Car tax in Kaliningrad. Transport tax Kaliningrad region benefits. Transport tax rates in the Kaliningrad region

Oddly enough, the question of what is the difference between parking and stopping has been a significant problem for many years.

The distinction between these concepts has often put many motorists in a difficult position, even though they are described in detail in the traffic rules.

However, drivers often come into conflict with traffic police.

The problem exists and to solve it, every driver should clearly understand the difference between parking and stopping from the position of traffic rules.

In order to identify the differences between these concepts, you need to know what a stop is and what a parking is, the definition of each maneuver separately.

If we talk in simple language, these terms differ in their duration. Stopping is a short maneuver. The parking lot is long. But there are other differences as well.

A stop is a deliberate cessation of movement of a vehicle for up to 5 minutes, but traffic rules allow for exceeding this period.

A prerequisite for a stop is the need to load or unload goods, or board and disembark passengers.

A prerequisite for a stop is the need to load or unload goods, or board and disembark passengers.

Parking is also a deliberate stop to the movement of vehicles, but for a period of more than 5 minutes for reasons not related to the conditions required for stopping.

If the stop lasted no more than 5 minutes, then such an action is considered a stop. IN in this case it doesn’t matter what the passengers and the driver are doing at this time.

If traffic has been stopped intentionally for the purpose of boarding or disembarking passengers, or for unloading or loading vehicle- such a maneuver is considered a stop. In this case, the duration of the maneuver does not matter.

All other deliberate stoppages of movement lasting 5 minutes or more and not related to the mandatory condition of stopping are considered parking.

So the difference between parking and stopping is as follows:

- Parking implies a duration, and stopping is a short-term maneuver.

- Stopping is not always prohibited where parking is prohibited.

- Parking will always be a violation in places where stopping is prohibited.

To distinguish between these maneuvers, you need to understand the difference between the “No Stopping” and “No Parking” signs.

To distinguish between these maneuvers, you need to understand the difference between the “No Stopping” and “No Parking” signs.

If there is a “No Stopping” sign - 3.27 (in old version Traffic rules 3.34), it is prohibited to stop and park.

This sign has the shape of a blue circle with two crossed red stripes.

And the sign “No parking” - 3.28, allows you to stop if necessary.

The sign is round in shape with one red stripe on a blue background.

Video: Stopping and parking

Chapter 12 of the traffic rules describes the rules for stopping and parking vehicles. In accordance with them, the vehicle can be parked in the following places:

- Stopping and parking of vehicles is allowed on the right side of the road on the side of the road.

- If it is absent - at the edge of the roadway.

- In certain cases established by traffic regulations - on the sidewalk.

First of all, the vehicle should be parked on the side of the road. Other options are allowed only if it is not available.

First of all, the vehicle should be parked on the side of the road. Other options are allowed only if it is not available.

It is important to take into account that if the side of the road is occupied by other cars or something else, then parking the car on the roadway is not allowed.

Parking vehicles on the roadway at its edge is only possible when there is no shoulder.

Quite often situations arise when a driver who does not know how to reverse park between cars parks his car a meter from the edge of the roadway. This is considered a traffic violation and should not be done.

You can stop on the left side of the road only in populated areas and only in the following cases:

- Two-lane roads with one side in each direction, but no tram tracks in the middle. If tram tracks are located on the right or left, this does not prohibit stopping on the left side of the road. But in such areas there is often a continuous marking line, which does not allow parking or stopping on the left side of the road.

- In one-way areas. In this case, the presence or absence of tram tracks does not play any role. But trucks may stop on the left side of one-way roads only to load or unload work. This means that in this situation the truck cannot park, stop for less than 5 minutes, or stop to pick up or unload passengers.

Chapter 12.2 of the Traffic Regulations describes how to park vehicles correctly. Cars are allowed to be parked in one row parallel to the edge of the roadway and as close to this edge as possible.

Chapter 12.2 of the Traffic Regulations describes how to park vehicles correctly. Cars are allowed to be parked in one row parallel to the edge of the roadway and as close to this edge as possible.

Thus, if the driver does not know how to parallel park and tries to park in front at a small distance, then most likely he will park the car at an angle. Such an action is considered a traffic violation and is subject to a fine.

Two-wheeled vehicles without a side trailer can be parked in two rows. This means that one of the motorcycles may not be parked at the edge of the roadway.

Parking cars at an angle to the roadway is permitted only where there is local widening of the roadway. In addition, road signs and markings must indicate this at the same time.

Parking on the edge of the sidewalk that borders the roadway is permitted only for passenger cars, motorcycles, mopeds, and bicycles in those places indicated by sign 6.4 along with one of the signs 8.4.7, 8.6.2, 8.6.3, 8.6.6 — 8.6.9.

These signs and plates mean the following:

These signs and plates mean the following:

- “Parking location” - 6.4.

- “Type of vehicle” - 8.4.1 - 8.4.8, indicate the type of vehicle to which the sign applies.

- “Method of parking cars” - 8.6.1 - 8.6.9.

It should be taken into account that only passenger cars, motorcycles, mopeds and bicycles have the right to park on the sidewalk. But it is no longer possible to place a cargo gazelle on the sidewalk.

In accordance with the rules, in the absence of a certain sign, stopping a passenger vehicle on the sidewalk will be considered a violation. And stopping a truck on the sidewalk - in any case.

For violation of stopping and parking rules in 2020, the law provides for penalties:

Every driver should know the concept of parking and stopping according to traffic rules, as well as the differences between them.. Stopping is a short maneuver, and parking involves a long period of deliberate cessation of movement.

Parking does not oblige the driver to have specific reasons. A stop, as a rule, lasts no more than 5 minutes and has mandatory conditions.

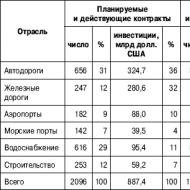

Tax rates for transport tax for 2015-2020 in the Kaliningrad region are set depending on engine power, jet engine thrust or gross tonnage of vehicles, vehicle category per one horsepower of vehicle engine power, one kilogram of jet engine thrust, one registered ton of vehicle or vehicle unit in the following dimensions:

Citizens pay transport tax on the car based on tax notice sent by the tax authority. The amount of car tax payable by citizens is calculated by the tax authorities on the basis of information that is submitted to the tax authorities by the bodies carrying out state registration vehicles on the territory Russian Federation. Individuals must pay transport tax in general procedure no later than December 1 of the year following the expired tax period.

The nuances of paying transport tax in Kaliningrad

Taking into account certain factors (engine power, length of ownership of the car, etc.) it is calculated for each tax period duty. In all regions, some conditions for finding and paying for it differ. This article will discuss Kaliningrad and the region.

In some cases, only partial restoration of the road surface is required. But sometimes it is much faster and easier to redo the canvas again. Funds for such work are taken from state budget. And the car tax in Kaliningrad and other regions of the country allows us to partially pay off the costs.

