The procedure for writing off fuels and lubricants. Fuel consumption: tax and accounting. The procedure for writing off fuels and lubricants

All expenses of an organization or enterprise for accounting and tax purposes must be documented otherwise, unaccounted expenses will be considered a serious violation, and the management of the legal entity may suffer quite serious liability because of them.

This also applies to the cost of fuels and lubricants, while it is worth noting that correctly calculated and drawn up they can be attributed to the expense items of the balance sheet. As a result, the taxable base, which is taken as the basis for calculating income tax, may decrease.

The concepts of "fuels and lubricants" and "Waybill"

Accounting for the movement of fuels and lubricants is directly related to waybills, while fuel and lubricants are understood as:

- fuels of various types, for example, diesel, gasoline, gas;

- oils and greases;

- various additives and additives, for example, coolants and brakes.

A specific list of used fuels and lubricants used in the operation of the vehicle, depends on its type and model... There are cars that run on gasoline and diesel fuel. In addition, some vehicles, such as buses, are equipped with gas-fueled equipment to save money.

A specific list of used fuels and lubricants used in the operation of the vehicle, depends on its type and model... There are cars that run on gasoline and diesel fuel. In addition, some vehicles, such as buses, are equipped with gas-fueled equipment to save money.

In this case, gas also belongs to fuels and lubricants. There are standards for their write-off, approved by the Ministry of Transport of Russia, and they can also be adopted at the enterprise independently. Such standards take into account some Extra options eg season and season and various adjustment factors.

Accounting for these materials at the enterprise in most cases is made on the basis of the primary accounting document - waybill... A waybill is understood as a document that records the place of departure and arrival of road transport, the consumption of fuel and lubricants, the name of the transported cargo, the purpose of the trip and other information related to it.

The waybill is issued both for own transport and for rented one. In general cases, a waybill is used. form No. 3, a form sheet is provided for commercial vehicles No. PG-1, when using a truck with a delayed form of payment, the form No. 4-P... There are also other forms of waybills.

In addition to the waybill for writing off fuels and lubricants, it is necessary order of the head of a legal entity, in which the norms of such write-off are approved. It should be noted that the use of a personal car in the interests of the company is also issued with a waybill for writing off fuel and lubricants.

In addition to the waybill for writing off fuels and lubricants, it is necessary order of the head of a legal entity, in which the norms of such write-off are approved. It should be noted that the use of a personal car in the interests of the company is also issued with a waybill for writing off fuel and lubricants.

The receipt of these materials at the enterprise is formalized credit slip ... The very same write-off occurs usually once a month by the person responsible for this. Such a person is almost always an accounting employee, for example, a material accountant.

As for the write-off procedure itself, it consists in drawing up an appropriate act by representatives of a specially created commission in the amount of at least three people.

Documents are attached to it primary accounting statements, namely: consignment note, refueling cards, gas station checks. The purpose of these documents is to confirm actual volume consumed fuels and lubricants.

Calculation example

The calculation of the write-off of fuels and lubricants is made for each brand of road transport separately, while the total mileage of the distance traveled is necessarily taken into account. So, make a calculation for passenger car you can use the formula:

QH = 0.01 * Hs * S * (1 + 0.01 * D), where

- H- the basic rate of fuel consumption, which is defined as the vehicle's mileage in liters per 100 kilometers;

- S- total vehicle mileage during a work shift in kilometers;

- D- correction factor in percent.

As an example, we can take the GAZ-3110 brand car with a ZMZ-4026.10 engine, which is quite common in production. Its base rate of fuel consumption is 13 liters per 100 kilometers.

As an example, we can take the GAZ-3110 brand car with a ZMZ-4026.10 engine, which is quite common in production. Its base rate of fuel consumption is 13 liters per 100 kilometers.

The car was used for sales finished products in winter. The total mileage in the region (NRo) was 104 kilometers, in the city (HPg) - 128 kilometers. As a result, a surcharge of 10% was taken for operation in the winter period and for operation

We calculate the fuel consumption rate: HPg = (0.01 * 13 * 128 * (1 + 0.01 * 20%)) = 16.67 liters НРо = (0.01 * 13 * 104 * (1 + 0.01 * 10)) = 13.53 liters. According to the waybill data, 30.2 liters were consumed during the working day. If we take such an indicator as an average, then for a month the consumption of fuels and lubricants for production purposes will be:

НРм = НРд * Т, where

HPm Is the standard fuel consumption per working day, T Is the number of working days in one month.

Thus, HPm = 30.2 - 21 = 634.27 liters.

In this case, when writing off fuel and lubricants, 623.27 liters of fuel can be indicated when the car is running for a month. As for the write-off of antifreeze, brake fluid, etc., they are written off in accordance with previously approved consumption standards.

It is worth mentioning separately that in the case overhaul car or reaching a service life of 5 years, the rate of consumption of lubricants and fuel can be increased by 20%.

Is it possible to write off without a waybill

There are cases when the write-off of fuels and lubricants is carried out without the use of a traveling person. It:

- accounting by limits;

- compensation for expenses incurred.

V first the case in the enterprise must be installed fuel and lubricants consumption control system... In this case, the reserved cash for their purchase.

Also used for this fuel cards Gas stations, while the money on them should not exceed the established rate. This system good when using vehicles on the same daily route.

In second case, it is required to conclude an agreement for the use of a personal car between the organization and its employee on the basis of Art. 188 of the Labor Code of the Russian Federation.

Here, restrictions on payments are set depending on the make, model and modification of the car. The very same write-off of fuels and lubricants is carried out on the basis of the standards established by the enterprise.

Accounting features

Before proceeding with the write-off of fuels and lubricants, legal entity it is necessary to decide on the method of accounting. So the driver of the car himself is directly filling the fuel, using the funds allocated for this. After finishing refueling, he must submit an advance report to the accounting department... A gas station check is attached to it. The fuel is subsequently credited according to account 10 "Materials".

Spent fuel and lubricants are reflected when written off to following accounts:

- 20 "Primary production";

- 26 « General running costs»;

- 44 Selling expenses.

Directly the choice of this or that account lies with the management of the enterprise. At the same time, for tax accounting, the operation of writing off fuel and lubricants is carried out in accordance with Article 254 of the Tax Code and is included in material costs.

At the same time, nothing prevents them from being classified as other expenses on the basis of Art. 264 of the Tax Code of the Russian Federation. In any case, it is worth deciding in advance with the policy of accounting and write-off of fuels and lubricants, since these procedures are current and will be periodically repeated.

Step-by-step instructions for writing off fuel and lubricants in 1C are presented below.

The cost of fuel and lubricants and their recognition in tax accounting is a "sore point" issue for accountants in most organizations. To what extent and on what basis it is possible to reduce the income tax base for these expenses, says L.P. Fomicheva (728-82-40, [email protected]), tax and levy consultant. In terms of automation, the material was prepared by the specialists of the Authorized Training Center "Master Service Engineering".

General provisions for accounting for fuels and lubricants

- fuel (gasoline, diesel fuel, LPG, compressed natural gas);

- lubricants (motor, transmission and special oils, greases);

- special fluids (brake and cooling).

An organization that owns, leases or uses cars free of charge and uses them in its activities to generate income can charge the cost of fuel and lubricants. But not everything is as simple as it seems.

