Car loan agricultural bank interest rates per year. Obtaining a car loan from the Russian Agricultural Bank. How to get money and get a loan

Car loans at Rosselkhozbank have certain features that differ from other banks. He offers his clients to get auto loans for new and used cars (but this is pretty standard in the market). But as of 2017, Rosselkhozbank stopped providing ... And in general, there are no promotions from large auto concerns and other marketing products (as, for example, inSetelem Bank ). Now everything is simple - two programs, choose any.

It is worth noting immediately what are the advantages of this type of lending in RS Bank:

It is worth noting immediately what are the advantages of this type of lending in RS Bank:

- relatively low interest rates, from 15.5% per annum

- loans for new and used cars

- line of discounts for payroll clients

- orientation, including those who run their own subsidiary plots

- you can even buy a car Trailer

- there is an opportunity to take out a loan and a CASCO insurance policy

- you can change your mind about taking a loan without any sanctions within the next few days after registration

- different sources are taken into account as income

- lack of a state support program

- no specialized promotions held jointly with car manufacturers

- availability down payment from 15%

- there are penalties for late payments

Conditions

Besides Rosselkhozbank issues a car loan on the following conditions:

Besides Rosselkhozbank issues a car loan on the following conditions:

- you can buy a car of categories: "B", "C", "D" and "Trailer"

- the loan amount should not exceed 3,000,000 rubles

- the loan is issued only in rubles

- the first installment is at least 15% of the cost of the purchased car

- issued for a maximum of 5 years

- for the fact that a loan is provided, the bank does not take additional commission

- the client can choose both annuity and differentiated monthly payment

- as collateral, the purchased car is mandatory

- a loan can be issued not only for the purchase of a car, but also for the purchase of insurance (CASCO)

- the maximum term for consideration of the application is 4 working days, however, the bank reserves the right to change it

- there are no other payments besides the loan

- there are additional agreements that the client is obliged to conclude with the bank in connection with obtaining a car loan from the Russian Agricultural Bank:

- the loan is provided by non-cash transfer of the required amount to the bank account of the borrower

- if the borrower changes his mind about taking out a loan after the bank has approved the application, he must notify the credit institution in writing

- the client has the right to repay the loan ahead of schedule without additional payment (the amount of early repayment can be any)

Additional contracts:

- if the borrower does not have a bank account agreement in the currency in which he takes a loan, then his responsibilities include concluding this agreement

- insurance contract in case of car damage or theft

- a contract that insures the life and health of the owner of the car (while payments are made in accordance with the tariffs of the company with which the obligations are concluded)

Interest rates and surcharges

If the bank has approved the client's application for a car loan from Rosselkhozbank, the borrower must make a minimum down payment of at least 15% of the purchase amount. The loan is provided for a maximum of 5 years at a minimum interest rate of 17.5% per year.

Surcharges and discounts to the interest rate are allowed in the following cases:

- + 6% if neither the borrower nor the co-borrower agree to take out life or health insurance (as well as in case of violation of the contract during the term of the debt obligations)

- - 2% for clients with a positive credit history

- - 1% for clients who receive salaries to the account of the Russian Agricultural Bank

If the borrower receives a salary on the account of Rosselkhozbank, and also has a positive credit history, then the credit discount is cumulative.

More information about interest rates can be found in the nearest branch of JSC "Rosselkhozbank"

Requirements for the borrower and the car

Car loans at Rosselkhozbank are provided to clients who meet the following requirements:

- the borrower is 18 years old at the time of the loan

- a pensioner can also receive a loan, but it must be repaid before the client turns 65 (and the record holder in this case , they give up to 85 years old)

- the borrower is a citizen of the Russian Federation

- there is a permanent registration in the area in which the bank branch is located

Requirements for income not related to the maintenance of personal subsidiary plots (LPH):

- if the borrower is an individual, his work experience must be at least 1 year over the last 5 years and at least six months at the current place of work