Transport tax of the Kaliningrad region

It is necessary to pay the transport tax no later than 02/01/2020 following the tax period; advance payments for transport tax must be made quarterly no later than the last day of the month that follows the previous reporting period.

In this article we will look at rates, terms, benefits of transport tax in Kaliningrad and the Kaliningrad region. Transport tax rates in each subject of the Russian Federation are set individually and can differ by a maximum of 10 times (up or down). In this way, attempts to impose excessively high taxes are prevented.

Boat tax in Kaliningrad

Mamonovsky urban district - provision of household services, their groups, subgroups, types or individual household services, classified in accordance with the All-Russian Classifier of Services to the Population; — provision of veterinary services; — provision of repair, maintenance and cleaning services vehicles; — provision of services for storing vehicles in paid parking lots; — provision of motor transport services for the transportation of passengers and goods carried out by individual entrepreneurs who have the right of ownership or other right of use, possession or disposal of no more than 20 vehicles intended for the provision of such services; — retail carried out through shops and pavilions with a sales floor area of no more than sq. Neman urban district - provision of household services to the population in accordance with the All-Russian classifier of types economic activity OKVED2 All-Russian classifier of products by type of economic activity OKPD2 related to household services, determined by the Government of the Russian Federation; — provision of veterinary services; — provision of repair, maintenance and washing services for vehicles; — provision of services for the provision of temporary possession and use of parking spaces for vehicles, as well as for the storage of vehicles in paid parking lots, with the exception of penalty parking lots; - retail trade carried out through shops and pavilions with a sales floor area of no more than sq.

Taxpayers who are organizations calculate the tax amount independently. The amount of tax payable by taxpayers who are individuals is calculated by the tax authorities on the basis of information submitted to the tax authorities by the authorities carrying out state registration of vehicles on the territory of the Russian Federation. The tax amount is calculated for each vehicle as the product of the corresponding tax base and tax rate. So, it is clear that with regard to technical requirements for small vessels, the system is failing.

To halve the base rates of transport tax is a consolidated proposal of the Ministry of Finance and the Ministry of Transport, according to federal media reports, which was recently approved by President Dmitry Medvedev. Now, as they say, the matter is small - in September the corresponding bill will be transferred to the State Duma, which, no doubt, will vote “for”.

“We will propose reducing the average transport tax rates by half, starting in 2011. At the same time, we propose to provide the opportunity for constituent entities of the Russian Federation to decide to install on passenger cars with a power of up to 150 Horse power zero rate,” said Ilya Trunin, head of the department of tax and customs tariff policy of the Ministry of Finance of the Russian Federation, adding that at the federal level the regions will be recommended to implement such a reduction in rates.

He also noted that the Russian government will propose to the president to increase excise tax rates on fuel and lubricants by one ruble. by one liter per year over the next three years. According to RIA Novosti, excise taxes on third-class gasoline will increase to 5.6 thousand rubles. per ton from 4.3 thousand rubles per ton. At the same time, the increase in rates for diesel fuel will be greater than for gasoline.

599ttt › Blog › Mass rally in Kaliningrad against transport tax

There were many more speakers from parties, associations of entrepreneurs, veterans and other groups. An appeal from the Omsk democratic movement to the meeting participants was read out, expressing recognition that our region sets an example for others in being organized and striving for a better life.

G. Boos, sensing something was wrong, took prompt action. He gathered representatives of all alternative parties with a proposal for joint actions to develop decisions that are important for the region. A month later, for this purpose, he created a political advisory committee, which included representatives of these organizations. On December 27, he, together with the faction of “his” party, made a decision recommending that deputies of the regional Duma return the previous transport tax rates (with minor exceptions). The next day, legislators unanimously implemented the recommendations. It is interesting that their formal initiators were precisely those who had recently voted for the increase.

In the Kaliningrad region, transport taxes will be reduced for owners of expensive cars

According to the changes, from 2020, in relation to passenger cars with an average cost of 3 to 5 million rubles inclusive, from the year of manufacture of which no more than three years, the tax amount will be calculated taking into account a single increasing factor of 1.1. For example, for a 2020 BMW fifth series with a capacity of 249 horsepower worth 4.3 million rubles, the tax would be 28 thousand. If we count in a new way, then the owner will have to pay 20 thousand.

Until now, the increasing coefficient when calculating transport tax for new cars depended on the cost and age of the cars. For cars costing from 3 to 5 million rubles and two to three years old, it is 1.1; for cars one to two years old - 1.3; for cars no more than one year old - 1.5.

Transport tax in Kaliningrad will not increase

In an Internet conference on Lente.ru, Konstantin Doroshok, positioned as the leader of the Kaliningrad Solidarity, said that the main reason for the earlier mass event was the sharp increase in transport taxes in the region. “What is important is the sincere attitude of the authorities to these problems, and not another spit in the face and a turn around, as with the story about the alleged cancellation of an increase in transport tax rates,” says the organizer, once again focusing on high stakes tax

However, it is worth noting that the increase in transport tax, approved by the regional Duma on November 30, 2009, did not take place. The local prosecutor's office drew attention to the fact that the deputies were guided by a document that had not yet entered into force (amendments to the Tax Code of the Russian Federation will come into force only on October 1, 2010 - almost a year later, relative to the law adopted on November 30). Moreover, prosecutors reminded that all regulations, relating to taxes, come into force no earlier than one month from the date of their official publication, and in the case of the law, the deadlines were not met, because the law on increasing transport tax rates adopted on November 30 was published on December 1, and not November 30.

Transport tax in Kaliningrad

Pavel Burenkov, Head of Department Federal service bailiffs in the Kaliningrad region: “We want our roads to develop in the region, and these citizens, who deliberately do not pay the transport tax, which, as we know, goes to the road fund, are trying in every possible way to hinder it. Agree that the majority should not suffer because of the minority. Therefore, the attitude towards them will be principled.”

We were looking for those who had accumulated big debts. Including the payment of transport tax. The worst defaulters from motorists turned into pedestrians - their cars were seized before full repayment debt. During the raid, called “Treasury,” more than 30 violators were identified.

In the Kaliningrad region, transport tax was increased by an average of 25%

“This bill was submitted to the Duma by the regional government. According to its provisions, tax rates for passenger cars with a capacity of up to 100 horsepower will not be revised. A 25% increase in rates is proposed for more powerful cars, boats and yachts, jet skis, airplanes, and helicopters,” said a Duma representative.

According to him, on the eve of the discussion of the bill, the United Russia faction made a proposal to maintain the previous transport tax rate for cars with an engine power of 100-150 hp, but after a meeting of faction members with Governor Georgy Boos, this proposal was withdrawn.

It will make it possible to quickly and correctly calculate the annual tax obligatory for car owners.

Since there is no single tax rate in the Russian Federation, each region sets its own coefficient, which cannot be more than ten times higher than the norm established in the country.