Are standards necessary when accounting for fuels and lubricants?

Currently accounting regulations do not establish limit norms for attributing to the prime cost the costs associated with the use of fuels and lubricants when operating vehicles. The only condition for writing off fuels and lubricants at the prime cost is the availability of documents confirming the fact of their use in the production process.

When calculating taxable profit, one must be guided by Chapter 25 of the Tax Code of the Russian Federation. The costs of maintaining service vehicles, which include the cost of purchasing fuel and lubricants, are related to other costs associated with production and sale (subparagraph 11 of paragraph 1 of article 264 and subparagraph 2 of paragraph 1 of article 253 of the Tax Code of the Russian Federation). The Tax Code of the Russian Federation does not limit the costs of maintaining official vehicles by any norms, therefore, for tax purposes, it is envisaged to write off the costs of fuel and lubricants at actual costs. However, they must be documented and economically justified (clause 1 of article 252 of the Tax Code of the Russian Federation).

In the opinion of the Ministry of Finance of Russia, set out in a letter dated March 15, 2005 No. 03-03-02-04 / 1/67, the cost of purchasing fuel and lubricants within the limits specified in the technical documentation for vehicle, can be recognized for tax purposes subject to the requirements established by the above paragraph 1 of Article 252 of the Tax Code of the Russian Federation. The UMNS of Russia in Moscow in a letter dated 23.09.2002 No. 26-12 / 44873 expressed a similar opinion.

The requirement of validity obliges the organization to develop and approve its own consumption rates for fuel, lubricants and special fluids for its vehicles, which are used for production activities, taking into account its technological features. The organization develops such norms to control the consumption of fuels and lubricants for operation, Maintenance and repair of automotive equipment.

An organization can, when developing them, proceed from the technical characteristics of a particular car, the season, prevailing statistics, acts of control measurements of fuel and lubricant consumption per kilometers, drawn up by representatives of organizations or specialists of a car service on its behalf, etc. traffic jams, seasonal fluctuations in fuel consumption and other correction factors. Norms are developed, as a rule, by the technical services of the organization itself.

The procedure for calculating the rates of consumption of fuels and lubricants is an element of the accounting policy of the organization.

They are approved by order of the head of the organization. All drivers of vehicles should be familiarized with the order. The lack of approved standards in the organization can lead to abuse by drivers, and, therefore, to unjustified additional costs.

Actually, these norms are used as economically justified for the purposes accounting for writing off fuel and lubricants and for tax purposes when calculating income tax.

When developing these standards, an organization may use the Fuel and Lubricant Consumption Standards for road transport approved by the Ministry of Transport of Russia on April 29, 2003 (guidance document No. Р3112194-0366-03 was agreed with the head of the Department of material, technical and social security of the Ministry of Taxes and Tax Collection of Russia and has been applied since July 1, 2003). The document contains the values of the basic fuel consumption rates for automobile rolling stock, fuel consumption rates for the operation of special equipment installed on cars, and the methodology for their application, as well as the standards for the consumption of lubricating oils.

Fuel consumption rates are set for each brand and modification of vehicles in use and correspond to certain operating conditions for road transport.

Fuel consumption for garage and other household needs (technical inspections, adjustment work, running-in of engine and car parts after repairs, etc.) is not included in the standards and is set separately.

The peculiarities of car operation associated with road transport, climatic and other factors are taken into account by applying correction factors to the basic norms. These ratios are set as percentages of the increase or decrease in the baseline value. If it is necessary to apply several allowances at the same time, the fuel consumption rate is set taking into account the sum or difference of these allowances.

The governing document also established the consumption rates of lubricants per 100 liters of total fuel consumption, calculated according to the standards for a given vehicle. Oil consumption rates are set in liters per 100 liters of fuel consumption, lubricant consumption rates - respectively, in kilograms per 100 liters of fuel consumption. Here, too, there are correction factors depending on the operating conditions of the machine. The consumption of brake and coolants is determined in terms of the number of fillings per vehicle.

Is it necessary to apply the norms established by the Ministry of Transport of Russia as the only possible ones? No. According to Article 4 of the Tax Code of the Russian Federation, the Ministry of Transport of Russia is not entitled to develop any standards for tax purposes. The norms approved by the Ministry of Transport of Russia are not an order and have not been registered with the Ministry of Justice of Russia as a normative legal act, mandatory for use by organizations throughout the Russian Federation. Considering all these circumstances, it can be said that, despite the name "Guidance Document", as well as the fact that it has been agreed with the Ministry of Taxes and Duties of Russia, the basic rates of fuel and lubricant consumption in road transport are only advisory in nature.

But the likelihood that the tax authorities will still be guided during checks on these standards, agreed with their department, is quite high. After all, if the expenses of the organization for the purchase of fuel and lubricants significantly exceed the norms established by the Ministry of Transport of Russia, their economic feasibility may cause doubts among the tax authorities. And this is logical: the norms of the Ministry of Transport of Russia are well thought out and quite reasonable. And although they were not designed for tax accounting, can be used in court and appears to serve as a convincing argument for judges.

Therefore, the organization needs to be ready to justify the reasons for the deviations of the norms it applies to write off fuel and lubricants for expenses from those approved by the Ministry of Transport of Russia.

Waybills

The purchase of fuels and lubricants does not yet indicate their actual consumption for a car used for business purposes. Confirmation that the fuel was spent for production purposes is a waybill, which is the basis for writing off fuel and lubricants at cost. This is confirmed by the tax authorities (letter from the UMNS in Moscow dated April 30, 2004 No. 26-12 / 31459) and Rosstat (letter Federal Service state statistics from 03.02.2005 № ИУ-09-22 / 257 "On waybills"). The waybill contains the speedometer readings and fuel consumption indicators, the exact route is indicated, confirming the production nature of transport costs.

Primary documents can be accepted for accounting if they are drawn up in a unified form (clause 2 of article 9 of the Federal Law of 21.11.1996 No. 129-FZ "On Accounting").

The following forms were approved by the Decree of the Goskomstat of Russia dated November 28, 1997 No. 78 primary documentation to account for the work of vehicles:

Since most organizations operate company cars or trucks, they use the forms of waybills for these vehicles.

The waybill of a truck (form No. 4-c or No. 4-p) is the main primary document for payments for the carriage of goods, write-off of fuels and lubricants for expenses on common types activities, accruals wages the driver, and also confirms the production nature of the costs incurred. When transporting commodity cargo, waybills of forms No. 4-c and No. 4-p are issued to the driver together with the waybill.

Form No. 4-c (piece-rate) is applied subject to payment for the work of the car at piece-rate rates.

Form No. 4-p (time-based) is applied subject to payment for the car's work at a time-based rate and is designed for the simultaneous transportation of goods to two customers within one working day (shift) of the driver.

Tear-off coupons of the waybill of forms No. 4-c and No. 4-p are filled in by the customer and serve as the basis for the organization-owner of the vehicle to present the invoice to the customer. The corresponding tear-off coupon is attached to the invoice.

In the waybill, which remains in the organization - the owner of the vehicle, identical records are repeated about the operating time of the vehicle with the customer. If the goods are transported by a car operating on a time basis, then the numbers of the consignment notes are entered in the waybill and one copy of these waybills is attached. The waybills are stored in the accounting department together with the shipping documents for their simultaneous verification.

