How and to whom can I get a loan from Sberbank

Any adult citizen of the Russian Federation who has reached the age of 21 and is not older than 75 years may well receive a loan. If a person is not a citizen of the Russian Federation, but permanently resides or works in the country, he has the right to receive a loan for the period of temporary registration. Credit products of this bank can only be used by working citizens or pensioners.

Important! For those who already use Sberbank products or are a payroll client, that is, receive a salary or pension on the card of this bank, in order to receive a consumer loan, you do not need to provide a certificate confirming the level of income and a certified copy of labor.

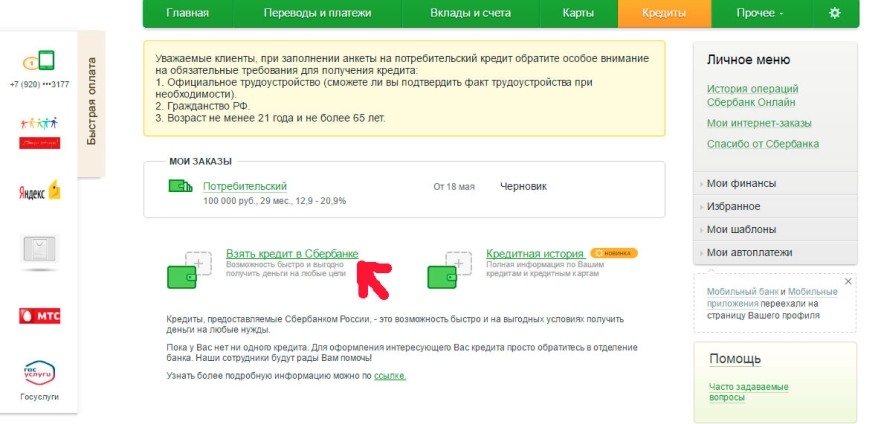

It is much easier for clients to apply for any loan using the Sberbank Online service. To do this, you need to go to your personal account (enter your login, password, which can be obtained when issuing a debit card).

At the top, select the Loans tab (in the figure it is highlighted in orange), click "Take a loan".

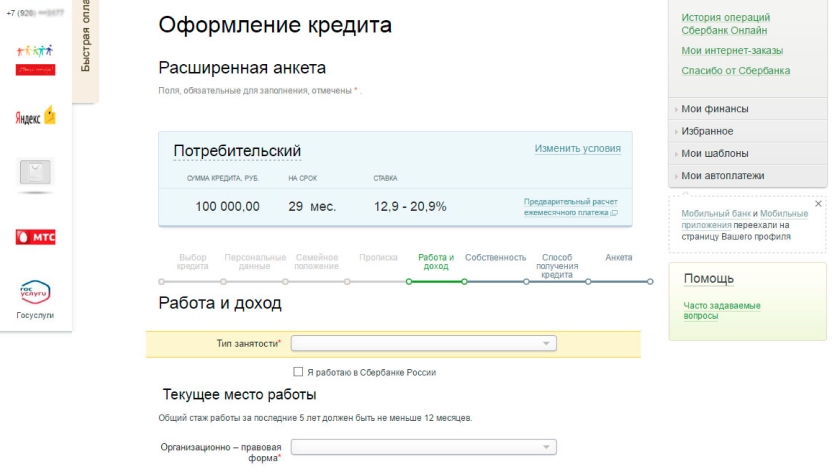

Fill out the form as required:

- select the required amount

- choose the term of the loan,

- indicate full personal data (full name, passport data, marital status),

- provide information about the place of work, income, family expenses,

- fill out a borrower application.

At any stage of filling out the request, if you have any questions or difficulties, you can contact the 24-hour customer support service by phone. The operator will indicate the necessary information from your words. Then the application will be considered. Then you will be invited to the bank's office to receive a loan.

In all other cases, in order to get a loan, a citizen who is not a client needs to contact any nearest branch to fill out an application. You will need to have the following package of documents with you (originals and copies):

- passport of a citizen of the Russian Federation with a residence permit indicated in it or a document confirming registration in the territory of the country,

- a copy of the work book certified by the employer,

- certificate of income form 2 personal income tax or in the form of a savings bank,

- pension certificate (for pensioners),

- additional documents, depending on the type of loan.