In the Kaliningrad region, the coefficient ranges from 2.5 to 147 rubles per 1 liter. With. depending on the power of the vehicle. The most “running” cars are those whose power is 100 – 150 hp. With. will cost their owner 250 - 2250 rubles per year. It is worth noting that the coefficient is 2.5 rubles. for 1 l. With. for cars with power up to 100 hp. With. is perhaps the smallest in the country. For comparison: in Moscow you will have to pay 1,200 rubles a year for such a car.

According to the Law of the Kaliningrad Region “On Transport Tax”, it must be paid by individuals no later than October 1 of the year following the previous tax period.

Car owners of the following categories who own passenger cars are completely exempt from tax:

- Heroes Council. Union;

- Heroes of the Russian Federation;

- Heroes of Social Labor;

- persons awarded Orders of Glory of three degrees;

- participants in the liquidation of the consequences of the Chernobyl accident.

Altai region Amur region Arhangelsk region Astrakhan region Belgorod region Bryansk region Vladimir region Volgograd region Vologda region Voronezh region Jewish Autonomous Region Transbaikal region Ivanovo region Irkutsk region Kabardino-Balkarian Republic Kaliningrad region Kaluga region Kamchatka Krai Karachay-Cherkess Republic Kemerovo region Kirov region Kostroma region Krasnodar region Krasnoyarsk region Crimea Kurgan region Kursk region Leningrad region Lipetsk region Magadan region Moscow Moscow region Murmansk region Nenets Autonomous Okrug Nizhny Novgorod Region Novgorod region Novosibirsk region Omsk region Orenburg region Oryol region Penza region Perm Krai Primorsky Krai Pskov region Republic of Adygea Republic of Altai Republic of Bashkortostan Republic of Buryatia Republic of Dagestan Republic of Ingushetia Republic of Kalmykia Republic of Karelia Republic of Komi Republic of Mari El Republic of Mordovia Republic of Sakha Republic of North Ossetia - Alania Republic of Tatarstan Republic of Tyva Republic of Khakassia Rostov region Ryazan region Samara Region Saint Petersburg Saratov region Sakhalin region Sverdlovsk region Sevastopol Smolensk region Stavropol region Tambov region Tver region Tomsk region Tula region Tyumen region Udmurt republic Ulyanovsk Region Khabarovsk Territory Khanty-Mansi Autonomous Okrug Chelyabinsk Region Chechen Republic Chuvash Republic Chukotka Autonomous District Yamalo-Nenets Autonomous District Yaroslavl Region

Buses Jet skis Passenger cars Trucks Snowmobiles, motor sleighs Motorcycles and scooters Non-self-propelled (towed) vessels Yachts and other sailing and motor vessels Airplanes with jet engines Airplanes, helicopters and other aircraft with engines Boats, motor boats and other water vehicles Other water vehicles and air vehicles without engines Other self-propelled vehicles, pneumatic and tracked machines and mechanisms

Vehicle power.

See also:Any car owner is required to pay an annual vehicle tax. A transport tax calculator will help you calculate it correctly - Kaliningrad region. If you own two or more vehicles, the Kaliningrad region transport tax calculator will help you calculate the tax for each of them.

Place the transport tax calculation on your website iframe:

Calculation result

Enter data...

Rates for calculating transport tax, which is valid in the region - the Kaliningrad region, vary from 12 to 150 rubles per 1 hp, based on the power of the car. In particular, for a small car (up to 100 hp) you will have to pay about 1,200 rubles per year. And, for example, in St. Petersburg, the tax on the same car will cost approximately 2,400 rubles per year. A very significant difference. In accordance with the Moscow City Law “On Transport Tax”, individuals are obliged to pay transport tax by October 3 of the year following the expired tax period.

What categories of citizens can receive tax benefits? (region Kaliningrad region)

- Heroes of Russia

- Heroes of the Soviet Union

- disabled people of groups 1 and 2

- veterans and disabled people of WWII and military operations

- former juvenile concentration camp prisoners

- one of the parents (adoptive parent, guardian) of a disabled child

- citizen owners of a car with power up to 70 hp.

- and others.

According to the legislation of the Russian Federation, several years ago all vehicles began to be taxed, and if the cost of the car exceeds 3 million rubles, the transport tax increases (the so-called luxury tax). Our transport tax calculator was created precisely so that interested car owners could calculate the amount required to pay the tax on the car they own.

Our calculator in the Kaliningrad region includes all current real time base rates, and when you enter the initial data, the calculator will adjust all base rates for the selected region, that is, the calculator will help calculate the amount of transport tax, no matter what region of Russia you are in, and no matter how much horsepower there is in your car. As a result, you will receive the exact amount of transport tax. Also, the transport calculator will inform you about the transport tax applicable to the same car in 2015, 2016 and of course in 2017.

How to use the transport tax calculator (Kaliningrad region)?

All you need to use the calculator is data about your car. So, the first thing you need to enter is the region of calculation. This is the region in which you are located and registered; at the address of this region you will receive letters from the tax office asking you to pay tax (for late payment, the legislation of the Russian Federation obliges you to pay a fine). The second item after selecting the region is the year of calculation - the year for which you need to calculate the transport tax. If you need to calculate the tax for the present, mark 2017. The next item available to us is the number of months of ownership. This item will be useful for those who need to calculate taxes not for the whole year, but for several months. After all, for example, it may turn out that you are selling the car after 6 months of operation. Then it would be necessary to calculate the tax for the whole year, and then multiply the resulting amount by 0.5. In our case, the calculator calculates everything itself. The fourth point of the calculator is the category of the vehicle. Here you select the vehicle for which you are interested in tax. After all, in addition to cars, other vehicles are also subject to transport tax - ATVs, motorcycles, snowmobiles and others. The most pressing and pressing issue is passenger cars; almost everyone has one. Our calculator is able to calculate the tax on absolutely any vehicle. The next point is the amount of horsepower.

Based on this value, all base rates for different regions are formed. Regional rates apply to each of the following intervals: 50-100 hp, 100-150 hp, 150-200 hp, 200-250 hp, more than 250 hp for the Kaliningrad region . For example, the rate on cars from 50 to 100 hp is 3 rubles, and on cars from 150 to 200 is 30 rubles. Horsepower has a direct impact on the amount of transport tax, because it is by horsepower that the rate is multiplied when calculating the tax using a calculator.

The last item in our calculator is the cost of your vehicle. As mentioned at the beginning of the article, if the price of a car exceeds 3 million rubles, a luxury tax will be introduced; an increasing factor will be charged on the tax, that is, the tax amount will increase from 1.2 to 2.5 times. After filling out all these points, all you have to do is click the calculate button, and in a few seconds the calculator will give you the exact amount of the transport tax.

The region is making concessions

In turn, the Law of the Kaliningrad Region dated November 16, 2002 No. 193 “On Transport Tax” (hereinafter referred to as the Law) establishes tax rates, the procedure and deadlines for tax payment, reporting forms and tax benefits in force in the region.

categories of taxpayers.

