Salary level is industry average. Where can I get data on the industry average salary by type of economic activity in the Moscow region. Industry average salary level by type of economic activity

According to tax officials, all companies should pay employees the maximum possible salaries, which will ensure an increase in payments to the budget. But the fight against shadow payments, or rather the efforts of inspectors aimed at legalizing such payments, sometimes makes conscientious taxpayers worry, who find it difficult to maintain even the same level of salaries during a crisis. What arguments can the company make in its defense?

07.10.2009"Economy and Life"

SITUATION

On September 2, 2009, we received a letter from the Federal Tax Service informing us that, due to the type of activity, our organization (LLC) is obliged to pay wages to employees of at least 22,934 rubles.

In addition, the letter contained an invitation to a meeting of the commission for monitoring the activities of enterprises and organizations regarding the remuneration of workers. But, unfortunately, the letter was delivered by mail a week later than the date of the invitation.

Our organization operates Federal law dated June 19, 2000 No. 82-FZ “On minimum size remuneration”, legislation of Moscow (tripartite agreement dated December 24, 2008, resolution of the Moscow government) and Art. 133.1 Labor Code RF.

Are there laws that stipulate that the wages of employees (literally - the level of average monthly wages per employee) are determined by type economic activity? Our OKVED is 60.21.11.

In 2008, we joined the Moscow Transport Union (MTS). Does this mean that the average wage in our organization should correspond to the average salary of organizations participating in MTS? Is this what the Federal Tax Service of Russia meant in the notification?

Minimum wage or OKVED

To date, there is no regulatory legal act, which would establish the obligation for the employer, when determining the amount of salary, to be guided by the average monthly wages per employee by type of economic activity.

Order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06/333@ established publicly available criteria for independent risk assessment for taxpayers. This document states that if the tax burden the taxpayer is below its average level for business entities in a specific industry (type of economic activity), it will be included in the travel plan tax audits. That is, this document does not oblige one to be guided by the average monthly salary of an employee by type of economic activity, but only warns the taxpayer about including him in the plan of on-site tax audits according to the named criterion.

One of the methods of combating shadow wages is to call the head of the organization to the so-called salary commission. In the capital, this commission operates on the basis of the order of the Federal Tax Service of Russia for Moscow dated February 22, 2008 No. 96.

We emphasize that the task of the tax authority is not to increase wages for employees, but to bring unofficial wages out of the shadows in order to fully transfer salary taxes to the budget.

The relationship between employee and employer, in particular wages, is regulated by the Labor Code of the Russian Federation. The salary amount is established for the employee by an employment contract in accordance with the employer’s current remuneration systems (Article 135 of the Labor Code of the Russian Federation), as well as taking into account the federal minimum wage and the minimum wage for the subject.

According to Art. 37 of the Constitution of the Russian Federation, everyone has the right to work in conditions that meet safety and hygiene requirements, to remuneration for work without any discrimination and not lower than the minimum wage established by federal law, and the right to protection from unemployment.

Article 133 of the Labor Code of the Russian Federation establishes that the monthly salary of an employee who has fully worked the standard working hours during this period and fulfilled labor standards (labor duties) cannot be lower than the minimum wage. This value is established by Federal Law No. 82-FZ of June 19, 2000 “On the minimum wage.” From January 1, 2009, the minimum wage is 4,330 rubles.

Article 133.1 of the Labor Code of the Russian Federation stipulates that a regional agreement may establish the amount minimum wage in a subject of the Federation - in relation to those who work on the territory of the corresponding subject of the Russian Federation, with the exception of employees of organizations financed from the federal budget.

The size of the minimum wage in a subject of the Federation is determined taking into account socio-economic conditions and the amount living wage working population in the corresponding subject of the Russian Federation. It cannot be lower than the minimum wage established by federal law.

According to Art. 133.1 of the Labor Code of the Russian Federation, the monthly salary of an employee working in the territory of the corresponding constituent entity of the Russian Federation and who is in an employment relationship with an employer in respect of whom the regional agreement on the minimum wage is valid in accordance with Parts 3 and 4 of Art. 48 of the Labor Code of the Russian Federation or to which the said agreement is extended in the manner established by Parts 6-8 of Art. 133.1 of the Labor Code of the Russian Federation, cannot be lower than the minimum wage in a given subject of the Russian Federation. Mandatory condition: the specified employee has fully worked the standard working hours during this period and fulfilled the labor standards (job duties).

In the capital, the minimum wage was established from January 1, 2009 - 8300 rubles, from May 1 - 8500 rubles, from September 1 - 8700 rubles. (Agreement on the minimum wage in the city of Moscow for 2009 between the Moscow Government, Moscow trade union associations and Moscow employer associations dated December 24, 2008). Salaries in Moscow cannot be lower than this level.

In confirmation of what has been said, we note that Art. 129 of the Labor Code of the Russian Federation reveals the concept of wages (wages). This is remuneration for work depending on the qualifications of the employee, complexity, quantity, quality and conditions of the work performed, as well as compensation payments(additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal, work in special climatic conditions and in areas exposed to radioactive contamination, and other payments of a compensatory nature) and incentive payments (additional payments and allowances of an incentive nature, bonuses and other incentive payments).

Article 132 of the Labor Code of the Russian Federation establishes that the salary of each employee depends on his qualifications, the complexity of the work performed, the quantity and quality of labor expended and maximum size not limited.

Conclusion: the approach to determining the salary of a particular employee depends on his professional qualities, such as qualifications, as well as on the complexity of the work, the quantity and quality of labor expended. Therefore, it is incorrect to generalize wages by industry (by type of economic activity), since there are no identical workers and they all differ to a greater or lesser extent in their level of professional knowledge.

What do tax authorities mean?

In the case under consideration, the Federal Tax Service of Russia did not mean the level of wages of employees of organizations participating in the Moscow Transport Union, but average salary by type of economic activity in a subject of the Federation, that is, in Moscow.

