Measures for the safety of cash. The procedure for ensuring the safety of funds in the organization. Procedure and timing of checks on the actual availability of cash

2.3 Ensuring security control money at the register

The internal control system means the existing policy of the organization and all related procedures aimed at identifying, correcting and preventing material errors and misstatements of information that may appear in accounting statements... Such control allows the management of the organization to carry out the correct and effective conduct of business, ensure compliance with the current legislation in the implementation of financial and economic activities, develop methods for the protection and safety of assets, prevent and detect fraud and errors, ensure the accuracy, completeness and protection of accounting records and the timely preparation of reliable accounting records. and financial statements.

Inventory of cash funds of the cash register of LLC "REMSTROYTEK" is carried out regularly in accordance with the Procedure for conducting cash transactions in Russian Federation, approved by the decision of the Board of Directors The Central Bank Russian Federation dated September 22, 1993 No. 40 and communicated by the letter of the Bank of Russia dated October 4, 1993 No. 18.

The procedure for conducting cash transactions does not establish the frequency of inventories. However, it is believed that the optimal period for conducting cash registers is one calendar month.

When calculating the actual availability of banknotes and other valuables at the cash desk, cash is taken into account, securities and cash documents (postage stamps, stamps state duty, bills of exchange, vouchers to rest homes and sanatoriums, air tickets, etc.). Checking the actual availability of forms of securities and other forms of documents strict accountability is made by types of forms (for example, for shares: registered and bearer, preferred and ordinary), taking into account the initial and final numbers of certain forms, as well as for each storage location and materially responsible persons.

Inventory may be required in the following cases:

Before preparing annual financial statements;

When changing the cashier;

If facts of theft of cash were revealed;

If cash was partially or completely destroyed due to a natural disaster, fire, or other emergencies.

The order and timing of the inventory of REMSTROYTEK LLC is determined by the head. The inventory is carried out by a special commission appointed by order of the head. The composition of the commission, as a rule, includes representatives of the administration of the enterprise, accounting employees and other specialists (for example, senior cashiers, specialists in cash registers etc.).

During the inventory, the commission checks the accuracy of the data accounting and the actual availability of funds, various values \u200b\u200band documents at the cash desk, by full recalculation.

Simultaneously with the verification of the actual availability of funds and monetary documents at the cash desk of the organization, an inspection is carried out:

The correctness of the execution of primary expenditure documents - the presence of signatures of recipients of cash, the presence of the signature of the head of the organization and the chief accountant on the settlement and payment (payment) statements for payment wages and other payment documents, for which the presence of these signatures is necessary for the implementation of spending funds;

Completeness and correctness of the posting of funds received at the bank institution. Cash must be posted at the cash desk on the day it is received at the bank. Verification is carried out by conducting a complete reconciliation of the data of statements on the state of the organization's current account in a credit institution with data from the cash book;

Completeness and timeliness of the posting of cash deposited on cash receipts;

Compliance with the limit on the balance of cash at the cash desk during the reporting year.

Separate checks of cash transactions and the availability of funds can be performed:

Founders of enterprises, higher organizations (if any), as well as auditors (audit firms) in accordance with the concluded contracts. During the production of documentary audits and inspections at enterprises, they audit the cash desk and check compliance with cash discipline.

Bank institutions that are required to systematically check the compliance of enterprises with the requirements of the Procedure for conducting cash transactions.

The internal affairs bodies, within their competence, - check the technical strength of cash registers and cash points, ensure the conditions for the safety of money and valuables at enterprises.

In addition, during the inventory of cash, a complete check of the status of settlements with financially responsible persons for the issued accountable amounts is carried out. The legality of the issuance of accountable amounts is checked (to persons with whom contracts on full financial responsibility have been concluded, as well as to persons sent on official or industrial business trips), the correctness of determining the amounts issued for reporting (for economic needs - in accordance with the norms established by a separate administrative document the head of the organization, for the acquisition of property - within the limits of the actual need, for business trips - in accordance with the calculation), the timeliness of repayment of the reporting amounts (presentation of an advance report and delivery of the unused balance).

It is also advisable to check compliance with the requirements of the Rules for Conducting Cash Operations in terms of ensuring the safety of funds during their transportation and storage.

For registration of the inventory, forms of primary accounting records, These include:

INV - 15 "Act of inventory of cash" (Appendix 15);

INV - 16 “Inventory list of securities and forms of strict reporting documents” (Appendix 16);

KM - 9 "Act on the verification of cash in the cash register".

The results of the inventory in REMSTROYTEK LLC are drawn up by the Certificate of Inventory of Cash. The same form of act is used to reflect the results of an inventory of the actual availability of various values \u200b\u200band documents (cash, stamps, checks (checkbooks) and others) held in the cashier of the organization.

The results of the inventory are drawn up in an act in two copies and signed by all members of the commission and persons responsible for the safety of valuables, and are communicated to the head of the organization. One copy of the act is transferred to the accounting department of the organization, the second remains with the financially responsible person. When changing financially responsible persons, the act is drawn up in triplicate. One copy is transferred to the financially responsible person who handed over the values, the second - to the financially responsible person who accepted the values, and the third - to the accounting department.

During the inventory, operations for the receipt and issue of funds, various values \u200b\u200band documents are not performed.

The organization may also carry out sudden audits of the cash register. Such a revision is possible:

At the initiative of the head of the organization;

On demand tax office.

The audit is also carried out by a special commission appointed by order of the head. If the audit is carried out at the request of the tax inspection, the commission includes its employee (inspector).

The audit is carried out within the time frame established by the head of the enterprise, as well as when changing cashiers at each enterprise, with a full sheet-by-sheet recount cash and verification of other valuables at the checkout. The cash balance at the cash desk is reconciled with accounting data for cash book.