The waybill of an official car (form No. 3) serves as the main primary document for writing off fuel and lubricants for expenses related to the management of the organization.

The register of the movement of waybills (form No. 8) is used by the organization to register the waybills issued to the driver and handed over after processing the waybills to the accounting department.

The waybill is issued to the driver by the dispatcher or another employee authorized to release him on the flight. But in small organizations, this may be the driver himself or another employee who is appointed by order of the head of the organization.

The waybill must contain a serial number, date of issue, stamp and seal of the organization that owns the car.

The waybill is valid for one day or shift only. For a longer period, it is issued only in the case of a business trip, when the driver performs the task for more than one day (shift).

The route of transportation or service assignment is recorded at all points of travel of the car in the waybill itself.

Responsibility for the correct execution of the waybill is borne by the heads of the organization and the persons responsible for the operation of vehicles and participating in filling out the document. This is once again emphasized in the already mentioned letter of the Federal State Statistics Service (Rosstat) dated 03.02.2005 No. ИУ-09-22 / 257 "On waybills". It also says in unified forms ah all requisites must be filled. Employees who completed and signed the documents are responsible for the accuracy of the data they contain.

If the waybill is filled in with violations, this gives the inspection authorities a reason to exclude fuel costs from the list of expenses.

An accountant who takes into account fuel and lubricants should be especially interested in the right front part of the waybill. Let's consider it on the example of a waybill of a car (form No. 3).

The readings of the speedometer at the beginning of the day of work (the column next to the signature permitting exit) must coincide with the readings of the speedometer at the end of the previous day of the car's work (the column - when returning to the garage). And the difference between the speedometer readings for the current day of work should correspond to the total number of kilometers traveled per day, indicated on the reverse side.

The section "Fuel movement" is filled in in full according to all details, based on the actual costs and indicators of devices.

The remainder of the fuel in the tank is recorded in the sheet at the beginning and end of the shift. The calculation of the consumption is indicated according to the standards approved by the organization for this machine. In comparison with this norm, the actual consumption, savings or overruns in relation to the norm are indicated.

To determine the standard fuel consumption per shift, you need to multiply the car's mileage per working day in kilometers by the gasoline consumption rate in liters per 100 kilometers, and divide the result by 100.

To determine the actual fuel consumption per shift, add the amount of fuel filled into the car's tank during the shift to the remaining fuel in the car's tank at the beginning of the shift, and subtract the remaining gasoline in the car's tank at the end of the shift from this amount.

The back of the sheet indicates the destination, the time of departure and return of the car, as well as the number of kilometers traveled. These indicators are the most important, they serve as the basis for including the cost of fuel consumed in expenses and confirm the operations with which the use of the machine was associated (obtaining values from suppliers, delivering them to buyers, etc.).

The bottom of the reverse side of the waybill is important for the driver's payroll calculator.

At the end of the section, a few words about whether the waybills should be filled out only for drivers.

Sometimes such a conclusion is drawn from the text of the resolution of the Goskomstat of Russia dated November 28, 1997 No. 78 (hereinafter referred to as Resolution No. 78) and the sheet forms themselves. And they draw the following conclusion - if directly staffing table the position of the driver is not provided, then the organization has no obligation to draw up the corresponding document. In the author's opinion, this is not true, the driver is a function, not just a position.

It is important that the service machine of the organization is exploited, and who controls it is the business of the organization. For example, a company car can be driven by a director, manager, and expenses on it will also be taken into account only on the basis of the waybill. In addition, in the absence of this document on the way, the employee, who actually performs the functions of the driver, may have a problem with the traffic police.

Formally, waybills are issued by organizations. This is stated in Resolution No. 78. Entrepreneurs, on formal grounds, do not have to fill out a waybill, since, according to Article 11 of the Tax Code of the Russian Federation, they are individuals.

But they use transport for production purposes. Inspectorate of the Ministry of Taxes and Duties of Russia in a letter dated October 27, 2004 No. 04-3-01 / [email protected] drew attention to the fact that waybills should be used by them.

Accounting for fuels and lubricants

Expenses for the purchase of fuels and lubricants are associated with servicing the transportation process and relate to the costs of ordinary activities for the element " Material costs"(Clause 7, 8 PBU 10/99" Expenses of the organization "). The expenses include the sum of all actual expenses of the organization (clause 6 of PBU 10/99).

The accounting department of the organization maintains a quantitative and total accounting of fuels and lubricants and special fluids. Refueling of vehicles is carried out at gas stations for cash or by bank transfer using coupons or special cards.

Without touching upon the specifics of the formation of the initial cost of fuels and lubricants and VAT accounting, we will say that an accountant, on the basis of primary documents (advance reports, invoices, etc.), receives fuels and lubricants by brands, quantity and value. Fuels and lubricants are accounted for on account 10 "Materials" subaccount 3 "Fuel". This is provided for by the Chart of Accounts (approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n).

- "Fuels and lubricants in warehouses (gasoline, diesel fuel, gas, oil, etc.)";

- "Paid coupons for gasoline (diesel fuel, oil)";

- "Gasoline, diesel fuel in car tanks and coupons from drivers", etc.

Since there are many varieties of fuels and lubricants, sub-accounts of the second, third and fourth orders are opened to account for them, for example:

- account 10 subaccount "Fuel", subaccount "Fuels and lubricants in warehouses", subaccount "Gasoline", subaccount "Gasoline AI-98";

- account 10 subaccount "Fuel", subaccount "Fuels and lubricants in warehouses", subaccount "Gasoline", subaccount "Gasoline AI-95".

In addition, analytical accounting of the issued fuels and lubricants is carried out for financially responsible persons - vehicle drivers.

The accountant records the receipt of fuel and lubricants in the material accounting card in the form No. M-17. The organization can develop its own form of a card for recording the receipt and write-off of fuels and lubricants, which is approved by the order of the head or is an attachment to accounting policy organizations.

The costs of maintaining vehicles of the organization are written off to the cost of products (works, services). In accounting, the costs associated with the transportation process are reflected on the balance sheet account 20 "Main production" or 44 "Sales costs" (only for trade organizations).

The costs of maintaining official vehicles are reflected in the balance sheet account 26 "General Business Expenses". Enterprises that have a fleet of cars reflect the costs associated with their maintenance and operation on balance sheet account 23 "Auxiliary production". The application of a particular cost accounting account depends on the direction of vehicle use. For example, if a truck transported goods on orders from a third-party organization, then the cost of fuel and lubricants is reflected on account 20, and if the car was used for business trips related to the management of the organization, then the costs are reflected on account 26.

In the accounting, the write-off of fuels and lubricants is reflected in the accounting entry:

Debit 20 (23, 26, 44) Credit 10-3 "Fuel" (analytical accounting: "Fuel and lubricants in the tanks of vehicles" and other relevant subaccounts) - in the actually consumed amount on the basis of primary documents.

When fuel and lubricants are released into production and otherwise disposed of, their assessment in accounting is carried out in one of the following ways (clause 16 of PBU 5/01):

- at the cost of a unit of inventory,

- at the cost of the first purchases (FIFO),

- at the cost of the most recent purchases (LIFO),

- at the average cost.