As follows from the order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06/333@, information on statistical indicators of the average salary level by type of economic activity in a city, district or in a whole subject of the Federation can be obtained from the following sources:

1) official websites of territorial bodies Federal service state statistics (Rosstat).

Information about the addresses of Internet sites of territorial bodies of Rosstat is posted on its official Internet site www.gks.ru.;

2) collections of economic and statistical materials published by territorial bodies of Rosstat (statistical collection, bulletin, etc.);

3) upon request to the territorial body of Rosstat or tax authority in the corresponding subject of the Federation (inspectorate, department of the Federal Tax Service of Russia for the subject of the Federation);

4) official Internet sites of the departments of the Federal Tax Service of Russia for the constituent entities of the Federation after posting the relevant statistical indicators on them.

Information about the addresses of Internet sites of the departments of the Federal Tax Service of Russia in the constituent entities of the Russian Federation is posted on the official website of the Federal tax service www.nalog.ru.

The indicator of average wages by industry is of interest not only to employees, but also to employers. First, he gives information about the correspondence of their salary level to the average level in a particular professional field. Employers can conclude that it is necessary to index wages if they are below the industry average.

Of course, the average wage indicator must be used with some conditionality. After all, the average indicator does not take into account the peculiarities of the functioning of a particular employer. Namely, the amount of remuneration of an individual employee actually depends on these specific conditions and factors.

Where to see the average salary in Russia in 2018-2019.

Average national indicators are calculated by the Federal State Statistics Service (Rosstat, formerly Goskomstat). These indicators are calculated based on the processing of static reporting submitted by organizations and individual entrepreneurs. Official statistics data are posted on the Rosstat website at www.gks.ru.

As of the end of 2018, of the most up-to-date information on wages by industry Rosstat has officially published information on the average nominal accrued wages of workers for a full range of organizations by type of economic activity in the Russian Federation for October 2018. It is indicated that the average salary in all industries in October 2018 was 42,332 rubles.

The first information on the average monthly salary in 2019 will appear on the Rosstat website no earlier than the end of February.

We talked about what nominal wages are in.

Industry average salary

Let's present data on the average salary of organizations by type of economic activity for October 2018 in the form of a table:

| Type of economic activity | Average salary (RUB) |

|---|---|

| Agriculture, forestry, hunting, fishing and fish farming | 29 295 |

| Mining | 77 382 |

| Manufacturing industries | 40 462 |

| Providing electricity, gas and steam, air conditioning | 44 901 |

| Water supply, sanitation, organization of waste collection and disposal, pollution elimination activities | 32 192 |

| Construction | 38 750 |

| Wholesale and retail trade, repairs vehicles and motorcycles | 34 424 |

| Transportation and storage | 46 993 |

| Activities of hotels and enterprises Catering | 26 356 |

| Activities in the field of information and communications | 60 969 |

| Financial and insurance activities | 83 353 |

| Operations activities with real estate | 32 034 |

| Professional, scientific and technical activities | 65 471 |

| Public administration and military security, social security | 43 591 |

| Education | 34 082 |

| Activities in the field of health and social services | 39 088 |

| Activities in the field of culture, sports, leisure and entertainment | 43 061 |

If a parent has an official stable salary, then child support in Russia is assigned in shares of his actual earnings. Often, alimony payers stop working officially, do not register with the Employment Center (PEC) and at some point stop paying funds for child support.

At the same time, they begin to accrue alimony debt, the amount of which is determined based on the size of the alimony debt in Russia. According to Rosstat, as of November 2019 it amounted to 46285 rub. At the same time, only the SWP is larger than the country as a whole.

The average salary in Russia is used to calculate alimony if payments for a child assigned as a percentage, and the payer:

- did not work (or did not work officially) during the period of debt formation;

- cannot provide documents confirming the amount of his earnings for this period.

- between the payer and the recipient;

- was;

- did not provide documents, confirming earnings or other income;

- was not registered at the employment center.

- in the event of subsequent employment of the debtor or identification of his other income, collect the accumulated debt in favor of the recipient of alimony;

- on the basis of the resolution on the calculation of the debt, apply to the debtor measures to bring him to various charges (administrative, civil, criminal).

- Part 4 Art. 113 of the Family Code of the Russian Federation;

- Part 3 Art. 102 of Law No. 229-FZ "On enforcement proceedings";

- “Methodological recommendations on the procedure for fulfilling the requirements executive documents on the collection of alimony"(approved FSSP of Russia 06.2012 № 01-16).

Thus, at its core, the average monthly salary is a theoretical value, but bailiffs widely use it in practical application, in particular, when.

When is alimony calculated from the average salary in Russia?

As you know, there are many more alimony debtors than bona fide payers, and the reasons for alimony debt can also be very different: from the real lack of a job to the concealment of income by the debtor. However, such factors do not relieve “evaders” from their assigned obligations and do not bring any particular difficulty to the bailiff: in relation to the debtor, a debt is formed and grows monthly.

The payment debt is incurred by the person obligated to pay alimony no matter, what form of collection of funds is not carried out by the draft dodger:

It is important to take into account that the bailiff will calculate the debt in shares of the SWP only if child support has been assigned as a percentage of income parent.

The alimony debt is determined by the authorized official FSSP based on the average salary in the Russian Federation, if during the period of debt formation the payer:

Calculation of alimony debt from the average monthly salary in the Russian Federation

When a voluntary notarial agreement or a court decision to collect alimony is not fulfilled by the debtor, calculate the accumulated debt for payments owed by this person. This is done in order to:

The main value used by the bailiff when , is the average monthly salary according to Russian Federation. The use of this particular indicator for the Federal Bailiff Service (FSSP) is regulated three regulations:

Art. 5.1 « Methodological recommendations…» determines the main points for calculating debt from the average monthly salary for FSSP employees:

- Information on the current average salary in the Russian Federation must be requested monthly from Rosstat or confirmed on its official website.

- Income tax individuals(NDFL), equal to 13%, when calculating debt not held.