If the audit detects a shortage or surplus of values \u200b\u200bat the cash desk, the act indicates their amount and the circumstances of occurrence.

The results of the audit are reflected in the act on checking the cash of the cash desk (form No. KM - 9).

A type of cash register can be called a daily reconciliation of data on the actual availability of funds and accounting data, carried out by the accountant himself - the cashier. Reconciliation is advisable to carry out before the conclusion of the cash book.

Reflection of the inventory of funds is made out as follows accounting entries:

1. Found surplus funds:

Debit 50 "Cashier"

Credit 91 "Other income and expenses" - subaccount 1 "Other income";

2. The shortages discovered as a result of inventory are collected from cashiers:

Writing off the missing money at the cash desk:

Debit 94 "Shortages and losses from damage to valuables"

Credit 50 "Cashier";

Filing a claim with the cashier:

Debit of account 73 "Settlements with staff on other operations" - subaccount 2 "Settlements for compensation material damage»

Credit 94 “Shortages and losses from damage to valuables”;

3. As the cashier pays in to reimburse the shortages, records are made:

Debit 50 "Cashier"

51 "Current account"

70 "Payments to personnel for wages"

Credit of account 73 "Settlements with personnel for other operations" - sub-account 2 "Settlements for compensation for material damage".

The last time the inventory of the cash register in "REMSTROYTEK" LLC was carried out before the preparation of the annual financial statements as of January 1, 2008, at the initiative of the head. The inventory was carried out by a commission appointed by order of the head No. 22 dated December 18, 2007.

The commission included representatives of the administration of the enterprise, employees of the accounting department.

Before the start of the inventory, the cashier gave a receipt stating that all the money and valuables received were capitalized, and those that left were written off as an expense. Expenditure and receipt documents for funds were handed over to the accounting department.

During the audit, no operations related to the acceptance or release of valuables from the cash register were carried out.

When carrying out the inventory, the commission checked the accuracy of accounting and the actual availability of funds, valuables and documents at the cash desk.

When calculating the actual availability of banknotes and other valuables at the cash desk, cash, securities and monetary documents (postage stamps) were taken into account. The verification of the actual availability of securities and other forms of strict reporting documents was carried out by types of forms, taking into account the initial and final numbers of certain forms, as well as for each storage location and materially responsible persons.

The cash balance at the cash desk was checked against the accounting data in the cash book.

The result of the inventory was formalized by an act. The commission did not find a shortage or surplus of values \u200b\u200bin the cash desk, which is reflected in the act.

The inventory act was drawn up in 2 copies: one remained in the accounting department, the other at the cashier.

In the act, the commission indicated how much cash was in the cash register at the time of the check. The act was signed by all members of the commission and the cashier.

The act must be kept in the archive of the organization for 5 years.

Short-term financial investments enterprises in securities of other enterprises, interest-bearing bonds of state and local loans granted to enterprises by other enterprises. Audit of cash transactions The circulation of funds is carried out directly at enterprises, organizations and institutions. This process is continuous in time. Therefore, it is important that for cash ...

With materials of ongoing inventories; - verification of compliance with the method of accounting for goods with the method fixed in accounting policy... In conclusion, it should be noted that accounting and audit of commodity transactions is aimed at systematizing the information obtained in the course of trading activities, and is a key link in the management and planning of the trading enterprise as a whole ...

In the media. During audit The audit firm considers the following areas: ü Compliance with the current legislation and regulations of the Bank of Russia on operations performed; ü the state of accounting and reporting on transactions performed; ü Compliance with mandatory economic standards established by the Bank of Russia; ü quality control ...

Since a decrease in prices leads to an expansion of the scope of activities and intensifies the flow of funds. The next stage of our research on the organization of accounting for settlement transactions in OOO TPK Zavolzhye is accounting for settlements with various debtors and creditors. Table 2. - Correspondence of accounts on account 62 "Settlements with buyers and customers" in TPK Zavolzhye LLC ...

Organizations (IP) independently determine measures to ensure the safety of cash when conducting cash transactions, storage, transportation, as well as the procedure and timing of internal audits cash (clause 7 of the Bank of Russia Ordinance No. 3210-U dated March 11, 2014). The procedure for conducting cash transactions in general in the Russian Federation is established The Central Bank Russia.

It is important for organizations and individual entrepreneurs to comply with the procedure for conducting cash transactions. Indeed, for violation of this order, there is not a small fine (part 1 of article 15.1 of the Administrative Code of the Russian Federation):

- for an organization - from 40 thousand rubles. up to 50 thousand rubles;

- for its officials and individual entrepreneurs - from 4 thousand rubles. up to 5 thousand rubles

The procedure for conducting cash transactions in 2019: cash limit

The organization must have a cash limit.

Cash limit - the allowed amount of cash that can remain in the cashier of the organization at the end of the working day. Over-limit amounts are subject to delivery to the bank.

The organization determines this limit independently based on the nature of its activities, as well as taking into account the volume of receipts and withdrawals of cash.

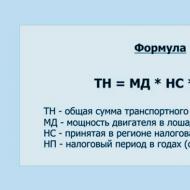

Formulas for calculating the cash limit can be found in ours.

It is important to note that organizations related to small businesses (SMEs), as well as individual entrepreneurs, have the right not to set a cash limit and keep in the cash desk as much cash as needed (clause 2 of the Instructions).

You can check whether your company belongs to the SMP on the FTS website.

Cash transactions in 2019: cash limit for separate divisions

Separate subdivisions (OP) that deposit cash to the bank must also have a cash limit. Moreover, the parent organization, if it has an OP, is obliged to set its own limit, taking into account the limits of these OP (clause 2 of the Instructions).