The last method is the most common.

The method chosen by the organization must be recorded in the order on accounting policy.

We draw the attention of accountants to the fact that, as a rule, in the tanks of cars there is always an amount of gasoline (or other fuel), which is the carry-over for the next month (quarter). This balance must be further taken into account on a separate subaccount "Gasoline in car tanks" (in the analytical accounting for materially responsible persons (drivers).

On a monthly basis, the accountant reconciles the results on the issue, consumption and the balance of petroleum products in the tanks of vehicles.

If the cost of expenses for fuel and lubricants accepted for consumption in accounting and tax accounting is different (for example, due to the driver exceeding the standards adopted in the organization for his car), then taxpayers applying PBU 18/02 will have to reflect permanent tax liabilities.

This is the requirement of clause 7 of this provision, which was approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n.

Consider the accounting of fuels and lubricants using the example of accounting for gasoline for a specific driver.

Example

The driver of a passenger company car A.A. Sidorov receives from the cash desk of LLC "Zima" cash for the purchase of fuel and lubricants and submits advance reports reflecting the costs of their purchase with the attachment of primary documents.

Gasoline is written off according to the norms based on the waybills handed over by the driver to the accounting department.

Quantitative and total accounting of fuels and lubricants is carried out using personal cards, the form of which was developed by the organization independently and approved by order of the head. A card is opened for each driver.

The remainder of the unwritten gasoline at the beginning of April at the driver was 18 liters, 10 rubles each.

On April 3, 20 liters of gasoline were purchased for 11 rubles. We do not consider VAT for simplicity.

On April 1,2 and 3, the driver used up 7.10 and 11 liters of gasoline, respectively.

The organization uses the moving average cost method when writing off materials, which is calculated as of the date of the transaction.

From April 1 to April 3, the accountant made the following entries on the driver card:

| date | Coming | Consumption | Remainder | ||||||

|---|---|---|---|---|---|---|---|---|---|

| qty | price | we stand. | qty | price | we stand. | qty | price | we stand. | |

| Balance as of 01.04 | 18 | 10,00 | 180,00 | ||||||

| 01.04 | 7 | 10,00 | 70,00 | 11 | 10,00 | 110,00 | |||

| 02.04 | 10 | 10,00 | 100,00 | 1 | 10,00 | 10,00 | |||

| 03.04 | 20 | 11,00 | 220,00 | 11 | 10,95* | 120,48 | 10 | 10,95 | 109,52 |

Note:

* 10.95 = (1 liter x 10 rubles + 20 liters x 11 rubles) / 21 liters

The following entries were made in the accounting of the organization:

Debit 26 Credit 10-3 subaccount "Gasoline A-95 in the tank of the car of Sidorov A.A." - 70 rubles. - written off according to the norms of 7 liters of gasoline according to the waybill of a passenger car of form No. 3 for April 1;

Debit 26 Credit 10-3 subaccount "Gasoline A-95 in the tank of the car of Sidorov A.A." - 100 rubles. - written off according to the norms of 10 liters of gasoline according to the waybill of a passenger car of form No. 3 for April 2;

Debit 10-3 subaccount "Gasoline A-95 in the tank of the car of Sidorov A.A." Credit 71 subaccount "Sidorov" - 220 rubles. - 11 liters of gasoline were capitalized on the basis of a cash register check attached to the driver's advance report; Debit 26 Credit 10-3 subaccount "Gasoline A-95 in the tank of the car of Sidorov A.A." RUB120.48 - written off according to the norms of 11 liters of gasoline according to the waybill of a passenger car of form No. 3 for April 3.

Rented transport

You can get a vehicle for temporary possession and use by concluding a vehicle lease agreement with a legal or natural person.

Under a lease agreement, the lessor (lessor) undertakes to provide the lessee (tenant) with the property for a fee for temporary possession and use. Unless otherwise provided by the vehicle lease agreement, the lessee shall bear the costs arising in connection with the commercial operation of the vehicle, including the cost of paying for fuel and other materials consumed during the operation (Article 646 of the Civil Code of the Russian Federation). The parties may provide for mixed conditions for paying rent in the form of a fixed share (directly rent) and payment of compensation for the current maintenance of the rented property, which may vary depending on external factors.

In the case when the cost of fuels and lubricants is borne by the employer of transport, accounting for fuels and lubricants is identical to the situation with the operation of your own vehicle. Such a car is simply taken into account not as part of fixed assets, but on off-balance sheet account 001 "Leased Fixed Assets" in the assessment adopted in the contract. Rent is charged for its use, and depreciation is not charged.

The rent is taken into account in the composition of other expenses related to production and (or) sale, regardless of who the car is rented from - from a legal entity or an individual (subparagraph 10 of clause 1 of article 264 of the Tax Code of the Russian Federation).

At the same time, the status of the landlord affects tax implications for other taxes. So, if a car is rented from an individual, he has taxable income.

As for the UST, it is necessary to distinguish between the rental of a vehicle with a crew and without it (clauses 1 of Art. 236 and 3 of Art. 238 of the Tax Code of the Russian Federation).

For the rented car, a waybill is issued for the time of work, since the organization disposes of the car. And subparagraph 2 of paragraph 1 of Article 253 of the Tax Code of the Russian Federation allows to include in expenses that reduce taxable income all funds spent on the maintenance and operation of fixed assets and other property that is used in production activities. This also applies to fuels and lubricants that are used on a rented car.

Free car use

The organization can conclude a contract for the free use of the car.

Under the contract of gratuitous use (loan), the borrower is obliged to keep the thing received for gratuitous use in good condition, including the implementation of current and major repairs, as well as bearing all costs for its maintenance, unless otherwise provided by the contract.

The expenses of the organization for the maintenance and operation of the car received under the contract of gratuitous use shall reduce the taxable profit in the generally established manner, if the contract stipulates that these expenses are borne by the borrower.

For gratuitous use agreements (loans), separate rules apply to the lease agreement. Expenses for fuels and lubricants are accounted for in the same way as a rented car, since the organization manages it.

Transfer of property for temporary use under a loan agreement - for tax purposes is nothing more than a service provided free of charge. The cost of such a service is included by the borrower in extraordinary income(Clause 8, Article 250 of the Tax Code of the Russian Federation). This cost must be determined independently, based on data on market value* renting a similar car.

Workers' compensation

Employees are paid compensation for the wear and tear of personal vehicles and reimbursed for expenses if personal transport used with the consent of the employer for business purposes (Article 188 of the Labor Code of the Russian Federation). The amount of reimbursement of expenses is determined by agreement of the parties employment contract expressed in writing.

Often, by order, the employee is paid compensation at the rate established by the Government of the Russian Federation and, in addition, the cost of gasoline.

Since such a provision is not directly provided for by the letter of the Ministry of Finance of Russia dated July 21, 1992, No. 57, the position of the tax authorities on this issue seems legitimate. The amount of compensation to the employee takes into account the reimbursement of operating costs for a personal car used for business trips: the amount of wear, the cost of fuel and lubricants, maintenance and current repairs (letter of the Ministry of Taxes and Tax Collection of Russia dated 02.06.2004 No. 04-2-06 / 419).

Compensation for the use of personal transport for official purposes is paid to employees in cases where their work by the type of production (official) activity is associated with constant business trips in accordance with their official duties.

