How to determine whether a Sberbank salary card is or not. Types of Sberbank salary cards. Parallel with credit

Salary card from Sberbank is a fairly popular product. After all, in all budget and commercial organizations wages It is customary for employees to be issued with the help of bank transfer. Of course, there are still those who pay bribes in envelopes, but they are becoming a thing of the past. Therefore, we decided to consider which salary card is best to open at Sberbank.

What are the cards?

First, you need to find out whether your employer has open salary projects in this bank. After all, the quality of service is directly related to this. Ordinary employees who are going to order a card from Sberbank and receive money on it monthly under a salary project between the enterprise and the bank will be offered to issue classic cards. This could be VisaClassic or MasterCardStandard.

Even small managers at various levels can count on VisaGold and MastercardGold. In any case, the service will be completely free. After all, according to this tariff plan monthly payment the employer contributes.

If you want to issue another card or issue another one, you will have to pay for it yourself. This could be a card called “Give Life”, “MTS” or “”.

With the Gift of Life package, you will transfer part of the money you receive to a fund to help seriously ill children. This amount will cost you pennies that you won’t even notice. After all, in essence, this is a simple rounding of change.

By choosing an Aeroflot card, you will receive special points that will be counted when purchasing airline tickets for this company.

If you decide to open an MTS card, then you will receive bonuses for purchases on your mobile account and when purchasing any services of this mobile operator.

If your employer does not have a specially signed agreement with Sberbank, you can also open a salary card with them. But, to do this, you need to contact the settlement department of your enterprise with an application in the established form. At the same time, you will choose a salary card yourself. Be sure to consider your interests, such as interest on cash withdrawals, online payments, ATM swipes abroad.

The cheapest card is Electron. And the highest status is Platinum. At the same time, the most common Sberbank card for salary projects is the Classic package.

Types of salary cards

In general, Sberbank salary cards are divided into three large groups. This could be Maestro, Visa or MasterCard. Maestros are not widespread abroad. But, the level of their service is approximately the same as on a Visa or MasterCard. A an additional bonus What happens is that the bank will issue you a card completely free of charge.

The classic options, Visa and Mastercard, will give you the opportunity to pay for purchases in any country on the globe. Their release will cost you 750 rubles. This figure will have to be paid for the first year of service, then it drops to 450 rubles.

The service life of the card is written on the front side. For a salary project, it usually does not exceed three years. You can pay attention not to the classic visa, but to Visaelectron. This card is much cheaper. Opening and the first year of service, as well as subsequent years, costs 300 rubles per year. Electronic Visas are fully suitable for paying at terminals and on the Internet. Please note that if you make the card yourself, you will have to pay for the service. And if your boss is the initiator, then these costs fall on him.

Withdrawing cash from a card

You can withdraw cash from any ATM, and it doesn’t matter whether it belongs to Sberbank or a completely different one financial organization. Of course, other ATMs will charge a fee. We recommend that you ask the bank employees who will give you the card. You will also have access to transfers to other accounts, paying for things or products online, paying through portable terminals and withdrawing cash abroad.

How to apply for a Sberbank salary card

Before you apply for a salary card at Sberbank, we recommend that you get a package necessary documents. This could be a passport, proof of annual income, a copy work book or contract. Naturally, all this must be supported by copies and special seals. After this, you can contact the bank branch.

You must come there in person. The consultant will give you a form to fill out. Essentially, that's all.

Then you just have to wait for it to be made. Typically this process takes place within two weeks. But, if you want to apply for a Momentum card that is not personalized, they will give it to you right away. You will also need to sign an agreement when receiving the card. The last step is to activate it at the ATM. If you, and not your employer, pay for the service, the cost of annual salary card service must be paid immediately.

When you are hired, you are given a separate card on which your wages are calculated. There are often cases when an employee himself opens a separate salary card, the number of which is entered by the accountant into the accrual system, after which payments are made to this card every month.

