Unique customer number (UNK) - what is it in VTB 24

Most modern banks delight their customers with the opportunity to use their services remotely. Some types of financial transactions require the highest level of security. For this, a unique client number is used, presented as a login for an online application. Let's consider how it works in practice, using the example of one of the banks. Let's find out, UNK, what is it? VTB 24 and its data protection system in Internet banking. Why is it needed, how to use it, and how to find out or reset the password if necessary.

Unique customer number (UNK)

UNK - a code that allows you to log into the Internet bank, where the user has already registered earlier. The code numbers for all clients are different, that is, they are unique and with their help you can connect to the Telebank service, through which various financial actions, information, etc. are carried out.

So, to enter Internet banking, you need a username and password. Your UNK is not always suitable as a login, because it is not so easy to remember, so it may be subject to replacement, which can be done in the Telebank settings.

UNK can be entered instead of a login to enter VTB 24 Online

How to find out the login - the personal number of the client

Login for VTB online is a set of numbers. Their length can vary from 3 to 20 values.

When registering online banking, you can choose the following type:

- Base with free connection at the branch and confirmation of entry using the code in SMS;

- extended with a password generator and increased security, which opens up the possibility of transactions with large amounts.

How to get a username and password:

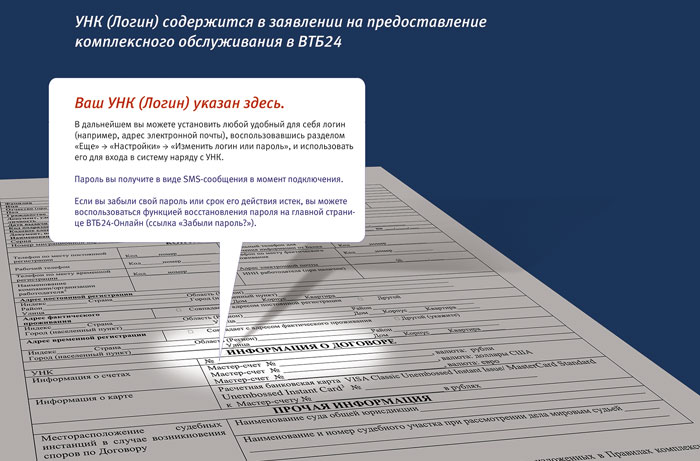

- look at the contract, there, most often on the main page, UNK is indicated at the top left;

- receive at a bank branch upon presentation of a passport;

- call the hotline 8-800-100-24-24 and say your full name, date of birth, the last four digits of the card and the code word.

How to find out or restore UNK

How to find out or restore UNK

Why Telebank is needed

Having found out what UNK VTB 24 is and how to use it, let's look at how VTB24 Internet banking works. This is especially true for those who are new to using bank cards or accounts. But Telebank provides many opportunities for its users:

- Making utility payments.

- Payment for television, internet, mobile communications.

- Making transfers to cards.

- Purchase of precious papers.

- Currency conversion according to the exchange rate.

- Working with deposits.

- charitable actions.

- Complete information on loans + the possibility of their repayment.

- Insurance.

- Repayment of loans.

- Submission of applications for financial transactions.

Thus, the VTB online application service is the most useful and convenient user application that can be used while staying in any city, country or continent.

If there are no ATMs, terminals or bank branches nearby, it will not be difficult for application owners to perform the necessary action without leaving their homes.

If customers have forgotten their VTB 24 password online, this is not a problem. After all, it can be renewed or changed without any problems. VTB Bank took care of the safety and convenience of work for its customers.

VTB 24 Internet banking can be used both on a PC and from a mobile gadget

VTB 24 Internet banking can be used both on a PC and from a mobile gadget

How to use the application from VTB 24

Today, the population of our country is an active user of various mobile applications. Telebank does not require special settings, because the service can be downloaded from PlayMarket or AppStore, depending on the device used by the client. In addition, you can install the application on your computer using any browser.

This service requires an internet connection or Wi-Fi. To enter, you open the downloaded application and enter using your password and login. Don't know how to find out the VTB 24 card login? Look at the contract drawn up by the bank, because the UNC is issued with it in a packaged form accessible only to the client.

Confidential information, such as CVV, is not needed to log in, so if such a request occurs, it means that the client has fallen for scammers and needs to contact the bank.

After a positive outcome of registration and login, you can start working with Internet banking in accordance with generally accepted conditions. Each time you log in to the system, you must enter your login and password for security, and the inability to transfer data to intruders if the mobile device is stolen or lost.

So that every time the question does not arise about where to get the numbers for the login, they can be changed to any desired nickname. With this option, even if the documentation information from VTB 24 falls into the wrong hands, it will be impossible to log into the application.

VTB 24 Internet banking allows you to perform many operations remotely

VTB 24 Internet banking allows you to perform many operations remotely

Restoring access to Telebank

The initial login numbers can be seen in the contract from the bank or heard in the voice menu by calling 8 (800) 100-24-24, you must select the menu "accounts, deposits, Internet banking".

If the client has forgotten the login, it can be renewed or changed in the same way by dialing the above number, selecting the same menu, and then go to the “Recovering the login and password in VTB24-Online” section.

The client receives the password during the initial registration on the day of connecting online banking via SMS . You can recover your password if it has been deleted or expired by going to the "Forgot your password or login" section.

In addition, you can perform this operation at an ATM, for which you need to click on the "Settings" section, select "Login and password for VTB24-Online".

VTB 24 allows users to carry out a large number of actions without leaving home. The Telebank system requires entering a personal code to enter, which should be remembered or written down, but such information should be hidden only in a safe place. VTB does everything for convenient work in the service, and in the event of a particular problem, it is quickly resolved using the hotline.