Halva card where you can pay, how to pay off debt, card limits

The Halva card is a project of Sovcombank (in the Russian Federation) and MTBank, which allows you to buy goods in installments without having to visit a bank branch and fill out a package of documents. The buyer will only need a card to make any purchase. The check issued at the checkout is the same agreement, under the terms of which payments for the purchase will be paid in equal installments, divided into 2-12 months. Is it possible to pay for utilities with Halva? Can it replace a regular credit card? How are payments made via Halva and where can it be used?

General information about the service

Payment using Halva can be made in partner stores of Sovcombank and MTBank. Currently, the service is supported by over 12 thousand points in the Russian Federation and Belarus. One has only to take into account that it is impossible to pay with a card issued by Sovcombank at Halva’s partners in Belarus and vice versa.

You can find out where you can pay for your purchases with Halva on the official website of the project. For MTBank clients - at ]]> https://www.halva.by/shops/ ]]>, for Sovcombank clients - ]]> https://halvacard.ru/shops/ ]]>. The information on the above sites is updated almost weekly, as new partner stores appear. There is also a convenient distribution by city. That is, it will not be difficult to find out, for example, where you can pay in Gomel, Moscow or any other city/town.

How are payments made for purchases? Exactly the same as if the buyer pays with any other bank card. It must be presented at the checkout and a financial transaction must be carried out through the terminal (by entering the PIN code). But the funds are not written off immediately. The entire purchase amount will be divided into 2-12 parts and will be written off monthly. The first payment will be made exactly 30 days from the date of purchase.

Is it possible to pay abroad? At the moment such a function is not provided. Is it possible to pay for utilities with Halva? Yes, but only if the company providing the service (supplier of electricity, gas, water, etc.) cooperates with the bank under the program. Unfortunately, there are few of them now and they work mainly in large cities or regional centers. Representatives of Sovcombank and MTBank assure that soon it will be possible to pay for utilities in almost any village, but specific dates have not yet been indicated.

How to pay off debt

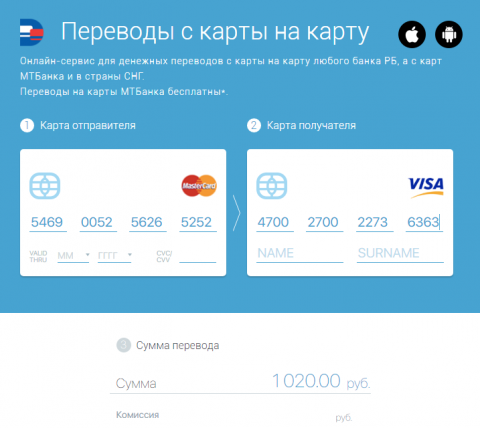

Where can I pay for the Halva card? The most convenient option is at the cash desk of a Sovcombank or MTBank bank branch for cash. In this case, no commissions are charged from the client. You can also use:

- bank transfers (in this case, a commission may be charged for the transfer itself by the bank from whose account the transfer is made);

- self-service terminals (there will be no commissions here either);

- in some partner stores (the exact list should be checked on the official website; a commission is provided in favor of the partner);

- in your personal online account on the official website of Sovcombank and MTBank (if you have an open bank account or any card, including a salary card).

Until what date is payment by card due? If the purchase was made, for example, on September 20, then the first payment must be made before October 20. The next one is until November 20 and so on. For each installment plan, the payment schedule is individual. You can also view it either on the official website or in the Halva mobile application (available for phones running iOS and Android).

If payment is not made on time, the debt will be charged the standard interest rate on the loan (according to the terms of the agreement). And when making subsequent payments, it is this debt that is written off first, and only then the installment plan itself.

Card limit

It is set individually for each client and depends on the information provided to the bank. Over time, if there are no debts and payments are made on time, the limit can be increased (in the online account).

How to pay with a Halva card if the established limit is not enough to make a purchase? For example, a client wants to purchase a laptop worth 40 thousand rubles, but the limit is only 30 thousand. In this case, part of the installment plan (at least 10 thousand rubles) must be repaid immediately, at the time of execution of the transaction. That is, the card itself must have at least 10 thousand client funds deposited into the account in advance. And the remaining 30 thousand can be repaid within 2-12 months (according to the terms of the installment plan).

And it’s worth noting that you can pay for several purchases at once. The main thing is that their total amount fits into the total allocated limit (in the above case - 30 thousand rubles). The number of executed transactions is not limited. That is, theoretically, you can purchase at least 10 thousand goods.

Using the card in any stores

Since mid-2016, payments using the Halva card can be made in any stores with installed payment terminals, but the card holder’s funds will be debited. You will not be able to use the allocated limit (overdraft). So, in fact, this card can already replace a traditional bank card. The only drawback is this. Until 2016, such a service was available, but later Sovcombank refused it without specifying the exact reason.

In total, you can find out where to pay with a Halva card on the official websites of the project. You can track your account status, as well as the installment payment schedule, in your online account. This information can also be obtained in the Halva mobile application. You can also pay for purchases outside of store partners, but only using customer funds, without using an overdraft.