What is a salary card?

A salary card is the same as a debit card; you do not have access to a credit limit, but you can perform the same transactions as with a regular card.

Types of Sberbank salary cards

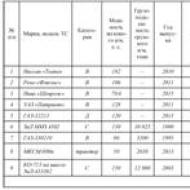

Since a salary card is a regular debit card, we can use one of the many types of Sberbank cards:

MIR and Visa salary cards, what are the differences?

Civil servants and public sector employees began to be issued MIR cards instead of the usual Visa. If you do not work in a government agency, you can choose any card and designate it as a salary card, but if you receive a salary in the civil service, you must, before July 1, 2018, change your salary card to MIR.

What is the MIR salary card?

MIR is an analogue of Visa and MasterCard; in order to strengthen the economy, it was decided to create its own payment system. This decision was prompted by the introduction of sanctions.

Advantages of the MIR salary card

- Free service (not available in all banks; Sberbank is just starting to develop a program with free service)

- Free transfers to Visa or MasterCard

Disadvantages of the MIR salary card

- Only ruble accounts

- Inability to pay for purchases

- Works only in Russia

- The service price is the same as for Visa or MasterCard

Price for servicing a Sberbank salary card in 2018

- Premium card – service 4900 rubles per year

- Gold card – service 3000 rubles per year

- Classic card - service for the first year 750 rubles, subsequent years 450 rubles

- Youth card – service 150 rubles per year

- Virtual card – service 60 rubles per year

- Aeroflot card - service 900 rubles per year

- Momentum card - free service

How to get a Sberbank salary card?

A salary card, except for the Momentum card, can be ordered online on the Sberbank website. The instructions below are written for the most common classic Sberbank card; the design of other cards does not differ significantly:

How long does it take to make a map?

It is impossible to give an exact time; on average, the preparation of the card and its arrival at the branch takes 10 days.

Advantages of a salary card from Sberbank

There are no advantages of a salary card; you receive bonuses and promotions, just like with a simple debit card. Advantages of a debit salary card:

- Managing expenses using Sberbank Online

- Bonus program “Thank you from Sberbank”

- Convenient payment for services and purchases

- Safety of funds even if the card is lost

Disadvantages of a salary card from Sberbank

- If you are a government employee or a student on a budget, you cannot choose a card

- Switching to the “MIR” card type

How to close a Sberbank salary card?

A Sberbank salary card can only be closed at a Sberbank branch, the procedure is as follows:

- It is necessary to write an application to close the card

- Withdraw cash or close existing debts, it is important that the card account is zero

- Hand over the closed card to the bank employee

Do I need a reissue for a Sberbank salary card?

A salary card needs reissue like any other. The issued card is valid for 3 years. Before expiration, it is produced new map, you will be informed about your arrival at the Sberbank branch via SMS. You need to come to a Sberbank branch with your passport and pick up the card.

What to do with a salary card after dismissal?

You can use it freely. Of course, cards such as “Momentum” and “Mir” are not very suitable for paying for purchases, but you can use these cards to transfer funds. If you do not want to use the card, you need to close it, as when using a classic card, a service fee is charged.

Is it possible to get a loan on a salary card?

The loan is easily credited to your salary card. Also, holders of salary cards are given loans more willingly and quickly, since the employer has all the necessary information about you. Some cards have an overdraft, you can spend a little more than you have on your balance and return the amount spent with interest.

Reviews of Sberbank salary card

Below are reviews from real salary card owners:

Review 1:

Advantages:

Convenient, profitable, informative

Flaws:

Yes, in Sberbank offices they point out that salary card holders are provided special conditions lending. But during these five years I have never taken advantage of these conditions. When it was necessary to take out a loan, the lending conditions from our native Sberbank turned out to be worse than the conditions of another bank, so we turned to their competitors. You often receive SMS messages on your mobile phone with an offer to take out a loan from Sberbank on special conditions, but after calculating all the interest, it turns out to be too much overpayment. But if a vital need arises, we may take advantage of their offer.

