Assignment definition in economics. Notes. Dictionary of financial terms

The word “assignment” has several meanings, each of which clarifies its essence. This is a paper banknote, which once replaced a metal coin. And a contract, under the terms of which valuables are given to one of the two parties to the transaction, and he has the right to demand that the third one reimburse their value. And paper money from the period of the French Revolution, which is actually government bonds, their owner received income in the form of interest.

Harbinger of money circulation

The banknote stands at the very beginning of the ladder leading to the emergence of the money we are familiar with and valuable papers. The birth of the banknote brought banks and exchanges to life. This happened in the 17th-18th centuries, when the formation of a securities market was launched in Russia, in which IOUs, bonds, and promissory notes were most widespread.

The first watermark to protect against counterfeiting was the banknote.

The first monetary reform is also connected with its existence. And due to the periodic issue of these securities, inflation and exchange rate fluctuations have become commonplace.

Modern money exists in non-cash form. A mass appeared financial instruments. Over the course of just a few centuries, a great evolution of money has taken place, and today it is possible to earn money while at home. A computer and mental abilities are all you need!

It’s worth looking back, leafing through the pages of history yellowed by time...

The first paper

The beginning of the story paper money dates back to the 15th century (then the printing press was invented) and lasts until the 19th century. To be fair, let us note a historical fact: at the end of the 14th century, banknotes made from mulberry leaves were already in circulation in China.

The beginning of the story paper money dates back to the 15th century (then the printing press was invented) and lasts until the 19th century. To be fair, let us note a historical fact: at the end of the 14th century, banknotes made from mulberry leaves were already in circulation in China.

In European countries and on the American continent, banknotes began to be used in the 17th-18th centuries. The active period of their circulation on the market dates back to two decades at the turn of the century. When the exchange rate fell, I had to use coins. The surge of interest in banknotes was spurred by the War of Independence - they again became in demand.

In Europe, paper money caused mistrust. It is difficult to accept the value of a piece of paper that has a short lifespan - not like gold and silver coins. The state had to act as a guarantor: the notes were issued as bonds.

What's in Russia

Two factors that caused the appearance of banknotes in our country were the growth in the production of goods and the need to remove coins from circulation. From an economic point of view, paper money is more convenient. Banknotes, coins made of gold and silver, even nickel, had equal circulation. A particular problem was the low protection; it was easy to make a fake. There is evidence that Napoleon took advantage of this, trying to destroy the economy of the country that he wanted to conquer by injecting counterfeit money to the Russian Empire.

Under Catherine the Great, banknotes were strengthened: their quality increased, and much attention was paid to protection through watermarks.

The Assignation Bank issued money. The Empress introduced the death penalty for counterfeiting banknotes. Due to repeated attempts at counterfeiting, a replacement became necessary. A new design was developed and received additional protection in the form of a bank manager’s signature. Subsequently appearance paper banknotes changed several times.

The beginning of the 19th century was marked by severe inflation - the volume of banknotes reached incredible levels, many counterfeit bills, the rate fell. The measures taken - old banknotes were disposed of, new ones were issued - were not successful.

Credit notes to replace banknotes

This happened in the middle of the 19th century. To invent high-quality protection, we turned to the help of scientists. Electroplating, discovered shortly before, made it possible to obtain impeccable copies of complex ornaments on banknotes.

This happened in the middle of the 19th century. To invent high-quality protection, we turned to the help of scientists. Electroplating, discovered shortly before, made it possible to obtain impeccable copies of complex ornaments on banknotes.

But it was not possible to abandon coins; silver was considered a hard currency, gold played the role of an auxiliary one.

Security

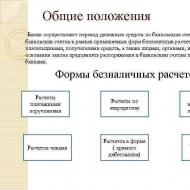

With the development of trade in the 19th century, a change in the assignment into a security occurred. In Germany, this was an act that indicated the three sides of monetary relationships - assignee, assignee, assignat. In Russia, as in England, the USA, France and Italy, there was a bill of exchange.

The Russian state actively promoted the use of bills. Control of payments on bills was established without delays, because payments were made in copper, and silver ended up in the treasury.

The banknote was of significant importance in the formation of the world monetary system.

The first paper money appeared in China in the 8th century. Few details of their appeal survive, but it is known that almost immediately they triggered runaway inflation. Almost a thousand years later, in the first half of the 18th century, the Englishman John Law appeared in Europe with the idea of introducing paper money, but his proposals to quickly enrich the treasury were rejected by the monarchs. After a long promotion of his plan, understanding was achieved with the regent of the young French king Louis XV. A bank was established that issued interest-bearing bonds in exchange for deposits in gold and silver coin. Law took part of the proceeds for himself, the rest went to the French treasury. At first, everything went well, until competitors began to spread rumors, because of which crowds of investors rushed to take their money. As a result, due to the low supply of coins, the bank collapsed. These were not exactly banknotes, but rather financial Pyramide, but in many ways the similarities with the paper money of the future were visible.

Considering the huge interest in everything French, Russia simply could not help but know about all this. However, the idea of quick replenishment state budget turned out to be stronger than any prejudice. The first project for introducing paper money was considered during the reign of Elizabeth Petrovna, but the Senate did not approve the idea. Preparations for the issue of banknotes began when Peter III ascended the throne; drafts of notes in denominations of 10, 50, 100, 500 and 1000 rubles were even prepared. The palace coup, organized in 1762 by the emperor's wife Catherine, put an end to all endeavors.