- The moment of debt collection is considered date of actual repayment of debt.

- The calculation of alimony arrears must be carried out by an employee of the FSSP quarterly.

The debtor should remember that alimony arrears will be calculated not by region of residence payer or claimant, and according to the Russian Federation, in order to protect the rights and legitimate interests of minors in whose favor alimony payments are accrued.

Since often the “statistical” average monthly salary in the country as a whole is much higher than real income working citizen in most subjects of the Federation, then become a debtor for alimony in in this case extremely unprofitable, primarily for the payer himself(and vice versa - this is often more beneficial for the recipient of alimony).

An example of debt calculation by bailiffs from the average salary

The payer Petrenko N.N. received a monthly salary at the enterprise in the amount of 20,000 rubles, his alimony obligations for 1 child according to court order accounted for 1/4 of all types of income. Since Petrenko N.N. had no other income, monthly payment for child support was 5,000 rubles.

Wanting to avoid payment obligations and hide his income, on December 1, 2018, Petrenko quit his job and got an unofficial job in a private company (without employment contract). In March 2019, he received from bailiff resolution on debt settlement for alimony for 3 months from the average monthly salary (AMS) in Russia in the amount of 43,062 rubles. for February 2019:

- December 2018 - 10765.5 rub. (1/4 of the SWP);

- January 2019 - 10765.5 rub. (1/4 of the SWP);

- February 2019 - 10765.5 rub. (1/4 of the SWP).

As a result, the debt of gr. Petrenko N. N. from 12/01/2018 to 03/01/2019 amounted to 32296.5 rub. It turns out that if this citizen continued to officially work at this or another enterprise and paid alimony in good faith, the amount of payments for the same period would be only 15,000 rub.- which is 2 times lower.

Average salary in Russia in 2020 according to Rosstat

The very large dispersion of the average monthly salary across the regions of the Russian Federation makes it unprofitable for payers in most regions of Russia the possibility of bailiffs calculating arrears of alimony based on the average salary in the country.

Thus, according to official data from Rosstat:

- The average salary in Russia as of November 2019 was 46285 rub.- this is the value used by the bailiffs when determining the amount of alimony debt as of the beginning of 2020, since the SPA for other periods has not yet been determined;

- the maximum average monthly salary was registered in Chukotka Autonomous Okrug - 106922 rub.;

- minimum salary as of November 2019 - in the Republic of Dagestan - 26644.8 rub.

Thus, the difference in income levels between residents of regions with the highest and lowest average monthly wages as of November 2019 was 106,922 - 26,644.8 = 80,277.2 rubles.

At the same time, out of 85 constituent entities of the Russian Federation:

- Total 19 regions have a salary higher than the national average (in these regions, calculating alimony debt from the average Russian salary of 46,285 rubles may be more profitable for payers and unprofitable for recipients of alimony payments);

- in the rest 66 regions the salary level is lower than the Russian average (here, using the average salary to calculate alimony is more beneficial for the recipient and unprofitable for the majority of payers).

Full data on the average salary in Russia as of November 2019 according to Rosstat are given in the table below.

| № | Name of the federal subject | Average monthly salary, rub. |

|---|---|---|

| 1 | Chukotka Autonomous Okrug | 106922 |

| 2 | Magadan Region | 106394,6 |

| 3 | Yamalo-Nenets Autonomous Okrug (Yamalo-Nenets Autonomous Okrug) | 89778,2 |

| 4 | Moscow | 88656,5 |

| 5 | Sakhalin region | 84665,6 |

| 6 | Nenets Autonomous Okrug (NAO) | 80562,3 |

| 7 | Kamchatka Krai | 74842,1 |

| 8 | The Republic of Sakha (Yakutia) | 71688 |

| 9 | Khanty-Mansiysk Autonomous Okrug - Yugra (KhMAO) | 65039,6 |

| 10 | Tyumen region | 64492,5 |

| 11 | Murmansk region | 62516,6 |

| 12 | Saint Petersburg | 61141,2 |

| 13 | Moscow region | 54006,2 |

| 14 | Arhangelsk region | 50592,8 |

| 15 | Komi Republic | 50416,8 |

| 16 | Khabarovsk region | 48887 |

| 17 | Krasnoyarsk region | 48445,2 |

| 18 | Amur region | 48057,3 |

| Average for the Russian Federation(used to calculate alimony in all regions of the country) | 46285 | |

