Sberbank gold debit card

Sberbank issues high-class payment cards for special category clients. With the help of privileged debit cards, customers primarily emphasize their high status. At the same time, a Sberbank gold debit card is not just part of the image of a successful person, but also a multifunctional financial instrument. How to issue such a card, and what privileges does its holder receive? All this is discussed in this article.

What is a Sberbank gold debit card

Gold cards occupy a special place in the line of debit products of the country's main bank. They allow you to quickly and conveniently make various monetary transactions.

Special services are available to gold card holders(*). Special privileges make using a financial instrument not only comfortable, but also profitable. A high level of security guarantees the safety of funds. In addition, owners of such cards receive personalized service. Terms of receipt and service

Sberbank has the following requirements for those who want to issue a gold payment card:

- citizenship - only Russian Federation;

- permanent registration in one of the regions of the Russian Federation;

- age to receive a main card is at least 18 years old;

- The age for receiving additional gold cards is from 7 years.

It is worth noting that the credit institution issues a privileged financial instrument to non-residents of the Russian Federation. Also, those who do not have permanent registration have the opportunity to become a holder of a special product. But the decision in both cases is always made on an individual basis. The credit institution reserves the right to refuse to issue a gold card to such potential clients without giving reasons.

Algorithm for issuing a gold card:

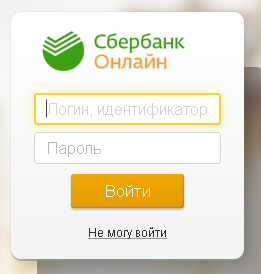

You can also apply for a top category card on the official website of the credit institution. In particular, orders for issuing cards with an individual design are accepted only on the website. If the application is submitted online, the client signs all documents immediately upon receipt of the financial instrument. In addition, you can only order a Visa payment system card online. A MasterCard Gold debit card can only be issued at bank branches.

The credit institution makes a decision on issuing its product within a maximum of two working days. Annual maintenance costs gold card holders 3 thousand rubles. For each additional card, Sberbank charges 2.5 thousand rubles. Re-issue of a privileged card is free of charge.

Pros and cons of the Sberbank gold debit card

A premium payment card, like any banking product, has its advantages and disadvantages. This has a lot of advantages. These include the following points:

- discounts and privileges from MasterCard and Visa payment systems;

- the ability to issue additional cards, including for children aged 7 years and older;

- service through the contact center not only during the day, but also at night;

- receiving cash on the territory of the Russian Federation and abroad in subsidiary banks on equally attractive terms;

- conducting various online operations in a special protected mode;

- emergency cash withdrawal if the card is lost in another country;

- non-cash payment for services and goods using the ATM network, as well as self-service devices, not only in Russia, but also abroad.

In addition, many Sberbank partner companies provide gold card holders with significant discounts on their products and services. As for the disadvantages of a product of a special category, there is only one - the high cost of service for a person with an average income. For people receiving a fairly large income, this amount is quite acceptable.

Sberbank debit gold card - reviews

Gold debit cards of the leading credit institution in our country are quite popular among its regular customers. Many of them prefer this financial instrument due to the availability of additional opportunities. Thus, some holders of the highest category card say that it helps to save a lot on daily expenses. Sberbank today cooperates with a large number of different companies. This list includes:

- restaurants;

- gas stations;

- clothing stores;

- airlines;

- entertainment centers, etc.

By paying for goods and services with gold plastic, you can save up to 20% of your money. Those who often travel abroad appreciate the possibility of hassle-free withdrawals from their cards in other countries. By law, large sums of money cannot be transported across the border. Therefore, many people put the required amount on their card, and after arriving in a foreign city, withdraw money from the nearest ATM. Also, regular customers who regularly use the card recommend it to protect their finances when traveling to cities in Russia and other countries.

Negative reviews about this device, as a rule, come from citizens who use it inactively. Many also complain about the high cost of servicing a gold payment card. But if you consider how many discounts and bonuses the holder of a financial instrument can receive, then the annual payment fully justifies all the costs. This product brings the greatest benefit to bank clients who receive a very high income.

- To control the movement of money in the account, it is recommended to review the report prepared by the bank on a monthly basis.

- Before traveling to another city or country, you should make sure that the card is active.