VTB 24 capital asset management. VTB mutual funds - profitability and comparison. Asset and investment management

Thanks to the capabilities of VTB24, users can purchase, change, and sell shares. To do this, you need to involve any partner in this procedure. The investor has a fairly wide choice from the following management companies:

1. Management Company TKBBNP Paribas Investment Partners

2. Management Capital

This company entered the domestic market in 1996. But the right to manage funds that relate to pension savings, she received only in 2003.

Currently, the management company manages 15 mutual open investment funds.

The smallest amount that can be invested in this organization is 5 thousand rubles (this is how much the first purchase costs). People who own shares of this Fund receive the right to make purchases starting from 1 thousand rubles.

When purchasing a share using the VTB24 system, additional funds for the transaction are not debited.

As for the discount that can be received if you redeem shares through a banking institution, its size depends on the date when the corresponding application was submitted. The longer the period the share was owned by the investor, the lower the amount of the share redemption will be - and vice versa. The commission may vary slightly - its size is within 1-2%, which is calculated from the share price (calculated).

This management company has the following mutual funds.

Highly profitable mutual fund

Note that this OPIFA (or open mutual fund of shares) is considered the most risky, but at the same time the leader in the VTB Mutual Funds profitability rating.

This option will be of interest to investors who want to invest in actively developing economies. In this way, they significantly diversify the existing investment risk.

The portfolio of this Fund includes shares of foreign investment funds, as well as shares (securities) of issuers of states that are members of BRIC.

This Fund is on this moment is actively growing, and BRIC shares are regularly becoming more expensive.

Stable mutual fund

« Mutual Fund VTB Treasury»

This OPIFO (or open bond mutual fund) is more suitable for “cautious” investors. Investment is carried out, as the name suggests, in bonds, which can be subfederal, state, municipal, or corporate. Thanks to this, investments have a high liquidity rate with minimal risks.

Mutual Fund Treasury VTB 24 is growing slowly, but steadily.

Mutual investment fund not yet meeting expectations

"Electric Energy Fund"

This OPIFA includes shares of Russian oil and gas firms and companies (GAZPROM, LUKOIL and others). This Fund is focused on long term investment(minimum 2 years).

It would seem that the promising Fund is not currently having the best results. Mutual Funds VTB the price of the share has decreased noticeably; this indicator has long since crossed the negative mark.

Mutual Funds VTB Capital Solid Management

Management Company "SOLID Management" began working in the field of collective investment in 2000. Today the company has 9 mutual funds in trust management, the total value of assets of which is 11 billion rubles.

To make the first purchase of a share, you will have to shell out 10 thousand rubles; the next ones will cost 1 thousand rubles. If the shares are purchased through a banking institution, there is a surcharge of 1.2%, if the shares are sold - 1%.

It must be said that the results of the activities of mutual funds of this management company in recent years are generally negative.

Stability and constant growth of shares is observed only in OPIFO “FDI Solid” (the Fund invests in corporate and government bonds). The VTB Eurobond Mutual Fund is also stable.

The most popular management company still remains VTB Mutual Fund Asset Management, since it is the oldest and most authoritative. VTB mutual funds profitability this management company is not the highest, but stable and reliable, which is most important today.

In the next article we will analyze in detail the VTB Oil and Gas Sector Mutual Fund, and also analyze the profitability and price chart of the VTB Eurobond Mutual Fund shares.

Asset Management? People investing equity, they want to have a high income at the output, an order of magnitude higher than the deposit made. They can invest capital in VTB 24 mutual funds. What is the reason for such actions? The answer is by increasing shares. What is the most profitable way to invest? financial resources? First you need to understand what asset management from VTB 24 and mutual funds is, and only after that search for the safest and most profitable way completing a transaction.

Who is in charge?

Assets are managed by qualified employees related to financial sector. Their task is to make profit as much as possible. It is also necessary to take measures to reduce all perceived risks. If these conditions are not met, the transaction may become unprofitable, which will cause losses to investors. If the diversification process is carried out correctly, the investor will receive a large profit, significantly exceeding the market one, even when the company operates below the expected level.

Specifics of mutual funds in VTB 24

When giving preference to mutual funds from VTB 24, you need to first compare the profitability, and this is mandatory. You also need to pay attention to the fact that there are two ways: carrying out the procedure yourself or entrusting it to professionals who know a lot about such matters.