| 19 | Irkutsk region | 45891,6 |

| 20 | Primorsky Krai | 45372,2 |

| 21 | Leningrad region | 44719,4 |

| 22 | Transbaikal region | 44398,7 |

| 23 | Tyva Republic | 43126,7 |

| 24 | Tomsk region | 42353,9 |

| 25 | Republic of Karelia | 42187,5 |

| 26 | Jewish Autonomous Region | 41527,7 |

| 27 | Kemerovo region | 41184 |

| 28 | Sverdlovsk region | 41155,3 |

| 29 | Kaluga region | 41118,5 |

| 30 | The Republic of Khakassia | 40073,7 |

| 31 | The Republic of Buryatia | 39984,9 |

| 32 | Vologda Region | 39160,1 |

| 33 | Republic of Tatarstan | 38289,2 |

| 34 | Novosibirsk region | 38237,2 |

| 35 | Perm region | 37986,4 |

| 36 | Tula region | 36756,7 |

| 37 | Chelyabinsk region | 36470,5 |

| 38 | Republic of Bashkortostan | 36266,7 |

| 39 | Samara Region | 35895,8 |

| 40 | Nizhny Novgorod Region | 35876,3 |

| 41 | Omsk region | 35615,6 |

| 42 | Astrakhan region | 35563,3 |

| 43 | Krasnodar region | 35334,4 |

| 44 | Yaroslavl region | 34933,8 |

| 45 | Udmurt republic | 34140,8 |

| 46 | Belgorod region | 34084,7 |

| 47 | Sevastopol | 33890,5 |

| 48 | Kaliningrad region | 33842,8 |

| 49 | Rostov region | 33716 |

| 50 | Lipetsk region | 33478,2 |

| 51 | Voronezh region | 33366,3 |

| 52 | Ryazan Oblast | 33192,2 |

| 53 | Tver region | 33168,1 |

| 54 | Kursk region | 32831,3 |

| 55 | Volgograd region | 32719,7 |

| 56 | Republic of Crimea | 32564,9 |

| 57 | Altai Republic | 32499,5 |

| 58 | Penza region | 32265,1 |

| 59 | Vladimir region | 32206,1 |

| 60 | Orenburg region | 32068,6 |

| 61 | Stavropol region | 31396,9 |

| 62 | Novgorod region | 31167,8 |

| 63 | Smolensk region | 31078,4 |

| 64 | Ulyanovsk region | 30511 |

| 65 | Kostroma region | 30395,4 |

| 66 | Saratov region | 30212,9 |

| 67 | Kurgan region | 30033,3 |

| 68 | Chuvash Republic | 29858,5 |

| 69 | Bryansk region | 29843,6 |

| 70 | Mari El Republic | 29829,2 |

| 71 | Kirov region | 29574,2 |

| 72 | Republic of Adygea | 29504,4 |

| 73 | Chechen Republic | 29397,3 |

| 74 | Oryol Region | 29341,2 |

| 75 | Tambov Region | 28932,1 |

| 76 | Pskov region | 28799,7 |

| 77 | The Republic of Mordovia | 28739,4 |

| 78 | Republic of North Ossetia - Alania | 28587,5 |

| 79 | Altai region | 27885,6 |

| 80 | Republic of Kalmykia | 27729,7 |

| 81 | Kabardino-Balkarian Republic | 27597,3 |

| 82 | The Republic of Ingushetia | 27213,6 |

| 83 | Ivanovo region | 27191,4 |

| 84 | Karachay-Cherkess Republic | 26704,6 |

| 85 | The Republic of Dagestan | 26644,8 |

- Advocate

- Salary by type of economic activity

- Average salary by industry type of economic activity

- Industry average salary in 2018 by type of activity Moscow

- Industry average wages by type of economic activity

- Veteransrussian-tatarstan.ru

- Wage

Lawyer Important Topic: analysis of the activities of a motor transport enterprise (using the example of Npatp LLC) Attention Clerk.Ru Accounting General accounting Remuneration and personnel records Industry average salary level by type of economic activity PDA View full version: Industry average salary level by type of economic activity Tanyok 20.07. 2007, 12:36 We received a letter from the tax office with a request to justify the level of remuneration, because

Industry average salary for accountants

Dismissal of a parent of a disabled child: there are specifics In the case where an organization plans to reduce its workforce and, among others, an employee who is the parent of a disabled child falls under this reduction, it is possible that the date of his dismissal will have to be postponed or his job will generally be retained.< … Старые «прибыльные» ошибки иногда можно исправить в текущем периоде Если организация обнаружила, что в одном из предыдущих отчетных (налоговых) периодов при исчислении налога на прибыль была допущена ошибка, исправить ее current period only possible if two conditions are met.< … Delivery of SZV-M for the founding director: the Pension Fund has decided Pension Fund finally put an end to the debate about the need to submit the SZV-M form in relation to the manager who is the sole founder.

So, for such persons you need to take both SZV-M and SZV-STAZH!< …

Average salary by industry

Order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06/ established publicly available criteria for independent risk assessment for taxpayers. Average wages by industry type of economic activity In the capital, there is a dynamic increase in the average wage level compared to previous years. Salary by type of economic activity Attention: The higher the average salary for the periods indicated above, the higher the actual pension that will be accrued at the moment.

To calculate the pension by year, the average salary for the periods indicated above and the average salary for the period from 2002 to the present are calculated and the final amount is determined by applying the methodology.

Is the salary below the industry average? letter from the Internal Revenue Service. what to do?

Attention

The salary of employees consists of an official salary, which is approximately the same for everyone (10,000-15,000) rubles and a monthly bonus, the amount of which is determined by the director depending on the labor contribution of each employee to the volume of services provided per paid month (from 0 to 100,000) rubles. Where to find the industry average salary level and how to prepare for this challenge? Answer Before going to the commission, make an explanation. The explanations should be written on company letterhead and signed by the manager.

It is not difficult to explain low wages. There may be several reasons. For example, in a company, most employees work part-time or their income depends on the company's performance. If performance indicators are negative, then the salary is below average.

All these arguments can be confirmed with a copy staffing table and wage regulations.

Industry average salary

The purpose of the commission is to force the company to abandon salaries in envelopes. And accordingly, increase personal income tax receipts.* Deadline for drawing up the document Explanations must be drawn up before going to the commission. What must be included in the document Explanations should be written on the company letterhead and signed by the manager.

It is not difficult to explain low wages. There may be several reasons. For example, in a company, most employees work part-time or their income depends on the company's performance. If performance indicators are negative, then the salary is below average. All these arguments can be confirmed by a copy of the staffing table and the salary regulations. Low salaries can also be explained by temporary difficulties: a drop in demand, a shrinking market, a crisis.* COMMON MISTAKE Sometimes, due to fear of a commission, a company significantly raises the level of salaries.

Salary by type of economic activity 2017

<… Зарплатные комиссии В зону риска попадают компании, сотрудники которых получают зарплату ниже МРОТ или среднеотраслевого уровня.

As well as organizations that began to pay less personal income tax to the budget compared to previous periods. The purpose of the commission is to force the company to abandon salaries in envelopes. And accordingly, increase personal income tax receipts into the budget.* WHAT TAX FILES ASK - Why is the salary in the company below the minimum wage or the industry average? There may be several reasons. It is not difficult to explain low wages. For example, in a company, most employees work part-time or their income depends on the company's performance. If performance indicators are negative, then the salary is below average.

- 2013 – 29,792 rubles.

- 2011 – 23,369.2 rubles.