The next Russian-Turkish war that began in 1768 required large expenses. There was a catastrophic shortage of silver and gold in the treasury; there was even a shortage of copper coins, despite the discovery of large deposits of copper ore in the Urals and Siberia. On December 29, 1768 (old style), a manifesto was issued on the establishment of exchange banks for issuing banknotes. On February 2, the manifesto was published. Initially, two banks were created in St. Petersburg and Moscow, and in 1772-1778 an additional 22 exchange offices were opened in other cities.

It was planned to issue tickets worth 2.5 million rubles and provide them with 2 million in coins. Capital banks received 50 thousand rubles for expenses (paper production, printing, organization of exchange). To bolster the interest of the population, 5% of banknotes were accepted as payment of taxes and fees, the rest in coin. Unlike John Law's notes, no interest was paid for holding money in banknotes. In this way they were similar to bills of exchange, known long before, but unlike them they could act as a means of payment.

The first banknotes were in denominations of 25, 50, 75 and 100 rubles, made in a uniform style with one-sided printing. Very few copies have survived to this day, and the paint on them has faded and parts of the design are difficult to see. Each banknote has a frame, in the upper part of which there are two ovals with drawings (on the left - a port, an eagle, banners, cannons, cannonballs; on the right - a rock above the sea), at the bottom there is an inscription about the bank’s exchange of the banknote for a coin and numerous signatures of the bank’s managers. The denomination is indicated in words only. On the money of the Moscow Bank it is indicated “Moscow Bank”, on the money of St. Petersburg - “St. Petersburg Bank”. The banknotes were marked with the date of issue, and not the date of the sample, as now. The watermarks were made in the form of inscriptions: “love for the fatherland”, “acts for the benefit of it”, “state treasury”. That is, with all its appearance, paper money reminded of the patriotic duty of the citizens of the empire.

(from the exhibition of the Goznak Museum)

Considering that the average wage workers were 15-20 rubles a month, and peasants mainly lived off their own farms, it becomes clear that only wealthy segments of society could afford banknotes. Due to their high value, counterfeiters immediately began to work on them. The most common counterfeit was changing the word “twenty” on a 20-ruble note to “seventy”, which turned it into a 75-ruble note. It was necessary to cancel the issue of 75-ruble notes in 1771 and stop accepting them in all payments.

The main purpose of issuing banknotes, which was communicated to the public, was to simplify the circulation of copper coins, which then occupied the bulk of all coins. The manifesto contains the following words: “the burden of the copper coin, which approves its own price, burdens its circulation.” By exchanging copper (or other) money for paper money, it could be easily transported large sums and also store them. At first, the free exchange for coins and back aroused great confidence among the population in paper money, but the government could not resist the temptation to repeatedly continue circulation, providing them less and less.

The fall of the paper ruble and new issues

In 1786, the exchange rate of the paper ruble had already dropped by 1-2 kopecks against the coin, this caused concern to the government. It is not surprising, because by this time there were already not 2, but 46 million rubles in banknotes in circulation! Of course, there weren’t enough coins to exchange, so payments were often delayed. Count I.I. Shuvalov proposed the following plan: issue an additional 54 million rubles in banknotes and begin issuing secured loans with them. At the same time, the amounts intended for issuance were clearly divided. Borrowers had to repay the entire amount, including interest, within a specified period.The Moscow Bank was abolished, the issue was now carried out only by the St. Petersburg Bank (analogous to the modern State Bank). To emphasize the importance of the actions being taken, all old banknotes were confiscated and new ones were issued, with additional denominations - 5 and 10 rubles on blue and red paper (hence the names of the “blue” and “red” banknotes). The colors of the 5- and 10-ruble bills were maintained with short interruptions until 1992.

The government assured that the volume of banknotes had reached its limit and would not be increased under any circumstances. The bank, in addition to issuing money, had to perform some other functions to replenish the state treasury. The treasury received part of the banknotes for own needs at a small percentage, and partly free of charge. For this, the bank had the right to independently issue issues at its own discretion and gained some independence from the state.

By the end of the reign of Catherine II, due to constant wars, active development of the capital, and enrichment of palaces, the issue of banknotes reached 150 million rubles, and their security was only 20%. The situation was further aggravated by the restriction on issuing coins to one person. The paper ruble was now unofficially given only 68 kopecks.

Paul I sought to rectify the situation, for this he declared official rate- 70 kopecks, then 60 kopecks. But these innovations did not bring any significant results. The emission continued in uncontrolled volumes, and the exchange rate fell and reached 25 kopecks by the end of the first decade of the 19th century. Unissued banknotes of a new type of 1802-1803 are known; apparently, it was planned to improve the economy by replacing money.

Another attempt to rectify the situation was the manifesto of Alexander I in 1810, which announced the stop of issue (except for the replacement of old banknotes) and the mandatory redemption of banknotes in circulation. For this purpose, a loan of 100 million rubles in banknotes was organized, the received paper money was publicly burned in front of the bank building to show the decrease in the amount of money and increase the confidence of the population. In the same manifesto, the silver ruble was officially recognized as the basis of monetary circulation, and copper and small silver coins became exchangeable coins. Additionally, the rate of banknotes for government fees increased, and new transactions had to be conducted only in paper money.