So, to sum up all of the above, I am satisfied with my Sberbank of Russia salary card and will continue to use the bank’s services. I hope they don’t change their salary bank at work.

Review 2:

Advantages:

for me no;

Flaws:

expensive maintenance;

Overall, the card is not bad, it opens up a lot of possibilities. It’s just bad luck, I practically don’t use any of it. I don’t have a salary card, I don’t go abroad, it’s too early to order cards for my child. Well, I’ll use it for a year, since I already paid for it, and I’ll go and give it up.

For those who travel a lot, they will connect automatic payments or issue additional cards in principle a good option. Well, or those who receive a salary for it. After all, many employers cooperate with Sberbank.

Review 3:

Advantages:

Flaws:

bad service, they make mistakes in spelling the last name

The appeal to Sberbank was as follows. They first accepted a statement of complaint. Having said that if it is their mistake, they will re-release it. I wonder whose mistake this could be? Mine? Funny! Illiterate! Within the specified period they should have contacted and announced a decision on the application. There is no answer from Sberbank. By calling hotline, the operator said that they admit their guilt, that they did not indicate the last name correctly, but they will not reissue the card for free, you need to pay 150 rubles.

The conclusion is this: when you order a personalized card, and issuing one costs money, if Sberbank messes up with the name on the card, they will not re-issue it for you for free, you will have to pay them again, for their own mistakes, even if they admit their guilt.

Review 4:

Advantages:

Sberbank-Online rules

Flaws:

They didn’t provide a contract for the card! Imposing additional services.

Most recently, our organization switched to Sberbank of Russia salary cards. Representatives of the Bank came directly to our work to issue cards. And they brought with them something like a portable Bank terminal. We completed the application very quickly because the employer provided all the necessary information in advance and they already brought us ready-made cards. To my question: Where is the agreement on the card? I received the answer: Here is a card, here is an envelope with a password - you don’t need anything else... Somehow strange in my opinion... Then we were offered to activate the card immediately on a portable terminal. And the Bank employee, without asking, starts connecting me to the service" Mobile bank". In response to my objections, I receive an answer that the first two months the service is free. When I persistently refuse the additional service again, I receive a bullshit version that claims without this, card activation is IMPOSSIBLE! What? What kind of nonsense? If my review is now being read by Bank employees answer: isn’t it enough to simply check the card’s balance? And why don’t they give me an agreement when registering? And why do they impose an unnecessary additional service? I can perform all the necessary operations by logging into the Sberbank-Online application from my smartphone. Why do I need your paid one? Mobile banking?

The salary arrives on the card on time. It is very convenient to make payments and make transfers through Sberbank Online. I recommend it for this alone. And there is a huge minus for the work of employees in imposing services...

All the best!

Review 5:

Advantages:

free service, bonus program

Flaws:

Surprisingly, despite the not very positive attitude towards to this bank, the service turned out to be very good. Money arrives on the card the same day, without delays. There are a large number of ATMs where you can always withdraw money without any problems. Card maintenance is completely free.

Plus, another small bonus was the bonus program from Sberbank Thank You, which awards small bonuses from all purchases made. It's a small thing, of course, but still nice.

So this time Sberbank was a pleasant surprise.

Receiving a salary on a plastic card has become so commonplace that many have already forgotten how they stood for hours at the accounting department’s cash desk, receiving their salary in the first days of the month. You can receive your salary on a debit card of any bank, but in this article we'll talk about the advantages of a Sberbank salary card.

What is the difference between Sberbank salary cards

As already mentioned, a salary card is a debit card. Funds are credited to the card account in the form of salary, pension, scholarship, various social payments, produced non-cash. You can transfer money to a debit card from other cards, accounts, passbooks, including making transfers from electronic wallets etc. You can also top up your card balance with cash through a bank cash desk or ATM.

