VTB 24 online: login to your personal account

VTB 24- one of the leading commercial banks in the country with state participation. It existed under the VTB 24 brand until January 2018, and was later renamed VTB. Specializes in consumer lending, as well as lending to small and medium-sized businesses. It ranks second in terms of assets and first in the country in terms of authorized capital. Some bank users forget to switch the keyboard layout and mistakenly enter bank instead of VTB24 in the search for DN 24.

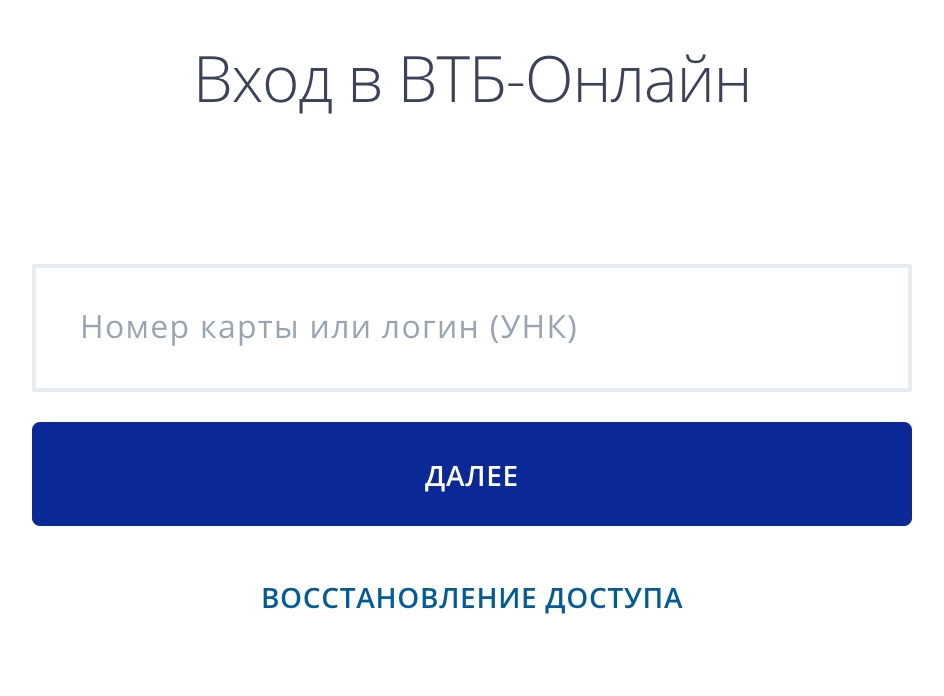

When you hover over the cursor, the system will offer you to choose between two versions of your personal account - for individuals and for legal entities. We select the first item - "VTB-Online". You can also follow the link to go to the personal account authorization page for individuals.

Login can be entered in two ways:

- UNK - universal client number (assigned to each client individually when concluding a banking service agreement)

- Your VTB card number

After these steps, the system will give you access to your VTB personal account, where the following options will become available:

- Detailed information about open accounts, deposits, loans and cards

- History of transactions made in the Internet bank

- Analysis of income and expenses

- Opening an account (both in rubles and in dollars and euros)

- Payment for services (mobile communications, utilities, Internet and TV, taxes and traffic police fines)

- Creation of templates and auto payments for regular transactions

- Transfers (between own accounts and cards, as well as to other banks using free details)

- Decor

- Loan payment

- Opening a deposit

- Ordering a new card and tracking its readiness status

- Card blocking (in case of theft or loss)

- Card reissue

- Create a PIN for a new card

- The current exchange rate and precious metals

- Currency exchange

- bonus program

- Feedback from the bank

- Information about discounts on VTB cards

- Search for nearest branches and ATMs

- Personal offers from the bank

Registration of a personal account VTB 24

In VTB, any client is already "by default" registered in the VTB-Online system. The UNK and your password serve as identification data.

If you do not have a password, then enter your UNK or card number and click "Next" - "Send a temporary password". An SMS with a login password will be sent to your mobile linked to a card or contract. We recommend changing the password from SMS to your more complex one for security purposes.

Login or password recovery

If you suddenly forgot your username or password, or maybe all together, then don't worry, they can be restored.

The system will offer 3 reasons why you cannot log in:

- You don't remember your username (UNK)

- You don't remember your password

- You don't know where to find your UNC

Depending on what you need to restore, click on one of these items.

I don't remember my login (UNK)

If you do not remember your login, then you can safely use your VTB card number instead of it to enter your VTB Online personal account. If you still need a login, then you can restore it at a VTB ATM, at a bank office or by calling the hotline at +7 (495) 777-24-24 or 8 (800) 100-24-24.

If you have chosen the login recovery method using the bank's hotline, then select "Internet banking" in the voice menu, and then "Recover login and password in VTB-Online".

I don't remember my password

If you do not remember your password, the system will prompt you to enter your VTB Bank card number or a unique bank customer number (UNK).

