Application for early loan repayment. Application for the return of interest on a loan in case of early repayment. Sample application for early loan repayment

An application for early repayment of a loan is a kind of document that bears a notification character. The application is sent to the lender by the borrower (for example, from the borrower to the bank) to notify the first about the debtor's intentions to repay the debt circumstances earlier than the period specified in the main agreement.

Remember that every borrower can use the right of early repayment, as it is provided by the Federal Law. At the same time, remember that the law applies to loans that are not related to entrepreneurial activity.

Sample (blank)

Application form for full / partial early loan repayment

I________________________________________

Place of Birth___________________________

Date of Birth____________________________

Passport data ________________________

i am a borrower under a loan agreement number ___________, which was concluded on "_____" ____________ 20 ___ between me and the bank __________, I declare that I undertake to fulfill my obligations under the loan agreement ahead of schedule.

In order to fulfill obligations to repay the loan and pay interest for its use, I ask you to transfer from my account number ___________ the amount of _______ thousand rubles to repay the loan, accrued interest, as well as other obligations to the bank.

I confirm that the above amount can be written off in full as early repayment of the principal.

On the conditions stipulated by the loan agreement, I ask you to recalculate the payment schedule while maintaining / reducing the amount of the next payment (for the form partial repayment credit).

Surname, name and patronymic of the borrower _________

Borrower's signature ________________________

Date____________________________________

Please note that this is only a sample application. It is possible that the bank where you took out a loan may be required to provide an application in a certain form. This form, as a rule, can be found on the official website of the bank, or get it at the nearest office of this credit institution... There you can also consult with a specialist in filling out the form.

If you have planned to close the loan debt before the deadline specified in the agreement, you must contact the bank in advance and write an application for early repayment ... Only in this case, the procedure will be performed, and the borrower can count on recalculation of interest.

Features of full early loan repayment

In this case, the borrower closes debentures in full in one amount. The bank needs to submit a preliminary application, since it needs to make a recalculation and indicate to the client exactly how much he should put into the account to perform this operation.

As a result of recalculation, all interest that the borrower could pay in the future is written off, he will owe the bank only the main part of the loan.

If you look at the schedule of loan payments, then in the column "Principal debt" you will see a figure that will reflect the approximate amount required to close the loan early (approximate, because the bank will calculate the day). For example, if you want to close the debt completely in the 12th month after registration, respectively, you need to look at the residual principal debt in the 12th line of the chart.

By law, the bank has no right to interfere with the borrower's intention to close the loan ahead of schedule.

Previously, banks in every possible way prevented this and did not allow early loan... They established moratoriums, for example, the condition that it is possible to close the debt ahead of schedule not earlier than six months after the loan was issued. Many banks took a commission for the procedure or even imposed fines. Now there are no moratoriums or fines.

How and where to write an application for early loan repayment

The procedure for performing this operation may differ depending on the bank. One conducts everything as quickly and simply as possible, in the other one cannot avoid bureaucracy and a delay in the process.

How exactly you can perform early repayment of the loan - can be found in the loan agreement. Examine it to see the order offered by the servicing bank. You can also call hotline bank and ask the operator for all the necessary information.

The standard banking procedure looks like this:

- The borrower decides to close the debt earlier the deadline and applies for this to the bank to write a statement.

- The application is written 14 days before the planned date of debt closure. Or for a different period, depending on the conditions of the bank. That is, if you have money in your hands today, then in fact you will be able to fulfill your plan only after the same 14 days.

- The application is submitted at the bank's office, where the manager on the spot makes the calculation and indicates to the borrower how much he must provide on the account by the due date.

- The client deposits this money, on the appointed date they are all debited from the credit account.

- Approximately on the 2-3rd day, you can go to the bank branch to get there a certificate of complete closing of the loan. This document should be kept for 3 years, just in case.

In fact, you do not need a sample application for early repayment of the loan. You will either be given a form at the bank to fill out, or you will be given for signing already ready statementgenerated by the program.

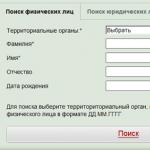

If you want to close a loan in Sberbank ahead of schedule

This bank offers a very simple procedure, it does not cause any difficulties for clients, and it is carried out quite quickly. You also do not need a sample application for early repayment of a Sberbank loan, the bank accepts applications from borrowers through the online banking system. That is, even though it is not necessary to go to the office, the whole procedure can be carried out remotely.

How to close ahead of schedule a loan issued by Sberbank:

You can also track the progress of the operation in the Sberbank Online system. And please note that you can only send an application for early cancellation in this way on a working day.