- if the borrower is already a client of Rosselkhozbank, that is, he has already taken out a loan from this bank and has a positive credit history or receives wages to a bank account, the total length of service over the past 5 years must be at least six months, and at the current place of work at least 3 months

- borrowers aged 18-20, as well as pensioners who receive a pension to the bank account of Rosselkhozbank, are not required to have a total work experience of at least 1 year over the past 5 years (read where else to get a loan in 20 years)

To obtain a car loan from the Russian Agricultural Bank, you need to carry out a number of actions:

- decide on the brand of the purchased car

- fill out an application in one of the branches of the bank or on the official website (if the application was filled out on the website, with a positive answer, an employee will contact you credit institution and will report it)

- then you will need to appear at the RSB office at the agreed time to sign the contract

- after signing the contract, you should receive cash (most often they are immediately received by the seller of the equipment to his bank account)

To avoid any misunderstandings, you must carefully read the completed car loan agreement:

- the first thing to check is the correctly filled out information about the borrower (full name, bank details, passport data)

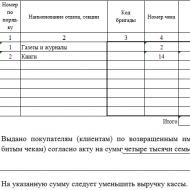

- equally important information - the exact amount in words and the name of the currency, as well as the conditions under which the car loan is provided and the purpose of its expenditure

- then the rules of the loan are indicated (the period for which the borrower is obliged to repay the loan, the annual interest rate, possible additional commissions)

- also, the agreement prescribes various fines and penalties for late payment of the loan (for example, the bank may reserve the right to withdraw funds from the borrower's accounts if he did not fulfill the promised payment on time)

- if the client violates any of the terms of the agreement, the bank has the right to pick up the completed object, which is located until the repayment of the debt secured by the bank

- the agreement must contain a clause that stipulates unforeseen circumstances, as a result of which the bank may terminate the agreement with the borrower

It should be remembered that you can only avoid further troubles if you carefully study the terms of the contract.

Many financial institutions include important information in small print at the end of the text or in an inconspicuous note. Such information is considered competently written from a legal point of view, but a person may not pay attention to it, as a result of which a misunderstanding of the situation may arise on the part of the client, thanks to which the bank will benefit more.

Every motorist planning to purchase for use new car is considering the possibility of acquiring it on credit. Rosselkhozbank is offered quite favorable conditions for car loans. There are different programs - to purchase a vehicle from the showroom, you can use the car loan program at Rosselkhozbank in 2019, a calculator for buying a used car.

A potential borrower who applies to Rosselkhozbank will be able to choose the most advantageous offer for himself from several possible ones, developed for different groups of borrowers. Here are the basic conditions for car loans at Rosselkhozbank:

- The maximum allowed loan amount is 2 million rubles.

- The average maturity period is 60 months.

- When buying a new car from the salon, you will need to pay up to 30% of the established cost.

- Interest rates from 13% to 15.5%.

You can apply to Rosselkhozbank for a car loan for a new car if you intend to return the money in a year. If the hands are about half of total amount, you can get a loan on the most favorable terms.

Rosselkhozbank car loan with state support

The most attractive and profitable terms for purchasing a car from the salon can be obtained when applying for a loan with state support... The only condition in this case is the cost limitation, vehicle should cost no more than 700,000 rubles. The first installment will be 15% of the car's value. Another important condition is the choice of a car, the brand of which is presented in a special list compiled by the state program. We are talking about cars from domestic manufacturers or from foreign ones, but assembled on the territory of the Russian Federation.

Not only new, but also used cars can be purchased under this program. Auto lending in 2019 with state support offers quite favorable conditions:

- At the time of settlement with the bank for a loan, the vehicle must be used for no more than 10 years;

- The down payment is 20% of the total cost of the car;

- A car loan is issued for a period of 36 to 60 months;

- The average interest rate is 15-16.5% per annum;

- If the loan is repaid in about a year, the total overpayment will be 14%.