The document that establishes the cash limit of a specific OP, the parent organization must transfer to this division.

Conducting cash transactions in 2019: exceeding the cash limit

Amounts over set limit must surrender to the bank.

True, the excess is allowed on the days of payment of salaries / other payments, including the day of receipt of cash at the bank for these purposes, as well as on weekends / non-working holidays (if the company spends on these days cash transactions). In this case, the company and its officials are not threatened with any penalties.

Cash transactions: cash settlement limit

In addition to the cash limit, there is also a limit for cash settlements between organizations / individual entrepreneurs. This limit is 100 thousand rubles. within the framework of one contract (). That is, let's say if an organization buys goods worth 150 thousand rubles from another legal entity under one contract. and plans to pay in installments, the sum of all cash payments should not exceed a total of 100 thousand rubles, the rest of the amount should be transferred to the seller by bank transfer.

Organizations / individual entrepreneurs can exchange cash with physicists without any restrictions (clause 6 of the Ordinance of the Bank of Russia dated 07.10.2013 N 3073-U).

Cash Regulations

Of course, documenting each cash transaction is also of great importance. After all, an unregistered operation can lead to the fact that money "on paper" will not coincide with their actual amount. And this, again, is fraught with a fine.

Rules for conducting cash transactions: who conducts cash transactions

Cash transactions must be conducted by a cashier or another employee appointed by the head of the organization / individual entrepreneur.

The cashier must be familiarized with his duties against signature (clause 4 of the Instructions).

If the organization / individual entrepreneur has several cashiers, one of them should be assigned the functions of a senior cashier.

By the way, the manager / individual entrepreneur can undertake the conduct of cash transactions.

Documentary registration of cash transactions

Cash documents (PKO, RKO) are drawn up by the chief accountant or another person whose duties, by order of the head / individual entrepreneur, include the execution of these documents. Also cash documents can be issued official companies or individuals with whom contracts for the provision of accounting services are concluded (clause 4.3 of the Instructions).

Individual entrepreneurs, regardless of the applied tax regime, may not draw up cash documents, but provided that they keep records of income and expenses / physical indicators (clause 4.1 of the Instructions, clause 2 of the Letter of the Federal Tax Service of Russia dated 09.07.2014 N ED-4-2 / 13338).

Cash transactions: who signs documents

Moreover, when registering cash documents on paper, the cashier is supplied with a seal or stamp (for example, a seal with the name of the company, its TIN and the word "Received"). By placing an imprint of a seal / stamp on cash documents, the cashier confirms the execution of the cash transaction.

If the manager himself is engaged in the conduct of cash transactions and the execution of cash documents, then, accordingly, only he should sign the cash documents.

Cash acceptance

As we noted above, cash is accepted at the cash desk by PKO.

Upon receipt of an incoming cash order, the cashier checks (clause 5.1 Instructions):

- the presence of the signature of the chief accountant or accountant (in their absence, the signature of the head) and verifies this signature with the available sample;

- compliance of the cash amount indicated in figures with the amount indicated in words;

- availability of supporting documents named in the PKO.

The cashier accepts cash by sheet, by piece count. In this case, the person who deposits cash at the cashier must be able to observe the actions of the cashier.

Having counted the money, the cashier verifies the amount in the PKO with the actual amount received and, if the amounts match, the cashier signs the PKO, puts a seal / stamp on the receipt to the PKO and gives this receipt to the person who deposited the cash.

When making settlements using a cash register or SRF, a cash receipt order can be issued on total amount accepted cash at the end of the cash transaction. Such PQS is filled out on the basis of the control tape of the cash register, the backs of the strict reporting forms (SRF), equated to the cash register receipt, etc.

Further movement of the PKO within the organization and its storage depends on the rules established by the head of the company. PKO should be stored for 5 years (clause 362 of the List, approved by the Order of the Ministry of Culture of Russia dated 25.08.2010 N 558).

Cash withdrawal

When issuing cash from the cash register, you need to issue a cash settlement. Having received it, the cashier checks (clause 6.1 Instructions):

- the presence of the signature of the chief accountant / accountant (in its absence - the signature of the head) and its compliance with the sample;

- correspondence of the amounts indicated in figures to the amounts indicated in words.

When dispensing cash, the cashier must check the availability of supporting documents listed in the cash register.

Before issuing money, the cashier must identify the recipient by his passport (another identity document). It is prohibited to issue cash to a person who is not listed in the cash settlement.

Having prepared the required amount, the cashier transfers the cash register to the recipient for signature. Then the cashier must recalculate the prepared amount so that the recipient can observe this process. Cash withdrawal is made by sheet, piecewise recalculation in the amount indicated in the cash settlement. After issuing money, the cashier signs the cash register.

As well as PKO, cash register are stored for 5 years according to the rules established by the head of the organization.

Cash withdrawal for salary payments

Payment of wages is carried out according to payroll (Form No. T-49, approved by the Resolution of the State Statistics Committee of the Russian Federation of 05.01.2004 N 1) / payrolls (Form No. T-53, approved by the Resolution of the State Statistics Committee of the Russian Federation of 05.01.2004 N 1) with drawing up a single cash register (for the amount actually paid) on the last day of payment of wages or earlier, if all employees received their wages before the deadline. Moreover, in such an RSC it is not necessary to indicate either full name. the recipient, no details of the identity document.

The term for issuing salary cash is determined by the head and must be indicated in the statement. But please note that this period cannot exceed 5 working days, including the day the money is received at the bank (clause 6.5 of the Instructions).

The employee must sign the statement.