If this method is not convenient for you, you can always use the classic one, that is, contact the Sberbank office and apply there with the help of a manager.

If you want to make a partial early cancellation

In this case, the form of early repayment of the loan and the procedure itself will be somewhat different. If the client has "extra" money, but it is not enough to completely close the loan, he can only partially cover it.

As a result of this procedure, the payment schedule will be changed. Some banks allow only one form of schedule change, others allow the borrower to choose.

Possible forms of changing the schedule after partial cancellation:

- The term of the loan remains the same, but by reducing the amount of the principal, the size of the monthly payment is reduced, and the debt burden on the borrower is reduced.

- The amount of the monthly payment remains the same, but due to the partial closure of the principal debt and its reduction, the repayment period is reduced.

Most often, banks use only the first option, since it is most beneficial for them. At the very least, they tune clients into this option.

Partial early cancellation credit debt can be done many times.

To perform this operation, you also need to contact the bank and submit an application. As for Sberbank, an application can also be sent to it through online banking, which is very convenient. When submitting a request, the borrower writes the amount that he is willing to spend for these purposes. The very same partial closure will be performed on the date of the next monthly payment, this rule applies to all banks.

Is it possible to repay the loan ahead of schedule? How to do this and what is needed for this? When do I need to apply and is it possible to return the interest on the loan? For detailed answers to these questions, read the article below.

Features of filing an application for early loan repayment

The borrower has the right to early repayment of both the full amount of the loan and part of it, unless otherwise specified in the loan agreement. To do this, it is enough to write in the form of a bank.

It should be remembered that the submission deadline must be at least one day before the desired loan repayment date. Most often, banks consider such applications within a calendar day, however, according to the law, they have the right to increase the period to thirty days.

Full repayment

In case of full early repayment of the loan, it is necessary to calculate the exact amount. To do this, you can use a special calculator on the bank's website or contact a specialist in the department.

In some banks, the account is credited only the next day, so the payment should be made one day earlier. Immediately after making the payment, it is necessary to obtain a certificate from the bank employee about the closing of the loan and the absence of debt.

In case of early repayment of the first type of loans, the bank is overpaid for using the loan. In order to return funds, you must:

- After paying off the debt, get a certificate from the bank about closing the loan.

- Make a copy of the contract.

- Write an application for a return of interest in case of early repayment of the loan and indicate the following in it:

- Full name and data of the identity card of the borrowed;

- data on the loan agreement (number, date, size, rates, etc.);

- exact size and date full repayment;

- account or card number to which you wish to receive the overpaid funds.

- Contact the bank with these documents and wait for the funds to be credited to the specified account.

- In case of refusal, ask for a certificate indicating the date and data of the employee serving you. Next, you should file a complaint with the controlling structures, such as Rospotrebnadzor, the Society for the Protection of Consumer Rights or the court.

Appendix to

Microloan rules

"Microfinance Agency"

SAMPLE NOTICE OF EARLY REPAYMENT OF A LOAN

Sample application for partial early repayment of a loan

to CEO

FOR YUR. FACE:

FOR SP, physical faces:

SP

___________________________________________

C / S _______________________________________

BIK _______________________________________

STATEMENT

I hereby notify you of my intention of partial early repayment of debt under loan agreement No. 000 / XXXX-000XXXX from XX. XX.20XX in the amount of _______________________ ( suma in cuirsive) rubles __ kopecks __.__. 20__ (desired early repayment date)

I ask you to restructure the debt by

- reducing the term of the contract without changing the amount of annuity payments

- reducing the amount of annuity payments without changing the term of the contract

organization seal ( )

20__ g. (date of application)

Sample application for full early loan repayment

to CEO

FOR YUR. FACE:

Name of the authorized representative of the legal entity: _______

Position of authorized representative in legal entity: _

Legal entity name: ___________________________

Legal address: _________________________

Mailing address: ____________________________

INN / KPP _________________ / _________________

PSRN _____________________________________

Р / С _______________________________________

in the bank ____________________________________

C / S _______________________________________

BIK _______________________________________

Tel / fax: __________________________________

FOR SP, physical faces:

SP (if individual entrepreneur) full name: _________________________,

Date of Birth ____________________________.

RF passport: ______________________________,

issued by ____________________________________

Permanent registration address: _______________

___________________________________________

Residence address:_____________________

___________________________________________

TIN ______________________________________

Account No. ____________________________________

In the bank ____________________________________

C / S _______________________________________

BIK _______________________________________

Tel: _______________________________________

STATEMENT

I hereby notify you of my intention of full early repayment of debt under loan agreement No. 000 / XXXX from XX. XX.20XX __.__. 20__ (desired early repayment date).