- 2009 – 18,637.5 rubles.

Statistics show that the growth rate of average wages has slowed down somewhat, which is due to the crisis in the economy and the depreciation of the national currency. The average wage indicator is an uninformative value for the average person. The figure for his labor income may differ significantly from the statistical one, both up and down. It all depends on the profession, region of residence, size of the locality. Rosstat data demonstrates that average wages vary significantly across regions of the country.

Average salary in Russia in 2018

Attention

In practice, this postulate is not observed: there is a gap between the two indicators not in favor of the first. The minimum wage is the minimum income of a Russian worker, and the average salary is necessarily higher than this indicator. The minimum wage is established by federal laws; in 2018 it is 9,489 rubles.

The legislation leaves the right to the authorities of the constituent entities of the Russian Federation to establish their own “minimum wage”, which will be no less than the federal value. If the region has a high standard of living, the minimum wage will be higher than the Russian average. For example, in Moscow it is 18,742 rubles for 2018.

Salary Average salary in the Russian Federation: current indicator and dynamics According to Rosstat, the average salary in Russia in 2017 was 35,845 rubles. This is a higher figure compared to data from previous years. For example, consider the values of previous periods:

Average salary by industry

Average salary in the regions of Russia in 2018 Subjects of the Russian Federation Average monthly salary, rubles Russian Federation 40766 Central Federal District 49390.41 Belgorod region 30775.93 Bryansk region 23454.24 Vladimir region 25687.98 Voronezh region 29410.87 Ivanovo region 23826.5 3 Kaluga region 30527.74 Kostroma region 25439.78 Kursk region 25687.98 Lipetsk region 27797.62 Moscow region 47901.25 Oryol region 18986.76 Ryazan region 24074.72 Smolensk region 22585.56 Tambov region 24198.82 T Verskaya region 22709.66 Tula region 28790.39 Yaroslavl region 30031.35

Wage

Based on this, a salary of 15 thousand rubles can be approximately considered average. The sector is noticeably smaller after 30 thousand rubles, which indicates a relatively small proportion of the population with salaries above this level. Distribution of visitors by salary received in 2014: Salary ranges: - 5-10 thousand - 10-15 thousand - 15-20 thousand - 20-25 thousand - 25-30 thousand - 30-35 thousand - 35 -40 thousand - 40-45 thousand - 45-50 thousand - over 50 thousand

Are there laws that stipulate that employees (literally - the level of average monthly wages per employee) are determined by type of economic activity? Our OKVED is 60.21.11. In 2008, we joined the Moscow Transport Union (MTS).

Average salary in Russia and other countries of the world in 2018

Ignoring directives from above entails the imposition of administrative liability on the company. An increase in the minimum wage means an increase in benefits for temporary disability and labor and employment. The authorities' initiative will contribute to the growth of average wages and will have a positive impact on the standard of living of the population.

The implementation of the program is financed from the federal treasury, the budgets of the constituent entities of the Russian Federation and employers’ own funds.

Average Russian salary 2018 Rosstat

Salaries of citizens with the same specialty, qualifications and experience differ by region of the country and locality. The final amount of monetary remuneration depends on the relationship between supply and demand in the local labor market and a number of subjective factors. Average monthly salary by specialty and industry The amount of a citizen’s income depends on his specialty and position.

Statistics show that the largest incomes in Russia are received by representatives of the following industries:

- energy – 80 thousand rubles;

- financial activities – up to 73 thousand rubles;

- mining - about 65 thousand rubles;

- fish farming – 65 thousand rubles;

- real estate transactions – 43 thousand rubles;

- transport – 40 thousand rubles.

According to official statistics, in 2016-2017.

Salaries in Russia

In Russia there is a general minimum wage, as well as regional and Moscow-specific minimum wages. Minimum wage in Moscow But it is worth remembering that if the employer has submitted a reasoned refusal to apply the minimum wage to the Labor Inspectorate, then he has the right to pay his employees such salary as he sees fit. Average salary according to qualifiers in 2018 According to Rosstat and data obtained from online surveys, the average income level of residents of the northern capital of Russia in 20186 changed as follows: in January and February, the average salary in the city of St. Petersburg reached 31 thousand. The accountant must take into account that the replacement must necessarily lead to an increase in the amount of the benefit.

It is overtaken by the United States, Belgium, France, Germany, Norway, etc. According to official data, the average annual income of a Russian is comparable to the monthly income of a Swiss.

Difficulties and errors in determining the average Russian salary The all-Russian indicator is the “average temperature in a hospital.”

It varies significantly for different parts of the country and has calculation errors. Among the difficulties that do not allow us to determine the value 100% correctly are the following: 1. Different climatic zones in the country. Wages in the northern regions are always higher than in the southern ones, because workers are entitled to bonuses and compensations for difficult natural conditions. 2. The gap between the incomes of residents of small and large cities One specialty and one level of qualifications will be valued differently in a large city, a regional center and a small village.

Average salaries in the world

- 1 What influences the average salary?

- 2 Average salary in the Russian Federation: current indicator and dynamics

- 3 Difficulties and errors in determining the average Russian salary

- 4 Average monthly salary by specialty and industry

- 5 Prospects for changes in average wages in the Russian Federation

What influences the average salary? When calculating the average salary, Rosstat takes into account the following elements:

- employee salaries;

- bonus payments;

- compensation and allowances;

- social benefits from hiring companies.

The modern methodology differs from the algorithm that existed earlier, when the “bare” salary was taken into account. To calculate the average salary, Rosstat uses information about the annual payroll received from domestic companies.

By the way, let us remind you that in June the All-Russian Public Opinion Center (VTsIOM) found out that currently Russians are most concerned about low wages. Age category of the site 12+ Average Russian salary for calculating alimony 2018 The determination of alimony debt based on the average salary indicator is carried out on the basis of the following legislative acts: Average salary in the regions of Russia The average salary in the Russian Federation is 27,339 rubles as of 01/01/2018. The average salary by region of the Russian Federation may vary significantly.

Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website. All cases are very individual and depend on many factors.

But, unfortunately, the letter was delivered by mail a week later than the date of the invitation. Our organization operates with Federal Law No. 82-FZ dated June 19, 2000 “On the minimum wage”, the legislation of Moscow (tripartite agreement dated December 24, 2008, resolutions of the Moscow government) and Art. 133.1 of the Labor Code of the Russian Federation. Are there laws that stipulate that the wages of employees (literally - the level of average monthly wages per employee) are determined by the type of economic activity? Our OKVED is 60.21.11. In 2008, we joined the Moscow Transport Union (MTS).

Industry average salary level 2016 according to qualifiers

All-Russian Classifier of Types of Economic Activities (OKVED 2) - OK 029-2014 (NACE Rev. 2) Approved and put into effect by Order of Rosstandart dated January 31, 2014 N 14-st. This group includes: - wholesale trade in fuels, lubricants, lubricants, oils such as: charcoal, coal, coke, firewood, solvent gasoline, crude oil, crude oil, diesel fuel, gasoline, fuel oil, heating oil, kerosene, liquefied fuel gases, butane and propane, lubricating oils and grease, refined petroleum products Code 46.71 OKVED 2 is included in the following branch of the classifier of types of economic activities (decoding of higher codes): G - Section “Wholesale and retail trade; repair of vehicles and motorcycles." 46 - Class “Wholesale trade, except wholesale trade of motor vehicles and motorcycles.”

Industry average salary

Of course, the average wage indicator must be used with some conditionality. After all, the average indicator does not take into account the peculiarities of the functioning of a particular employer.

Namely, the amount of remuneration of an individual employee actually depends on these specific conditions and factors. Where to look at the average salary in Russia in 2017. Average indicators nationwide are calculated by the Federal State Statistics Service (Rosstat, formerly Goskomstat).

These indicators are calculated based on the processing of static reporting provided by organizations and individual entrepreneurs. Official statistics data are posted on the Rosstat website at www.gks.ru.

Newforms.rf

This is remuneration for work depending on the qualifications of the employee, complexity, quantity, quality and conditions of the work performed, as well as compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal, work in special climatic conditions and in territories exposed to radioactive contamination, and other compensation payments) and incentive payments (additional payments and incentive allowances, bonuses and other incentive payments). Article 132 of the Labor Code of the Russian Federation establishes that the salary of each employee depends on his qualifications, the complexity of the work performed, the quantity and quality of labor expended and is not limited to the maximum amount.

The salary of employees consists of an official salary, which is approximately the same for everyone (10,000-15,000) rubles and a monthly bonus, the amount of which is determined by the director depending on the labor contribution of each employee to the volume of services provided per paid month (from 0 to 100,000) rubles. Where to find the industry average salary level and how to prepare for this challenge?

Salary level by type of economic activity 2018

Answer Download the handy cheat sheet “Why you will be called to the salary commission.” Before going to the commission, make an explanation.

The explanations should be written on company letterhead and signed by the manager. It is not difficult to explain low wages. There may be several reasons.

For example, in a company, most employees work part-time or their income depends on the company's performance. If performance indicators are negative, then the salary is below average.

Average salary by industry

This means that it is more convenient to order from a bank once. - Why did the employee come to you for a lower salary than he received before? The company has no obligation to track what salary the employee had at his previous job. An employee has the right to choose where to work. This means that he was satisfied with the conditions of the company’s new employer.

For example, work schedule, location, benefits package, etc. - Why does your organization issue so much cash on account? Tax officials suspect that the company uses the accountable amounts for salaries in envelopes.

Does this mean that the average salary in our organization should correspond to the average salary of organizations participating in MTS? Is this what the Federal Tax Service of Russia meant in the notification? Minimum wage or OKVED Today, there is not a single regulatory legal act that would establish an obligation for an employer, when determining the amount of wages, to be guided by the average monthly wage per employee by type of economic activity. Order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06/ established publicly available criteria for independent risk assessment for taxpayers. This document states that if a taxpayer’s tax burden is below its average level for business entities in a particular industry (type of economic activity), he will be included in the plan of on-site tax audits.

From an article in the magazine “Accounting.Taxes.Pravo” No. 33, September 2014 Tricky questions inspectors ask at commissions (with ready-made answers)<… Зарплатные комиссии В зону риска попадают компании, сотрудники которых получают зарплату ниже МРОТ или среднеотраслевого уровня. А также организации, которые стали платить в бюджет меньше НДФЛ по сравнению с предыдущими периодами.

The purpose of the commission is to force the company to abandon salaries in envelopes. And accordingly, increase personal income tax receipts into the budget.* WHAT TAX FILES ASK - Why is the salary in the company below the minimum wage or the industry average? There may be several reasons.

It is not difficult to explain low wages. For example, in a company, most employees work part-time or their income depends on the company's performance. If performance indicators are negative, then the salary is below average.

For example, in the nuclear energy industry, the monthly tariff rate for a category 1 worker should not be less than the subsistence level of the working-age population of the constituent entities of Russia in which the organizations are located (clause 6.2.2 of the Industry Agreement on Nuclear Energy, Industry and Science for 2015–2017). For commercial organizations, industry agreements are mandatory only if they join them (Article 48 of the Labor Code of the Russian Federation). The chief accountant advises: do not pay wages below the industry average earnings established in your region (if such information is communicated to organizations). The organization's taxes will not be assessed (see, for example, letter of the Federal Tax Service of Russia for the Moscow Region dated July 23, 2007 No. 18-19/0372, resolution of the Federal Antimonopoly Service of the Volga District dated October 16, 2008

No. A55-1720/2008, Moscow District dated July 30, 2007

Type of economic activity Average salary (rub.) Agriculture, hunting and forestry 21,616 Fishing, fish farming 54,524 Mining 65,199 Manufacturing 35,018 Production and distribution of electricity, gas and water 37,657 Construction 32,295 Wholesale and retail trade; repair of vehicles, motorcycles, household products and personal items 28,708 Hotels and restaurants 21,691 Transport and communications 40,061 Financial activities 73,209 Real estate transactions, rental and provision of services 43,830 Public administration and military security; social insurance 41,918 Education 29,008 Healthcare and social services 29,552 Provision of other utility, social and personal services 31,546 Subscribe to our Yandex channel.