If on the last day of payment of wages one of the employees did not receive it, then the cashier opposite his surname and initials in payroll/ payroll affix an imprint of the seal (stamp) or makes the entry “deposited”. Then the cashier:

- calculates the amount actually given to the employees and the amount to be deposited;

- writes these amounts to the corresponding lines of the statement;

- reconciles these amounts with the total amount indicated in the statement;

- affix his signature and gives the statement for signature to the chief accountant / accountant (in his absence - to the head).

If we are talking about some kind of one-time payment (for example, the payment of a salary to a resigning employee), then there is no point in drawing up a statement - you can issue money immediately through cash settlement services in the usual way.

Cash disbursement to the accountant

In this case, the RSC is drawn up on the basis of a written in free form, or an administrative document of the organization / individual entrepreneur (clause 6.3 of the Instructions). This application must contain information about the amount of cash, the period for which the money is issued, the signature of the manager and the date.

The presence of the accountant's debt for the amounts previously received under the report is not an obstacle to the next issue of funds to him.

Receiving cash from the OP and issuing cash to a separate unit

When the parent organization accepts money from its OP, an incoming cash order is also drawn up, and when issuing - an outgoing cash order. Moreover, each organization determines the procedure for issuing cash to its OP independently (clause 6.4 of the Instructions).

Conducting cash transactions: issuing cash by proxy

Cash intended for one recipient can be issued to another person by power of attorney (for example, receiving a salary for a sick relative). In this case, the cashier must check (clause 6.1 Instructions):

- compliance of the name of the recipient indicated in the cash settlement and the full name of the principal indicated in the power of attorney;

- compliance of the full name of the authorized person specified in the cash settlement and the power of attorney with the data of the presented identity document.

In the payroll / payroll, an entry “by proxy” is made before the signature of the person to whom the money is issued.

The power of attorney is attached to the cash settlement / payroll / payroll.

If cash is issued under a power of attorney issued for several payments or to receive money from different legal entities / individual entrepreneurs, a copy of such a power of attorney is made. This copy is certified in accordance with the procedure established by the organization / individual entrepreneur and is attached to the cash settlement.

In a situation where the recipient is entitled to several payments from one legal entity / individual entrepreneur, the original of the power of attorney is kept by the cashier, with each payment a copy of the power of attorney is attached to the cash settlement / payroll / payroll, and at the last payment - the original.

Book of accounting of accepted and issued cash

If the company or individual entrepreneur has several cash desks, then cash transfer operations between the senior cashier and cashiers are recorded by the senior cashier in the book of accounting of funds received and issued by the cashier during the working day (Form No. KO-5, approved by the Resolution of the State Statistics Committee of the Russian Federation of 18.08. .1998 N 88).

Cash book

The OP sends a copy of the cash book sheet to the parent organization. The procedure for such a direction is established by the organization itself, taking into account the period for drawing up accounting / financial statements.

Method of registration of cash documents and books

They can be executed on paper or in electronic form (clause 4.7 of the Guidelines).

Paper documents are drawn up by hand or using technical means, for example, a computer and signed with handwritten signatures.

Corrections can be made to documents drawn up on paper (except for PKO and RKO). The persons who made the corrections must put the date of such correction, as well as indicate their surname and initials and sign.

Documents issued in electronic form must be protected from unauthorized access, distortion and loss of information.

Electronic documents are signed with electronic signatures.

It is prohibited to make corrections to documents issued in electronic form.

Cash register inventory

To ensure the reliability of accounting data and financial statements, organizations are required to carry out an inventory of property and liabilities, during which the presence, condition and assessment are checked and documented.

Inventory of the cash register is aimed at checking the safety of funds and valuables in it. In this case, a discrepancy between the actual availability of funds and their credentials may be revealed. One of the measures to ensure control over the safety of funds is an inventory. It can be carried out in accordance with the schedule established in the organization (planned) and can be unscheduled.

The procedure for conducting an inventory of the cash register and registering its results is regulated by Order of the Ministry of Finance of Russia No. 49. The methodological guidelines link the mandatory inventory taking with the occurrence of the following cases:

1) when transferring the property of the organization for rent, redemption, sale, as well as in cases provided for by law;

2) before drawing up annual financial statements;

3) when changing materially responsible persons;

4) in case of natural disasters, emergency cases;

5) when establishing the facts of theft, abuse, damage to valuables;

6) upon liquidation (reorganization);

With regard to the inventory of the cash register, it was determined that it should be carried out in accordance with the procedure for conducting cash transactions, which determined that, in addition to the annual inventory, it was necessary to conduct regular sudden checks with a full recount of cash and verification of other valuables in the cash register. This must be reflected in the accounting policy of the organization. The schedule of cash checks is approved by the head of the organization. Before conducting an audit, an order must be issued by the head. It indicates: the composition of the commission and the timing. According to the methodological instructions of the commission, organizational points should be observed:

1) it is necessary to receive the latest receipt and expenditure documents and traffic reports at the time of the inventory before starting the check material values and cash;

2) the chairman of the commission must endorse all incoming and outgoing documents attached to the reports with the indication "Before inventory (date)", which should serve as the basis for the accounting department to determine the remaining property by the beginning of the inventory;

3) receive receipts from materially responsible persons that by the beginning of the inventory, all incoming and outgoing documents for property have been handed over to the commission. Make sure that a full liability agreement has been concluded with the cashier.

After that, proceeds to directly check the actual availability of property by compulsory counting. The check is carried out with the obligatory participation of the materially responsible person.

During the inventory of the cash desk, the following are checked: cash book, cashier reports, PKO, cash register, register of income and expense cash orders, power of attorney log, deposited amount log, payroll log and other supporting documents.

Particular attention is paid to the design of the cash book, which must be laced, numbered and sealed, as well as the calculation of totals and the transfer of amounts of cash balances from one page to another. During the inventory of the cash desk, the commission reconciles the amounts of cash entered into the cash desk with the amounts written off from the current account.