Napoleonic forgeries

The paper ruble, strengthening as a result of all the measures, faced a new test, which it was no longer able to withstand. The Napoleonic army that invaded Russia in 1812 brought not only destruction, but also counterfeit money. They were prepared by a private organization commissioned by Napoleon himself. The experience of undermining the economy of a state by introducing a large number of fakes has already been mastered in Europe; moreover, this made it possible to supply the army with food on foreign territory.Bags of counterfeit banknotes (only 25 and 50 rubles are known) were carried along with all the equipment, and along the way they were used for payments in the villages. The peasants were not willing to accept money from the French, but in general they did not refuse, since purchases were made at high prices. No one could have imagined that the great emperor would condescend to issue counterfeit money. But soon the shortcomings of the banknotes began to emerge, which were clearly visible among certain dates. Firstly, the corners were cut much smoother than the real thing, and some copies even had grammatical errors.

Now collectors know of four types of counterfeit banknotes: with the word “hot coin” instead of “hot coin”; with the word “state” instead of “state”; with two errors; and also without errors. The latter differs only in the technology of cutting corners.

Latest attempts to restore the hardness of the paper ruble

The mass production of counterfeits greatly undermined the already shaky trust in paper money; the exchange rate reached 20 kopecks. By 1817, there were already 836 million rubles in banknotes in circulation. Starting this year, several more government loans in banknotes are being organized. Some loans are interest-bearing, and some are accepted immediately with a premium to the amount. This all reduced the money supply, but the exchange rate rose only by 5 kopecks.

(from the exhibition of the Goznak Museum)

To get rid of counterfeits, in 1819 another exchange of all banknotes was made for new ones, and the old ones were declared invalid and not accepted for payments. The new money began to have a more complex design, but remained one-sided. Additionally, a 200 ruble banknote has been introduced. It was planned to issue a denomination of 20 rubles, but it remained in a trial version.

(from the exhibition of the Goznak Museum)

Minister of Finance E.F. Kankrin in 1839 abolished the exchange of paper money for coins. The issuance of interest on deposits is carried out only in banknotes, which now have a strict rate of 30 kopecks in silver, and the issuance of coins in one hand is limited to 100 rubles. For this purpose, special copper coins were issued with the designation “silver kopecks” and were large in size. Acceptance of banknotes for government payments is stopped.

Credit tickets

Reform E.F. Kankrina. Silver standard

Various ideas have been put forward to improve the economy. Emperor Nicholas I proposed introducing tickets on which investors could make a profit as a percentage, but this was already carried out in the second decade of the 19th century and led to negative consequences. Instead of an increase in silver in the treasury, it increased state debt. Therefore, the reform organized by E.F. Kankrin in 1839-1843 meant the introduction of new paper money, not government loans. Loans at interest were handled by savings banks established in 1842 (the predecessors of the modern Sberbank).The first stage of the reform was the formation of an exchange fund in silver coins. For this purpose, they organized a depository office and, from January 1, 1840, issued deposit tickets in denominations from 3 to 25 rubles, which were replenished a year later with 1, 50 and 100 rubles. Deposits were accepted in silver and gold coins and were issued completely freely to depositors without limiting the amount. There were so many people willing to invest money that there were queues at the exchange offices. In the first year, we managed to collect 24 million rubles in coins.

Deposit notes were completely identical to the first banknotes, but were supported by stable reserves of coins in the treasury. The basis of monetary circulation for 20 years has been the silver ruble, and in order to also use copper, large-sized copper coins are issued with the designation “silver kopecks.” In this way, the government managed to completely equate all three types of coins - gold, silver and copper, but payments were still carried out in silver.

(from the exhibition of the Goznak Museum)

The summer of 1841 brought the country little harvest, it was necessary to start purchasing abroad, so the untouchable exchange fund began to gradually melt. At the end of the year, a Loan Bank was organized, which issued credit notes with a face value of 50 rubles, partially backed by silver. Tickets were issued mainly against real estate, but there was also a direct exchange for silver.

On June 1, 1843, the last stage of the reform was carried out: all existing paper money was exchanged for new credit notes of the 1843 model in denominations of 1, 3, 5, 10, 25, 50 and 100 rubles. The exchange was made 1:1 for deposit notes and Loan Bank notes, and for banknotes at the rate of 3 rubles 50 kopecks per new ruble. Credit notes were required to be backed by at least 1/3 silver and gold coins. Since 1860, the issue of bank notes was taken over by the created National Bank, which replaced the Commercial Bank.

Simple exchange without any restrictions contributed to increasing the population's confidence in credit notes; they circulated freely and were willingly accepted in all payments. The exchange fund was sufficient in reserve, and the surplus went to state needs. Because of economic crisis in other European countries, many foreigners came to Russia to exchange their savings for hard credit notes.

In their artistic design, the credit notes were similar to the banknotes of the latest issues: a figured frame indicating the denomination, inside which there is information about the mandatory size for a gold or silver coin, and signatures officials. On the back, against the background of the state emblem, were excerpts from the Supreme Manifesto on credit notes.

