Alfa Bank credit card: 100 days without interest

Our service is ready to analyze current offers and select a bank with the lowest percentage.

Pick up

Wait, we are selecting the best offer: 17.0% loan.

We have selected several profitable offers from banks with 12.0% per annum on a loan.

The form to fill out is below.

In this material, you can learn more about the current conditions for the Alfa Bank card - 100 days without interest. This banking product has a long grace period, and the high availability of bank services allows you to get it almost anywhere in the country. If you were planning to issue a credit card with a long grace period on favorable terms, we recommend that you pay attention to this credit solution.

Alfa-Bank credit card terms and conditions

Alfa-Bank credit cards are issued within the international payment systems Visa and MasterCard. If you plan to issue this product, but are not familiar with the fundamental differences between these systems, be sure to read the site on our website. It will help reduce the overpayment, which may appear when converting currencies.

The cards are also divided into categories - Classic, Gold and Platinum. The fundamental difference between them lies in the size of the cash limit, commissions for withdrawing cash from ATMs and the cost of service. In addition, premium card holders receive a personal bank manager who can promptly resolve any problems with a credit card.

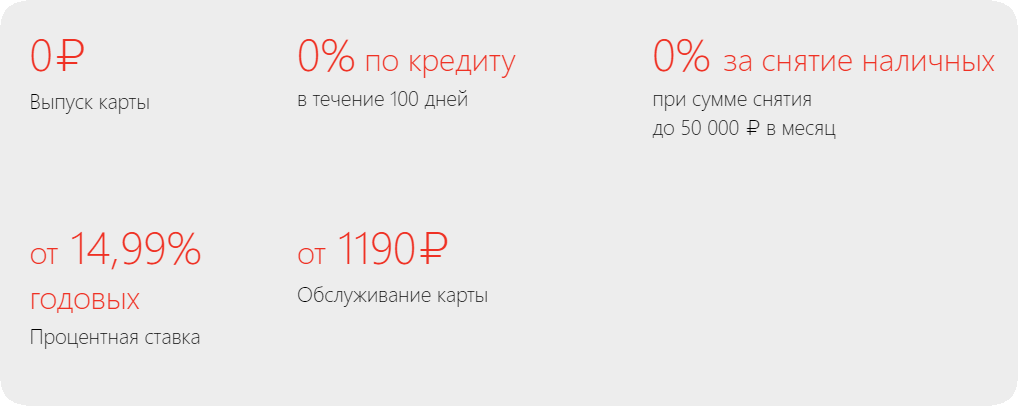

classic map

- The rate outside the grace period is 15% -32%. Determined individually after reviewing the submitted documents.

- The financial limit is 300,000.

- The duration of the grace period is up to 100 days. Valid for cashless purchases and cash withdrawals.

- Commission for withdrawing cash from an ATM - 5.9% of the amount if the limit of 50,000 per month is exceeded. Otherwise - interest-free.

- Product maintenance - from 1190 rubles every 12 months of use.

- Late payment penalty - 36.5% per annum.

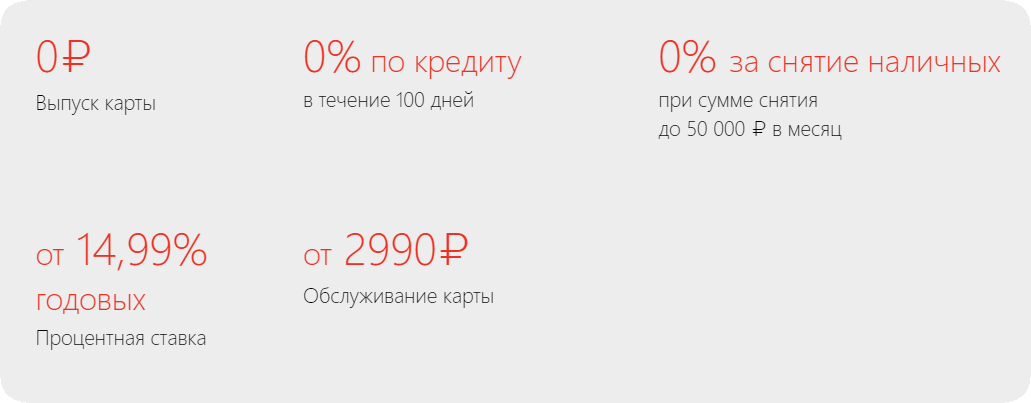

golden card

- The rate is 15% -32%.