The issuance of cash is checked according to the documents attached to the cash statements. They must contain the signatures of the recipients and must be stamped "Paid" with the date. Erasures, corrections in cash documents should not be. The commission also checks the cashier's compliance with the cash balance limit, the timeliness of the deposit of unpaid wages, and the correspondence of invoices for the transaction.

When calculating the actual availability, they recalculate both cash, monetary documents (postage stamps. State duty stamps, vouchers to sanatoriums, rest homes, air tickets, etc.), and strict reporting forms, taking into account the initial and final numbers. The results of the audit are drawn up in an act, which is drawn up in at least two copies, signed by the commission and the materially responsible person. The first copy of the act is transferred to the accounting department of the organization, the second remains with the materially responsible person.

Before the start of the audit, a receipt is taken from each materially responsible person. When changing the materially responsible person, the act is drawn up in triplicate. Since the cashier is fully financially responsible for the safety of the values \u200b\u200bentrusted to him, he must compensate the damage in full with the onset of the following cases:

1) shortage of values \u200b\u200bentrusted to him on the basis of an agreement;

2) deliberate infliction of damage;

3) causing damage as a result of an administrative offense;

4) causing damage in a state of alcoholic, drug intoxication;

5) damage caused as a result of criminal actions of an employee, established by a court judgment;

6) disclosure of information constituting a secret protected by law (state, official, commercial secret);

7) damage caused by the employee's failure to fulfill his labor obligations.

The withdrawal of money from the cash desk is not confirmed by the recipient's receipt in the cash register and justification of the balance of cash at the cash desk is not accepted, this amount is considered a shortage and is collected from the cashier. Revealed in the course of the inventory is reflected: D94 K50.

In accordance with the Labor Code of the Russian Federation, the employee is obliged to compensate the employer for the damage caused to him, which means a real decrease in the employer's cash assets. For the damage caused, the employee bears material responsibility within the limits of his average monthly earnings, except for the cases provided for by the Labor Code of the Russian Federation, when the employee may be held liable for the full amount of damage. The amount of the shortage of funds is recovered from the guilty employee: D73 / 2 K94.

D70 K73 / 2 - withheld from wages.

D50 K73 / 2 - the shortage was entered in the cashier.

Experts recommend conducting a cash register inventory on a monthly basis. The timing must be fixed in the order on the accounting policy of the organization. The head issues a separate order, which approves the composition of the commission. If the organization has a cash register equipment, readings are taken from it, then they are checked against the amount of proceeds, with the data of the cash register and cash counters.

The amounts reflected in the book of the cashier-operator, in the cash register and on the counters of the cash register equipment must be equal to the amount of money in the cash register. If the commission found shortages or surpluses, they must be entered in the columns of the book. Based on the results of the check, the reasons are found out and an act is drawn up. Revealed surplus at the cash desk: D50 K91 / 1.

Checking the accounting of cash transactions is a mandatory component of inventory programs. Its goal is to identify violations and abuses in cash accounting, to prevent errors and inaccurate information. Control of cash transactions - checking the completeness, reliability and accuracy of the reflection in accounting and reporting of settlements for the audited period, as well as compliance with legislative and regulatory documentsgoverning accounting rules.

The main documents used by the commission in the course of checking cash transactions are:

1) RKO and PKO;

2) cash book, cashier reports;

3) logs of registration of PKO and RKO, issued powers of attorney, deposited amounts;

4) payrolls, etc.

An inventory of funds and strict reporting forms stored in the cash register is carried out by a commission with the obligatory participation of the chief accountant and cashier.

Simultaneously with the inventory, the conditions of storage of funds are checked.

Ensuring the safety of funds at the cash desk.

The cashier is responsible for the safety of money and other valuables in the cash register. His registration for work is carried out after the issuance of the order of the head, then an agreement on full material responsibility is concluded with him. In accordance with this, the cashier bears full financial responsibility for the safety of all the values \u200b\u200bhe has accepted and for damage caused to the organization as a result of deliberate actions, negligence or bad faith in his duties. The liability agreement is drawn up in duplicate, one remains with the cashier, the second is transferred to personnel service or to the accounting department.

In order to safeguard funds, all cash and securities must be kept in fireproof metal cabinets, which, at the end of the cashier's work, are closed with a key and sealed with the cashier's seal. It is forbidden to leave keys and seals in public places, transfer to unauthorized persons or make unaccounted duplicates. The registered duplicate keys are kept by the manager. During the inventory, they are checked.

Keeping cash and other valuables that do not belong to this organization at the cash desk is prohibited. During the check, the limit of the cash balance at the cash desk is checked, exceeding which is a gross violation of cash discipline and is classified as an administrative offense entailing the imposition of an administrative fine:

1) for officials - from 4000 to 5000 rubles.

2) for legal entities persons - from 40,000 to 50,000 rubles.

When making payments in cash, an important point is to comply with them limit size... Currently, it is 100,000 rubles. For exceeding the specified amount of payments, administrative liability is provided.

Cash register inventory is carried out in accordance with:

The procedure for conducting cash transactions in the Russian Federation (section "Cash desk audit and control over compliance with cash discipline")

The procedure for conducting cash transactions, approved by the Central Bank of the Russian Federation by regulation of 12.10.2011, No. 373-P.

© 2015-2019 site

All rights belong to their authors. This site does not claim authorship, but provides free use.