The initial document that established this compensation is the letter of the Ministry of Finance of Russia dated July 21, 1992 No. 57 "On the conditions for paying compensation to employees for using their personal cars for business trips." The document is valid, although the payment rates themselves changed in the future. Here we recommend that the accountant read it especially carefully. Paragraph 3 says that the specific amount of compensation is determined depending on the intensity of the use of a personal car for business trips. The amount of compensation to the employee takes into account the reimbursement of operating costs for a personal car used for business trips (the amount of wear, the cost of fuels and lubricants, maintenance and current repairs).

The calculation of the amount of compensation is made according to the formula:

K = A + fuels and lubricants + TO + TP,

where

K - the amount of compensation,

A - vehicle depreciation;

Fuels and lubricants - the cost of fuels and lubricants;

TO - maintenance;

TR - current repair.

Compensation is calculated on the basis of the order of the head of the organization.

Compensation is calculated monthly in a fixed amount, regardless of the number of calendar days in the month. During the time the employee is on vacation, business trip, his absence from work due to temporary incapacity for work, as well as for other reasons, when the personal car is not used, compensation is not paid.

The most difficult thing in this situation is the confirmation of the fact and intensity of the use of the machine by the employee. Therefore, the basis for calculating compensation, in addition to the order of the head, may be a traveling list or another similar document, the form of which is approved in the order on the accounting policy of the organization. Waybills in this case are not compiled.

Compensations paid to an employee for using a personal car for business purposes are expenses for the organization for ordinary activities on the basis of clause 7 of PBU 10/99.

Compensation paid to an employee in accordance with the law, within the limits of the approved norms, is not subject to personal income tax (Article 217 of the Tax Code of the Russian Federation) and the unified social tax (Article 238 of the Tax Code of the Russian Federation). In this case, the legislative document is the Labor Code of the Russian Federation. Due to the fact that the Government of the Russian Federation has developed compensation norms applicable only to paragraph 11 of Article 264 of the Tax Code of the Russian Federation (income tax), they are not subject to application for the purpose of determining tax base on personal income tax.

The tax authorities insist that the norms applied in the organization cannot be applied to personal income tax, since they are not the norms established in accordance with the current legislation of the Russian Federation (letter of the Ministry of Taxes and Tax Collection of Russia dated 02.06.2004 No. 04-2-06 / [email protected]"On reimbursement of expenses when employees use personal transport").

However, in its Resolution of 26.01.2004 No. F09-5007 / 03-AK FAS of the Ural District came to the conclusion that to apply the norms compensation payments established by Chapter 25 of the Tax Code of the Russian Federation, for calculating personal income tax unlawful. Compensation for personal transport is exempt from income tax in the amount established by a written agreement between the organization and the employee. This is indirectly confirmed by the decision of the Supreme Arbitration Court of the Russian Federation of January 26, 2005 No. 16141/04 (read more).

Thus, in our opinion, in the situation under consideration, there is no taxable base for personal income tax.

Compensation for the use of personal cars for business purposes for the purpose of calculating income tax is a standardized amount. The current norms are established by the RF Government Decree No. 92 dated 08.02.2002.

Expenses for compensation for the use of personal cars and motorcycles for business trips within the limits for tax purposes are related to other expenses (subparagraph 11, clause 1 of article 264 of the Tax Code of the Russian Federation). In tax accounting, these expenses are recognized on the date of actual payment of the accrued compensation.

The amount of compensation accrued to an employee in excess of the maximum norms cannot reduce the tax base for calculating corporate income tax. These expenses for tax purposes are considered to be above the norm.

Of course, this point of view can be challenged by relying on the more recent position of Article 188 Labor Code RF. But after all, the letter from the Ministry of Finance also said that when calculating compensation, it is necessary to take into account all the features of using a personal car by an employee for production purposes. And there is a norm for taxation, and it is unambiguous. Therefore, the cost of purchasing fuel and lubricants in parallel with the payment of compensation is not taken into account for the purposes of taxation of income tax, since this car is not a service car (subparagraph 11, clause 1 of article 264 of the Tax Code of the Russian Federation).

The costs of compensating the employee in excess of the established norms, as well as the cost of consumed fuel and lubricants, excluded from the calculation of the tax base for income tax both in the reporting and subsequent reporting periods, are recognized as a permanent difference (clause 4 of PBU 18/02).

For the amount of constant tax liability calculated on its basis, the organization adjusts the amount of notional expense (notional income) for income tax (clauses 20, 21 PBU 18/02).

Accounting for fuels and lubricants in "1C: Accounting 7.7"

Accounting for fuels and lubricants in the configuration "1C: Accounting 7.7" (rev. 4.5) is kept on account 10.3 "Fuel". In the directory "Materials" for elements related to fuels and lubricants, you should specify the type "(10.3) Fuel" (see Fig. 1).

The purchase of fuels and lubricants is reflected in the documents "Receipt of materials" or "Advance report", in last document the corresponding account should be indicated 10.3.

To reflect the consumption of fuels and lubricants, it is convenient to use the document "Transfer of materials" by selecting the type of transfer: "Transfer to production" (see Fig. 2). In the document, you need to indicate the cost account corresponding to the direction of use of the car (20, 23, 25, 44) and the cost item.

It is recommended to set two items in the directory of cost items to reflect expenses on fuels and lubricants, for one of which set "Type of expenses" for tax accounting purposes "Other expenses accepted for tax purposes", and for the second (excess expenses) - "Not accepted for purposes of taxation "(Fig. 3).

Accountants who are responsible for accounting for fuels and lubricants (POL) face many problems. How to calculate the standards, why apply them, how to reflect the gasoline that was in the tank of the purchased car? You will find answers to these and other pressing questions in the article.

Let's start with the innovation. Guidelines on fuel and lubricant consumption rates for a number of car brands manufactured since 2008 have been updated once again (order of the Ministry of Transport dated 06.04.2018 No. NA-51-r). It is noteworthy that the document has been in effect since April 4, but it has appeared in the legal bases quite recently. This happens with "recommendation" documents.

Life according to the standard

If there is no limit approved by the Ministry of Transport for the car, or the organization has decided to use a different value, it has the right to calculate its own limit. Typically, in such a situation, companies act in one of two ways.

The first way is to borrow information on fuel consumption from the technical documentation for the car.

The second way is to create a commission and take measurements. To do this, a certain amount of gasoline must be poured into the empty tank of the car, for example, 100 liters. Then the car must run until the tank is completely empty. Based on the readings of the speedometer, it is necessary to determine how many kilometers it took to completely empty the tank. Finally, the number of liters must be divided by the number of kilometers. As a result, you get a figure showing how much gasoline the car consumes when driving one kilometer. This indicator should be recorded in the act and signed by all members of the commission.

Since fuel consumption depends on the conditions of the trip, it is better to make control measurements, as they say, for all occasions: separately - for a loaded and empty car, separately - for summer and winter trips, separately - for idle time with the engine running, etc. All the results obtained should be reflected in the act drawn up and signed by the commission.

There is also a simpler option: to approve one basic standard (for example, for the summer period) and increasing coefficients: for winter trips, for trips on congested roads, etc.