- Credit limit - 500000.

- The duration of the grace period is up to 100 days for paying for purchases and withdrawing cash from ATMs.

- The fee for cash withdrawal is 4.9% of the amount if the monthly limit of 50,000 has been exceeded. Otherwise - 0%.

- The cost of the service is from 2990 per year.

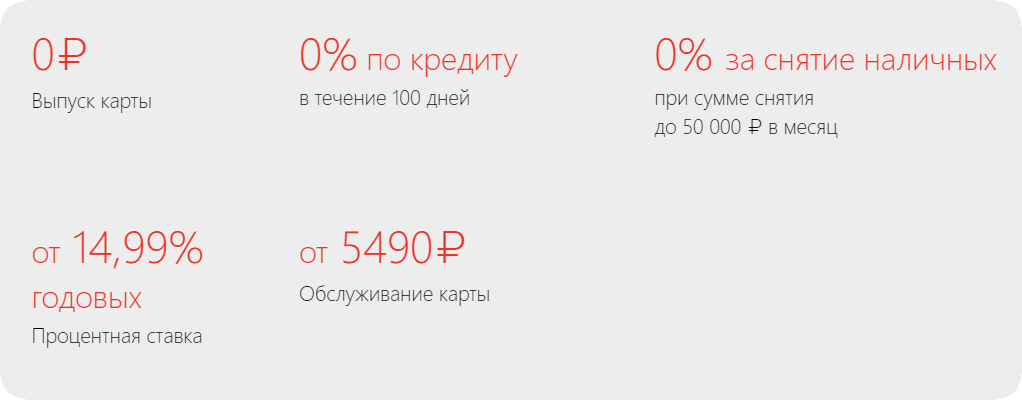

Platinum Card

- Annual percentage - 15%.

- The cash limit is 1 million rubles.

- The term of the interest-free period is up to one hundred days to pay for purchases and withdraw cash from ATMs.

- Additional fees - 3.9% of the amount if the monthly cash withdrawal limit was exceeded.

- Annual card support — from 5490.

- Penalty for violation of payment terms - 36.5% per annum.

Outcome! When choosing a suitable tariff, you need to proceed from your needs. For example, if you do not plan to make purchases for one million rubles, then it may be worth issuing a credit card of a different category. This will make its use more profitable, as the cost of annual maintenance will decrease.

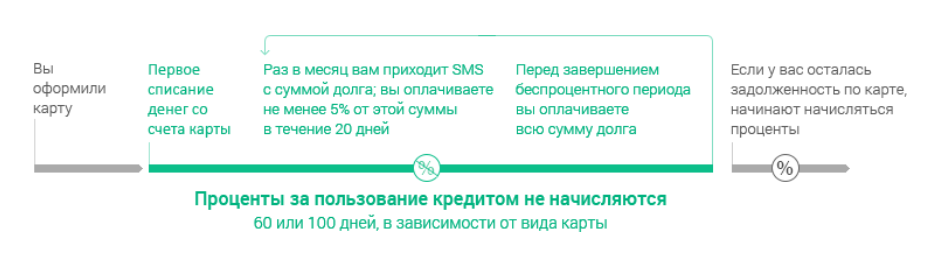

How the grace period works

The interest-free or grace period of a credit card is usually called the period during which you can use credit funds and not overpay at the rate. In Alfa-Bank, under the program "100 days without interest", the duration of the grace period can be up to 100 days, or 60 days for other credit cards of the same bank.

To maintain the interest-free period, the cardholder must make timely payment of mandatory payments and completely eliminate the debt before the end of the grace period. If the repayment of the debt by the last day is not carried out in full, then the interest will be recalculated from the date of receipt of the loan for the entire loan amount at the current lending rate.