Date the page was created: 2017-06-30

On June 1, 2014, two Central Bank Directives came into force at once, concerning cash settlements. The new procedure for conducting cash transactions, which is applied instead of the previous Regulation, approved. The Bank of Russia dated 12.10.2011 No. 373-P, extends its effect to legal entities (except for banks), and also allows entrepreneurs and small businesses to keep records of cash transactions in a simplified form. Have the forms of cash documents changed? What is the simplification of the procedure for conducting cash transactions for small businesses? You will find answers to these and other questions in the auditor's article L.P. Fomicheva... As regards the commentary to the second document - Ordinance of the Bank of Russia dated 07.10.13 No. 3073-U, which regulates the rules for making cash payments - the material was prepared by experts from 1C.

The Bank of Russia Ordinance No. 3210-U of March 11, 2014 approved a new procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation by legal entities (except for banks), as well as a simplified procedure for conducting cash transactions by individual entrepreneurs (IE) and small businesses (hereinafter referred to as Instruction No. 3210-U). Recipients of budget funds when conducting cash transactions are guided by Instruction No. 3210-U, unless otherwise specified by a regulatory legal act regulating the procedure for conducting cash transactions by recipients of budget funds.

The document was registered with the Ministry of Justice of Russia on May 23, 2014 (No. 32404) and published in the Bank of Russia Bulletin No. 46 (1524) dated May 28, 2014. Ordinance No. 3210-U entered into force on June 1, 2014, except for the requirements for software and hardware for accepting Bank of Russia banknotes, which will be effective from January 1, 2015.

From the date of entry into force of Ordinance No. 3210-U, the Regulation of the Bank of Russia of 12.10.2011 No. 373-P "On the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia in the territory of the Russian Federation" (hereinafter - the Regulation) becomes invalid.

In connection with the introduction of the Instructions, amendments should be made to the internal documents of the organization, which have a link to the Regulation.

No significant changes have been made to the procedure for conducting cash transactions, with the exception of the possibility of using a simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses.

The procedure for conducting cash transactions for small businesses is simplified

Let us remind you that the previous Regulation applied to organizations on the "simplified" system and to entrepreneurs in full and did not provide for any peculiarities of their cash transactions. This aroused fierce resistance from these persons and their attempt to prove the illegality of such an order in court. Indeed, from Article 128 and paragraph 2 of Article 209 Civil Code RF it follows that the funds used by the entrepreneur in his activities belong to him by right of ownership and he has the right to dispose of them at his own discretion. Consequently, the funds available in the current account of an individual entrepreneur can be used by him for any purpose, including his personal needs.

However, the Federal Tax Service of Russia in a letter dated 31.08.2012 No. AS-4-2 / [email protected] and the Central Bank of the Russian Federation in a letter dated 02.08.2012 No. 29-1-2 / 5603 insisted that individual entrepreneurs comply with the Regulations.

Instruction No. 3210-U also provides for two main changes:

- clause 2 of Instruction No. 3210-U clearly states that individual entrepreneurs, small businesses may not set a limit on the balance of cash;

- in subparagraphs 4.1 and 4.6 of Direction No. 3210-U it is established that individual entrepreneurs conducting in accordance with Tax Code RF, accounting for income or income and expenses and (or) other objects of taxation or physical indicators characterizing a certain type of entrepreneurial activity, the cash book may not be kept and cash documents may not be drawn up.

As for small businesses, according to the new provisions, they may not set a limit on the balance of cash (clause 2 of Direction No. 3210-U).

Restriction on keeping money: only in the Bank of Russia system

Clause 3 of the Instructions establishes that cash authorized representatives legal entity are obliged to hand over to a bank or to an organization that is part of the Bank of Russia system that carries out the transportation of cash, cash collection, operations for accepting, counting, sorting, forming and packing cash of bank customers, for crediting their amounts to a bank account.

If there is a separate subdivision, a procedure for depositing cash must be established - to the cash desk of a legal entity or to a bank, or to an organization that is part of the Bank of Russia system, for crediting their amounts to the bank account of a legal entity.

The fact that money can be handed over to the organization of the federal postal service (clause 1.5 of the Regulations) is not mentioned in the Instructions.

Cash balance limit calculation method has been adjusted

Appendix to Ordinance 3 3210-U is called “Determination of the limit on the balance of cash”. Previously, a similar section was in the Appendix to the Regulation. In principle, the text of the document has practically not changed, it has two options for calculating the limit - taking into account the volume of receipts or volumes of cash withdrawal.

The basic formula for calculating the cash balance limit was not changed. It is still required to be used by a separate subdivision of a legal entity that deposits cash to a bank account opened for a legal entity in a bank.

At the same time, in clause 2 of the Instructions it is specified that a separate subdivision means a subdivision of a legal entity, at the location of which a separate workplace (workplaces) is equipped.

Additionally, it was prescribed that a legal entity, which includes separate divisions that donate cash to the cashier of a legal entity, determines the limit on the balance of cash, taking into account the limits established by these separate divisions. A copy of the administrative document establishing a separate unit of the cash balance limit is sent by a legal entity to a separate subdivision in the manner prescribed by the legal entity.

There is a slight difference in the second method of calculating the limit - based on the volume of cash withdrawals. Previously, it was applied in the absence of cash receipts for goods sold, work performed, services rendered. Now the second method is equivalent to the first - based on the volume of cash receipts, and the legal entity that determines the limit has the right to choose one of the methods.

As already noted, individual entrepreneurs and small businesses may not set a limit on the balance of cash, but they have the right to set a limit, like another legal entity.

The procedure for issuing money for a report and for a salary has not changed

In clause 6.3 of the Instructions, as before in clause 4.4 of the Regulation, it is said that cash disbursement against expenses must be made on the basis of an accountable person's statement, drawn up in any form and containing a record of the amount of cash and the period for which cash is issued , signature of the head and date.