For passenger cars with engine power over 100 hp. up to 200 hp inclusive, produced over 7 years, including the year of manufacture, and a more reducing factor of 0.7 was in effect only when calculating tax for 2007. For trucks with a power of more than 250 hp that carried out international transportation, a reduction factor of 0.7 was in effect when calculating the tax for 2006 and 2007.

Changes made in May 2010 to the regional law on transport tax reduced tax burden for two categories of taxpayers: - individuals who own cars manufactured before 1993 inclusive, with an engine power of up to 150 hp. inclusive. They pay tax for 2009 at a rate to which a coefficient of 0.5 is applied. For 2010, a coefficient of 0.75 will be applied to this rate; — organizations and individual entrepreneurs. They pay tax on trucks with an engine power over 250 hp, produced after 2006 inclusive and with an engine environmental class of 4 or 5 (“Euro-4” or “Euro-5”), for 2010 applying a coefficient of 0.5 to the tax rate.

Transport tax Kaliningrad region benefits

Changes to OSAGO. The priority form of compensation for damage will now be restoration repairs at the station Maintenance. More details

Payment of tax and advance payments of tax is made by taxpayers to the budget at the location of vehicles in the manner and within the time limits established by the laws of the constituent entities of the Russian Federation. At the same time, the tax payment deadline for taxpayers who are organizations cannot be set earlier than the deadline provided for in paragraph 3 of Art. 363.1 Tax Code of the Russian Federation. The tax amount is calculated taking into account the number of months during which the vehicle was registered to the taxpayer, based on the results of each tax period, based on documented data on vehicles subject to taxation (Articles 52 and 54 of the Tax Code of the Russian Federation).

The subject of the Russian Federation: Kaliningrad region

OKTMO : 27000000

Payment deadline (for 2016) for individuals. persons: no later than 12/01/2017

Payment deadline (for 2016) for organizations: Tax no later than 02/01/2017. Advance tax payments - quarterly no later than the last day of the month following the expired quarter.

In addition to paying transport tax, to drive a car you must buy compulsory insurance policy.Casco- This voluntary insurance vehicle (VEHICLE) from damage, theft or theft, which is purchased at the request of the vehicle owner. It is important to understand that OSAGO- This compulsory insurance civil liability vehicle owners to third parties: payments under the policy are made in favor of the victim, and comprehensive insurance is a voluntary property insurance that protects the interests of the insured (beneficiary) regardless of his fault. Therefore, unlike OSAGO, cost of comprehensive insurance are not regulated by the state, but are established by the insurance company itself. Buy comprehensive insurance and insurance policy possible from insurance companies.

Transport tax in the Kaliningrad region in 2018-2017

The procedure, rates and deadlines for paying transport tax in the Kaliningrad region for 2017-2018 are established by the Law of the Kaliningrad Region dated November 16, 2002 N 193 “On transport tax” (with appropriate amendments and additions in force in 2018). It applies to all cities in the region. The administrative center is Kaliningrad. Big cities And settlements: Sovetsk, Chernyakhovsk, Baltiysk, Gusev, Svetly, Zelenogradsk, Guryevsk, Gvardeysk, Svetlogorsk, Pionersky, Neman, Mamonovo, Polessk, Bagrationovsk, Yantarny, Vasilkovo, Ozersk, Nesterov, Slavsk, Pravdinsk, Ladushkin, Znamensk, Krasnoznamensk, Bolshoye Isakovo.

Procedure and deadlines for paying transport tax in the Kaliningrad region

The total amount of transport tax payments goes to the regional budget.

Taxpayer organizations during the tax period, make advance payments of tax calculated at the end of each reporting period in the amount of one-fourth of the product of the corresponding tax base, tax rate and tax benefits. Tax reporting periods for taxpayer organizations are the first quarter, second quarter, and third quarter of the calendar year.

Taxpayers who are organizations calculate the amount of tax and the amount of advance tax payment independently. Advance payments are paid no later than the last day of the month following the expired quarter, and tax payment for the expired tax period is made no later than February 1 of the year following the expired tax period.

Citizens pay transport tax on a car based on a tax notice sent by the tax authority. The amount of car tax payable by citizens is calculated by the tax authorities on the basis of information submitted to the tax authorities by the authorities carrying out state registration of vehicles on the territory of the Russian Federation. Individuals must pay transport tax in the general manner no later than December 1 of the year following the expired tax period.

That is, the transport tax for 2016, respectively, at the rates established for 2016, is paid before December 1, 2017, the car tax for 2017 - until December 1, 2018, and the car tax for 2018 - until December 1, 2019.

For reference. Since 2016, the deadline for payment of transport tax for individuals has changed - now the tax must be paid before December (previously, the payment deadline was set until October 1).

Non-payment of tax in deadlines entails the accrual of penalties in accordance with current legislation.

Transport tax rates in the Kaliningrad region

Tax rates for transport tax for 2015-2018 in the Kaliningrad region are set depending on engine power, jet engine thrust or gross tonnage of vehicles, category of vehicles per one horsepower of vehicle engine power, one kilogram of jet engine thrust, one registered ton of vehicle or vehicle unit in the following dimensions:

Name of taxable object

Tax rate (in rubles) for 2015-2017, 2018

Passenger cars

Motorcycles and scooters with engine power (per horsepower):

up to 20 hp (up to 14.7 kW) inclusive

over 20 hp up to 35 hp (over 14.7 kW to 25.74 kW) inclusive

over 35 hp (over 25.74 kW) inclusive

Buses with engine power (per horsepower):

up to 200 hp (up to 147.1 kW) inclusive

over 200 hp (over 147.1 kW)

Trucks with engine power (per horsepower):

up to 100 hp (up to 73.55 kW) inclusive

over 100 hp up to 150 hp (over 73.55 kW to 110.33 kW) inclusive

over 150 hp up to 200 hp (over 110.33 kW to 147.1 kW) inclusive

over 200 hp up to 250 hp (over 147.1 kW to 183.9 kW) inclusive

over 250 hp (over 183.9 kW)

Other self-propelled vehicles, machines and mechanisms on pneumatic and caterpillar tracks (with each horsepower)

Snowmobiles, motor sleighs with engine power (per horsepower):

up to 50 hp (up to 36.77 kW) inclusive

over 50 hp (over 36.77 kW)

Boats, motor boats and other water vehicles with engine power (per horsepower):

up to 100 hp (up to 73.55 kW) inclusive

Yachts and other sailing-motor vessels with engine power (per horsepower):

up to 100 hp (up to 73.55 kW) inclusive

over 100 hp (over 73.55 kW)

Jet skis with engine power (per horsepower):

up to 100 hp (up to 73.55 kW) inclusive

over 100 hp (over 73.55 kW)

Non-self-propelled (towed) ships for which gross tonnage is determined (from each registered ton of gross tonnage)

Airplanes, helicopters and other aircraft with engines (per horsepower)

Airplanes with jet engines (per kilogram of thrust)

It is very easy to calculate the transport tax in the Kaliningrad region yourself using a regular calculator. To do this, you need to multiply the vehicle power (in hp) by the tax rate (second column of the table).