First you need to understand what is asset management for mutual funds in VTB 24? It represents the accumulation of capital of individuals and legal entities who are investors. Hereinafter they are called shareholders. What is the essence of the program? Thanks to large amounts of money You can take part in such procedures on a confidential level, similar to trading on the financial market. Income is received by mutual funds without any risks. When reporting period ends, mutual fund specialists receive their profits, which are subsequently divided among shareholders. Of course, the management company also receives income. A percentage of this profit is transferred to the persons who carried out the financial procedure, depending on what was stated at the time of concluding the agreement on the transaction. Asset Management commercial bank VTB 24 is now very popular.

What is it? represent assets with high liquidity of the following sample:

- bonds and shares, both with and without government participation;

- securities and precious metals of foreign issuers;

- deposits and Eurobonds of financial companies.

Differences between funds

There are certain differences between all funds, which consist in the specifics of the work and in the structure of the corresponding profile. The state of the industry is reflected in the structure of mutual funds. Investors also need to take into account that such transactions can both bring great profits and, in principle, not become a source of income. In this case, the deposit is not refunded. In this case, the reason is a fall in quotes. Therefore, before investing your capital, it is necessary to assess the expected risks. This is why it is best to get expert advice. What is the method of asset management for VTB 24 Bank?

Mutual Fund "Treasury VTB 24"

There is a stated goal of investing Money in the instruments segment. In this case, a fixed income is provided. What are its advantages? The fact is that they focus on the safety of investors' funds. In this case, the profitability looks like this: the purchase of government, subfederal, and corporate bonds, which have a fairly high degree of credit quality.

Credit examination

Profitability and risk are stabilized through a preliminary credit examination. Active management of duration is also of great importance, which depends directly on the opinion of the manager, assessing the dynamics of interest rates depending on market indicators. What does such a system rely on? Initially, a thorough analysis of issuers is carried out. The current process in macroeconomics both in the Russian Federation and throughout the world is also very important. IN in this case investment terms - from one year. Interest rate ranges from 0.09 to 0.55 per day. For more up-to-date information, please visit the official website financial organization or contact a financial segment employee.

"VTB 24 Capital" - asset management

The profitability of VTB 24 mutual funds is obvious. Such a program is quite in demand among that clientele financial institution, which is looking for an option for acquiring income in this area, but does not have the necessary knowledge to independently carry out the bidding procedure. In this case, shares are an excellent option that does not require scrupulous work or a lot of time. These issues can be dealt with by a specially trained employee of a financial institution for a certain fee. Why is asset management attractive to VTB 24? Special attention clients?

As an example, you can take an electric power mutual fund. The purpose of investing is to invest in the shares of the relevant companies. This is done for long-term capital growth. At the same time, assets can be placed in ordinary shares, and into privileged ones. Validity period: from two years. A specialist working on such a program first develops strategies and analyzes schedules. In this case, the risks will be eliminated almost completely. Every investor should still understand that there is no 100% guarantee.

The profitability of asset management at VTB 24 varies from 0.09 to 0.55% per day.

How can you become an investor?

To purchase shares, you need to register your “Personal Account” in the system. To do this, you need to visit a VTB 24 branch and also provide bank employees all documents. This procedure lasts no more than fifteen minutes. In the future, the investor carries out his actions in the financial institution’s system through the “Personal Account” on the official website. This improves service levels and ensures safety because everyone financial transactions You need to enter a code sent to the phone number specified during registration. A VTB 24 client can cooperate with such organizations as Solid Management, Investment Partners and VTB 24 Capital Asset Management.

No comments yet. Be first! 16,713 views

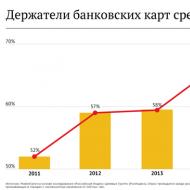

On Russian market More than a dozen banks operate and offer mutual funds to their clients. VTB24 is one of the largest banks in the domestic financial market.

In addition to standard offers (capital investment, loans), the bank offers investing in mutual funds. Thus, each client will be able to receive income, often at times more percent by deposits.

VTB24 Bank offers the services of several companies for the management (purchase or sale) of mutual funds, whose agent it is: CJSC " VTB Capital Asset Management", Management Company "BFA", OJSC "TKB BNP "Paribas Investment Partners", Management Company "Solid Management".

To participate in a mutual investment fund (hereinafter referred to as UIF), you just need to contact a bank branch or an application acceptance point with two documents. One of them is a passport, identification and a notarized copy of the TIN.

It is also necessary to have details of the current account where the profit from the assets will be transferred. The client is allowed to purchase shares of one or more funds in unlimited quantities.