Credit notes in the second half of the 19th century

For 10 years, credit notes remained a hard form of money, and due to convenient use were in great demand among the population. But, like any paper money, sooner or later they would depreciate. The reason was uncontrolled emissions to cover government expenses during the Crimean War. By 1858, a paper ruble was already worth 80 kopecks. This further provoked queues at the change desks, and consequently reduced confidence in credit tickets.

(from the exhibition of the Goznak Museum)

Previously, silver and gold were accumulated by the population, and to normalize money circulation, all that remained was to find a way to extract it (for example, through loans). Now precious metals were going abroad, the population was buying up more stable English pounds. The shortage of silver coins was partially eliminated by reducing the weight, and then the standard of 5, 10, 15 and 20 kopecks in silver. The coins became smaller and contained only less than half the precious metal. They also limited the issuance of coins to one person - no more three rubles, the rest was to be issued in credit notes.

Improvements that began in the 1860s financial system allowed to raise the exchange rate of the paper ruble, but the next Russian-Turkish war again forced them to resort to mass printing of banknotes, which quickly reduced their value to an average of 66 kopecks.

In 1881, with the coming to power of Alexander III, previously printed credit notes with a face value of 25 rubles, modeled on one-sided English pounds, came into circulation. The population's trust in pounds should have transferred to these tickets, but the experiment did not show significant results. Trying to fight a huge paper money supply accumulated among the population, the emperor signs a decree to stop issuing banknotes, of which there were already more than a billion rubles. The decree envisaged an annual reduction of paper money by 50 million, but over 10 years it was possible to confiscate approximately only 150 million rubles worth of tickets.

The appearance of the banknotes did not remain unchanged. In 1866, new banknotes of the same denominations appeared, but portraits of Russian rulers appeared on large ones for the first time in history. On 5 rubles - Dmitry Donskoy, on 10 - Mikhail Fedorovich, on 25 - Alexey Mikhailovich, on 50 - Peter I, and on 100 rubles - Catherine II. It is unknown why the artist chose them, and on what basis the portraits were selected for each denomination. Already at the end of the 1880s, new tickets were issued in denominations from 1 to 25 rubles, without portraits, and 50 rubles were no longer printed. The 100 rubles that lasted the longest were issued unchanged until 1896; they had a rainbow background, which was then the pinnacle of printing art. The portrait of Catherine II on the 100-ruble banknote will survive the subsequent reform (with a change in the design of the banknote), will last until the Revolution, and will be called “Katenka”.

Tickets of the same design could be issued under different rulers, with only the emperor's monogram changing. For example, 100 rubles were with the monogram of Alexander II, Alexander III and Nicholas II. Until 1898, money was marked with the date of issue, after which they began to indicate the date of the sample. In the 1890s, pre-reform tickets in denominations of 5, 10 and 25 rubles were updated for the last time; they received complex, highly artistic design in the spirit of imperial times.

Reform S.Yu. Witte. gold standard

At the beginning of the reign of Nicholas II, the Minister of Finance was a competent politician and economist Sergei Yulievich Witte. Back in 1895, he proposed transferring the Russian monetary system to the gold standard, that is, each ruble would be expressed in a certain amount of gold, and silver and copper coins would become small change. Due to the clear link to gold, the depreciation of money theoretically became impossible.It was necessary to gently, without unnecessary shocks, equate the new ruble to 1.5 old (at the established exchange rate). And there were plenty of shocks at that time: growing distrust in government, strikes and revolutionary movements, terrorism.

The largest gold coin with a denomination of 10 rubles was then unofficially called imperial. New coins of the same weight were developed, denominated not only in rubles, but also in imperials: “IMPERIAL. 10 RUBLES GOLD”, there was also a semi-imperial. At the same time, attempts were made to call the largest coin “Rus” or “Rus”. All this did not go beyond trial copies. Instead of new money, they decided to simply exchange the old 10 rubles for the new 15; for this purpose, in 1897, coins with a face value of 15 and 7.5 rubles were issued in mass circulation, weighing 10 and 5 old rubles, respectively. And the new 10 rubles reduced the weight by one and a half times, and they were equated to 10 new “golden” paper rubles.

But in order to introduce a new type of credit notes, a significant exchange fund in gold coin was needed. Until this time, little attention was paid to gold; it was not in great demand. For creating reserve fund, even 20 years before the reform, decrees began to be issued on the preferential acceptance of gold coins in government payments and as duties, as well as foreign currency in golden terms. Additionally, deposits are being introduced that are accepted in gold in exchange for deposit receipts.

Since 1895 many government fees begin to be expressed in gold and are calculated daily at the metal reception rate. The silver ruble began to be equal to 17.424 shares of pure gold, that is, 0.774 grams. This was exactly 2/3 of the weight of the old-style gold ruble. Old type paper money is accepted at the rate of 15:10. That is, the population gradually mastered payments in gold bars, the paper form of which was to become credit notes.