Please note that since 2015, increased transport tax rates have been applied to expensive cars costing more than three million rubles.

Attention: Due to the fact that the final tax amount depends on the category and make of the car, its power, we do not recommend using online calculators. The most accurate calculation is achieved by simply multiplying the car's power by the tax rate (taking into account increasing factors for expensive cars).

Transport tax benefits in the Kaliningrad region

The legislation of the region establishes preferential categories of citizens and organizations that are exempt from paying car tax or pay it in a smaller amount. Let's figure out who doesn't pay transport tax in Kaliningrad and the region.

The following categories of citizens and organizations are exempt from paying tax:

- Heroes of the Soviet Union, Heroes of the Russian Federation, citizens awarded the Order of Glory of three degrees, having passenger transport;

- categories citizens exposed to radiation as a result of the Chernobyl disaster, in accordance with the Law of the Russian Federation “On social protection of citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant”, having passenger transport;

- enterprises engaged in maintenance highways common use, with a contract concluded with the regional road management authority and whose share of income from this activity is 70 percent or more total amount their income;

- professional emergency rescue services, professional emergency rescue teams;

- management bodies and divisions of the State Fire Service of the Ministry of the Russian Federation for civil defense, emergency situations and disaster relief;

- bodies and divisions of the internal affairs department;

- bodies, divisions and enterprises of the Department of Execution of Punishments of the Ministry of Justice of Russia;

- disabled people of groups I and II who have motorized wheelchairs and cars with an engine power of up to 100 horsepower;

Old age pensioners, labor veterans, combatants, large families There are no benefits for paying transport tax in the Kaliningrad region.

The legislation of the region does not establish additional discounts for paying car taxes.

Transport tax benefits in the Kaliningrad region

Open group

Medvedev may cancel the transport tax at the end of November

The Black List - Kaliningrad and the Region ™ is an online directory with open content, which is a general repository of negative reviews about individuals and legal entities carrying out commercial activities on the territory of the Kaliningrad region.

The project was created to exchange information about unscrupulous individuals and organizations with a dubious reputation. The purpose of the project is to warn about possible negative consequences in relationships with persons or organizations listed on this list.

The following are included in the black list:

— Unscrupulous employers who violate labor Code who fail to fulfill their obligations to employees.

— Negligent employees against whom there are justified complaints from employers.

— Organizations with a dubious reputation, with which partnership and cooperation are not recommended.

— Service sector enterprises and individuals performing poor-quality work or providing services of inadequate quality.

— Trade enterprises that have negative reviews and complaints from customers.

1. The following are exempt from paying tax:

(as amended by the Law of the Kaliningrad Region dated May 19, 2010 N 453)

Heroes of the Soviet Union, Heroes of the Russian Federation, citizens awarded the Order of Glory of three degrees, having passenger transport

categories of citizens exposed to radiation as a result of the Chernobyl disaster, in accordance with the Law of the Russian Federation “On social protection of citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant”, having passenger transport

enterprises engaged in the maintenance of public roads, under a contract concluded with the regional road management authority and whose share of income from this activity is 70 percent or more of the total amount of their income

professional emergency rescue services, professional emergency rescue teams

management bodies and divisions of the State Fire Service of the Ministry of the Russian Federation for Civil Defense, Emergency Situations and Disaster Relief

bodies and divisions of the internal affairs department

bodies, divisions and enterprises of the Department of Execution of Punishments of the Ministry of Justice of Russia

disabled people of groups I and II who have motorized wheelchairs and cars with an engine power of up to 100 horsepower

(paragraph introduced by the Law of the Kaliningrad Region dated March 26, 2003 N 241)

disabled people who, before January 1, 2005, had the right to receive (purchase) a car through the social protection authorities and exercised this right by receiving (purchasing) passenger cars with an engine power of up to 150 horsepower (up to 110.33 kW) inclusive - in relation to specified vehicles

(paragraph introduced by the Law of the Kaliningrad Region dated November 25, 2005 N 684)

The paragraph became invalid on January 1, 2007. — Law of the Kaliningrad Region of November 25, 2005 N 684 (as amended on November 25, 2005).

If a taxpayer who is an individual entitled to a benefit in accordance with this paragraph is the owner of several vehicles, the benefit applies to only one of these vehicles (at the payer’s choice).

(paragraph introduced by the Law of the Kaliningrad Region dated March 26, 2003 N 241 as amended by the Law of the Kaliningrad Region dated May 19, 2010 N 453)

2. Individuals pay tax on passenger cars with an engine power of up to 150 hp. (up to 110.3 kW) inclusive and produced up to 1993 inclusive:

for 2009 - with a coefficient of 0.5 applied to the tax rate

for 2010 - applying a coefficient of 0.6 to the tax rate

(as amended by the Law of the Kaliningrad Region dated March 5, 2011 N 555)

for 2011 - with a coefficient of 0.7 applied to the tax rate.

(paragraph introduced by the Law of the Kaliningrad Region dated March 5, 2011 N 555)

(Clause 2 introduced by the Law of the Kaliningrad Region dated May 19, 2010 N 453)

3. Organizations and individual entrepreneurs pay tax on trucks with engine power over 250 hp. (over 183.9 kW), produced after 2006 inclusive and having an engine environmental class of the fourth or fifth (Euro 4 or Euro 5), for 2010-2013 with a coefficient of 0.5 applied to the tax rate.

(Clause 3 was introduced by the Law of the Kaliningrad Region dated 05/19/2010 N 453 as amended by the Law of the Kaliningrad Region dated 03/05/2011 N 555)

4. Tax benefits established by paragraph 2 of this article, are provided on the basis of data from the authorities carrying out state registration of vehicles, without taxpayers submitting supporting documents to the tax authorities.

(clause 4 introduced by the Law of the Kaliningrad Region dated May 19, 2010 N 453)

Transport tax in the Kaliningrad region has been reduced

The region is making concessions

The tax is regional, therefore the amounts paid by the owners of registered vehicles, including those registered in the Guryevsky district, go to the budget of the Kaliningrad region.

All taxation issues, including the procedure for calculating taxes and tax rates, are regulated by the Tax Code.

In turn, the Law of the Kaliningrad Region dated November 16, 2002 No. 193 On Transport Tax (hereinafter referred to as the Law) establishes tax rates, the procedure and deadlines for tax payment, reporting forms and tax benefits applicable in the region.

Duly registered cars, motorcycles, scooters, buses, self-propelled vehicles or pneumatic and tracked mechanisms, all kinds of air and water transport, etc. are subject to taxation.

During various periods of the Law’s validity, the regional legislator made decisions both easing and complicating the situation of some

For example, owners of passenger cars with engine power up to 150 hp. inclusive, produced over 15 years, including the year of manufacture, or more, when calculating tax for 2006, 2007 and 2008, they paid tax at a rate to which a coefficient of 0.5 was applied. This cut the tax in half.