Regardless of whether a new or a used car is purchased, it must be issued as a deposit financial institution... This is a guaranteed refund if the client is unable to repay the Rosselkhozbank car loan.

Rosselkhozbank has an opportunity to purchase not only passenger cars, but also cargo and specialized commercial vehicles under a car loan. Take advantage of advantageous offers for car loans can be young people over the age of 18, as well as pensioners. In the second case, it is important that the age of the elderly at the time of closing the loan does not exceed 65 years. Regardless of age, a potential borrower must prepare the following documents:

- Passport of a citizen of the Russian Federation.

- Certificate of income received, drawn up in the form of 2-NDFL.

- Copy work book or an agreement concluded with an employer.

Among the mandatory requirements, one can note not only the initial payment, but also car insurance under the CASCO system. Rosselkhozbank does not have any commissions and hidden fees. It is possible to repay the loan without any penalties if the calculated amounts are paid on the payment dates strictly specified in the schedules.

Important! The main terms of lending are prescribed in the agreement. Before signing it, you need to study it very carefully.

Car loan calculator calculate Rosselkhozbank

In the process of choosing a car and offering a car loan, the future borrower needs to make preliminary calculations... This will help you understand what interest will be accrued, how much the overpayment will amount to, and for how long you need to issue a loan. You can make similar calculations using the Rosselkhozbank auto loan interest rate 2019 calculator.

In the process of choosing a car loan program, a decisive role is assigned not only to the potential client's capabilities, but also to certain criteria of the bank. The package of collected documents and the amount of monthly income are important. There is an approximate amount that a bank can approve as a car loan. You will need to take 40% of the monthly income as a basis, multiply it by the number of months of the estimated term of the future loan.

If the amount approved by the bank is not enough to purchase the car you like, the problem can be solved using different additional measures... Here are some options for how to get the right amount:

- Follow a program that takes into account the income of the whole family;

- Provide a surety of a reliable person;

- Increase the amount of the initial payment;

- Confirm the additional income received - renting real estate, various benefits, interest on deposits and shares and pension accruals.

The presented car loan programs provide special preferential rates for clients who receive salaries at the bank, corporate clients enjoy preferential preferential terms.

Conclusion

When deciding to take a car loan from a bank, you should carefully study and consider the basic conditions. The registration process is quite simple and straightforward. You will need to collect the necessary documents, choose a car, make an initial payment, conclude an agreement with the bank and go to buy the desired car, having previously issued CASCO insurance. In certain cases, various additional points may appear, which are solved quite successfully by professionals.

Rosselkhozbank: loans to individuals in 2019 at low interest rates

Rosselkhozbank announced a decrease in the rate on consumer loans in cash within the framework of three promotions at once:

1. "To all working people";

2. "Good story";

3. "Honorable age".

For example, special conditions of the "To All Working People" campaign allow you to get a loan without guarantors at a rate of 9.9% per annum for reliable ones, from 11% for salary clients and from 13.5% for other clients. In this case, the period should be from 1 year, and the amount - up to 750 thousand rubles (up to 1.5 million rubles for salary clients). The promotion will last until June 30, 2019 (inclusive).

Below in this review, we take a closer look at the interest rates and conditions that apply to all promotions.

However, the programs consumer lending Rosselkhozbank there are other benefits... Among them:

- - Lack of commission;

- - Selection by the borrower of the repayment scheme (annuity / differentiated);

- - Early repayment with no restrictions;

- - Possibility of confirming income in the form of a bank;

- - Attracting co-borrowers to increase the loan amount.

Basic requirements for borrowers

In 2019, Rosselkhozbank loans can be obtained by Russian citizens under the age of 75 (at the time of loan repayment), including individuals who have been running private household plots for at least 12 months. For those who do not receive a salary on the RSHB card, at least 6 months are also required at the current place of work and at least 1 year of total experience over the past 5 years.