Since writing off according to the standard implies errors, the organization must periodically reconcile the data reflected in the accounting and the actual balances. Such reconciliation can be carried out once a week, a month, or a quarter. Some companies do it every day.

note

The taxpayer has the right to take into account the cost of gasoline for official vehicles in the amount of actual costs. Of course, provided that the costs are economically justified and documented (that is, in the presence of waybills, checks, receipts).

Different methods are used to determine the actual balance. The easiest way is to pour gasoline from the tank into a measuring container and find out the volume. However, organizations rarely do this. Another method is more common, the essence of which is as follows. First you need to fill the tank completely. Then you need to look in the technical documentation to find out what the volume of the tank is. And also find out by the check of the gas station how much fuel was poured into the tank. If we subtract the volume of the filled gasoline from the volume of the tank, we get the remainder that was in the tank before refueling. This figure must be verified with the one that was listed according to the accounting data for the same number.

There are other methods - for example, using a special dipstick with a scale applied. However, none of the methods, except for emptying the tank, excludes errors.

By the way, now the so-called satellite tracking systems (another name is satellite navigation systems) are becoming more and more popular. They allow you to establish exactly when and how many kilometers the car traveled and how much gasoline it spent. In this regard, the company that purchased such a system can write off the actually consumed fuel and lubricants without using the standards. The need for inventory also disappears.

To reflect in the accounting the transition to the use of a satellite system for accounting for fuels and lubricants, it is necessary to issue an order that cancels the previously used fuel consumption standards. In the same document, fix new way fuel metering - based on system data. It is important that the date of the order coincides with the date when the system was put into operation.

Next, you will need a printout from the system, which shows the gas consumption for each flight. The accountant will pin these printouts to the waybills and, on the basis of these documents, write off the fuel and lubricants. The Ministry of Finance of Russia does not object to this method (letter from the Ministry of Finance of Russia dated June 16, 2011 No. 03-03-06 / 1/354).

How to write off fuel and lubricants correctly? This is a difficult question for many organizations. It's not a secret for anyone that you need to write off fuel and lubricants in accordance with the established standards, but what are these standards, where to get the fuel consumption rates? In the article, we will talk about how the accounting and tax accounting of fuels and lubricants at the enterprise takes place.

Organizations using transport are constantly faced with the issue of accounting for the costs associated with their operation and maintenance. It is very important to correctly account for these costs in accounting and tax accounting, because these costs can reduce the tax base when calculating income tax, therefore it is important that the costs are correctly identified, economically justified and documented. All this is necessary so that if you have any questions, tax authority, you were able to prove the need to write off fuel and lubricants in just such an amount.

What concerns fuels and lubricants?

- fuel (gasoline, diesel, gas);

- lubricants (various types of lubricants, oils used in the maintenance and repair of vehicles);

- liquids (brake, cooling).

That is, as we can see, fuels and lubricants are not only fuel, but also related materials used for the repair and maintenance of vehicles.

How is fuel and lubricants expenses written off in accounting and tax accounting? Certain standards are used to write off fuels and lubricants.

The Ministry of Transport of Russia has established norms for writing off fuel and lubricants as expenses of the organization, you can use these standards. At the same time, the Tax Code of the Russian Federation does not prohibit the development of its own norms for the consumption of fuels and lubricants and to be guided by its own norms when writing off.

How to calculate the rate of consumption of fuels and lubricants?

When setting your own limits for the use of fuel and lubricants, you need to remember that the received standards must be economically justified and documented. Only then will it be possible to write off fuel and lubricants as expenses of the organization and reduce it by this amount.

To develop your own standards, you can use the existing technical documentation for the vehicle. According to this documentation, set the consumption of fuel and other lubricants depending on seasonality, time of year and other factors.

In addition, the calculation of the rate of consumption of fuels and lubricants can be performed in another way: analyze the statistics actual use of the given transport and make measurements.

In order to correctly carry out measurements, you need to create a commission that will control the process. The measurement procedure itself is as follows: fuel is poured into an empty tank, the speedometer readings are noted. Then the car is used until the tank is completely empty. When the tank is empty, the speedometer is noted again. Based on the initial and final data of the speedometer, the number of kilometers that the car has traveled on the filled amount of fuel is determined. After that, the amount of fuel is divided by the number of kilometers and we get the fuel consumption per 1 km. This value will act as the rate of consumption. This method calculation of consumption rates of fuels and lubricants is used most often.

When making measurements, it should be remembered that many factors can affect the final result:

- vehicle load;

- the presence of traffic jams;

- season;

- the presence of vehicle downtime with the engine running.

In order to take into account all these factors, you need to take measurements in various situations. This will result in several different norms assets that should be followed when writing off fuel and lubricants as expenses of the organization.

In order to approve the received norms, it is necessary to draw up an act reflecting all the results of measurements. The members of the commission must sign the document.

In addition, an order for the write-off of fuel and lubricants must be drawn up, approving the received norms.

An organization can use several different standards depending on the operating conditions, or it can determine one standard in a standard situation and various correction factors for it, reflecting different transport operating conditions.

Accounting for fuels and lubricants at the enterprise:

In accounting, fuels and lubricants are written off as (works, services) for manufacturing enterprises or as sales costs for trade enterprises.

The posting for writing off fuels and lubricants is as follows D20 (23, 26, 44) K10 / 3.

This posting is carried out on the basis of the following primary documents:

- waybill: the fuel used is written off on the basis of this document;

- fuel write-off act: on the basis of this documents, other lubricants can be written off.

Fuel and lubricants in the accounting department are written off to the debit of account 20 "Main production" in the event that the car is used for business purposes, for example, for the delivery of goods to customers.

If the car was used for business trips related to the management of the organization, then the fuel and lubricants are debited to the debit of account 26 "General expenses".

On account 23 " Auxiliary production»Fuel and lubricants are usually written off by enterprises that have a whole fleet of vehicles.

The above posting to write off fuel is made for the amount of actual fuel used. It is often quite problematic to determine how much fuel was actually consumed, because there is no way to accurately determine how much fuel is left in the car's tank. In this case, the organization can write off the fuel in accordance with the established standards. Very often, this is exactly what organizations do, write off fuel based on the developed norms for the consumption of fuels and lubricants.

The purchase of fuels and lubricants occurs either for cash or non-cash. In the event that a driver, for example, refills a car at a gas station for cash, then the required amount of money is issued to him on the basis of advance report... The purchased fuel is credited to the debit of account 10/3 on the basis of this advance report, as well as the documents attached to it, confirming the payment, for example, a check.

If fuel and lubricants are purchased for non-cash payment, then these materials are credited to the debit of account 10/3 on the basis of invoices and other documents confirming non-cash payment.