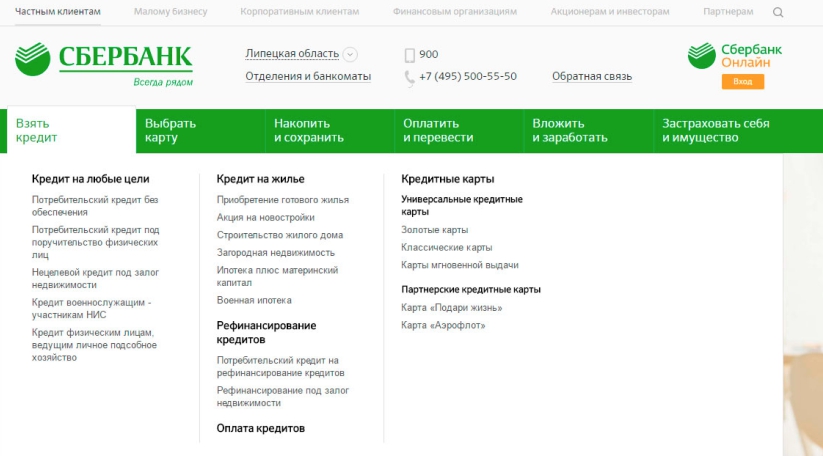

Sberbank loan products

Money in the bank can be taken for different purposes and on individual terms. The Bank offers the following loan products to its customers:

| Loan for various purposes | Housing loan | Refinancing of other loans | Credit cards |

|---|---|---|---|

| - without guarantors | - for the purchase of finished housing (used and new buildings) | - without collateral | - gold card |

| - with a guarantee | - to build a house | - secured by real estate | -classic map |

| - secured by real estate | - using funds from maternity capital | - instant issue card | |

| - for military personnel | - military housing | ||

| -for leading subsidiary plots |

If the loan is issued with guarantors, then each of them provides exactly the same package of documents. To apply for a loan secured by property, it is necessary to provide documents confirming the fact of ownership of real estate (the contract under which the property was purchased, a certificate of ownership). If it is necessary to apply for a mortgage loan using funds from maternity capital, you will need to provide the original and a copy of the maternity capital certificate and a special certificate of the balance of the capital, marriage and birth certificates. When applying for a loan under the program for military personnel, a military ID is required. For any mortgage loan - a package of documents for the property being financed.

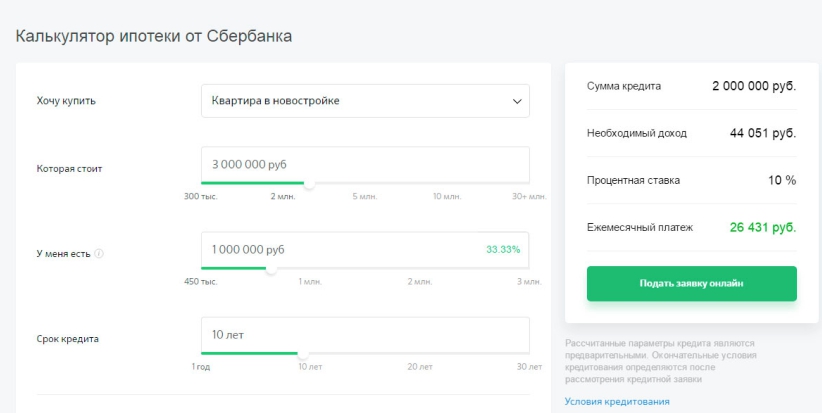

Mortgage lending in Sberbank

A very convenient Sberbank service is DomClick. If you need to take a loan to buy a home, you can fill out an application on this site, calculate the monthly payment.

By submitting an application on this site, you can reduce the interest rate by taking out life or property insurance and electronically completing the transaction through the DomClick real estate center. Thus, the purchase of an apartment or house becomes as fast and comfortable as possible for the client.

In this bank, lending to both individuals and legal entities is possible. There are several lending programs for small businesses. In order to get a loan, an entrepreneur needs to contact the lending division of Sberbank PJSC to familiarize themselves with the conditions and obtain a loan.