Loan of the Russian Agricultural Bank to individuals 2019: conditions and interest rates

Rosselkhozbank today has a whole line of loans, among which there are consumer loans cash:

1.without guarantors for ordinary individuals;

2. without collateral for payroll clients;

3. with security;

4. secured by real estate;

5. retirement;

6.to buy a car

7. for owners of garden and summer cottages.

Let us consider in more detail at what interest it is now possible to issue consumer loans for individuals in the Russian Agricultural Bank.

Credit of Rosselkhozbank without collateral and guarantors

This consumer loan is issued to individuals for any purpose without any collateral. It can be obtained by citizens of the Russian Federation aged 23 to 65 years (at the time of loan repayment). The amount that can be received from Rosselkhozbank without collateral and guarantors is not very large today, but the interest rate is higher than under other lending programs.

Conditions

Maximum amount: 750,000 rubles. / 1.5 million rubles. for payroll clients.

Term: up to 5 years / up to 7 years for salary clients / "reliable" clients / state employees.

Security: not required

Interest rates

Special bets

For individuals with a positive credit history

Up to 300 thousand rubles

Special bets

For individuals

Up to 300 thousand rubles

For "reliable" clients

Up to 300 thousand rubles

For state employees

Up to 300 thousand rubles

Up to 300 thousand rubles

Special bets,

valid in case of filing an application through the remote banking system"Internet bank", " Mobile bank"Or the official website of the Bank on the Internet until December 31, 2019.

For individuals

Up to 300 thousand rubles

For "reliable" clients

Up to 300 thousand rubles

For state employees

Up to 300 thousand rubles

For state employees - "reliable" clients

Up to 300 thousand rubles

Standard rates

For individuals

Up to 300 thousand rubles

For "reliable" clients

Up to 300 thousand rubles

For state employees

Up to 300 thousand rubles

For state employees - "reliable" clients

Up to 300 thousand rubles

Allowances:

Compare the interest on loans in RSHB and Sberbank.

Unsecured loan for payroll clients

This loan for any purpose without collateral and surety for individuals is issued only to those who receive salaries to an account with Rosselkhozbank. It can be obtained by citizens of the Russian Federation aged 21 to 65 years (at the time of loan repayment). The loan has a preferential interest rate.

Conditions

Minimum amount: 10,000 rubles;

Maximum amount: RUB 1.5 million for salary clients;

Term: up to 7 years;

Security: not required.

Interest rates

Special bets

For payroll clients

In the amount of 1 million rubles

For the amount from300 thousand rubles

For the amount from300 thousand rubles

For the amount from300 thousand rubles

For the amount from300 thousand rubles

For the amount from300 thousand rubles

For the amount from300 thousand rubles

Allowances:

4.5% in case of refusal to carry out life and health insurance during the entire loan term.

Credit of Rosselkhozbank with collateral

This consumer loan can be taken for any purpose. The main thing is to provide a surety or a pledge and then the interest rate will be quite low.

Conditions

Minimum amount: 10,000 rubles.

Maximum amount: 1 million rubles. (2 million rubles - for participants salary project Rosselkhozbank).

Term: up to 5 years (up to 7 years for salary clients / "reliable" clients / employees of budgetary organizations);

Security: surety of at least 1 individual / surety legal entity / pledge of liquid property.

Interest rates

For individuals

Up to 300 thousand rubles

For salary or reliable clients

Up to 300 thousand rubles

For state employees

Up to 300 thousand rubles

For state employees - salary or "reliable" clients

Up to 300 thousand rubles

Allowances:

4.5% in case of refusal to carry out life and health insurance during the entire loan term.

Credit of Rosselkhozbank secured by housing

This consumer loan for individuals of Rosselkhozbank today is issued for any purpose on the security of the property owned by the borrower.

Conditions

Minimum amount: 100,000 rubles;

Maximum amount: 10 million rubles (no more than 50% of market value property pledged).

Term: up to 10 years.