Attention

KA-A41/7118-07, West Siberian District dated October 30, 2008 No. F04-6627/2008(15063-A45-25)). However, they can order an on-site tax audit (order of the Federal Tax Service of Russia dated May 30, 2007 No.

No. MM-3-06/333).* From an article in the magazine “Accounting.Taxes.Pravo” No. 14, April 2014 Safe wages have been updated in the Urals. We have presented new industry averages for each type of activity in the table.* New safe wages in the Ural region as of 01.01.14* How salaries will be checked During a survey of eight Ural departments of the Federal Tax Service, we found out that tax officials in all these regions pay attention to the salaries of employees and, if salaries are low, call for commissions. But inspectors have different reasons for calling a commission.

1 Noskova A.R. 1

1 Perm National Research Polytechnic University

The article is devoted to the analysis of indicators of nominal average monthly wages of employees of organizations by type of economic activity in the Russian Federation. The average monthly salary is calculated by the Federal State Statistics Service based on information received from organizations about the accrued wage fund and the average number of employees. The article highlights the territorial units of the Russian Federation with the highest and lowest levels of average monthly wages. According to the all-Russian classifier, types of economic activity are given. A comparison of the levels of average monthly wages of economic sectors in 2015 was made, and sectors with the highest and lowest levels of average monthly wages were identified. The dynamics of the average monthly wage of the economy as a whole and those types of economic activities that are most covered by the employed population are also shown.

nominal average monthly wage

types of economic activities

dynamics of average monthly wages

1. On the adoption and entry into force of OKVED: Resolution of the State Standard of Russia dated November 6, 2001 N 454-st (as amended on March 31, 2015). URL: http://www.consultant.ru/document/cons_doc_LAW_34086/ (date of access: 07/07/16);

2. Federal State Statistics Service. Employed population by type of economic activity. URL: http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/wages/labour_force (access date: 07/07/16);

3. Federal State Statistics Service. Average monthly nominal accrued wages of employees of organizations by type of economic activity in the Russian Federation. URL: http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/wages (access date: 07/07/16);

4. Federal State Statistics Service. Average monthly nominal accrued wages of workers in the economy as a whole by constituent entities of the Russian Federation. URL: http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/wages (access date: 07/07/16);

5. Yurkova T.I., Yurkov S.V. Enterprise Economics./GATSMiZ. Krasnoyarsk, 2006. – 116 p.

Labor is a commodity, and like any commodity, labor has a price. Wage is the amount of monetary remuneration paid to an employee for performing work over a certain period of time. Wages undoubtedly play a significant role, since they are the main source of income for most members of society.

The average monthly salary is calculated based on information received from organizations about the accrued wage fund and the average number of employees. The average monthly salary in the Russian economy as a whole for 2015 is 34,029.5 rubles. Moreover, the territorial unit with the highest average monthly salary is the Far Eastern Federal District, where the average monthly salary for 2015 is 43,164 rubles. In particular, the average monthly salary for the Chukotka Autonomous Okrug, which is part of this federal district, is 79,531 rubles, which is the highest average monthly salary throughout the country. The territorial unit with the lowest average monthly salary is the North Caucasus Federal District with an average monthly salary for 2015 of 21,720 rubles. The Republic of Dagestan, which is part of this federal district, has the lowest average monthly salary in the country in the amount of 19,239 rubles.

The Russian economy covers a wide range of economic activities, which, according to the Classification of Types of Economic Activities (OKVED), form the following sectors:

· Agriculture, hunting and forestry (section A);

· Fishing, fish farming (section B);

· Mining (section C);

· Manufacturing industries (section D);

· Production and distribution of electricity, gas and water (section E);

· Construction (section F);

· Wholesale and retail trade; repair of motor vehicles, motorcycles, household products and personal items (section G);

· Hotels and restaurants (section H);

· Transport and communications (section I);

· Financial activities (section J);

· Transactions with real estate, rental and provision of services (section K);

· Public administration and military security; social insurance (section L);

· Education (section M);

· Healthcare and provision

social services (section N);

· Provision of other communal, social and personal services (section O).

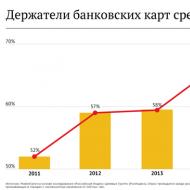

The levels of average monthly wages in different sectors of the economy differ significantly, as can be seen in the histogram shown in Figure 1.

Rice. 1 - Levels of average monthly wages of types of economic activity in 2015

Based on data for 2015, the highest average monthly salary falls on financial activities, it is 70,087.7 rubles; mining is also relatively highly valued, the average monthly salary of this sector of the economy is 63,695.3 rubles. The lowest average monthly salary of 19,721.1 rubles falls on agriculture, hunting and forestry. Moreover, the trend of the highest level of average monthly wages in financial activities, and the lowest level in agriculture, hunting and forestry, has persisted for more than 10 years.

According to the Federal State Statistics Service, the largest share of the employed population has consistently been in the manufacturing sector for 10 years. The share decreases from year to year, giving way to other sectors of the economy. If in 2006 the share of those employed in manufacturing was 18% of the total employed population, then in 2015 it was 14.3%. After manufacturing in 2015, a large share of the employed population was employed in the field of transport and communications (9.5%), education (9.2%), healthcare and social services (7.9%), construction (7.6%) .

Let's analyze the average monthly wages of workers in manufacturing, transport and communications, education, healthcare and social services, and construction, since these are the sectors that are most covered by the employed population. The level of average monthly wages of workers in these types of economic activities increases from year to year, but at different rates. The dynamics of average monthly wages in these sectors of the economy, as well as the economy as a whole, in the period from 2006 to 2015 is shown in Figure 2.

