Gazprombank credit card with a grace period

Credit cards are the most popular product among commercial bank customers. When deciding to issue a credit card, potential borrowers carefully study and compare bank offers in order to get the most profitable one in the end. One of the popular banks for both individuals and entrepreneurs is Gazprombank, let's take a closer look at a product such as a Gazprombank credit card, terms of registration and use, as well as requirements for the borrower and other nuances.

Credit cards from Gazprombank

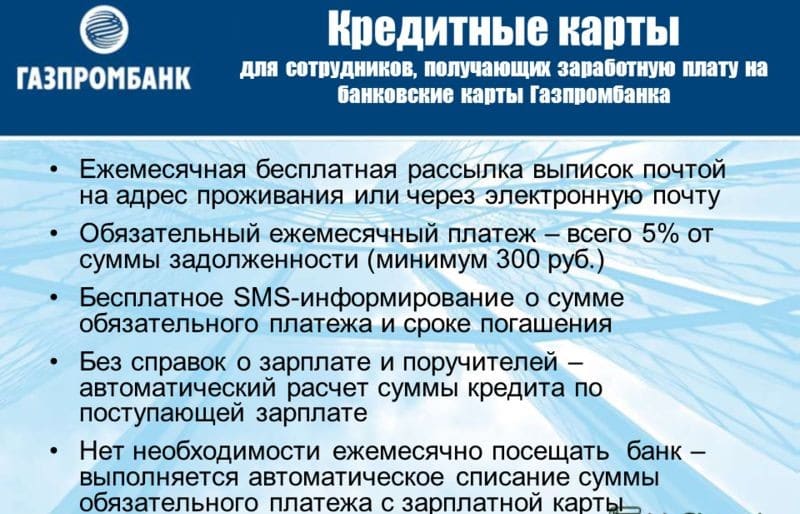

Unlike many Russian banks, Gazprombank offers a wide range of credit cards from 4 global payment systems: Visa and MasterCard (USA), as well as JCB (Japan) and UnionPay (China). The lender also offers payment cards with different statuses: classic, standard, gold or platinum. There is only one significant drawback - only payroll customers of Gazprombank can become the owner of plastic.

A potential borrower can issue a main card for free and an additional one with a bonus accrual system. Also, as a credit card, you can issue:

- "Gazprombank-Gazpromneft" gives its owner to get participation in the bonus program "On Our Way" from the network of gas stations Gazpromneft and gold status, which gives 20% more bonuses.

- "Gazprombank-Express Card" it gives its owner a non-cash way to pay for travel in the subway and ground public transport.

Requirements for the borrower and methods of registration

As mentioned earlier, only participants in the bank's salary project can become a credit card holder, this product is not available to others. If you are a payroll client, then the lender's requirements are as follows:

- citizenship of the Russian Federation and passport;

- age from 20 to 59 years for women and 64 years for men;

- home office and mobile phone.

To obtain a credit card from a potential borrower, a minimum of documents is required, more precisely, only a passport is enough. There is no need to confirm the level of income and employment.

You can apply directly at the office of a financial institution or through a self-service device. In addition, you can call the hotline or use the services of the Home Bank, fill out the questionnaire through your personal account in Internet banking. To sign a loan agreement, you will need to come to the sales office of Gazprombank, after the lender gives a positive answer, terms of consideration of the application from 2 to 7 days.

Please note that participation in a salary project does not give you a 100% guarantee of issuing a credit card, the final decision is made by the lender, which may depend on many factors.

Terms of Use

Gazprombank credit cards for payroll clients have a fixed rate of 23.9%. Also, this category of cardholders has the option of installment payment - a rate of 21.9%. The maximum loan limit depends entirely on the income of the borrower. If a client receives a salary to a bank account for six months or more, then a limit of up to three salaries is available to him. For new payroll customers, a credit card is available with a minimum threshold of 15,000 rubles. The maximum possible limit on credit cards is up to 600,000 rubles.

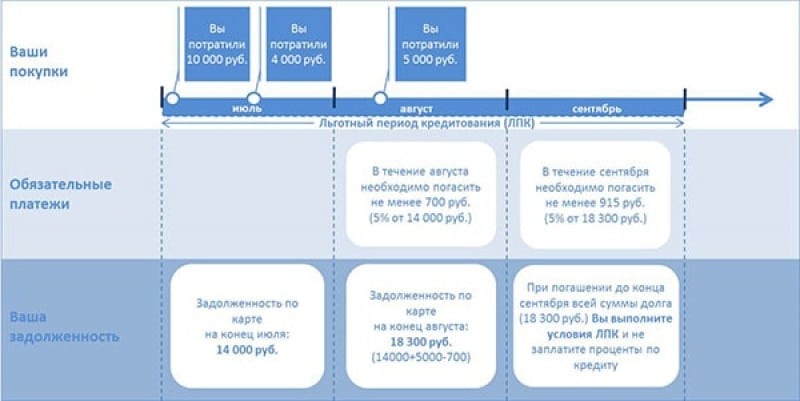

How is the grace period calculated for Gazprombank credit cards

A Gazprombank credit card with a grace period is a unique opportunity to use a loan for free. The duration of the grace period is up to 3 months. It is enough for the user to make a mandatory monthly payment in the amount of 5% of the debt amount, and before the end of the grace period, make the remaining amount, the bank does not need to pay interest.

The last question that the Gazprombank credit card leaves is cash withdrawals. Many bank customers know that it is unprofitable to withdraw cash from a credit card, and this also applies to Gazprombank. For cash withdrawals from an ATM, a fee of 4.9% of the amount is charged, but not less than 290 rubles.

Please note that third-party financial institutions may charge an additional fee for servicing Gazprombank cards.

How to pay a loan

The bank offers its users several ways to pay off credit card debt. Participants of the salary project can pay the debt from their debit card. There are other ways:

- via the Internet from accounts in another bank or electronic wallet;

- through self-service devices: ATMs and terminals;

- through the cash desk of Gazprombank;

- through remote services Home Bank and Telecard.

Advantages and disadvantages

Undoubtedly, the use of a credit card is beneficial for the client. If you correctly use plastic and repay the debt during the grace period, the user can completely free himself from paying interest to the bank. In addition, all credit cards have a fixed interest rate and a fairly high limit.

The main drawback is that the product is not available to a wide range of clients; this offer is focused only on participants in the salary project. That is, before becoming the owner of a credit card, you need to become a recipient of wages to a bank account. Another drawback is the high commission for cash withdrawals, the card is only suitable for non-cash transactions, including online.

In most cases, the bank independently sends out offers for obtaining a credit card to its payroll customers. But this, of course, does not guarantee the approval of the application, because after filling out the questionnaire, the lender checks your financial reputation in the credit bureau, if it is positive, then your chance of becoming a credit card holder is much higher.