According to Part 6 of Article 12 of the Federal Law of 01.01.2001 "On Microfinance Activities and Microfinance Organizations", please do not charge a fee for early repayment of the loan amount.

signature (full transcript)

organization seal ( if the loan was issued to an organization or individual entrepreneur)

20__ g. (date of application)

If there is an intention of partial early repayment, the date is indicated taking into account that repayment is possible only on the date according to the current Schedule of debt repayment (Appendix to the Loan Agreement)

When specifying this request, it should be borne in mind that part 6 of Article 12 of the Federal Law of 01.01.2001 provides for the cancellation of sanctions for early repayment of the loan only subject to the Borrower's written notification to the Lender of the intention to repay the loan early at least 10 days in advance.

Today, many people receive loans for a variety of purposes. A huge number of families plan purchases based on consumer loans that are issued to them by banks. It will not be a secret to anyone, how huge the number of loans issued in our country is.

The most pleasant moments that are directly related to the loan, of course, will be the day of its issuance and the day of repayment of the loan. And if the date of receipt is quite obvious, then the date of full debt coverage can be changed by the borrower. In our article we will tell you how this day can be brought closer, namely, how to repay the loan ahead of schedule with the help of an appropriate application.

Is it possible to repay the loan ahead of schedule?

Yes, you can. the federal law №284 otf October 19, 2011 just speaks about the borrower's right to repay the existing debt ahead of schedule. I.e he can unilaterally terminate the loan agreement, because he will pay the entire remaining amount. The main condition is that he must inform the bank in advance about his intention.

Moreover, in case of early repayment of an existing loan, the bank has no right to fine you for such an action. The same rule applies to additional fees or penalties for early deposit of funds. Such actions on the part of the bank will mean an obstacle to the exercise of your legal rights. As a result, such actions will be illegal.

Before repaying an existing loan ahead of schedule, we strongly recommend that you contact the bank where it was issued, and carefully. Preliminary clarification of details will be extremely useful and will be able to insure you against surprises at the bank's office. So, for example, if they talk to you about some commissions for early repayment, then you will immediately have to jointly file a complaint.

How is early repayment done correctly?

According to the Federal Law,which we have already written about above, the borrower must first notify the bank about his desire to repay the loan ahead of schedule. This is done 30 days before full maturity date... Such a warning is necessary for the accurate calculation of the debt balance, as well as for the write-off itself.

Simply depositing funds into the account will be a wrong action, because the bank will not know that you want to repay the loan ahead of schedule. As a result, funds will simply be gradually debited according to the current schedule. And since the interest will not be recalculated, the amount on the account may not be enough. In order for the deposit of funds to be, it is necessary to act legally correctly.

An application for early repayment of the loan is just a document, after the submission of which the funds will be written off already for the full repayment of the debt and termination loan agreement... However, different banks may have different deadlines for submitting an application, which may be much less than the prescribed thirty days. You will need to first clarify this issue with the bank.

Always carefully check the information provided to you about the balance of the debt. The bank has the right to charge you interest only for the period of use credit funds... Situations may arise when interest is not debited during early repayment of the loan, and as a result, money is illegally deducted from you. If you are faced with the wrong amount for full repayment, then select further actions.

Sample application

The statement itself is a fairly standard document. You can fill it out at home or immediately at the bank office. If you choose the second option, then when you contact a bank branch, you will be given an application form, or a bank employee will enter your data on his own. The application itself is issued to you for review and signature.

The specifics of filling out the application differs only depending on what kind of early repayment will be, because they are of two types:

- Full early loan repayment with the subsequent closure of the loan agreement;

- Partial early repayment of a loan with the recalculation of the balance and the construction of a new payment schedule.

Both have their own advantages and disadvantages. Overall, however, the early repayment application remains similar. Again, the type of application will be influenced by the terms of the current loan agreement.

The application for early repayment of the loan must contain:

- Your personal data, including full name and passport data;

- Loan agreement number, as well as the date of his conclusion and other necessary data about him. What exactly is required additionally must be clarified at the bank's office;

- Early repayment request and your stated intention to deposit fundsif they have not been added yet;

- Accurate , which should be voiced to you by bank employees;

- Account detailsfrom where the funds should be written off to pay the debt;

- An indication that, according to current legislation, you have the right to repay ahead of schedule available credit without commissions and penalties.

A statement is made in two copies, because one will remain in the bank, and the second must be with you. Remember that the date of debt repayment, which you indicate in the application, must comply with the law. You can download a sample application below to view or fill it out at home.