For passenger cars with engine power over 100 hp. up to 200 hp inclusive, produced over 7 years, including the year of manufacture, and a more reducing factor of 0.7 was in effect only when calculating tax for 2007. For trucks with a power of more than 250 hp. those carrying out international transportation, a reduction factor of 0.7 was in effect when calculating tax for 2006 and 2007.

Changes made in May 2010 to the regional law on transport tax reduced the tax burden for two categories of taxpayers: - individuals who own cars manufactured before 1993 inclusive, with an engine power of up to 150 hp. inclusive. They pay tax for 2009 at a rate to which a coefficient of 0.5 is applied. For 2010, a coefficient of 0.75 will be applied to this rate for organizations and individual entrepreneurs. They pay tax on trucks with engine power over 250 hp. manufactured after 2006 inclusive and having an engine environmental class of 4 or 5 (Euro-4 or Euro-5), for 2010 with a coefficient of 0.5 applied to the tax rate.

Recent changes have also affected the timing of tax payment. Thus, individuals must pay tax for 2009 no later than August 1, 2010 (previously the deadline was July 1, 2010).

Information about these changes can be found on the official website of the Guryevsky district administration www. gurievsk.gov39.ru

Transport tax in the Kaliningrad region is a big deal

In our region, the maximum possible rates have been set for 2009 (except for the tax for cars with an engine power of up to 100 hp). Regional authorities, increasing rates last year, explained this by the fact that in other regions of Russia everything has long been set to the maximum.

We decided to compare the amount of transport tax in the Kaliningrad region and in two automobile cities in Russia - Moscow and Vladivostok. It turned out that in these cities, much less than three skins are torn from car owners. Judge for yourself - in Moscow, in order to ease the tax burden for cars with different engine power, the authorities have “detailed” the tax rates as much as possible depending on the number of horses, in Vladivostok - depending on the age of the cars (see table). Both cities have the lowest rates for domestic cars - only 3-5 rubles. In addition, a lot of benefits are provided. In the Kaliningrad region, such benefits are available to a minimum number of motorists - Heroes of Russia and the USSR and Chernobyl victims. Other beneficiaries - budgetary organizations and federal security forces. In the Kaliningrad region there was a benefit for low-power cars up to 150 horsepower over 15 years old, and even that was canceled last year.

No plans known

On Friday, the State Duma finally approved a two-fold increase in transport tax rates for Russians. After the Federation Council and the President of Russia sign the law, the regions will have full right to regulate the transport tax as they please.

“So far we know nothing about the plans of the regional government - how much it is going to increase the tax and whether it will increase it at all,” the head of the budget committee of the regional Duma Valery Frolov admitted to Komsomolskaya Pravda. “But they still have a few days to get the law published before December 1, otherwise it won’t come into force next year.”

“The regional government will be able to submit a bill for consideration by deputies only after the amendments to the Tax Code approved yesterday come into force,” commented the situation in the legal department of the regional Duma.

Three days ago, we asked all people's representatives from the Kaliningrad region to express their position on increasing transport tax rates. All five refused to comment - senators Nikolai Tulaev and Oleg Tkach, State Duma deputies Yuri Savenko, Evgeny Fedorov, Andrei Golushko.

Transport tax

1. Transport tax and object of taxation. 2

2. Tax incentives for transport tax in St. Petersburg. 2

3. Calculation of transport tax in St. Petersburg. 2

4. Procedure for paying transport tax. 13

List of used literature. 18

The topic of this work is transport tax. It is relevant today; transport tax is considered relatively new for taxation. This tax applies to all individuals and legal entities having a vehicle: airplane, boat, car, and so on. That is, the percentage of transport tax payers is quite large, so this topic is socially and economically important.

Therefore, you need to know: at what rates is it taxed? this tax who is the taxpayer, what is the tax base.

— become familiar with the concepts: transport tax, object of taxation of transport tax

— identify tax benefits for transport tax

— study the calculation of transport tax

Present the procedure for paying transport tax

— Study the prospects for changes in transport tax

1. Transport tax and object of taxation

Transport tax is a tax on persons on whom a vehicle is registered, recognized as an object of taxation. The tax is imposed on cars, motorcycles, buses, airplanes, yachts and other vehicles registered in the manner established by the legislation of the Russian Federation.

The transport tax was introduced on January 1, 2003, and is levied on owners of registered vehicles in local budget, as it relates to regional taxes. The amount of tax, the procedure and terms for its payment, reporting forms, as well as tax benefits are established by the executive authorities of the constituent entities of the Russian Federation, however, the object of taxation, the procedure for determining the tax base, the tax period, the procedure for calculating tax and the limits of tax rates are determined by Federal legislation.

Tax rates are established by the laws of the constituent entities of the Russian Federation, respectively, depending on engine power, jet engine thrust or gross tonnage of vehicles, categories of vehicles per one horsepower of a vehicle engine, one kilogram of jet engine thrust, one register ton of a vehicle or a vehicle unit in the following sizes:

Rates can be increased (decreased) by the laws of the constituent entities of the Russian Federation, but not more than 10 times. In addition, the laws of the constituent entities of the Russian Federation may establish differentiated tax rates in relation to each category of vehicles, as well as taking into account the period beneficial use Vehicle.

Payment of tax on vehicles (in particular on a car) is regulated by Chapter 28 Tax Code RF.

The car tax is paid by the owner annually as long as the car is registered with the traffic police. Notification of tax payment is sent by the tax authority once a year by mail to the address where the car owner is registered. Data about the car and its owner are received by the Federal Tax Service from the traffic police. Individuals pay tax no later than July 1 of the year following the expired tax period. The tax payment deadline for 2014 is no later than November 3.

Transport tax is levied on duly registered vehicles: cars, motorcycles, scooters, buses, self-propelled vehicles and pneumatic and tracked mechanisms, as well as various types of air and water transport.

The obligation to pay tax rests with the owners of the vehicle in whose name the vehicle is registered. The need to pay tax does not depend on the condition of the vehicle, therefore, the driver of an old Zhiguli car, which has been rotting for a long time somewhere in a vacant lot or in the courtyard of a residential building, is obliged to pay the tax on the same basis as the driver of a new car. To save yourself from unnecessary expenses, the owner of such a junk car needs to contact the traffic police department at the place of residence with an application to deregister the car.

Car owners who sold a car by proxy also find themselves in a difficult situation. By law, they are the owners of the vehicles and are required to pay the prescribed fees. Meanwhile, the law clearly prescribes actions in such a situation. If the power of attorney was issued before July 30, 2002, then the person specified in the power of attorney will pay the transport tax.

To do this, the official owner of the vehicle must submit a tax office at the place of residence, a notice that must indicate:

1) Full name the person to whom the vehicle is registered and who submits the notification

2) Make and type of vehicle

3) Full name person to whom the vehicle is transferred based on a power of attorney

4) Power of attorney and rights transferred under it in relation to vehicles

5) Full name notary (in case of notarization of a power of attorney).

