Privileges of the VTB 24 World card: reviews

VTB24 Bank offers a huge selection of plastic cards, and each of them is unique, because it not only makes it possible to pay for purchases, but also receive privileges in the form of bonuses. The VTB 24 world map is attractive in that the owner receives bonus miles, which can later be exchanged for free rail or air tickets. Let us consider in more detail all the options for these cards, their advantages, owner reviews, design methods, and privileges.

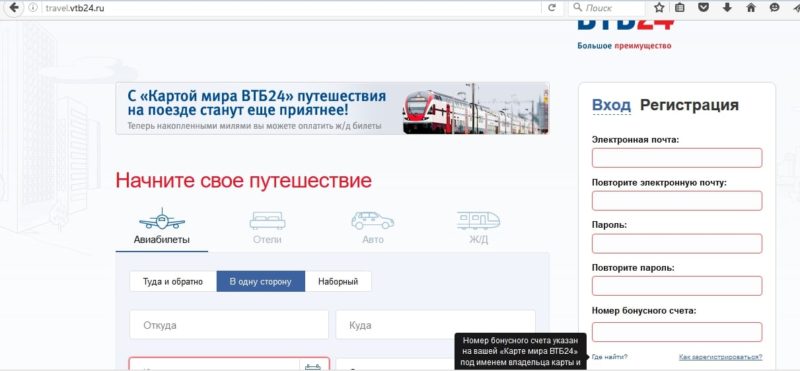

The main privileges of the VTB 24 World card are bonus miles, which the owner can receive depending on the expenses on the card. The minimum amount of expenses from which miles are credited is 35 rubles, the number of miles depends on the plastic you choose, more on that later. Subsequently, bonuses can be exchanged for Air or train tickets, hotels or car rental. You can buy tickets only on the website https://travel.vtb24.ru/, and judging by user reviews, the prices presented here are more expensive than those of other providers.

Why are most potential users attracted by the terms of VTB 24 Bank? It is worth paying attention to the fact that there are quite a lot of similar offers on the modern financial services market, but the fact is that in this bank, depending on the status of the plastic, you receive from 1.9% to 3.8% of your expenses in the form of bonuses, this despite the fact that most other banks are much smaller.

Debit cards

A world map without a credit limit can only be issued as part of a service package, that is, the bank offers its customers not only a payment instrument, but also a range of services, of course, for a fee. You can choose one of the four service packages "Classic", "Gold", "Platinum" and "Privilege", they all differ from each other and have certain conditions, we will consider them.

Please note that the World Map is not included with the Classic Package.

"Golden" package of services

As part of this package, you can apply for a VTB 24 World Gold Debit Card, in which you get 2 miles for 35 rubles from expenses, at the same time you get the opportunity to open up to 3 accounts in different currencies.

The cost of the service package is 1,050 rubles for 3 months, there is no fee, provided that at least 350,000 rubles are placed on the debit account, and debit transactions on the card are from 35,000 rubles per month. Card service is paid separately. For the Visa Gold World Card, the issuance fee is 300 rubles, and the service is free, Visa Gold and MasterCard Gold will cost 3000 rubles for the issue and the same for the service.

"Platinum" package of services

Within the framework of this package, you can also issue a Kara of the World, and here you get 4 miles for every 35 rubles spent from the card. The issue price is 500 rubles, there is no annual service for Visa and MasterCard. The cost of servicing the package is 2,550 rubles for every 3 months, if the amount of funds placed on the debit account is less than 700,000 rubles, and the expenses on the card are less than 75,000 rubles. The cost of the Visa Platinum and Mastercard Platinum World Card is 5000 rubles for registration and the same amount for annual service.

Service package "Privilege"

The Privilege service package is designed for wealthy clients. Here you can apply for a platinum World Map. Bonus accrual system: 4 miles for 35 rubles. They can later be exchanged for air and train tickets, hotel reservations and car rentals. The package is provided free of charge, provided that at least 1.5 million rubles are deposited on the account, at least 120,000 rubles per month are credited to the card, and the monthly turnover is from 55,000 rubles. The cost of servicing Premium class plastic is the same as for platinum cards.