Security: pledge (mortgage) of the real estate object - apartment, residential building with land plot (including a townhouse).

Interest rates

Allowances

1.00% in case of refusal to carry out life and health insurance during the entire loan term.

Credit of Rosselkhozbank "Pensionny"

This is a loan for urgent needs for individuals who are retired. Citizens of the Russian Federation under the age of 75 can receive it today. No collateral required. The money is issued for up to 7 years in the amount of up to 500 thousand rubles. More information about the conditions and interest rates of a loan for retirees can be found

Car loan of Rosselkhozbank

This is a loan program for the purchase of a new passenger car of foreign or Russian production.

Credit "Gardener"

This is a program for owners of garden and summer cottages or those who are just going to purchase them. With credit funds, you can, for example, build a bathhouse, run water and even buy yourself a plot with already finished house... The interest rate on the Sadovod loan is lower than on standard loan programs.

Who are the "reliable" clients of Rosselkhozbank

“Reliable” customers include customers with a positive credit history on an active or repaid loan with JSC Rosselkhozbank, active / in effect for at least 12 calendar months before the date of application for a loan / until the date of its repayment, and a positive credit history in other banks.

How to get a loan for individuals at Rosselkhozbank

To obtain a loan, you must immediately contact the bank in person or make a preliminary online application. Then you need to provide a complete package of documents. The bank promises to consider loan application within 3 days (the term for consideration of the application can be changed at the discretion of the bank).

You can get money within 45 calendar days from the date the bank made a positive decision to grant a loan. The funds will be transferred in full to the client's current account with Rosselkhozbank. No commission is charged for issuing loans to individuals.

Loan documents for individuals in the Russian Agricultural Bank

To apply for a loan, you must fill out an Application Form, as well as submit a certificate of income in the form of a bank. To obtain a secured loan, in addition to the Application Form from the borrower and the guarantor, it is also necessary to bring to the bank documents for the property pledged as collateral.

Loan repayment in cash of Rosselkhozbank

Rosselkhozbank offers its clients an interesting financial product - car loan. Under the program, borrowers can obtain a cash loan to purchase a new or used car of Russian and foreign production. In 2019, the bank set attractive rates and affordable lending conditions.

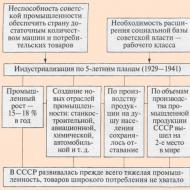

RSHB was created in 2000 with the aim of supporting and promoting the development of the agricultural complex. But since then, the financial structure has significantly expanded its services offering consumers a wide range of banking products... Among which one of the most popular is car loans.

Rosselkhozbank offers two car loans in rubles, which will help to buy a new car or a used one. The bank's client independently chooses the brand of the car and the country of the manufacturer.

Car loans at Rosselkhozbank are targeted. The money received can be used for:

- purchase of a vehicle;

- payment of insurance or CASCO premium for the first year.

Car loan conditions at RSHB

Rosselkhozbank has established the same conditions for car loans, both for cars from the assembly line and for used cars:

- the vehicle must be a new category B, C, D or a trailer;

- credit limit up to 3,000,000 rubles;

- loan term up to 60 months;

- consideration of an application, registration and issuance of a loan without commissions.

Interest rates

In Rosselkhozbank, you can take out a loan for a new car at an annual interest rate of 12.25%. The upper threshold is not indicated: the tariff is determined by the bank individually for each client. The final amount of the bet depends on:

- the results of the solvency check;

- borrower categories. For salary clients and "reliable" clients (with a positive CI) a 0.5% discount is provided;

- execution of contracts voluntary insurance borrower and co-borrower (if involved). In case of refusal to take on the obligation to issue a life and health insurance policy for the entire period of validity loan agreement, annual rate will increase by 4.5%.

An initial fee

When buying a new car, 15% of its loan amount is enough as an initial payment. A used car can be borrowed only if at least 25% of the car loan amount is paid.

