfer money to a bank account of another credit institution. |

| Alfa Bank | 1,9-2,1 | Rent without the need to pay | The need to issue a cash account, no turnover limit, access to the global network is required. |

| VTB Bank of Moscow | 1.8 and above | Free rental | Commission on turnover, free materials |

| Binbank | 1,4-1,8 | 17.5 tons (purchase in installments). | There are no turnover requirements, two SIM cards are issued, free training. |

| Promsvyazbank | 1,59-1,89 | Rent (no payment) | The size of the commission varies depending on the type of activity, crediting money to the bank account on the same day, assistance 24 hours a day. |

| ICD | 1,6-1,9 | Rent (free) | Universal POS-terminal, free training, issuance of consumables. |

To determine the cheapest acquiring, LLC representatives need to focus on the type of business, turnover and requirements for the bank. Only with an integrated approach can you choose a financial institution that offers favorable rates. It should be taken into account that the total costs are formed from three components - the price of equipment, commissions and fees for settlement services (in many banks you will have to open a current account).

Let's talk about what merchant acquiring is. Let's see what tariffs for this service are offered by the TOP-14 Russian banks for entrepreneurs. Here are instructions on how to connect merchant acquiring for business.

Merchant Acquiring - Tariff Rating

We have collected in one table the tariffs for merchant acquiring from the TOP-14 Russian banks.

| Bank | Commissions | Equipment price, ₽ | Reviews | Rating | Official site | |

|---|---|---|---|---|---|---|

| Dot | 1,3% | 2,3% | 12 000 – 20 000 | 10 | ||

| Module-Bank | 1,6% | 4% | 8 000 – 35 000 | 10 | ||

| Tinkoff-Bank | 1,59% | 1,99% | Is free | 10 | ||

| Sberbank | 0,5% | 3% | Installment from 1000, months | 10 | ||

| Promsvyazbank | 1,59% | 1,89% | Free rental | 10 | ||

| Raiffeisenbank | 1,99% | Rent 190 – 990, month | 9 | |||

| Sovcombank | 2,3% | Is free | 9.47 | |||

| Alfa Bank | 1,9% | 2,1% | Is free | 7 | ||

| VTB | 1,6% | 2,7% | 5 000 – 41 500 | 10 | ||

| Vanguard | 1,7% | 11,9% | Rent 250 – 750, month | 0 | ||

| ICD | 1,65% | Free rental | 10 | |||

| MTS Bank | 1,69% | 1,69% | Rent 1499, month | 10 | ||

| Uralsib | 1,65% | Rent 2600, month | 7 | |||

| Russian standard | 1,8% | 2,2% | 17 600 – 30 000 | 9.5 | ||

| min | max | |||||

What is merchant acquiring?

Merchant acquiring - non-cash payment for services and goods. It is available in many stores: they have terminals for cards. If you insert a card and enter a PIN code, then the money will be debited from it and sent to the seller. Since 2016, smartphone payments have also been working in Russia: customers do not carry cards with them, but use Apple Pay, Samsung Pay or Google Pay.

Please note that merchant acquiring is only in a physical store (one that physically exists). If you accept payment on the Web, then this is Internet acquiring. It has its own features and tariffs for service.

How does merchant acquiring work?

Below is a brief description of how merchant acquiring works in a physical store.

- the buyer inserts or applies the card, smartphone to the terminal

- enters PIN code

- the terminal contacts the payment system (it can be Visa, MasterCard, MIR) and “asks” if it is possible to carry out the operation

- the terminal contacts the bank that issued the card and “asks” if the buyer has enough money

- if all is well, the funds are debited from the account, the seller gives a check.

How to choose an acquiring bank?

We have prepared a list of 9 criteria by which you can choose the best acquiring bank.

#one. What are the turnover requirements?

See how the acquiring bank changes the commission depending on the turnover. If the conditions are such that you can pay the bank less than 2% of the turnover, then you can order acquiring in this bank. If, for a commission of 2% or less, you need a turnover of 500,000 rubles per month or more, we recommend that you look at other banks.