Accounting for fuels and lubricants in posting accounting:

Operation name |

||

| Purchase of fuels and lubricants for cash | ||

Money was given out for the report on the purchase of fuels and lubricants |

||

The purchased fuels and lubricants were capitalized for cash |

||

Unspent cash returned to the cashier |

||

| Purchase of fuels and lubricants for cashless payments | ||

Listed payment to the supplier for fuel and lubricants |

||

The purchased fuels and lubricants were capitalized for non-cash payment |

||

Allocated VAT from the cost of fuels and lubricants presented by the supplier |

||

Allocated VAT is deductible |

||

| Write-off of fuels and lubricants | ||

The cost of spent fuel and lubricants has been written off as selling expenses (for trade enterprises) |

||

Written off the cost of spent fuel and lubricants for the cost of products, works, services (for manufacturing enterprises) |

||

Inventory of fuels and lubricants:

Periodically, the organization must carry out an inventory of fuels and lubricants, check the actual balances in the tanks of vehicles with the accounting data. In order to take an inventory, you can use the following methods:

- completely drain the fuel from the tank and determine its amount, and then check with the balance on the account 10/3;

- add fuel to the tank before filling it, knowing the full volume of the tank and the volume of the added fuel, it is possible by subtracting the second value from the first value to determine how much fuel was in the tank initially.

An inventory of fuels and lubricants should be carried out at the required frequency, for example, once a week or a month, often the organization checks the remains of fuels and lubricants on a daily basis.

Accounting for the consumption of fuel and lubricants by trade enterprises and Catering

Talalaeva Yu.N.

Specificity of activity enterprisestrade and publicnutrition is such that it involves the use of motor vehicles. Transport is used for the transportation of purchased and sold goods, raw materials, delivery of meals, as well as for management needs. Accordingly for accountants of these organizations, the problem of documenting, accounting and control spendingfuel and lubricatingmaterials.

These and other issues are covered in this article.

Documentation of fuel and lubricant consumption

Article 9 of the Law on Accounting requires the registration of all produced by the organization business transactions supporting documents... These documents serve as primary accounting documents on the basis of which accounting is kept. Primary accounting documents are taken into account if they are drawn up according to the form contained in the albums of unified forms of the primary accounting records.

Trade and catering organizations that operate vehicles and are senders and recipients of goods transported by road are obliged to keep primary records according to unified forms of primary accounting documentation, approved by the Resolution of the State Statistics Committee of the Russian Federation of November 28, 1997 No. 78 "On approval of unified forms of primary accounting. documentation on accounting for the work of construction machines and mechanisms, work in road transport ”(hereinafter - Resolution No. 78).

The waybills are the documentary evidence of fuel consumption. They record the mileage of the vehicle, the brand and amount of fuel dispensed according to the refueling sheet, the remainder of the fuel when leaving and when returning, the consumption at the rate and actual, the economy or excessive consumption of fuel is determined.

Resolution No. 78 approved the following forms of waybills that should be used by trade and catering organizations:

waybill of a car (form No. 3) . It is the primary document for accounting for the operation of light vehicles and the basis for calculating wages to the driver. Waybill issued in one copy by a dispatcher or an authorized person, valid for one day or shift only... For a longer period, it is issued only in the case of a business trip, when the driver performs the task for more than one day (shift). The waybill must contain the serial number, date of issue, stamp and seal of the organization that owns the car;Form number 4-s (piecework) it is used in the implementation of transportation of goods, subject to payment for the work of the driver of the car at piece rates.waybill of a special vehicle (form No. 3 special) . It is the main primary document for accounting for the work of a special car and the basis for calculating wages to the driver. The form designed to carry out an assignment for two customers and valid for one day only (shift)... It is issued in one copy by the dispatcher or a person authorized for this, and issued to the driver against receipt, subject to the delivery of the previous waybill. Tear-off coupons of the waybill are filled in by the organization that owns the special car and serve as the basis for presenting an invoice to the customer;

waybill of a truck (forms No. 4-c and 4-p) . Such waybills are the main document of primary accounting, determining, together with the consignment note for the transport of goods, indicators for recording the work of the rolling stock and the driver, as well as for calculating the driver's wages and making payments for the transportation of goods.

Form No. 4-p (time-based) is applied subject to payment of the car driver's work at a time rate and is designed for the simultaneous transportation of goods to two customers within one working day (shift) of the driver. Filling in the waybill before issuing it to the driver is carried out by the dispatcher of the organization or by a person authorized to do so. The rest of the data is filled in by employees of the organization - the owner of the vehicle and customers.

Waybills in forms No. 4-c and 4-p are issued to the driver against a signature by an authorized person only for one working day (shift) subject to the delivery by the driver of the waybill of the previous day of work. The issued waybill must necessarily have the date of issue.

Waybills are stored in the organization together with shipping documents, which makes it possible to check them simultaneously.

To control the movement of waybills issued to the driver and the delivery of processed waybills to the accounting department, The register of the movement of waybills (form No. 8).

Fuel consumption rates

The rate of consumption of fuel (or lubricant) in relation to vehicles implies the established value of the measure of its consumption when a vehicle of a particular model, brand and modification is operating.

On April 29, 2003, the Ministry of Transport of the Russian Federation approved Guidance document R3112194-0366-03 "Rates of consumption of fuels and lubricants in road transport"(hereinafter - new standards; new Guidance document), which was introduced to replace the "Standards for the consumption of fuels and lubricants in road transport" R3112194-0366-97 dated April 29, 1997 (hereinafter - the old standards) and is valid from the date of approval until January 1, 2008 of the year.

As in the old standards, the new Guidance Document contains the values of the basic fuel consumption rates for general-purpose automobile rolling stock, fuel consumption rates for the operation of special vehicles, the procedure for applying the rates and methods for calculating the normalized fuel consumption during operation, reference standards for the consumption of lubricants, values of winter allowances, etc.

Compared to the previously valid norms, the list of cars for which fuel consumption is normalized has been significantly expanded, which is explained by the development of the structure of the vehicle fleet, the emergence of new models, brands and modifications of cars. The expansion of the list was mainly due to foreign cars. In this regard, in the new list for each type of road transport (cars, buses, flatbed trucks, tractors, dump trucks, vans), fuel consumption rates are given separately for foreign cars and for domestic and CIS countries.

The norms themselves for cars present in the old and new lists, in most cases, have not changed.

Who should use fuel consumption rates and for what purposes?

According to the new Guidance Document, it is intended for road transport enterprises, organizations, entrepreneurs, etc., regardless of the form of ownership, operating vehicles and special rolling stock on the chassis of vehicles on the territory Russian Federation... The purpose of the document is defined in it as follows: "Rates of fuel (lubricant) consumption in road transport are intended for calculating the standardized value of fuel consumption, for maintaining statistical and operational reporting, determining the cost of transportation and other transport work, planning the needs of enterprises in providing petroleum products, settlements for taxation of enterprises, implementation of the regime of economy and energy saving of consumed oil products, settlements with users of vehicles, drivers, etc. ”.

However, it should be borne in mind that this document has nothing to do with taxation of profits. The fact is that Chapter 25 "Corporate Profit Tax" of the Tax Code of the Russian Federation does not contain provisions limiting the acceptance of fuel and lubricants for tax purposes. Of the costs of maintaining motor vehicles, only the costs of compensation for the use of personal cars for business trips are subject to rationing for tax purposes (see subparagraph 11 of paragraph 1 of Article 264).

However, you should pay attention to the fact that that according to paragraph 1 of Article 252 of the Tax Code of the Russian Federation, the expenses of an organization accepted for tax purposes are justified and documented costs incurred (incurred) by the taxpayer. In this case, justified costs are understood to be economically justified costs, the assessment of which is expressed in monetary form.