New credit notes were issued into circulation in 1898. The denominations of 1, 3, 5, 10 and 25 rubles remained the same design, but instead of indicating the obligatory exchange for a silver coin, an inscription appeared on them indicating the exchange of each ruble for 17.424 shares of pure gold, or 1/15 of an imperial. The name “imperial” is transferred to the 15-ruble coin. Brand new banknotes of 50, 100 and 500 rubles appear with portraits of Nicholas I, Catherine II and Peter I, respectively. Old gold coins were not withdrawn and were equal to 1.5 new ones. Silver and copper coins did not change in appearance or weight, but became a secondary means of payment. The issue of banknotes was limited to at least 50% backing in gold coin, and the issue of over 600 million had to be fully backed by gold.

Among influential circles there were many opponents of the reform, who believed that Russia was not ready for the transition to the gold standard, unlike more developed countries. The prosperous existence of a monetary system of this type was possible only if there was a large gold reserve, and in the event of the slightest shock it would go abroad. And so it happened, the strong ruble lasted only 16 years.

Money circulation at the beginning of the 20th century

Russia entered the new century with stable paper money backed by large gold reserves. Even the Russo-Japanese War had only a minor impact on emissions. Instead of issuing all banknotes, the government focused on printing low-denomination notes. At the same time, 3 rubles of a new type appeared, which were printed in the first months of Soviet times.Under Nicholas II, many reforms were aimed at the flourishing of autocracy, despite the growth in the number of revolutionary movements. The changes have not spared money either. In 1909-1912, new banknotes from 5 to 500 rubles were issued, made with excesses of artistic design in the Baroque spirit. On them, in richly decorated figured frames, there were portraits of Russian emperors, there were images of complex architectural elements, a multi-color background, and microtext. Special attention deserves 500 rubles of the 1912 model with a portrait of Peter I and a full-length female figure, symbolizing Russia. Only 50 rubles, a ruble and 3 rubles were left unchanged.

Money circulation had reached unprecedented heights, and it seemed that nothing was in danger. To confirm this, it is worth citing a few numbers. At the beginning of 1914, there were about 2.5 billion rubles in circulation in banknotes and coins of all types. Of these, 1664 million rubles were in credit notes, 494.2 million in gold coins, 226 million in silver and 18 million in copper coins. At the same time, the gold reserves of the State Bank covered credit notes by 31 million rubles. That is, according to the 1898 manifesto, it was allowed to issue more than 300 million rubles in paper money without increasing the exchange fund.

After Russia joined the First in 1914 World War uncontrolled emissions began. In just three years, the number of credit notes grew to 10 billion rubles, and the exchange rate of the paper ruble again began to fluctuate. At the beginning of 1917, only 25 kopecks were given for it, and in Europe it was quoted at the rate of 0.56 to a gold coin. Silver and gold began to disappear from the population, and coin production ceased.

In 1915, instead of silver coins, stamp money appeared in denominations of 10, 15 and 20 kopecks, modeled after postage stamps for the 300th anniversary of the Romanovs. They were produced in sheets of 100 pieces with perforations for tearing. On the front side there were portraits of the emperors, on the reverse side the coat of arms and denomination were depicted in numbers and words. At the same time, the copper coin is gradually being replaced by banknotes in denominations of 1, 2, 3 and 5 kopecks, and a 50-kopeck bill also appears. 10, 15 and 20 kopecks of this type did not come into circulation and are now considered rare. Next year, stamp money will be issued in denominations of 1, 2 and 3 kopecks. The minting of copper coins stopped completely in 1917, and silver coins in 1916. Gold coins have not been issued since 1911.

Money of the Provisional Government

After the February Revolution, representatives of the former State Duma and other political figures came to power and formed the Provisional Government. To begin the reforms that opponents of the tsarist government were waiting for, it was necessary to increase the issue of paper money. In 8 months, 9.5 billion rubles were printed in credit tickets.Banknotes have been issued without changes for many years; the only differences were in the signatures of the manager and cashier, as well as in the number series. By comparing all these parameters, collectors can determine the exact year of printing, since all are marked only with the date of the sample. For example, a ruble with the date “1898” was signed by the manager Pleske, who was at the helm of the State Bank until 1903, then Timashev took his place, and in 1910 Konshin. Among the rubles with the signature “I. Shipov" there are four main types: 1914-1916, 6 digits in the number; 1916, 3 digits in the number; Provisional Government Issue and Soviet Government Issue. There were also local issues of the Arkhangelsk province with perforation “GBSO”; they exist with different numbers and signatures. A novice collector picks up a banknote with the date “1898” and does not even suspect that it was issued already Soviet power, although these are the majority of banknotes.

In addition to the tsarist-style banknotes, in the summer of 1917, the production of completely new 1000 ruble banknotes with the coat of arms of the Provisional Government began: a double-headed eagle without crowns (similar to the modern emblem of the Central Bank). On the front side of this money there was an image of the State Duma building, for which they were nicknamed “Dumka” or “Duma money”. In the fall, by decree of the Prime Minister Kerensky, small cards with denominations of 20 and 40 rubles were issued in uncut sheets of 40 pieces; they immediately received the nickname “Kerenki”. Also in September, the issue of 250 ruble banknotes began. Some are horrified to discover a swastika on banknotes of the Provisional Government, which is not noticeable upon a quick inspection. In fact, this symbol had not yet been taken by the Nazis and meant peaceful existence, but it appeared long before that in India.