#2. What about equipment?

See how the bank issues equipment. Should I buy it or can I rent it for free? Is it necessary to buy a terminal at a bank or will acquiring be connected to a device purchased somewhere else?

#3. Where will the funds be transferred?

Banks take an additional commission if the proceeds from acquiring need to be transferred to an account with another company. From our TOP-14 banks, you can arrange acquiring and not pay for the transfer of money to another bank at Sberbank.

#4. How quickly will the money be transferred?

#5. How quickly will the terminal be connected?

Check with the bank manager how quickly the terminal will be installed and connected in your store. In most banks from our TOP-14, this will be done 1-2 weeks after the application or earlier.

#6. What payment systems are accepted?

If an individual entrepreneur and LLC works with tourists, then it is better for him to connect acquiring with the support of JCB, American Express, Union Pay, which are popular abroad. Terminals must also accept MasterCard, Visa, MIR, the most common in Russia.

#7. What are the RKO rates?

Find out how much the bank charges for maintaining the account. It may turn out that cheap acquiring rates are “compensated” by expensive service. And vice versa: there is a large commission for “clearing” in banks where account maintenance is free.

#eight. How much does maintenance cost?

Find out how much it costs to visit a specialist to set up the terminal and repair it. The price for these services is individual, depending on:

- what is the turnover of the business

- how many terminals are there in stores

- what model are they

- how far to go to shops.

#9. Is there employee training?

Uralsib and MKB-Bank are companies from the TOP-15 banks that will teach employees how to use terminals for free. This is useful if you buy a lot of different devices - POS-terminals, pinpads, online cash registers.

We recommend that you determine for yourself which of the nine criteria are most important for your business. For example, sole proprietorships and LLCs with small incomes should pay attention to turnover requirements - commissions for such a business will be significant. And for large businesses, we recommend choosing a bank where they install, repair terminals and transfer money to the account the fastest.

What determines the cost of acquiring?

We have identified three factors that determine the cost of acquiring:

- equipment price, terms of its use (purchase or lease)

- transaction fees

- bank account fees.

We recommend evaluating all factors that affect the cost of acquiring. In banks where there are small commissions, there may be expensive terminals and tariffs for maintaining an account. And in companies that take 2-3% of turnover, they can provide equipment for free rent and do not charge a commission for account maintenance.

What is the equipment for merchant acquiring?

We have prepared a small overview of all types of equipment for acquiring. They described not only the terminals, but also other equipment.

#one. Stationary terminals

Installed in physical stores. Do not move: Internet connection is usually via cable. Used by stores that already have cash registers and cash payments.

#2. Portable terminals

You can carry them with you - work at several points, and buy one terminal. Portable equipment has a battery that lasts for 2-3 days of operation. They have SIM-cards and work without a cash register.

#3. POS systems

POS systems include:

- payment terminal

- keyboard, display for entering purchased goods, services

- Barcode Scanner

- fiscal apparatus.

The most expensive type of merchant acquiring equipment. Completely replaces the traditional workplace of a cashier. Suitable for new stores that are equipped from scratch.

#4. SMART systems

SMART-system consists of:

- mobile terminal

- fiscal accumulator

- smartphone or tablet.

The mobile terminal used in a SMART system is smaller and cheaper than a conventional device. It connects to a smartphone or tablet via Bluetooth. It turns out a full-fledged terminal, like in a store.

#5. Pinpads

Auxiliary device. This is a gadget with a PIN-code keyboard and a screen where the client puts a card / phone or inserts a card. The pinpad does not work on its own - only in conjunction with the terminal.

Is there merchant acquiring without a bank account?

No. If an individual entrepreneur or LLC wants to connect merchant acquiring, then you will need a bank account. Otherwise, there is nowhere to transfer money that buyers transfer by bank transfer.

If the entrepreneur already has an account, and profitable terms according to merchant acquiring they give in another bank, then it is not necessary to open an account. You can arrange acquiring in one bank, and receive money in another. Sberbank will do this without additional fees.

