Salary loan calculator will help you calculate a mortgage or consumer loan

One of the most common reasons for refusal to obtain a mortgage loan is too much credit burden on the family's monthly income. As a rule, according to the conditions of most banks, this ratio should be no more than 50%. In order to avoid refusal of a loan for such reasons as much as possible, to assess your financial capabilities as a borrower, and to choose the optimal, comfortable loan parameters, it is advisable to use a mortgage income (salary) calculator.

What is a mortgage income calculator

This is a kind of loan calculator for calculating the parameters of a mortgage loan, based on the level of wages and other documented income.

It is mainly used to determine the maximum possible loan amount for a certain period.

What does it look like

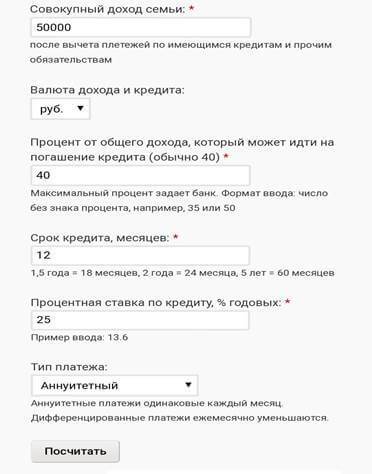

The calculator consists of several fields that must be filled in sequentially in order to get the final result.

There are different versions of the calculator, depending on the number of parameters taken into account.

The simplest calculation (for example, this one https://calcsoft.ru/ipotechnyy-kalkulator-po-dohodu first shows what maximum amount you can count on for the desired term and for a given percentage of the credit load.

|

If the calculated amount is not enough, the service offers a choice of several options for increasing it (changing the term, attracting co-borrowers).

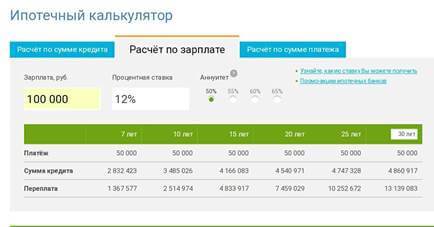

Or those where a comparative table with different terms is immediately shown http://podboripoteki.ru/calculators/simple/.

|

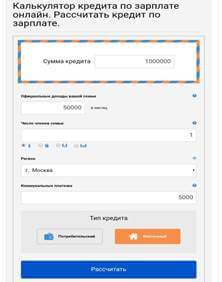

There are more complex options, where in addition to the minimum set of conditions, the number of family members, the subsistence level in the region, utility bills, etc. are also taken into account.

An example of such a calculator: https://calcsoft.ru/ipotechnyy-kalkulator-po-dohodu

Most calculators also show the amount of the overpayment on the loan.

All these are universal calculators, the calculation of which is based on the assumption of the approximate requirements of banks for the level of monthly income.

Fill Features

The following features of filling in the fields of the calculator should be noted:

- The column "Monthly income" indicates the amount of net monthly income minus other credit obligations (loans, credit cards). Banks take into account all current payments on loans, even if you do not indicate them in the questionnaire.

- Income other than wages includes income from part-time work, accrued interest on deposits, from renting out real estate and any other amounts that you can document.

- The longer the specified term of the loan, the greater the amount of the loan you can count on.

Sberbank mortgage calculator

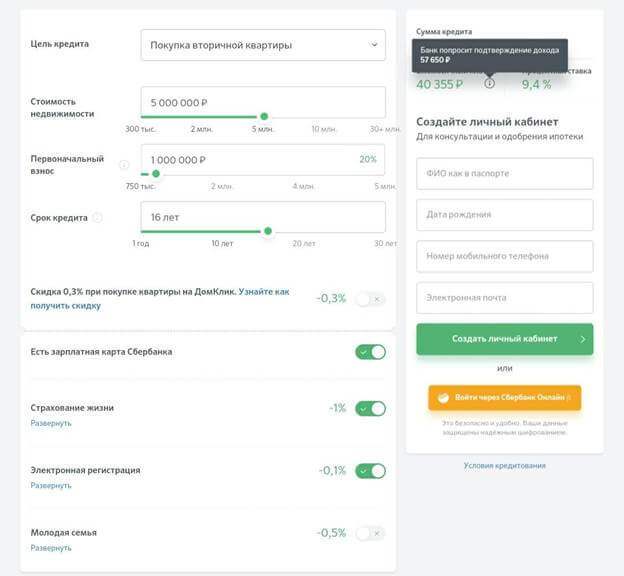

At the moment, the Sberbank mortgage calculator does not provide for calculating the maximum mortgage amount based on the amount of wages. But with the given mortgage parameters, it shows what minimum income will need to be officially confirmed by the bank https://ipoteka.domclick.ru/.

The interface of the calculator is quite convenient. Here you can immediately select a lending program and mark all the conditions that allow you to reduce the interest rate.

Based on the results of the calculation, you can immediately see the final interest rate, which allows you to reduce the time to look for interest on various mortgage programs.

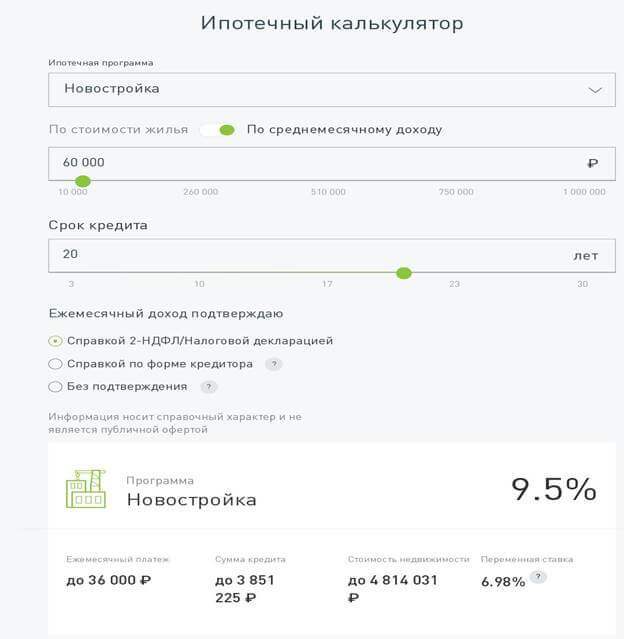

AHML Mortgage Calculator

The official website of the Agency for Housing Mortgage Lending has a mortgage income calculator https://xn--d1aqf.xn--p1ai/mortgage/.

To get information about the maximum possible mortgage amount, monthly payment, real estate value, it is enough:

- Select the type of calculation "by income".

- Select a loan program

- Indicate the amount of income and the desired period.

- If applicable, select the options "No Confirmation" or "Lender Form Help".