I don’t know where to find my UNK client of VTB Bank

If you do not know your UNK, then you can find it in your banking service agreement. Simply search for your Comprehensive Service Application.

It will be indicated after the heading "CONTRACT INFORMATION".

VTB 24 mobile application online

The Internet banking system of VTB Bank, in addition to a computer, is also available on a smartphone. The VTB-Online mobile application allows you to perform almost all the same operations as on a computer. With the help of the VTB mobile application, you can manage your finances when you need it and anywhere in the world 24 hours a day.

With the VTB-Online application, you will have access to:

- Replenishment of VTB card with cards of other banks

- Transfers to cards of other banks

- Transfers using free bank details

- History of financial transactions on your account

- Card blocking

- Change login and password

- Payment for services

- Deposits and loans

- Currency exchange

- Search for the nearest ATMs and VTB Bank offices

Note! For ease of use, when you first enter the application, you will be prompted to set up authorization using a PIN code (4 digits) and a fingerprint.

The VTB app is available for iOS, Android and Windows Phone mobile platforms. You can download the VTB-Online mobile application using the links:

VTB 24 business online

For legal entities, the bank has a separate personal account for VTB Business Online. Legal entities whose accounts are serviced at VTB Bank have access to this cabinet. To access the business version of the account, you must have a login, password and an electronic key containing the electronic signature of your organization. You can get the key at the VTB Bank office. You can enter your personal account at the link https://bo.vtb24.ru/login or by clicking on the picture below.

In case of problems or questions about the work of VTB Bank, you can contact the hotline at the number:

- 8 (800) 100-24-24 - call within Russia is free from any phone number

- +7 (495) 777-24-24 - for calls from abroad (according to the tariffs of your operator)

The hotline is available around the clock. A call to the hotline is free of charge when making a call within Russia.

How to activate VTB Online

When connecting the VTB-Online Internet banking service, you need to perform several steps to activate your account:

- Go to the login page and enter your login and password (received on the phone within 1 day from the moment the card is received at the bank branch)

- Change your temporary password to a permanent one (recommended for security reasons)

What to do if you forgot the pin code from the VTB card

If you have forgotten the PIN code from the card, then you need to contact the bank's customer support service to reissue the card. The average turnaround time for a card is 10 to 14 calendar days.

I can’t log into VTB Online: what to do

If you get a login error when entering your login and password, then the first thing to do is to check the correctness of the details entered. You may have made a mistake in the keyboard layout or in the password. If you enter the wrong password from your VTB-Online personal account 3 times in a row, then your UNK is blocked for 30 minutes for security purposes. In this situation, you must wait for the specified time.

It is recommended that after the 2nd unsuccessful login attempt, use the password recovery function to avoid temporary blocking of UNK. To do this, on the login page, click on the link "Forgot your password?" and follow the system prompts.

Access to VTB-Online is blocked: what to do if UNK is blocked

Access to VTB Online can be blocked for a number of reasons:

- You entered your password incorrectly 3 times in a row

- Suspicious transactions in your account

- System error

When blocking UNK, the time of blocking the account is always indicated. To unblock VTB-Online, you can wait until the specified time has passed or call the customer support service of VTB Bank and report the problem.

How to block VTB Online

If you want to suspend access to the VTB-Online system, then you can do this by contacting the bank's support service by calling the hotline 8 (800) 100-24-24. To identify you as a customer, the call center operator will ask for your data and also ask for a code word, after which he will fulfill your request. You can unblock Internet banking in the same way.

How to block a VTB card

If the card is lost or stolen, it is extremely important to quickly block access to it. There are several ways to block a card:

- Block the card in your personal account VTB-Online

- Block the card in the mobile application of VTB Bank

- Perform a blocking by calling the bank hotline

After that, you can reissue the lost card or simply transfer money to another card. In the same ways, you can unblock your card if necessary.

Why is my VTB card blocked

The card can be blocked for many reasons:

- Suspicious transactions were made on the card

- The court decision on writing off the debt by bailiffs was transferred to the bank

Suspicious card transactions

It's no secret that every major bank has its own monitoring system that analyzes transactions on each client's accounts and, based on this, learns to prevent theft of funds and other negative financial situations.

For example, a blocking of a card can occur if you have made card transactions in the amount of up to 50,000 rubles for the last year and suddenly tried to make a purchase for 400,000 rubles.

In this case, you will be notified by the bank's system about the blocking and the need to make a call to the bank's support service to confirm the operation and unblock the card.

The bailiffs seized the account

According to the legislation of the Russian Federation, all banks must comply with the law. When a court decision is received from bailiffs, the bank clearly complies with the court order, this may be withholding the amount from the debtor's account every month to the creditor's account or completely blocking the card and account, depending on the order of the legislature. In this case, you need to call the client department of the bank and clarify the contact details of the bailiff who seized the account. Then contact the FSSP bailiff in charge of your case and resolve the debt issue.