The notification must be accompanied by documents confirming the date of purchase of the vehicle: a purchase and sale agreement and documents confirming payment, a certificate of invoice and the fact of transfer of the vehicle - a receipt for receipt of the vehicle, a document issued by carriers when sending vehicles to the recipient, as well as a power of attorney or its copy.

2. Tax incentives for transport tax in St. Petersburg

Transport tax is regional. Therefore, the benefits for this tax are different in different regions. Let's look at transport tax benefits using the example of the city of St. Petersburg, taking into account changes for 2014.

On January 1, 2014, changes to the law “On Transport Tax” came into force in St. Petersburg, which increase the number of categories of citizens exempt from paying this type of tax. This can be seen as additional measure social support vehicle owners. Lightening the burden tax burden occurs against the background of rising prices for diesel fuel and gasoline caused by an increase in excise tax rates at the federal level fuels and lubricants. As the vice-governor emphasized, citizens who have received the right to benefits may not have to pay transport tax, starting from January 1, 2014, and they will not need to pay transport tax for 2013, the payment deadline for which is in 2014.

So, in particular, in accordance with the Law of St. Petersburg dated November 17, 2010 No. 635-158 “On Amendments to the Law of St. Petersburg “On Transport Tax” and the Law of St. Petersburg “On Tax Benefits” for categories of citizens, and earlier enjoying benefits, the capacity of vehicles covered by the law has been increased, and benefits for pensioners have been expanded:

· will receive benefits in the form of complete exemption from payment of transport tax for any vehicle up to 150 horsepower inclusive (previously - up to 100 horsepower) - veterans of the Great Patriotic War, veterans of military operations on the territory of the USSR, on the territory of the Russian Federation and the territories of other states, disabled people of groups I and II, disabled people with disabilities of II and III degrees, citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant, citizens who, as part of special risk units, took direct part in testing nuclear and thermonuclear weapons, liquidation of nuclear accidents installations on weapons and military facilities, citizens of the Russian Federation who were exposed to radiation as a result of nuclear tests at the Semipalatinsk test site, citizens of the Russian Federation who were exposed to radiation as a result of the accident in 1957 at the Mayak production association and the discharge of radioactive waste into the Techa River, parents (guardians, trustees) of disabled children

· will be able to take advantage of benefits in the form of complete exemption from payment of transport tax for one a car domestic production with an engine power of up to 150 horsepower inclusive (previously - up to 100 horsepower), a boat, motor boat or other water vehicle (except for yachts and other sail-motor vessels, jet skis) with an engine power of up to 30 horsepower inclusive ( Previously, the benefit was provided in the amount of 30% of established rate), are pensioners.

In addition, in accordance with the changes, the following categories of citizens will additionally receive benefits in the form of complete exemption from payment of transport tax:

· spouses of military personnel, private and commanding officers of internal affairs bodies, the State Fire Service and state security bodies who died in the line of duty military service(official duties) who have not remarried - for one domestically produced passenger car with an engine power of up to 150 horsepower inclusive, a boat, a motor boat or other water vehicle (except for yachts and other sailing-motor vessels, jet skis) with engine power up to 30 horsepower inclusive

· one of the parents (adoptive parents), guardians (trustees) with a family of four or more children under the age of 18 - for any one vehicle with an engine power of up to 150 horsepower inclusive.

All transport tax benefits established earlier are also retained for Heroes of the Soviet Union, Heroes of the Russian Federation, Heroes of Socialist Labor, full holders of the Order of Glory, full holders of the Order of Labor Glory.

Taxpayers are individuals in order to receive benefits established by Article 4-1 of the Law of St. Petersburg dated November 4, 2002 No. 487-53 (in new edition), are provided in tax authority at the location of the object of taxation (vehicle) documents confirming their right to the benefit.

3. Calculation of transport tax in St. Petersburg.

For vehicles equipped with an engine, transport tax is charged on each horsepower.

The tax is calculated by multiplying the established coefficient by the number of horsepower. If, during the repair or replacement of a failed unit, a vehicle is equipped with an engine of a different power than specified in technical specifications, the owner of such a car must contact the traffic police department at the place of registration of the vehicle with a statement about the need for changes in the registration certificate. After this, the transport tax will be calculated based on the actual engine power.

Legal entities calculate transport tax on their own, while the tax office calculates it for individuals.

Let's look at examples of calculating transport tax for various cars in St. Petersburg.

Reducing the basic transport tax rate by half will not help residents of St. Petersburg save money. The fact is that along with the reduction in the base rate, regional authorities the opportunity was given to increase the maximum bet multiplier from five times (until 2014), to ten times (starting from 2014). For St. Petersburg motorists, the maximum multiplier was set, thus the reduction in the base rate was fully compensated by the regional multiplier.

Transport tax rates.

Transport tax rates established by the Law of St. Petersburg “On Transport Tax” dated November 4, 2002 No. 487-53 (with amendments coming into force from January 1, 2011) are indicated in table 3.1.

Transport tax rates for St. Petersburg for 2014.

Transport tax rates in St. Petersburg

Boats, motor boats and other water vehicles with engine power (per horsepower)

Other water and air vehicles without engines (per vehicle unit)

Tax benefits (Law of St. Petersburg No. 487-53)

(introduced by the Law of St. Petersburg N 621-92)

The following categories of citizens registered at their place of residence in St. Petersburg are exempt from paying tax:

Heroes of the Soviet Union, Heroes of the Russian Federation, Heroes of Socialist Labor, full holders of the Order of Glory, full holders of the Order of Labor Glory - for one vehicle registered to citizens of one of the specified categories, provided that this vehicle has an engine power of up to 200 horsepower inclusive (paragraph introduced by St. Petersburg Law No. 489-93).

By Resolution of the Statutory Court of St. Petersburg N 016/08-P, the provisions of Article 4-1, according to which citizens who, as part of special risk units, took direct part in testing nuclear and thermonuclear weapons, eliminating accidents of nuclear installations at weapons and military facilities, are exempt from payment of tax for one vehicle registered in the name of these citizens, provided that this vehicle has an engine power of up to 100 horsepower inclusive, are recognized as complying with the Charter of St. Petersburg.

Veterans of the Great Patriotic War, veterans of combat operations on the territory of the USSR, on the territory of the Russian Federation and the territories of other states, disabled people of groups I and II, disabled people with disabilities of II and III degrees, citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant , citizens who, as part of special risk units, took direct part in testing nuclear and thermonuclear weapons, eliminating accidents of nuclear installations at weapons and military facilities, citizens of the Russian Federation who were exposed to radiation as a result of nuclear tests at the Semipalatinsk test site, citizens of the Russian Federation who were exposed to radiation as a result of the accident in 1957 at the Mayak production association and the discharge of radioactive waste into the Techa River, parents (guardians, trustees) of disabled children - for one vehicle registered to citizens of one of the specified categories, provided that this vehicle has engine power up to 100 horsepower inclusive, or more than 15 years have passed since its release (as amended) Laws of St. Petersburg N 558-77, N 600-85, N 416-81, N 489-93).