Under the Provisional Government, money-stamps in denominations of 1, 2 and 3 kopecks continued to be issued instead of small change coins. They were distinguished by the presence of a black overprint in the form of a denomination number on the front side. Under Soviet rule, at first these denominations were also printed, but on the reverse side, instead of the coat of arms, the denomination was repeated in black paint.

1. Gusakov A.D. "Monetary circulation in pre-revolutionary Russia." – M., 1954.2. Gusakov A.D. "Essays on money circulation Russia." – M.: Gosfinizdat, 1946.

3. Shchelokov A.A. "Paper money. Historical facts, legends, discoveries."

Photos provided by site users: Shurik92, Letta, Kuzbass, Admin, MushrO_Om

By which one party transfers to another for some reason a certain amount of money, securities or other valuables.

Dictionary of financial terms.

Note

Paper money issued in Russia since 1769 and canceled in 1849, when as a result monetary reform Silver monometallism was introduced in Russia. Traditionally, the term is still used to refer to paper money-banknotes.

Terminological dictionary of banking and financial terms. 2011 .

Synonyms:

See what "ASSIGNATION" is in other dictionaries:

banknote- and assignment f., German Assignment, floor. asygnacya, lat. assignatio. 1. Written order, appointment. SL. 18. Contractors took the salt from the peasants’ brewhouses... and put it in accordance with the banknotes of the salt boards, too. different cities. Hold 7... Historical Dictionary of Gallicisms of the Russian Language

- (Latin assignatio, from assignare to indicate, assign). Paper tokens established by the supreme power in place of specie. Dictionary of foreign words included in the Russian language. Chudinov A.N., 1910. ASSIGNATION lat. assignatio, from assignare... Dictionary of foreign words of the Russian language

Banknote, money Dictionary of Russian synonyms. banknote noun, number of synonyms: 2 banknote (3) money ... Synonym dictionary

A. Paper money issued in Russia from 1769 to 1849. B. The accepted term for paper money banknotes. Dictionary of business terms. Akademik.ru. 2001 ... Dictionary of business terms

ASSIGNATION, and, female. Paper banknote in Russia (from 1769 to 1849). | adj. assignment, aya, oh (special). Ozhegov's explanatory dictionary. S.I. Ozhegov, N.Yu. Shvedova. 1949 1992 … Ozhegov's Explanatory Dictionary

Note- (from Latin assignatio appointment; English assignation; French assignats; Polish asygnatja) 1) the name of paper money that was first issued in France in 1789. In Russia they were introduced in 1769 by Catherine II. A. prepared in the Senate,... ... Encyclopedia of Law

ASSIGNMENT- (Polish asygnacija purpose) the historical name of paper money issued in Russia from 1769 to 1849. Appeared in connection with the development of commodity production and the economic feasibility of withdrawal from circulation as money... ... Legal encyclopedia

Definition

Assignation ruble

Banknotes 1769-1785

Banknotes 1786-1818

Banknotes of 1802

Note - This historical name for paper money issued in Russian Federation in from 1769 to 1849 and Appeared in connection with the development of commodity production and the economic feasibility of withdrawal from circulation as money gold and other metals. To a certain extent, the name "A." has survived to this day.

Note - this is the name of the order that one person - the assignee - gives to another - the assignee - to receive from a third - the assignee a certain value, and at the same time the assignee receives an order to make this issue. It may happen that the assignee is a debtor of the assignataire and a trustee of the assignat, and in this case, by means of an assignat, he simultaneously fulfills his claim and destroys the obligation lying on him. However, it also happens that the assignee does not have the right to demand anything, but only uses the assignat to borrow from the assignat; he may not even be a debtor of the assignat, but simply wants to help him through the assignat loan or just authorize him to collect money at his, the assignee's, expense. Normalizing the ordinary banknote more closely (it makes no difference whether it is expressed in writing or simply verbally), most current legislation follows in the footsteps of Roman law, which emphasized not the property nature of the obligation and the associated right of claim, but the personal one, and looked at them only as an individual relationship between strictly defined individuals. The issuance of a banknote by the assignee only implies the acceptance of an order to collect, and therefore does not oblige the assignee to anything. But only the last one accepts it offer, he is already obliged to fulfill the order given to him, must induce the assignat to fulfill it by announcing to him about the assignat, and is responsible for the malfunction, for example. for non-collection. In the same way, it is not necessary for the assignat to accept the order to make the payment; only from the moment of the announcement of its acceptance does the latter become obligatory for him. If he evades the promised payment, he must unconditionally answer to the assignee for the harm and losses resulting from this.

The question of whether the assignee can independently demand from the assignee by the court the fulfillment of the promise of taking over the assignat, or whether only he is given the right of recourse to the assignee, seems controversial. After satisfying the assignee, the assignee may demand from the assignee, on the basis of the authority received from him, the repatriation of what was paid, if he did not owe the same amount to the assignee or received from him the corresponding amount of money for this payment. If the acceptance or payment of the assignation has not taken place, the legal relationship arising between the assignee and the assignee should be determined. If the assignee's demand was to be satisfied by means of an assignment, then his right of recourse against the assignee arising from the original obligation is returned to him, for example. he has the right to demand payment of the purchase price if he has been authorized to collect by means of an assignation the amount due from the assignee for the said payment. In this case, the objection that he has already received satisfaction from the provision of the banknote cannot matter, since " banknote- non-payment" and the debtor-assignee remains obligated until the assignee is actually satisfied. In the case where the assignee completely deprives the assignee of his right of claim, for example, when assigning an obligation, assignment, the assignee is responsible only for authenticity (ventas nominis), but not for successful implementation (bonitas nominis) of the claim; if the assignation is expressed in the form of a delegation, then he is exempt from all liability. An assignment that has not yet been executed can be unilaterally destroyed at the will of the assignee, and, like all other powers of attorney, terminate with his death.