Information about the size of the credit limit, the timing of regular payments, the end of the grace period or any other information of interest can be viewed at any time in the user's account on the organization's website or in the Alfa-Mobile application for portable devices.

Requirements for applicants

Every resident of the country will be able to become a happy owner of an Alfa Bank credit card with a grace period of one hundred days, if the following conditions are met:

- Citizenship of the Russian Federation.

- The minimum age of receipt is 18 years.

- The presence of a permanent income of 5 thousand rubles after deducting tax deductions. For residents of the capital of Russia, this limit is 9000.

- There is a contact mobile or landline home phone.

- Telephone at the workplace or the number of an employee of the accounting department at the place of employment.

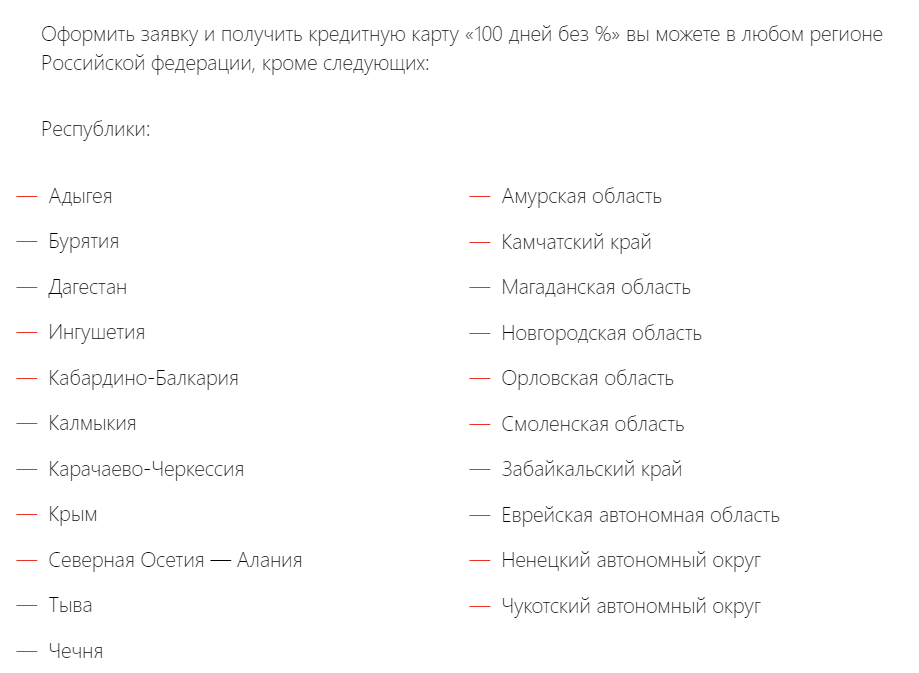

- Permanent registration in the Alfa-Bank service region. Below are the regions where you can't get a card.

Required documents

To use any credit services of the organization, you should collect the minimum set of documents requested by the bank to consider the application. The standard package of documents looks like this:

- Internal passport of a citizen of the Russian Federation.

- An additional document that helps identify the client's identity (foreign passport, vehicle driver's license, taxpayer number, compulsory insurance document, name card of other credit institutions).

- Optional documents to increase the likelihood of approval (legal documents for a vehicle, a copy of a voluntary medical insurance or CASCO policy, a bank statement on an account balance of more than 150 thousand rubles).

Important! If you are applying for a card with a money limit of more than 450,000 rubles, then the above optional documents will be required to be submitted. You should also present to the employees of the financial institution a certificate of employment and financial status in the form of 2-NDFL or a sample established by the bank.

For salary card holders, only an internal passport is a mandatory document, and the rest should be considered recommended, but not mandatory. They may slightly increase the likelihood of a positive decision on the application.

We hope that this review helped to better understand the current conditions on the Alfa Bank card with a grace period of up to 100 days without interest, and to choose the appropriate tariff. It will be an excellent source of additional funds for making purchases and getting cash. If you are interested in the conditions for credit cards issued by other banks, we recommend that you familiarize yourself with. It will help you choose the best solution for both temporary financial difficulties and regular purchases.

JavaScript must be enabled in your browser settings for the survey to work.