For those who are thinking about purchasing shares for the first time and are just beginning to study the financial market, it is recommended to visit the official website of VTB24. Find the “Investment Portal” tab.

You will be consulted online completely free of charge. You will ask your questions and receive additional information by email. It is worth noting that the response arrives on weekdays as quickly as possible.

For those who cannot finally decide on the choice of mutual fund, in the online version of the bank, when filling out an application, the calculator itself will calculate your return on invested capital. Your financial capabilities, timing and wishes will be taken into account. The investment calculator will select the most advantageous offers for you.

VTB Capital Asset Management was founded in 1996. The package of offers includes more than 150 mutual funds. Of these, 120 are closed, i.e. A person can join them only by invitation.

Management companies VTB24

For novice investors or those who are just planning to start collaborating with VTB, 30 possible options are offered. For the first entry, you must purchase shares in the amount of 5 thousand rubles, with an additional purchase of 1 thousand rubles.

Mutual funds for the period 2013-2015

- Open investment fund "VTB - Telecommunications Fund". In 2013-2015, the share price showed the greatest increase - over 50%;

- Mutual Fund " Consumer Sector Fund - the cost has increased by over 35%;

- Okhotny Ryad – fund of consumer sector enterprises» – the cost has increased over 36%;

- OPIFA "VTB - BRIC" - the cost of the share increased by 19%;

- « Treasury Fund» – with the main goal of preserving capital (mainly federal-level shares), the cost increased by 9%;

- OPIFA "VTB - Electric Power Fund" - reduction in the value of the share by 62%.

Thus, this group is dominated by mutual funds with high returns on invested capital.

Mutual funds managed by TKB BNP Paribas Investment Partners

TKB BNP Paribas Investment Partners was founded in 2002. Today the company occupies a leading position in asset reliability. They amount to more than 3 billion rubles in 20 mutual funds.

To join, assets worth over 10 thousand rubles are purchased. In the future, the purchase minimum is 1 thousand rubles. When purchasing through a bank office, the premium is 1.22%; when selling, the discount is 1%.

Mutual funds for the period 2013-2015:

- TKB BNP "Paribas - Prospective Investments" - the asset increased by 14% compared to the year the mutual fund was opened. Please note that shareholders should take into account the high possibility of losing savings and the long duration of the investment;

- TKB BNP "Premium" Equity Fund - the value of the unit increased by 37%;

- "Fund money market» – the value of the share has increased by 75% since its inception;

- OPIFA "TKP BNP Paribas - Russian Oil" - the value of the share increased by 26%;

- OPIFF "TKB BNP Paribas - Gold" - investing in precious metals is experiencing a decline in prices. The share price fell by 9%.

Mutual funds managed by Solid Management

Was founded in 2000. For today total amount assets amount to more than 11 billion rubles. To purchase an open share you will need 10 thousand. rubles, with further acquisition -1 thousand rubles. When purchasing through a bank office, a surcharge of 1.2% is applied; when selling in a similar way, a discount is 1%.

The composition includes only open mutual funds.

- Since its opening, the Solid-Globus mutual fund has shown only positive growth in its shares. Their value over the entire period of the fund’s existence increased by 18%;

- Open-end mutual fund of bonds "FDI Solid" - the cost of shares increased by 18%;

- Open investment fund "Solid-Metallurgy and Structural Materials" - the cost of the share increased by 5%.

Mutual funds managed by Management Company "BFA"

Created in 2002 by VTB North-West Bank. To purchase open assets you will need to deposit 5 thousand rubles, for interval ones - 50 thousand rubles. With additional purchases in the future, for open ones - 10 thousand rubles, for interval ones - 20 thousand rubles.

The composition includes both open and closed mutual funds, and interval ones.

- Unit investment fund “Financier” – the value of the unit increased by 14%;

- OPIFA "STOIK - Electric Power Industry"– the value of the share fell by 9%;

- OPIFA "Oplot" - the cost of the share increased by 12%.

VTB mutual funds: comparison of profitability

Above were the mutual funds of VTB24 Bank with the most positive dynamics of management companies (purchase/sale). Investing can bring you a return of 2%-50% of your investment. However, we should not forget that any high return on assets is associated with risk.

In the case of mutual funds, no one will give you a guarantee of a 100% return of your capital. Unprofitable investment of funds by the head of mutual funds can lead to a decrease in the value of the share. For example, you bought it for 1200 rubles, but in a year you can only sell it for 800 rubles.