There are many deviations from these basic provisions in banknotes made by merchants, called trade banknotes. These deviations are caused by the need to put future values into circulation as components of property and use them for payment. In view of this, the law allows certain deviations from the provisions that determine the relations of the persons participating in the original transaction, and an independent system of rights and obligations arising from the abstract assignment transaction is created for all participants. According to German law, a trade note (kaufm dnische Anweisung) consists of a written act, also called “Anweisung” and containing an indication of the amount, an order for payment, the names of the assignee, the assignee and the assignee, the time of payment, the place and date of issue. Such banknotes are similar to bills of exchange and therefore are compared with them by legislation: Saxon, Bavarian, Saxe-Weimar, Saxe-Altenburg and Reis principalities. A. is mainly used by small manufacturers and merchants in order to create for themselves loan. When a note is issued by a reputable trading house, it is tacitly assumed that the assignee wishes to induce the assignee to payment for delivered goods after revenue within a certain period. The assignee cannot induce the assignee to pre-announce the acceptance payment according to the banknote and, nevertheless, if one is denied to him, to take advantage of the established for bills the right of recourse against the previous scribe or the person who issued the note. But once the note is accepted by the assign, then the power of bill law applies to it. In the same way, in France, Belgium, the Netherlands, Italy, Portugal, Britain and the United States of North America, banknotes, and even non-commercial ones, are given promissory notes. Other German states, besides those mentioned above, guided by the German trade regulations, distinguish trade notes from ordinary ones in the sense that the assignee can force the assignee as soon as the latter has accepted the note for payment according to trade custom, without being embarrassed by any excuses arising from special assignee-to-assignee relationship. In addition, such a note, if it is only issued not only for payment to the original recipient, but also “to whomever he orders,” can be further transferred by signature and, finally, in case of loss, can be depreciated in the same way as .

In our legislation we do not find any special instructions on banknotes. An instruction given to the debtor to make payment to a third party may be carried out as a transfer by signature debt obligation, which, if its subject consists of a cash payment not secured by a pledge, can be transferred regardless of the will of the debtor, but without recourse (recourse) to lender(Article 2058, X volume, 1 part of the St. Civil Law), and by way of a power of attorney or assignment given to a third party, i.e., without providing him with an independent claim, much less recourse. In our legislation, a banknote in the precise sense of the word merges with the concept of a draft.

Assignment ruble

Assignment ruble- first the settlement, auxiliary, and then the main monetary unit united Rus' from 1769 to January 1, 1849, which was in circulation on a par with the silver ruble with the market exchange rate for both currencies. In total there were 4 monetary issues of Russian banknotes: in 1769-1785, 1786-1818, 1802 and 1818-1843. On Russian banknotes the inscriptions “Acts for the benefit of the Fatherland” and “Love for the Fatherland” were used.

Banknotes 1769-1785

The appearance of assignation rubles was caused by large government expenditures on military needs, which led to a shortage of silver in the treasury (since all payments, especially with foreign suppliers, were carried out exclusively in silver and gold coins). a lack of silver and the huge amounts of copper money in domestic Russian trade meant that large payments were extremely difficult to make. Thus, the district treasuries were forced to equip entire expeditions when collecting poll taxes, since a separate supply was required to transport on average every 500 rubles of tax. All this necessitated the introduction of certain state obligations, a kind of bills for large calculations.

The first attempt to introduce banknotes was made by Peter III, who signed a decree on the establishment on May 25, 1762 state bank, which was supposed to issue banknotes in denominations of 10, 50, 100, 500 and 1000 rubles for total amount 5 million rubles.

The decree was not implemented due to a coup d'etat carried out by Catherine II, who in turn returned to the idea 7 years later issue of securities banknotes. On December 29, 1768, a manifesto was signed and published on February 2, 1769 on the establishment of branches of the Assignation Office in St. Petersburg and Moscow jar who received the exclusive right release banknotes. The manifesto stated that banknotes circulate on a par with coins and are subject to immediate exchange for coins on demand in any quantity. It was established that the issue of paper money should not exceed the cash amount of the coin in bank. The original Assignation Bank amounted to 1 million rubles in copper coins - 500 thousand rubles each in the St. Petersburg and Moscow offices. The monetary issue of banknotes was also determined at 1 million rubles. The bank issued the following denominations: 25, 50, 75 and 100 rubles. This issue of securities had a primitive appearance, which simplified falsification. Banknotes in denominations of 25 rubles were converted into 75. Therefore, by decree of June 21, 1771, banknotes in denominations of 75 rubles were discontinued and withdrawn from circulation. The size of the banknotes 1769-1773. 190 x 250 mm. These banknotes are rare and are of collector's interest.