In other words, the account of such a card contains any receipts of money on the card that are not related to loans or bank loans. For borrowed funds The bank issues a special credit card in your name.

To get a debit card, just take your passport with you and write an application by contacting any Sberbank branch. And to get a credit card, the bank must first approve your loan application. There are a number of other differences that are discussed in other articles on the site.

Almost any Sberbank debit card can be a salary card: Visa Classic, MasterCard Standard, Visa Electron, Maestro "Student", but most often entry-level bank cards are used to receive salaries: Sberbank-Maestro and Visa Electron. These plastic cards have a minimal annual maintenance cost and are equipped with almost all the capabilities of modern bank cards.

Annual maintenance cost Visa cards Electron - 300 rubles per year. For comparison, the fee for annual service credit card Sberbank Standard Master Card and Visa Classic is 750 rubles.

You can find out more about what cards the bank issues and their features on the Sberbank website, or by calling the toll-free phone line 8800-555-55-50

to the bank support service.

Advantages of Sberbank salary cards

There is no special card, just for receiving salaries. It’s just that many enterprises sign an agreement with the bank to open an individual bank account for each employee for non-cash transfer of wages, bonuses and other payments. As a rule, in this case, you receive a plastic card completely free of charge, since the cost of annual card maintenance is borne by the company. Here's your first advantage.

The main advantage is that you have the opportunity to make purchases, pay for housing and communal services, traffic police fines, taxes, etc. without wasting a lot of time visiting the post office or bank. Using the card is simple and easy minimal commissions You can top up your phone balance and make a number of other payments, especially if you take advantage of the additional services Mobile Banking and Sberbank Online. With these services, you will no longer need terminals or ATMs. You can make a payment anywhere and anytime using just your mobile phone.

Since monthly payments are consistently received into your salary card account, you gain another advantage - the ability to easily apply for a loan from Sberbank without collecting numerous income certificates.

In addition, Sberbank offers an overdraft for salary card holders. This is a kind of short-term small loan, stipulated by the contract bank for salary card. Convenient to use additional amount money when buying expensive household appliances, or simply “borrow until payday” a small amount at the bank without visiting the office. You simply withdraw a small amount from an ATM, “going into the red,” and when your salary arrives in the card account, the debt is automatically repaid. The overdraft limit is negotiated individually and depends on the amount of monthly cash receipts on the card in the form of a salary.

If you need your relatives to be able to withdraw money from the card account without your participation, you can issue additional cards from Sberbank in the name of a relative or a trusted person. And then, while on a long business trip, your family will be able to receive part of your salary independently, in the amount that you specify in the contract.

If you often make purchases using your card, Sberbank offers salary card holders numerous bonus programs and discounts on purchases of goods and services in stores and services that have service agreements with the bank. Follow regular updates on discounts and special offers on the bank’s website and receive discounts on the purchase of goods and services.

Additional services of Sberbank for salary cards

The services "Mobile Bank" and "Sberbank Online" greatly increase the possibilities of any plastic card, making payment transactions convenient and secure. You will be promptly informed by the bank about any movement of funds on the card account. If necessary, you can instantly block your card account.

When paying for purchases in an online store, you no longer have to provide card details, since one-time passwords sent by the bank to the number are used instead mobile phone, “linked” to the card, etc.

You can read more about how to connect these services and their capabilities in other articles on the site.

The Mobile Bank and Sberbank Online services can be connected to any Sberbank card. To do this, you just need to indicate in the contract the mobile phone number registered in your name. You can activate these services after receiving the card by contacting the same Sberbank branch with your passport. An incomplete package of these services can be activated without visiting the bank, through a terminal or online.

Pay attention to the publication date of the article, possibly at the moment Some information is out of date or has changed.

Publication date: 12/05/2014

In order for the accounting department of your company to be able to transfer your salary to the card, you need to inform the accounting department employees about the card account details. The card number and the card account number are not the same thing. The card number is on the front side of the card (16 digits), and the card account number is indicated in the “secret envelope” (20 digits).