This doesn't have to happen. Therefore, before investing, you should carefully study financial market. Determine liquid areas, familiarize yourself with the activities of the mutual fund for recent years and its conditions.

Tip: Over the past few years, telecommunications and information technology stocks have shown high returns. Least profitable markets precious metals and electric power industry.

VTB Capital Broker LLC (VTBC Broker), License professional participant securities market for brokerage activities No. 045-12014-100000, issued: February 10, 2009, License of a professional participant in the securities market for dealer activities No. 045-12021-010000, issued: February 10, 2009, License of a professional participant securities market for the implementation of depository activities No. 045-12027-000100, issued: February 10, 2009

- The contents of the site and any pages of the site (the “Site”) are for informational purposes only. The site is not and should not be considered an offer by VTBC Broker to buy or sell any financial instruments or provide services to any person. The information on the Site cannot be considered as a recommendation to invest funds, as well as guarantees or promises of future investment returns.

Nothing in the information or materials presented on the Site constitutes or should be construed as individual investment recommendations and/or the intention of VTBK Broker to provide investment advisory services, except on the basis of agreements concluded between the Bank and clients. VTBC Broker cannot guarantee that the financial instruments, products and services described on the Site are suitable for all persons who have read such materials and/or correspond to their investment profile. Financial instruments mentioned in the information materials of the Site may also be intended exclusively for qualified investors. VTBC Broker is not responsible for financial or other consequences that may arise as a result of your decisions regarding financial instruments, products and services presented in the information materials.

Before using any service or purchasing a financial instrument or investment product, You must evaluate for yourself economic risks and benefits from the service and/or product, tax, legal, accounting consequences of concluding a transaction when using a specific service, or before purchasing a specific financial instrument or investment product, your readiness and ability to accept such risks. Upon acceptance investment decisions You should not rely on the opinions expressed on the Site, but should conduct your own analysis of the financial position of the issuer and all risks associated with investing in financial instruments.

Neither past experience nor the financial success of others guarantees or determines the same results in the future. The value or income from any investments mentioned on the Site may change and/or be affected by changes in market conditions, including interest rates.

VTBK Broker does not guarantee return on investment, investment activities or financial instruments. Before making an investment, you must carefully read the conditions and/or documents that govern the procedure for its implementation. Before purchasing financial instruments, you must carefully read the terms and conditions of their circulation.

- No financial instruments, products or services mentioned on the Site are offered for sale or sold in any jurisdiction where such activity would be contrary to securities or other local laws and regulations or would oblige VTBC Broker to comply with the registration requirement in such jurisdiction. In particular, we would like to inform you that a number of states have introduced a regime of restrictive measures that prohibit residents of the relevant states from acquiring (assisting in the acquisition) of debt instruments issued by VTB Bank (PJSC). VTBC Broker invites you to make sure that you have the right to invest in the financial instruments, products or services mentioned in the information materials. Thus, VTBC Broker cannot be held liable in any form if you violate the prohibitions applicable to you in any jurisdiction.

- All figures and calculations on the Site are provided without any obligation and solely as an example of financial parameters.

- This Site does not constitute advice and is not intended to provide legal, accounting, investment or tax advice and you should not rely on the contents of the Site in this regard.

- VTBC Broker makes reasonable efforts to obtain information from, in its opinion, reliable sources. However, VTBC Broker does not make any representations that the information or estimates contained in the information material posted on the Site are reliable, accurate or complete. Any information presented in the materials of the Site may be changed at any time without prior notice. Any information and assessments provided on the Site do not constitute conditions of any transaction, including potential ones.

- VTBC Broker hereby informs you of the possible presence of a conflict of interest when offering financial instruments considered on the Site. A conflict of interest arises in the following cases: (i) VTBC Broker may be the issuer of one or more financial instruments in question (the recipient of the benefit from the distribution of financial instruments) and a member of the group VTB persons(hereinafter referred to as a group member) and at the same time a group member provides brokerage services and/or trust management services (ii) a group member represents the interests of several persons simultaneously when providing them with brokerage, consulting or other services and/or (iii) a group member has his own interest in carrying out transactions with a financial instrument and at the same time provides brokerage, consulting services and /or (iv) a group member, acting in the interests of third parties or the interests of another group member, maintains prices, demand, supply and (or) trading volume in securities and other financial instruments, including acting as a market maker . Moreover, group members may have and will continue to have contractual relationships for the provision of brokerage, custody and other professional services with persons other than investors, and (i) group members may receive information of interest to investors and participants the groups have no obligation to investors to disclose such information or use it in fulfilling their obligations; (ii) the conditions for the provision of services and the amount of remuneration of group members for the provision of such services to third parties may differ from the conditions and amount of remuneration provided for investors. When resolving conflicts of interest that arise, VTBK Broker is guided by the interests of its clients.