Rice. 2 - Dynamics of average monthly wages

Thus, in the period from 2006 to 2015, the average monthly salary in manufacturing industries increased by 3.12 times (up to 31,910.2 rubles), in the transport and communications sector - by 2.91 times (up to 38,982.2 rubles), education - 3.86 times (up to 26,927.8 rubles), healthcare and social services - 3.5 times (up to 28,179 rubles), construction - 2.76 times (up to 29,960 rubles). Moreover, in the manufacturing sector, the highest average monthly wage belongs to the production of coke and petroleum products, it amounts to 81,605.2 rubles, the smallest, in the amount of 15,757.6 rubles, belongs to textile and clothing production.

In the economy as a whole, nominal average monthly wages increased by 3.2 times by 2015. Its growth is also observed in 2016; as of April 2016, the average monthly salary of workers in Russia is 36,497 rubles.

Bibliographic link

Noskova A.R. ANALYSIS OF AVERAGE MONTHLY SALARY BY TYPE OF ECONOMIC ACTIVITY // International Student Scientific Bulletin.

Average salary by industry

– 2016. – № 2.;

URL: http://eduherald.ru/ru/article/view?id=16616 (date of access: 09/07/2018).

Current as of: February 22, 2017 The average salary by industry is of interest not only to employees, but also to employers. For the former, it provides information about the correspondence of their salary level to the average level within a particular professional field.

Salary by type of economic activity

The employer can conclude that it is necessary to index wages if it turns out to be below the industry average. Of course, the average wage indicator must be used with some conditionality. After all, the average indicator does not take into account the peculiarities of the functioning of a particular employer. Namely, the amount of remuneration of an individual employee actually depends on these specific conditions and factors. Where to look at the average salary in Russia in 2017. Average indicators nationwide are calculated by the Federal State Statistics Service (Rosstat, formerly Goskomstat).

Industry average salary

February 24,036 26,620 29,255 March 25,487 28,693 31,486 April 25,800 30,026 32,947 May 26,385 29,723 33,272 June 27,494 30,986 33,726 July 26,684 30,229 32,515 August 25,718 29,226 30,763 September 25,996 29,346 31,929 October 26,803 30,069 32,439 November 27,448 30,290 32,546 December 36,450 39,648 41,985 Salary dynamics according to official data - 2012 - 2013 - 2014 Average monthly accrued salary (without social payments) by type of economic activity in 2013 and 2014 is presented in the table below.

ImportantThe salary level in 2014 is 9-10% higher than the salary level in 2013. In what cases will the wages of your employees raise questions from the tax authorities?

- December 14, 2017 / Internet State-owned, budgetary, autonomous institutions: Features and innovations in the formation of annual financial statements for 2017.

Activities to mark the end of the financial year.

Average salary by industry

Salary by type of qualifier in 2018 Industry average salary in 2018 by qualifier Leningrad region Salary level by qualifier in 2018 Important Contents:

- Minimum wages in 2016 (by region)

- Minimum wages in 2013 (by region)

- Accounting info

- Living wage in Moscow in 2017: table

- If a day off or holiday happens to be a working day

- Purpose of the winrik software package

- New business ideas

- Purchasing information

- Salary level according to qualifiers in 2018

The value of the minimum wage in 2016 (by region) Dependence of business profitability on the size of investment For this type of business, there is such a feature that with high attendance at the entertainment center, the profitability of the business will be greater, the greater the investment that was initially invested in the project.

Average salary by OKVED codes in Moscow

Home → Accounting consultations → Remuneration Current as of: February 22, 2017 The average salary by industry is of interest not only to employees, but also to employers.

For the former, it provides information about the correspondence of their salary level to the average level within a particular professional field. The employer can conclude that it is necessary to index wages if it turns out to be below the industry average.

Of course, the average wage indicator must be used with some conditionality. After all, the average indicator does not take into account the peculiarities of the functioning of a particular employer.

Namely, the amount of remuneration of an individual employee actually depends on these specific conditions and factors.

Industry average salary level by type of economic activity

AttentionUrgent special issue

- The procedure for calculating average earnings has been changed

- In May, due to the new minimum wage, recalculate payments to employees

- Chief accountants were obliged to pay the company's debts

- The Supreme Court allowed accountants to lose sick leaves

Download the special issue for free. According to some industry agreements, employee salaries should no longer be less than the subsistence level. For example, in the nuclear energy industry, the monthly tariff rate of a first-class worker should not be less than the subsistence level of the working-age population of the constituent entities of Russia on whose territory the organizations are located (clause

6.2.2 Industry Agreement on Nuclear Energy, Industry and Science for 2015–2017). For commercial organizations, industry agreements are binding only if they join them (Art.

48 Labor Code of the Russian Federation).

Industry average salary in 2016 according to qualifiers

For commercial organizations, industry agreements are mandatory only if they join them (Article 48 of the Labor Code of the Russian Federation). The chief accountant advises: do not pay wages below the industry average earnings established in the territory of your region (if such information is communicated to organizations). Organizations will not be charged additional taxes (see, for example, the letter of the Federal Tax Service of Russia for the Moscow Region dated July 23, 2007.

No. 18-19/0372, resolutions

Industry average salary in 2017 by type of activity

Where to look at the average salary in Russia in 2017. Average indicators nationwide are calculated by the Federal State Statistics Service (Rosstat, formerly Goskomstat). These indicators are calculated based on the processing of static reporting provided by organizations and individual entrepreneurs.

Official statistics data are posted on the Rosstat website at www.gks.ru. As of January 25, 2017, from the most current information on wages by industry, Rosstat officially posted information on the average nominal accrued wages of workers for a full range of organizations by type of economic activity in the Russian Federation for November 2016.

It is indicated that the average salary of organizations in all industries in November 2016 was 36,195 rubles. We talked about what nominal wages are in our separate consultation.