How to use zapsibcombank bonuses

Zapsimcombank (it is one of the largest banks in the Ural Federal District in terms of assets, its head office is currently located in the city of Tyumen) has a special bonus program. When paying for goods and services, its participants benefit from paying with a card, not cash. After all, for each purchase made, bonuses are awarded in the amount of five percent of the spent. Accordingly, the more expensive the purchase, the more it returns with bonus points. At the same time, it is worth noting that the program is not intended for all cards - for example, it is not available for holders of Business cards and supercards with a 100-day Platinum credit limit from the bank in question.

How to join the Bonus program

To take advantage of the program, Zapsibkombank customers must first subscribe to it. This can be done in several ways:

- at the Zapsibkombank ATM (for this you need to select the section "Service Management", and then to the subsection "Loyalty program");

- on the bank's website (here you first need to select the item "Cards" and then click on the link "Enable Loyalty Program");

- at a bank branch (you just need to approach a free employee and make your request).

How to spend Zapsibkombank bonuses and other important information about the loyalty program

- The user has the right to freely dispose of bonuses only after debiting funds for the operation, as a result of which these same bonuses appeared on the account.

- Bonuses are awarded only for transactions worth more than three hundred rubles.

- The maximum number of bonus points for accumulation by cards is determined in accordance with the level of the card. For example, for Gold format cards (it doesn't matter if it is basic or additional) - the maximum possible number of bonuses accrued per year is 7500, for Classic or Standard format cards - 3000 bonuses per year.

- Interestingly, bonuses are accrued here (unlike a large number of other similar programs) both for purchases in the territory of the Russian Federation and abroad.

- One bonus is equal to one ruble for ruble cards. And for currency cards, 1 bonus is considered equal to 3 US cents or 2 euro cents.

- Bonuses can be exchanged for a discount of up to 99 percent of the total cost of purchased goods and services.

To activate bonuses, send an SMS to the short number of the so-called mobile bank or use the Personal Account on the Zapsibkombank online resource. In the Personal Account, you just need to change the option in the appropriate column "Stash" per option "Spend". Here you have the right to specify the limit of bonus points and choose exactly those categories of stores and enterprises in which you want to buy. When you activate bonuses and make a payment with the appropriate card, Zapsibkombank will automatically calculate the exact amount of the discount.

The validity period of bonuses is one year from the date of activation of the program. If during this period they have not been used by the program participant, they will “burn out”. You can always see the date of "burning out" (and the beginning of a new annual period) in your Personal Account on the Zapsibkombank portal.

When there is no bonus accrual

So, Zapsibkombank bonuses are not accrued in the following cases:

- during operations of cash and non-cash replenishment of the card;

- when withdrawing cash from an ATM;

- when transferring from card to card (in particular, using full details);

- in operations related to deposits (deposit opening, replenishment, withdrawal, closing);

- when repaying loans (regardless of the method);

- when paying for utilities, mobile and Internet communications, cable TV;

- when paying for public services (fines, alimony, paying taxes, and so on);

- in case of mortgage payments, purchase of bonds and other securities;

- when paying for brokerage and other financial services.

In addition, bonuses are not awarded if you purchase from network marketing companies and companies that sell lottery tickets or casino chips. If you pay with a Zapsibkombank card at fast food restaurants or at Russian Post offices, bonus points will not be credited either. The cardholder also cannot count on bonuses when paying for certain transport services (paying for a taxi, purchasing metro passes, tickets for buses, trains, electric trains, etc.). We especially note that in this case we are talking only about ground and underground transport. When paying for air travel, it is possible to receive and use bonus points.

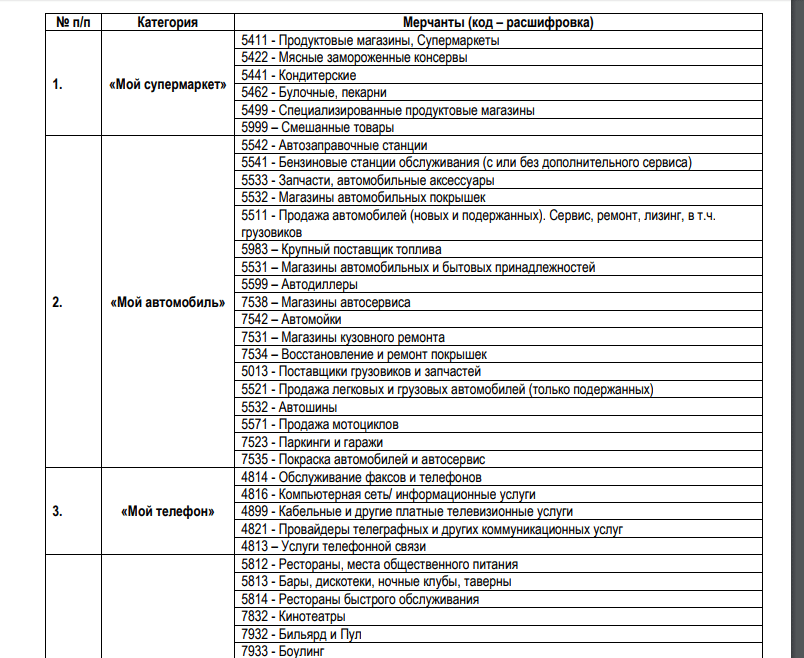

Available and unavailable MCC codes for users of the Zapsibkombank loyalty program

For clients who are thinking about how to use Zapsibkombank bonuses as efficiently as possible, it is advisable to have an idea about MCC codes. The English abbreviation MCC stands for Merchant Category Code, and simply put, this is the code for the direction or scope of the outlet. This code exists in the format of a four-digit number. These numbers are assigned to trading platforms by the issuing bank for further provision of acquiring services. That is, the MCC code is required for payment using plastic cards of Visa, AmEx, MIR, MasterCard payment systems. Today, the MCC code is assigned directly when setting up a POS terminal - this takes into account the information that was indicated by the representative of the outlet in the questionnaire for the issuing bank.

On the website of Zapsimkombank there is a document with a list of all MCC codes of outlets where you can spend or just get bonuses. They are divided into several groups:

- « My travels» ;

- « My technique» ;

- « My clothes» ;

- "My car";

- "My Supermarket";

- « My phone» ;

- "My health and beauty";

- « My entertainment» .

In addition, the terms of the program specifically stipulate that the bonuses available on the account cannot be credited or spent on transactions with certain specific MCCs - for example, 4111, 4131, 4812, 4814, 4821, 4900, 5046, etc. A complete list of such "Forbidden" MCC can also be viewed on the official website of the bank.