- Any logos other than the logos of VTBK Broker, if any are shown in the materials of the Site, are used solely for informational purposes and are not intended to mislead clients about the nature and specifics of the services provided by VTBK Broker, or to obtain additional benefit through the use of such logos, as well as promoting goods or services of the copyright holders of such logos, or damaging their business reputation.

- The terms and provisions contained in the materials of the Site should be interpreted solely in the context of the relevant transactions and operations and/or securities and/or financial instruments and may not completely correspond to the meanings defined by the legislation of the Russian Federation or other applicable legislation.

- VTBC Broker does not warrant that the operation of the Site or any content will be uninterrupted or error-free, that defects will be corrected, or that the servers from which this information is provided will be protected from viruses, Trojan horses, worms, software bombs or similar items or processes or other harmful components.

- Any expressions of opinions, estimates and forecasts on the site are the opinions of the authors as of the date of writing. They do not necessarily reflect the views of VTBC Broker and are subject to change at any time without prior notice.

VTBC Broker is not responsible for any losses (direct or indirect), including actual damages and lost profits, arising in connection with the use of information on the Site, for the inability to use the Site or any products, services or content purchased, received or stored on Website.

CJSC VTB Capital currently has 19 mutual investment funds (otherwise known as mutual funds), providing a unique opportunity for anyone to profitably and with minimal risks invest your own savings.

You can learn how investing is done from this article.

Features of mutual funds from VTB Capital Asset Management

Mutual funds are effective tool for a profitable investment of money in order to obtain a high income.

The property of the funds is formed at the expense of the funds of investors (otherwise known as shareholders), and trust management carried out by the relevant management company (MC). Thus, by purchasing a share, the investor becomes the owner of part of the property of a particular fund.

The profit received on the assets of mutual funds is distributed among shareholders in proportion to the number of shares they have. The management company also receives a certain percentage of given income for competent management of the fund's property.

Advantages of mutual funds from VTB Asset Management:

- the ability to invest any amount of money;

- high liquidity of units owned by active funds;

- professional asset management;

- no taxation of shares until the withdrawal of money from the fund;

- the opportunity to receive high income (up to 30% per annum);

- the presence of control over the activities of mutual funds by government authorities.

The investment share represents security, the cost of which is determined by the management company taking into account the price of net assets fund based on the results of the working day or at the time of closing the interval. This document confirms the fact that the investor has rights to part of the mutual fund’s property.

The profitability of VTB Capital mutual funds depends on the competent management of the fund’s assets, so the value of the shares may periodically increase and decrease.

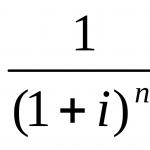

In fact, the profit from this type of investment is the difference between the price of the share at the time of its acquisition and at the date of its redemption, multiplied by the total number of shares.

Investors cannot count on the payment of dividends, accrued interest and various bonuses.

You can get acquainted with the cost of shares, the degree of risk and the level of profitability of each fund presented in VTB Capital by following this link.

How to purchase shares in mutual funds "VTB Capital"?

Persons purchasing a share for the first time must open a personal account in the register of investment shares of the fund they have chosen. For this purpose, the corresponding and are filled in.

In addition, the future investor must have a passport in hand. The sale of shares is carried out if you have the details of a ruble account.

A potential shareholder can apply with the relevant documents:

- to the office management company VTB Capital;

- to branches of partner banks.

At the same time, persons who previously purchased investment shares in this company can submit an application online through Personal Area. With its help, the client is able not only to perform various operations with shares, but also to monitor them current state.

You can connect your personal account:

- at the company office;

- through the government services portal;

- on the VTB Capital website by filling out this electronic form.

Instead of the client, his legal representative can contact the office. In this case, he must have with him a passport, a valid power of attorney, giving him the opportunity to buy shares on behalf of the principal, the above questionnaire and application for opening personal account in the fund, containing the certified signature of the investor.

If you have already purchased shares of a particular fund, you just need to contact the office of the company or its partners with your passport and details of a ruble account opened in your name. In addition, the application in this case can be submitted remotely.