How to get a loan at Sovcombank for a pensioner at 12 percent?

A cash loan for pensioners at 12 percent at Sovcombank is a profitable banking offer worthy of a more detailed consideration of the conditions and requirements. What percentage of the loan is offered by the bank, the procedure for registration and how long to wait for a response from the lender - questions of interest to pensioners and disclosed in this material.

What are the terms of the loan?

Sovcombank offers a loan at 12 percent per annum to clients whose age at the time of the final payment of the debt will be 85 years.

A pensioner is required to have Russian citizenship, the ability to be in touch, have a mobile or home phone and be registered in the country. Permanent residence must be located in the city where there is a branch of Sovcombank, or in a nearby settlement, but not more than 70 kilometers from its borders.

The best loan offers of 2019:

| Amount, rub: from 5,000 to 400,000 | |

| Amount: from 25,000 to 3 million rubles. | |

| Amount: up to 4,000,000 rubles. | |

| Amount: from 10,000 to 1 million rubles. | |

| Amount, rub: up to 1,000,000 | |

| Amount, rub: from 300,001 to 1,000,000 | |

| Sum: | |

| Amount, rub: up to 2,000,000 | |

| Amount, rub: up to 700,000 | |

| Amount, rub: from 100,000 to 1 million. | |

| Amount, rub: up to 2 mln. |

Loans to pensioners, both employed and unemployed, are issued by Sokcomombank with two documents:

- Passport of a citizen of Russia;

- pensioner's certificate;

Loan agreements at Sovcombank are approved along with a package of voluntary financial and insurance protection for a pensioner acting as a borrower.

You can issue a loan product at 12 percent per annum for a period of one year in the amount and currency of 100,000 Russian rubles.

The interest rate depends on the percentage of targeted spending of funds issued by the bank and represents the following picture:

- 12% - with the targeted use of more than 80% of the financial resources from the DS provided by Sovcombank;

- 17% - purposeful use of less than 80% of the DS issued at the disposal of the client.

These percentages apply to individuals, both with and without financial protection.

How to calculate payment?

There is no online loan calculator on the bank's website, but there is already calculated information on a loan at 12 percent:

Calculations of other amounts, terms and loan products are carried out by the bank's specialists directly in the branch itself.

Registration procedure

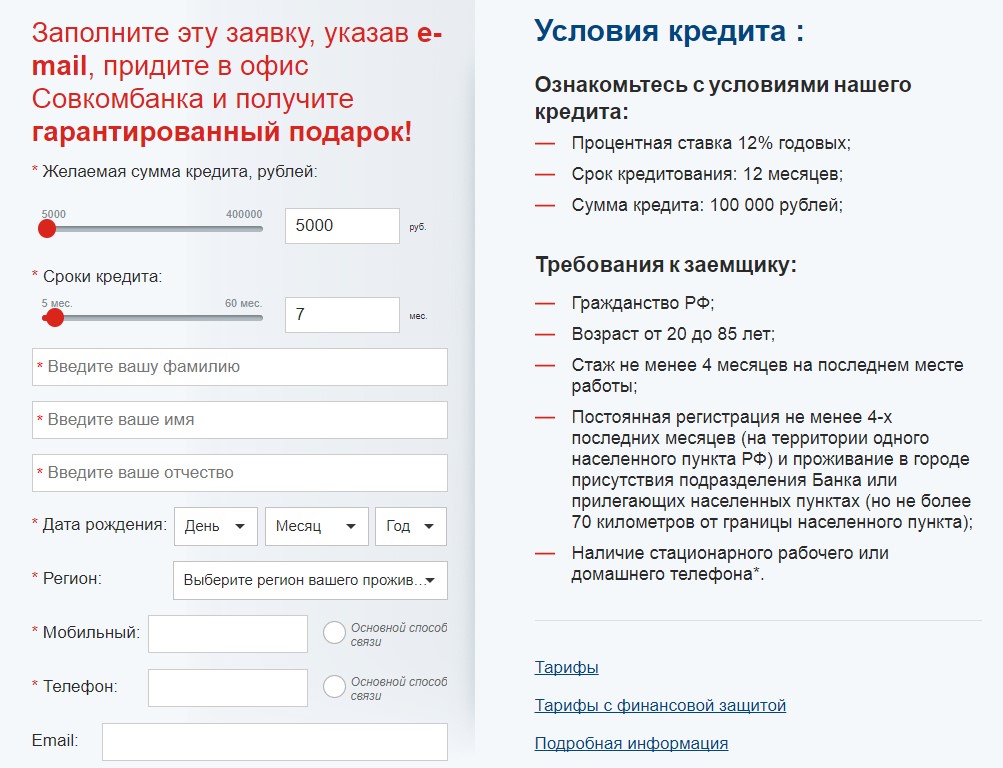

On the official website of Sovcombank, in an understandable and accessible form, there is a function for filling out an online application for a loan. Having correctly entered all the fields of the questionnaire with a personal e-mail address, the pensioner takes part in the campaign for a guaranteed gift when visiting the office.

Online application form on the website of Sovcombank

Online application form on the website of Sovcombank The client receives a preliminary response on the day of registration of his application, the final decision is considered no more than five business days.

Pension Plus or 12% Credit

Sovcombank offers its customers a wide range of loan products for every taste. The advantage of this bank among a number of others lies in the cooperation with working and non-working pensioners under the age of 85 years. Depending on the needs, goals and opportunities, a pensioner can take any offer he likes.

The table shows comparative data of the Pension Plus product, specially created for this category of people, and the most profitable loan today at 12 percent per annum.

| Loan offers and conditions | Loan at 12 percent | pension plus |

|---|---|---|

| Term | Up to one year | 12 to 36 months |

| Annual percentage | From 12% to 17% | From 19.9% to 29.9% |

| Sum | Up to 100,000 rubles. | From 40,001 to 299,999 rubles. |

| Age limit | Up to 85 years | |

| Financial Protection Entry Fee | 12% | 9.6% to 18.6% |

Despite the fact that the Penson Plus package is aimed at the category of persons of the same name, it is significantly inferior in profitability to a loan at 12 percent. Even having received a five percent discount for transferring and receiving a pension through Sovcombank, the annual interest rate does not decrease to the desired level.

Its positive properties are:

- Absence of "paperwork" - the program does not require additional certificates, collateral, guarantors;

- Servicing pensioners when applying for this loan offer out of turn.

About Sovcombank loans

For pensioners, the bank opens up many opportunities, and the main thing is a loyal requirement regarding the age of an elderly person. A huge list of different programs is available to any client under the age of 85 and does not require additional guarantees for the return of DS, except for social security.

| Loan product and its features | Loan term | Amount (rubles) | Interest rates |

|---|---|---|---|

| "Standard Plus" Consumer credit with the ability to use for different purposes. | From 18 months up to three years. | 40 001 -299 999 | 23,6 % - 34,9% |

| "Express plus" Among the required documents is only a passport of the Russian Federation. | From 6-18 months | 5 000 – 40 000 | 24,9% – 34,9% |

| "For responsible plus" Provided to couples and clients with higher education. | 18 to 36 months | 40 001 -299 999 | 19,9%- 29,9% |

| On the security of a car | From 18 -60 months. | From 50,000 to 1,000,000 | 17 %- 19% |

| "Superplus" Required documents: income statement, personal income tax. | From 12 to 60 months. | From 200,000 to 1,000,000 | 19% - 23,9% |