Bank requirements

RSHB issues car loans to customers who meet the following criteria:

- russian citizenship;

- age from 18 to 65 years old (by the end of the loan agreement);

- registration in the RSHB service region;

- work experience: at the last job from 6 months, total - at least 1 year over the last 5 years. The exception is salary clients - 3 months are enough for them and retirees, for them seniority is not important at all;

- income that is sufficient to repay the loan. Not only salary or pension is taken into account, but also alternative sources (for example, from entrepreneurial activity, under rental contracts, etc.).

Car loan registration in RSHB

The Rosselkhozbank website has the ability to submit an online application for a car loan. It will not be possible to complete everything without visiting the office. But there is an opportunity to get a preliminary decision and find out the indicative conditions of an individual loan agreement.

The application is considered within 4 working days from the moment the client submits all the documents necessary to the bank. If the decision is positive for the applicant, you should come to the office with the following package of documents:

- the passport of the borrower and co-borrowers;

- documents confirming the amount of income;

- vehicle sale and purchase agreement;

- a copy of the TCP;

- payments confirming partial payment for the car;

- insurance company accounts.

After submitting all the documents, a loan agreement is concluded between the client and the bank. In addition to the loan agreement with the bank, the borrower draws up:

- CASCO in case of loss, total loss or damage to the vehicle;

- life and health insurance. According to the law, this policy is optional, and the borrower can refuse to issue it.

After the conclusion of all agreements, the money is credited by wire transfer to the borrower's account. Since the car loan at Rosselkhozbank is targeted, in the future the funds received must be transferred to the seller of the vehicle or to the account of the insurance company.

Under the terms of the bank, the car purchased on credit is registered in the ownership of the borrower and becomes a pledge for the purpose of security. There are no restrictions on the use of the machine. The borrower can drive the car without parking it with the lender.

Car loan repayment

The borrower independently chooses the procedure for repayment of the car loan - differentiated or annuity payments. The installments are monthly, according to the repayment schedule received with the contract.

The borrower has the right to fully or partially repay the car loan ahead of schedule by notifying the bank of this intention in writing. In this case, no additional fee will be charged. The interest on the loan will be recalculated downward.

Advantages and disadvantages of car loans in RSHB

Pros of a car loan:

- simple and straightforward choice of a car, since the bank does not place strict restrictions on the vehicle;

- confirmation of the borrower's income by alternative means;

- the opportunity to attract a co-borrower;

- lower rates for "their" clients;

- choice of repayment method;

- several options for making a monthly payment without paying commissions;

- the possibility of including insurance payments in the loan amount.

- compulsory CASCO insurance;

- high interest rate, plus the bank does not indicate a boundary maximum threshold;

- consideration of the application up to 4 working days.

RSHB does not specialize in car loans. There are no specials here preferential programs in partnership with car manufacturers. But the available two universal car loans are quite enough. The conditions for them allow the purchase of a car for both personal and commercial purposes.

In the article:

For a modern person, a personal car is not a luxury, but a means of transportation necessary for everyone. However, not everyone can afford to buy transport, because such a purchase requires a significant amount. A car loan at Rosselkhozbank enables many Russians, including pensioners, to become car owners. The bank offers very attractive conditions for borrowers.

Types of car loans at Rosselkhozbank

In 2018, a car loan at Rosselkhozbank is provided under several programs designed for various categories of citizens, including pensioners. One of the most demanded today is a car loan with state support. In addition, you can take a car loan from Rosselkhozbank for used cars, new vehicles of foreign and domestic production.

Lending is designed for Russians aged 18-65 who are registered at the place of residence in rural areas or by the type of activity are somehow connected with the agro-industry. Loans are not issued without a down payment. It is allowed to conclude contracts without an expensive CASCO policy with increased rate.

What is a car loan: interest accrual, rules of use, documents for individuals required for consideration.

To buy a new car

If you are going to buy a new car at a car dealership, then this financial institution offers very attractive terms for the borrower. In 2018, a car loan at Rosselkhozbank can be taken for the purchase of cars and commercial vehicles, regardless of the country of origin.