When withdrawing cash from a salary card at an ATM, you are required to enter a PIN code. Follow the rules for safe use of bank cards, do not allow strangers to observe your actions, cover the keyboard with your hand when typing the code. Don't forget to pick up your card and receipt.

After receiving the card, you must activate it. You can activate in different ways, the simplest of which is to request the card balance at an ATM. The card can be activated by calling the bank's support service.

For pensioners, Sberbank offers special conditions for obtaining a card. Firstly, free annual maintenance for an entry-level pension card. Secondly, for leftovers cash Pensions on the card account can accrue interest, just like on funds in a personal savings book account.

You can make purchases online using your Sberbank salary card. To avoid providing card details, make purchases in online stores using safe technology 3-D Secure.

Counted: corporate, overdraft cards, pension, student, salary cards.

Organizations and institutions that use hired labor are required to pay remuneration to employees on salary cards. Such cards are issued to each staff unit as part of the salary project. The largest operator of salary projects in Russia is Sberbank. Employees of almost all government agencies and a significant part of commercial and private enterprises receive salaries on Bank No. 1 cards.

What is a salary card

Each institution must have a current account with any credit institution operating in the Russian Federation. Organizations connect to the salary project of a conditional bank, after which each employee is issued personalized card to transfer remuneration to her account (salary card).

The introduction of salary cards into circulation occurred due to the need to control the income of the population from tax authorities. Credit organizations provide all necessary information upon the first request of the territorial bodies of the Federal Tax Service.

Salary cards are issued from zero balance. There is no credit limit or overdraft placed on their account. By default, they are intended only for salary transfers. Availability credit limit or overdraft is excluded by itself, since the formal recipient of such cards is an organization or enterprise.

In addition, such cards initially do not contain any additional or paid services. Considering that the main flow of funds to the card account comes in the form of wages, the organization cannot decide for its employees about connecting to certain paid services.

Salary cards have all the key options required for any plastic card. They provide for the use of the following functions:

- Cash withdrawal.

- Making incoming and outgoing transfers.

- Making purchases without cash.

- Connection of a number of additional services is at the request of the cardholder.

- Using a card as an additional card to a credit or debit card.

- Participation in programs and bonus promotions developed by a credit institution - at the request of the card owner.

Consequently, having a salary card, its owner can use all standard options and services, and manage his funds at his personal discretion. The client activates any other additional / paid services independently - after registration and receipt of the card.

The difference between a debit card and a salary card

Taking into account the main features of the most common salary card, we can conclude that it is a debit card. Cardinal difference debit card from credit, lies in the absence of a credit limit on the first type of cards. The bank does not trust its funds to the client, therefore it is envisaged to use only personal money. Therefore, it is considered that a salary card is a type of debit card.

At the same time, there are a number of differences. The first is additional options. For most salary projects, programs such as Cash-back, cumulative (bonus) points, interest on the account balance, and others are automatically excluded. Credit organizations issue “blank” salary cards to make the client’s income easier to control.

The second difference is the provision of security and control of operations by the credit institution. Salary cards have all the tools aimed at protecting funds and safely conducting transactions. It is salary projects that are controlled especially carefully by credit institutions, since the banks themselves are under the control of the territorial bodies of the Federal Tax Service.

This rule is mentioned for the reason that all salary cards of one project are interconnected. For example, if an organization’s accountant intentionally or mistakenly makes transactions that fall under the heading of suspicious, credit institution will be obliged to conduct an inspection, the result of which may be the blocking of the company's current account.

When a current account is blocked, all salary cards linked to it are also blocked. While the proceedings continue, the client will not be able to use his salary card. It is not known exactly how long it will take to find out the reasons. And during this entire time, cardholders will not have access to their funds.