The accountable person is obliged, within a period not exceeding three working days after the day of expiry of the period for which the cash was issued against the account, or from the day of going to work, to present an advance report with the attached supporting documents to the chief accountant or accountant. Review of the advance report by the chief accountant or accountant, its approval by the head and the final calculation of advance report are carried out within the period established by the head.

Cash withdrawal is carried out under the condition full repayment the accountable person of the debt for the amount previously received under the report.

The procedure for paying salaries has not fundamentally changed either. For the actually issued amounts of cash on the payroll, an expense cash order is drawn up.

As before, measures to ensure the safety of cash during cash transactions, storage, transportation, the procedure and timing of checks of the actual availability of cash are determined by a legal entity, an individual entrepreneur independently (clause 7 of the Instructions, clause 1.11 of the Regulations).

Forms of cash documents remained the same

Cash transactions are still drawn up by primary accounting cash documents. The unified documents, which are currently used for processing cash transactions (forms No. KO), were approved by the Resolution of the State Statistics Committee of the Russian Federation of 08/18/1998 No. 88, and on labor accounting and remuneration (Form No. T) - by the Resolution of the State Statistics Committee of the Russian Federation No. ...

Since January 1, 2013, the use of unified forms of primary accounting documents in accordance with Federal Law No. 402-FZ of December 6, 2011 “On Accounting” is not mandatory. An exception is the forms of documents established by authorized bodies in accordance with other federal laws and on their basis, for example, cash documents (information of the Ministry of Finance of Russia No. PZ-10/2012 "On entry into force from January 1, 2013 No. Federal law dated December 6, 2011 No. 402-FZ "On accounting" "). In addition, there are some features for the use of unified forms for accounting for labor and its payment.

Initially, the draft Guidelines planned to approve new cash documents. But the Russian Ministry of Justice refused to register the Instructions in this form, and the document was sent back for revision. According to the author, one of the reasons for the refusal was the impossibility of applying new forms of documents approved by the Central Bank of the Russian Federation, without canceling the previous forms that were approved by the State Statistics Committee.

In the final document, registered by the Ministry of Justice, there are no new cash documents in the annexes, and the text provides a link to previous forms... True, instead of the traditional names of cash documents Nos. KO-1 - KO-5 and settlement and payment documents Nos. T-49, etc., they are called numbers of unified forms according to OKUD - 0310001 - 0301011.

Cash documents of a legal entity, an individual entrepreneur can still be drawn up by a person who is defined in the administrative document. In addition to the chief accountant, manager, accountant or other employee (including the cashier), it is now indicated that this can be an official or an individual with whom the labor contract or a civil law agreement on the provision of accounting services (clause 4.2 of the Instructions). At the same time, the head is no longer obliged to coordinate the candidacy with the chief accountant.

Documents in electronic form are drawn up using technical means, taking into account their protection from unauthorized access, distortion and loss of information. They are signed with electronic signatures in accordance with the requirements of the Federal Law of 06.04.2011 No. 63-FZ "On Electronic Signatures". It is not allowed to make corrections to them after signing.

The storage of documents issued on paper or in electronic form is organized by the head.

Clause 4 of the Directives states that all economic entities can conduct cash transactions using software and hardware. For these technical means, the Bank of Russia, by a special regulation, will approve machine-readable security features of banknotes, four of which technology will have to recognize. This requirement is proposed to come into force on January 1, 2015.

New rules for cash payments established

It should be said that now Ordinance No. 3210-U in terms of requirements for individual entrepreneurs is consistent with Ordinance No. 3073-U of the Bank of Russia dated 07.10.13 “On the implementation of cash settlements” (hereinafter - Ordinance No. 3073-U), which is also valid from 01.06. 2014.

This document was published in the Bank of Russia Bulletin on May 21, 2014 and is applied from June 1, 2014 (clause 7 of Direction No. 3073-U). The previously valid Bank of Russia Ordinance No. 1843-U of 20.06.2007 (hereinafter referred to as Ordinance No. 1843-U) has ceased to be effective from 01.06.2014. Let us consider in more detail its new provisions.

The list of purposes for which you can spend money from the cash register

Instruction No. 3073-U, as before, prohibits the spending of cash from the cash desk, with the exception (clauses 2, 6 of Instruction No. 3073-U):

- payments to employees included in the payroll;

- payments to employees of a social nature;

- payments of insurance claims (sums insured) under insurance contracts to individuals if they paid the insurance premium in cash (no more than 100,000 rubles under one contract);

- issuing cash for personal (consumer) needs of an individual entrepreneur, not related to his entrepreneurial activities;

- payment for goods (except for securities), works, services (no more than 100,000 rubles under one contract);

- issuing cash to employees on account of the report;

- return for previously paid in cash and returned goods, work not performed, services not rendered (no more than 100,000 rubles under one contract);

- issuing cash in the course of transactions by a bank payment agent (subagent) in accordance with the requirements of Article 14 of the Federal Law dated 27.06.2011 No. 161-FZ "On national payment system"(No more than 100,000 rubles under one contract).

It should be noted that credit institutions can spend cash from the cash desk for any purpose. However, this rule applies only to Russian rubles.

Let us remind you that the list established by Ordinance No. 1843-U was more limited. For example, the entrepreneur's right to spend money from the fund for personal needs was not previously provided for.

Operations for which you can spend money received from the account

The adopted Ordinance No. 3073-U has one more essential difference from its predecessor. So, a list of operations has been established for which organizations and entrepreneurs can spend cash from the cash desk if it is received from their current accounts. These include (clause 4 of Directive No. 3073-U):

- operations with securities;

- lease payments real estate;

- issuance and return of loans, interest on them;

- activities for the organization and conduct of gambling.