Initially, the issue of banknotes was a great success, but since there was only a copper coin in the bank, the banknotes were exchanged only for it. This provision was enshrined in law by a decree of January 22, 1770. Thus, the banknote was firmly tied to the copper coin, which from now on became in fact only a means of exchange for the latter. At the beginning of the existence of the new monetary system, this disparity could not yet greatly influence purchasing power new, unsecured precious metal ruble Since 1780, the import and export of bank notes abroad was prohibited: the banknote ruble ceased to be convertible. At the same time, the monetary allocation increased, and from the second half of the 1780s. a sharp decline in the exchange rate of paper money began, pulling with it its exchange equivalent - copper coins. Price scissors appeared, and from now on there were two independent monetary units: a silver ruble, backed by precious metal reserves in the treasury and equal to 100 silver kopecks and an assignation ruble, unbacked by anything other than the population’s trust in the authorities and equal to 100 exclusively copper kopecks.

Banknotes 1786-1818

By the end of the 18th and beginning of the 19th century, the rate of banknotes fell sharply. Military costs Russian Federation were so great that in 1814-1815 the exchange rate was 20 kopecks per ruble

The government promised to reduce the amount of paper money, but it was never kept. The manifesto of June 1787 provided for the number of banknotes at 100 million rubles, but it grew to 57.7 million rubles.

For the purpose of undermining Russian economy Napoleon began issuing counterfeit banknotes. It was difficult to distinguish a fake banknote from a real one - the fakes often looked even more convincing because they were printed on better paper. Unless the signatures were made in a typographical way (on the original banknotes these were genuine signatures made in ink). Some fakes had spelling errors: for example, the word “walking” on the fakes was displayed as “holyacheyu”.

Banknotes of 1802

Banknotes of this type are known only in samples. Number 515001 is the same on all issue notes. The sizes of banknotes of each denomination are not the same.

The section is very easy to use. In the field provided, just enter the right word, and we will give you a list of its values. I would like to note that our site provides data from various sources - encyclopedic, explanatory, word-formation dictionaries. Here you can also see examples of the use of the word you entered.

Meaning of the word assignation

banknote in the crossword dictionary

Dictionary of financial terms

ASSIGNMENT

a contract under which one party transfers to another, for some reason, a certain amount of money, securities or other valuables.

Explanatory dictionary of the Russian language. S.I.Ozhegov, N.Yu.Shvedova.

banknote

And, well. Paper money in Russia (from 1769 to 1849).

adj. assignment, -aya, -oe (special).

New explanatory dictionary of the Russian language, T. F. Efremova.

Wikipedia

Note (meanings)

- Note- a type of securities and/or banknotes (see Bonds)

- State banknotes- the first paper money in Russia

- Banknotes- paper money of the French Revolution

Examples of the use of the word assignation in literature.

Haggai Nikitich strongly rebelled against this condition, for he still had a capital of five hundred rubles banknotes, had a lot of things that could be sold, but Miropa Dmitrievna didn’t want to hear anything.

Stoffle AND THE ROYAL ARMY This Vendée banknote was nailed to the wall by the former gardener, who died in the monastery of the old Chouan, who was replaced by Fauchelevent.

Apparently, the conductor refuses to accept the property into his sphere of influence, but by the time Bakhnov and Kostyukovsky caught up with their interlocutors, a certain crispy banknote, in connection with which the guide decided not to contradict the owner of the chest anymore.

The rest are paper money: blue - five, red - ten, white - banknote at 25 rubles, rainbow - at 100 and 500 rubles.

As for the young man in the bowler hat, he too, according to Murzaev, lost a lot and, while paying, took money out of a large leather briefcase, which he never parted with, and Murzaev noticed that the briefcase was filled to capacity banknotes.

On a Friday night, ten minutes before closing, the doors of many banks swing open and singing coolies enter, like some chorus in a fucking Broadway musical, shoving boxes of crumpled banknotes and demand money for a barrel.

In 1795, Guys due to the fall in exchange rate banknotes completely ruined.

But if, let’s say, a person buys a piece of silk for ten cranes, and then resells it for a hundred cranes, how does this differ from redying banknotes?

Accept, most respected, with my sincere gratitude,” he continued, handing the hostess a pack of banknotes, and then initially squeezed her hand, and then kissed her cheek.

The corps were released, went to the chamberlain Priklonsky, after meeting them with his son, the page Priklonsky, and took from him a tortoiseshell snuffbox in a gold frame and 500 rubles from his bureau banknotes.

Here I am for this very apartment before five hundred banknotes I paid, and now it’s worth five hundred pieces of silver out of my pocket!

Scammers and deceivers are held in high esteem; they will not only sell a worthless item, but also cheat during the settlement with a clever deception banknotes into the palm, look away.

Following his example, Stremyanny also took one centenary, pulled out another from his pocket and began to carefully compare both banknotes.

New banknotes worth twenty-five rubles, obviously counterfeit, could only get into the mining engineer’s wallet in one way - through Kabayashi!

A sentry stood nearby, and around - at neighboring tables - staff clerks were counting banknotes and immediately entered the calculated amounts into the statements.