Merchant acquiring and online cash registers

Since 2017, stores that sell goods and services must have online checkouts. This is a requirement of Federal Law N 54-FZ of May 22, 2003. If they are not, there will be fines: for officials– from 1500 to 3000 ₽, for companies – from 5000 to 10000 ₽.

If merchant acquiring is connected in the store, then an online cash desk will still be needed. It is equipped with a fiscal drive that sends all sales data to the Federal Tax Service. This is necessary to accurately calculate taxes from the store.

When connecting merchant acquiring, check online cash desks: they must comply with the requirements of the law. We talked about penalties for violations above.

How to connect merchant acquiring?

We have prepared a brief instruction that will help you connect merchant acquiring. It has 7 steps.

#one. Choose a bank

Choose a bank the best conditions on merchant acquiring. We recommend using the criteria described above.

#2. Submit an application

Send an application for merchant acquiring:

- in internet bank

- through the site

- by phone.

A bank consultant will contact you and clarify for which business acquiring is needed. He will tell you in detail about the current tariffs and help you choose the best one.

#3. Prepare documents

A package of documents for connecting merchant acquiring:

- passport of an individual entrepreneur or director of an LLC

- extract from the USRIP (for individual entrepreneurs), USRLE (for LLC)

- certificate of registration of an individual entrepreneur or LLC

- account details.

Please note that this list is not complete. Your bank may ask for other documents.

#4. Pick up equipment

Choose the equipment you need for merchant acquiring. We talked about the types of equipment above. A bank consultant will be able to tell you how many pieces of equipment will be needed for the store.

#5. Sign an agreement

Sign the merchant acquiring agreement at the office or in the Internet bank. It is drawn up as an additional to the cash settlement agreement.

#6. Install hardware

Bank specialists will go to the store, install and configure the equipment. Prepare the conditions for the work of the masters.

#7. Start payment

The specialists of the acquiring bank will train employees (if such a service is available). After that, you can turn on the equipment and accept payments from customers by bank transfer.

Conclusion

According to Alfa-Bank experts, merchant acquiring increases business revenue by up to 30%. And Unistream-Bank claims that individual entrepreneurs with merchant acquiring earn 80,000 rubles more per year.

According to the Uniteller company, which works with enterprises from 40 business sectors and serves more than 3.5 thousand stores, a customer spends 30% more with cashless payments than if he paid in cash.

Therefore, we recommend connecting merchant acquiring for any business. Among the TOP-14 Russian banks there are those that charge 1.5-2% commission for all transactions. And these banks will also help install terminals, service them and transfer the proceeds to the bank where it is convenient for the entrepreneur.

owner of Beauty Manufactura

If everyone wants to pay with Apple Pay, it's our top priority to make sure that this payment method works for us just like it does elsewhere. The girl did a manicure, she does not need to go into her wallet for money - she just put the phone to the terminal. Money is debited automatically.

Acquiring can also be different. It is in Sberbank Money earned on Monday is already in our account on Tuesday.

In his Sberbank Business Online I see what receipts were for each month, I can analyze which one brought more cash and receipts to the current account.

Alexandra Alimbekova

co-founder of MATCHA BOTANICALS

At Sberbank - one of the most low rates by acquiring. That's why I chose him. When acquiring was installed, everything was done through the Sberbank Business Online application. Leave a request, and the next day the specialist is ready to come and install the cash register.

30% of our clients pay with cards. And it is important for me not to miss them and not to lose to competitors at the food court. Another acquiring is safe and convenient, no need to keep cash in a drawer.

Dmitry Bakhirev

managing partner VR-quests ANVIO

80% of payments go through our website. It's comfortable- we immediately receive revenue, and the user pays the way he is used to: with cards, Apple Pay and Google Pay.

Previously, users booked quests without prepayment and paid the entire amount in cash on the spot. They could not come, and we lost 20-30% of the revenue. Now there is a prepayment through the site - we save revenue.

When they were launched, acquiring was urgently needed. Filled out an application on the Sberbank website - a couple of days later they installed terminals and set up accepting payments through the site.