It should be noted that for these operations, the limit of 100,000 rubles should be observed within the framework of one contract (clause 6 of Direction No. 3073-U). The exception is calculations with individuals (p. 5 of Directive No. 3073-U).

The procedure for settlements with individuals who are not entrepreneurs

The new order, as before, obliges organizations and entrepreneurs to make settlements with citizens only in Russian rubles. At the same time, there are no restrictions regarding the maximum amounts (clause 5 of Directive No. 3073-U).

What document should be followed when planning measures for the safety of funds in the operating cash desk located in the sports and recreation center?

Is it permissible in a self-developed internal document to focus on the requirements established in the canceled Procedure for conducting cash transactions in the Russian Federation, approved by the decision of the Board of Directors of the Central Bank of Russia dated 09.22.1993 N 40?

Having considered the issue, we came to the following conclusion:

To date, the requirements for the special equipment of the cash office (operating cash desk) of non-credit organizations regulations not installed. This question is entirely left to the discretion of the economic actors themselves. When planning and organizing measures to ensure the safety of cash, they can use the Recommendations for ensuring the safety of cash during storage and transportation (Appendix No. 2 to the Procedure for conducting cash transactions in the Russian Federation, approved by the decision of the Board of Directors of the Central Bank of Russia dated September 22, 1993 No. 40) and Uniform requirements for technical strength and equipment with signaling of offices of enterprises' cash offices (Appendix No. 3 to it). These documents have lost their legal force, but can be used as a guide.

Rationale for the conclusion:

From June 1, 2014, the procedure for conducting cash transactions with cash in the territory of the Russian Federation by legal entities is determined in accordance with the Bank of Russia Ordinance No. 3210-U of March 11, 2014 (hereinafter - Ordinance No. 3210-U).

According to clause 2 of Instruction N 3210-U for conducting operations for accepting cash, including their recount, issuing cash (hereinafter - cash transactions), a legal entity by an administrative document establishes the maximum allowable amount of cash that can be stored in a place for conducting cash transactions , determined by the head of the legal entity (hereinafter - the cash desk), after being displayed in the cash book ( uniform form N KO-4, approved by the decree of the Goskomstat of Russia of 18.08.1998 N 88, OKUD Code 0310004) the amount of cash balance at the end of the working day.

Instructions N 3210-U do not contain any requirements for the equipment of the cash desk (operating cash desk) of the organization, that is, there are currently no special requirements that the cash desk should be located in a separate room, etc. At the same time, these special requirements of the regulator (Central Bank of the Russian Federation) apply to cash registers credit institutions and brought them to separate regulations (for example, Appendix 1 to the Regulation of the Bank of Russia dated 24.04.2008 N 318-P, letter from the Moscow State Technical University of the Central Bank of Russia dated 14.05.2005 N 02-28-3-07 / 34740 "On equipping premises for performing transactions with valuables", letter from the Association of Russian Banks from 01.08.2008 N А-02 / 5-452) (see also Guidelines Р78.36.032-2013 "Engineering and technical strength and equipping with technical means of protection of objects, apartments and MHIG, taken under centralized security by private security units. Part 1", and other firms and organizations with technical means of security, video control and engineering protection. Standard options "R 78.36.003-99 (approved by the GUVO MIA RF 20.12.1996)).

Thus, the question of how and in what place the cash transactions should be carried out should be settled economic entity independently (clause 7 of Instructions N 3210-U).

Earlier (before 01.01.2012) the requirements for the premises of the organization's cash desk were established by Appendix No. 3 "Uniform requirements for technical strengthening and alarm equipment for the cash offices of enterprises" to the Procedure for conducting cash transactions in the Russian Federation (approved by the decision of the Board of Directors of the Central Bank of Russia dated September 22, 1993 No. 40 ) (hereinafter - Order No. 40).

Order No. 40 established the requirements according to which the heads of organizations equipped a cash desk (an isolated room intended for receiving, issuing and temporary storage of cash) and ensured the safety of funds in the cash office. The cash register room was supposed to be isolated, and the doors to the cash register were locked from the inside during transactions. Access to the cashier's premises to persons not related to its work was strictly prohibited. All cash and securities at enterprises were to be stored in fireproof metal cabinets, and in some cases - in combined and ordinary metal cabinets, which at the end of the working day were to be locked with a key and sealed with the cashier's seal (clauses 29, 30 of the Procedure N 40).

From 01.01.2012 to 31.05.2014 on the territory of the Russian Federation, the Regulation on the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia in the territory of the Russian Federation was applied (approved by the Bank of Russia on 12.10.2011 N 373-P). This document replaced Order No. 40. And already from that date (01.01.2012), the absence of a safe for storing funds and a separately equipped room for issuing cash could not lead to administrative liability for the organization, since Regulation No. 373-P did not contain requirements for the equipment of a separate cash register room and the availability of a safe for storing funds.

And for example, the provisions of the fourth paragraph of clause 4 of Direction N 3210-U established that organizations, individual entrepreneur can conduct cash transactions using software and hardware, such as a payment terminal, which can be installed anywhere. This follows from the letter of the Bank of Russia dated December 26, 2013 N 02-45-2 / 6525.

In other words, when planning and organizing measures to ensure the safety of cash, you can use the Recommendations for ensuring the safety of cash during storage and transportation (Appendix No. 2 to Order No. 40) and the Uniform Requirements for Technical Strengthening and Equipment with Signaling of the Cash Facilities of Enterprises (Appendix N 3 to it). These documents have lost their legal force, but can be used as a guideline.

We recommend that you familiarize yourself with the materials:

- Encyclopedia of solutions. Financial control;

- Encyclopedia of solutions. Cash register equipment.

Prepared by:

Expert of the Legal Consulting Service GARANT

Volkova Olga

Answer passed quality control