Tax on income from the sale of an apartment

Tax deduction when purchasing a plot

Return income tax, review

On amendments to the Law of St. Petersburg “On Transport Tax” and the Law of St. Petersburg “On Tax Benefits”

On amendments to the Law of St. Petersburg On Transport Tax and the Law of St. Petersburg On Tax Benefits

1) in paragraph three, words up to 100 horsepower inclusive are replaced with words up to 150 horsepower inclusive

To the taxpayer - to an individual who simultaneously has the right to receive a tax benefit on several grounds provided for by this Law of St. Petersburg, the benefit is provided on one of them (at the taxpayer’s choice)..

1) in the third paragraph of the word, this vehicle is a passenger car with an engine power of up to 100 horsepower, inclusive, or a passenger car, from the year of manufacture of which, replace with the words this vehicle has an engine power of up to 150 horsepower, inclusive, or from the year of its manufacture

2) in paragraph four the word is inclusive. replace with the word inclusive

3) paragraph five should be stated as follows:

pensioners - for one vehicle registered to a citizen of the specified category, provided that the specified vehicle is a domestic passenger car (Russian Federation, USSR until 1991) with an engine power of up to 150 horsepower inclusive, a boat, a motor boat or other watercraft a vehicle (except for yachts and other sailing-motor vessels, jet skis) with an engine power of up to 30 horsepower inclusive

4) after paragraph five, add the following paragraphs:

spouses of military personnel, private and commanding personnel of internal affairs bodies, the State Fire Service and state security bodies who died in the performance of military service (official duties), who did not remarry - for one vehicle registered to a citizen of the specified category, with provided that the specified vehicle is a domestic passenger car (Russian Federation, USSR until 1991) with an engine power of up to 150 horsepower inclusive, a boat, motor boat or other water vehicle (except for yachts and other sailing-motor vessels, jet skis ) with engine power up to 30 horsepower inclusive

one of the parents (adoptive parents), guardians (trustees) with four or more children under the age of 18 in the family - for one vehicle registered to a citizen of the specified category, provided that this vehicle has an engine power of up to 150 horsepower inclusive.

Taxpayers - individuals, in order to receive the benefits established by this article, provide to the tax authority at the location of the taxable object (vehicle) documents confirming their right to the benefit.

A taxpayer - an individual who simultaneously has the right to receive a transport tax benefit on several grounds provided for by this Law of St. Petersburg, is granted a benefit on one of them (at the taxpayer's choice).

1. This Law of St. Petersburg comes into force the next day after the day of its official publication and applies to legal relations arising from January 1, 2010, with the exception of provisions for which this article establishes a different date for entry into force.

2. Paragraph five of paragraph 4 of Article 1 and paragraph five of paragraph 4 of Article 2 of this Law of St. Petersburg come into force on January 1, 2011, but not earlier than one month from the date of its official publication and not earlier than the 1st day of the next tax period for transport tax.

About transport tax benefits for individuals

Text of the document as of July 2011

Department of the Federal Tax Service of Russia for St. Petersburg in connection with the adoption Federal Law RF dated August 22, 2004 N 122-FZ “On amendments to legislative acts of the Russian Federation and the invalidation of certain legislative acts of the Russian Federation. » draws attention to the following.

Categories of citizens named in Article 4-1 of the Law of St. Petersburg dated November 4, 2002 N 487-53 “On Transport Tax” (as amended by the Law of St. Petersburg dated November 11, 2003 N 621-92) are exempt from paying transport tax.

At the same time, in 2004, separate categories citizens not named in Article 4-1 of the above-mentioned Law of St. Petersburg, but classified by the legislation of the Russian Federation in terms of providing tax benefits to one or another category provided for in this article, including:

1) persons who were former minor prisoners of concentration camps, ghettos and other places of forced detention created by the Nazis and their allies during the Second World War were exempted from paying transport tax, on the basis of Decree of the President of the Russian Federation of October 15, 1992 N 1235, resolution of the Ministry of Labor and social development RF dated 07/07/1999 N 20 “On approval of the clarification “On the procedure and conditions for providing benefits to former minor prisoners of concentration camps, ghettos and other places of forced detention created by the fascists and their allies during the Second World War”, articles 14, 15 of the Federal Law of the Russian Federation dated 01/12/1995 N 5-FZ “On Veterans”

2) categories of citizens of the Russian Federation who were exposed to radiation as a result of the accident in 1957 at the Mayak production association and the discharge of radioactive waste into the Techa River, named in Articles 2, 3, 4, 6, were exempt from payment of transport tax (with the exception of citizens resettled from the resettlement zone) Federal Law of the Russian Federation dated November 26, 1998 N 175-FZ “On the social protection of citizens of the Russian Federation exposed to radiation as a result of the accident in 1957 at the Mayak production association and the discharge of radioactive waste into the Techa River,” in accordance with the above-mentioned Federal Law of the Russian Federation dated November 26, 1998 N 175-FZ and Article 14 of the Law of the Russian Federation dated May 15, 1991 N 1244-1 “On the social protection of citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant”

3) citizens from special risk units were exempt from paying transport tax on the basis of Resolution of the Supreme Council of the Russian Federation dated December 27, 1991 N 2123-1 “On the extension of the RSFSR Law “On the social protection of citizens exposed to radiation as a result of the disaster at the Chernobyl Nuclear Power Plant” to citizens from units of special risk" and Article 14 of the Law of the Russian Federation of May 15, 1991 N 1244-1 "On the social protection of citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant."

Taking into account the changes made by the above Federal Law of the Russian Federation dated August 22, 2004 N 122-FZ:

- in Articles 14, 15 of the Federal Law of the Russian Federation of January 12, 1995 N 5-FZ “On Veterans”

- in Article 14 of the Law of the Russian Federation of May 15, 1991 N 1244-1 “On the social protection of citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant”

- in Articles 2-7 of the Federal Law of the Russian Federation of November 26, 1998 N 175-FZ “On the social protection of citizens of the Russian Federation exposed to radiation as a result of the accident in 1957 at the Mayak production association and the discharge of radioactive waste into the Techa River”

- in paragraph 2 of the resolution of the Supreme Council of the Russian Federation dated December 27, 1991 N 2123-1 “On the extension of the RSFSR Law “On the social protection of citizens exposed to radiation as a result of the Chernobyl nuclear power plant disaster” to citizens from special risk units”,

coming into force on January 1, 2005, the grounds for extending transport tax benefits to the above categories of citizens are excluded.

Thus, the right to benefits for the payment of transport tax from 01.01.2005 will only have the categories of citizens named in Article 4-1 of the Law of St. Petersburg dated 04.11.2002 N 487-53 “On Transport Tax” (as amended by the Law of St. Petersburg dated November 11, 2003 N 621-92).