Basic conditions this car loan, the following:

- Loan term up to 5 years;

- Down payment - not less than 10% of the cost of the vehicle;

- Loan amount - up to three million rubles;

- Rate - 14.75-17.25% per annum;

- Early repayment is possible at any time at the request of the client. No commission is charged;

- Loan currency - euros, dollars, rubles (excluding car loans under the state subsidy program);

- CASCO policy is required (can be included in the loan amount, if you make a contribution of at least 20%).

To find out the size of the monthly payment and the specific rate, you need to find on the official website of the bank credit calculator and calculate them. For example, the amount of overpayment is influenced by the term of the contract, the availability of voluntary life and health insurance of the client, and the cost of the purchase.

To buy a used car

Car loan at Rosselkhozbank on a used model, conditions:

- Loan term - up to 5 years.

- Loan amount - no more than 3 million rubles.

- Mandatory down payment - not less than 20% of the cost of the car.

- The amount of overpayment is -15.5-18.25%.

- CASCO is required.

Requirements for borrowers in 2018

To obtain approval from this financial institution, you must meet certain criteria. The borrower must be registered in a rural area or work in the industry agriculture... Have a positive credit history and official income. Also, the applicant must confirm his work experience of at least 4 months at the current job and at least 1 year (total). For positive borrowers and salary clients of the bank, there is an opportunity to get a car loan with an experience of 6 months or more.

If you have already chosen the car of your dreams and familiarized yourself with the programs of a particular bank, then you can apply for a loan. Package required documents is standard and includes:

- borrower's passport;

- driver's license;

- copy of the work book;

- income statement.

The application is submitted online through the official website, in a car dealership or in person at a bank branch. After the positive decision of "Rosselkhozbank" you need to appear at the agreed time to conclude the transaction. The required amount is transferred to the client's account or issued in cash.

Credit calculator

So that each client can clearly see the accruals for a car loan, the final overpayment for a purchased car, a special tool is provided on the bank's official website - a loan calculator. Citizens planning to take a car loan from Rosselkhozbank in 2018, the calculator will help determine the loan program, choose a convenient term and calculate the appropriate rate.

It is very easy to use the built-in settlement system on the official website, you just need to enter the parameters of the car you are buying, the desired loan term and the amount. The figures obtained should be considered only approximate.

Car loan with a government subsidy program

The purpose state program subsidies - to raise the volume of sales of cars produced by Russian factories, therefore, a car loan at Rosselkhozbank for preferential terms can be issued only for a limited list of cars. The government subsidy represents compensation for part of the overpayment under the contract. As a result of the transaction, the client pays interest less 2/3 of the part (calculated at the refinancing rate of the Central Bank).

Parameters of a car loan with state support from Rosselkhozbank in 2018:

- The car is assembled in Russia.

- Transport weight - no more than 3.5 tons.

- Cost - up to 1 million 150 thousand rubles.

- The vehicle should not be registered with the traffic police, belong to a private person.

- The maximum term of the loan agreement is 3 years.

- Loan amount - no more than RUB 920 thousand.

- The amount of the initial payment is at least 20%.

- The amount of overpayment, minus compensation from the state - 8.5% - 9% per annum.

- Early repayment is available upon prior request from the client. No commission is charged.

To evaluate material benefit of this offer, it is recommended to use the loan calculator on the official website of the bank. To conclude an agreement, the bank requires customers to have additional security for the transaction, so the borrower can draw up a personal insurance agreement, provide guarantors or collateral.

Conclusion

A car loan at Rosselkhozbank in 2018 has already helped many Russians to acquire personal transport... Among the advantages of this bank's offer should be noted the absence of hidden fees, a small amount of overpayment, the ability to include insurance in the principal amount of the loan. The terms of the transaction are very loyal, because the client does not need a large number of papers.