Therefore, it is possible that when checking the validity of the costs incurred, the tax authorities will be guided by the Fuel Consumption Rates approved by the Ministry of Transport of Russia. And in the case of too large a discrepancy, the organization will have to prove the economic feasibility of these costs.

Since the accounting regulations also do not contain requirements for the application of the Fuel Consumption Standards, it can be stated that for trade and public catering enterprises, the Fuel Consumption Standards are advisory in nature and are not mandatory for application. If organizations nevertheless decide to apply these norms for accounting purposes, this decision should be recorded in the accounting policy.

Let's consider the procedure for calculating the standardized fuel consumption using specific examples.

In accordance with the Guiding Document, a distinction is made between fuel consumption baseline, which is determined for each model, make or modification of the car as a generally accepted norm, and the calculated standard value of fuel consumption, taking into account the transport work performed and the operating conditions of the car.

Accounting for road transport, climatic and other operational factors is carried out using correction factors, regulated in the form of a percentage increase or decrease in the initial value of the norm (their values are established by order of the heads of enterprises operating vehicles or heads of local administrations).

For example, fuel consumption rates increase when vehicles operate in the winter season (depending on the climatic regions of the country - from 5 to 20 percent), on the roads common use in mountainous areas, on public roads with complicated plan, in cities and urban-type settlements (depending on the size of the population), etc.

The fuel consumption rate may decrease when working on public roads outside the suburban area on flat, slightly hilly terrain (altitude up to 300 m above sea level) on roads of categories I, II and III - up to 15 percent.

If it is necessary to apply several allowances at the same time, the fuel consumption rate is set taking into account the sum or difference of these allowances.

As an example, let's calculate the standardized fuel consumption value for a passenger car.

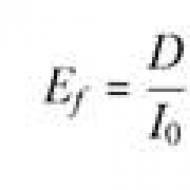

According to section 1.1 of the Guidance Document for cars The standardized value of fuel consumption is calculated according to the following ratio:

Qн = 0.01 x Hs x S x (1 + 0.01 x D),

where Qн- standard fuel consumption, liters;

Hs- basic rate of fuel consumption per vehicle mileage, l / 100 km;

S- vehicle mileage, km;

D- correction factor (total relative increase or decrease) to the norm in percentage.

Example 1. (Figures are conditional).According to the Guidance Document:The trade organization has a UAZ-469 passenger car on its balance sheet. It was established from the waybill that the car served a retail outlet located in a mountainous area at an altitude of 850 meters, and made a run of 90 km.

- Hs) for a passenger car UAZ-469 is 16.0 l / 100 km;

- allowance for work in mountainous areas at an altitude of 801 to 2000 m ( D) - 10 percent.

Qн = 0.01 x Hs x S x (1 + 0.01 x D) = 0.01 x 16.0 x 90 x (1 + 0.01 x 10) = 15.84 liters.

Example 2. (Figures are conditional).According to the Guidance Document:The catering organization (cafe-restaurant) uses an IZH-2717 passenger car to deliver meals to customers. The car is operated in a city with a population of 400 thousand people in the winter. It was established from the waybill that the car covered 60 km.

- basic fuel consumption rate ( Hs) for a passenger car IZH-2717 is 9.4 l / 100 km;

- bonus for work in a city with a population of 250 thousand to 1.0 million people - 15 percent;

- the allowance for work in the winter is 10 percent.

Qн = 0.01 x Hs x S x (1 + 0.01 x D) = 0.01 x 9.4 x 60 x (1 + 0.01 x 25) = 7.05 liters.

Reflection in accounting

A prerequisite for attributing the cost of consumed fuel to the cost of products (works, services) is correctly drawn up primary accounting documents - waybills.

For the amount of the cost of actually consumed fuel, an entry is made in the accounting records:

debit of account 44 "Expenses for sale" credit of account 10, sub-account 3 "Fuel".If accounting policies For the organization of trade or public catering, it is envisaged to use the Fuel Consumption Standards for accounting purposes, the above record is drawn up for the amount of fuel consumed within the limits of the norms.

Excess fuel consumption refers to non-operating expenses of the organization:

debit of account 91 "Other income and expenses", subaccount 2 "Other expenses" credit of account 10, subaccount 3 "Fuel" - for the amount of fuel consumption in excess of the norms.Regardless of the procedure for reflecting fuel consumption in accounting, for tax purposes, the cost of all actually consumed fuel is assumed.

Example 3. For the conditions of example 1, the actual fuel consumption was 18 liters. The rated fuel consumption is 15.84 liters. Let's assume that the accounting cost of 1 liter of fuel is 10 rubles.In the account of a trade organization regulating fuel consumption for accounting purposes in accordance with the accounting policy, postings will be issued:

debit of account 44 credit of account 10, subaccount 3 "Fuel" - for the amount of the cost of fuel consumed within the limits - 158.4 rubles. (10 rubles x 15.84 l);To reduce the tax base for income tax, 180 rubles will be attributed as material costs. (the cost of actually consumed fuel).debit of account 91, subaccount 2 "Other expenses" credit of account 10, subaccount 3 "Fuel" - in the amount of the cost of consumed fuel in excess of the norms - 21.6 rubles. ...

As a rule, trade organizations and catering organizations have a small fleet of cars and therefore do not store fuel, but purchase it at gas stations for cash.

Funds for the purchase of fuel are issued to the driver, under the report, which is reflected in the accounting by wiring:

debit of account 71 "Settlements with accountable persons" credit of account 50 "Cashier" - for the amount of funds issued for the report.The purchase of fuel for cash is carried out within the framework of the purchase and sale agreement, in which accountable person acts as individual... In accordance with paragraph 6 of Article 168 of the Tax Code of the Russian Federation, when selling goods (works, services) to the population at retail prices (tariffs), the indicated prices (tariffs) include the corresponding amount value added tax... At the same time, the amount of tax is not allocated on the labels of goods and price tags set by sellers, as well as on receipts and other documents issued to the buyer. According to paragraph 7 of this article, when selling goods for cash by organizations (enterprises) and individual entrepreneurs For retail trade, the requirements for the execution of settlement documents and the issuance of invoices are considered fulfilled if the seller has issued a cashier's receipt or other document of the established form to the buyer. That is, the seller's failure to issue an invoice to the accountable person does not contradict the current legislation.

Since, in accordance with Article 172 of the Tax Code of the Russian Federation, in the general case, one of the main conditions for deducting the value added tax paid as part of the price of goods is the presence of an invoice issued by the seller, when purchasing goods through accountable persons, the right to tax deduction does not arise.

In this case, the tax paid as part of the price of the goods is accounted for in the accounts of inventory accounting. This procedure for accounting for the amount of value added tax is provided for in paragraph 147 Methodical instructions on accounting of inventories approved by order of the Ministry of Finance of the Russian Federation of December 28, 2001 No. 119n.

Since, in accordance with paragraph 6 of PBU 5/01, the assessment of inventories purchased for a fee is carried out by summing up the actual costs of their purchase, sales tax amounts paid for the purchase of fuel are also included in its cost.

The capitalization of fuel based on the driver's advance report will be reflected by the entry:

debit account 10 credit account 71 - for the amount of the cost of fuel, including VAT and sales tax.Writing off the cost of fuel to expenses carried out on the basis of the driver's waybill in the order described above.