Consequently, the salary card, in fact, is not the user’s personal card, since for any violation committed by other persons participating in the project, the card and account will be blocked without the actual fault of the other users. Taking these circumstances into account, we can summarize the following:

- Salary and debit cards provide different packages of services and programs.

- The holder is personally responsible for the debit card, and salary cards can be blocked by the bank for any violation committed by other project participants.

- The validity period of the cards is the same - 3-5 years;

Salary cards have lower limits on withdrawals and transfers than debit cards. That is why users receive wages on one card and use the other for personal purposes.

What is the difference between a debit card and a salary card at Sberbank

For most of its programs, Sberbank prioritizes cooperation with corporate or payroll clients. For example, a potential client needs to receive a regular consumer loan or a credit card from the bank's line. The chances of getting the product you are looking for will be much greater if the applicant is a salary client of the bank.

In this case, there will be no need to confirm either the length of service or the level of solvency, since the bank “sees” all this without providing unnecessary documents from the client. If you do not take into account the set of options and some differences in the rules for using cards, then there is no fundamental difference in Sberbank debit and salary cards.

For ease of use own funds holders issue additional debit cards to their salary cards. This is done so that, upon receiving wages, the money can be transferred to personal card, which will not be blocked by the bank due to the fault of an accounting employee or another participant in the salary project. It is most advisable to issue an additional debit card at another credit institution.

In relation to Sberbank, there is a rule according to which the “Thank you” program also operates within the framework of salary projects. To do this, the card holder needs to call the bank line and use the help of an operator.

For debit cards, the “Thank You” program is connected in the same way. It should also be remembered that salary cards are automatically blocked by the bank upon termination of the card holder’s employment relationship with his employer.

: If the client is not interested in using additional services and he is not interested in bonuses and savings programs, then the salary card can be used as a debit card. There are no significant differences in the rules of use.

For salary card holders Sberbank is important to know additional features“plasticity” and its privileges. Stay up to date with events(*), use available services with maximum benefit and benefit for yourself.

What types of salary cards does Sberbank offer?

A salary card is a debit card. You receive your salary into her account, transfer funds and withdraw as much money as you have.

- discounts from international partners when paying for purchases abroad;

- if the card is lost abroad, cash is issued by subsidiary banks;

- security of online purchases with 3D-secure technology;

- payment for purchases without commission abroad;

- connecting the account to international systems(Yandex.Money, WebMoney, etc.).

In 2014, the national payment systems Visa and MasterCard stopped servicing cards from banks that were subject to sanctions. The Government of the Russian Federation decided to launch the Russian NPS (National Payment System) . Sberbank was one of the first to acquire the rights to release Mir.

In December 2015, a trial pilot project was launched to service the card in all terminals.

In the second half of 2016, the issuance of new NPS Mir salary cards will begin.

Do I need to pay for servicing a Sberbank salary card?

Debit cards involve payment. The question is: who pays these expenses, the owner himself or the enterprise where he works? Look for the answer in the contract.

If the card was issued through the accounting department, then all expenses are borne by the company.

If you opened a bank account yourself, the payment falls on your shoulders.

There is an option to issue a card without paying an annual fee. Open a universal account. “Plastic” is issued without indicating the first and last name. This is a way out of the situation when issuing a salary card with zero costs for maintaining an account.

How much is the limit of a Sberbank salary card?

All banks impose restrictions on the withdrawal limit for plastic cards:

All banks impose restrictions on the withdrawal limit for plastic cards:

- platinum cards “Give Life”: 5,000,000 rubles/month and 500,000 rubles/day;

- gold cards: RUR 3,000,000/month. and 300,000 rubles/day;

- premium level cards: RUB 1,500,000/month. and 150,000 rubles/day;

- mid-segment cards: RUB 500,000/month. and 50,000 rubles/day.

For a complete list of all limits and commissions, check out the Sberbank website in the “Good to know” section, “Collection of tariffs for debit cards”.