There is another advantage here: the owners of the premium package of services have the opportunity to receive the Traveler Protection insurance program free of charge from the insurance company VTB Insurance. That is, the owner receives a policy that provides insurance coverage for:

- trip cancellation;

- civil liability;

- medical expenses;

- accident;

- flight or baggage delays.

The maximum payout amount is up to $ 50,000, and this protection is valid not only outside our country, but also when traveling from 100 km from the permanent residence of the owner of the plastic. It is only valid for the first 90 days.

Please note that miles on the VTB World card are converted at the following rate: 3 miles are equal to 1 ruble.

World Credit Card

It is possible to issue a credit card with a system for accruing bonus miles only in two versions: gold or platinum. They differ in credit limit and some other conditions:

- Gold credit card with a maximum limit of up to 750,000 rubles. Bonus accrual system: 2 miles for every 35 rubles spent, 2,000 welcome miles as a gift at checkout, free Traveler Protection insurance program. The registration fee is 350 rubles, the cost of maintenance is 350 rubles, if the turnover is less than 25,000 rubles, the interest rate is 26% per year.

- Platinum credit card with a credit limit of up to 1 million rubles, bonuses - 4 miles for every 35 rubles. First 6,000 miles welcome bonus on first purchase. The owner receives a free Travel Protection policy, an interest rate of 22% per year, the issue price is 850 rubles. No service fee is charged if the turnover is 65 thousand rubles or more, otherwise 850 rubles per month.

Please note that all credit cards have a grace period of up to 50 days.

You can apply for a credit card only if you provide a salary certificate in the form of 2-NDFL or a bank form. As a confirmation of financial viability and solvency, the lender considers a passport, a vehicle passport.

Advantages and disadvantages

It should be noted right away that these cards have a huge number of advantages, despite the fact that there is only one drawback here - this is the high cost of maintenance, plus the paid issue of plastic. On the other hand, you can use the card for free, but you must comply with the required monthly turnover of funds. By the way, the bank writes off the service fee every month, if in the current month you have not met the conditions for the minimum turnover, then the next month the fee will be charged.

Now about the benefits, as mentioned earlier, that at VTB 24 Bank a rather high percentage of purchases is converted into miles. By the way, according to the conditions, if you want to accumulate as many bonuses as possible, then it is wiser to issue a platinum card, which is attached to free insurance program "Protection of travelers". There is another visible advantage for credit cards - the grace period applies not only to debit transactions, as is usually the case, but also to cash withdrawals from ATMs. The interest rate on the credit limit is fixed and depends on the status of the plastic.

If we talk about the benefits, we can note the following points, the owners of Gold and Platinum status cards have access to some services for free, for example, SMS informing, concierge service, Internet banking. You can use this card only in Russia, but also abroad, and also use it to receive discounts and bonuses from bank partners and issue additional cards in different currencies for yourself and your family members.

Please note that the concierge service of VTB Bank is a complex of information and other services, for example, with the help of it you can book a hotel, arrange courier delivery, receive information support, and other services.

How to spend bonuses

Each client holding a world card from VTB 24 Bank has access to a personal account. First you need to register on the site https://travel.vtb24.ru. In the registration form, you need to specify an email address, create a password, indicate the date of birth and the number of the bonus account. The bonus account number is a combination of 10 digits, you can find it on a credit card, if you are the owner of a debit card, you will receive this code in an SMS message after making the first purchase. After the registration is completed, you can open your personal account at any time and control the bonus account. How to check VTB 24 miles on the World map? You just need to open your personal account, after which all information on your bonus balance will be available.

Website travel.vtb24.ru

Spend bonuses on the VTB 24 Mira card in your personal travel account. More precisely, you can open the main page of the site, fill out a search form, that is, indicate the direction of the route, the estimated travel dates, the number of people. The system will automatically find you a ticket, in the same way you can find a hotel, train tickets and transport for rent. After the search is over, several offers will open in front of you, among them you can choose the one that suits you best and pay for the service with the accumulated bonuses. By the way, all prices are indicated both in bonuses and in rubles. After you choose a service, you can pay for it. With the help of bonuses, you can pay at least half of the cost of the service or in full.

Please note that card bonuses are non-expiring, that is, they do not expire.