How to get a Sberbank salary card

When you apply for a job, you automatically become a salary card holder. The organization's accountant fills out an application form to receive a debit card. Production of “plastic” takes 14 working days. It contains your initials.

It is also possible to independently issue a salary card. To do this, visit the Sberbank office. Contact a specialist to open a current account. The employee will fill out a form to receive “plastic”. Production takes 14 working days. On the appointed day, call and clarify information about the readiness of the card.

Please note: in this case, the annual maintenance fee will be your responsibility.

If you get a job, the accounting employee will provide the necessary information to receive a salary card. All you have to do is sign on the back and receive an envelope with a PIN code.

To apply for a card yourself, contact the Sberbank office. Select the office closest to your home or work. Don't forget to take your passport with you. Without it, they will not open an account for you.

There is no online application process. Previously there was such an opportunity, but the decision was made to cancel this service. Because After submitting an application online, the cardholder still visits the bank branch.

What documents will the bank require to issue a Sberbank salary card?

There are two options for card design:

- If the company where you work is connected to the salary project. In this case, the accounting employee himself collects and sends the necessary information to the bank to issue a card. All maintenance costs are borne by the organization.

- Independently contact a bank branch to issue a debit card (if the organization is not connected to the salary project).

Provide the following documents:

- passport and its copy;

- original TIN;

- application for card issue;

- certificate 2-NDFL from work for the last six months, if you want to set an overdraft limit.

In this case, you solely pay for the annual account maintenance.

What does a contract for a Sberbank salary card look like?

When you apply for a salary card, you sign an agreement.

It states:

- general provisions;

- terms and definitions;

- terms of payment;

- obligations and rights of the parties;

- liability of the parties to the contract;

- force majeure;

- dispute resolution procedures;

- duration of the contract.

In case of violation of the conditions, the document is terminated unilaterally.

If a fine is provided, the violator is obliged to pay it.

In case of late payment, the bank has the right to contact your employer. That is, the organization in which you work acts as a guarantor. Therefore, the lender is calm about the loan issued and reduces interest. Effective rate difference between salary project and the usual is 0.5-2%.

The monthly loan payment is automatically debited from your card.

How to apply for a Sberbank loan using a salary card

You can apply for a loan in 2 ways:

You can apply for a loan in 2 ways: - appear in person at a bank branch;

- fill out a form on the Sberbank website.

When visiting a bank office in person, take the following documents with you:

- passport;

- a copy of the work book;

- salary card.

When filling out an online application, go to the official website of Sberbank. Use the loan calculator to calculate the monthly payment, overpayment, commission. After that, select the “Loans” section and click on the appropriate loan program. Next, click “Apply online form” and fill it out. After 2-3 days, a branch employee will contact you and tell you the bank’s decision to issue a loan or refuse a loan.

The main advantages and disadvantages of Sberbank salary cards

The main advantages of Sberbank salary cards:

- ease of use when paying for purchases;

- mobile service with detailed information about the card balance and transactions;

- reduced interest rates on loans;

- special promotions and offers.

The disadvantages include inconvenience in terms of queues at ATMs and in the service hall. But this suggests that the bank is a popular and reliable partner in the field of financial relations.

Despite the large number of branches, customers wait for 15-20 minutes. From time to time, failures occur in the system of terminals and ATMs. But the Sberbank Online service will help out, with the exception of cash withdrawals.

- When conducting online transactions, use a computer or phone with an antivirus.

- Do not give your card password even to a bank employee.

- When visiting Sberbank Online, check the website address. It must match the name of the service. If another address appears, do not enter personal information.

- To control the spending of funds on the card, issue an account statement.

- If so, urgently contact the bank branch to block the “plastic”.

- When paying for goods and services, the cashier has the right to require you to show your passport to verify data.

- To make purchases or payments online, you do not need to enter a PIN code. If you are asked to enter this data, leave the site immediately. It could be cyber fraudsters.

- Call center specialists work around the clock and are always ready to help you.